Since mid-September 2023, there has been a magnificent wave of daily-level upward momentum, and we are now at the end of this uptrend. This week (December 4-10) has been another week of crazy gains in the altcoin market, with opportunities everywhere and severe FOMO sentiment. Everyone is looking for buying points, and every altcoin seems to be gaining momentum. It is in such a sentiment that we need to remain calm.

Coincidentally, over the weekend, there was a slight pullback in the market. We need to continue to observe whether the bullish trend will continue or if it's time to consider taking profits and securing gains.

Daily Level:

From the shape of the MACD at the daily level and considering the internal structure, it is entirely possible to start a downward trend at the daily level, i.e., a downward trend at the 4-hour level.

The extent of the downward trend at the 4-hour level cannot be anticipated. Once this level of pullback is confirmed, it is necessary to reduce positions and consider shorting.

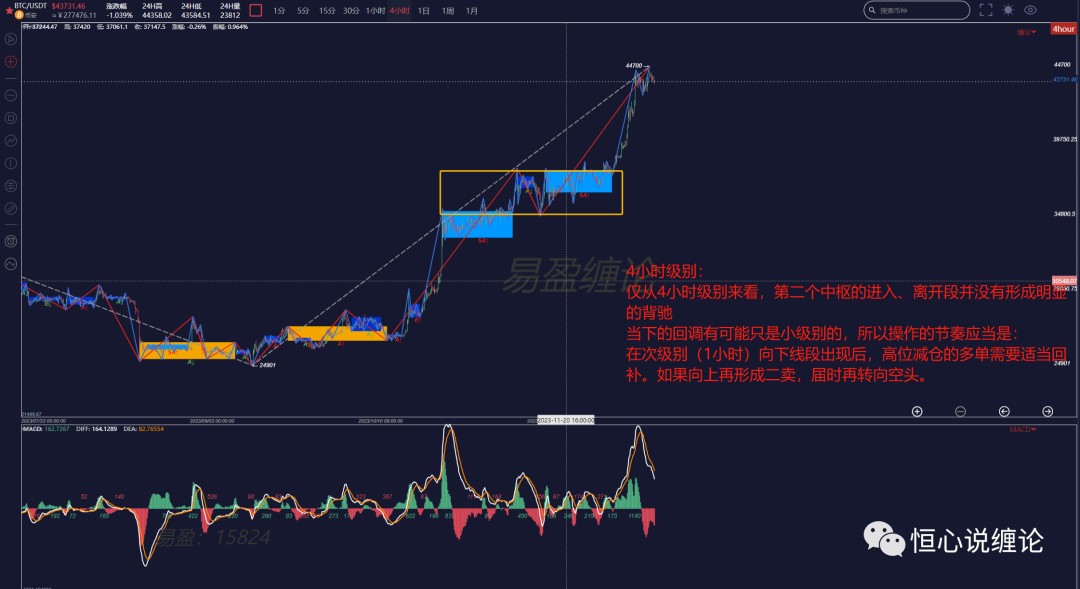

4-hour Level:

There is no obvious divergence in the entry and exit phases at the 4-hour level, and there is currently no signal of weakening in the bullish trend. Therefore, it is necessary to observe the trend's development more finely at a lower level.

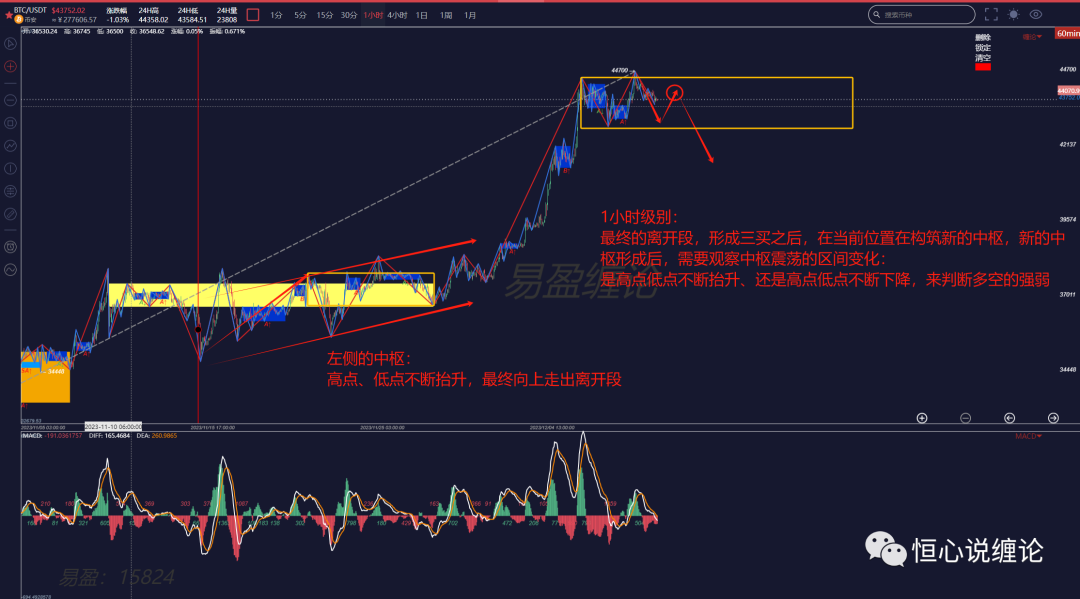

1-hour Level:

The 1-hour level is about to form a consolidation zone, and within this consolidation zone, the continuous changes in the highs and lows can be used to sense the strength and weakness of the trend.

The most probable trend is that after the formation of the consolidation zone at the 1-hour level, it is likely to set the final high point (bull trap) and form a trend divergence.

While Bitcoin fluctuates at high levels, altcoins may continue to maintain the current fervent market, but at this stage, it is essential to set up a moving stop-loss to guard against a flash crash.

Simple terminology explanation:

Level: A unique concept in the Chande theory, representing the market in two dimensions of time and space. The larger the level, the longer the time and the greater the fluctuation space, generally including 4-hour level, 1-hour level, 30-minute level, etc.

Trend type: Divided into consolidation and trend, with rising and falling trends; each level has a corresponding trend type.

Segment: The trend type at a lower level, "a segment of a certain level" specifically refers to a segment.

Divergence: Refers to the end of an upward or downward trend, where the price reaches a new high/low but shows obvious exhaustion in momentum. Usually judged with the help of MACD.

The views in the article are for learning and reference only and do not constitute investment advice.

If you want to systematically learn the Chande theory, use the Chande automatic drawing tool, participate in offline Chande training camps, improve your trading skills, and develop your own trading system to achieve a stable profit target, use Chande technology to timely escape the peak and buy the dip. You can scan the following QR code to add the WeChat account (vhenrythu) for consultation and learning exchange!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。