昨天并没有迎来市场的反弹,而是持续阴跌,从形态上看就是4小时向下线段的延续。1小时周末的反弹,只是多头的一点出工不出力的小火花。在技术面上没有太多需要讲的,依然是继续等待右侧的买点出现。

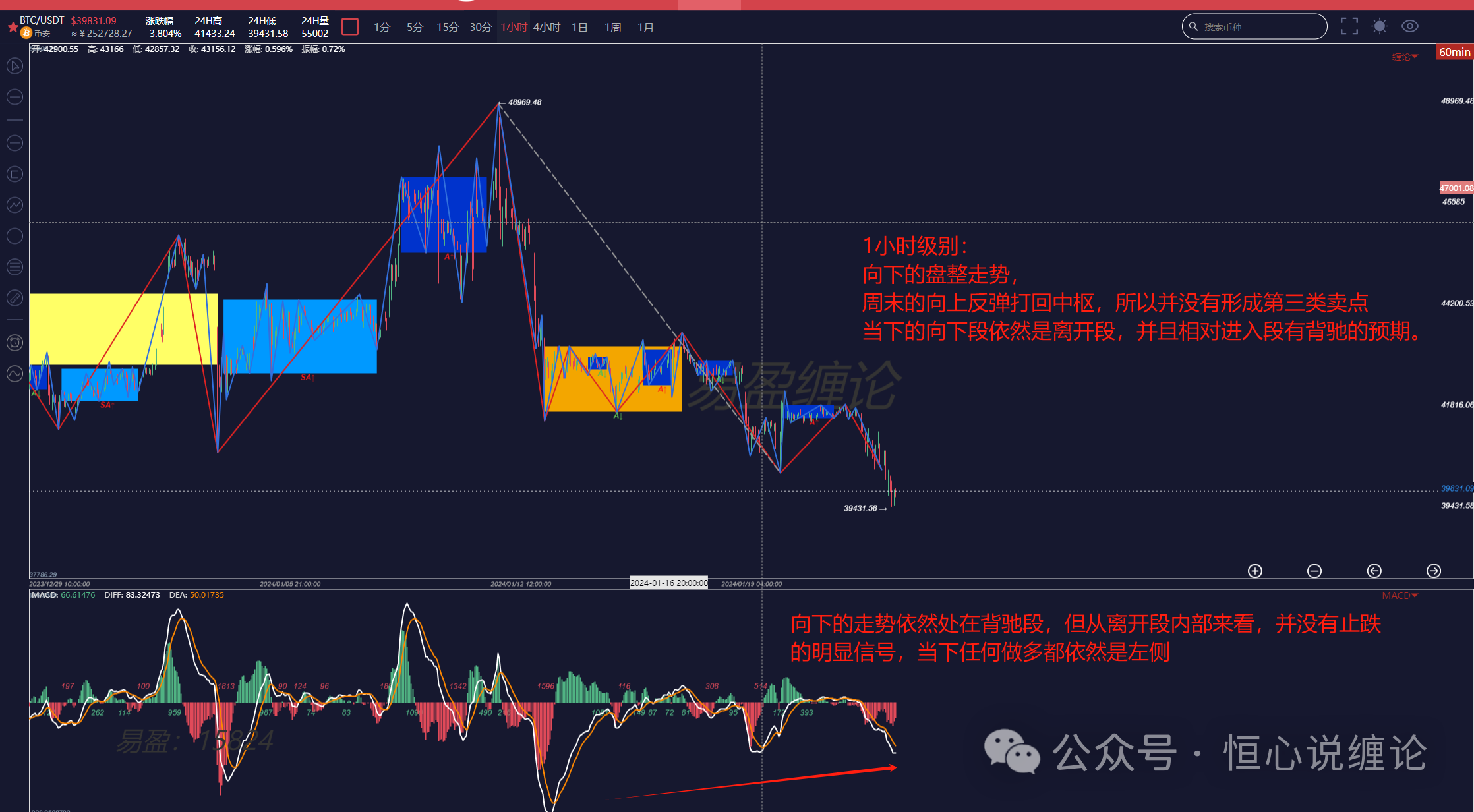

1小时级别当下的结构:

盘整背驰之后向上反弹一段,并没有进入多头的节奏。当下的形态看,向下依然有空间,所以做多一定还是要等待右侧的机会(1小时或者30分钟级别二买)。

最近两天全国下雪,隔壁大A又是处在水深火热之中。今天早上也是刷到了很多骇人听闻的消息。在此,也给自己一个警醒:做交易,一定要让自己的交易系统稳健,君子不立于围墙之下。但如何才能做到呢?真正做过交易的人,一定深有体会,让自己稳健。说来说去可能也就那么几个点,在这里我想再次总结一下:

1. 一定要在自己的交易系统内操作,不是自己计划中的交易绝不出手。(参考比特皇,只在预期日线一段的时候才出手。虽然不知道他用的是不是缠论,但从他的操作上能看出来)

2. 坚持加仓只在右侧。与这一条相对应的,就是已出现浮亏就像加仓拉低成本,完全没有在买卖点操作。或者在仓位浮亏之后,又在自己认为的买卖点、但是依然是左侧的机会加仓,极有可能浮亏更多。这些操作只会让自己越来越被动。但一旦确认了右侧的机会,至少市场当下有可能进入了自己的节奏。

3. 随时跟随市场的走势调整自己的预期+动态调整仓位。成熟的交易员,一定是懂得跟随市场的变化调整自己对走势的预期的,一旦市场出现跟初始预期不相符的走势,一定要将自己的想法调整过来。并且敢于在市场出现“不对的苗头”的时候调整仓位。刚开始肯定会有很多次卖飞,但这一步必不可少,因为这是让自己不抗单、长久存活在市场上的必须要走的一步。动态调整仓位,就是即便出现了反向延伸的走势(如当下的比特币向下延伸),账户浮亏依然在自己可控范围内。

4. 杜绝场外杠杆。有足够的稳定盈利的能力,即便再小的资金,在成熟的交易员手里也能日有所涨。有经历低谷再东山再起的能力,才是真正的强大。场外加杠杆,一定是贪婪所致。如果生活中非常需要钱,在场外加杠杆来市场中赚钱一定不是好的选择,而是导致多少人家破人亡的选择!

5. 永远相信自己的能力,相信技术、交易系统的力量。与上一条联动。这也是让自己在诡谲多变的市场中存活下来的定心丸。无论出现看起来多么可怕的失误或者亏损,一定要坚信自己能把这件事情做好。在漫长的交易生涯中,一两次、数十次失败只不过是沧海一粟,对我们的人生又算得上什么。

最后,希望大家都能在交易中成长,见人生、见自己。

简单的术语说明:

级别:缠论中特有的概念,代表在时间和空间周期两个维度的行情,级别越大,时间越长、波动空间越大,一般为4小时级别、1小时级别、30分钟级别等

走势类型:分为盘整和趋势两类,有上涨的走势和下跌的走势;各级别都有对应的走势类型

线段:次级别的走势类型构成,“某某级别的一段”特指线段

背驰:是指一段上涨或下跌的末尾,价格出现新高/新低,但力度上明显衰竭的走势。通常以MACD辅助判断。

文章内的观点仅供学习参考,不构成投资建议。

有想一起操作的朋友,在大牛市抓住大饼及优质山寨的机会,可以添加我的微信(vhenrythu)咨询、交流学习!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。