Source: BlockBeats

In recent years, the stablecoin market has undergone significant changes. With the maturity and expansion of the cryptocurrency field, stablecoins, as a key bridge connecting the traditional financial and digital currency worlds, have seen continuous growth in market share and application scenarios.

As we all know, BUSD, a stablecoin resulting from the collaboration between Paxos and Binance, has long been the third largest stablecoin after USDT and USDC. However, due to regulatory pressure from the SEC, Paxos chose to terminate its partnership with Binance regarding BUSD and ceased issuing new BUSD. Subsequently, Binance also announced the delisting of BUSD.

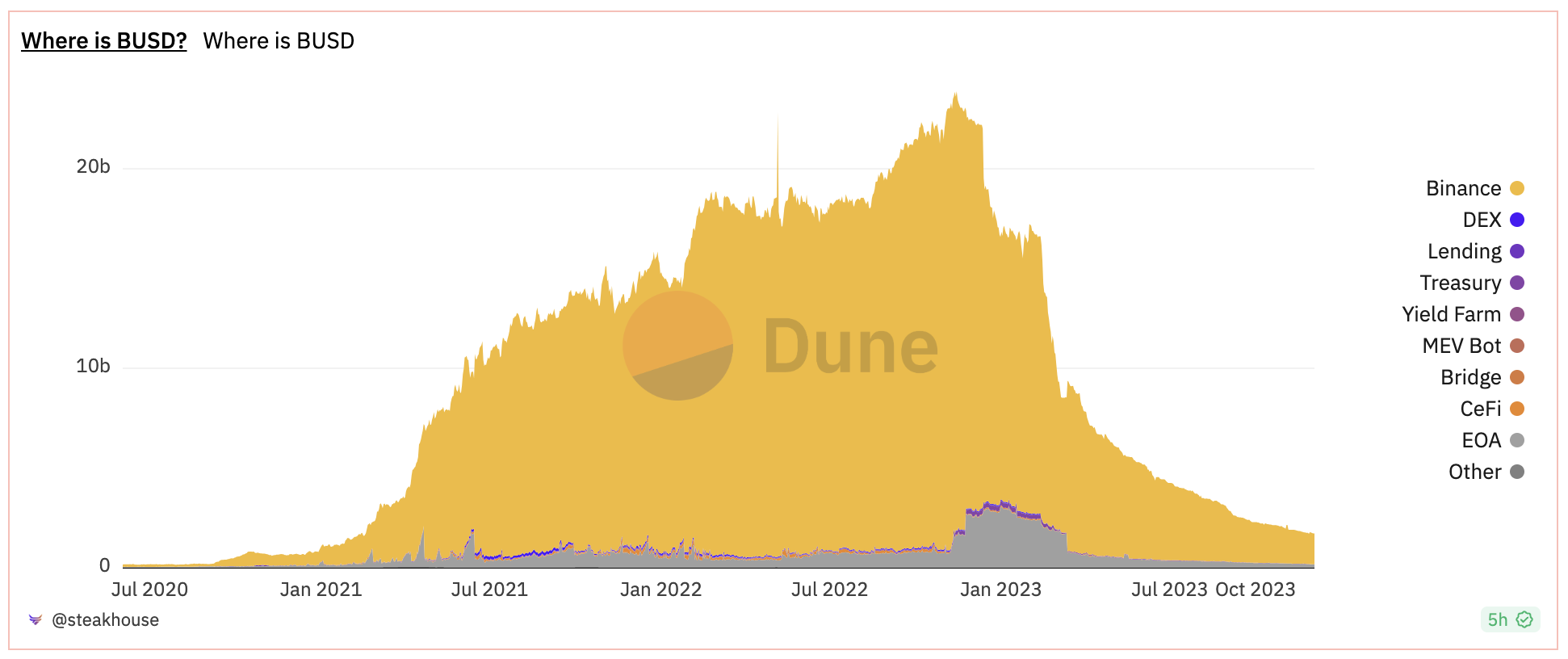

Since November 2022, the trading volume of BUSD on Binance has plummeted, and it will gradually exit the stage by the end of December this year. This change has provided opportunities for other stablecoins in the market, especially for those looking to expand their market share.

Data Source: Dune

In this context, who will be Binance's new "designated" stablecoin? The community is currently focusing on stablecoins commonly used in Binance launchpad trading pairs, such as the recently launched FDUSD and the longer-standing TUSD.

What is the background of the newly launched FDUSD on Binance?

First Digital USD (FDUSD) is issued by FD121 Limited (branded as First Digital Labs), whose parent company, First Digital Trust, is a qualified custodian and trust company headquartered in Hong Kong. On June 1 of this year, it officially announced the launch of FDUSD, a stablecoin pegged to the US dollar, which is regulated in Asia.

According to data, First Digital completed its earliest round of financing in 2020 and has completed a total of 3 rounds of financing, raising a total of $25.15 million, with investors including Nogle and Kenetic Capital.

Data Source: QCC

When launching FDUSD, First Digital stated that as a company registered under the Hong Kong Trust Ordinance, they must keep all FDUSD reserves in an independent account at a regulated financial institution in Asia, which prevents the commingling of FDUSD reserves with other assets of First Digital Trust Limited.

Public information shows that Vincent Chok is the CEO of First Digital. According to his LinkedIn profile, apart from serving as CEO at First Digital, Vincent Chok has been the CEO of First Digital's parent company, Legacy Trust Company Limited, since 2015. Additionally, the current COO of First Digital, Gunnar Jaerv, previously held positions as the head of proprietary trust and digital asset departments at Legacy Trust Company Limited, where he worked for 7 years.

Related Reading: "What is the background of the newly launched FDUSD stablecoin on Binance?"

The longer-standing TUSD

It is no exaggeration to say that TUSD is one of the earliest stablecoins in the market. According to its official website, TUSD was launched in April 2018 and is the first US dollar stablecoin operated by a regulated operator.

Although it had a relatively weak presence during DeFi Summer, in reality, TUSD was launched earlier than USDC, USDP, and BUSD. In its debut year, TUSD's circulation exceeded $200 million, and it established a significant position in the cryptocurrency market due to its stability and reliability, becoming one of the major stablecoins at the time.

At the end of 2020, an investment company registered in the British Virgin Islands, Techteryx Ltd., led the acquisition of TUSD, which is currently managed by Techteryx. It is reported that Techteryx operates globally and has office locations in countries and regions such as Singapore and Hong Kong. Additionally, Techteryx has established long-term partnerships with leading enterprises in the industry to enhance user trust in TUSD and promote its widespread adoption and development.

Application scenarios determine the upper limit of stablecoins

In terms of background, TUSD, as one of the earlier stablecoins, has a longer history and a more mature market and user base. On the other hand, FDUSD, issued by First Digital Labs and belonging to First Digital Trust, began financing in 2020 and was officially launched in 2023, making it a newcomer.

For stablecoins, application scenarios are a very important factor. In September 2018, after obtaining the license to issue stablecoins from the New York State Department of Financial Services (NYDFS), Paxos promptly launched the USDP stablecoin, which initially held nearly 30% of the stablecoin market on Ethereum. However, due to limited application scenarios, its market share continued to decline. This illustrates the importance of application scenarios.

Comparatively, TUSD and FDUSD have some similar application scenarios: both are widely used on cryptocurrency trading platforms as trading pairs to help investors mitigate the impact of market volatility. Due to their stability and low transaction costs, both are suitable for international cross-border payments and remittances. Both TUSD and FDUSD can be used on DeFi platforms, such as for lending and liquidity pools, providing stable asset options.

However, they also have different application scenarios. In terms of smart contracts and programmable finance, FDUSD particularly emphasizes its programmability, allowing users to conduct complex financial transactions, custodial services, and insurance arrangements using smart contracts without the need for intermediaries. While TUSD can also be used in smart contracts, its application in terms of programmability is not as prominent as FDUSD.

From the perspectives of asset-backed financing, commercial enterprise payment solutions, and everyday consumer digital wallets, TUSD is more commonly used in the collateralization and financing of digital assets, especially as stable collateral on DeFi platforms, due to its early market presence and widespread acceptance. TUSD not only plays an important role in traditional cryptocurrency trading and DeFi platforms, but it also demonstrates broad applicability in numerous payment scenarios globally, successfully integrated into platforms across various industries and fields.

Specifically, TUSD is also used as a payment tool in the travel industry through Travala.com, allowing users to book travel and vacations using stablecoins. This not only provides users with more payment options but also promotes the use of cryptocurrencies in traditional industries. As a cutting-edge Web3 shopping platform, UQUID provides convenience for users to purchase gift cards, clothing, and over 120 million products by supporting TUSD payments, deepening the penetration of TUSD in the e-commerce field.

As the largest Web3 freelance marketplace, HYVE accepts TUSD as a payment method, enhancing the competitiveness and application scenarios of TUSD in the job market. Additionally, the cryptocurrency payment platform NOWPayments also supports physical merchants to accept TUSD as a payment method.

While FDUSD theoretically could be used in these scenarios, due to its later launch, it may not have the same level of adoption in these application areas as TUSD.

Overall, TUSD and FDUSD both provide the core functions of stablecoins, such as serving as a stable store of value and medium of exchange in cryptocurrency trading and cross-border payments. FDUSD's feature in smart contracts and programmable finance is more prominent, while TUSD has successfully integrated into platforms across various industries and fields, such as Travala.com, UQUID, HYVE, and NOWPayments, making it more mature and diverse in daily consumption, online shopping, and other payment needs.

Deployment Platforms and Chains, and Market Performance

As the birthplace of TUSD, Ethereum has become its native blockchain network. TUSD initially existed in the form of an ERC-20 token, making efficient use of Ethereum's smart contract technology for management.

In addition, TUSD is deployed on over ten mainstream public chains, including BSC, Avalanche, TRON, Fantom, and Polygon. As of now, TUSD has been listed on over 100 trading platforms, including Binance, Coinbase, OKEX, HTX, and Gate.io, with the largest trading volume on DeFi automated market makers such as Binance and Curve.

Turning to FDUSD, to improve accessibility, FDUSD chose to issue on Ethereum and BNB Chain, using proof of stake (PoS) or proof of stake authority (PoSA) consensus mechanisms to ensure the immutability and transparency of FDUSD. Both TUSD and FDUSD plan to deploy on more chains.

In terms of trading platforms, the newly listed FDUSD is currently trading on cryptocurrency exchanges such as Binance, BingX, BitVenus, and Gate.io, with the potential to further expand to other major trading platforms.

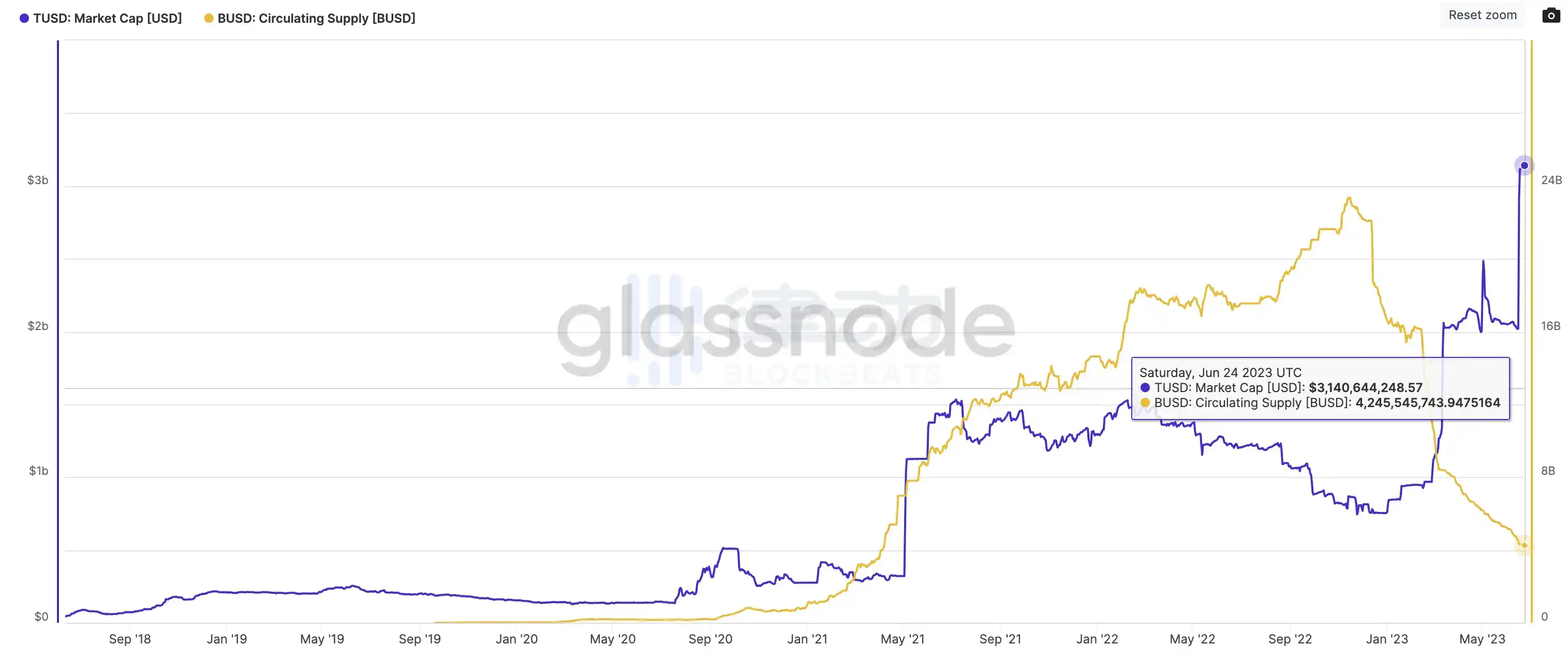

As of June 2023, with the issuance of TUSD (TrueUSD) increasing once again, its circulation has exceeded 3 billion, approaching the market value of BUSD, making it the fifth largest stablecoin. In 2023, TUSD's circulation increased by over 200%, making it the only stablecoin with rapid growth in circulation during the cryptocurrency bear market.

Due to different coordinate systems, the chart only represents trends. Data source: glassnode

However, with the exit of BUSD, TUSD's market value has already surpassed BUSD, reaching approximately $2.95 billion, ranking fourth in the stablecoin market. The current market value of FDUSD is approximately $960 million.

Data source: coinmarketcap

Overall, TUSD supports multiple blockchains, including Ethereum, Binance Smart Chain, and Avalanche, with a market value of approximately $2.95 billion. It is widely used on various trading platforms and applicable in cross-border payments, DeFi, and other scenarios. FDUSD is currently mainly on Ethereum and BNB Chain, with programmability suitable for smart contracts and financial services, with a market value of approximately $960 million.

Audits Can Also Be Fun?

It is reported that First Digital Labs places great importance on transparency. To ensure accurate maintenance of reserves, independent third parties such as Prescient Assurance conduct regular audits. These audits are released monthly, allowing users easy access to the latest reserve details, further strengthening the stability of FDUSD through transparent information.

TUSD has put in more effort in audits than imagined. Previously, TUSD was continuously audited in real-time by an independent industry professional accounting firm, The Network Firm, to ensure a 1:1 ratio of its US dollar reserves to circulating token supply, with a 100% collateralization rate.

The Network Firm is an independent accounting firm based in the United States, specializing in the digital asset industry. Since 2016, the founding team of the company has been at the forefront of developing native cryptocurrency accounting and attestation services, as well as traditional tax and audit capabilities, accumulating rich experience in the industry.

The collaboration with The Network Firm enables TUSD to achieve real-time attestation 24/7, ensuring transparency and stability of its reserves, and providing users with a better investment experience.

At the same time, TUSD is using Chainlink's Proof of Reserves (PoR) technology to ensure minting security, further ensuring transparency and reliability. As the first stablecoin to secure on-chain real-time verification by an independent third-party institution, TUSD demonstrates a new paradigm of decentralization, transparency, and independent verification.

With the integration of Chainlink PoR, TrueUSD (TUSD) is the first USD-backed stablecoin to secure minting with proof of reserves, ensuring minting security and further ensuring transparency and reliability. Users can access relevant data through the official website tusd.io for daily automatic audits.

Conclusion

The development of the stablecoin market is not only driven by technological innovation and market demand but also significantly influenced by regulatory environments. In recent years, as global regulatory agencies have deepened their focus on the cryptocurrency market, the development strategies and compliance of stablecoins, as an important part of the cryptocurrency field, have become hot topics. As a stablecoin operating outside the United States, TUSD has shown a certain degree of flexibility and adaptability in addressing regulatory challenges.

As the profit model of stablecoins has been successfully validated by Tether, global giants such as PayPal have also entered the market, opening up new possibilities for the stablecoin market. As of mid-2023, the stablecoin market has exceeded $100 billion. According to market researchers, the stablecoin market is expected to grow to trillions of dollars in the next five years.

With the continuous expansion of the stablecoin market, as a key link in the cryptocurrency market, its prospects for application in cross-border payments, fund transfers, financial services, and other fields are broad. As important participants in the market, TUSD and FDUSD are expected to "eat into" the market of BUSD and play a more important role in this rapidly developing market.

In comparison, the newly listed FDUSD is still a newcomer, while TUSD is one of the earliest stablecoins in the market. TUSD and FDUSD both provide the core functions of stablecoins, such as serving as a stable store of value and medium of exchange in cryptocurrency trading and cross-border payments. However, FDUSD's feature in smart contracts and programmable finance is more prominent, while TUSD, due to its early market presence, has a wider acceptance, making it more mature and diverse in asset collateral, financing, and daily consumption applications.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。