Author: DigiFT, HashKey Capital

Recently, the leading on-chain real-world asset trading platform DigiFT and HashKey Capital, which has successfully obtained the Singapore capital market services license and recognized market operator certification, jointly released a heavyweight research report on the tokenization of real-world assets (RWA) and its market potential, titled "Tokenization of Real World Assets Leading the Next Generation of Capital Markets." Click the original link at the end to download the full report in Chinese and English.

Author's Preface

Ryan Chen, Head of Research and Innovation at DigiFT

RWA is not just an asset class, but also a bridge that can connect the traditional financial world and the crypto asset world. In the traditional financial world, there is a huge potential for efficiency improvement in the existing system; in the crypto world, the current trillion-dollar market size of native crypto assets is just the beginning, with more asset types urgently needing to be introduced. A huge amount of capital is still locked in the traditional world, waiting for explorers in the crypto world.

RWA is a huge opportunity for the future, but it also needs time to grow. Whether it's in terms of technology, business, or regulation, there is still a long way to go. As a leading participant, DigiFT obtaining the capital market services license and recognized market operator certification from the Monetary Authority of Singapore is an important milestone in the RWA track. As the first exchange on the public blockchain to conduct secondary trading using the AMM mechanism, DigiFT will continue to delve into the intersection of finance and blockchain technology, unlocking the vast market of tokenizing real-world assets, and establishing the next generation of capital markets through responsible innovation.

Henrique Centieiro, Senior Research Manager at HashKey Capital

Currently, the RWA market is still dominated by institutional investors and focused on products related to US Treasury bonds, with enormous market potential. It is expected that the market value will reach tens of trillions of dollars. DeFi protocols have made significant progress in fixed income products, and based on this, this report provides a more comprehensive analysis of the structure, infrastructure, advantages, regulatory environment, and key players of RWA. Although the market is currently mainly focused on fixed income products, the evolving regulatory framework may pave the way for more types of RWA assets, reshaping the future of the capital market. Thanks to the DigiFT team, they have achieved pioneering results in the compliant RWA DEX field, and are also attempting to provide effective advice to the crypto community through in-depth reports.

Recommendations

Annabelle Huang, Managing Partner at Amber Group

The report comprehensively introduces the field of real-world assets/tokenization and provides an in-depth analysis of the technical architecture of major protocols. This will serve as a valuable guide in the rapidly developing RWA field, pointing out the opportunities and challenges ahead.

Joseph Goh, Investor at Superscrypt

While many in the industry recognize the huge potential of tokenized assets, we are still in the early stages of widespread adoption, facing significant challenges. DigiFT's research report provides a comprehensive analysis of the industry and regulatory environment, revealing key aspects such as KYC/AML compliance, sales restrictions, asset ownership, and investor rights. These insights are crucial for exploring the evolving prospects of digital assets.

Sébastien Derivau, Co-founder and Partner at Steakhouse Financial

Real World Assets (RWAs) represent an evolutionary leap for decentralized finance (DeFi), introducing a whole new set of fundamental elements. DigiFT's RWA research report provides an in-depth analysis of this dynamic and thriving market.

Aaron Collett, Contributor at Goldfinch

DigiFT is an emerging leader in the RWA field, and their report provides excellent analysis of key aspects and participants in the RWA industry. The RWA industry and its related regulations are still in the early stages, so each RWA protocol takes a unique approach to the structure and customer handling of its products. The report delves into the structures of various protocols, providing detailed information for understanding this small yet diverse industry. The regulatory and pioneer challenges faced by the launch of RWA products are short-term, but compared to traditional finance, the advantages of on-chain assets have huge long-term potential. The report balances different viewpoints, analyzes innovative models currently available, and outlines the gradual progress needed to redefine financial operations for RWAs. DigiFT's close collaboration with MAS and the depth of team knowledge showcased in the report excites me about their role in the RWA field. Few participants can solve complex problems on a massive scale alone, so industry collaboration is crucial - I hope Goldfinch can collaborate with DigiFT to jointly build a new financial market.

Table of Contents

I. Summary

II. Preface: Native Crypto and Real World

III. Introduction: What is RWA (Real World Asset) and How Does It Work?

IV. Issuance Models: Direct Issuance and Asset-Backed Models

V. Current Situation: Supply side for fixed income products, demand side for institutional investors

VI. Dilemma: Why is it only available to accredited investors?

VII. Driving Forces: Bi-directional migration from the real world and the crypto world

VIII. Global Regulation: United States, Europe, and Asia

IX. Key Participants: Approaches, models, and current situation

X. RWA Business Innovation Models: Integrating RWA with DeFi

XI. Conclusion and Future Prospects: Limited scale, unlimited potential

XII. References and Data Sources

I. Summary

Limited scale, unlimited potential: The overall market size of RWA (Real-World Assets) is relatively small, currently valued at only tens of billions of dollars compared to traditional financial markets. However, driven by the efficiency and cost advantages of blockchain technology, the potential market value of RWA may reach tens of trillions of dollars in the next five years.

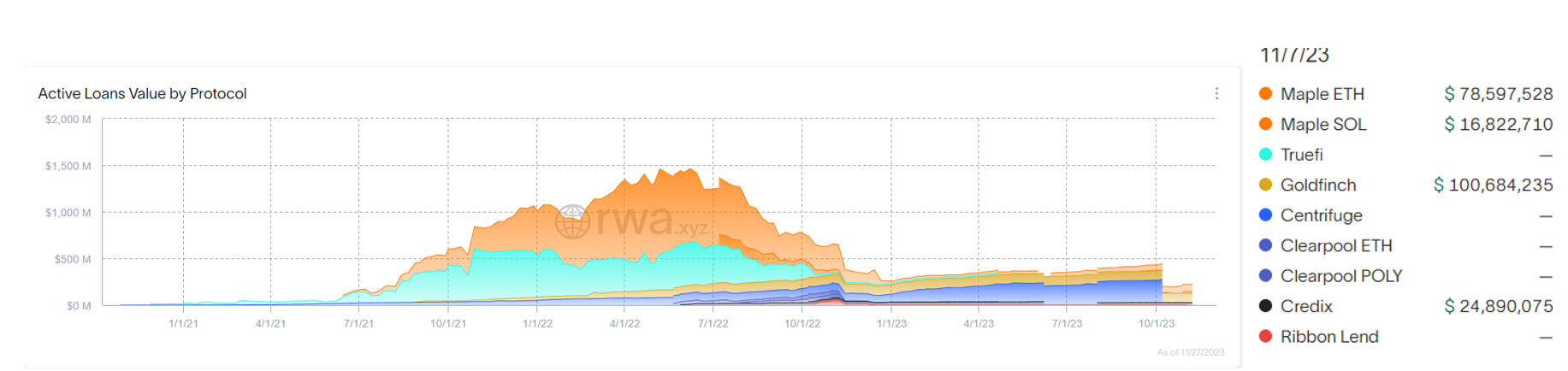

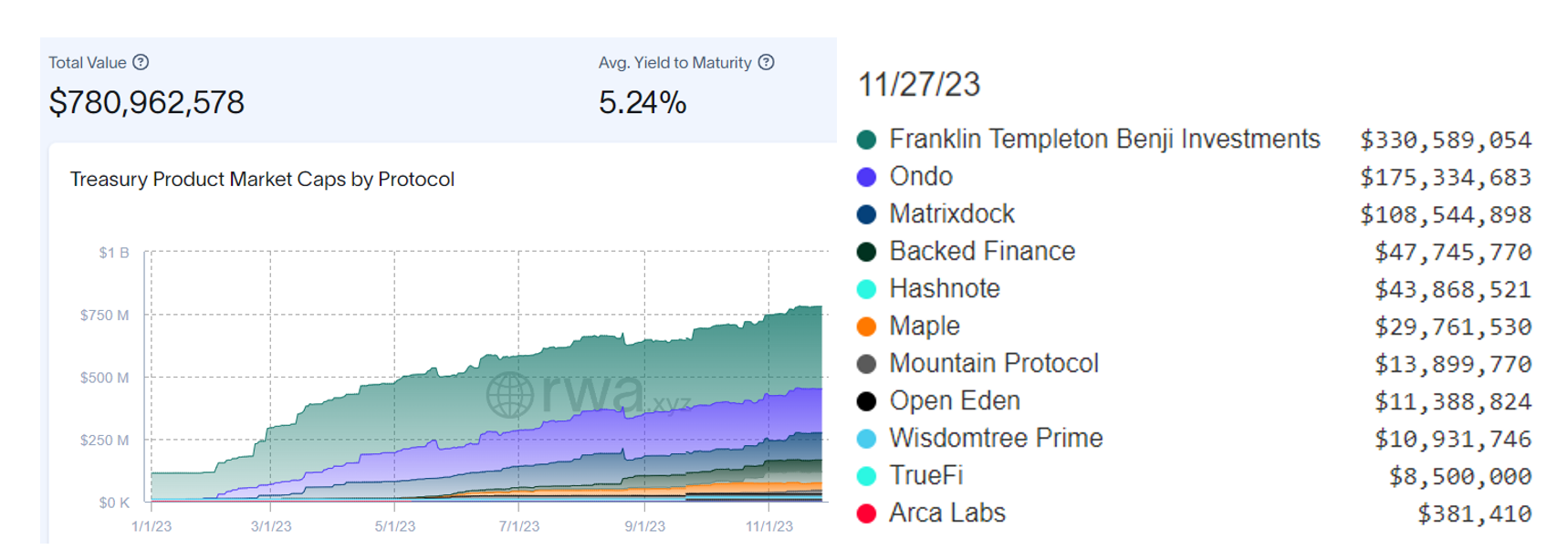

Supply side is mainly focused on fixed income products, with the rise of treasury bond tokens and a decline in private credit: According to data from RWA.xyz and Dune.com, the TVL (Total Value Locked) of the main RWAs is concentrated in products related to US Treasury bonds, growing from $100 million at the beginning of 2023 to a total market value of $784 million at present, showing rapid growth even in the crypto market's winter. The TVL of private credit products has declined from a peak of $1.5 billion in mid-2022 to only $500 million at present due to project defaults such as FTX, 3AC, and Luna.

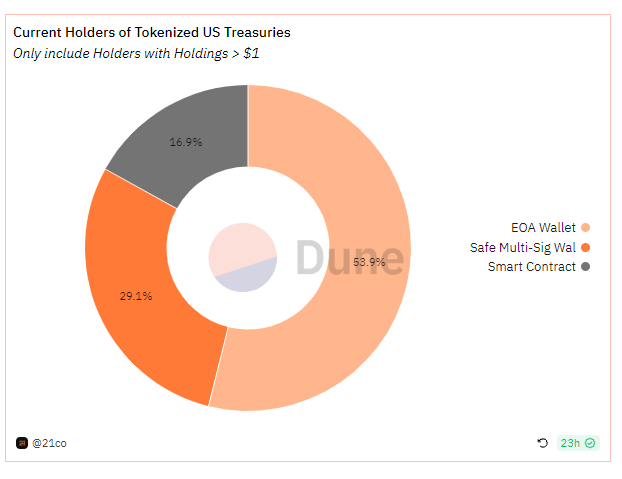

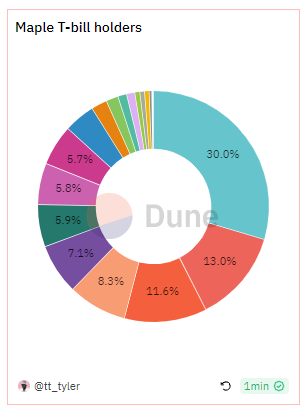

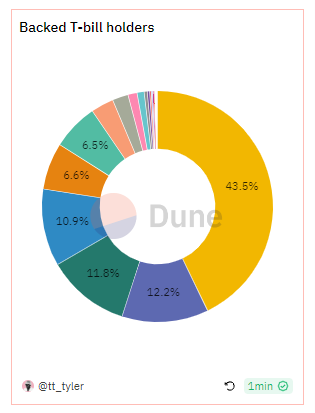

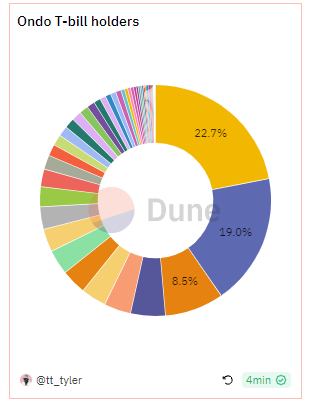

Demand side is mainly from institutional investors for short-term cash management and portfolio diversification: Analysis of wallet addresses related to treasury bond tokens reveals that the main holders are institutional investors. The current demand for RWA is mainly focused on the short-term cash management needs of investors in the crypto market. In addition, DeFi protocols such as stablecoin protocols and lending protocols have also introduced RWAs to achieve portfolio diversification and reduce overall system risk.

Regulatory challenges still exist: RWAs face diverse regulatory environments globally. The United States has strict securities laws and has global influence. In contrast, Switzerland, Singapore, and the Hong Kong Special Administrative Region have shown positive support, providing a more favorable regulatory environment for RWAs.

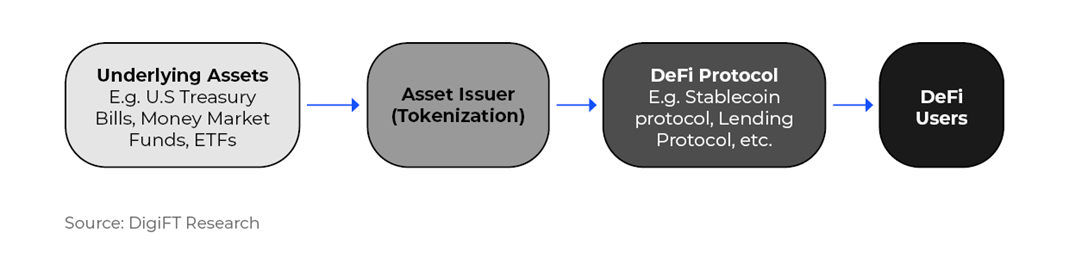

Innovative models integrating RWA with DeFi: By adopting innovative business models such as lending and token packaging, RWAs with higher investment thresholds can be integrated into DeFi. However, challenges such as anti-money laundering compliance, sales restrictions, and unresolved asset ownership issues still need to be addressed. The integration of RWA and DeFi will to some extent guide DeFi towards compliance.

Outlook: In the short to medium term, as the crypto market lacks stable income products and the demand for risk diversification, RWA market products will continue to be dominated by fixed income products. In the medium to long term, as the market's understanding of compliant assets deepens and relevant legal frameworks are perfected, we will see more diversified RWA assets, and may witness the next generation of capital markets driven by blockchain and tokens.

II. Preface: Native Crypto and Real World

The emergence of the concept of "Real World Assets" (RWA) is a metaphor proposed in the development of crypto assets based on blockchain technology, similar to the concept of "stablecoins." These metaphors are not meant to be novel, but rather to allow people with different backgrounds and experiences to intuitively understand new phenomena through imagination and symbols, without requiring extensive background knowledge. In the process of technological innovation, metaphors serve as a management tool, consciously or unconsciously created by people to facilitate the exchange of explicit and implicit knowledge.

Tangible assets such as real estate and gold, which exist in the physical world, cannot exist in electronic form compared to the widely used electronic systems. In order to integrate them into electronic systems, there are corresponding issuers for traded gold. For electronic systems, these physical tangible assets also fall under the category of "Real World Assets," but their existence is already familiar to the public and not considered a particularly novel concept.

The "Real World Assets" discussed in the crypto world are actually tokenized, allowing token holders to have legally recognized ownership of the underlying assets represented by the tokens. These "Real World Assets" include tokenized equities, bonds, real estate, and other assets that exist outside the crypto world. The category of "Real World Assets" is too diverse, and there are various implementation models. The simplest way to define "Real World Assets" is to define "native crypto assets," thereby distinguishing the two types of assets.

"Real World Assets," from a technical perspective, essentially involve mapping existing asset types onto the blockchain through technological and legal means, using "tokens" to represent ownership of the "underlying assets," and thereby benefiting from the efficiency and low cost brought about by new financial settlement tools.

If new technology does indeed bring breakthrough efficiency improvements and cost reductions, and has no fatal flaws, it will eventually be adopted. The medium of financial transactions, from paper documents on the counters of the New York Stock Exchange a century ago to the widely adopted electronic trading systems today, is likely to evolve towards token forms based on blockchain as the underlying technology.

Before bridging the gap between the virtual and real worlds, the crypto world and the real world were disconnected. Therefore, the concept of "Real World Assets" serves as a metaphor that enables mutual understanding between the two worlds and is widely discussed.

This research report will focus on the most important and future mainstream part of Real World Assets (RWA) - financial securities, to study the current state of the on-chain capital market and explore the next generation of capital markets.

These metaphors serve as an intermediate form, facilitating the transition from native assets in the crypto world to the integration of the real world; blockchain is the new financial technology infrastructure, and the essence of finance should not change.

Introduction: What is RWA (Real World Asset) and How Does It Work?

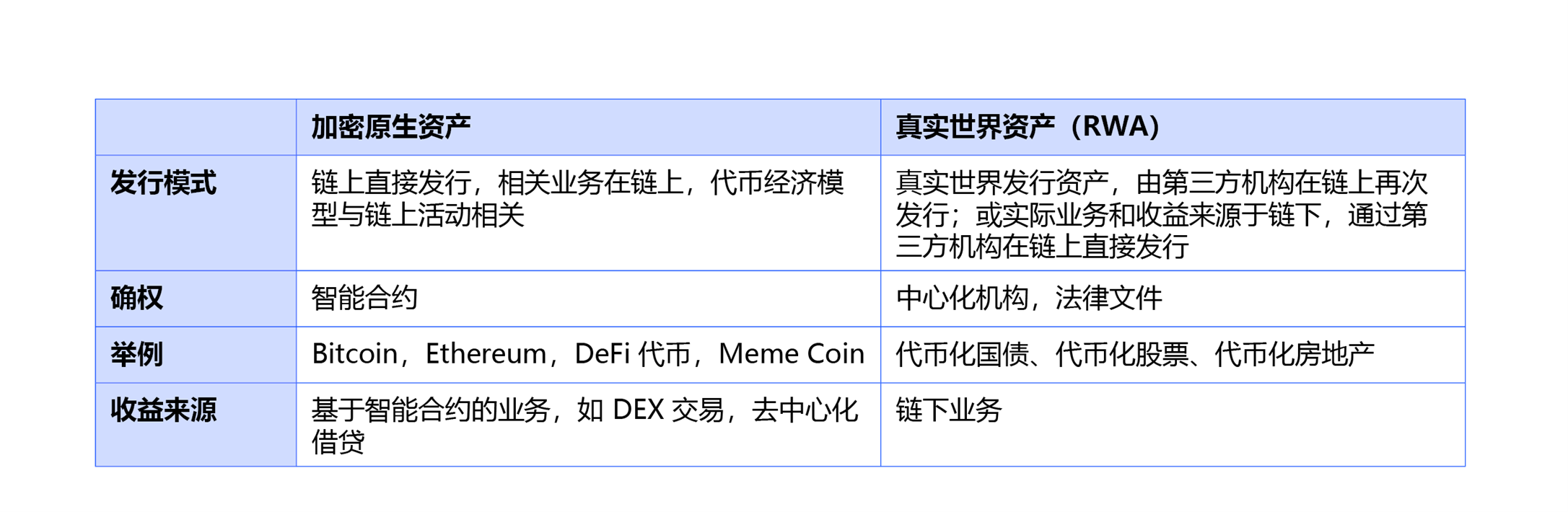

Most native crypto assets are implemented through smart contracts, and the related asset operation logic and business are run through on-chain code. Typical native crypto assets include public chain tokens and DeFi tokens. In comparison, Real World Assets (RWA) are more complex and diverse. RWAs can be of any type, and their business and income do not come from on-chain assets. For example, wine, cars, (traditional) financial securities, and precious metals can all be classified as RWAs.

Native crypto assets define rules through smart contracts, often referred to in the crypto community as "code is law." However, for "Real World Assets," the implementation process is completed through tokenization. Since more asset relationships occur in the real world off-chain, what we commonly refer to as tokenization is not simply the issuance of an on-chain token, but rather a series of processes, including the purchase of underlying assets, custody, the legal framework linking the underlying assets and tokens, and token issuance. Through tokenization, combined with off-chain legal regulations and related product operation processes, token holders have legal claim rights to the underlying assets. Therefore, especially for financial assets, off-chain legal regulations are a more critical part, and the tokenization of RWAs cannot be separated from the framework of the traditional world.

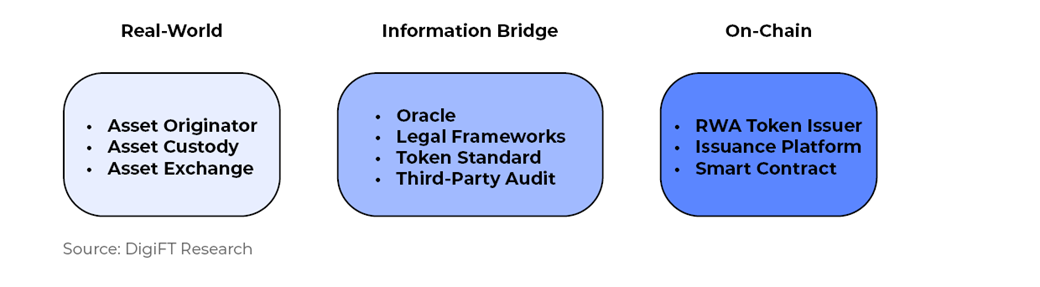

RWA Implementation Structure

The tokenization of RWAs is mainly achieved through three parts, with different roles assuming their respective responsibilities based on the asset type:

Real World: Asset originator, asset custodian, asset purchase channels

Information Bridge: Oracle, legal framework, token standards, third-party audits, fiat/crypto payment channels

On-chain: RWA token issuer, issuance platform, smart contracts

Figure 1: RWA Implementation Structure

Issuance Models: Direct Issuance Model and Asset-Backed Model

The legal and regulatory requirements for securities-type financial assets are relatively strict. Discussing from the perspective of securities-type assets can cover the majority of situations that assets may encounter. Here, we mainly discuss the issuance and trading of securities-type tokens.

From the perspective of issuance models, all crypto assets are issued through a direct issuance model, where ownership registration and registration occur directly on the blockchain. Since there are no real-world business and underlying assets, their asset nature cannot be clearly defined. In general, the issuance of securities-type assets requires registration and registration with relevant authorities; except for Switzerland's Distributed Ledger Technology Act (DLT Act), there are currently no laws explicitly allowing the direct issuance of securities-type products on the blockchain. Due to the lack of relevant precedents for reference, the current direct issuance model for securities is mostly experimental, with typical examples including the Diners Club 1-month note issued by DigiFT and Diners Club Singapore.

Crypto world assets are highly homogeneous and relatively volatile, while RWA assets have relatively low volatility and weak correlation with crypto assets, leading to a certain demand for RWAs from crypto world investors. To better integrate the concept of RWAs into the crypto world, there needs to be a widely accepted asset, with the preferred choice being the US dollar, i.e., stablecoins; followed by US Treasury bonds, which are the mainstream of RWAs and fall under the category of securities-type tokens. These assets cannot be issued through a direct issuance model unless a sovereign entity, such as the US government, issues them on-chain (e.g., CBDC). This has led to another issuance model, where the corresponding quantity of tokens is issued by obtaining the corresponding assets from traditional capital markets as collateral, known as the asset-backed model.

This section mainly discusses these two models.

Classification of Asset Issuance Models

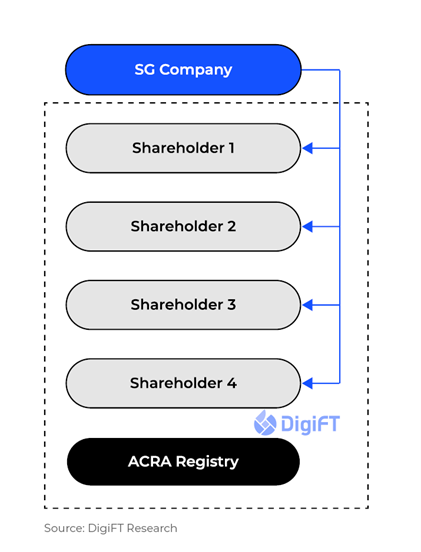

To understand the token issuance models for RWAs, let's first take a look at the traditional asset issuance model. Taking securities as an example, the following diagram illustrates a typical issuance model for company equity in Singapore.

Figure 2: Traditional Stock Issuance Model

A company will have multiple equity holders, and the ownership of these equities will be registered with the Accounting and Corporate Regulatory Authority (ACRA) in Singapore, and their transaction and transfer records will also need to be registered with ACRA.

ACRA serves as the securities registration institution in Singapore. In other markets, there are corresponding institutions, or different market mechanisms may be involved, such as the Transfer Agent in the United States, which is responsible for the registration and registration of securities holders.

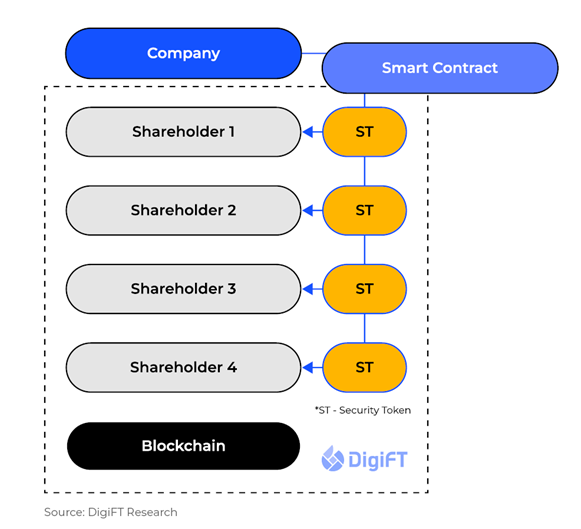

As shown in the following figure, issuing tokens on the blockchain actually involves registering and recording asset ownership on the blockchain as a ledger, and recording each transfer process.

Figure 3: Direct Issuance Model

In a few countries and regions at the forefront of financial innovation, they support direct registration of securities on the blockchain, such as the DLT Act enacted in Switzerland. Therefore, in these regions and countries, securities can be directly issued on the blockchain by authorized institutions, as these regions and countries recognize the blockchain as a tool for equity registration. However, in other major financial markets such as the United States, Singapore, and the Hong Kong Special Administrative Region, the relevant laws do not currently support direct registration and recording of securities on the chain. Therefore, most assets need to take a detour, such as funds issued on-chain by Wall Street financial institutions like Franklin Templeton, which still primarily use centralized accounting systems, with the blockchain serving as a secondary accounting tool.

As a result, the mainstream issuance models in the current market can be classified into two categories: the direct issuance model and the asset-backed model. Essentially, both issuance models involve issuing relevant bonds on-chain, but the form of issuance and corresponding rights are completely different.

It is important to note that private securities, if they meet certain conditions, such as a limited amount of issuance and a limited type of investors, have a very limited impact on the financial market and can be issued in compliance, with the issuer choosing to use the blockchain as a tool for equity registration. This is also the reason why most RWA projects currently target qualified investors only, which will be detailed in the "Dilemma: Why Can Only Target Qualified Investors" section later.

Direct Issuance Model

The direct issuance model involves the asset issuer using the blockchain as a ledger to register and record assets, and issuing corresponding tokens on-chain. The tokens represent the underlying assets themselves, and investors who purchase and hold such assets can directly obtain various related rights belonging to the assets, such as voting rights for stocks and repayment rights for bonds.

However, the direct issuance model still has many limitations in the current market environment. For example, these types of securities are tokenized and are not compatible with the current mainstream securities exchange structures (such as Nasdaq, SGX, etc.), or there are certain friction costs. Currently, the legal structure is also not perfect, and there are not enough legal cases to serve as future precedents.

Asset-Backed Model

Due to the current legal imperfections and the limited nature of on-chain assets, many projects also choose to use the asset-backed model for issuance. Essentially, this type of token is a new security that represents the economic rights of the underlying assets. The asset issuer registers and records the asset issuance outside the blockchain system, and after a third party purchases the asset, tokens are issued in proportion to the corresponding relationship, with the counterparty risk borne by the asset issuer and the token issuer.

The asset-backed model is currently a more common RWA model, as it can bring real-world income onto the chain, but it introduces additional risks, and although the issued tokens can contain the economic value of the underlying securities assets, the rights may differ from the actual securities rights.

V. Current Situation: Supply Side for Fixed-Income Products, Demand Side for Institutional Investors

Currently, on-chain securities-type RWAs mainly consist of private credit and US Treasury bond tokens. RWA-related assets began to emerge through private credit in 2020, with the mainstream products being unsecured credit, involving projects such as Maple Finance, Clearpool, and Centrifuge.

Figure 4: RWA Private Credit Active Credit Volume, Classified by Protocol, Data Source: rwa.xyz, Data as of November 27, 2023

The private credit market also has its cycles. When the market has a good foundation of trust, borrowers are willing to borrow at appropriate interest rates, and lenders are willing to take on the risk and provide funds. However, after the collapse of Luna and FTX, several lending pools in the private credit market were affected, leading to defaults and a significant decrease in TVL, currently in a relatively low cycle.

On the other hand, due to the high interest rates of the US dollar in the external macro market and the lack of returns in the crypto asset market, the rise of US Treasury bond tokenization-related assets has occurred. According to data from DeFi Llama, the TVL of US Treasury bond-related RWA projects is in a phase of continuous growth in the market with clear demand.

Figure 5: US Treasury Bond-Related Token On-Chain Total Market Value, Source: rwa.xyz, Data as of November 27, 2023

Among them, experiments in the tokenization of US Treasury bonds conducted by two US asset management giants, Franklin Templeton (green portion in the figure) and Wisdomtree on the public chain Stellar, have already reached a TVL of hundreds of millions of dollars. However, these projects are primarily based on centralized equity registration, with the blockchain serving as a secondary tool for recording token ownership.

Holder Situation

Compared to DeFi assets, from the perspective of returns and gameplay, RWAs themselves are not as attractive, but due to the security of the underlying assets, they have attracted institutional investors seeking stable returns and high liquidity. Due to their connection to real-world assets, most platforms have KYC and AML requirements, and if they are securities-type assets, stricter legal regulations will generally require qualified investors. These compliance restrictions and factors related to returns make it more difficult for RWA assets to enter the hands of retail users. Currently, the main RWA TVL is concentrated in US Treasury bond-related products. US Treasury bonds, as the most market-consensus, stable-income, and liquid asset class, have been adopted by many DeFi protocols and crypto asset investors in the context of a macro bear market.

We observe that the main RWA holdings are in the hands of institutions and protocols, either for direct short-term liquidity management needs or to structure products based on underlying financial assets (which will be covered in the "Innovative Business" section later). By directly observing on-chain data, we can query the current major US bond-related token holdings. The data comes from Ondo Finance OUSG, Maple Finance USDC Cash Management, Backed Finance bIB01/bIBTA, OpenEden Tbill, and MatrixDock STBT token on-chain information. It is found that 29.1% (valued in USD) of the tokens are held in multi-signature addresses, which can be understood as being held by institutions/companies. 16.9% (valued in USD) is held in contracts, for DeFi applications such as the Ondo Finance OUSG token in the lending platform Flux Finance. These DeFi projects design ways to transmit the returns of RWAs to the DeFi ecosystem in a permissionless manner through lending and other methods. In addition, 53.9% (valued in USD) is held in EOA addresses. Considering that companies/institutions hold assets through MPC wallets, third-party custody, or hardware wallets, the on-chain address format still appears as EOA addresses, so a larger proportion of the tokens are held by institutions.

图 6: Distribution of US Treasury Bond Token Holdings by Address Type, Source: Dune Analytics, 21co, Data as of November 27, 2023

Summary of RWA Current Situation: Transition from B2B to B2B2C Model

In the short term, we believe that direct sales of RWA assets will continue to be primarily B2B. We can also see that RWAs are being combined with DeFi to serve as underlying assets for various structured products. Examples include Angle Protocol (underlying asset is Backed Finance bC3M), Spark Protocol (underlying asset is US Treasury bonds purchased through a trust structure from MakerDAO), USDV (underlying asset is MatrixDock STBT), T Protocol (underlying asset is MatrixDock STBT), Mantle mUSD (exchangeable for Ondo Finance USDY), and Flux Finance (collateralized by Ondo Finance OUSG), implementing the B2B2C model. These combinations, while meeting compliance requirements, can accelerate the promotion and practical application of RWA.

Figure 7: RWA Asset Supply Chain

VI. Dilemma: Why Can Only Target Qualified Investors?

Apart from a few projects that have implemented RWA issuance schemes targeting retail investors within certain restrictions through compliance with specific local laws, issuing special prospectuses, and specific securities registrations (details can be found in the RWA Innovation module), most RWAs in the current market can only target qualified investors. According to regulations in different regions, investors are required to have a certain amount of financial assets to be considered qualified investors, such as Singapore's requirement of 1 million SGD (approximately 730,000 USD) in personal financial assets.

The reason why most RWA products, including US Treasury bond-related products, can only target qualified or institutional investors is that issuing securities to retail investors through compliance would incur high costs.

These costs stem from the lack of correlation between the underlying assets and the tokens ultimately issued. Relevant securities laws have strict requirements for issuing securities to retail investors, including the preparation and registration of prospectuses. Additionally, laws in most jurisdictions stipulate that ownership of stocks and bonds, among other assets, needs to be recorded in a specific manner (e.g., in a register maintained by the issuer). Currently, regulatory authorities do not accept tokens and blockchain as direct tools for ownership registration, meaning that under these laws and regulations, token ownership cannot directly represent ownership of the underlying assets.

For RWAs issued using the asset-backed model, such as RWA tokens with US Treasury bonds as underlying assets, there needs to be a "bridge" between the underlying assets and the expected RWA tokens. The RWA token is a new security, and this "bridge" can be established by treating the RWA token as its own independent security. However, this also means that the RWA token needs to independently comply with all relevant securities laws, meaning the issuer needs to prepare and register a prospectus for the RWA token as a security.

To understand this, we can look at the traditional process of issuing securities to retail users. Whether issuing stocks or bonds, it involves:

- Internal company preparation stage, determining the characteristics of the company's securities, selecting and hiring investment banks (underwriters), and other financial professionals such as lawyers and accountants to assist in the IPO process.

- Selection of underwriters. Underwriters assist the company in preparing and executing the bond issuance.

- Due diligence, auditing, and rating (for bonds), reviewing internal controls and governance structures to ensure compliance; for bonds, the rating will affect the credit quality of the bonds.

- Prospectus. If targeting retail investors, the prospectus must be approved by regulatory authorities to ensure investors have sufficient information.

- Pricing, determining valuation and issuance terms in collaboration with underwriters.

- Marketing, conducting roadshows, interacting with potential investors, explaining the company's business, etc.

- Issuance and listing, complying with exchange listing requirements and standards.

- Post-transaction management, such as financial disclosure and announcements.

It can be seen that if securities-type assets are to be sold to retail investors, they need to go through a complex process. In these processes, two reasons make it difficult for RWAs to directly target retail investors:

- High costs and insufficient returns. The entire process of issuing securities to retail investors would incur costs in the millions of dollars and require regulatory approval. The overall size of the crypto market is relatively small compared to traditional markets, unable to meet large-scale financing needs. Therefore, the high cost of compliant issuance and insufficient returns.

- Inadequate infrastructure. Tokens do not have compliant securities exchanges to provide trading services, and securities registration agencies do not currently support tokens as a means of ownership registration, and so on.

To avoid such high costs and trading friction, issuers can only offer products to qualified and institutional investors. The mainstream RWA assets in the current crypto market are established by SPVs set up by startup companies. If traditional capital market securities, such as US Treasury bonds, are used as underlying assets and issued using the asset-backed model, investors purchasing these issued bonds are essentially buying corporate bonds issued by the SPV with US Treasury bonds as underlying assets, resulting in very high counterparty risk. This means that US Treasury bonds, originally rated AA+, become BBB-rated corporate bonds through this structure. Other directly issued corporate bonds are mostly issued by smaller companies and have not gone through a complete issuance process targeting retail investors, saving costs, and resulting in only targeting qualified investors.

VII. Driving Forces: Bidirectional Pursuit from the Real World and the Crypto World

RWA is related to both the real world (traditional financial world for securities products) and the crypto world. From the performance of current market participants, there are sufficient driving forces on both sides.

Driving forces from the traditional world:

- Cost reduction and efficiency improvement using new financial infrastructure. Blockchain consensus mechanism-based ledger synchronization technology simultaneously ensures security and significantly reduces the time and cost of financial transaction settlement.

- Self-custody. After experiencing the collapse of multiple banks/financial institutions, the black box of traditional finance is no longer trusted; the self-custody property of crypto assets is beginning to be favored by mainstream capital.

- Asset flexibility. Tokenized assets have penetrability on-chain and can seamlessly integrate with on-chain applications, providing users with a better experience, such as lending, trading, staking, etc., and even programmability of assets through smart contracts.

- Real-time settlement. Trading and lending are achieved through on-chain smart contracts, without intermediaries, and assets are settled and cleared directly on-chain, without complex and dispersed accounting systems, achieving real-time settlement and significantly reducing time costs.

- Transparency and traceability. Transaction records are real-time, public, transparent, and traceable, enabling real-time analysis and monitoring.

- Globalization. Through DeFi infrastructure, investors have the opportunity to easily access global assets.

Driving forces from the crypto world:

- On-chain asset management demand. On-chain asset management seeks stable returns and good liquidity, and financial products such as US Treasury bonds are widely recognized investment targets.

- Seeking alternative sources of income. Native on-chain income mainly comes from staking rewards, trading fees, and lending interest. The decrease in on-chain financial activity during a bear market leads to varying degrees of decline in these three types of income. If seeking income with low correlation to on-chain native assets, RWA-related assets need to be introduced.

- Portfolio diversification. Investing solely in on-chain assets is very monotonous and has high correlation and high volatility. Introducing RWA assets that are more stable and unrelated to on-chain native assets can hedge and form a more diverse and effective investment portfolio strategy.

- Introducing diversified collateral. The high correlation of on-chain assets leads to the vulnerability of lending protocols to runs or large-scale liquidations, further exacerbating market volatility; introducing RWA assets with low correlation to on-chain assets can effectively mitigate such issues.

In the overall macro background, DeFi assets lack yield; at the same time, the yield of DeFi assets fluctuates greatly, making it difficult to provide certainty. In comparison, traditional financial products are more diverse and multi-faceted, with better hedging capabilities, and can provide more stable returns. Therefore, DeFi protocols and Web3 institutions are turning their attention to RWA.

Due to the smooth operation of the legal framework and product processes in the early stage, RWA is mainly in the form of bonds in the short to medium term, until the next development cycle due to new market demand. We expect a continued demand for RWA assets, especially bond-type assets, in the crypto world before the arrival of the risk asset market. The main demand comes from the need for short-term cash management and the transmission of returns to retail users through DeFi protocols to meet the liquidity management needs of retail users. Demand for RWA assets will weaken during the bull market of risk assets, and there will also be new RWA assets with higher risk and higher returns to compete with native crypto assets.

The trend of building a new generation of capital markets with blockchain and smart contracts at its core will not reverse once established.

VIII. Global Regulation: United States, Europe, and Asia

Given that most RWA assets are tokenized securities, RWA tokens will be regulated by the relevant securities laws of various jurisdictions. As the United States is one of the few jurisdictions that explicitly stipulates the extraterritorial effect of its securities laws, the crypto industry may be more aware of and cautious about US securities laws. The US securities laws apply to any securities offered to or by US residents. To address the former, most RWA tokens specifically emphasize that they are not sold to US residents. To address the latter, any RWA tokens issued by US-based companies need to register their issuance with the US Securities and Exchange Commission, or (more likely) utilize one of the registration exemptions. Some examples of such exemptions include Regulation A/D (small offering) and Regulation S (offering made outside the US).

Regulation A (Reg A): Often referred to as a "mini IPO".

- Reg A Tier 1: Allows companies to raise up to $20 million within 12 months, with lower ongoing reporting requirements, and can be offered to both accredited and non-accredited investors.

- Reg A Tier 2: Allows companies to raise up to $75 million within 12 months, with stricter ongoing reporting requirements, and can be offered to both accredited and non-accredited investors.

Regulation D (Reg D): Provides exemptions from full SEC registration requirements for certain private securities.

- Rule 504: Allows companies to raise up to $5 million within 12 months and can be offered to both accredited and non-accredited investors.

- Rule 505: Allows companies to raise up to $5 million within 12 months, but is typically limited to accredited investors and a maximum of 35 non-accredited investors. Non-accredited investors need to provide certain financial disclosures.

- Rule 506(b): Allows for unlimited fundraising from accredited investors and a maximum of 35 non-accredited investors. General solicitation or advertising is prohibited.

- Rule 506(c): Allows general solicitation or advertising, but limits the offering to accredited investors only.

Regulation S (Reg S): Provides an exemption from US securities law registration requirements for offerings made to non-US persons in compliance with foreign jurisdiction regulations. While Reg S offerings are primarily aimed at non-US retail investors, US issuers can also participate in Reg S offerings as long as they comply with the relevant rules and restrictions.

Unlike the US, the EU and Asia do not have a comprehensive securities framework - instead, securities laws will vary by specific jurisdiction. Within the EU, Switzerland notably supports tokenized securities and is one of the few countries to recognize and regulate tokens as valid proof of ownership through Digital Ledger Technology (DLT) laws.

In Asia, Singapore and the Hong Kong Special Administrative Region of China, historically centers of traditional finance, are also at the forefront. The Singapore government has expressed support for asset tokenization multiple times. It is reported that Hong Kong plans to release guidelines for the issuance of security tokens in the near future.

IX. Key Participants: Participation Paths, Models, and Current Situation

MakerDAO

MakerDAO is a stablecoin protocol that generates stablecoins through collateralized assets. As the DeFi protocol with the largest on-chain RWA holdings, MakerDAO uses RWA as collateral to generate the new stablecoin Dai. Although most of MakerDAO's RWA holdings are currently purchased through off-chain methods, the discussion is that RWA is difficult to leave MakerDAO.

As early as 2021, MakerDAO began to introduce RWA assets as collateral, making it one of the earliest projects to combine RWA and DeFi. MakerDAO initially collaborated with the lending protocol Centrifuge to bring off-chain assets onto the chain as collateral to generate new Dai.

Since the assets issued by Centrifuge belong to private credit (private credit issued by small companies, as large companies have traditional, mature financing models), they often have a higher default risk. For example, the lending pool ConsolFreight related to freight agent invoices defaulted, causing a $1.84 million risk exposure to MakerDAO.

MakerDAO proposed the idea of purchasing US Treasury bonds as collateral for Dai in early 2022, with the initial demand hoping that USDC in the Dai peg stability module (PSM) could generate income for the protocol. This led to two projects launched in 2022, Monetails Clydesdale, and in 2023, BlockTower Andromeda; both use off-chain trust structures with beneficiaries being MakerDAO MKR and DAI holders to purchase money market funds, US Treasury bonds, or US Treasury bond ETFs. These two projects currently have over $2 billion in related asset purchases and use these assets as collateral to generate Dai. For the implementation method and trust structure of Monetails Clydesdale, please refer to the previous MakerDAO RWA report written by DigiFT.

Currently, the MakerDAO community is considering the possibility of tokenizing US bond products, with strategic consulting advisor Steakhouse proposing the idea and receiving proposals from multiple platforms.

MakerDAO passes the returns from the US Treasury bonds to Dai holders through the Dai Saving Rate (DSR) of Spark Protocol. The DSR was previously raised to 8% and maintained for about a month, attracting a large amount of assets (mainly USDC) to be minted into Dai. The DSR rate has now been lowered, with 1.62 billion Dai in the DSR pool.

Jurisdiction: Decentralized organization

Product: sDai (Dai stable coin in DSR)

Issuance model: Off-chain trust model

Investor requirements: No permission required

DeFi Protocol Integration: The lending protocol Spark Protocol, among others, indirectly gains RWA returns through direct investment in sDai.

DigiFT

Established in Singapore in 2021, DigiFT is the first licensed on-chain real-world asset exchange, certified by the Monetary Authority of Singapore as an approved market operator and holding a capital markets services license.

DigiFT allows asset owners to issue blockchain-based security tokens and provides liquidity through various channels, including innovative automated market maker (AMM) trading mechanisms, over-the-counter (OTC) trading, and peer-to-peer (P2P) trading. Investors can engage in continuous liquidity trading through the AMM mechanism and retain control of the digital asset tokens in their wallets.

Currently, DigiFT offers various products, including the single US Treasury bond token DUST, US Treasury bond funds, bank notes, and compliant ETH collateral products.

- Jurisdiction: Singapore

- Products: Single US Treasury bond token DUST, US Treasury bond fund tokens, bank note tokens, compliant Ethereum collateral tokens, etc.

- Supported currencies: USDC, USD

- Issuance model: Asset-backed model, direct issuance model

- Investor requirements: Accredited investors and institutional investors

- DeFi Protocol Integration: No current DeFi protocol integration

Backed Finance

Backed Finance is a platform for tokenizing RWA, such as ETFs, stocks, and other real-world assets, and enabling their transfer on-chain. Tokens issued by Backed Finance track the prices of underlying assets and are backed 1:1 by the underlying assets. Backed Finance aims to build a decentralized platform that can integrate with various DeFi protocols and support multiple blockchains.

The token design of Backed Finance is unique, with no whitelist mechanism, allowing users to freely transfer tokens after purchase. Tokens can be sold on-chain through licensed resellers, and some tokens previously had liquidity on Uniswap. The specific implementation will be detailed in the "Innovation Module."

- Jurisdiction: Europe

- Products: US Treasury bond ETF tokens, Eurozone government bond ETF tokens, stock tokens, etc.

- Supported currency: USDC

- Issuance model: Asset-backed model

- Investor requirements: Purchase: accredited investors; redemption: retail investors after KYC; secondary market purchase: no permission required

- DeFi Protocol Integration: Angle Protocol integrates Eurozone government bond ETF token bC3 M as collateral to generate its Euro stablecoin

Ondo Finance

Ondo Finance offers tokenized ETFs, including bond funds, US Treasury bond funds, and US money market funds, primarily targeting accredited investors. Ondo Finance's main product is the short-term US Treasury bond fund token OUSG.

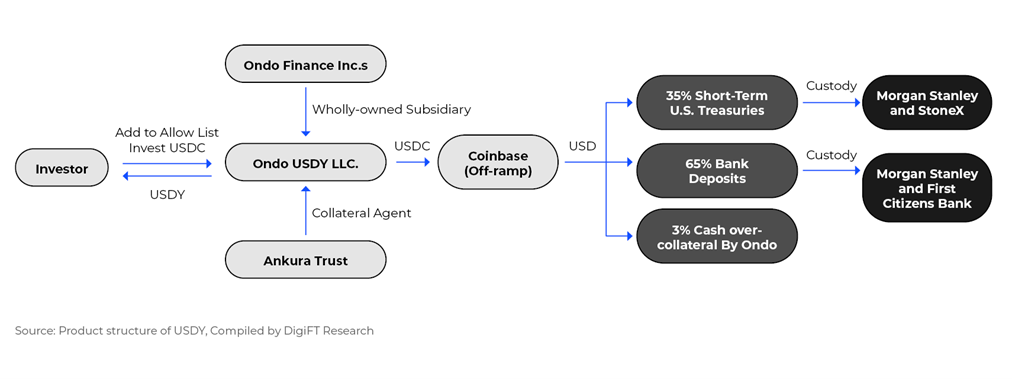

Ondo Finance issued U S DY in August 2023, with underlying assets in short-term US Treasury bonds and bank current deposits. USDY, registered under SEC Reg S, can be sold to non-US retail investors.

- Jurisdiction: United States

- Products: US Treasury bond ETFs, US money market funds, high-yield bonds

- Supported currency: USDC

- Issuance model: Asset-backed model

- Investor requirements: Accredited investors; non-US retail investors (USDY)

- DeFi Protocol Integration: Layer 2 network Mantle integrates USDY into its on-chain decentralized exchange; Ondo Finance integrates with Flux Finance lending platform to provide lending services for OUSG holders

Maple Finance

Maple Finance is a lending platform that selects pool delegators through DAO voting to manage the use of funds in the pool, connecting borrowers and lenders.

- Jurisdiction: United States

- Products: Various lending products, underlying assets include government bonds, accounts receivable, etc.

- Supported currency: USDC

- Issuance model: Asset-backed model

- Investor requirements: Main products, such as US Treasury products (Cash Management), target accredited investors and institutional investors; some lending pools have no investor restrictions

- DeFi Protocol Integration: UXD Protocol purchases Maple Cash Management products as collateral to generate stablecoins

Centrifuge

Centrifuge is an RWA lending infrastructure that provides on-chain financing for real-world assets, building a lending capital market. Asset originators set up a special purpose vehicle on Centrifuge to establish a fund pool, tokenize RWA assets on-chain through NFTs, lock them in the fund pool as collateral, and generate tokens for investors to subscribe to. Centrifuge collaborated with MakerDAO in 2021 to introduce RWA assets as collateral into MakerDAO. MakerDAO is the largest buyer of assets on the Centrifuge platform.

- Jurisdiction: Determined by the issuer of its products

- Products: Asset-backed bonds of various RWAs, such as accounts receivable, emerging market corporate bonds, etc.

- Supported currency: Dai

- Issuance model: Asset-backed model

- Investor requirements: Open to individual investors (requires KYC); US-based investors need to meet accredited investor requirements

- DeFi Protocol Integration: Multiple RWAs are used as collateral to generate the stablecoin Dai in MakerDAO

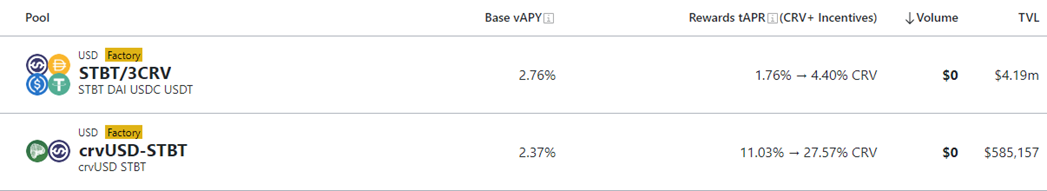

MatrixDock

MatrixDock is a platform that invests in real-world assets and provides digital asset financial products and services to accredited investors. Its main product, STBT, offers holders returns from US Treasury bonds, with the underlying assets being a basket of short-term US Treasury bonds. It is designed with dynamic rebase rules, anchoring each STBT token to 1 USD, and updating the token balance daily to reflect its returns. STBT supports Chainlink's Proof of Reserve to ensure sufficient reserves of underlying assets, gaining investors' trust.

- Jurisdiction: Seychelles

- Products: STBT

- Supported currency: USDC

- Issuance model: Asset-backed model

- Investor requirements: Targeted at accredited investors and institutional investors

- DeFi Protocol Integration: STBT can be traded on the decentralized exchange Curve on Ethereum; DeFi lending protocol TProtocol integrates STBT to provide a lending fund pool for the token; stablecoin project Verified USD issues USD V with STBT as the underlying asset.

OpenEden

OpenEden is a platform that builds on-chain short-term US Treasury bond products through a structure of bankruptcy isolation. Its only product currently is TBILL VAULT. OpenEden operates and manages through a professional fund registered in BVI, investing in short-term US Treasury bonds and holding the bonds in compliant institutional custody.

- Jurisdiction: BVI

- Products: TBILL

- Supported currency: USDC

- Issuance model: Direct issuance model

- Investor requirements: Targeted at accredited investors and institutional investors

- DeFi Protocol Integration: UXD Protocol purchases OpenEden Tbill products as collateral to generate stablecoins

Securitize

Securitize operates in the private fund market and is relatively unique. It consists of Securitize, Inc and its subsidiaries. The subsidiary Securtize Markets is a broker-dealer, a FINRA member, and an SEC-registered ATS (Alternative trading system, acquired through acquisition), capable of conducting primary market issuance and secondary market trading. The subsidiary Securitize LLC is an SEC-registered transfer agent, able to use blockchain technology to trade and record asset ownership.

Securitize collaborates with multiple funds and brokerages to issue tokenized funds, primarily targeting accredited investors and institutional investors, with a direct issuance model.

- Jurisdiction: United States

- Products: Mainly various funds

- Supported currency: USDC

- Issuance model: Direct issuance model

- Investor requirements: Primarily targeted at accredited investors and institutional investors

- DeFi Protocol Integration: None

Goldfinch

Goldfinch is a decentralized credit protocol that allows borrowers to issue asset-backed securities using off-chain assets as collateral, borrowing USDC from the pool. Users provide liquidity to the pool by investing USDC to earn returns, effectively purchasing senior bonds with lower default risk. Additionally, backers purchase junior bonds to assume higher default risk. Goldfinch's main borrowers come from third-world countries with high growth potential.

- Jurisdiction: United States

- Products: Asset-backed bonds

- Supported currency: USDC

- Issuance model: Asset-backed model

- Investor requirements: Targeted at accredited investors in the US and non-US retail investors

- DeFi Protocol Integration: None

Data Observation

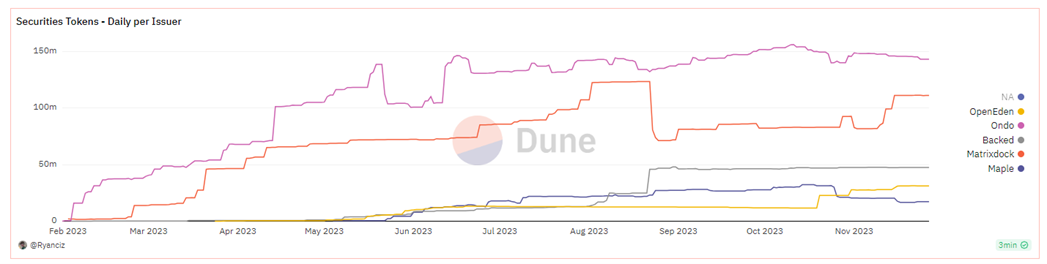

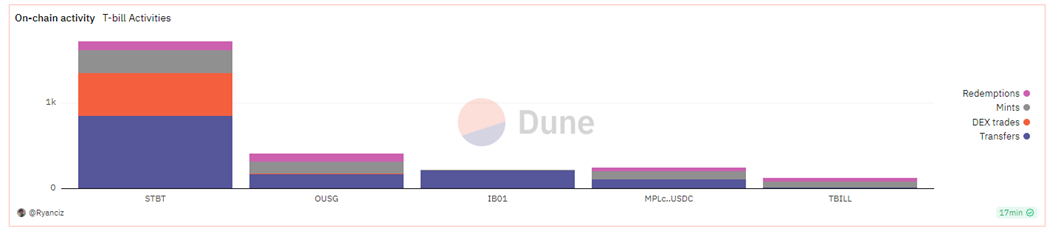

The participants in the RWA track of the above-mentioned crypto market currently have TVL mainly concentrated in US Treasury bond-related products. Therefore, we observe the participation of issuers and investors in the market with a focus on US Treasury bond products. The data mainly includes: MatrixDock (STBT), Maple Finance (Cash Management USDC), Openeden (TBILL), Backed Finance (bIB01), and Ondo Finance (OUSG) since their issuance.

This section's data is as of November 27, 2023, and some tokens are deployed on multiple chains, but this report only looks at data on the Ethereum blockchain.

Figure 19: TVL of MatrixDock (STBT), Maple Finance (Cash Management USDC), Openeden (TBILL), Backed Finance (bIB01), Ondo Finance (OUSG) since issuance

Figure 20: On-chain activities of MatrixDock (STBT), Maple Finance (Cash Management USDC), Openeden (TBILL), Backed Finance (bIB01), Ondo Finance (OUSG) since issuance

Where:

MatrixDock STBT (issued in January 2023):

- Total supply: 111.29 million USD

- Number of holding addresses: 163

- Average purchase amount: 836,721 USD

- Average redemption amount: 1,076,914 USD

- Total number of purchases: 266

- Total number of redemptions: 106

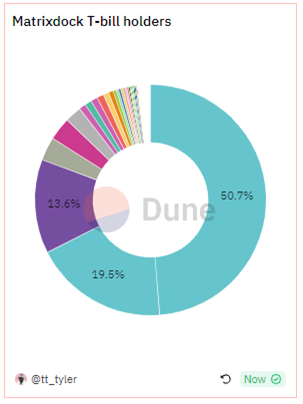

Figure 21: MatrixDock STBT holding distribution

Openeden TBILL (issued in March 2023):

Total supply: 11.64 million USD

Number of holding addresses: 28

Average purchase amount: 219,186 USD

Average redemption amount: 68,720 USD

Total number of purchases: 67

Total number of redemptions: 43

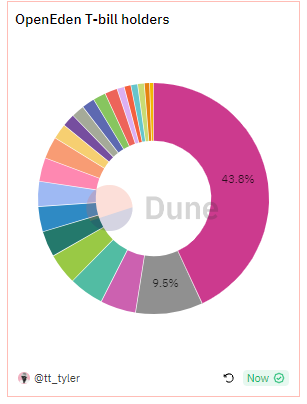

Figure 22: Openeden Tbill holding distribution

Maple Finance Cash Management USDC (issued in May 2023):

- Total supply: 17.23 million USD

- Total number of holding addresses: 20

- Average purchase amount: 472,312 USD

- Average redemption amount: 692,152 USD

- Total number of purchases: 98

- Total number of redemptions: 42

Figure 23: Maple Finance Cash Management USDC holding distribution

Backed Finance bIB01 (issued in March 2023):

- Total supply: 46.27 million USD

- Total number of holding addresses: 27

- Average purchase amount: 3,855,531 USD

- Average redemption amount: No redemption transactions yet

- Total number of purchases: 12

- Total number of redemptions: No redemption transactions yet

Figure 24: Backed Finance bIB01 holding distribution

Ondo Finance OUSG (issued in January 2023):

- Total supply: 143.43 million USD

- Total number of holding addresses: 61

- Average purchase amount: 1,424,793 USD

- Average redemption amount: 1,494,384 USD

- Total number of purchases: 191

- Total number of redemptions: 92

Figure 25: Ondo Finance OUSG holding distribution

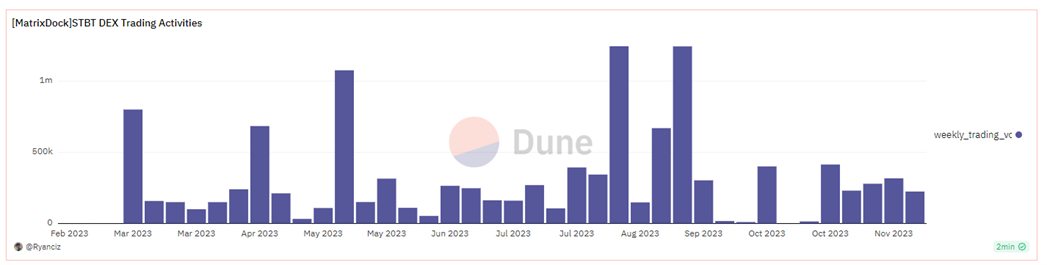

Additionally, MatrixDock's STBT has deployed liquidity on the decentralized exchange Curve, with approximately 4.8 million USD in liquidity, enough to support transactions of up to 100,000 USD, converting STBT to USD stablecoins such as DAI, USDC, or USDT.

Figure 26: MatrixDock STBT liquidity deployment on Curve, Source: Curve.fi, data as of November 27, 2023

As of November 27, 2023, there have been a total of 514 transactions on Curve for STBT, with a total transaction volume of 11,819,420 USD, averaging 22,995 USD per transaction. There is a transaction volume of several hundred thousand USD per week.

Figure 27: MatrixDock STBT weekly transaction volume data, Source: Dune.com, compiled by DigiFT, data as of November 28, 2023

Backed Finance uses an anonymous securities structure to issue its government bond token bIB01. The token does not have a whitelist design, and the on-chain transfers are relatively active, with a total of 207 transfers.

From the above data, we can observe that:

US Treasury bond tokens are generally held in large amounts and for the long term. The frequency and amount of purchases/redemptions are relatively low.

There is a demand for secondary market trading. Most government bond tokens require more than T+2 time to process purchases and redemptions, and there is a lack of on-chain secondary market trading scenarios for security-type tokens. Currently, only STBT has liquidity on Curve, and interaction requires whitelisted addresses. Based on the STBT trading situation, compared to purchase/redemption operations, the volume of individual transactions in the secondary market is smaller, but the frequency of trading is higher.

Government bond token holdings are relatively concentrated. The top three addresses for each of the five projects account for over 50% of the total supply.

X. Innovative Business Models in RWA: Integrating RWA with DeFi

Due to the fact that most securities-type RWA assets can only be offered to accredited investors, the market space is very limited. Many RWA protocols are exploring innovative business models from legal and operational perspectives to integrate RWA into DeFi, allowing users to obtain returns from US Treasury bonds in a permissionless manner, or to build infrastructure similar to an on-chain money market fund.

Lending Model: Ondo OUSG - Flux Finance

Ondo Finance has designed a lending protocol, Flux Finance, for its US Treasury bond token OUSG. Flux Finance replicates the code of the Compound V2 lending protocol and has made a series of modifications to support whitelisted assets as collateral and to modify its interest rate curve and collateralization ratio to adapt to the characteristics of OUSG. Currently, the only collateral on Flux Finance is OUSG, with a collateralization ratio of 92%.

The other end of the lending protocol is permissionless, allowing any DeFi user to participate. Users can deposit stablecoins into Flux Finance's lending pool to earn interest on the borrowed funds. Currently, Flux Finance supports four stablecoins: Frax, USDC, USDT, and DAI, with a utilization cap of 90%. OUSG holders can borrow stablecoins from Flux Finance by collateralizing OUSG, gaining liquidity. Flux Finance keeps the borrowing interest rate below the returns of OUSG, and through the lending model, it transfers the returns from holding OUSG to USDC holders in a permissionless manner, while the pool maintains 10% liquidity for users to withdraw at any time.

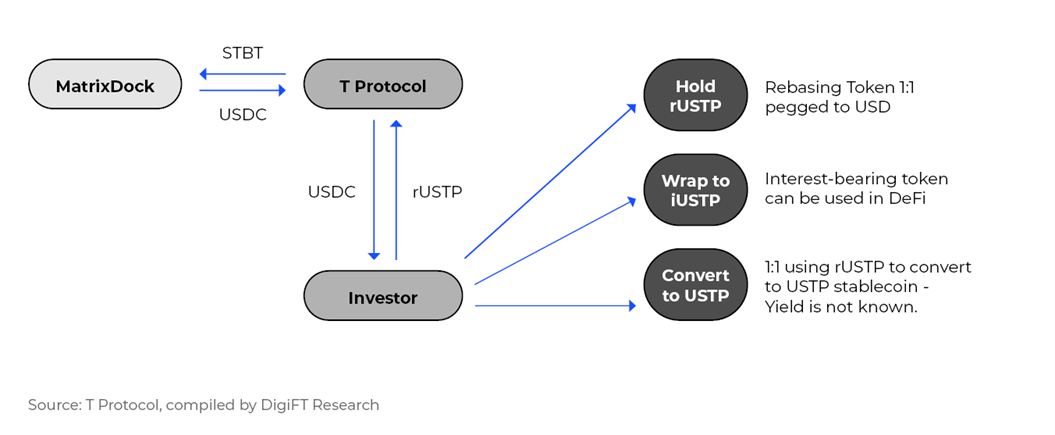

Token Wrapping and Lending Model: MatrixDock - TProtocol

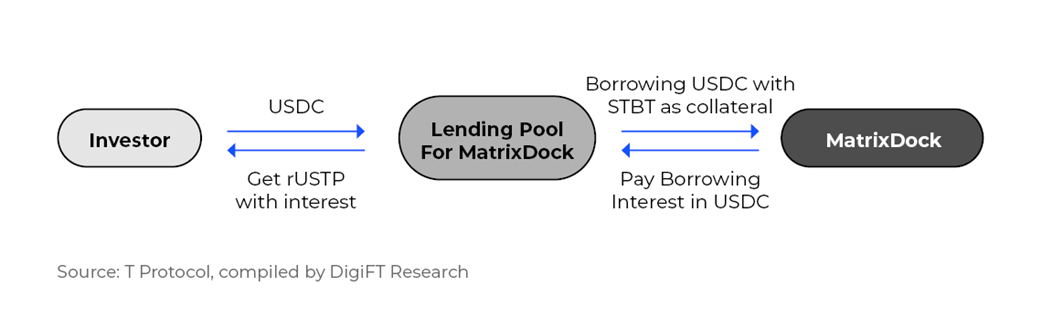

Recently, T Protocol announced a collaboration with MatrixDock to provide a lending pool in T Protocol V2's lending protocol for MatrixDock and to help MatrixDock transmit the returns of its US Treasury bond token STBT to DeFi applications.

TProtocol v1

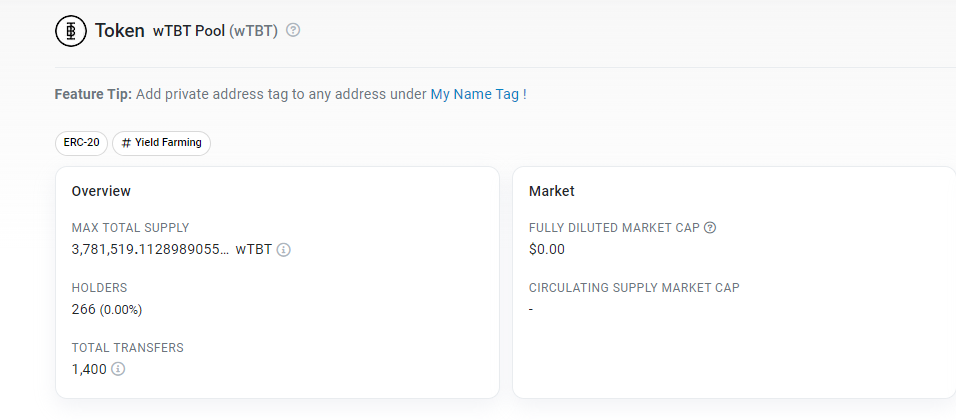

Previously in TProtocol V1, it achieved permissionless sales of its US Treasury bond token by wrapping MatrixDock STBT for secondary trading. TProtocol used the purchased STBT as collateral to issue the corresponding token wTBT, which follows the changes in the amount of STBT held, but without whitelist restrictions, allowing better integration with various DeFi applications. It can also interact with different blockchains through cross-chain bridges. The corresponding token wTBT currently has a circulation of 3.7 million.

Figure 28: T Protocol V1 wTBT token, Source: Etherscan, data as of November 27, 2023

TProtocol v2

Figure 29: T Protocol V2 product flowchart

In September 2023, TProtocol and MatrixDock reached a collaboration to provide a lending pool for MatrixDock's STBT. MatrixDock STBT is a token with a dynamic adjustment (rebasing) mechanism, with each STBT pegged to 1 USD. The underlying assets of STBT are a basket of short-term US bonds and money market funds, providing returns to holders, which are reflected in a dynamic adjustment (rebasing) mode, updating the token quantity daily based on the underlying asset prices.

In the future, TProtocol will open lending pools for relevant collaborating institutions, currently supporting only MatrixDock STBT. Users can deposit USDC into this lending pool and receive a corresponding amount of rUSTP tokens. Holders of MatrixDock STBT can borrow USDC by collateralizing STBT at a 99% loan-to-value ratio (LTV).

The interest rate provided to USDC users in the lending pool is variable and will not exceed the interest rate of STBT itself. The protocol is designed to pass on as much interest as possible to USDC users.

The rUSTP tokens received by depositing USDC are rebasing tokens, with each rUSTP pegged to 1 USD. The interest rate is reflected through daily quantity increases; theoretically, based on the design of the lending rate, the yield of rUSTP will follow the yield provided by STBT.

MatrixDock currently holds a certain amount of USDC in the lending pool. If users need to redeem their USDC, they will first be redeemed through these USDC. If the amount is insufficient, direct selling of STBT on Curve will be used. For larger redemption volumes, redemption through STBT on MatrixDock will be implemented, requiring T+3 days for redemption based on the current design.

rUSTP can be converted into USTP, a stablecoin without yield. The remaining interest income does not specify where it will go (possibly to TProtocol itself). Users can also exchange it for iUSTP based on the internal exchange rate, which is an interest-accumulating token. The quantity of the token itself does not change, and its value accumulates over time, integrating better with various DeFi protocols.

The overall process is as follows:

Figure 30: T Protocol V2 product flowchart

TProtocol V2 adopts a lending model to avoid the direct introduction of potential compliance issues with securitized tokens, similar to Ondo Finance and Flux Finance. According to TProtocol's documentation, users will be able to deposit USDC into pools managed by different institutions in the future, earning returns from RWA assets, backed by a stablecoin supported by RWA tokens.

RWA-based Stablecoin: MatrixDock - USDV

The stablecoin project USDV (Verified USD) is backed by STBT as the underlying asset, issuing the RWA-based stablecoin USDV. Compared to centralized stablecoin issuers like Circle and Tether, RWA-based stablecoins have more transparency with on-chain assets as the underlying assets, providing a more stable credit foundation for the stablecoin.

Typically, stablecoin issuers receive USD, mint the corresponding amount of stablecoins, and use the USD to purchase US Treasury bonds or high-rated bank bonds as one of their sources of income. Some stablecoin issuers, such as Circle, distribute a certain percentage of the income to ecosystem partners. USDV follows a similar approach, directly sharing the income from the underlying assets through smart contracts with ecosystem participants to drive the stablecoin ecosystem, such as minters, market makers, and liquidity providers.

Holders of STBT, after KYC verification, can become minters of USDV, depositing STBT into the contract to mint new USDV. USDV, through a special coloring design similar to Bitcoin's UTXO mechanism, can identify the minters of this portion of stablecoins on-chain. The income generated from the dynamic adjustment of the corresponding quantity of underlying assets STBT will be retained in the contract, with 50% of the income distributed to the minters of these stablecoins, and the remaining 50% distributed to market operators and liquidity providers. These market participants of USDV can earn income or further incentivize the development of the ecosystem based on this income.

Bearer Instruments: Backed Finance Bearer Instrument Design

The above solutions involve wrapping and lending to transfer income to DeFi protocols through another associated party in a permissionless manner, while retaining the original entity's compliance requirements. The model of Backed Finance and the subsequent Ondo Finance USDY is more of a breakthrough in terms of legal and regulatory aspects.

Before understanding the implementation of Backed Finance, let's first understand registered instruments and bearer instruments:

Registered instruments: Generally, the negotiable instruments circulating in the market, especially securities-type assets, are registered instruments, where the issuer or an authorized registrar needs to register the holder of the instrument for each transaction and transfer.

Bearer instruments: The issuer or registrar only needs to know the identity of the holder of the instrument when needed, such as during purchase/redemption/trading. Real-time recording of the holder of the instrument is not required during the circulation process.

Backed Finance issues "tracker certificates," a derivative to track the price of underlying real-world assets. Each token represents a "tracker certificate," and token holders have related rights to the value of the underlying assets in the contract.

Backed Finance has registered the "base prospectus" of the "tracker certificates" with the financial market supervisory authority in Liechtenstein. As Backed Finance is a company registered in Switzerland, under Swiss law, Backed Finance can only promote to qualified investors. "Authorized participants," licensed banks, securities firms, and non-Swiss regulated financial institutions, can purchase products from Backed Finance and sell them to retail clients after KYC verification. On the Backed Finance platform, token purchases are only available to qualified professional investors, but retail investors who purchase Backed Finance-related products from elsewhere can also redeem them after KYC verification by Backed Finance.

In the prospectus, the tokens issued by Backed Finance are designed as bearer instruments, with only a blacklist mechanism in the token contract design. Therefore, after issuance, transfers can be made without permission, or directly interact with various DeFi protocols. Identity authentication is only required during the purchase and redemption process with Backed Finance.

Figure 31: Transaction records of Backed Finance tokens on Ethereum, showing liquidity on Uniswap, Source: Etherscan, data as of November 27, 2023

Looking at the subscription and redemption situation, there are only two subscription addresses for the Backed Finance short-term government bond ETF token bIB01, with no redemptions. After subscription, the tokens were transferred to other investors, indicating that the two addresses mentioned might be authorized dealers transferring Backed's tokens to DeFi protocols or users. Tokens sold through dealers may only need to meet KYC requirements, bypassing the restrictions that end users, such as qualified and institutional investors, might encounter.

Interest-bearing Stablecoin: Ondo USDY - Mantle

The newly launched USDY by Ondo Finance is now available on the Layer 2 network Mantle as an interest-bearing stablecoin. Users on the Mantle network will be able to directly purchase USDY on DEX. While Backed Finance embeds RWA into DeFi through special European laws, Ondo Finance has chosen a different approach.

Figure 32: USDY product structure diagram

USDY is issued by Ondo Finance Inc.'s wholly-owned subsidiary Ondo USDY LLC. and is a bankruptcy-isolated SPV. USDY is a token backed by short-term US government bonds and bank demand deposits, registered under US RegS, allowing sales to non-US retail users under certain restrictions. Currently, there is a restriction on USDY, with a lock-up period of 40 to 50 days after sale, meaning users have to wait for the lock-up period to end after subscription before receiving the on-chain tokens, and cannot sell to US investors within one year.

The Ethereum-based USDY token contract includes a whitelist and blacklist design. Unlike other RWA token designs, the whitelist design for USDY is unique, allowing anyone to add their address to the whitelist by calling the contract, creating a transaction similar to authorization. The USDY website directly provides the function to send this transaction, and after checking the IP address, users can agree to the terms and add their address to the whitelist without the need for KYC. Additionally, the USDY token contract is associated with a legal document stored on IP FS, indicating that users, by adding their address to the whitelist, are also agreeing to the legal terms.

Currently, USDY is an interest-accumulating token, accumulating returns over time. Ondo Finance later released USDY and mUSD on Mantle, removing the whitelist and retaining only the blacklist function. mUSD is a stablecoin pegged to the dollar and operates in a dynamic adjustment (rebase) mode, adjusting the balance periodically. mUSD can be directly exchanged for USDY at the current ratio on the Ondo Finance platform.

The five models mentioned above address the compliance requirements for qualified investors in RWA assets from different perspectives such as technology, business, and law, allowing RWA assets to enter DeFi and reach a broader audience. For RWA project parties, this can increase the sales volume of their platforms, while for DeFi, it adds more asset classes and stable foundational returns, enabling a more diversified range of financial products through asset combinations.

However, regardless of the model used, there are several challenges:

AML restrictions: DeFi protocols cannot prevent non-compliant assets, such as stablecoins from risky addresses, from entering their protocols, while RWA protocols need to convert stablecoins to fiat to purchase real-world assets, often requiring strict KYC and AML compliance. This mismatch may affect some DeFi protocols' efforts to strengthen the scrutiny of fund sources. If more RWAs enter the DeFi space, the compliance of DeFi fund sources will also be strengthened.

Time mismatch: Traditional financial asset markets are open for only five working days a week, for a few hours each day, and are closed on holidays. Asset transactions require settlement through banks, brokerages, and other systems, often taking T+1 or even longer for settlement. DeFi protocols operate 24/7. If there is a need for liquidity, such as market fluctuations during holidays, DeFi protocols need to liquidate assets, and RWA assets will require a longer processing time. Protocols that hold RWA assets need to consider liquidity carefully.

Sales restrictions: Many RWA projects require investors not to be residents of certain countries and regions, possibly due to tax (such as the complex tax system for US residents), AML (sanctioned regions), or the complex financial systems of certain countries and regions. DeFi protocols are likely to sell assets to residents of regions or countries where they should not be sold. Since most RWA assets are defined as securities, they are subject to strict legal restrictions in those regions or countries, leading to sanctions against the RWA project in those areas.

Asset ownership: It is difficult to confirm how RWA protocols complete KYC for RWA protocols, how they store acquired assets, and the legal ownership of RWA assets purchased with stablecoins deposited by users. Generally, DeFi protocols open accounts using foundations or establish SPVs to purchase relevant assets for RWA projects. Legally, the ownership of these RWA assets belongs to the foundation or SPV, with the ultimate beneficiaries being the shareholders behind the foundation or SPV, not the users of the DeFi protocol. However, DeFi users are generally anonymous or use DAO forms, and only have a claim right implemented by code, not a legal claim right. Safeguarding user asset rights is still a challenge.

Conclusion and Future Outlook: Limited Scale, Unlimited Potential

The overall RWA market is still relatively small. If blockchain is expected to serve as the infrastructure for the next generation of capital markets, the current market value of USD stablecoins at one hundred billion USD and US government bond tokens at two billion USD is still a small part compared to traditional financial markets. However, the efficiency and cost advantages demonstrated by blockchain have led traditional financial giants to continue exploring the RWA field. For example, Franklin Templeton and WisdomTree are experimenting with tokenizing US government bonds on Stellar. Although relatively centralized, they are using blockchain as a record, with issuance in the hundreds of millions, which is quite significant.

We expect RWA to continue to develop, with the following considerations:

From the perspective of asset types, we will see more exploration and experimentation in tokenizing financial assets further as RWA assets. In the short to medium term, RWA assets will continue to be dominated by financial assets, with fixed-income products, relatively scarce on-chain, at the core of financial assets.

From the perspective of market supply and demand, RWA assets will compete with native crypto assets. In a macro environment of high interest rates, US government bond products, with strong consensus and considered risk-free assets in USD, will remain core. During rate cuts, the market will favor risk assets, reducing the attractiveness of fixed-income RWA types. However, as the crypto world gains a better understanding of compliance, there will be more compliant issuance of on-chain assets, competing with native crypto assets.

In terms of issuance models, the current mainstream RWA issuance models are asset-backed, effectively adding an additional counterparty risk layer, reducing efficiency. In the future, more direct issuance models of RWA assets will emerge to further realize the efficiency and cost advantages of the on-chain financial system.

As more and more traditional financial institutions explore the direct issuance of assets on public chains, accumulating practical cases and legal regulations through experiments and practices, compliant financial assets will eventually enter the chain.

Section Twelve: Citations and Data Sources

1) BCG, ADDX: Relevance of On-chain Asset Tokenization in ‘Crypto Winter’

2) Binance Research: Real World Assets: The Bridge Between TradFi and DeFi

3) RWA.xyz: Analytics On Tokenized Assets

4) DeFillama: RWA TVL Rankings

5) Steakhouse Financial on Dune.com: Tokenized Public Securities

6) 21co on Dune.com: Tokenization: Government Securities

7) DigiFT Research: Exploration of RWA Issuance Models – Asset-Backed Model and Direct Issuance Model

8) DigiFT Research: How Do DeFi Protocols Adopt Real-world Assets (“RWA”) – An Overview of MakerDAO’s RWA layouts

9) Steakhouse Financial: Tokenized T-Bills Review 2023

10) RWA.xyz: The Spectrum of Tokenization

11) Steakhouse Financial: Tokenized T-Bills Review 2023

12) HashKey: Tokenization of RWA using US Treasury Bonds as an Example

13) Wallfacerlabs on Dune.com: Tokenized T-bills

Special Thanks

Special thanks to Siya Yang, Scarlett Xiao, Amos Song, James Pek, Wee Ping Lim, Evelyn Xiong, Marilyn Cher, and Holly Chen for their help and support. Without their advice and assistance, this report would not have been as comprehensive and complete.

Click here to download the full report.

Feedback on this research report is welcome here.

About DigiFT

DigiFT is the first licensed on-chain real-world asset exchange, certified by the Monetary Authority of Singapore as an approved market operator and holding a capital markets services license. DigiFT enables asset owners to issue blockchain-based security tokens, and investors can engage in continuous liquidity trading through an AMM mechanism.

Established in Singapore in 2021, DigiFT is committed to meeting regulatory requirements in the Singapore capital markets sector with high standards, while providing innovative financial solutions in a responsible manner, pushing the boundaries of financial services. The founding team of DigiFT consists of executives who have held key positions in the financial and fintech sectors at Citibank, Standard Chartered, Morgan Stanley, and the Shenzhen Stock Exchange, with extensive knowledge of blockchain technology and a successful track record in building digital asset exchanges and products.

- Twitter: https://twitter.com/digifttech

- Telegram: https://t.me/digifttech

- Website: https://digift.sg

- LinkedIn: https://linkedin.com/company/digift-tech

About HashKey Capital

HashKey Capital is an institutional asset management company focused on the digital asset and blockchain industry, characterized by its digital-native and global layout, dedicated to helping traditional institutions, Web3 founders, and top talent seize the high-growth opportunities in the blockchain industry. As one of the most influential and largest crypto funds globally, and one of the earliest institutional investors in Ethereum, HashKey Capital has managed over $1 billion in assets since its inception, investing in over 500 projects across various domains, including infrastructure, tools, and applications. With a deep understanding of the global blockchain industry, the HashKey team has built an ecosystem connecting entrepreneurs, investors, developers, community participants, and regulatory authorities.

- Twitter: https://twitter.com/HashKey_Capital

- Website: https://hashkey.capital/

- LinkedIn: https://www.linkedin.com/company/hashkeycapital/

Disclaimer

This article and its content are for informational purposes only and do not replace independent professional judgment. Under no circumstances should the information contained in this article be considered as an offer or solicitation to buy or sell any securities. No part of this article may be copied or redistributed without the prior written consent of DigiFT Tech (Singapore) Pte. Ltd. and HashKey Capital (collectively referred to as the "Companies"). The public information contained in this article is only as of the specified date and may become outdated thereafter. No express or implied representations or warranties are made regarding the fairness, accuracy, or completeness of the information contained in or referred to in this article. The Companies, their advisors, affiliates, or any other person shall not be liable for any loss directly or indirectly caused by this article or its content. All information, opinions, and estimates contained in this material are as of the date hereof and are subject to change at any time without notice. This material should not be considered as advice or recommendation regarding asset allocation or any specific investment.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。