Monthly mobile wallet users: +23%, adjusted stablecoin trading volume: +49%.

Author: a16z crypto

Translated by: Deep Tide TechFlow

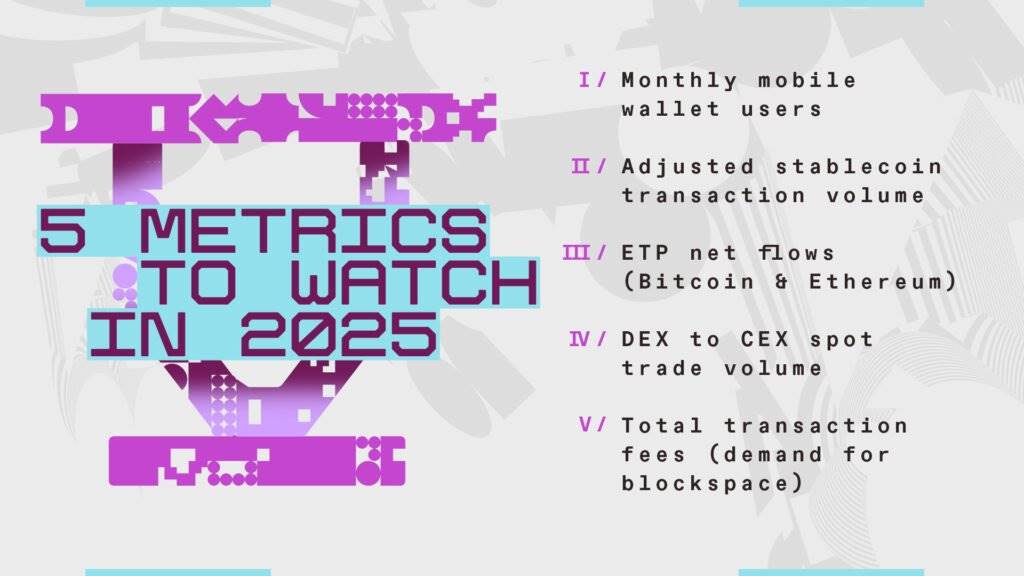

1. Monthly mobile wallet users: +23%

2025 average: 34.4 million monthly active mobile wallet users

2024 average: 27.9 million monthly active mobile wallet users

Why this matters:

Wallet infrastructure has significantly improved—we now have low transaction fees, new account abstraction protocols (EIP-7702), embedded wallet products (Privy, Turnkey, Dynamic), etc. Now is an excellent time to build the next generation of mobile wallets.

Related news:

- This month, Stripe acquired leading wallet infrastructure provider Privy.

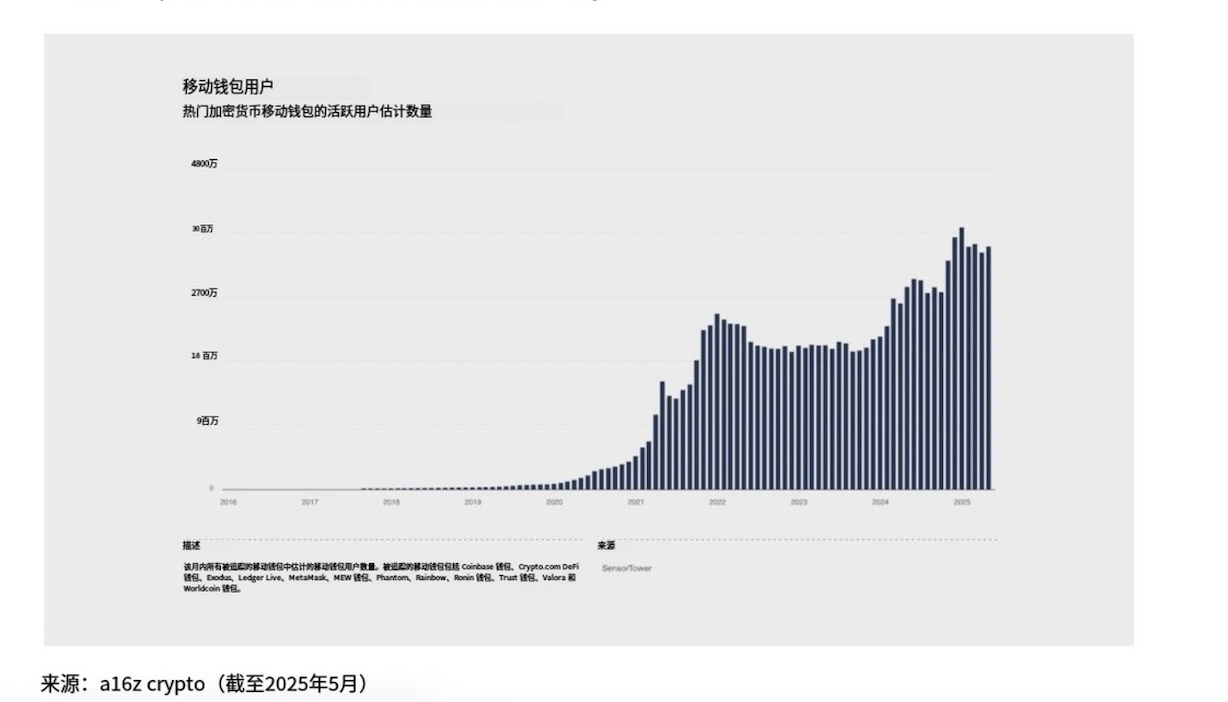

2. Adjusted stablecoin trading volume: +49%

2025 average: $702 billion in monthly adjusted stablecoin trading volume

2024 average: $472 billion in monthly adjusted stablecoin trading volume

Why this matters:

Stablecoins have found a product-market fit. We can now send dollars in under 1 second at a cost of less than 1 cent, making stablecoins an excellent product in the payments space. Major financial institutions are seizing this opportunity.

Related news:

Dollar stablecoin issuer Circle went public on the New York Stock Exchange.

Stripe acquired stablecoin infrastructure provider Bridge and announced the launch of several new products.

Coinbase released a proxy payment standard supporting stablecoin payments.

Visa and Mastercard enhanced their support for stablecoins.

Reports indicate that Meta is negotiating to use stablecoins as a payment method.

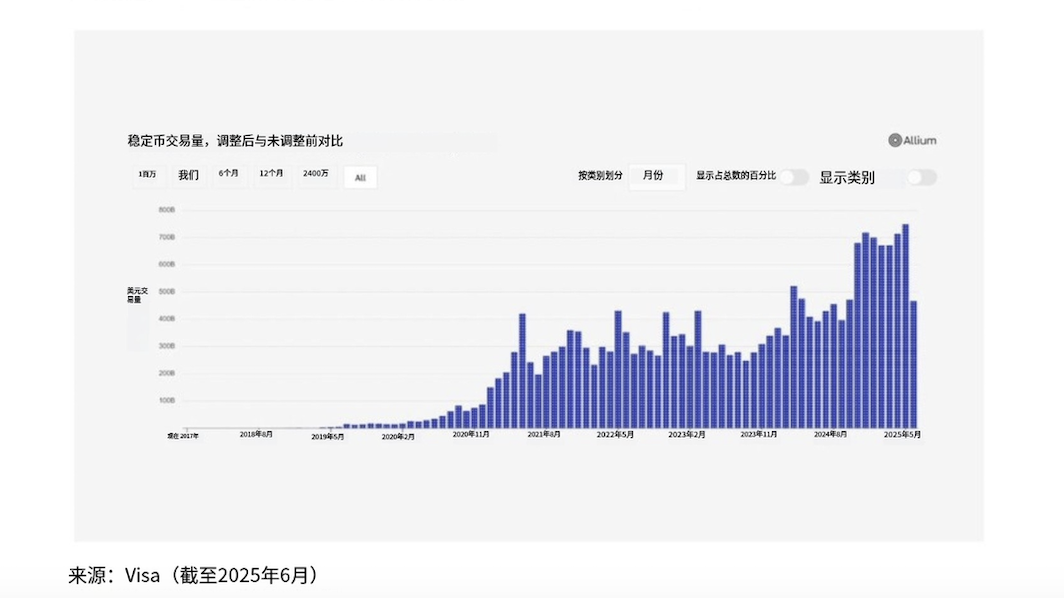

3. ETP net inflows (Bitcoin and Ethereum): +28%

June 2025: Total ETP net inflows of $45 billion (Bitcoin $42 billion, Ethereum $3 billion)

End of 2024: Total ETP net inflows of $35 billion (Bitcoin $33 billion, Ethereum $2 billion)

Why this matters:

Institutional capital entering the cryptocurrency space is a sign of overall industry maturity. As regulations become clearer, key issuers are starting to operate, and the net amount of funds flowing into ETPs should continue to increase.

Related news:

- The SEC recently requested Solana spot exchange-traded fund (ETF) issuers to update their S-1 filings, indicating that approval may occur in the near future.

Source: Dune@hildobby (as of June 2025)

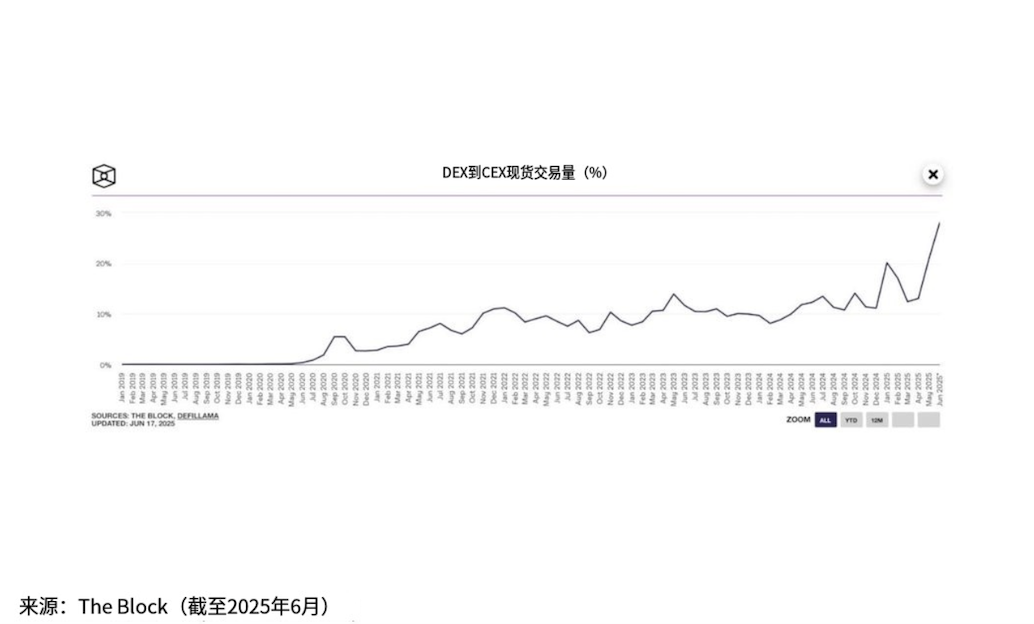

4. DEX to CEX spot trading volume: +51%

2025 average: Monthly DEX trading volume relative to CEX increased by 17%

2024 average: Monthly DEX trading volume relative to CEX increased by 11%

Why this matters:

As more people go on-chain, we expect the usage of decentralized exchanges (DEX) relative to centralized exchanges (CEX) to increase in the cryptocurrency trading space. This rising ratio highlights the overall development of the DeFi ecosystem.

Related news:

Coinbase just announced native DEX trading directly from the Coinbase app, making thousands of new assets available for trading.

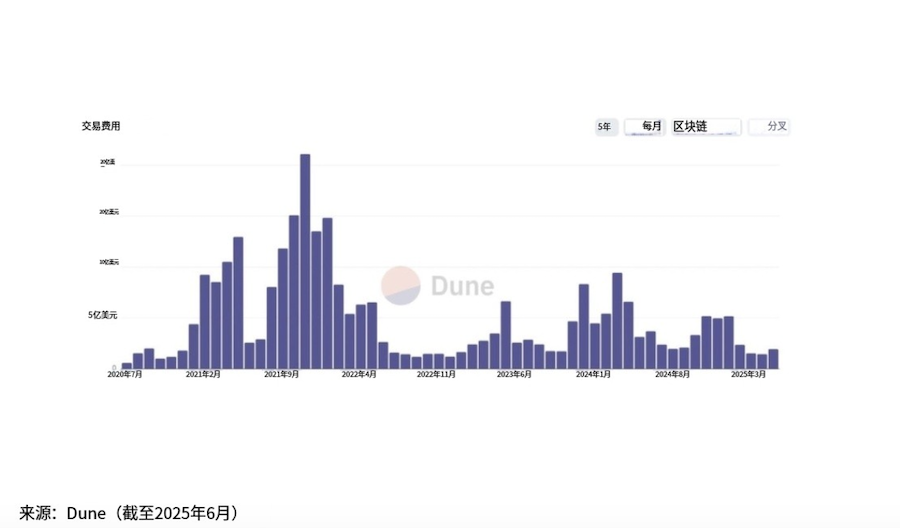

5. Transaction fees (demand for block space): -43%

2025 average: $239 million in monthly transaction fees

2024 average: $439 million in monthly transaction fees

Why this matters:

The total transaction fees in dollars indicate the overall demand for a given chain's block space—i.e., actual economic value.

However, this metric has many nuances, as most projects explicitly try to lower user fees. For this reason, it is also important to consider unit transaction costs—the fees corresponding to a given amount of blockchain resources. Ideally, overall demand (total transaction fees) would increase while Gas (the cost per unit of resource usage) should remain low.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。