Bull market tops occur when funds join, and the next bull market top occurs when the country starts buying.

Written by: 0XKYLE

Compiled by: Deep Tide TechFlow

As we approach 2024, my core investment portfolio is now fully configured. This article is about my perspective on the developments in 2024. I will do my best to express my views on investment in this article. However, this is not financial advice, just an insight into how I view the development of cryptocurrencies in 2024.

If you don't plan ahead, your investment will fail

Over the past few months, we have finally seen Bitcoin break out of the nearly 500-day range between 15k and 32k, and now everyone is looking forward to the bull market.

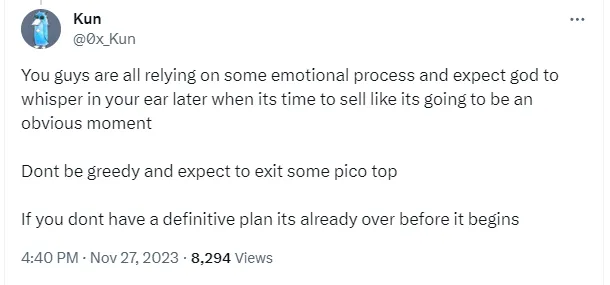

But as my favorite blogger 0x_Kun on Twitter said:

Make an investment plan and stick to it. Because when the market turns bad, you will know what to do.

Therefore, the core of this article is to delve into my 2024 plan. This article is divided into two main parts:

How I view the development of 2024

Narratives I believe will perform well

Part 1: Bull market scenarios in 2024

I always like to take a top-down approach when investing: first macro, then micro. Therefore, here are the key narratives I believe are most important in driving the bull market:

Bitcoin ETF

Interest rate cuts

Bitcoin halving

There are many other smaller factors - such as presidential election years, China's stimulus policies, etc. But I believe the three factors mentioned above are the most important, and they have the greatest impact on my investment portfolio. If you worry about every small factor, you will never make a trade.

Next, I like to list a series of possible events and make predictions for the probability of each event occurring. I believe the wisest investment is to determine how the cycle will develop over the longer term.

Scenario analysis

Before we delve into the scenarios, let me explain some basic assumptions about the key narratives I have listed.

BTC halving is certain

In all of these scenarios, I believe that Bitcoin halving does not necessarily mean an immediate price increase.

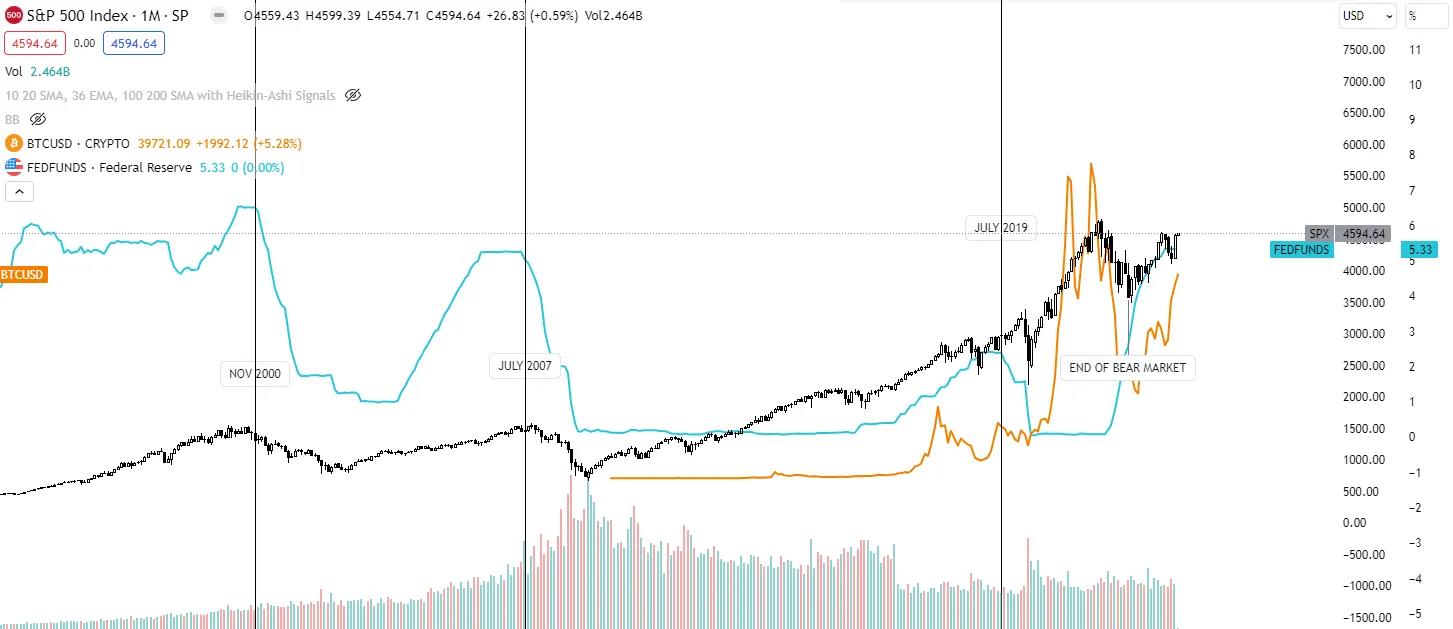

As can be seen from the chart above, Bitcoin halving always occurs before the bull market, but it is never the direct catalyst for the bull market. There is always a delay between halving and price increase.

Interest rate cuts are bearish

Interest rate cuts drive Bitcoin prices down

Secondly, I believe that interest rate cuts are bearish. Like halving, they are events that occur before the bull market, but when interest rate cuts occur, they are bearish for the market.

With that said, we can analyze the five scenarios I believe in.

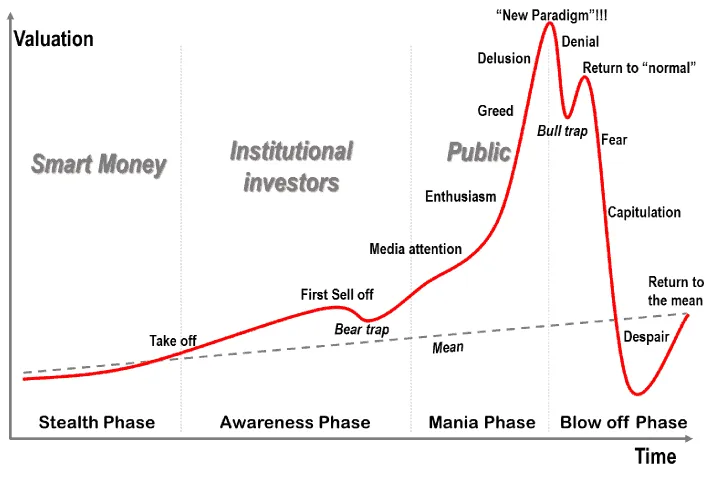

Could this bull market be different from the past?

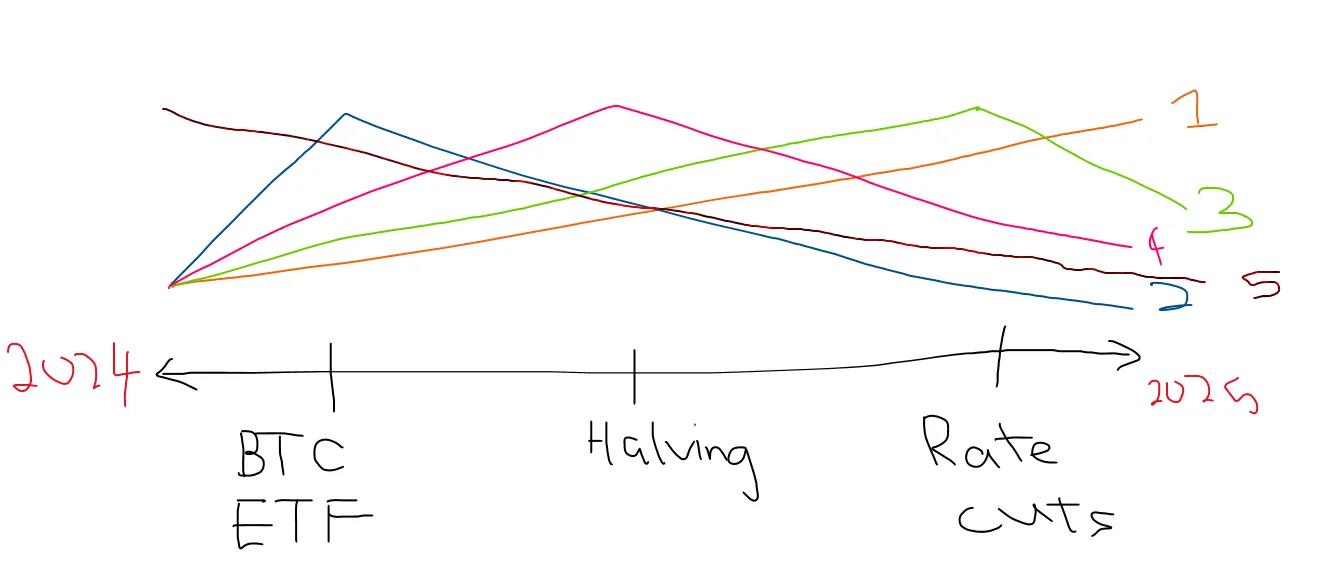

The market will have 5 different trends. Each trend will perform differently with each event

Scenario 1 - Best case, but least likely

Scenario 1 is a bull market from 2024 to 2025, with prices continuing to rise. There is not much explanation needed for this scenario.

Scenario 2 - Bitcoin ETF approval leads to a decline, also unlikely

The Bitcoin ETF creates a local top, then falls until a certain point in time before rising again. Now, if you have been following me before, you will know that I have talked about how the approval of the ETF would lead to a price decline, as Bitcoin rose when the event was expected to occur. At that time, no one thought that the approval of the Bitcoin ETF would lead to a decline, everyone was just buying in anticipation of the formal approval of the Bitcoin ETF.

My position has changed, and now everyone is talking about how the ETF will lead to a decline, and I believe this will cause huge price fluctuations when the Bitcoin ETF is approved.

Scenario 3 - Interest rate cuts are bearish, most likely

Compared to traditional financial markets, cryptocurrencies have not been around for that long. When we look at how Bitcoin performed under high interest rates, we only have one data point to look at - 2019.

2019 is remarkably similar to the situation we are facing now. I believe this is the most likely event: we will see a local top due to interest rate cuts at some point in 2024, followed by a few months of decline, and then enter the biggest bull market we have ever seen.

ETFs, halving, and interest rate cuts are mainly setting the stage for a larger bull market in the long term. 2024 is definitely not just about going up.

Scenario 4 - Halving is bearish, less likely

I don't need to say much more - this is similar to Scenario 2, except that the halving will lead to a top earlier.

Scenario 5 - Prices only decline; also unlikely

If prices continue to decline, it may catch the entire market off guard, and I don't think this will happen.

Scenario 6 - Local top, but then rebound

I didn't describe this in the chart above because it would be too complex, but Scenario 6 is basically any of the previous 5 scenarios leading to a rapid decline after we fail to reach the price high I expected. This means that the shorts and sidelined capital will be caught off guard as people wait for a "better entry opportunity."

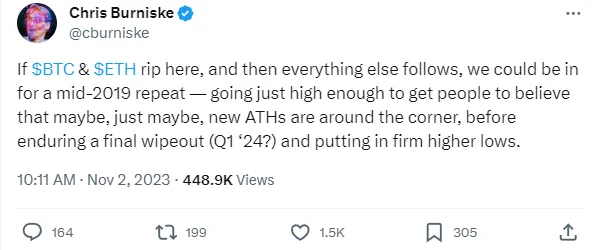

So the conclusion is: I believe we will see a situation similar to 2019, where we will see a decline at some point when people expect a new all-time high. This tweet almost summarizes what I think will happen:

So what will I do?

The biggest risk I learned in 2023 is that my position was too low when I knew there would be another price increase at some point in the future.

As a retail investor, I am not bound by LPs (limited partners) and do not have to constantly adjust my assets to optimize returns. I can manage my assets as I please.

Therefore, my strategy will be very biased towards the left, and I will reduce the risk of my investment portfolio before the interest rate cut by a certain proportion, and then buy back at a lower price, while keeping the rest of the position unchanged.

This is a simple strategy, and I prefer to optimize the simplicity of investment rather than the return. I believe that more complex investment methods are equivalent to a greater chance of making mistakes. This strategy will not bring the maximum return, but it is very easy to manage.

In addition, I think I will hedge by shorting major cryptocurrencies, or reducing the number of my long positions. Other ways may include diversifying investments in more defensive assets, or buying forward out-of-the-money options.

As I said, retail investors should keep their investment methods simple. 😎

In summary, I anticipate a price decline after the interest rate cut, followed by an increase.

Part 2: Narratives worth paying attention to

What narratives will be most prominent in 2024?

Once again, we need to take a top-down approach. One question to address is: who is buying?

I believe 2024 will be primarily dominated by institutions, as it becomes increasingly obvious with the launch of Bitcoin ETF and growing attention to cryptocurrencies. Narratives are essentially just hype, with everyone jumping on board and trying to get off before everyone else.

Therefore, the best-performing narratives will be those with the most buyers, and I believe these buyers are primarily institutions. I think the best-performing narratives will meet certain criteria, namely:

Regulatory compliance

Products that have demonstrated market adaptability

This is not to say that all narratives must meet these criteria. In the past month, we have seen many narratives in the crypto space, such as RWA, DeSci, etc. These will obviously continue to appear in the bull market, but for simplicity's sake, I prefer to focus on narratives that I believe will consistently perform well.

1. ETF Beneficiaries

Inflows of ETFs into Bitcoin mean that its performance may see a significant increase in the short term. We have already seen this happen with investment targets such as STX, ORDI, TRAC, etc.

After the approval of the Bitcoin ETF, there may be a continuous influx of traditional financial institutions.

Top investment choices: COIN (stock) / BTC / ETH

Considering that Coinbase has been selected by 9 out of 12 ETF issuers, I believe Coinbase will be a huge beneficiary of the ETF narrative. The price increase is simply due to people chasing performance, and Coinbase is the recipient of direct liquidity into the crypto ecosystem.

Imagine this: large institutions like BlackRock, Franklin Templeton, etc., coming to you and saying they want to custody their products on your platform. It seems like it would drive the stock price up.

Naturally, we may also see an Ethereum ETF, so you can expect ETH to rise when this happens.

Derivative narrative: BRC-20 / LSTs

Correspondingly, as derivative assets of BTC and ETH, BRC-20 and LST will also rise.

2. Lindy Effect

(In the crypto space, antifragility is very important, and we have already seen VanEck's paper on Solana. While traditional finance wants higher excess returns, they do not want "air coins," making this a perfectly segmented market.)

Top choice: SOL

I have written a comprehensive report explaining why I believe SOL will skyrocket at around $20; you can read it here. I believe that once FTX estate fully liquidates their remaining unpledged SOL, funds will start accumulating it as a high-quality asset. Solana could become the next Ethereum.

Derivative narrative: TIA / Aptos / L2

TIA is definitely not a representative of the Lindy effect, as when investors ask, "What is SOL beta?" Tia is the first ecosystem that comes to mind.

Aptos has great potential as they are doing something. While MATIC may be considered to have the best BD team, the partnerships Aptos has established this year with Windows, Alibaba, etc., are impressive.

Finally, L2 is a good product with good use cases, but with 10 different L2s appearing in the past month, from Blast to… an L2 for board games? I am a bit bearish on this because it seems more like "random attempts" rather than technological innovation.

Community is very important in building strong tokens, and Solana has a very resilient community; those that rely more on breadth rather than depth often perform worse.

3. Regulatory Compliance and Market Fit

I believe 2024 will also be the year of regulation. I think that when DeFi regulation is still unclear, no fund will be willing to invest in DeFi. Instead, I believe people will tend towards products that have passed tests and have demonstrated clear market fit.

There is only one vertical that fits both categories: exchanges.

Top investment choices: MMX / dYdX

Exchanges are one of the few products in crypto that solve core problems. I believe Perp DEXes will see a resurgence, especially considering that the SEC is now regulating all centralized exchanges: first Binance, now ByBit.

I think MMX and dYdX are two choices that will benefit, as in the past, any negative news about CEX almost always meant an upward trend for dYdX (CEX vs DEX narrative). dYdX has shown continuous technological innovation: now v4 is here, and funds may see it as a more "revenue-generating" play.

MMX is also a bet on Saudi funds, and the recent 33x oversubscription of the Pheonix Group IPO (a BTC mining company) makes me think they are eager to invest in cryptocurrencies.

You might wonder - why isn't DeFi on my list? Well, as I said, DeFi is currently in an unclear area. I tend to think that there may be some form of regulation for DeFi in the near future.

Derivative narrative: Other Perp DEXes

GMX, Hyperliquid, Level Finance, Synthetix, etc.

4. Decentralized Artificial Intelligence

Again, I wrote a full-length article explaining why you should be bullish on DecAI. This may be the main narrative for me in 2024, as you have a product that is innovating in the 21st century, and ordinary investors actually agree on decentralization.

Sam Altman's legend has left a bitter taste in people's mouths as they realize the dangers of centralization, leading more and more people to say we need "open-source" artificial intelligence.

Preferred: TAO / OLAS

Derivative narrative: TAO subnet tokens / RNDR / AKASH / other AI tokens

I believe RNDR's performance will not be as good, as this coin has a large number of large holders from past cycles who may control the market and engage in large-scale selling after profiting.

5. GameFi

In the previous cycle, we were very interested in GameFi, and in this cycle, we will see the release of these games. Many crypto OGs dislike GameFi - play2earn, play-and-earn… but who cares? They are all high FDV tokens and should be thrown in the trash.

Many funds have shadows over investing in GameFi with high FDV, which is why I believe GameFi will be disliked. But this cycle, those Web3 games that have truly built amazing things will perform the best.

Top investment choices: Overworld / Treeverse / Prime / L3E7

Derivative narrative: NFTs → BLUR

The bottom of NFTs may have already been reached, and I believe we will see a renewed focus on game NFTs.

6. Other Potential Narratives

In addition to the above five narratives, I have also listed narratives that I believe have shown good potential in the past few months:

dePIN / RWAs

deSci

Memes (BONK / DOGE / PEPE / HPOS10INU)

RUNE / CACAO

GambleFi

Airdrops (LayerZero / Starknet / ZKSync)

Conclusion

Congratulations if you've made it this far! This article summarizes my views on the cryptocurrency market in 2024.

One thing I haven't discussed is how I think this cycle will end. Recently, I have been thinking more and more about GCR's view: "Bull market tops occur when funds join, and the next bull market top occurs when the country starts buying."

At first, this sounded absurd, but after learning that high-inflation countries are considering adding Bitcoin to their portfolios (e.g., Argentina), I think this is becoming more and more likely.

But that's the subject of another article. Happy New Year in advance!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。