TL;DR

The Solana ecosystem is on the verge of a comprehensive outbreak, maintaining strong growth despite challenges such as FTX bankruptcy. Total Value Locked (TVL) has significantly increased, with DeFi Velocity showing very high liquidity utilization. Daily trading volume is steadily rising, far exceeding other public chains.

The Solana Foundation is taking frequent actions: network stability and decentralization are steadily advancing, hosting the Hyperdrive hackathon to support ecosystem projects, and focusing on the Asia-Pacific market.

Ecosystem highlights are frequent: Visa has launched USDC settlement functionality on Solana, MakerDAO is considering integrating Solana SVM into its system as part of its "Endgame" upgrade plan, and Solana Pay has integrated with Shopify.

The ecosystem is flourishing with various projects: the largest-ever Solana airdrop season is about to begin, with star projects in DeFi, LSD, Meme, Inscriptions, NFT, and DePIN attracting market attention.

Introduction

After Ethereum's transition from POW to POS, centralization issues have been brought to the forefront. The competition between Layer2 solutions has intensified, further fragmenting liquidity, and the application layer is lacking.

In the Bitcoin ecosystem, BRC20 has led a variety of inscription protocols, sparking community FOMO, reaching a climax after being listed on Binance, and accompanied by criticisms of "no applications, only Meme" starting to gradually recede.

Following the FTX bankruptcy event, the SOL token plummeted to a low of $8, with a drop of over 95%. However, despite the heavy blow, the Solana ecosystem and community have continued to develop positively over the past two years. The ecosystem has over a million users and more than 2000 developers, with new projects constantly emerging in DeFi and NFT. Jump Crypto's development of the second Solana validator node, Firedancer, has also officially launched on the testnet.

With BTC's price rebounding, the SOL token price has surged over 200% in two months. Currently, Grayscale Solana Trust's premium is approximately 800%, indicating institutional investors' optimism towards Solana.

The outburst effect caused by Stepn in the last bull market is still vivid, and with the negative news settling, the next explosive application in the Solana ecosystem is sure to ignite the market.

I. Overview

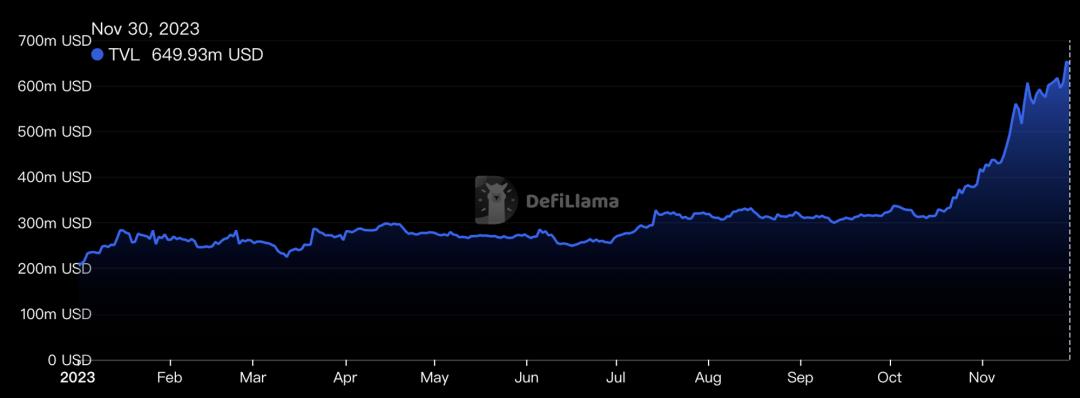

Since early 2023, Solana's Total Value Locked (TVL) has shown significant growth, reaching $650M, an increase of over 200%.

Ian Wu stated, "With the recent introduction of new assets on the platform, the SOL token plays a central role. SOL is not only the staking coin in the entire ecosystem, but also serves as collateral and underlying asset in transactions, making it a crucial native crypto asset for the entire platform.

In addition, as SOL is used to purchase NFTs and participate in on-chain activities, a large amount of SOL is locked in the market, reducing its circulation. This locking effect is expected to drive up its price, creating a positive growth spiral. As new assets are issued and listed in the Solana ecosystem, the locked value of SOL tokens will gradually increase. This will not only dilute previous profit-taking and selling pressure, but also stimulate more holders to stake SOL tokens due to the positive impact of new assets. Therefore, the total locked value (TVL) of Solana will become an important indicator closely watched by analysts and investors for pricing SOL in the future."

https://defillama.com/chain/Solana

DeFi Velocity (TVL utilization rate):

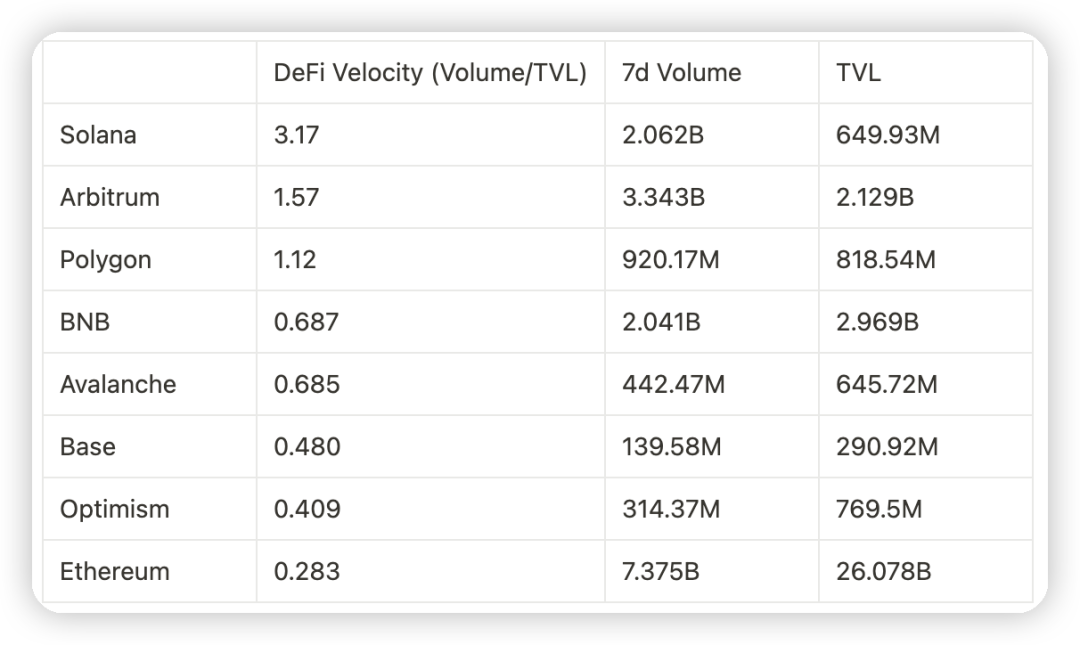

DeFi Velocity, i.e., trading volume/TVL, is a key metric for measuring blockchain activity and adoption, more valuable than observing TVL alone.

In the past week, Solana's 7-day DeFi Velocity ratio reached 3.17. This means that every $1 of liquidity can generate approximately $3.17 of weekly trading volume. Compared to other chains such as Arbitrum, Binance, Base, Optimism, and Ethereum, Solana has shown the highest TVL utilization rate in the past 7 days.

Daily Trading Volume:

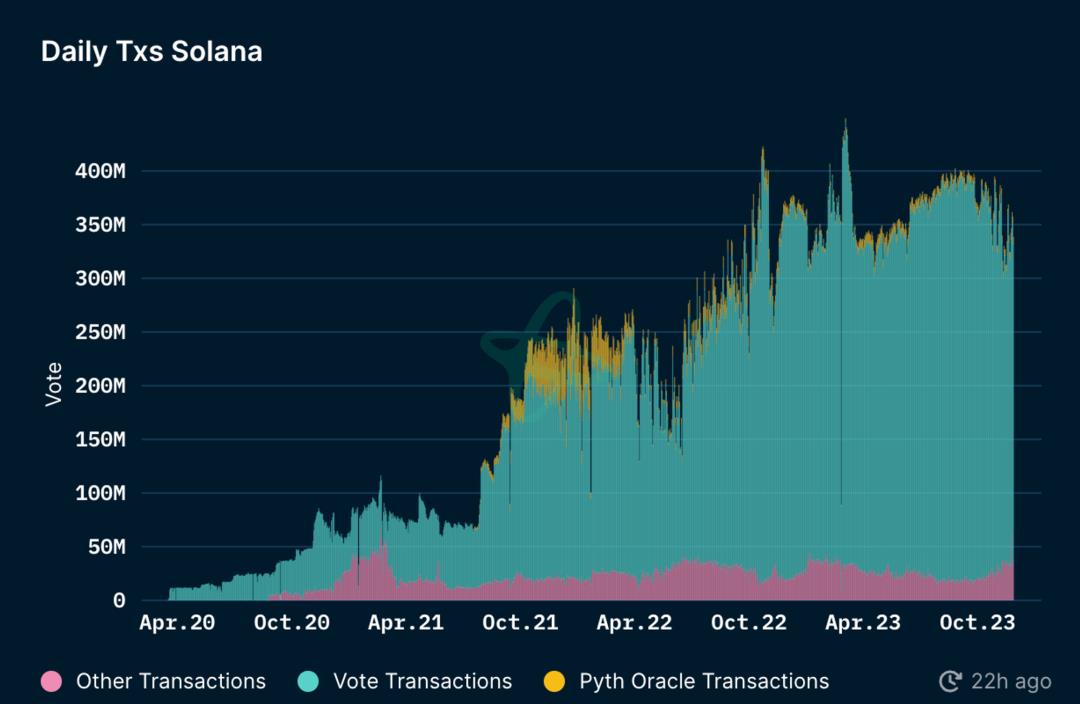

Since 2023, Solana's daily trading volume has shown a stable trend, especially with an increase in voting transactions.

Transactions are mainly divided into voting and non-voting types, with voting transactions mainly involving validator voting accounts.

Comparison of average daily trading volume over six months with other ecosystems

Despite challenges such as network interruptions and FTX/Alameda's collapse, Solana has continued to operate normally, demonstrating its improvement and adaptability.

Solana's continuously growing TVL, strong DeFi development, and stable trading data collectively demonstrate its potential to become an active economic hub.

Ecosystem Highlights:

In September 2023, Visa chose to launch USDC settlement functionality on Solana, which is significant for the payment architecture and other application scenarios between public blockchains and financial entities.

Also in September, the founder of MakerDAO considered integrating Solana SVM into Maker's new native chain as part of its "Endgame" upgrade plan, expected to last 2 to 3 years and be implemented in five phases.

In August 2023, Solana Pay integrated with Shopify.

Foundation

Personnel Changes

On April 19, 2022, the Solana Foundation announced leadership changes to its five-member board. Firstly, Anatoly Yakovenko, co-founder of Solana Labs, stepped down as Chairman of the Solana Foundation to focus on launching new applications at Solana Labs, effective since December 2021. Secondly, to ensure high-quality leadership continuity and embrace the next chapter of the Solana Foundation, the foundation appointed Leopold Schabel to join the board. Schabel is a leader at Jump Crypto and co-founder of Certus One, a blockchain consulting company that provides validation services for the Solana ecosystem and other proof-of-stake networks.

New Financial Strategies

The Solana Foundation has announced a new funding strategy, including convertible grants and investments. These flexible funding options are designed to meet the diverse needs of projects within the Solana ecosystem, from early-stage development to mature enterprises seeking financial support. The foundation's convertible grant program provides financial assistance to early-stage projects, focusing on development, research, and innovation. These grants will be distributed to projects with the potential to have a significant impact on the Solana ecosystem. For established and successful projects or startups, the Solana Foundation offers investment support, with funds used to expand their operations and bring innovation to the market.

Retrospective Public Goods Funding (RPGF) Program

The Solana Foundation and OpenBlock Labs have innovatively introduced a retrospective funding model to support public goods and open-source projects within the Solana ecosystem. RPGF aims to provide sustainable income to the creators behind public goods resources widely used by the community. Unlike traditional forward-looking funding, RPGF incentivizes and rewards past contributions that have been beneficial to the broader ecosystem. The first round of RPGF received a warm response, attracting over 100 project applications, with approximately 36 receiving funding. This process not only rewards past contributions but also sets a precedent for community-led support of public goods.

Hackathons

The Solana Foundation recently successfully hosted the 8th edition of the "Solana Hyperdrive" hackathon, an online competition focused on attracting high-impact projects to the Solana ecosystem. The event brought together founders and developers from around the world, with over 7,000 participants submitting 907 projects, setting a record for the largest-scale Solana hackathon in history. The event covered multiple areas, including infrastructure, mobile consumer applications, payments, decentralized autonomous organizations (DAOs), and artificial intelligence, and received support from several well-known companies such as AWS, Ironforge, UXD, and Magic Eden. Dan Albert, Executive Director of the Solana Foundation, stated that the nearly 1000 teams generated from these events will play a significant role in shaping future trends in areas such as artificial intelligence, finance and payments, physical infrastructure networks, gaming and entertainment, mobile consumer applications, cryptographic infrastructure, DAOs, and network nations.

Future Plans

On the technical front, the Solana Foundation is focusing on several key technological innovations, expected to show results by the end of this year or early next year.

1. FireDancer Mainnet Launch: FireDancer is an independent Solana validator designed to enhance network robustness and performance. It is a system capable of reaching 1 million TPS during internal testing, although it may achieve 100,000 TPS in actual operation, which is sufficient to meet the needs of high-frequency trading applications. Its purpose is to maintain an independent technical stack, diversify the supply chain of blockchain networks, and reduce exposure to single points of failure. FireDancer adopts a deep defense strategy, isolating its components as independent processes and implementing strict communication protocols to reduce the impact of potential vulnerabilities. The development team also integrates strong security practices into its development lifecycle, identifying and mitigating security vulnerabilities through continuous collaboration between security and engineering teams, as well as using fuzz testing and code reviews. Its goal is to launch FireDancer on the Solana mainnet and upgrade security measures, such as external audits and the introduction of bug bounty programs.

2. Asynchronous Execution/Leaderless Banking: In Solana's leaderless banking model, leaders do the least work necessary to produce effective blocks. This design reduces the memory operations required by leaders before banking execution by three times. The responsibilities of leaders include verifying signatures in transactions, ensuring fee accounts have sufficient balances, and managing balance caches.

3. Quorum Subcommittee: The size of the quorum and the implementation of voting are crucial to Solana's security and performance. The network uses secondary message overhead to ensure classic Byzantine fault tolerance consensus. Solana's design allows the network to maintain high throughput and low costs while ensuring a high level of security. The size of the quorum and the implementation of voting are critical to Solana's design, ensuring security and performance.

4. Dynamic Storage Pricing and Old State Compression: Solana has introduced a state compression solution that significantly reduces the cost of on-chain storage. This technology relies on Merkle trees and can compress the verifiability of a data tree into a hash. This compression-friendly structure allows developers to store small amounts of data on-chain and update it directly in the Solana ledger, greatly reducing data storage costs while maintaining the security and decentralization of the Solana base layer.

5. Dynamic Base Fees: In Solana, the calculation of transaction fees currently does not depend on the resources consumed by the transaction. Instead, fees are determined by the number of signatures that need to be verified. The fee rate (e.g., lamports per signature) may change from block to block. However, transaction fees can still be calculated deterministically before creating the transaction and signing it.

Focus

Currently, the focus of the Solana Foundation is on strengthening and expanding its influence in the Asia-Pacific region. Especially after the FTX event last year, the foundation has decided to increase its investment in the Chinese-speaking region and the Asia-Pacific market. The foundation recognizes the importance of the Asia-Pacific market in both the labor market (developer market) and the capital market, and is committed to establishing a more balanced and comprehensive development in the region.

The Solana Breakpoint event is scheduled to take place in Singapore from September 19th to 21st, 2024, highlighting the importance of the Asia-Pacific region in Solana's strategic plans.

Additionally, the foundation is also expanding its influence in India and Europe, especially in Germany and the UK.

II. Recent Popular Projects

Mad Lads & Backpack

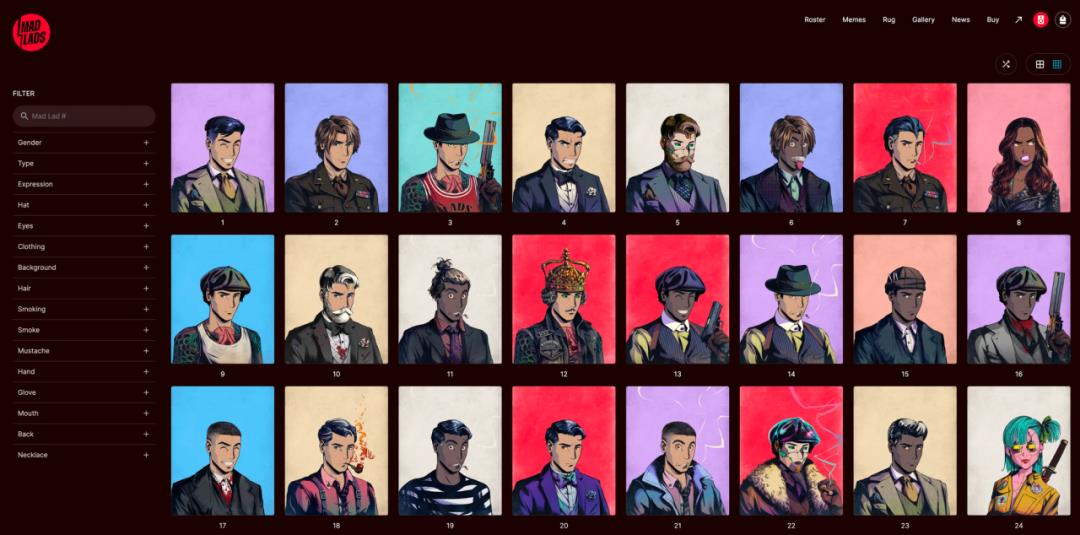

Mad Lads is an NFT project created by the Solana framework development company Coral, launched by Armani Ferrante and Tristan Yver. This project marks a significant innovation in blockchain technology and the NFT space for Coral. During its initial release, Mad Lads was exclusively available through Coral's all-in-one wallet application, Backpack. This choice not only demonstrates Coral's confidence in its own products but also highlights the advanced technology and market potential of Backpack.

The most significant feature of Backpack is its focus on "executable NFTs" (xNFTs). These xNFTs are essentially non-fungible tokens embedded with executable programming scripts, making them operational Web3 application platforms. This innovative technology transforms Mad Lads from just a digital collectible into a platform capable of running code and enabling more complex interactions, greatly enhancing the functionality and appeal of NFTs. The xNFT series opens up new avenues for program distribution. Game developers can mint entire games as limited edition xNFTs. A DeFi protocol can distribute early access to a new frontend based on wallet addresses. A two-factor authentication can be generated as an NFT and automatically updated in a loop. As explained on Solana's website, these are the possibilities available to xNFT users, which also states that artists can create beautiful immersive 3D experiences that cannot be replicated and can run directly in wallets. These possibilities are almost limitless.

Mad Lads' success can be attributed to several key factors. Firstly, its innovative xNFT concept has brought new vitality to the NFT market. These new types of NFTs are not just digital assets but also have the ability to execute embedded code, providing users with more interactivity and utility. Secondly, Mad Lads has performed exceptionally well in the market. It generated over $8.16 million in sales within 24 hours, surpassing the Bored Ape Yacht Club during the same period. This significant sales achievement is largely due to its uniqueness and high market expectations. Additionally, the floor price of Mad Lads has increased by 200% within two weeks, reaching 160 SOL, making it one of the most valuable in the Solana NFT series, highly recognized by the market.

In terms of technical and market strategies, the Backpack development team has demonstrated its creativity and ability to address challenges. During the reissue of Mad Lads, the team created two minting portals to prevent market manipulation by bots, effectively distinguishing between real users and bots. This strategy not only effectively prevented malicious behavior but also garnered widespread attention and discussion among legitimate users, enhancing community interest and participation in the project.

After Solana lost its well-known NFT projects DeGods and y00ts, there was a void in the community. These projects moved to Ethereum and Polygon, leaving a significant gap in the Solana community. The timing of Mad Lads' launch closely coincided with the departure of these projects from Solana, providing a good opportunity for the success of Mad Lads. We believe that Mad Lads has the potential to become the Bored Ape Yacht Club (BAYC) of Solana.

However, with the collapse of FTX, the entire Solana ecosystem faced significant challenges, and a portion of the Backpack team's funds were trapped in FTX. In this predicament, the Backpack team not only successfully maintained operations but also began to seek new development directions. The success of Mad Lads is seen as a rebirth for the Solana community, eliminating the damage caused by the FTX association and the accompanying narrative. Backpack is currently undergoing public testing, and the long-term goal is to open it to the community, allowing anyone to build on it.

In September 2022, Coral completed a $20 million financing round, led by FTX Ventures and Jump Crypto, with strategic investors such as Multicoin Capital participating.

In October 2023, Backpack announced the launch of a "regulated" trading platform called Backpack Exchange, demonstrating the team's continued commitment to innovation and adapting to market changes.

Mad Lads and Backpack are stories of innovation, adaptability in the market, and seeking new opportunities in adversity. This case fully demonstrates the resilience and innovation capabilities of the Solana ecosystem.

Jupiter

Jupiter is one of the largest decentralized exchanges on the Solana blockchain and has become a key protocol in the Solana ecosystem since its establishment in 2021. As the first aggregator on Solana, Jupiter aims to provide users with the best exchange rates by integrating all major liquidity markets on the blockchain. To enhance user experience, Jupiter continuously optimizes and updates, integrating more mainstream DEXs on the Solana chain, such as Orca, Raydium, and Serum.

Jupiter has also made significant efforts in user experience, providing real-time updated exchange rates and the ability to quickly access integrated DEX project websites. For example, in the process of exchanging SOL for USDC, Jupiter can match multiple trading routes for users and select the best path and price, saving users time and fees. Additionally, Jupiter provides transparent information for each transaction, including transaction speed, price impact rate, and the minimum amount users can receive after the transaction, facilitating asset planning for users.

In terms of financing and token plans, Jupiter has made significant progress. It is preparing to launch its native token JUP and announced at the Solana Breakpoint conference that 40% of JUP tokens will be distributed to the Jupiter Exchange community through airdrops, with approximately 955,000 eligible users. Another 20% of the tokens will be distributed through token sales, and the remaining 40% will be reserved for internal personnel and strategic reserves. As a community-centric initiative, Jupiter announced a retrospective token airdrop plan, planning to distribute 40% of the 10 billion Jupiter tokens (4 billion) to the community.

Pyth Network

Pyth Network is hailed as a game-changer in the DeFi oracle field, primarily aggregating and distributing price data for smart contract applications by leveraging the power of top exchanges, market makers, and financial service providers. As an innovative decentralized oracle, Pyth can obtain financial market data from over 90 information sources, including major exchanges and market makers such as CBOE, Binance, OKX, and Bybit, and distribute this data to over 40 blockchains.

Pyth consists of three core components: data providers (primarily exchanges), the Pyth protocol (designed to aggregate data from different providers and create a unified price and confidence interval for each price source every 400 milliseconds), and data consumers (end users, such as applications supported by Pyth on blockchains, which read aggregated price sources and seamlessly integrate the data into their smart contract logic).

Pyth Network raised funds through three rounds of financing, with the latest round completed on January 7, 2022. The token debuted with a market value of $468 million, with 90,000 wallets receiving airdrops. The initial trading price of the PYTH token was approximately $0.32, with a circulating supply of 1.5 billion, and the remaining 85% of the total supply was subject to lock-up periods ranging from 6 to 42 months.

Additionally, Pyth Network supports over 230 applications, including decentralized exchanges (DEXs), lending protocols, and derivatives platforms. Its infrastructure can achieve updates of over 65 million times per day, improving the accuracy and security of smart contract operations.

Jito

Jito launched a referral program at the end of August and introduced a points system in mid-September. Similar to Blaze, Jito has increased its appeal to users by rewarding JitoSOL holders and increasing their points in DeFi. The value of locked JitoSOL has increased by 320% compared to the previous quarter, reaching 6.67 million SOL. At the end of the quarter, approximately 35% of JitoSOL was locked in the protocol, compared to only 13% at the beginning of the quarter.

One of the unique aspects of Jito is that users can earn MEV rewards through it. The Jito staking pool delegates users' SOL to MEV-supporting validator nodes, and MEV rewards are allocated as additional APY to the staking pool. Anatoly Yakovenko, CEO of Solana Labs, also spoke positively about Jito.

Jito Labs has raised a total of $12 million in two rounds of financing. The latest round of financing occurred on August 11, 2022, as a Series A round, with Multicoin Capital and Framework Ventures leading the investment.

As of November 30, 2023, Jito reached a new TVL high of $400 million, with 6.67 million SOL staked, showing a continuous upward trend since its launch. Jito is the first staking product on Solana to include MEV rewards.

On November 28, the Jito Foundation announced the launch of the JTO governance token, a significant step in the development of the Jito network. The JTO token will empower community members with the ability to directly influence decisions and the direction of the Jito network.

In terms of governance, the launch of JTO enables token holders to make critical decisions and shape the future of the Jito network, allowing it to continue to develop and thrive according to the needs of its users and the broader Solana ecosystem. These decisions and actions may include:

Setting fees for the JitoSOL staking pool

Updating delegation strategies for the StakeNet project through governance on Realms

Managing JTO tokens held by the DAO and fees generated by JitoSOL

Contributing to the ongoing development and improvement of the Jito protocol and products

In terms of token economics, the total supply of JTO is 1 billion tokens, with 10% allocated for airdrops, 24.3% directly controlled by token holders through DAO governance on Realms, 25% allocated for ecosystem development, 16.2% allocated to investors (fully locked for 1 year, fully unlocked within three years), and 24.5% allocated to core contributors, including Jito's founders and early ecosystem contributors (fully locked for 1 year, fully unlocked within three years).

The total airdrop amount is 10%, or 100 million JTO tokens. Of this, the foundation will immediately distribute 90 million JTO tokens, with an additional 10 million unlocking over the next year, all from the allocation of 3.42857143 billion tokens for community growth.

Eligibility for the JTO token airdrop is determined by contributions to the development and growth of the Jito network. This includes users who have held JitoSOL for the long term, those who have used JitoSOL in various DeFi protocols, Solana validators running Jito-Solana MEV clients, and researchers actively using Jito network MEV products.

This airdrop is based on past behavior, with eligibility snapshots taken on November 25, 2023. As part of this airdrop, the previously announced points program has ended, and points will no longer be updated.

BONK

BONK, as the first meme token in the Solana ecosystem, has recently shown significant performance in the market. It initially gained attention through a large-scale airdrop to the Solana community during Christmas 2022. The token aims to oppose "Alameda"-style token economics after the FTX incident and restore confidence in the Solana ecosystem and SOL holders. As its one-year anniversary approaches, BONK has become active again, sparking comparisons with SHIB and speculation about its potential listing on mainstream trading platforms.

On November 22, Binance launched 1-50x leveraged perpetual contracts for BONK, demonstrating support for this meme coin. Built on the Solana blockchain, BONK, similar to the well-known SHIB, is a new MEME Coin for the masses. 50% of the total token supply has been airdropped to Solana's Degen and DeFi traders, NFT artists, and developers, injecting more liquidity into the Solana ecosystem.

The BONK team began planning the project on December 9, 2022, and actively encouraged interaction with other projects in the Solana ecosystem. As Christmas approached, they conducted a large-scale airdrop for the Solana ecosystem. With the resurgence of Solana and related ecosystem tokens as its first anniversary approaches, BONK has seen a valuation recovery. However, despite its significant surge in the past month, its market value as a meme coin is relatively high, having increased by over 12 times in just one month.

Orca

Orca is an important decentralized exchange (DEX) in the Solana ecosystem, recognized for its user-friendly interface and efficient trading experience. As the only DEX platform on Solana with pure automated market maker (AMM) functionality, Orca also has its own liquidity pools, providing a simple and composable trading experience, seen as an ideal choice for the next generation of DeFi applications.

Described as the most user-friendly DEX on Solana, Orca offers pure AMM functionality and a user-friendly trading interface, allowing users to efficiently exchange assets, provide liquidity, and earn rewards. Orca emphasizes providing the best exchange experience for users, including minimal trading fees and low latency, while ensuring fair prices.

In terms of technical innovation, Orca continues to innovate according to its development roadmap. For example, Orca began testing centralized liquidity active market maker AMM similar to Uniswap V3—Whirlpools, and officially launched it on April 25, 2021, as an important step in improving capital efficiency.

Additionally, Orca raised $18 million in a Series A financing round in 2021, led by Polychain, Placeholder, and Three Arrows Capital. Sino Global, Collab+Currency, Coinbase Ventures, and Solana Capital also participated in this round of financing. This investment will help Orca further develop its platform and ensure its competitiveness and innovation in the rapidly evolving DeFi space.

As for token market value, the price of Orca's token (ORCA) is currently $3.27, with a market value of approximately $143.8 million, a fully diluted valuation of approximately $326.8 million, a total locked value (TVL) of $85.12 million, and a circulating supply of approximately 43.99 million ORCA tokens. Orca has become a key player in the Solana ecosystem due to its technical advancement, focus on user experience, and strong financial support.

Drift Protocol

As a derivatives exchange on Solana, Drift Protocol has recently surpassed a total trading volume of over $1 billion. Its TVL at the end of the quarter reached $17.3 million, an 87% increase compared to the previous period, and a 976% increase year-over-year.

Drift Protocol has disrupted the decentralized derivatives market on Solana. Drift chose Solana for its low-latency block time and high bandwidth, enabling the lowest trading fees and fast settlement. In November 2021, Drift launched V1, introducing the concept of Dynamic Automated Market Makers (DAMM), providing guaranteed liquidity and superior trading experience, with nearly $10 billion in trading volume within six months. V1 introduced limit order functionality and Maker Orders, allowing users to become market makers. In December 2022, Drift launched V2, enhancing liquidity through "Triple Liquidity," becoming a comprehensive decentralized exchange. V2 introduced robust security measures, achieving over $100 million in trading volume and a TVL of $10 million. As of September 2023, Drift has accumulated a total trading volume of $1 billion and a TVL of $19 million. Drift has integrated Pyth price feed data oracles, providing diverse markets such as SOL, BTC, ETH, ensuring data quality and low-latency user experience. Pyth's confidence interval feature also helps Drift promptly identify market fluctuations and unusual price distributions, protecting users and funds.

On October 26, 2021, Drift raised $3.8 million in seed funding, with investment institutions including Multicoin Capital, Jump Capital, and Not3Lau Capital.

Zeta Markets

Zeta Markets is a comprehensive cross-margin derivatives protocol based on the Solana blockchain. It specifically offers various trading options, including options trading, fixed-term futures, and perpetual futures since November 4, 2022. These services are all integrated on one platform.

As a low-collateral derivatives platform, Zeta Markets features a fully on-chain risk engine and a Central Limit Order Book (CLOB). This makes it a user-friendly platform, providing all the necessary features for traders interested in leveraged trading in a decentralized environment.

On October 27, Zeta Markets announced the launch of Z-Score (the first step in token issuance), allowing users to earn Z-Score based on their trading activity on Zeta. Users will receive 1 Z-SCORE point for every $1 traded, and a 24-hour profit and loss ranking will also determine the reward multiplier. The first season of Z-Score will continue until December 20.

In December 2021, Zeta Markets announced the completion of an $8.5 million financing round led by Jump Capital, with participation from Race Capital, Electric Capital, DACM, Airtree Ventures, Amber Group, Wintermute, Sino Global Capital, Genesis Block Ventures, QCP Capital, Alameda Research, Solana Capital, MGNR, 3kVC, Orthogonal Trading, LedgerPrime, and SkyVision Capital.

Hivemapper

Hivemapper is a blockchain-based mapping network that launched its global network in 2022, collecting and creating map coverage through dedicated dashcams and storing the data on the Solana blockchain network. Drivers can now start using Hivemapper's dashcams to contribute to street-level images and increase decentralized maps of places they visit, earning the company's cryptocurrency, HONEY, as a reward.

The Hivemapper project began in 2015 and completed an $18 million Series A financing round led by Multicoin Capital on April 5, 2022. Hivemapper's native token, HONEY, is used to reward contributors of fresh and updated map data, while map consumers burn HONEY tokens to access the API. Burned tokens are then re-minted, increasing the token rewards for contributors. As a token in the Solana ecosystem, the total supply of HONEY is 10 billion, but due to the incentive-based mining mechanism, less than 200 million have been mined. The project plans to control the release pace of token mining in the future to stabilize and increase the token's value.

The initial token allocation is as follows:

40% allocated to contributors as a reward for participating in building the Hivemapper network 20% allocated to investors to provide initial capital for the Hivemapper network 20% allocated to Hivemapper Inc. employees for building the necessary technology and operating systems for the Hivemapper network 15% allocated to Hivemapper Inc. for research and operational support for the Hivemapper network 5% allocated to the Hivemapper Foundation to promote the ongoing management and success of the Hivemapper network The token reallocation mechanism ensures that the number of tokens received by contributors is not limited to 4 billion HONEY. To use data from the network (e.g., through the map image API), HONEY tokens must be burned in exchange for map points. The net amount of burned tokens will be re-minted and distributed to contributors based on the net emission model. As more data is consumed, more HONEY is burned, and more tokens are redistributed to contributors.

III. Inscriptions, NFTs, DeFi, DePin

Inscriptions

On Solana, there are two notable inscription projects—Sols and Lamp. Sols inscriptions are created using the SPL-20 protocol, similar to the Bitcoin Ordinals protocol, with a total supply of 21,000. Despite the complex minting process, they have been highly sought after due to their innovation and multi-stage effective screening. As of November 28, Sols has a trading volume of 114,000 SOL on the NFT platform Magic Eden, with a floor price of nearly 6.3 SOL. On the other hand, Lamp inscriptions have also caused a sensation on Solana, with the smallest unit, Lamport, similar to Bitcoin's Satoshi. The floor price for Lamp is 0.1 SOL, with a total trading volume of over 12,000 SOL and over 5,400 holding addresses.

Sols quietly launched on the OKX Web3 wallet trading market on November 22 and has since been open for trading, causing a surge in the floor price of Sols inscriptions from approximately 5.3 SOL to about 12.5 SOL.

The popularity of Solana inscriptions may be related to the strong rise in SOL prices. With the launch of BRC-20 and the popularity of inscriptions in the Bitcoin ecosystem, the market has been ignited, leading to a noticeable FOMO effect and liquidity overflow. The inscription market's fairness and lack of pre-mining or VC funding have attracted widespread participation.

In particular, the emergence of Lamp inscriptions, proposed by Twitter user @babla11001, follows the SPL-20 format with a total supply of 210,000. The process of creating these inscriptions has garnered significant attention, including multiple steps such as uploading images, setting transfer rules, engraving NFTs, and verification. Due to the high website traffic, the pages for minting, engraving, and verification often crash, leading to intense competition among participants, with success largely depending on luck.

NFT

Magic Eden

Magic Eden, the primary NFT marketplace on Solana, recently announced support for compressed NFTs (cNFTs) on Solana. This initiative aims to provide a cost-effective and scalable option for digital collectible enthusiasts.

Unlike traditional Solana NFTs, the data for cNFTs is compressed and stored off-chain. This approach supports mass production, as the minting cost is significantly reduced.

In terms of technological upgrades, Solana introduced state compression technology in the second quarter, an efficient way to store data on-chain. This technology has been successfully applied to the cNFT standard created by Metaplex. For example, the cost of minting 1 million cNFTs is approximately 5.3 to 63.7 SOL, far lower than the 24,000 SOL for uncompressed NFTs.

Market dynamics: By the third quarter, nearly 45 million cNFTs had been minted, a 316% increase year-over-year.

Magic Eden believes that cNFTs are well-suited for mass production of collectibles in industries such as gaming, music, events, and the metaverse. Lowering the cost of NFT production may increase the popularity of NFTs and serve as an ideal entry point for newcomers to the NFT world. With reduced costs, the financial risk of collecting NFTs is correspondingly reduced.

The minting of cNFTs benefits from Solana's state compression feature, with a cost of approximately $110 to mint up to 1 million NFTs, far lower than the cost on Ethereum.

Solana has significantly reduced the cost of NFT minting by introducing solutions such as state compression and isolated fee markets.

For example, the cost of minting 1 million NFTs on Solana, before and after state compression, is $253,000 and $113, respectively. In comparison, the cost of minting the same number of NFTs on Ethereum and Polygon is $33.6 million and $32.8 million, respectively.

DRiP: In the third quarter, DRiP dominated the majority of the cNFT market share (87.5%). DRiP collaborates with artists to mint a large number of free NFT artworks. In mid-August, DRiP announced the completion of a $3 million seed round financing, led by Placeholder.

Dialect: A Web3 messaging application that utilizes cNFTs, launched its web application in early September, becoming one of the largest NFT collections on-chain.

Other Projects:

Mad Lads: A project that adopts the executable NFT (xNFT) standard, representing a new token standard that can tokenize code. xNFTs represent dApps and can be accessed directly from the user's wallet.

Crossmint: Provides infrastructure for developers to build NFT applications.

After large projects like DeGods and y00ts left Solana, Magic Eden chose to support multiple chains, including Ethereum and Bitcoin. Despite the setback, Solana's NFT ecosystem is recovering and showing new vitality.

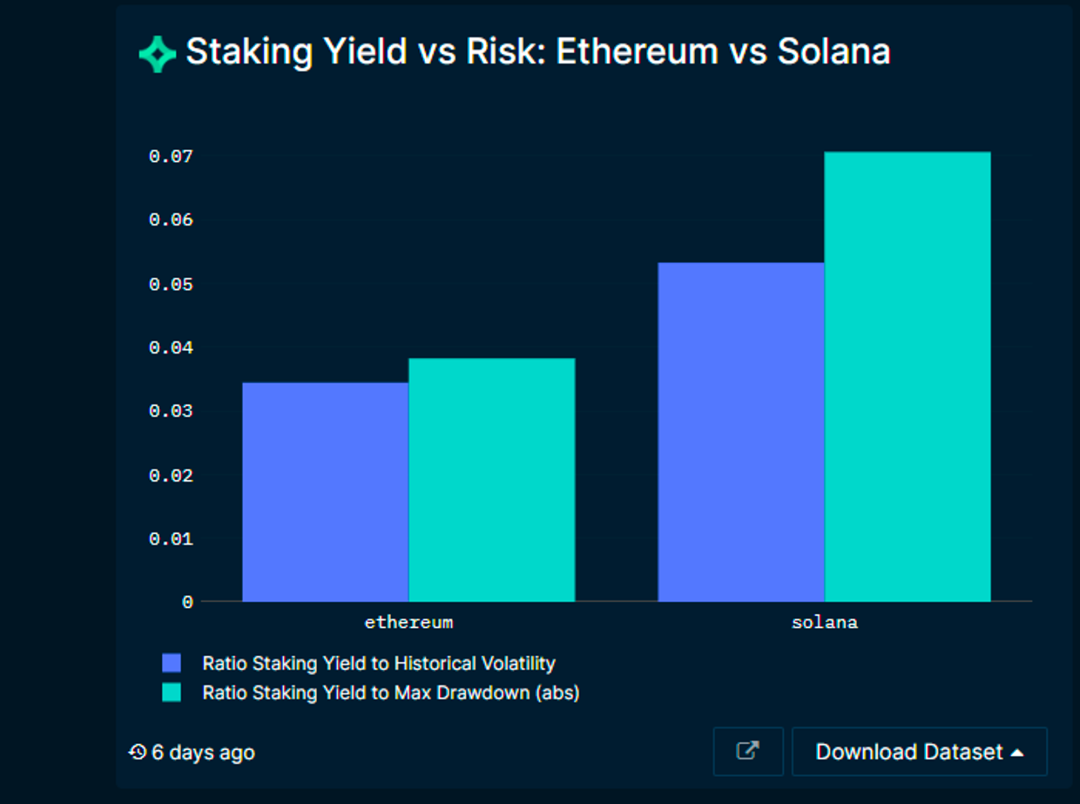

Solana's near $20.22 billion in staked assets compared to Ethereum's staked assets reveals its significant growth potential. In terms of risk and return, at similar risk levels, Solana's staking returns are almost double that of Ethereum.

Staking Status:

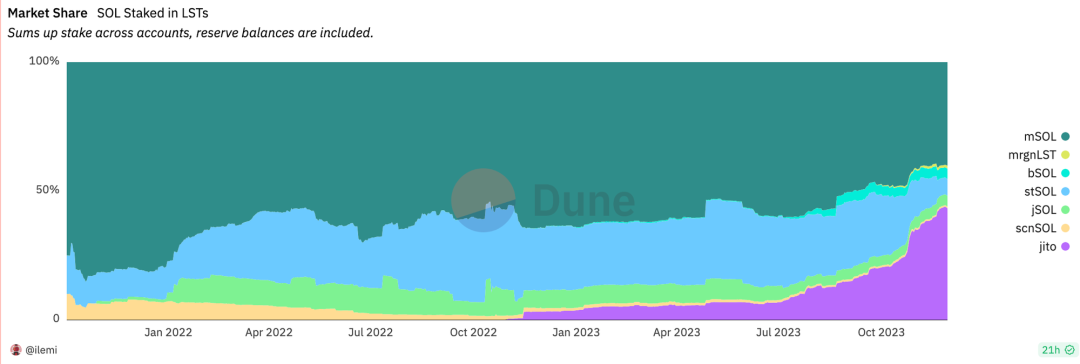

- Currently, there are 295.7 million SOL staked on the network, but the application of staking derivatives is not yet widespread.

- During the FTX event, the TVL of staking dropped from a peak of 12.8 million SOL to a low of 5 million SOL, but later recovered to over 12 million SOL, similar to pre-FTX event levels.

The recently launched Jito staking service has accumulated a total TVL of over $44.86 million (2.3 million SOL) since late November last year. The growth of cross-staking derivatives (LSD) and DeFi use cases has also been significant.

Marinade Finance, as the project with the highest TVL in the Solana ecosystem, focuses on simplifying the staking process on Solana. Its main feature is providing "liquid staking," allowing users to convert staked assets into liquidity at any time without waiting for an unlocking period. Marinade recently launched the Marinade Native program, allowing users to seamlessly delegate staking rights while retaining withdrawal rights. Additionally, Marinade announced the Marinade Earn reward program, running from October 1, 2023, to January 1, 2024, where participants will receive a reward of 1 MNDE/SOL during this period. There is also a referral system where referrers can earn an additional 1 MNDE/SOL through a unique link.

BlazeStake, a newly launched staking protocol in 2023, aims to promote decentralization of Solana nodes. Stakers can choose standard delegation pools or any validator to stake SOL while earning staking rewards in bSOL. Blaze has been hinting at airdrops for bSOL holders since last year. In August this year, it introduced a point system and its own token BLZE, with airdrops based on user points. The value of SOL locked in Blaze has grown by 1,234% in the quarter, reaching 678,560 SOL (valued at $40 million as of November 30, 2023).

DeFi

In recent quarters, some emerging Solana DeFi protocols have shown significant growth, defining themselves as "Solana DeFi 2.0." This term represents a commitment to avoiding the predatory and low-circulation token economic models common in previous cycles. Most of these protocols have not yet launched their native tokens.

MarginFi

As one of the leaders in this trend, the lending protocol MarginFi introduced a point system on July 3, rewarding users for their deposits, borrowing, and referrals. Its TVL grew by 743% annually, ranking sixth in Solana DeFi TVL, reaching $22 million. At the end of the quarter, MarginFi also launched its own staking token LST.

Cypher

Perps trading platform Cypher launched a point system in mid-July. In early August, Cypher suffered an attack of about $1 million, and to help users recover their losses, it accelerated its CYPH IDO. In the IDO and airdrop, over 50% of CYPH was allocated to the community.

Solend

In early August, the lending platform Solend introduced a point program. Unlike potential airdrops using points, Solend combined points with its existing SLND token. The first season of the point program lasted about three months, with a minimum reward pool of 100,000 SLND (valued at $54,000). Under the point program, Solend's TVL grew by 43% year-on-year, reaching $57 million.

Raydium

Raydium, once the first AMM-style decentralized trading platform in the Solana ecosystem, was a core project of Solana Summer. However, with the bankruptcy of FTX and the threat to the Serum protocol, which shares liquidity with Raydium, and attacks on Raydium's own liquidity pools, Raydium suffered significant damage, with its recovery slightly lagging behind Orca.

Phoenix

Phoenix is a decentralized limit order book on Solana that supports spot markets and recently completed a $3.3 million financing. Before its official launch at the end of August, Phoenix underwent testing. Since its launch, Phoenix has performed well in certain trading pairs, with a TVL of $378,000 at the end of the quarter.

Squads Protocol

Squads Protocol is a newly launched comprehensive multi-signature platform that has protected $6 million in assets and a total trading volume of $9.5 million.

Kamino Finance

Kamino Finance is an automated liquidity solution that earns profits through market-making. In the third quarter, Kamino's trading volume exceeded $1 billion, generating $1.25 million in income for depositors.

DePIN

DePIN, or Decentralized Physical Infrastructure Network, is leveraging Solana's efficient technology to cover multiple areas such as mapmaking, energy, and logistics, providing opportunities similar to the modern gig economy. According to Kuleen Nimkar, head of DePIN at the Solana Foundation, people can earn additional income by contributing hardware to the DePIN protocol.

Helium

Helium network uses Solana's state compression technology to mint network hotspots as NFTs, reducing costs. Helium is a typical case of DePIN business, collaborating with Hivemapper to use the Helium network to verify the location of drivers.

Helium, a decentralized wireless hotspot network, is considered a pioneer in the DePIN field, with its history dating back to 2013, initially operating as a Layer 1 network. On April 20, 2023, Helium announced its migration to the Solana network (according to HIP 70). Developers prefer Solana for its extensive ecosystem, integration of numerous developers, applications, and teams, and its cost and speed advantages over other chains.

The native token of the Helium network, HNT, was not pre-mined, with a total supply capped at 223 million. In Helium, the only way to pay for data transmission fees is through Data Credits (DC) obtained by burning HNT. These credits are priced in USD, non-transferable, and only usable by the original owner.

After the implementation of HIP-52, hotspot deployments no longer receive HNT rewards but are rewarded with IOT and MOBILE protocol tokens, used for the Helium IoT and Mobile networks. The multi-token model allows each wireless network to govern independently, facilitating better decision-making by DAOs. Tokens earned from IoT and Mobile network deployments can be exchanged for HNT, providing value to the network tokens. Currently, Helium has a market capitalization of approximately $420 million, making it the largest DePIN project in the Solana ecosystem.

Teleport

With the emergence of decentralized maps, decentralized ride-sharing applications like Teleport have been launched and are currently available on the Apple Store. Teleport is a ride-sharing application owned and managed collectively by drivers, passengers, and developers without the need for permission. On October 27, 2022, Teleport completed a $9 million seed round financing, led by Foundation Capital and Road Capital.

Founder Paul Bohm pointed out that existing ride-sharing giants like Uber have a monopoly in the shared mobility industry. To address this issue, Teleport has built the shared mobility protocol TRIP, aimed at benefiting drivers, passengers, and the local economy while achieving autonomy. This protocol will first be applied on the Teleport platform, and participants in the operation and development of the network will receive TRIP rewards, some of which may appear in the form of NFTs. TRIP rewards also represent participation and voting rights in the network. The project has not yet released a token, and the official website and Twitter will provide the latest information.

Tekkon

Tekkon is a Japanese project that encourages users to take photos of local infrastructure or report damaged infrastructure to earn token rewards while helping improve the local environment. This project was launched by the non-profit organization Whole Earth Foundation founded by Takashi Kato, who previously founded Fracta Inc., a software company that helps identify weaknesses in urban water supply networks.

In the Philippines, Tekkon has been well-received due to token incentives, forming a group known as "infrastructure hunters." According to Bloomberg, Tekkon has over 128,000 active users, with 90,000 from the Philippines, uploading approximately 30,000 photos daily.

Whole Earth Coin (WEC) is Tekkon's reward token, which can be exchanged for cash on Line Pay in Japan. The initial supply of WEC is 3 billion, with no limit. The token is used for various purposes, including rewarding users and in-app operations. Tekkon plans to enhance the token's functionality in multiple ways to build a more complete and sustainable ecosystem.

Render Network

Render Network has expanded its services from Polygon to the Solana blockchain, allowing individuals to contribute idle GPU power to assist in motion graphics and visual effects rendering.

Conclusion

Solana has addressed key challenges through a series of technological innovations. The Breakpoint 2023 conference in Amsterdam brought together over 3,000 developers, investors, traders, business leaders, and artists to discuss ecosystem innovation and future network planning. For example, the launch of the Firedancer validator client will increase validator diversity, a key factor in achieving long-term resilience and decentralization for Solana.

Solana's economic activity is diversifying. Render Network successfully migrated from Ethereum to the Solana blockchain, enabling new features such as real-time streaming and dynamic NFTs, benefiting from Solana's fast transaction speed, low costs, and extensive network architecture.

Solana's decentralized efforts have received crucial support and enhancements. For example, Nikolay Vlasov, a senior solutions architect at Amazon Web Services, announced at Breakpoint that Solana nodes can now be rapidly deployed on AWS, helping to expand user experiences globally.

Solana has demonstrated its commitment to technical collaboration and innovation. James Tromans, Web3 lead at Google Cloud, announced that Google Cloud's BigQuery has now integrated Solana data, allowing developers, businesses, and users to query detailed Solana data. This integration underscores Google's existing infrastructure, making it an ideal company to onboard developers into the blockchain space.

Top Solana protocols plan to distribute tokens to their most active on-chain users through airdrops. As newly acquired tokens circulate on Solana, the resulting TVL injection will help increase the overall valuation of the Solana ecosystem.

With the growth of TVL, DeFi project airdrops, and the maturation of the liquidity staking market, DeFi and LSD products on Solana may attract significant capital. NFT projects, especially those combining with the metaverse and gaming sectors to empower unique user experiences and innovative projects (such as xNFT), may become investment hotspots.

In the long run, with a focus on the Asia-Pacific market and global expansion plans, Solana may become the world's leading public chain ecosystem, attracting more international users and developers. Solana's technological innovations, such as high TPS and low latency, will position it as a leader in high-performance blockchain applications, such as large-scale games and complex DeFi applications. With the success of the DePIN project, it may lead a new trend in blockchain applications, integrating blockchain technology into various real-world scenarios, bringing innovation to traditional industries.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。