This article will explore the core functions of Pyth Network and its role in DeFi, while focusing on analyzing how Wormhole efficiently utilizes cross-chain technology.

The development of DeFi cannot be separated from oracles, which act as "messengers" between smart contracts and real-world data, enabling DeFi applications/protocols to securely and reliably obtain financial data from the external world to maintain accurate and stable system operation. Therefore, many oracle protocols have emerged in the market, including well-known ones such as Chainlink. However, with the increasing complexity of the market, high-quality market data has become more scarce, becoming an obstacle to building transparent and efficient DeFi services.

In this context, Pyth Network emerged, dedicated to providing real-time, reliable first-hand financial market data for decentralized applications. As a leading cross-chain information transmission protocol, Wormhole provides a seamless and efficient solution for connecting different blockchains, thereby propelling Pyth Network to new heights. Through the cross-chain information transmission service provided by Wormhole, Pyth Network has successfully distributed its first-hand data to various corners, making it one of the world's top oracle networks.

This article will explore the core functions of Pyth Network and its role in DeFi, while focusing on analyzing how Wormhole, through efficient cross-chain technology, enhances the capabilities of Pyth Network, making it one of the most influential data oracles in the market.

Before starting the main text, here is a message “Wormhole Completes a New Round of $225 Million Financing with a Valuation of $2.5 Billion and Announces the Establishment of Wormhole Labs”. Those who want to join the Chinese community of Wormhole can scan the code to join:

Part1 What is Pyth Network?

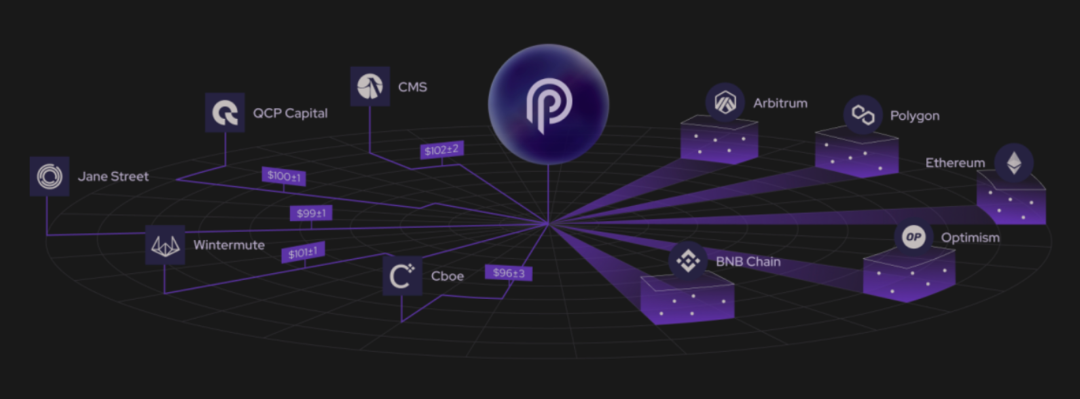

Pyth Network is an oracle network designed to provide real-time, high-precision market data for the crypto market and DeFi ecosystem, including but not limited to price, interest rate, and volatility information. The network collects first-hand data from over 90 trusted data providers, including well-known exchanges, market makers, and financial institutions, and makes it available for smart contracts and other on-chain or off-chain applications. To date, Pyth has provided real-time price data for cryptocurrencies, stocks, foreign exchange, ETFs, and commodities to smart contract developers on over 40 blockchains.

Pyth Network's main features are reflected in its unique insights and technological innovations in the DeFi field, including the following aspects:

01 Decentralization and Strong Security

Pyth Network aggregates data from multiple sources in a decentralized manner, reducing the risks associated with a single data source. Additionally, with numerous independent data providers maintaining and updating the data, it establishes a robust security network, enhancing the system's resistance to attacks.

02 Low Latency, High-Frequency Data Updates

Pyth Network adopts a pull model, achieving lower latency and high-frequency data updates compared to common push model oracles by updating prices off-chain at a high frequency. Each price feed is updated every 400 milliseconds, providing better support for financial scenarios requiring low latency and high-frequency price updates.

03 Comprehensive Data Coverage and Multi-chain Availability

Pyth Network's data coverage is extensive, including various asset classes such as cryptocurrencies, stocks, foreign exchange, ETFs, and commodities. Moreover, Pyth Network is not limited to specific blockchains. After price publication and data aggregation on Pythnet (Pyth application chain), price updates are transmitted across chains through Wormhole, extending asset price data to dozens of blockchains. Multi-chain availability means that applications on all supported blockchains can access this data in real-time, providing seamless data support for building cross-chain DeFi solutions.

04 Transparent, High-Precision, High Availability Data

Pyth Network emphasizes the transparency and accuracy of data. It directly obtains data from traditional and decentralized financial data creators, ensuring that each data point can be traced back to its publisher and is first-hand data, with the publisher's identity and reputation guaranteeing data quality. Through this approach, Pyth Network ensures the transparency, verifiability, and high precision of the provided data, increasing its availability. High availability ensures that users can access the required data anytime, anywhere, which is crucial for ensuring the continuity and reliability of DeFi services.

It is these characteristics that make Pyth Network a trusted DeFi data provider platform, securing its position in the competitive oracle market through technological innovation and a strong ecosystem participant network.

The main difference between Pyth Network and many well-known oracles lies in the data update mechanism, namely the difference between push-type oracles and pull-type oracles, which also leads to differences in their applicable use cases. To help readers understand, we will use Chainlink as an example to briefly summarize the differences between the two.

Data Update Mechanism:

Chainlink is a push-type oracle, which actively "pushes" data to the blockchain at specific time intervals or when price changes reach a certain threshold.

Pyth Network is a pull-type oracle, allowing users or smart contracts to actively request (pull) data. This means that demand-side (decentralized applications/smart contracts, etc.) can obtain data at a custom frequency. When smart contracts are designed to frequently check and pull the latest data, it can reduce latency and achieve higher frequency updates.

Applicability of Use Cases:

Chainlink is suitable for DeFi products with low update frequency requirements (such as lending, swaps, etc.), as these products do not require high-frequency, low-latency real-time price updates.

Pyth Network's low-latency feature makes it very suitable for applications requiring high-frequency, low-latency real-time data, especially in financial scenarios with high market volatility or sensitivity to fast trade execution, such as derivatives and margin trading.

Part2 Synergy between WH × Pyth

Through the previous text, we learned that Pyth Network has established a solid DeFi data provider platform and price feeding system through technological innovation and a strong ecosystem participant network. To enable data to be disseminated and used in a broader blockchain ecosystem, the intervention of a cross-chain communication protocol is needed. When it comes to real-time data transmission and inter-chain interoperability, Wormhole plays an indispensable role as a crucial hub connecting the heterogeneous blockchain world in the process of transmitting information between Pyth Network and different blockchains.

As early as 2021, Wormhole and Pyth Network established a partnership. Through Wormhole's cross-chain communication technology, Pyth Network can transmit its first-hand, high-frequency updated market data in real-time to any blockchain connected to Wormhole. This allows the price data provided by Pyth Network to be used by dApps on dozens of blockchains without worrying about data tampering or delays. Well-known Web3 applications such as Synthetix, Venus, Hashflow, involving chains such as Ethereum, BNB Chain, Optimism, Arbitrum, Polygon, Avalanche, are all using price data from Pyth Network transmitted through Wormhole for cross-chain interoperability.

The following diagram shows how Pyth Network transmits price data from Pythnet to the target chain through Wormhole:

The process is roughly as follows:

[1] Data Publication: Data providers first publish their price data on Pythnet.

[2] Data Aggregation: On-chain oracle programs on Pythnet aggregate this price data to form comprehensive prices and confidence levels.

[3] Data Transmission: Validators on Pythnet send Wormhole messages for each Pythnet slot to the Wormhole contract on Pythnet, containing the Merkle root of all prices.

[4] Wormhole Guardians Verification: Wormhole guardians observe these Merkle root messages and create a signed VAA (Verifiable Action Approval) for them.

[5] Hermes Monitoring and Storage: The price server Hermes continuously monitors Pythnet and Wormhole to obtain Pyth's Merkle root information and stores the latest price messages along with their Merkle proofs and signed Merkle roots.

In simple terms, Hermes acts as the latest price data repository for Pyth, ensuring that users can access the latest information. All end-users (including applications, smart contracts, etc.) wishing to utilize Pyth Network's price data interact with Hermes to retrieve the latest pricing information, which is then integrated into their applications and trading activities. Additionally, Pyth also provides an API for on-chain protocols to integrate with Pyth contracts through a simple API to obtain and use the current price data provided by Pyth.

Through this process, Pyth Network achieves efficient, secure, and real-time data transmission between different blockchains, ensuring that decentralized applications can access the latest and most accurate market price information.

In summary, the integrated cooperation between Wormhole and Pyth Network brings about a powerful synergistic effect. Wormhole's cross-chain communication technology, combined with Pyth Network's real-time market data, lays the foundation for building a more robust, efficient, and interconnected DeFi environment. As more blockchains join Wormhole in the future, the influence and coverage of Pyth Network will further expand, making it a key link connecting real-world data and blockchain applications.

Part3 Conclusion

In today's increasingly mature DeFi ecosystem, the collaboration model between Pyth Network and Wormhole provides an innovative example for the entire industry. We are witnessing the birth of a new data and asset circulation model, in which Pyth Network and Wormhole play indispensable roles.

Pyth Network's high-precision, low-latency market data solution, combined with Wormhole's efficient cross-chain communication capabilities, has jointly created a reliable, flexible, and widely applicable data transmission framework. This framework not only provides stable and reliable data support for many existing DeFi applications but also opens the door for new applications and innovations. As more blockchains and asset types are included, this framework will further expand its service scope and influence.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。