Title: Exploring the Role of Crypto from a Financial Perspective and Its Impact on Local Life

Author: @ivyfanshao

Crypto presents two different faces in different regions. It is a speculative target in developed regions and a financial lifeline in emerging regions. When a country's economy faces collapse, cryptocurrencies such as Bitcoin and stablecoins will spread among the public, as seen in Ukraine, Turkey, and Argentina. Over the past decade, the Turkish lira, the Argentine peso, and the South African rand may be among the world's three weakest currencies.

In regions with weak fiat currencies, foreign exchange controls, and insufficient liquidity of mainstream currencies such as the US dollar and the euro, Crypto has fertile ground, providing local residents with tools for storing value and achieving financial freedom.

I once heard an Argentine friend talk about using Crypto to pay for medical clinic fees, renew Spotify subscriptions, and shop at supermarkets. This was a scenario I could not imagine. In order to understand the world from more perspectives, during my time at ZuConnect, I interviewed residents from 7 countries and regions, attempting to explore the role of Crypto from a financial perspective and how its adoption affects local life.

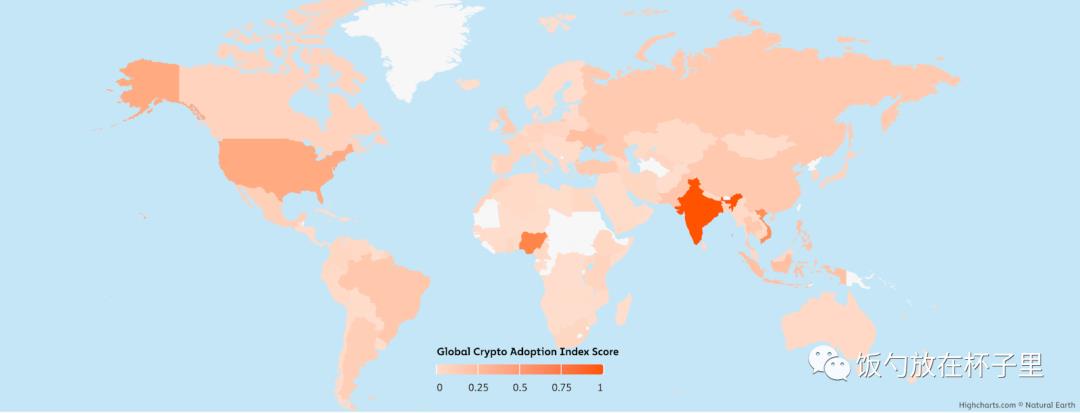

Image: 2023 Crypto adoption rates, with Nigeria, Vietnam, Turkey, and Argentina ranking 2nd, 3rd, 12th, and 15th, respectively

Source: chainalysis

1. Turkey - 52% of Turkish Adults Invest in Crypto, Financial Freedom, Relaxed Regulation

Overview

With inflation as high as 80%, no foreign exchange controls, free buying and selling of lira for US dollars and euros, a highly developed banking system, and easy account opening with low KYC requirements, these are the financial conditions and regulatory situation in Turkey.

Low barrier to Crypto investment: Licensed local exchanges in Turkey (Binance TR & Coin TR) allow direct deposits and withdrawals to bank accounts, and even cash transactions (in USD/lira/euro) at offline stores. There are many fiat-to-Crypto exchange stores in the bustling market, with real-time prices flashing like bullet comments. These deposit and withdrawal stores are all legitimate businesses and are subject to taxation by the government. However, Crypto payments are illegal, as businesses are required to report taxes annually, and income tax is a core source of government revenue.

Free flow of foreign exchange: Individuals have no exchange restrictions, while corporates have an upper limit of 800,000 USD. There are exchange stores everywhere, and no KYC is required, making it easy for Turkish people to hold US dollars and euros for savings.

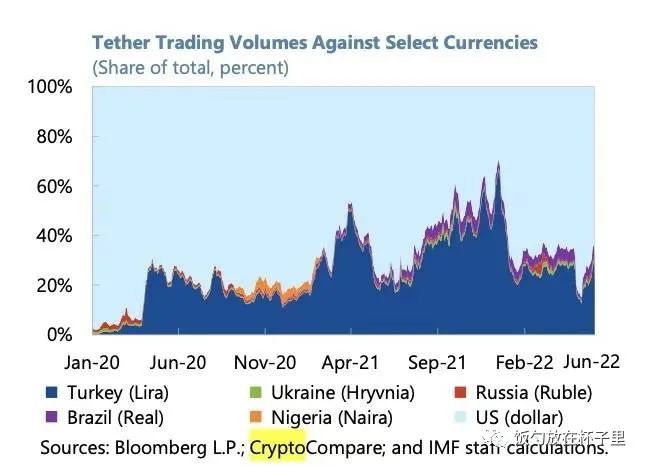

Image: Trading volume of USDT/TL, far exceeding that of other emerging market currencies

In 2021, the lira-to-dollar exchange rate collapsed, and the trading volume of USDT/TL even surpassed that of USDT/USD.

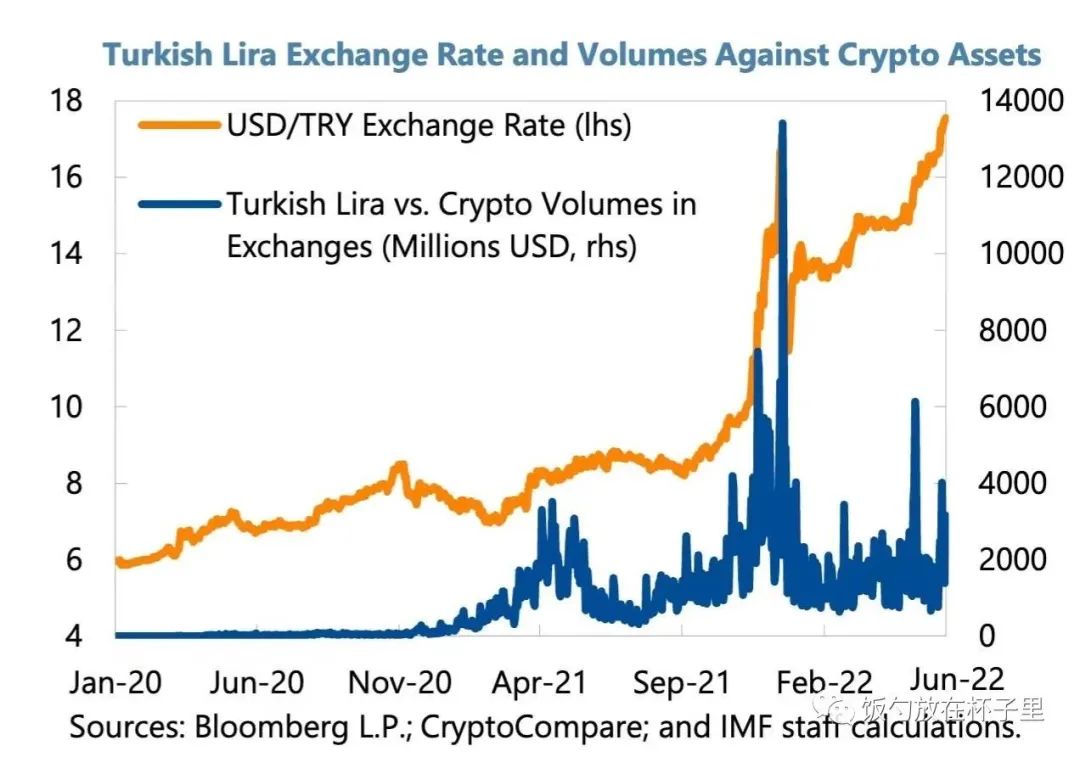

Image: Lira-to-dollar exchange rate collapse in November 2021, with daily Crypto trading volume approaching half of Turkey's daily foreign exchange trading volume

Cross-border remittances: Local PayPal has been unavailable since 2016 due to failure to comply with local regulations, so people generally use Wise or Western Union.

Cards as the mainstream payment method: Debit and credit cards are widely used in Turkey. According to data from the Interbank Card Center (BKM) of Turkey, the total number of credit and debit cards in 2021 was 291 million, including 150 million debit cards and 83.8 million credit cards. In 2021, Turkey led Europe in terms of the total number of bank cards. The total amount of transactions made with credit and debit cards in 2021 reached 1.71 trillion lira.

The Turkish banking industry is highly developed, far surpassing that of Europe. There are over 50 commercial banks, the vast majority of which offer an experience comparable to Alipay.

Relaxed regulation on financial technology:

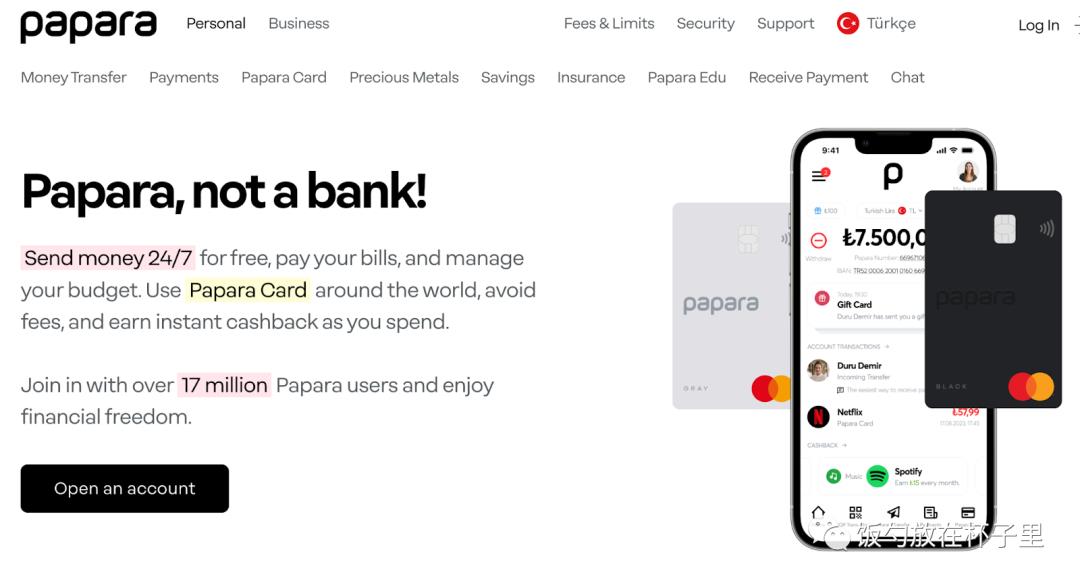

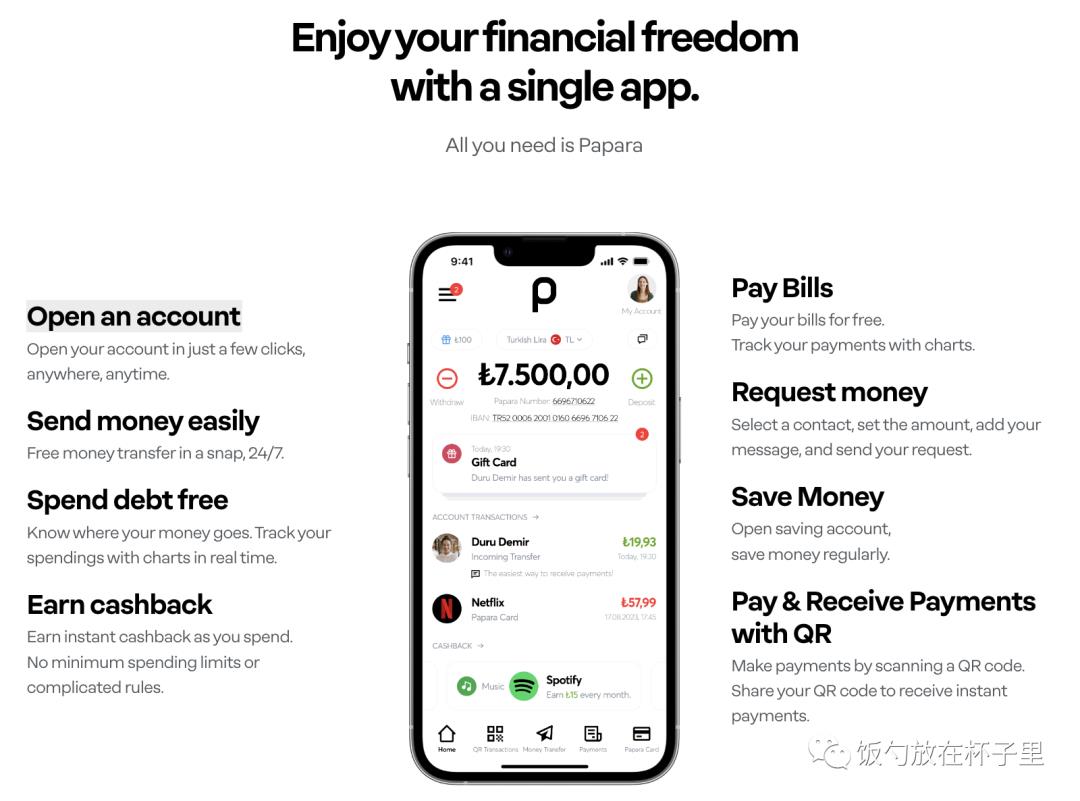

Despite having a developed banking system, Turkey still has a high proportion of the population without bank accounts, at 26%. A payment product outside the banking system, Papara, has 17 million users, requiring only a local Turkish phone number and email, with no need for ID KYC, zero transfer fees, and collaboration with Mastercard to issue physical cards. Apart from being regulated by the Central Bank of Turkey, it provides a certain degree of financial freedom unique to decentralized wallets and the convenience of card payments.

Case study: Papara, a payment product outside the banking system

Image: Papara exists outside the banking system, and the Papara Card provides a banking card experience

Image: Papara product features include sending and receiving money, paying bills, and paying subscription fees

Source: https://www.papara.com/en

High degree of population information/residence/government affairs digitization: Residents can handle all government affairs, pay fines, file taxes, apply for passports, and obtain student enrollment certificates from home.

Image: Turkish public service platform

Source: https://www.turkiye.gov.tr/

Smooth channels for deposits and withdrawals: Licensed exchanges Binance TR and Coin TR allow direct withdrawals to various bank accounts, with a fee of only 3 TL.

Crypto adoption rate

As of October 2022, approximately 8 million people actively invest in cryptocurrencies. If immediate family members are included, the number is around 14 million.

Source: https://www.kucoin.com/blog/more-than-half-of-Turkish-adults-invest-in-Crypto

Crypto exchanges in Turkey:

- Licensed exchanges in Turkey, supporting bank card deposits and withdrawals

- Binance TR

- Coin TR

- Local exchanges commonly used in Turkey: Local exchanges Paribu and Btctürk each have over 6 million registered users

- https://www.btcturk.com/

- https://www.paribu.com/https://ventures.paribu.com/

- https://www.bilira.co/

Image: BtcTurk logo seen everywhere at Istanbul Airport. Source: Author's photo

It is worth mentioning the state-owned enterprise in the exchange—Coin TR. Coin TR has partnered with two national banks in Turkey, Ziraat Bank and Vakif Bank, to open fiat deposit and withdrawal channels. It is more like a company jointly established by regulatory authorities, traditional banking institutions, and international technical teams, and has been attempting to solve Turkey's exchange rate and US dollar reserve issues since its inception.

2. Argentina - 25% of Argentine Adults Frequently Trade Crypto and Use It as a Daily Payment Currency

Overview

The people of Latin America need solutions to issues such as inflation, remittances, value preservation, and savings, and they have enjoyed the benefits of Crypto, becoming some of its most enthusiastic supporters. In Argentina, it has become mainstream, with approximately 5 million people (out of a total population of 45.8 million) using it.

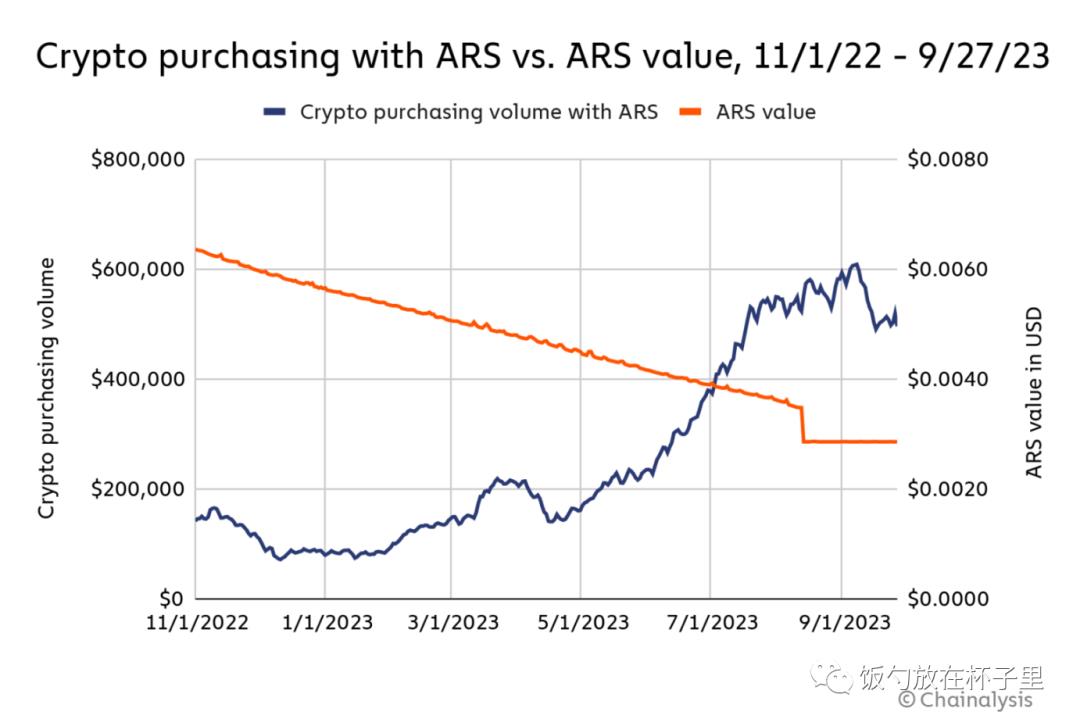

Image: Crypto trading volume surges in Argentina as the peso faces inflation. Source: chainalysis

Inflation: In October 2023, Argentina's inflation rate soared to 121%, and such inflation has been ongoing for many years.

Foreign exchange controls: The Central Bank of Argentina faces a shortage of foreign exchange and implements foreign exchange controls to prevent capital flight. Exporters are required to repatriate profits from overseas sales within 5 days, and institutions and banks need authorization to purchase US dollars in the foreign exchange market. Argentine citizens are limited to purchasing no more than $10,000 in US dollars per month.

The desire for US dollars and foreign exchange controls have given rise to the black market. In 2023, the desire for US dollars in Argentina drove the black market exchange rate to soar nearly 600 times. When unable to buy US dollars, people seek alternative solutions, namely Crypto. This financial environment has spurred the demand of Argentines for investment, inflation resistance, and financial freedom—approximately 25% of adults in Argentina hold Crypto.

Crypto adoption rate: According to data from Americas Market Intelligence, the adoption rate of cryptocurrencies in Argentina is growing at a rapid pace. At the end of 2021, only 12% of Argentine smartphone users had purchased cryptocurrencies, but by April 2022, this number had grown to 51%. Additionally, as many as 27% of Argentine consumers claim to be regularly purchasing cryptocurrencies.

Local exchanges in Argentina

- Binance

- Bybit

- eToro

- OKX

- Gate.io

Image: Binance advertisement—Argentine merchants contribute to financial freedom in Latin America through Binance P2P

Economic structure and geographical factors

Approximately 50% of Argentina's economy is in the gig economy, leading to a significant demand for cross-border payments. Argentina is in the same time zone as North America and ranks among the top in education levels in Latin America, providing Argentines with ample conditions to provide R&D services to North American companies.

Crypto in the daily lives of Argentines

According to AMI statistics, 71% of Argentines hold Crypto for investment, 67% for inflation resistance, and 46% for financial freedom.

- Daily life: 25% of Argentines frequently use Crypto for daily consumption and savings. Even ordinary housewives can proficiently use cryptocurrencies for daily shopping and paying for medical clinics.

- AMI's data shows that Argentina is an important market for Crypto debit and credit cards. For example, Mastercard and Binance Crypto Exchange have decided to jointly launch prepaid Crypto debit cards nationwide. According to Mastercard's statistics, at least 51% of Latin Americans use cryptocurrencies for shopping. Furthermore, from 2021 to 2022, the total inflow of cryptocurrencies in Latin America exceeded $562 billion, a 40% increase from 2020.

Image: In the past year and a half, the number of debit cards issued by several local exchanges such as Lemon, Buenbit, and Belo has grown rapidly

- Investment and savings: According to AMI's survey data, over 50% of Argentines purchase Crypto assets as a "inflation hedge" similar to gold.

- Remittances: World Bank data shows that Argentina receives approximately $650 million in remittances annually. Chainalysis found that an increasing number of Latin American immigrants are using Bitcoin remittances to send money to their families in their home countries. Now, Argentines can access the Bitcoin Lightning Network on apps like Strike, and more Argentine immigrants are beginning to enjoy the benefits of cross-border cryptocurrency transactions.

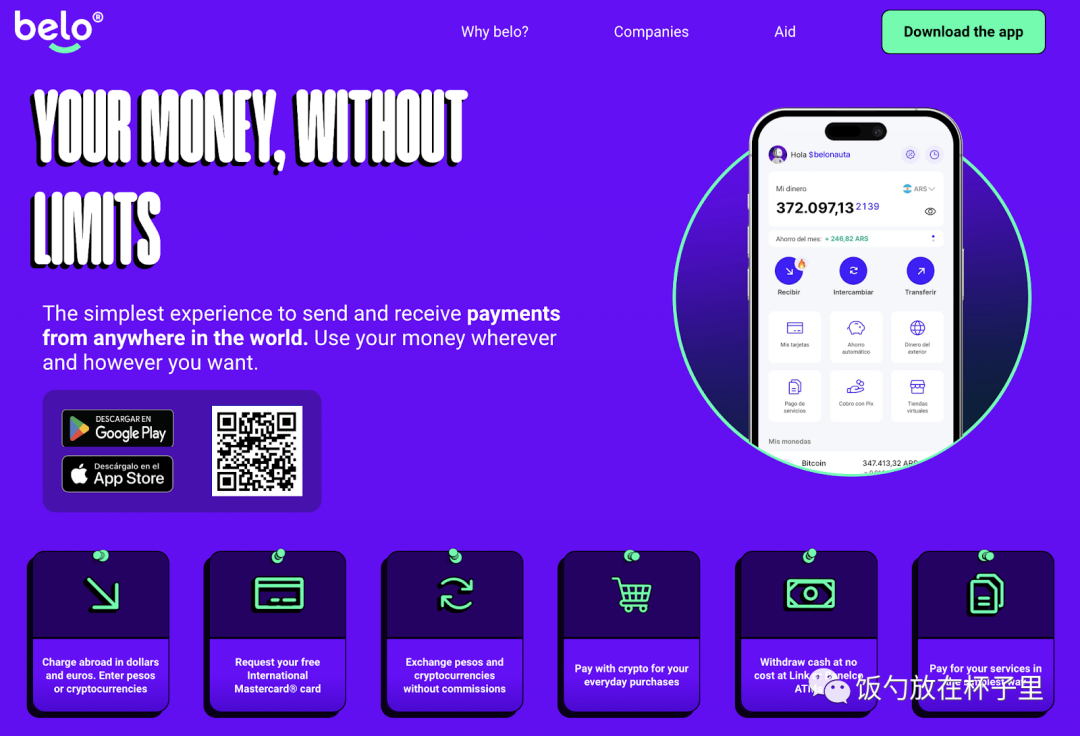

Case study: Crypto payment app belo—providing Argentines with tools for savings and financial freedom

belo is a local payment app in Argentina that combines the advantages of web2 + web3, integrating the banking system, financial technology, and Crypto payments. The receiving end can receive cross-border payments without verification, enabling the rapid and secure transfer of funds. The paying end can directly spend Crypto, and the recipient receives fiat currency, similar to a debit card. However, opening a belo account requires an Argentine ID/passport.

Image: belo—providing Argentines with tools for savings and financial freedom. Source: belo.app

Payment end:

- Card payments: The payer can directly spend Crypto, and the recipient receives fiat currency. Consumer users can spend any Crypto (BTC, ETH, USDT), and then pay in fiat currency (Argentine peso) in the form of a debit card, with a 2% cashback for each transaction.

- The app offers a wide range of daily consumption payment functions, very localized, such as phone recharges, utility payments, financial insurance payments, basic service payments, shopping services, dining services, telecom services (supporting 4 telecom operators), and more. Users can also create an unlimited number of virtual cards, similar to Wise, with each virtual card having a daily spending limit for various subscription services.

Receiving/recharging:

1. Transfer funds from Payoneer balance

Transfer the balance from Payoneer (a Latin American online payment company) to belo with no delay. The funds are automatically converted to USDC at the current exchange rate upon deposit, for storage, conversion into other cryptocurrencies, or use with the Belo Mastercard. A 4% commission is charged for depositing funds, with a minimum amount of $5 and a maximum of 5 withdrawals per day, up to $5,000.

2. Cross-border Euro receipts

belo supports SEPA transfers to receive Euro payments. In the future, it will also be possible to receive USD payments through SWIFT and ACH transfers.

Receiving payments from abroad incurs a 1.5% commission and takes 1 to 4 business days to be credited. The balance is automatically converted to USDC at the current exchange rate and can be exchanged for other cryptocurrencies. Using an Argentine DNI to create an account allows it to be used with the Belo Mastercard.

3. Directly deposit Crypto via address

Image: belo supports SEPA transfers to receive Euro payments, transfer funds from Payoneer balance, and direct Crypto deposits. Source: help.belo.app

Key success factors: The belo product comes from the hands of Argentine founders, and the local team has several advantages:

- Deep insight into user daily needs, and very detailed. Just as PG said, what looks smooth, when magnified ten thousand times, still has gaps, and these gaps are where product optimization lies, such as automatically converting peso balances into stablecoins, with optional conversion periods (daily, weekly, monthly).

- Connecting web2 + web3 account systems: Transferring funds from seven or eight account systems such as local banks, financial technology (Payoneer), Crypto, and achieving seamless connection between fiat and Crypto requires very strong local relationships and resource integration.

3. Africa - Large Regional Disparities, Fragmented Markets, Unclear Crypto Regulation, Limited Infrastructure Solutions

Overview

The situation in Africa is complex, with large regional differences and 54 sovereign countries with a population of over 900 million. Geographically, Africa is commonly divided into five regions: North Africa, East Africa, West Africa, Central Africa, and Southern Africa. Africans, like Latin Americans, are eager to share and hope that the economic and financial infrastructure of their countries will be heard and seen by the world.

Payment and account systems in Africa:

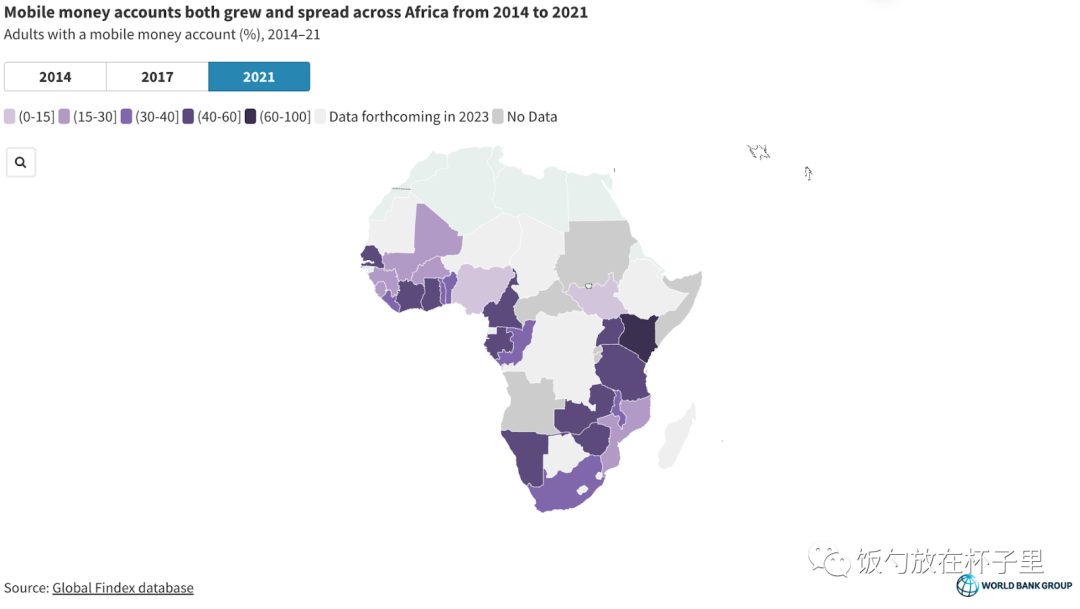

Mobile money is a key driver of inclusive finance in sub-Saharan Africa. It promotes account penetration through mobile payments, savings, and lending.

Account penetration for mobile money. Mobile money account holders are not just using their accounts for P2P payments as originally designed. In 2021, about three-quarters of mobile account holders in sub-Saharan Africa used their mobile money accounts to make or receive at least one non-personal payment.

Mobile money accounts have also become an important savings method in sub-Saharan Africa, with 15% of adults in the region (and 39% of mobile money account holders) using mobile money accounts for savings, a proportion equal to those using formal accounts with banks or other institutions.

Mobile money as financial infrastructure. 7% of adults in sub-Saharan Africa also use mobile money accounts for borrowing.

Image: The World Bank's 2021 Global Findex Database found that 55% of adults in sub-Saharan Africa have accounts, with 33% of adults having mobile money accounts.

Source: The Global Findex Database 2021

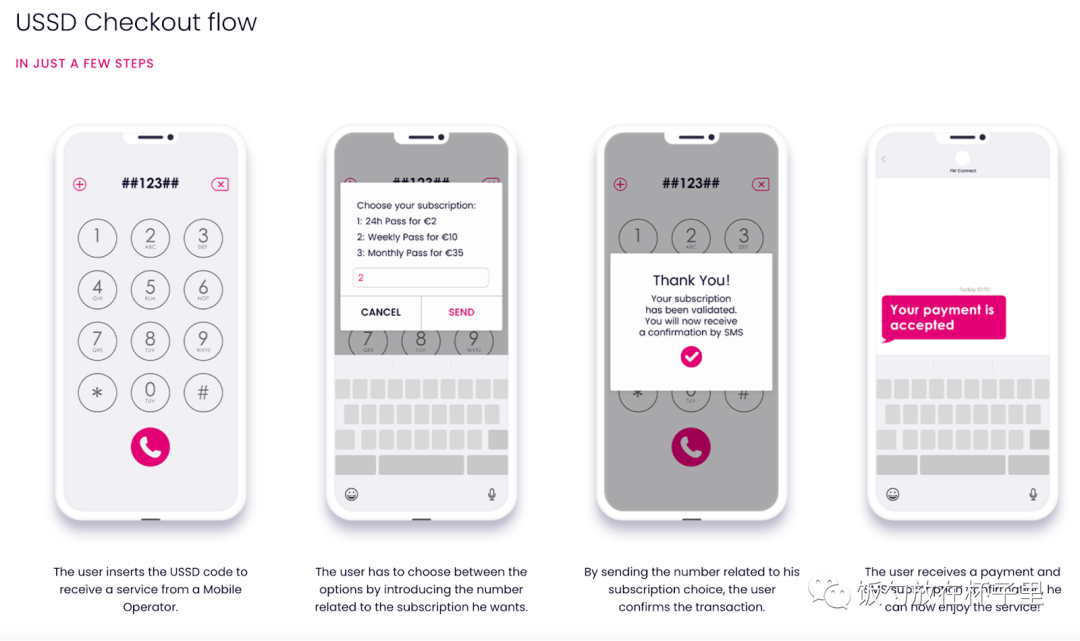

Mobile money technology implementation: USSD

USSD has very low infrastructure requirements and has become a very powerful payment method in Africa. USSD technology allows users to create a mobile wallet with their phone number, electronically store funds, and directly transfer funds, pay bills, top up airtime, and make payments to merchants on their phones. It is accessible and usable globally, without the need for an internet connection, meeting the needs of all types of consumers.

Image: USSD technology: Users can create a mobile wallet with their phone number, electronically store funds, and directly transfer funds, pay bills, top up airtime, and make payments to merchants on their phone.

Source: Author's photo

Image: USSD user flow

Source: Digital Virgo

Nigeria - 25% of Nigerians Hold Crypto, Another Solution for Inclusive Financial Services

The Nigerian currency is weak, with a significant difference between the black market exchange rate and the official exchange rate. According to 2021 World Bank statistics, the proportion of people without bank accounts in the region is as high as 55%. All of this greatly stimulates the local demand for Crypto.

Image: In 2021, the proportion of people without bank accounts in Nigeria is as high as 55%.

Source: The Global Findex Database 2021

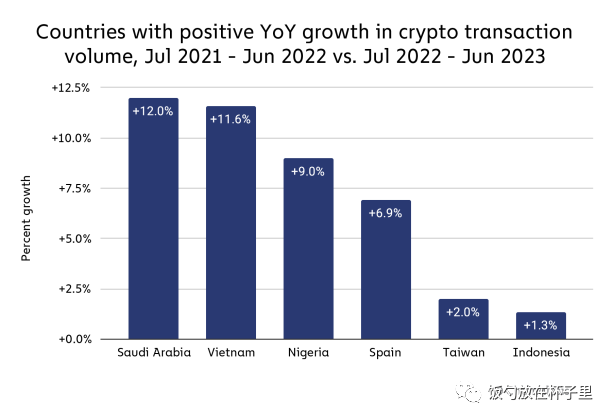

Image: Crypto adoption rate in Nigeria increased by 9% year-on-year.

Source: Chainalysis

Regulation is still strict, with the majority of areas prohibiting the use of Crypto for payments. Binance C2C is the most commonly used channel for deposits and withdrawals.

4. Vietnam - With 16 Million Crypto Holders, Strong Economic Growth Momentum, and a Young Population Structure

Overview

Vietnam's use of Crypto and its regulatory situation are similar to China's. The majority of people hold Crypto for speculative purposes, and they often trade coins on centralized exchanges, with KOL-led trading being common. Additionally, Crypto adoption in Vietnam is very high, increasing the country's attractiveness to global projects.

Foreign exchange controls: Vietnam has strict foreign exchange controls.

Inflation: The Vietnamese dong (VND) has an inflation rate of 4-7%, which is essentially offset by bank deposits earning 6-7% interest.

Economic and geographical characteristics of Vietnam

Vietnam has seen significant economic growth over the past decade, with an average annual GDP growth rate of 6%, making it one of the fastest-growing economies in Southeast Asia.

The booming economy, combined with its strategic geopolitical positioning, has attracted top technology companies such as Apple, Samsung, and Intel to establish their manufacturing bases in Vietnam. In addition to manufacturing, Vietnam also frequently provides software development services to developed countries and regions.

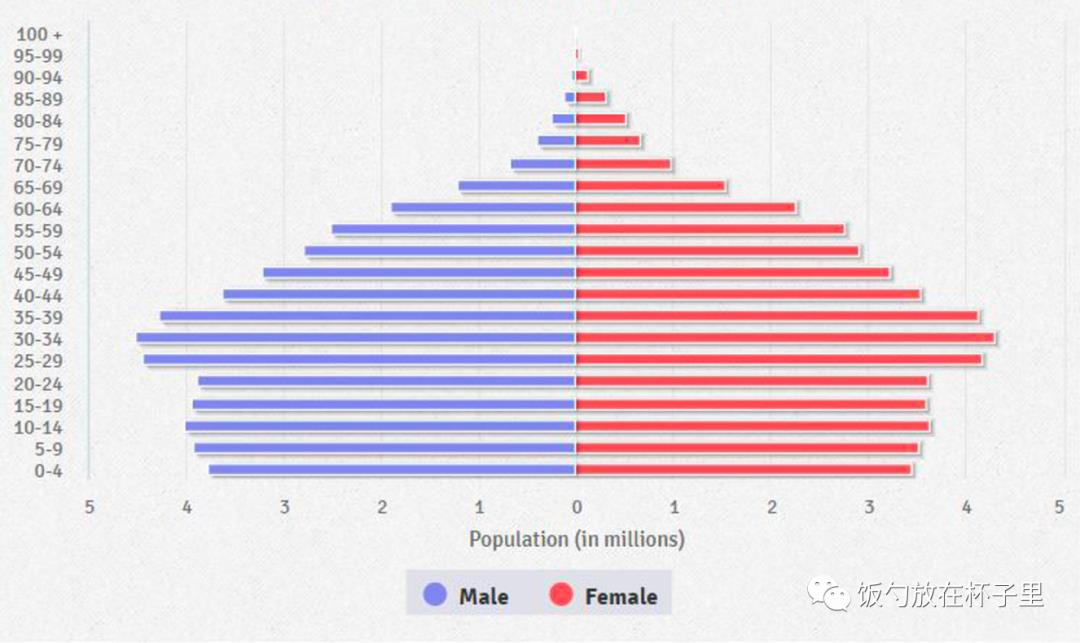

In terms of population structure, Vietnam is one of the youngest countries in the world, with 30% of the population aged under 25. The young population (aged 10-24) in Vietnam accounts for 21% of the total population, or 20.4 million people. This demographic window is expected to continue until 2039.

Image: Vietnam is one of the youngest countries in the world, with 30% of the population aged under 25.

Source: vietnamplus.vn

Vietnam has over 16.6 million Crypto holders, making it the second Southeast Asian country with the most Crypto investors. About 31% of these investors hold Bitcoin, accounting for approximately 17% of Vietnam's total population. The motivation for holding Crypto is largely speculative, leading to a significant number of local Crypto trader KOLs.

Vietnam has approximately 200 active blockchain projects, mainly in the DeFi, NFT, infrastructure, and GameFi sectors. Notable projects include Axie Infinity, Kyber Network, and Coin98.

In terms of regulation, in 2020, the State Bank of Vietnam announced that it does not accept cryptocurrencies as legal tender or a means of payment. Crypto payments are still in a gray area.

Local payments

- MoMo (digital wallet): MoMo is the most popular digital wallet in Vietnam, with 20 million users, leading in the mobile wallet field, followed by Mocan and Zalo Pay.

- In Vietnam, credit cards are still the main online payment method, occupying 31% of the market share.

5. Switzerland - Zug, the Experimental Ground for Crypto Valley

Switzerland is known as Crypto Valley, mainly due to its historical development and the registration of the Ethereum Foundation in Switzerland. Zug is also a pilot city for Crypto payments. However, affluent areas like Zug do not necessarily need Crypto as a supplement to their financial infrastructure, and the establishment of Crypto payment special zones is more experimental in nature.

In addition, in the 2021 Democracy Index by The Economist, Switzerland ranked 9th, making it a suitable region for DAO practices.

In summary: The two extremes of Crypto - speculation in developed areas vs. financial lifeline in emerging areas

In regions where the mainstream currency (such as the US dollar and euro) is not easily accessible due to foreign exchange controls and limited liquidity, Crypto has fertile ground, providing a tool for local residents to store value and achieve financial freedom.

Among the four countries and regions mentioned, Argentina has the best soil for Crypto payments;

- Turkey has a developed banking system and a relatively high degree of financial freedom, but with a ban on Crypto payments looming, it is not conducive to the development of Crypto payments; Vietnam has a good Crypto ecosystem, but there is a tendency for speculative purposes in holding Crypto;

- Africa lacks financial infrastructure, making it difficult to open bank accounts, and with a weak currency, there is a strong demand for stable currencies and cross-border remittances. However, it is the lack of infrastructure and regulations that have caused many Crypto wallet projects to fail;

- Affluent areas like Zug in Switzerland do not necessarily need Crypto as a supplement to their financial infrastructure, and the establishment of Crypto payment special zones is more experimental in nature.

Furthermore, Crypto and financial technology products like Papara and mobile money can help users obtain financial accounts without barriers.

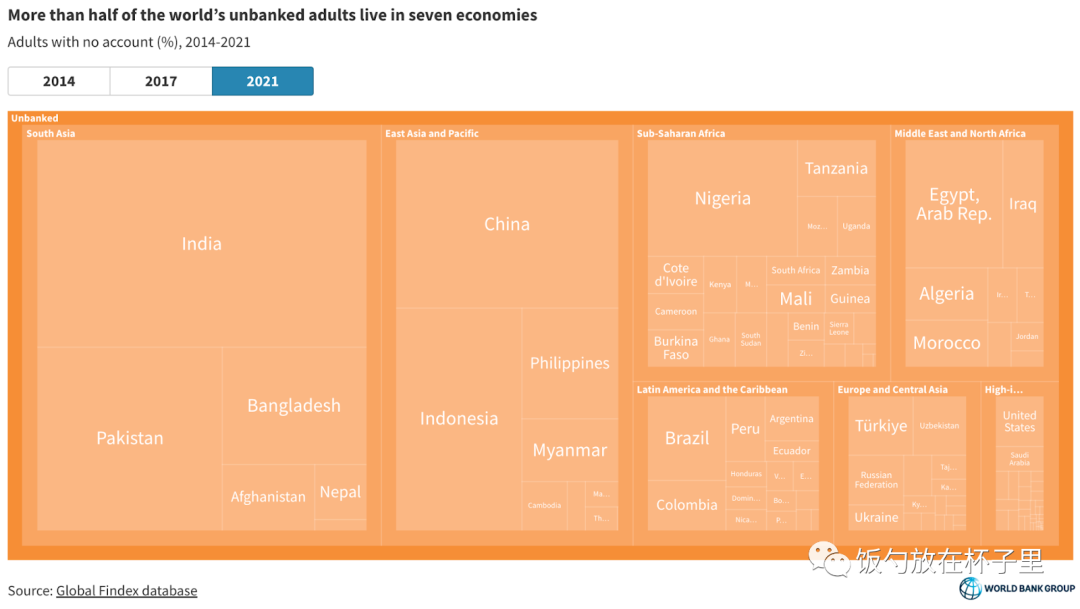

According to World Bank data in 2021, 1.4 billion unbanked adults cited lack of money, distance to the nearest financial institution, and insufficient documentation as the main reasons for not having an account. This can be addressed through technological solutions and financial regulatory policies, drawing from the technical experience of mobile money popularization in Africa. It can also be addressed by directly using permissionless Crypto accounts to increase the account penetration rate among the population.

Image: Proportion of unbanked population in various countries in 2021

Source: The Global Findex Database 2021

As two friends from Africa and Argentina have said,

"Living in China, the US, Japan, and Korea, you don’t really need Crypto. They hold Crypto to speculate.

People in Africa and Argentina need Crypto to live."

"People don't care about self-custodial, they don't give you a shxx

People care about how to transfer money across borders easily."

Crypto presents two different faces in different regions. It is a speculative asset in developed areas and a financial lifeline in emerging areas. For residents living in China, the US, Japan, and Korea, Crypto is not essential and is mostly used for speculation and narratives. However, residents in Africa and Argentina truly need Crypto to improve their daily lives, unrelated to narratives.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。