Original Title: "Is Solana Airdrop Season Here?"

Original Author: Jack Inabinet, Bankless

Original Translator: Luccy, BlockBeats

Editor's Note:

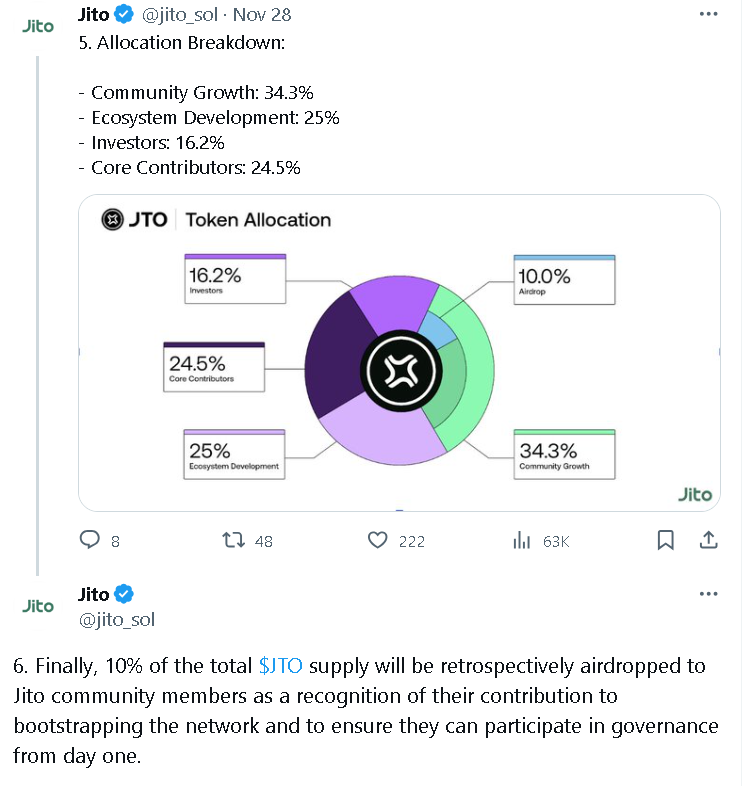

On November 28th, Jito announced the launch of 1 billion governance tokens JTO, with 90 million tokens distributed in this airdrop, and the remaining 10 million tokens to be distributed next year. Jito is a liquidity staking service on Solana, where users deposit SOL into Jito's liquidity staking pool and receive JitoSOL. In addition to receiving staking rewards, users' JitoSOL also accumulates MEV rewards.

As of now, Jito's TVL has approached nearly 6.8 million SOL, with over 50,000 stakers. Bankless analyst Jack Inabinet delves into the rise of airdrops in the Solana ecosystem and discusses the potential impact of these airdrops on the Solana DeFi ecosystem, as well as whether this signals the beginning of a new phase for Solana.

Additionally, the article raises points about the impact of airdrops on TVL (Total Value Locked) and token protocols, as well as the challenges Solana may face in competing with Ethereum, while also highlighting some key questions for Solana's future development.

Solana Stimmy Szn is here!

Earlier this month, Oracle network Pyth and DEX aggregator Jupiter announced airdrop plans, while Jito, the largest non-custodial protocol platform on Solana, announced its token on Monday.

Three significant projects have announced token airdrops to users. Is this wave of wealth influx sufficient to inject vitality into Solana's DeFi ecosystem, especially in the context of its Total Value Locked (TVL) being drier than the Sahara Desert?

Today, we will delve into the impact of these airdrops and discuss whether this is just the beginning of a Solana airdrop frenzy.

Underperforming TVL

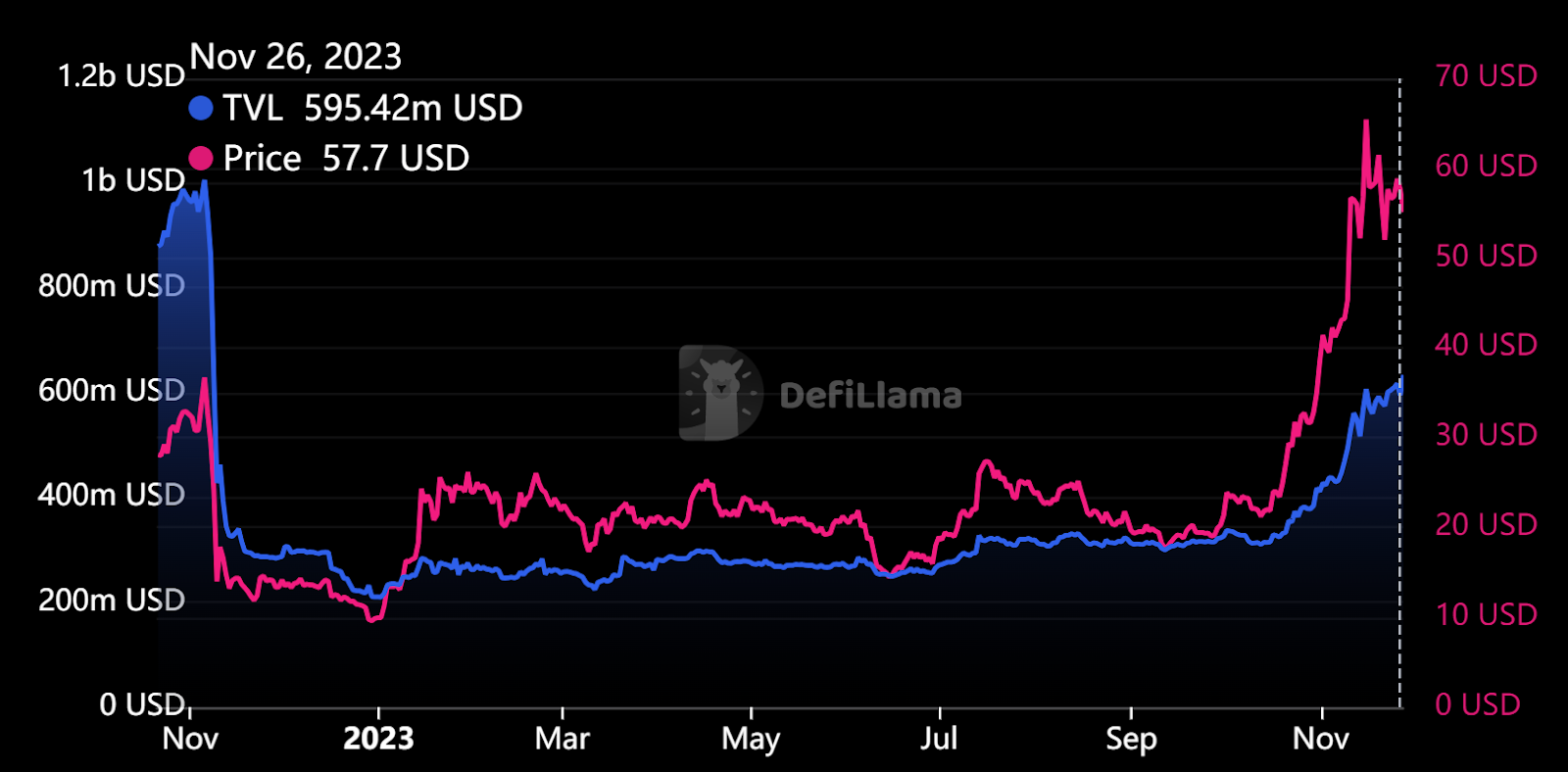

Since 2023, market participants have been eager to buy SOL, yet their greedy desire to drive up token prices has not translated into a desire to participate in Solana's DeFi ecosystem.

Despite SOL's 500% increase in price so far this year, its price growth far exceeds the growth of TVL.

Solana's TVL in USD has risen by 200%, which seems impressive, but it still remains below the pre-crash baseline of 1 billion USD for FTX, and is only a makeshift measure for TVL priced in SOL, which has decreased by 45% this year!

Solana's Next Chapter

Top Solana protocols plan to distribute tokens to their most active on-chain users through airdrops. The resulting TVL injection from the circulation of newly acquired tokens on Solana will help increase the valuation of the entire Solana ecosystem.

The arrival of airdrops on Solana may not necessarily lead to a strong performance in TVL, as these two are positively correlated indicators, but it should exert upward pressure on both figures and may be the force that actually drives the growth of TVL priced in SOL in 2024!

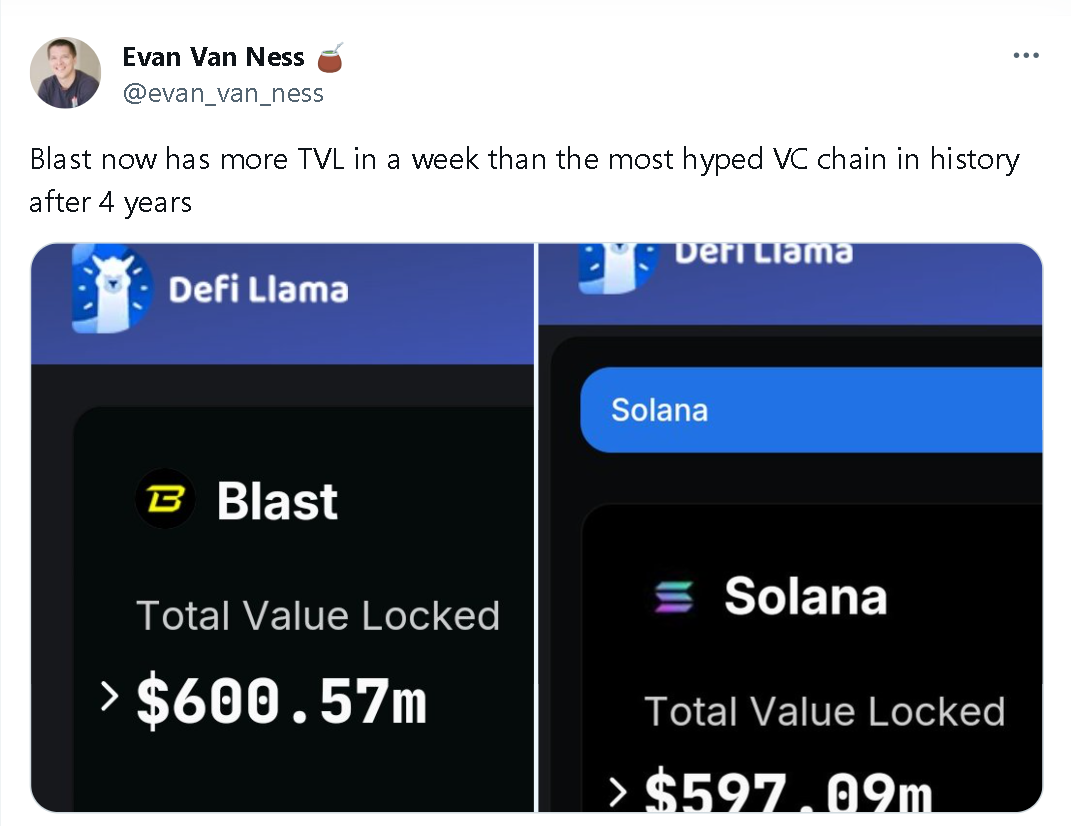

The sudden rise of Blast demonstrates the ability of airdrops to attract TVL. This is an L2 project that offered "points" rewards to users who deposited funds into a multi-signature account before the mainnet launch in February. Despite being launched just last week and not yet having a product, Blast's TVL briefly exceeded that of Solana.

The arrival of airdrops is a key part of initiating a potential supercycle for Solana and is one of the easiest ways to attract users to the chain!

Users of EVM chains are eligible to participate in Pyth's airdrop. However, to claim the airdrop, they must download a Solana native wallet to receive their Solana native assets, which can then be used in Solana native DeFi protocols. The recipients of PYTH airdrop from EVM may represent a net addition of users to Solana!

Airdropped tokens also help attract attention to projects, reminding users and developers of the cool applications on the chain. This has come a long way in establishing Solana as a viable ecosystem and an alternative to Ethereum.

Key Points

The arrival of "Solana Stimmy Szn" may herald a revival of the Solana DeFi ecosystem, but this outcome is not guaranteed. While some top-tier projects may be preparing for large-scale airdrops, the number of successful and innovative Solana protocols capable of conducting airdrops is scarce.

Liquidity still remains on Ethereum, just as protocols like Blast can attract hundreds of millions of USD in TVL based on vague promises and questionable innovations from airdrops alone, incentivizing developers to build there. Therefore, Solana will face a tough competition in terms of protocols, liquidity, and users.

With its low-cost environment, global state machine, and the ability to provide consensus at the speed of light, Solana promises to open up new application areas that are impossible on Ethereum, hoping they will arrive soon!

While the hype cycle of airdrops and the resulting wealth effect are likely sufficient to attract new ecosystem participants to join Solana and support key statistics, for Solana to succeed from airdrops, it must nurture its own DeFi ecosystem and be prepared for various protocols to conduct airdrops.

Perhaps airdrops will become the catalyst for another wave of Solana protocols. However, unfortunately, the lack of depth in non-custodial protocols on the network at present greatly diminishes the potential benefits that airdrops could bring to the Solana ecosystem.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。