Original | Odaily Planet Daily

Author | Loopy Lu

The current round of market rise is due to the expectation of the approval of the Bitcoin spot ETF; but this week, the fervor in the crypto market has gradually subsided.

On November 18th, Beijing time, the final possibility of a Bitcoin spot ETF being approved by the SEC has temporarily settled.

The SEC stated that the decision date for the approval of Franklin Templeton's Bitcoin spot ETF has been extended from the original 45 days to next year. Bloomberg ETF analyst James Seyffert analyzed that this delay was expected.

With the recent intensive postponement of ETF applications by the SEC, when will the "window period" for the next ETF decision come? Odaily Planet Daily has compiled the specific decision time points for various ETFs as follows:

The data shows that the recent "window period" for decisions has all ended, and it is unlikely to see any bullish news about ETF approval within the year. The next key time point for the next round of ETF decisions will start as early as January 1st next year.

However, it is important to note that the deadline is only the final date for the SEC to make a decision. The SEC can make an approval, rejection, or postponement decision on any day before the deadline.

Will the ETF bullishness shift to ETH?

Although there has been continuous bullish news about Bitcoin recently, it has not yet broken through the $40,000 mark. In the past two days, Bitcoin has fluctuated widely in the range of $35,000 to $37,000. Despite the insignificant decline, the market sentiment has cooled noticeably.

While the Bitcoin spot ETF has "cooled down," we have also seen another potential direction for the market: the ETH spot ETF.

On November 16th, Beijing time, BlackRock submitted its S-1 application for an Ethereum spot ETF to the SEC, designating Coinbase as the custodian of the ETH target; on November 18th, Fidelity submitted a 19b-4 filing for an Ethereum spot ETF, becoming the seventh applicant for an Ethereum spot ETF. In addition, other asset management companies such as Grayscale, ArkInvest, ProShares, and Valkyrie have also submitted applications for an Ethereum spot ETF.

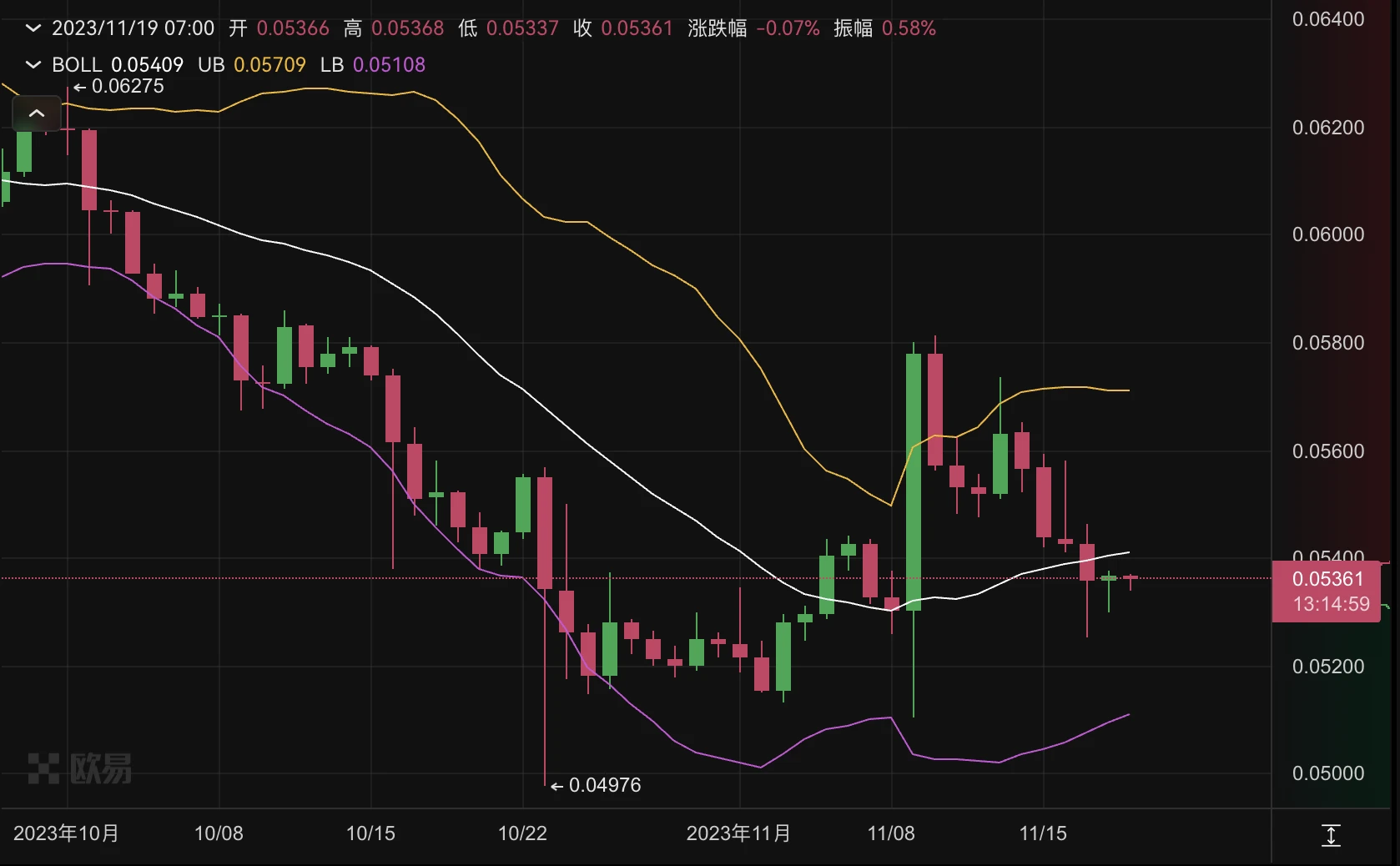

Influenced by the news, the OKX market shows that the ETH/BTC exchange rate has stopped its long and persistent decline in recent days.

With one traditional financial giant after another submitting applications for ETH ETFs, will the speculative expectations for ETF bullishness shift from BTC to ETH?

Can the ETF bring about a new bull market?

The entire crypto market is eagerly anticipating the approval of ETFs. But as a "bullish" news, how much change can the approval of ETFs bring to the crypto market? Before the "bullish" news lands and runs smoothly for a period of time, no one can give an exact answer.

Currently, there is still a difference of opinion in the market about the actual impact of this "bullish" news.

JPMorgan observed that similar ETFs in Canada and Europe have attracted little interest from investors since their launch. In mid-November, a report released by JPMorgan showed that analysts are skeptical about the bullish effect of ETFs. They believe that ETFs will not bring new capital into the crypto market, but will transfer existing Bitcoin capital to the newly approved spot Bitcoin ETF.

In addition, analysts also question whether the SEC's recent losses in the Grayscale and Ripple cases will lead to a relaxation of regulatory positions. "Regulations for the U.S. crypto industry have not yet been established, and we believe that U.S. legislators will not change their stance due to the above two legal cases, especially in the fresh memory of the FTX fraud incident."

Analysts believe that the recent significant rise is excessive compared to the fundamentals of Bitcoin. Analysts believe that the 30% increase in Bitcoin price over the past month is mainly driven by the expectation of the approval of the spot Bitcoin ETF. However, this factor is not enough to support such a large price increase.

Is the mini bull dead, or has the big market arrived?

The MVRV indicator shows that the current MVRV is between 1.7 and 1.8. Generally, this indicator can reflect whether the current market sentiment is overheated.

Since the beginning of this year, the MVRV indicator has continued to rise and has now reached a recent high, returning to the level of January to April 2022. Data from The Block shows that the current discount rate of Grayscale GBTC is 14.78%, reaching the lowest level since the end of December 2021, and continues to narrow, which also indicates the acceptance of traditional market investors' expectations for the spot Bitcoin ETF.

Currently, we cannot assert whether the current rise is the beginning of a new bull market or the end of a "mini spring."

Regardless of the market direction, the halving event in 2024 will come as scheduled. It is expected that in April 2024, Bitcoin will experience the next halving. JPMorgan analysts believe that due to the instability of the fundamentals, the recent rise in Bitcoin may encounter setbacks, and the impact of the halving event is already well reflected in the current Bitcoin price.

At a price of around $36,000, the potential return between Bitcoin and its all-time high (ATH) reached in November 2021 of nearly $69,000 is only about 48%. From the current perspective of the crypto market, the potential return between Bitcoin and its ATH at the current price is not high.

With the approach of the ETF and halving, where will the market go next? Will the market go beyond the "mini bull" ending that optimists expect?

JPMorgan analysts believe that the current risks in the cryptocurrency market are still greater than the recent strong gains. Although the crypto community is still optimistic about the approval of the spot Bitcoin ETF, he believes that the approval of the spot Bitcoin ETF may lead to a "buy the rumor, sell the news" type of decline.

Odaily Planet Daily reminds investors that the crypto market is volatile, so please be cautious and manage risks carefully.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。