A. Market View

1. Macro Liquidity

Monetary liquidity is easing. The October CPI data in the United States cooled significantly, dropping to the lowest level in two years, consolidating the market's expectation that the Federal Reserve has completed its rate hikes, with over a 50% chance of a rate cut in June 2024. The weekly US dollar index fell, while the US stock market rose. The performance of the cryptocurrency market paled in comparison to the US stock market.

2. Overall Market Trends

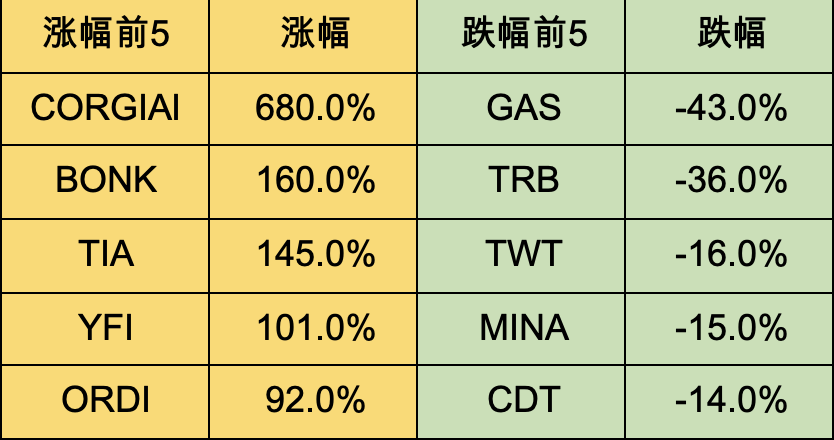

Top 100 market cap gainers:

BTC consolidated this week, and capital risk preferences gradually shifted towards altcoins. Market hotspots revolved around BTC inscriptions, public chains, and new stocks. New stocks have a relatively good chip structure and usually ferment in the later stages of the market. Large funds speculated on public chains, with the SOL and Cosmos ecosystems (KUJI, TIA, RUNE, INJ, etc.) showing relatively bright performances. Retail investors speculated on BTC inscriptions, with significant wealth effects from the tens of times increase.

TIA: This year's theme in the ETH ecosystem is modularity and data availability. TIA is part of the Cosmos ecosystem and is currently mainly used for ETH modularity. TIA's chip washing is relatively thorough, airdrops have been fully released, and staking requires a 21-day unlock. Therefore, the circulating supply is relatively small, making it suitable for market manipulation.

FTT: This is the platform token for the FTX exchange. News indicates that FTX exchange is expected to resume operations in the second half of 2024. The bankrupt FTX exchange holds a large amount of SOL and FTT, which may provide the impetus for a rally.

DYDX: Originally on the ETH chain, it later moved to the Cosmos ecosystem to build its own trading public chain. It recently launched a test version of the mainnet, which allows for staking rewards. However, in December, there will be a large unlock of $6 billion, approximately double the circulating supply, which may lead to a positive rally before the unlock, providing liquidity for institutional exits.

3. BTC Market Trends

1) On-chain data

BTC miner income has significantly increased. BTC inscriptions made a strong comeback last month, pushing transaction fees to a six-month high. There are over 150 days until the next BTC halving, which is expected to occur at the end of April 2024.

The market value of stablecoins has started to rise for the first time in nearly two years, with a continuous 1% increase after hitting bottom. New liquidity continues to flow into the market, driving a more prosperous market and a general rise in altcoins.

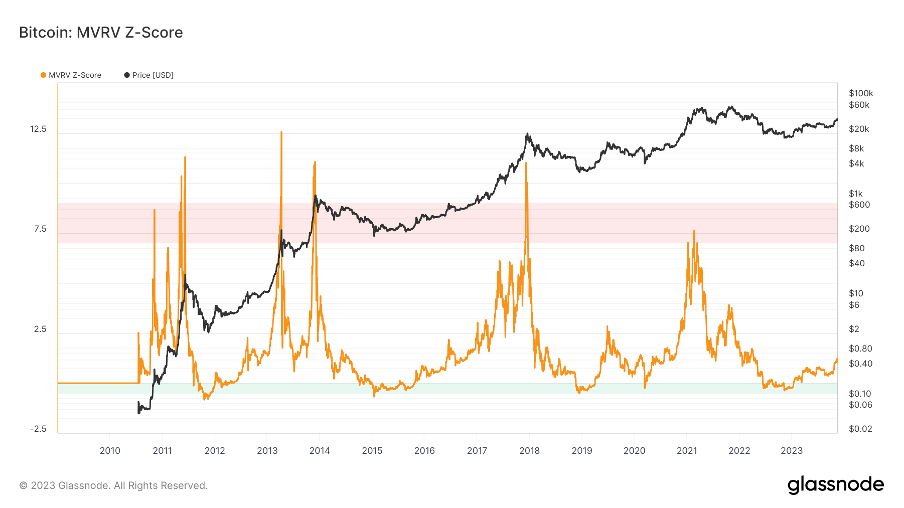

The long-term trend indicator MVRV-ZScore is based on the total market cost and reflects the overall profitability of the market. When the indicator is greater than 6, it is in the top range; when the indicator is less than 2, it is in the bottom range. MVRV has fallen below the key level of 1, indicating that holders are generally at a loss. The current indicator is 1.2, entering the recovery phase.

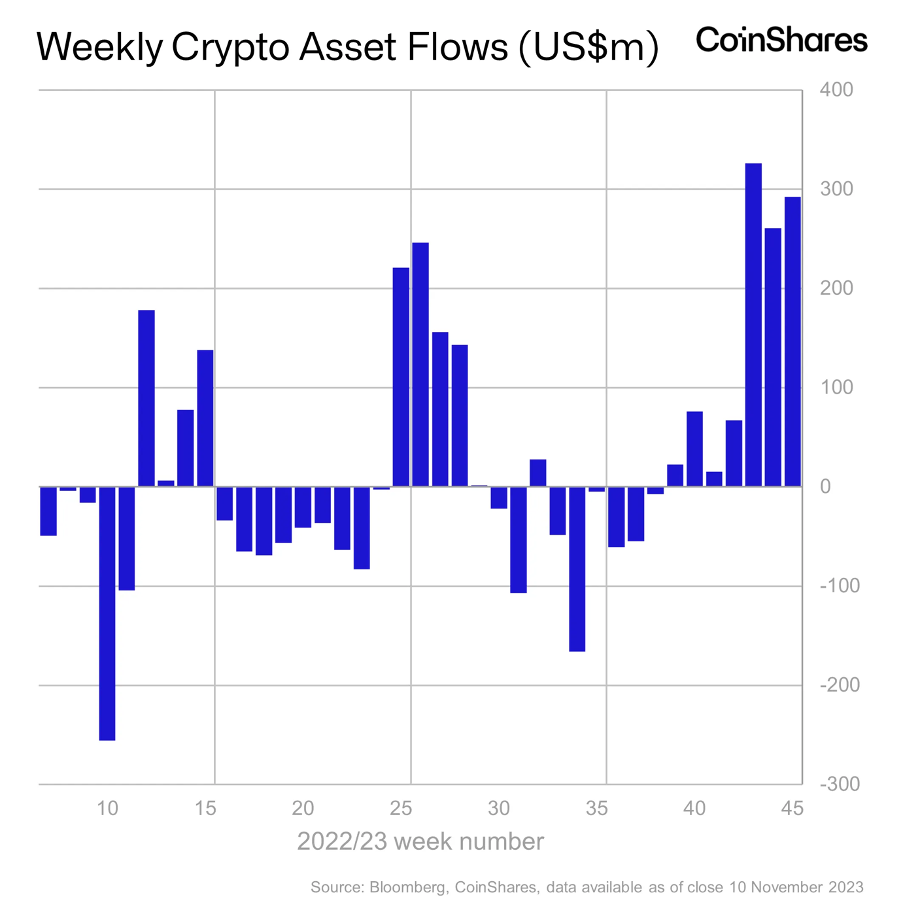

Cryptocurrency investment products have seen net inflows for 7 consecutive weeks, with a total inflow breaking through the $1 billion mark. Institutional interest in the cryptocurrency market may increase significantly in 2024.

2) Futures market trends

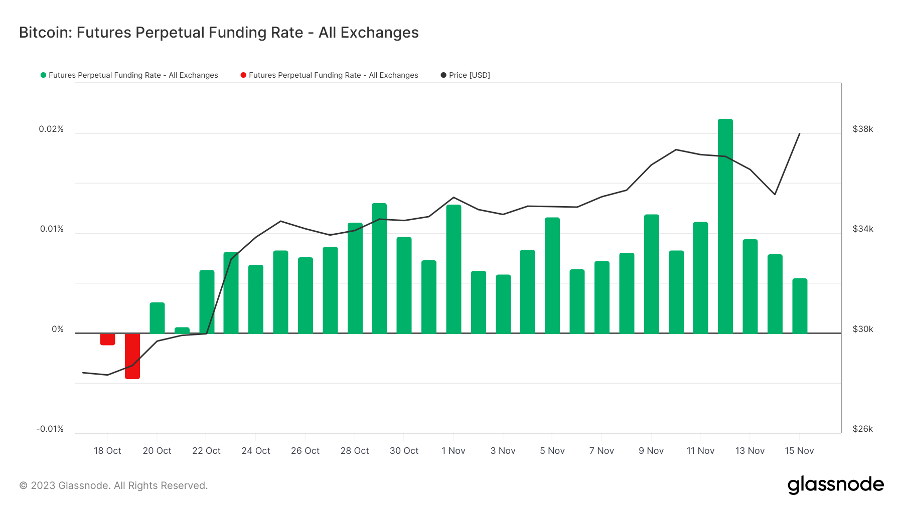

Futures funding rate: This week's rate is positive, indicating strong bullish sentiment. After hitting the highest rate of the year on November 12, the BTC rate began to adjust. A rate of 0.05-0.1% indicates a high level of long leverage and may signal a short-term market top; a rate of -0.1-0% indicates a high level of short leverage and may signal a short-term market bottom.

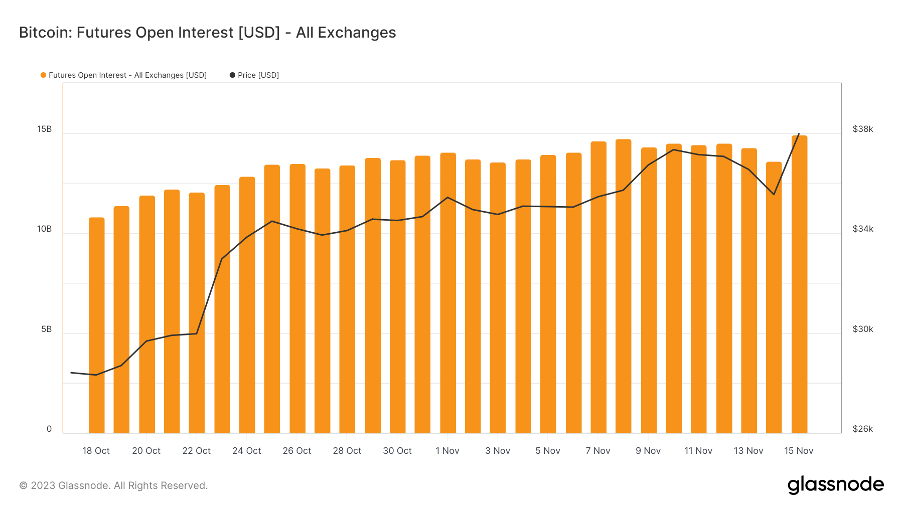

Open interest: The total open interest for BTC rose slightly after adjustments, roughly in sync with price fluctuations.

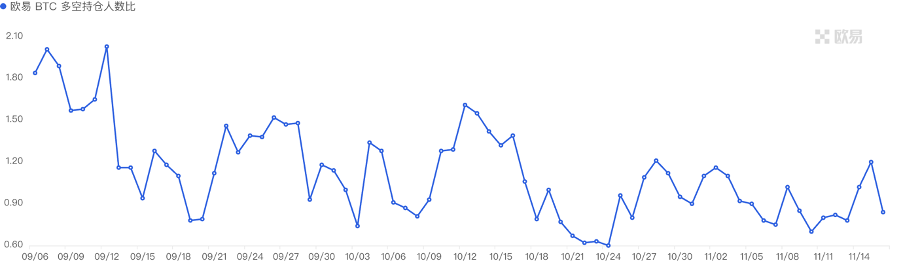

Long/short ratio: 0.7. Retail sentiment is bearish. Retail sentiment is often a contrarian indicator, with below 0.7 indicating fear and above 2.0 indicating greed. The long/short ratio data fluctuates greatly, weakening its significance as a reference.

3) Spot market trends

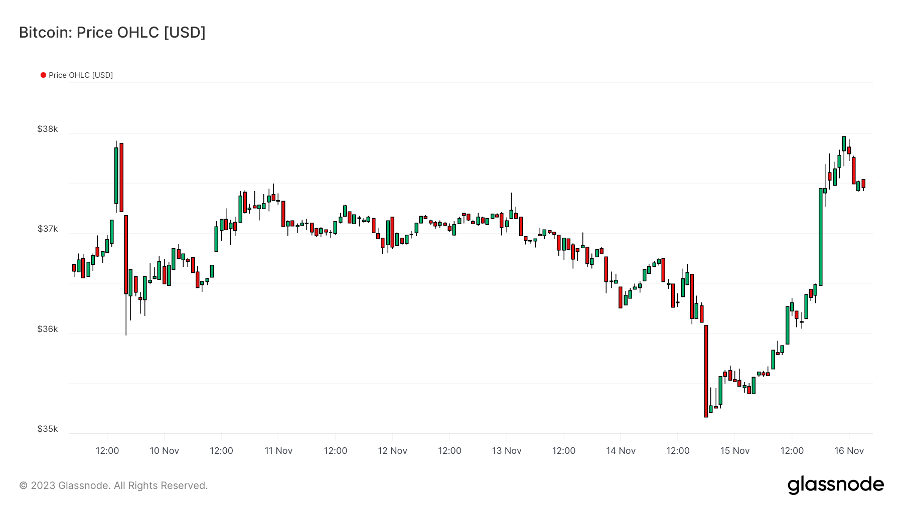

The market remains strong, with BTC reaching new highs after consolidating its adjustments. The confirmation of the end of the Federal Reserve's rate hike cycle has led to continuous inflows of new funds into the cryptocurrency market, sparking a boom in altcoins. The BTC spot ETF for November may be delayed, and its actual approval may not necessarily be a positive catalyst.

B. Market Data

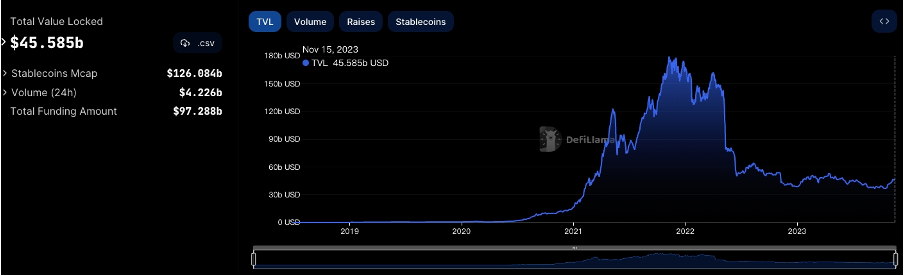

1. Total Lock-up Volume of Public Chains

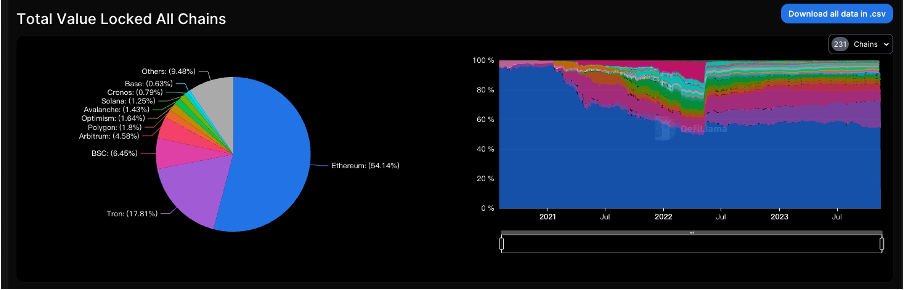

2. TVL Distribution of Various Public Chains

The overall TVL decreased by approximately $3 billion, a drop of around 0.7%. The market first experienced a sharp decline this week, which was quickly recovered. BTC once again attempted to break through $38,000 but was unsuccessful. This week, TVL on the ETH chain rose by nearly 14%, while TVL on the SOLANA chain rose by over 17%, with an increase of over 81% in the past month. OP and ARB chains both saw increases of 4% and 5%. Mainstream public chains all saw increases of over 10%.

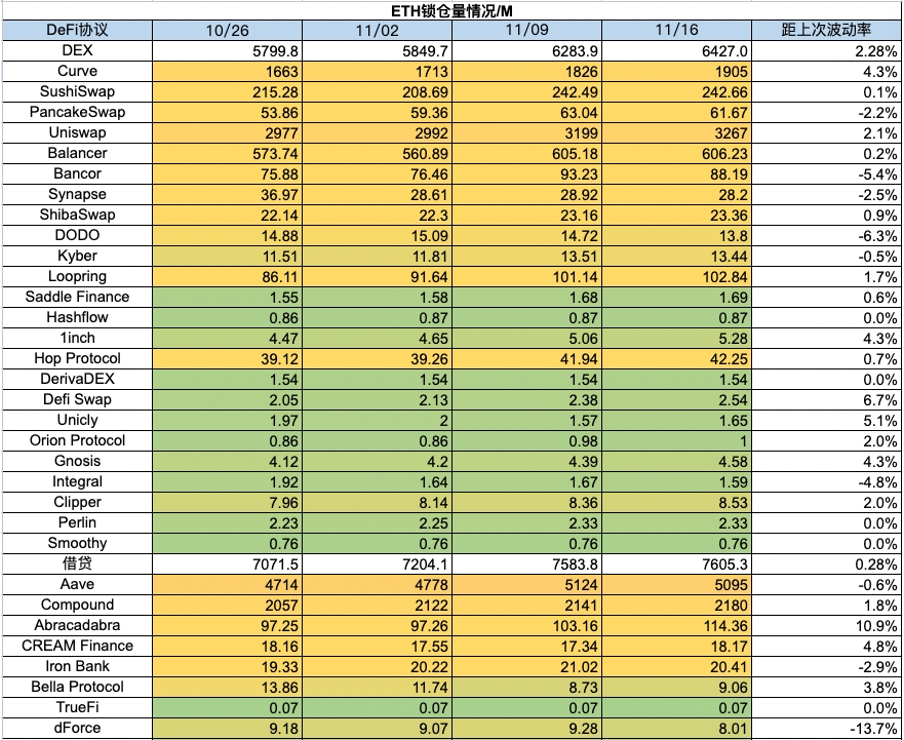

3. Lock-up Volume of Protocols on Various Chains

1) ETH Lock-up Volume

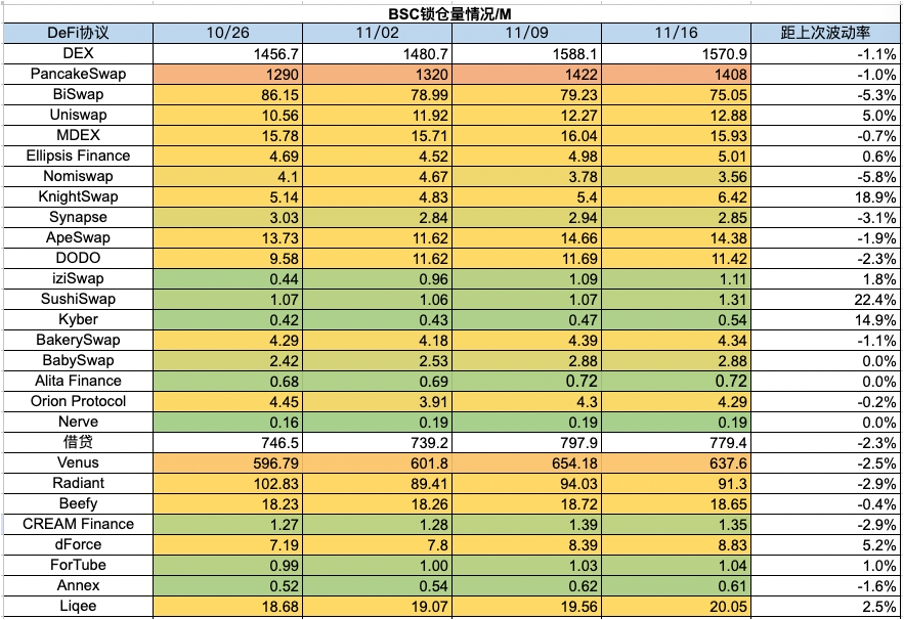

2) BSC Lock-up Volume

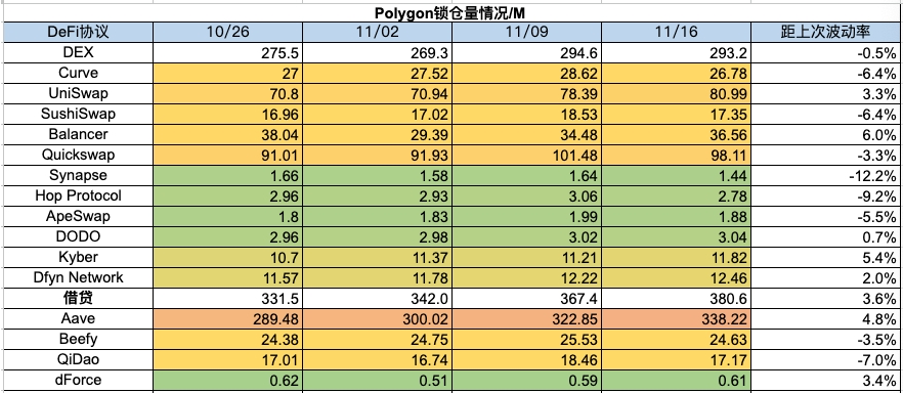

3) Polygon Lock-up Volume

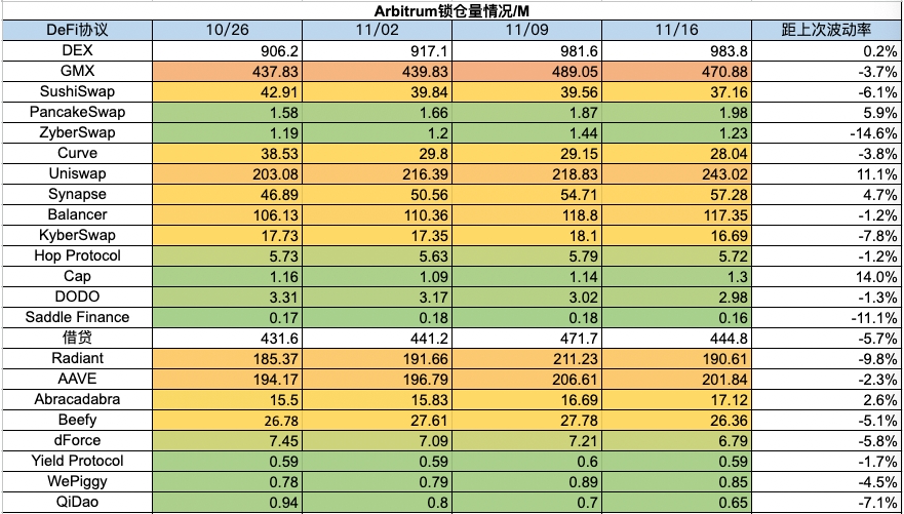

4) Arbitrum Lock-up Volume

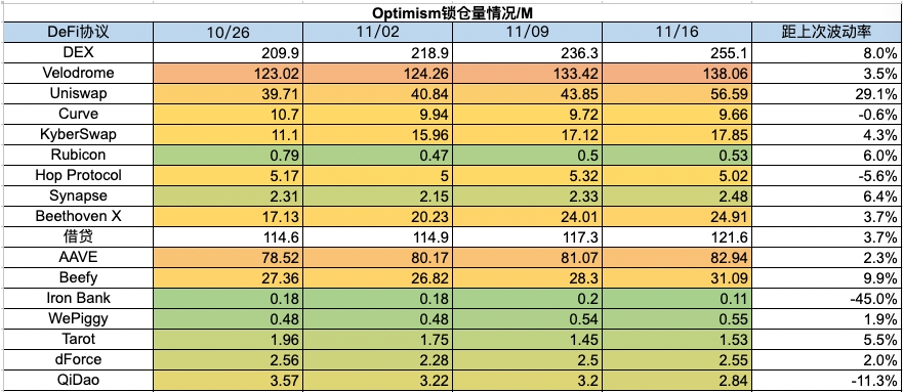

5) Base Lock-up Volume

6) ETH Gas Fee Historical Data

The on-chain transfer fee is approximately $29.62, Uniswap transaction fee is about $15.35, and OpenSea's transaction fee is about $5.96. This week, gas usage and transaction fees have significantly increased. In terms of gas consumption, Uniswap still holds the top position, accounting for 12% of the entire market.

Five, NFT Market Data Changes

1) NFT-500 Index

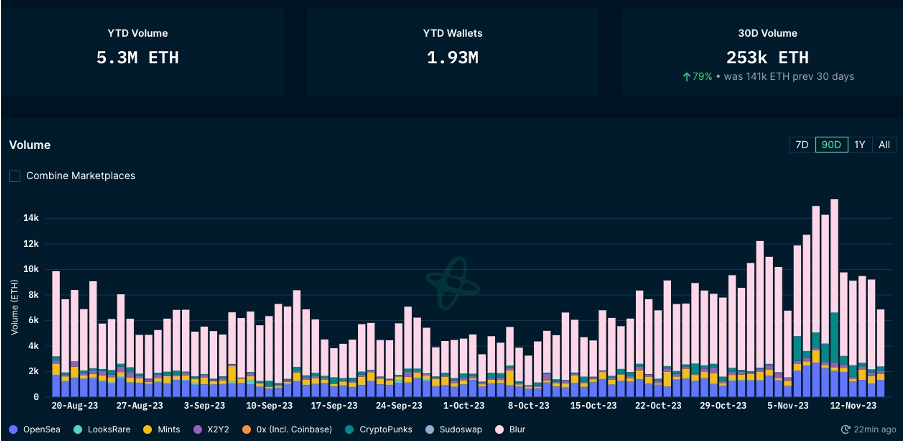

2) NFT Market Situation

3) NFT Trading Market Share

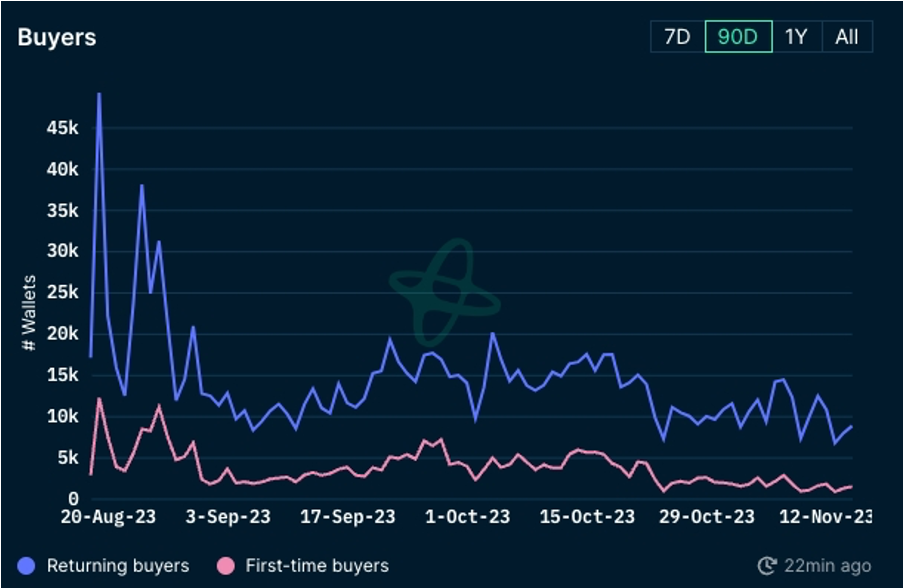

4) NFT Buyer Analysis

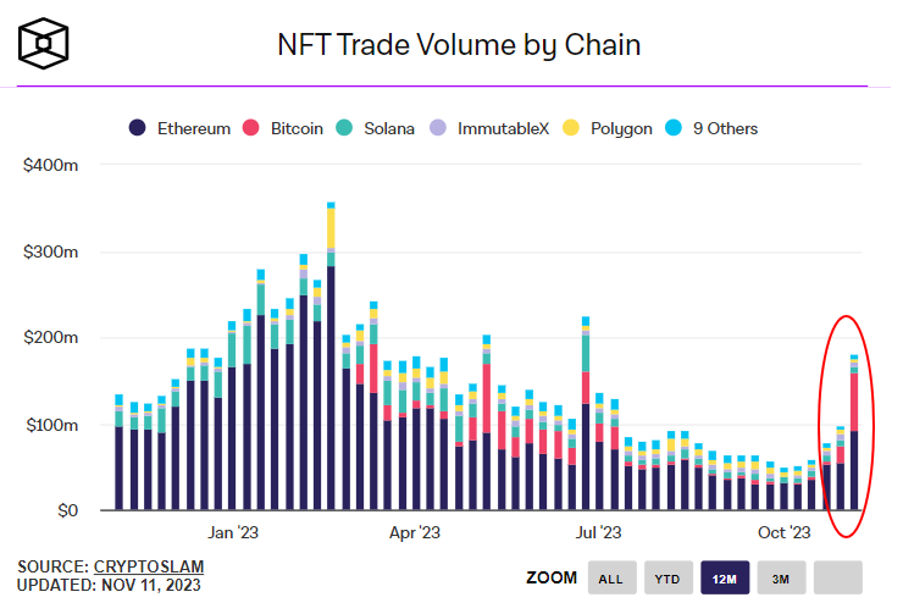

This week, the floor prices of top blue-chip projects have seen both increases and decreases, with BAYC rising by 1.2%, The Captainz falling by 14%, and CloneX falling by 9%. Notably, Sofa Maker has surged by 2854% in the past week, nearly 30 times. The trading volume in the NFT market has significantly decreased over the past week, but there has been a considerable increase in the number of repeat buyers and first-time NFT buyers. The NFT market continues to be subdued, with no signs of recovery yet.

Five, Latest Financing Situation of Projects

Six, Post-Investment Dynamics

1) Mocaverse - NFTAnimoca Brands' NFT series Mocaverse announced that the third phase of Moca ID minting will start at 3:00 Eastern Time on November 16, with no need for pre-booking for eligible users.

2) Shardeum - Layer1

Shardeum announced that Sphinx Validator 1.7.2 has gone offline, and developers are currently investigating the root cause. They plan to restart the network later this week and conduct additional checks and repairs. Node operators should shut down their nodes until the new version is released.

Seven, Other Related

1) Foresight Ventures Acquires Majority Stake in The Block for $70 Million Valuation

Foresight Ventures announced the acquisition of the majority stake in the cryptocurrency media The Block, valuing the transaction at $70 million. The Block will continue to operate as an independent business and maintain its existing business lines. As part of the acquisition, Foresight Ventures CEO Forest Bai will assume the position of Chairman of The Block's board, and Foresight Ventures partner Tony Cheng will also join The Block's board. Larry Cermak will continue to serve as The Block CEO.

Foresight Ventures aims to enhance The Block's unique strengths while expanding its influence and ensuring the integrity of its editorial and research teams. The completed acquisition will help Foresight expand its media business into the US and European markets and provide necessary funding for The Block to enter the Asian market and expand its product portfolio.

2) BGX Announces Subscription of $710 Million in New Shares of OSL's Parent Company BC Technology Group

Cryptocurrency group BGX has made a strategic investment in BC Technology Group, the parent company of the licensed virtual asset exchange OSL, subscribing to approximately $710 million in new shares. The transaction is subject to shareholder approval.

Previously, OSL's parent company BC Technology Group was suspended from trading on the Hong Kong Stock Exchange and applied for a temporary halt to trading of its shares on the Hong Kong Stock Exchange to publish an announcement regarding the issuance of new shares (constituting insider information).

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。