Writing: Deep Tide TechFlow

Recently, there has been new activity in the stablecoin arena.

The privacy stablecoin protocol Zephyr has rapidly risen, with its token ZEPH increasing in market value by 5 times to reach $30 million within one month. Why has it been able to stand out in the fiercely competitive stablecoin market?

Firstly, Zephyr is built on Monero, even using the same wallet.

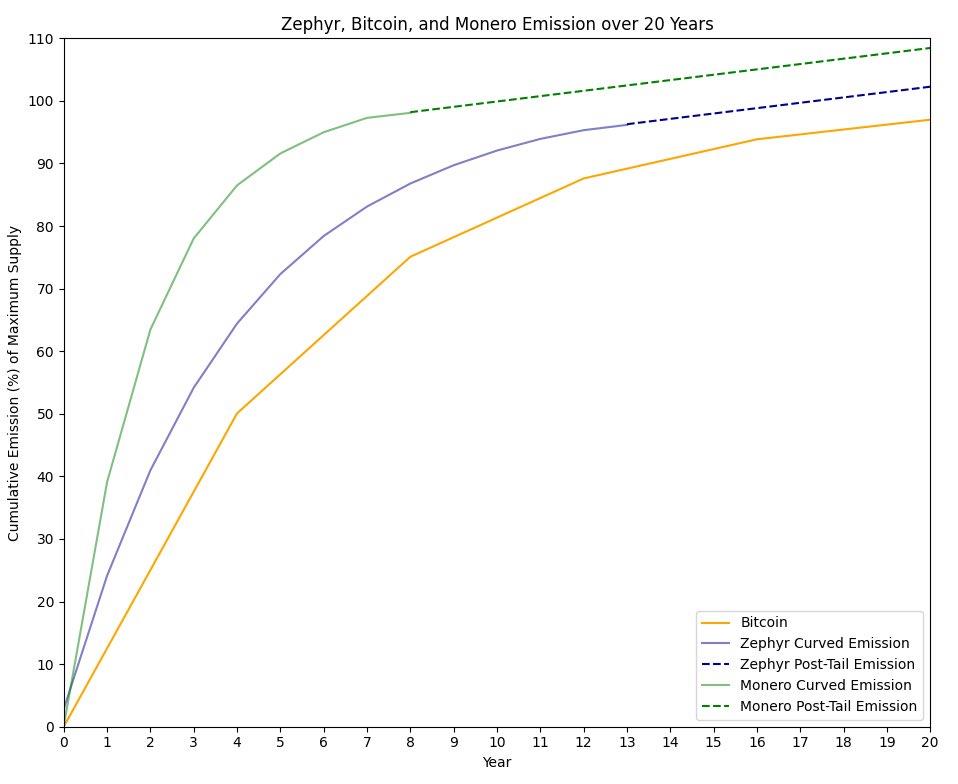

ZEPH is the protocol's base currency, with a total supply of 18.4 million, and a current circulation of 1.35 million. The Zephyr protocol operates on the RandomX Proof of Work (PoW) algorithm, aiming to optimize general CPU and support decentralized and equal mining. However, Zephyr has a block time of 120 seconds, slightly slower than Monero. This choice was made to reward early adopters and limit dilution, slowing initial emissions and mitigating any inflation impact on the price of ZEPH, thereby enhancing the stability of the algorithmic stablecoin system. The following image shows the emissions compared to Bitcoin and Monero:

The core of the Zephyr protocol is an over-collateralized stablecoin protocol backed by cryptocurrency, a concept perfected by the innovative Djed protocol.

What is DJED? Djed, inspired by AgeUSD, is a stablecoin protocol developed by renowned organizations Emurgo, IOHK, and the Ergo Foundation, with a stable mechanism that has been market-tested, and currently, its underlying zephUSD has shown almost no deviation.

How does ZEPHYR avoid the "death spiral"?

Although Luna's collapse was some time ago, the "death spiral" is still a topic that stablecoins cannot avoid. So, how does ZEPHYR avoid the "death spiral"?

The "death spiral" usually refers to the situation where algorithmic stablecoin protocols are forced to mint an excessive amount of base tokens to maintain the peg of their stablecoin, leading to a spiral decrease in the value of the base token.

The Zephyr protocol ensures that additional ZEPH is not created spontaneously, as the support for ZephUSD is over-collateralized by ZEPH in the reserve, and importantly, the core mechanism of this stablecoin does not rely on the algorithm. The supply of ZEPH only grows through regular emissions. This approach ensures the stability and value of the network, as a constant emission rate eliminates the risk of sudden inflationary shocks that could disrupt the system's stability.

In other algorithmic stablecoin protocols, spontaneous and unrestricted minting of base tokens is usually used to ensure the stability of the stablecoin, leading to the potential for a death spiral. Fundamentally, Zephyr does not follow this approach.

Zephyr Protocol v1.0.0

On October 1, 2023, the Zephyr Protocol implemented a crucial hard fork, enabling two new assets on the Zephyr blockchain. Zephyr Stable Dollar ($ZSD) and Zephyr Reserve Shares ($ZRS).

$ZSD is a privacy stablecoin, over-collateralized by ZEPH and backed by it.

The main advantages of $ZSD compared to other stablecoins are:

Privacy: Transactions with $ZSD hide the amount, recipient, and destination address.

Decentralization: Other stablecoins (e.g., USDT) are operated by centralized entities, contrary to the decentralized spirit of DeFi.

No base coin inflation: Algorithmic stablecoins must mint base coins to maintain their peg, leading to inflation. $ZSD is not pegged through an algorithm but is backed by cryptocurrency.

Over-collateralization: When minting $ZSD, the reserve needs >400% ZEPH to support $ZSD. USDT is backed by 1% government bonds.

Proven: The inspiration for the Zephyr protocol comes from the market-tested Djed protocol, which has been implemented alongside SigmaUSD (Ergo) and Djed (Cardano) for years.

Low transaction fees

Meanwhile, Zephyr Reserve Shares ($ZRS) holders receive a portion of the block rewards in each block, as a premium for supporting Zephyr Stable Dollar ($ZSD). Reserve providers effectively bet on the value and adoption of Zephyr.

Incentives for reserve providers include:

Leveraged positions: With the rise in Zephyr price, the value of ZEPH in the reserve also means more available equity.

Conversion fees: With increasing adoption and more frequent protocol usage, more fees will be generated, increasing reserve assets.

Block rewards: 20% of block rewards go directly into the reserve, providing another avenue for supporting the reserve and increasing the value of ZRS.

Spot and MA divergence: Due to the dual pricing of Zephyr assets, users will use the "spread" exchange rate between spot prices and moving average prices. This mechanism is used to prevent manipulation but also provides additional benefits for the reserve.

This incentive structure is called the "pseudo-staking reward" for $ZRS on the Zephyr protocol.

Examples of asset collaboration within the Zephyr ecosystem

Let's understand the mechanism and functionality of the Zephyr protocol through two user scenarios. For simplicity, we exclude fees and other additional protocol features in these examples:

Scenario 1: When the base currency (ZEPH) price rises

Suppose Alice is a user with 100 ZEPH, seeking value stability.

On the other hand, Bob has 200 ZEPH and seeks asset appreciation, so he bets on the future value of ZEPH.

Bob becomes a reserve provider, depositing his 200 ZEPH into the Zephyr protocol and minting reserve tokens ($ZRS). As long as the reserve is above the minimum reserve ratio, these tokens can be redeemed for the underlying ZEPH reserve at any time.

Alice deposits her 100 ZEPH into the protocol and mints $100 worth of stablecoin ($ZSD).

Now, the total reserve equals 300 ZEPH. Four weeks later, the price of ZEPH has risen by 10%.

Excited by the recent price surge, Alice decides to close her position. She exchanges $100 worth of stablecoin and withdraws $100 worth of ZEPH. When the ZEPH price is $1.10, her stablecoin is exchanged for 90.90 ZEPH, leaving 209.1 ZEPH in the protocol reserve for future use.

Bob wants to ensure profits and exchanges his reserve tokens for the remaining reserve, receiving 209.1 ZEPH. Therefore, by becoming a reserve provider, Bob has profited by 9.1 ZEPH, while Alice has maintained value stability by minting stablecoin.

Scenario 2: When the base currency price falls

Now, let's consider the situation when the price of ZEPH falls. Suppose Alice and Bob initially have the same amount of stablecoin/reserve tokens as in the previous example. Four weeks later, the price of ZEPH has dropped by 10%.

Alice decides to exchange her stablecoin for $100 worth of ZEPH. When the ZEPH price is $0.90, she will receive 111.12 ZEPH, leaving 188.88 ZEPH in the protocol reserve.

Next, Bob decides to close his reserve token position and receives the remaining reserve tokens, receiving the remaining 188.88 ZEPH in the reserve. In this case, by providing reserves to the protocol, Bob has incurred a loss of 11.12 ZEPH, while Alice has maintained relative value stability against the US dollar through stablecoin ($ZSD).

From the above examples, it is clear that Zeph, ZSD, and ZRS collaborate to form a stable flywheel:

- Zeph - a base coin with limited supply

- ZSD - stablecoin

- ZephRSV - a portion of block rewards and profits for those minting and redeeming

However, privacy coins always carry regulatory risks. Many governments do not recognize privacy coins, which may limit their appeal to ordinary cryptocurrency users, a challenge currently faced by ZEPHYR. The solution proposed by Zephyr is to integrate with decentralized exchanges (DEX), but the effectiveness of this approach remains to be seen.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。