Expanding the scope of taxation (to non-custodial wallets) will also put tremendous pressure on the market.

Author: Matthew Lee, European Cloud Chain Research Institute

On November 15th, Beijing time, the Internal Revenue Service (IRS) of the United States held a highly anticipated hearing to discuss expanding the taxation scope of cryptocurrency assets. The hearing covered many key issues, including user privacy, the scope of encrypted entities required to report transaction information, the inclusion of stablecoins, the application of proposed regulations to participants in decentralized finance, and the reporting of wallet addresses.

The rapid development of DeFi has made it a focus of regulators. According to research by Barclays Bank, the cryptocurrency tax gap is at least $500 billion. This move is aimed at the vague definition of DeFi projects, the lack of taxable history, the lack of experience in on-chain transactions, and the difficulty of regulation caused by other entities impersonating DeFi entities, so the IRS is attempting to ensure tax transparency and integrity by including them in the regulatory framework.

The main content of the hearing revolved around the definition of "broker." According to the proposed regulations formulated in August, the definition of a broker may be expanded to include "digital intermediaries that directly or indirectly affect the sale of digital assets," and the expanded definition will directly include DeFi, non-custodial wallets, and wallet developers in the scope of brokers. Brokers are required to be responsible for the following:

- Taxpayer's name, address, and taxpayer identification number;

- Name, type, quantity, date, and time of sale of digital assets;

- Total proceeds received by the seller from the sale (including exchange proceeds and on-chain proceeds);

- Total proceeds from the seller for paying transaction fees;

- Wallet address to which the seller transferred digital assets;

- On-chain transactions related to the sale or transfer into the account, and transaction identifiers or hashes related to the sale.

In short, the IRS requires decentralized projects that rely on code operation, such as Uniswap, Sushi, and Metamask, to conduct KYC on all users, including tracking transactions on exchanges and on-chain, on-chain addresses, and having a clear understanding of users' on-chain transaction trends and transaction profits.

Although this hearing has been criticized by the public, there are some issues in the current market: 1. A significant increase in trading volume on decentralized exchanges; 2. Inability to track fund transfers in non-custodial wallets; 3. Private wallets (lack of third-party reporting) leading to an increase in illegal activities, which has led many industry experts to believe that expanding the scope of taxation will become inevitable, with the formal legislation expected to be introduced in 2025.

What impact will expanding the scope of taxation have?

Users

In addition to reducing a certain amount of income, users will also face complex data processing and paperwork. The provisions in the 2021 "Infrastructure Investment and Jobs Act" in the United States previously instructed the IRS to implement new rules for cryptocurrency brokers. If the scope of taxation is expanded, digital brokers must report the tax Cost Basis, and the complexity of Cost Basis will bring more problems to brokers, taxpayers, and the IRS. Taxpayers have two options for calculating Cost Basis:

- First in, First out (FIFO, default): If you purchased Bitcoin at prices of $1000 and $2000, and then sold at $4000, FIFO will assume that you sold the part of Bitcoin at $1000.

- Specific identification: This method allows taxpayers to choose which digital assets to sell, selectively minimizing tax burdens, but requires taxpayers to clearly identify and track each transaction.

With specific identification, taxpayers need to delve into not only exchange but also on-chain transaction records dating back several years, and mark specific bitcoins in their inventory that they intend to sell, even if they are entrusted to brokers, they must identify the specific assets they want to sell in on-chain or exchange history.

Simple FIFO may result in additional taxation because the United States has two applicable tax rates: long-term and short-term. Short-term tax rates apply to holdings of less than one year and are subject to progressive tax rates, while long-term tax rates apply to holdings of over one year, and even the highest tax bracket for long-term rates only requires a 20% tax, while short-term rates require 37%.

The IRS also acknowledges that collecting cryptocurrency taxes will bring them a massive amount of paperwork, and the massive on-chain data may increase the number of 1099-DA forms for 13 to 16 million taxpayers by 8 billion. Currently, brokers do not have the ability to support the identification of specific transactions, and users can only rely on systematic learning of basic tax knowledge and the use of on-chain data tools to track and record digital asset transactions, transfers, and holdings, and file taxes accordingly.

Industry

Taxation requires complete transaction records to calculate Cost Basis, capital gains, fair market value, etc., but tracking asset changes in exchanges, wallets, and decentralized protocols is a very complex task, making it difficult for the IRS to produce tax reports directly. According to relevant institutions, tax reports for over a million cryptocurrency investors are inaccurate.

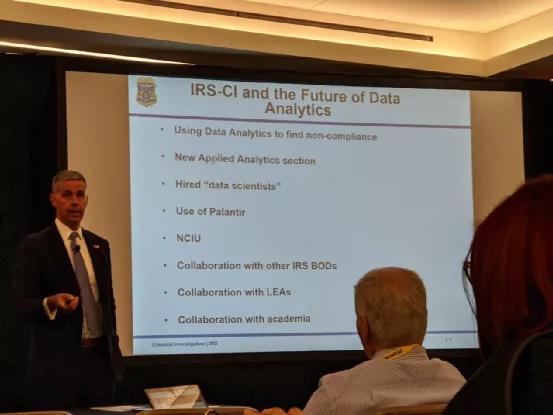

IRS discloses cryptocurrency tax investigation methods; Source: Cointracker

In the future, commercial institutions or tax authorities will rely on on-chain and centralized data to build more intelligent automated tax reporting systems similar to Turbo and H&R Block, integrating records of on-chain activities such as purchases, sales, airdrops, forks, minting, swaps, and gifts. This system of tax reporting mechanisms will result in a large amount of public information being disclosed, shaking the industry's "decentralized" ideal.

Public Opposition

Tens of thousands of people have expressed opposition to this hearing. Most people believe that such excessive regulation will infringe on personal privacy and undermine individual freedom. This concern also reflects the public's concern about government overreach, believing that regulation should protect citizens' basic rights while safeguarding social order. Congress has previously attempted to include a definition of intermediaries similar to "any decentralized exchange or peer-to-peer market," but it was ultimately rejected. Now the IRS is reinterpreting the definition of "broker" using language similar to that of intermediaries, exceeding the statutory definition, leading to public questioning of potential administrative law violations.

In the author's view, taxing DeFi is not practical. Over 95% of projects in the market have not generated positive cash flow and are in a very early and fragile stage, and taxation would impose additional burdens on DeFi projects. Expanding the scope of taxation (to non-custodial wallets) will also put tremendous pressure on the market. After Biden increased the capital gains tax for the wealthy in 2021, Bitcoin experienced a sharp decline. If a new tax system is implemented, with the scope expanded to on-chain assets, there will be more users engaging in tax-loss transactions, selling for profit before officially paying taxes to reduce tax liabilities.

Taxation still has a long way to go, involving multiple government agencies, and there are currently many areas of ambiguity: for example, whether stablecoin transactions need to be reported, and how to confirm non-financial assets. The Vice President of Tax at Coinbase stated at the hearing, "Reporting taxes without income or loss (including stablecoins) will result in a large number of low-value reports." A senior advisor to the Blockchain Association also stated: the proposal is too broad, forcing decentralized projects to choose between 1. abandoning decentralized technology; 2. staying away from the United States.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。