1. Bitcoin Market

From May 3 to May 9, 2025, the specific trends of Bitcoin were as follows:

May 3: Bitcoin exhibited a volatile downward trend throughout the day, with prices starting from a high of $97,754 and undergoing adjustments. Both bulls and bears engaged in fierce battles around key support levels. The price briefly fell to around $97,000 but failed to gain effective support, subsequently dropping further to the day's low of $95,986. Near the end of the trading session, the market rebounded, closing at $96,523, showing initial signs of a short-term stop in the decline, with bearish momentum slowing down.

May 4: Continuing the weak pattern from the previous day, Bitcoin experienced a day of fluctuating declines. After a brief rebound during the day, it continued to weaken, hitting a low of $95,328, and closed slightly higher but overall remained weak, indicating insufficient bullish confidence.

May 5: The market was highly volatile, with a significant "cliff-like" drop occurring during the day. Prices quickly fell from a morning high of $95,734 to a low of $93,612. Although there was a rebound to $94,752 during the day, the overall trend remained weak, and it ended the session down at $93,696, indicating a significant increase in bearish pressure.

May 6: Bitcoin continued the previous day's volatile pattern, remaining in a wide range of fluctuations. There were multiple attempts to rebound to $94,816 and $95,114, but none were able to hold effectively, leading to another drop to a low of $93,438. Subsequently, market sentiment gradually stabilized, and prices rebounded quickly, closing at $94,703, forming initial short-term reversal signals.

May 7: Bitcoin continued the rebound momentum from the previous day, rising to $95,100 in the morning before quickly surging, reaching an intraday high of $97,583. Although it later retraced to $96,336, it again surged to $97,379 near the end of the session. Overall, bullish sentiment gradually dominated, and market trading activity significantly increased.

May 8: After a brief pullback at the opening, Bitcoin dipped to $95,866. Subsequently, bullish strength rapidly increased, with prices rebounding strongly and breaking through previous highs, reaching $97,317. The upward momentum accelerated further, with an intraday high of $99,819, approaching the key psychological level of $100,000. Market sentiment significantly turned bullish, with prices continuing to rise under bullish dominance. After a brief pullback, it surged again, ultimately breaking through the $100,000 mark, with significant gains throughout the day and a strong trend.

May 9: The upward momentum continued, with Bitcoin reaching $101,506 in the morning before a slight technical adjustment occurred. However, it quickly resumed its upward trend, breaking through to a new high of $103,756. The market then entered a phase of consolidation, with prices retreating to around $102,850. As of the time of writing, Bitcoin was reported at $102,945, maintaining a high-level range, still showing a strong trend in the short term.

Summary

This week, the Bitcoin market overall experienced a process of "initial suppression followed by a rise." In the first half of the week, due to insufficient market confidence and external macro factors, prices experienced a pullback, briefly falling below the $94,000 support level. However, after May 6, market sentiment gradually recovered, with bullish efforts driving prices to rebound significantly. Coupled with positive news stimuli, Bitcoin continuously broke through multiple technical resistance levels, strongly surpassing the $100,000 mark, and on May 9, it reached a new high of $103,756, demonstrating the market's strong resilience and optimistic expectations under bullish dominance. From a technical perspective, the bullish trend is gradually establishing itself, and short-term attention should be paid to changes in trading volume and the sustainability of sentiment to support future market movements.

Bitcoin Price Trends (2025/05/03-2025/05/09)

2. Market Dynamics and Macroeconomic Background

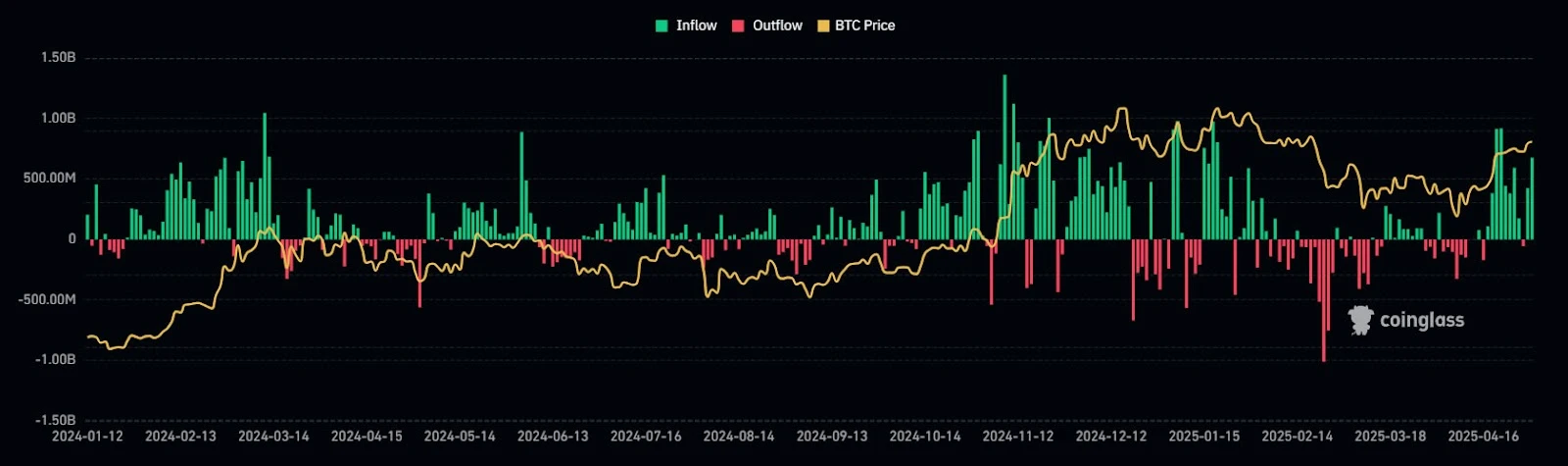

Capital Flow

1. Market Dominance: Bitcoin's Market Share Continues to Rise, Altcoins Relatively Weak

In the past week, Bitcoin's market dominance (BTC Dominance, BTC.D) has risen strongly, repeatedly setting new highs since the start of this bull market, reflecting the continued inflow of funds back into Bitcoin during the market adjustment phase: On May 4, according to CoinMarketCap data, Bitcoin's market dominance rose to 61.8%, a new high since September 2022; on May 5, according to TradingView data, BTC.D increased to 64.85%, marking the ninth consecutive week of growth, with market share returning to mid-January levels; on May 6, Bitcoin's market dominance briefly surpassed 65%, a new high since February 2021, further exacerbating the relative weakness in the altcoin market.

The continuous rise in Bitcoin's market dominance indicates an increase in market risk aversion, with funds concentrating on mainstream assets. Historical data shows that a significant rise in BTC.D is often accompanied by the bottoming out of altcoins and subsequent rotation. If Bitcoin's price remains stable at high levels, it may initiate a rebound cycle of funds rotating into altcoins in the future.

2. On-chain and Exchange Capital Flow: Whales Exiting vs. Continuous Outflow from Exchanges

Exchange Bitcoin Balances Decline, Continued Outflow of Funds:

On May 5, according to Coinglass data, major exchanges experienced a net outflow of 15,710 BTC over the past week, with Coinbase Pro seeing an outflow of 10,274 BTC and Binance 7,241 BTC. Currently, the total amount of Bitcoin held by exchanges is 2.2 million BTC, at a low level since 2021, indicating an increase in long-term bullish signals in the market.

Whale Accounts Short-term Large-scale Reduction:

On May 6, according to crypto analyst @ali_charts, over the past 10 days, whale addresses (wallets holding more than 1,000 BTC) have cumulatively reduced their holdings by nearly 50,000 BTC. This is interpreted as a short-term profit-taking behavior following the recent rise in Bitcoin, but it has not triggered large-scale selling pressure in the market.

Despite the whales reducing their holdings, the continuous decrease in exchange Bitcoin balances indicates a tightening overall market supply, with chips flowing towards long-term holders and cold wallets. Combined with the ongoing accumulation of ETFs, the market structure appears healthier, and short-term fluctuations do not alter the long-term bullish trend.

3. Bitcoin ETF: Daily Inflows Volatility Amplified, Institutional Attitude Cautiously Bullish

As of May 4, according to Dune data, the total on-chain holdings of U.S. spot Bitcoin ETFs have reached 1.136 million BTC, accounting for approximately 5.72% of the circulating supply, valued at about $10.96 billion. According to Farside data, as of now, the cumulative net inflow into Bitcoin ETFs has reached $40.207 billion, nearing the year's high (with $40.78 billion on February 7).

This week's ETF inflow details:

May 5: +$425 million

May 6: -$86.21 million

May 7: +$142 million

May 8: +$48.4 million

ETF funds have shown some volatility but overall maintained a net inflow trend. May 6 was a negative inflow day, possibly related to the market's short-term adjustments. Overall, ETFs remain the main force for medium- to long-term capital entry, providing downward support for prices.

Technical Indicator Analysis

1. Relative Strength Index (RSI 14)

According to Investing.com data, as of May 9, 2025, Bitcoin's 14-day Relative Strength Index (RSI) was 75.144. This indicator is above the critical threshold of the overbought zone (typically, RSI > 70 is considered overbought), indicating strong buying sentiment in the current market, with bullish momentum significantly prevailing. Although there are no obvious divergence signals yet, the technical aspect has released a short-term overheating risk warning, and attention should be paid to whether prices experience a volume-based pullback or whether the RSI shows a decline, serving as a potential leading signal for a market reversal.

2. Moving Averages (MA)

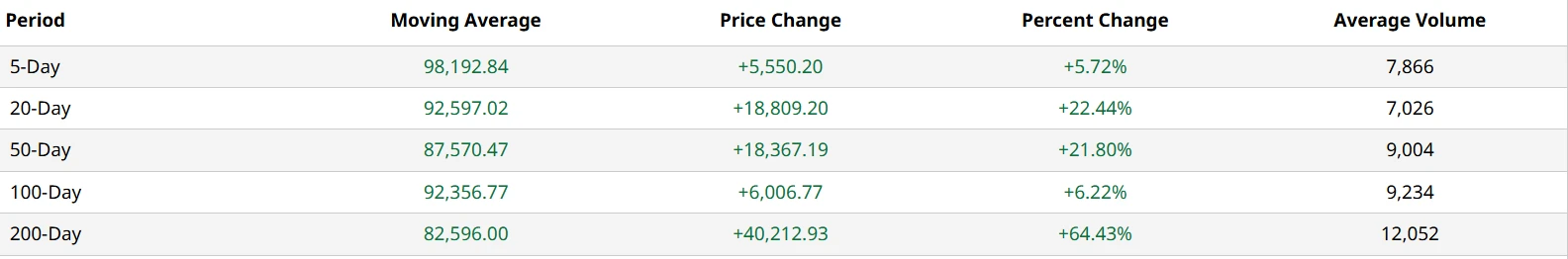

5-day Moving Average (MA5): $98,192.84

20-day Moving Average (MA20): $92,597.02

50-day Moving Average (MA50): $87,570.47

200-day Moving Average (MA200): $82,596.00

Current market price: approximately $102,932

MA5, MA20, MA50, MA200 data image

As of May 9, 2025, Bitcoin's price has consistently remained above the major moving averages across all periods, indicating a strong bullish arrangement structure. The short-term MA5 has clearly crossed above the medium- to long-term moving averages, forming a typical "bullish arrangement," reflecting the continuous release of short-term buying momentum. At the same time, the current price shows a certain divergence from MA5, indicating a rapid short-term increase, which may require a technical pullback.

From a trend perspective, both MA20 and MA50 are steadily rising, confirming an upward medium-term trend. MA200 shows a gentle upward trend, indicating that the long-term bullish pattern remains solid, and the market foundation is relatively healthy.

Overall, the moving average system supports Bitcoin's continued upward trend, but caution should be exercised regarding the risk of corrective fluctuations due to excessive short-term divergence. If prices can stabilize and consolidate at high levels with volume support, further upward movement is expected.

3. Key Support and Resistance Levels

Support Levels:

The current main support area for Bitcoin is between $101,000 and $98,000, representing the first structural support band within the short term. This area corresponds to the lower edge of the previous price consolidation platform, possessing significant technical buying support capability. If a pullback occurs, it is likely to trigger proactive buying behavior.

If this area is lost, the market may further test around $94,000, which corresponds to a dense trading area during the recent upward process and intersects with the 20-day and 50-day moving averages, representing a key mid-term support level. If prices effectively break below this area, it may indicate structural damage to the short-term upward trend, and market sentiment could shift from bullish to cautious or even neutral.

Additionally, $94,000 may also become a watershed for short-term traders to observe whether bears are in control. If this level holds and rebounds with volume, it will be seen as a signal for bulls to regroup; if it breaks without significant support, further retracement to around MA50 (approximately $87,500) should be guarded against.

Resistance Levels:

As of the time of writing, the first important resistance level above is at $104,000, corresponding to the intraday high on May 9, and is also an area where short-term profit-taking expectations exist. If it breaks through and stabilizes, it will open up space for testing the $105,000 to $108,000 range, which is a combination of important trading zones and potential psychological resistance levels, likely triggering intense bullish-bearish battles.

If subsequent volume continues to be released and market sentiment remains high, it is even possible for prices to further challenge the unprecedented $110,000 mark, which holds strong symbolic significance and emotional guidance, forming an important directive for the medium- to long-term market trend.

Market Sentiment Analysis

1. Cautiously Optimistic, Structural Bullishness Combined with Macroeconomic Policy Expectations

This week, Bitcoin's price continued to rise, reaching a high of $103,756 and successfully breaking through the important psychological level of $100,000, reflecting a shift in market sentiment from cautious observation to optimistic chasing of gains. The overall structure shows characteristics of structural bullishness, mainly reflected in the following aspects: Bitcoin's market share rose to 65%, setting a new high for this phase, with funds clearly concentrating on mainstream cryptocurrencies; the balance of Bitcoin on exchanges continued to decrease, indicating an increased willingness for long-term holding; ETF funds showed stable inflows, reflecting institutional confidence in the medium- to long-term trend.

In terms of macroeconomic policy, the Federal Reserve announced on May 7 during the FOMC meeting that it would maintain the federal funds rate in the range of 4.25%-4.50%. Chairman Powell emphasized the need to wait for more economic data to assess the persistence of changes in inflation and the labor market. The market generally expects that the interest rate hike cycle has essentially ended, and the expectation of easing policies provides medium- to long-term support for risk assets.

Technical and Sentiment Outlook: If Bitcoin effectively breaks through and stabilizes above $104,000, it will create a dual resonance of sentiment and technical aspects, potentially triggering a new round of trend-based capital inflow, and the market is expected to enter a medium-term upward channel. Conversely, if it fails to stabilize and experiences a pullback, there may be short-term profit-taking pressure, leading to a cautious observation state in market sentiment.

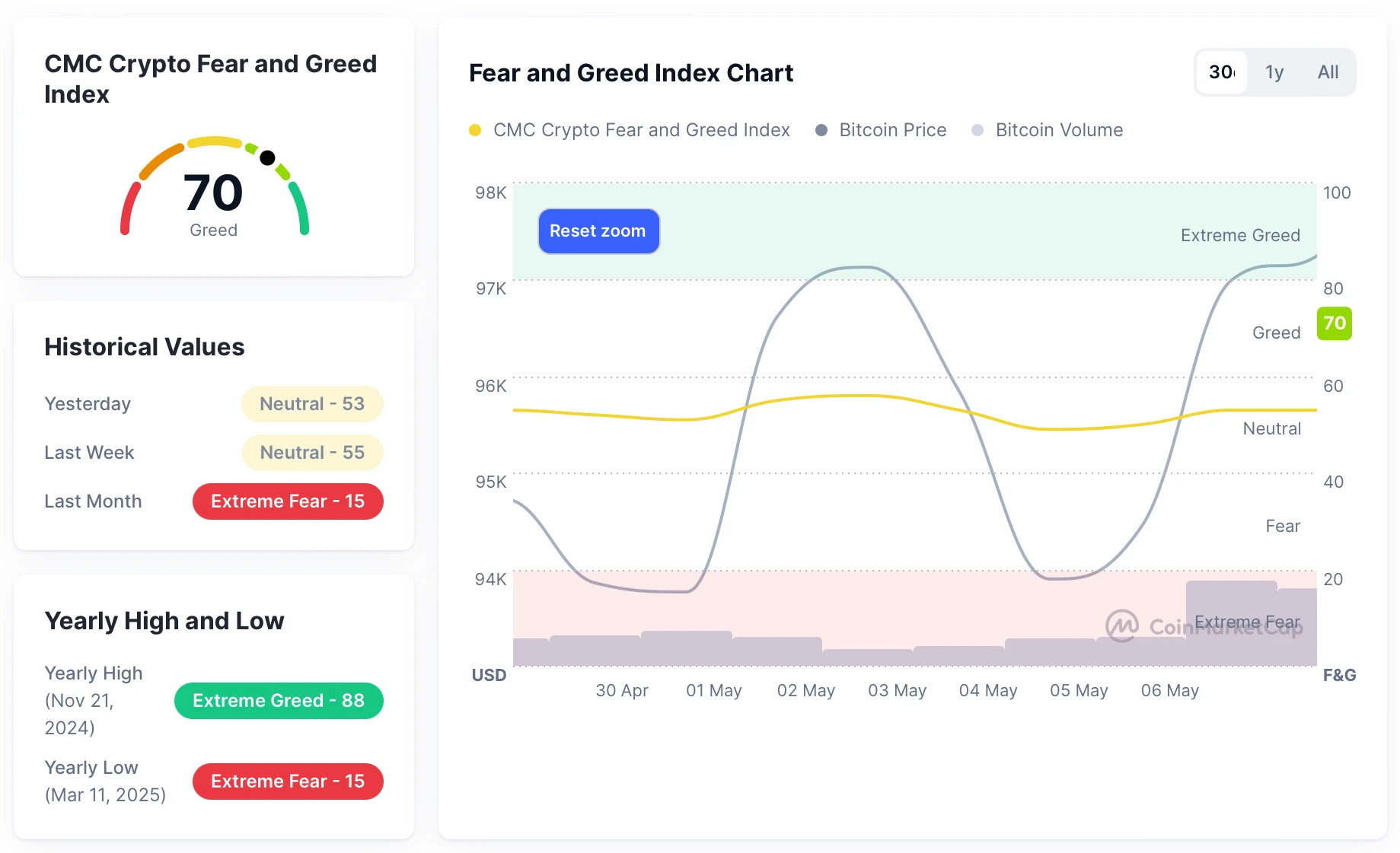

2. Key Sentiment Indicators (Fear and Greed Index)

According to CoinMarketCap data, as of May 9, the Fear and Greed Index was at 70, indicating a state of "Greed." The index showed a flat trend this week: May 3: 56 (Neutral); May 4: 53 (Neutral); May 5: 49 (Neutral); May 6: 50 (Neutral); May 7: 53 (Neutral); May 8: 53 (Neutral).

This change indicates that market sentiment is gradually shifting from a neutral and conservative stance to a more positive chasing of gains, with investors' risk appetite increasing. Especially after Bitcoin broke through the key psychological level, greed sentiment has warmed up, but the index has not yet entered the "Extreme Greed" phase (typically above 80), indicating that current market sentiment still has room for further increase.

Additionally, it is worth noting that the number of active addresses on-chain and transaction volume have both increased, corroborating the rising trend of the greed index and validating that investor participation is heating up, with potential momentum accumulating. However, caution should also be exercised regarding the short-term volatility risk brought about by overheating sentiment.

Fear and Greed Index Data Image

Macroeconomic Background

1. Policy and Geopolitical Dynamics

US-China Trade Negotiations Restart

The US Treasury Secretary announced talks with Chinese officials in Switzerland, attempting to ease tense trade relations and boost market confidence, driving up Bitcoin and other risk assets.

Trump Administration Strengthens Crypto Strategy

President Trump signed an executive order to launch a "Strategic Bitcoin Reserve" plan, encouraging states to hold cryptocurrencies. New Hampshire was the first to respond, allowing up to 5% of state reserves to be invested in Bitcoin, indicating a friendly government policy towards crypto assets.

2. Federal Reserve Policy and Economic Trends

Interest Rates Held Steady, Policy Remains Cautious

On May 7, the Federal Reserve maintained the federal funds rate in the range of 4.25%-4.5%, with Chairman Powell stating that more data would be awaited to assess changes in inflation and unemployment, and current policies would remain stable.

Signs of Economic Growth Slowing

The US GDP fell by 0.3% in the first quarter of 2025. Despite strong employment data, the uncertainty brought about by high tariff policies is impacting business and consumer confidence, suppressing investment and consumption.

3. Europe: Weak Growth, Divergent Policies

Construction Industry Continues to Shrink, German Orders Rebound

The construction industry in the UK and Eurozone has been declining, indicating weakness in infrastructure and real estate. German factory orders increased by 3.6% month-on-month, bringing a glimmer of hope to the Eurozone economy.

Bank of England May Cut Rates to Address Pressure

Due to the slowdown in global demand and the spillover effects of US policies, the Bank of England is expected to lower interest rates by 25 basis points this month, releasing easing signals to stimulate the economy.

4. Market Summary and Outlook

Global financial markets continue to focus on US-China trade relations and Federal Reserve policies, with US stocks slightly rising while European stocks performed poorly due to economic data. The global economy faces triple pressures: the impact of US trade protection policies on the foreign trade environment, weak fundamentals in Europe, and China's efforts to stabilize growth through easing policies. Market volatility is increasing, and investor sentiment is becoming cautiously optimistic, necessitating close attention to policy directions and flexible adjustment of allocation strategies.

3. Hashrate Changes

From May 3 to May 9, 2025, Bitcoin's network hashrate exhibited fluctuations, with the following specifics:

On May 3, the overall network hashrate fell from 922.97 EH/s to 859.61 EH/s before starting to rise, reaching a daily high of 1077.53 EH/s, showing signs of some recovery in hashrate. On May 4, the hashrate showed an overall downward trend, continuously dropping from 1047.71 EH/s to a low of 811.22 EH/s, with significant daily fluctuations, possibly influenced by miner revenue pressures or energy costs. On May 5, hashrate fluctuations intensified, maintaining an upward trend overall. The hashrate reached 926.05 EH/s, 1080.63 EH/s, and 1095.40 EH/s, although it briefly fell to 974.24 EH/s, it quickly rebounded, indicating strong network recovery capability. On May 6, the hashrate entered a correction phase again, maintaining a downward trend throughout the day, sliding from 1076.27 EH/s to 912.23 EH/s and then to 818.57 EH/s, reflecting that some miners or equipment temporarily exited the network. On May 7, the hashrate initially dropped to a weekly low of 743.05 EH/s, then gradually recovered to 910.84 EH/s, possibly indicating that miners adjusted their deployment rhythm based on electricity prices and network difficulty. On May 8, the hashrate briefly rose to a high of 963.39 EH/s, then briefly pulled back to 907.12 EH/s, but climbed again within the day, reaching a peak of 1061.27 EH/s. After that, the hashrate fell back to 948.67 EH/s. Entering May 9, the hashrate slightly adjusted down from 975.91 EH/s to 939.56 EH/s.

Overall, from early May 2025 to now, Bitcoin's network hashrate has shown a wide range of fluctuation characteristics. During this period, the hashrate fluctuated significantly between approximately 743 EH/s and 1095 EH/s, indicating frequent adjustments in the distribution of network hashrate in the short term. This phenomenon may be related to miners reassessing revenue models, changes in electricity costs, or fluctuations in power grids in some regions of North America and Asia.

Bitcoin Network Hashrate Data

4. Mining Revenue

According to YCharts data, the total daily revenue of Bitcoin miners (including block rewards and transaction fees) for this week is as follows: May 3: $50.4 million; May 4: $43.16 million; May 5: $52.29 million; May 6: $41.32 million; May 7: $46.4 million; May 8: $50.31 million. Overall, the average daily revenue for miners this week remained in the range of approximately $43.0 million to $52.0 million, showing moderate fluctuations. Although there were slight pullbacks on some trading days, the overall performance was stable, indicating that current network trading activity is relatively high, and fee income provides certain support for miners' revenue.

From the perspective of unit hashrate revenue, as of now, the Bitcoin hash price (Hashprice) is approximately $54.91 per PH/s per day, having rebounded to a relatively high level over the past month. The Hashprice has been rising for several consecutive days, reflecting stable market demand for hashrate, while also benefiting from the stabilization of Bitcoin's spot price and active trading activities.

The rebound in hash price helps to enhance miners' profit margins, especially signaling positively for mining operations with high operational efficiency and low unit electricity costs. In the current market environment, the improvement in hashrate revenue may attract more miners to restore or expand computational resources, further driving fluctuations in the overall network hashrate. Additionally, the upward trend in Hashprice indirectly indicates that some high-cost mining machines still have economic feasibility for operation within the current price range, which will support hashrate return and network stability in the short term.

Hashprice Data

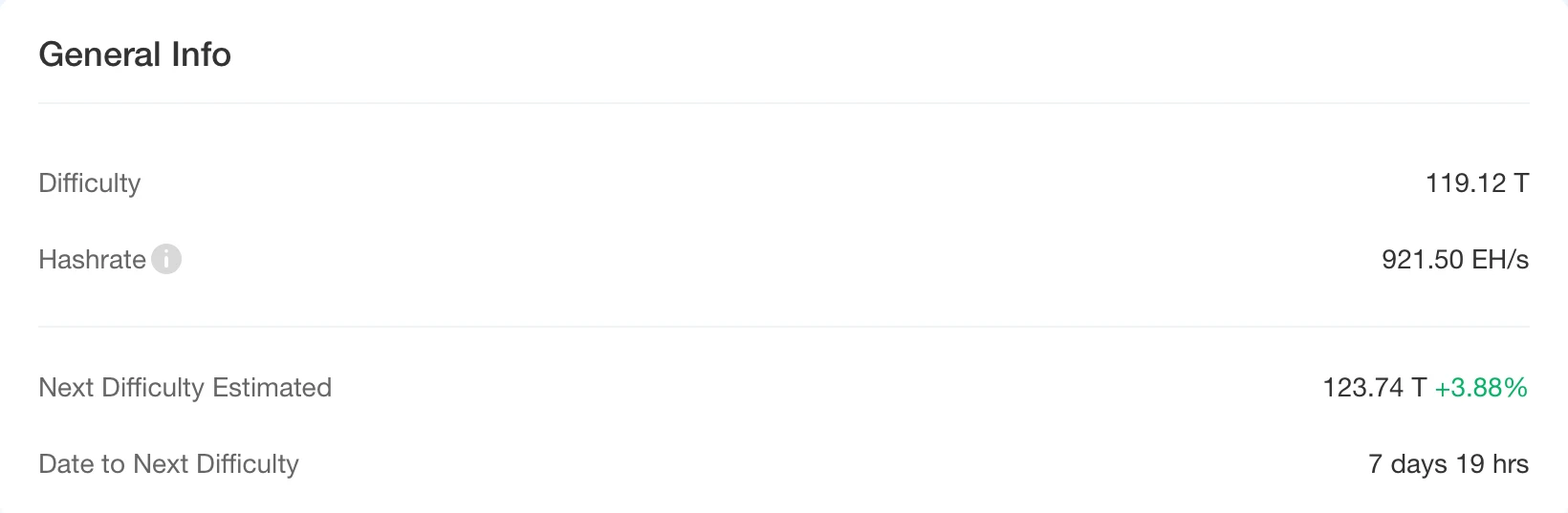

5. Energy Costs and Mining Efficiency

According to CloverPool data, the Bitcoin network completed its latest difficulty adjustment on May 4, 2025, at 05:00:13 (block height 895,104), with the mining difficulty reduced by 3.34% to 119.12 T. As of May 9, 2025, the total network hashrate remained at approximately 921.50 EH/s, with the mining difficulty still at 119.12 T. Considering the current hashrate trend, the next difficulty adjustment is expected to occur around May 17, with an anticipated increase of approximately 3.88% to 123.74 T. This trend indicates that after short-term fluctuations in hashrate, the overall network hashrate is steadily recovering, and mining activities are gradually returning to higher load levels, reflecting a warming of miner participation and an enhancement of network processing capacity.

From a cost perspective, according to the latest model calculations from MacroMicro, as of May 7, 2025, the unit production cost of Bitcoin is approximately $88,965.59, while the spot price during the same period is $97,032.32, resulting in a mining cost-to-price ratio of 0.92. This ratio is slightly below 1, indicating that the current Bitcoin market price is still above the average mining cost, with most miners in a profitable state and having economic incentives to continue investing computational resources.

In summary, the Bitcoin network currently shows a clear recovery trend in terms of mining difficulty, hashrate fluctuations, and cost structure. The upward trend in hashrate, the expected difficulty increase, and the positive cost-price differential together constitute a positive signal for miners, further supporting the stable operation and decentralized security of the network. Overall, the Bitcoin network continues to demonstrate good resilience and market responsiveness after experiencing the halving adjustment phase.

Bitcoin Mining Difficulty Data

6. Policy and Regulatory News

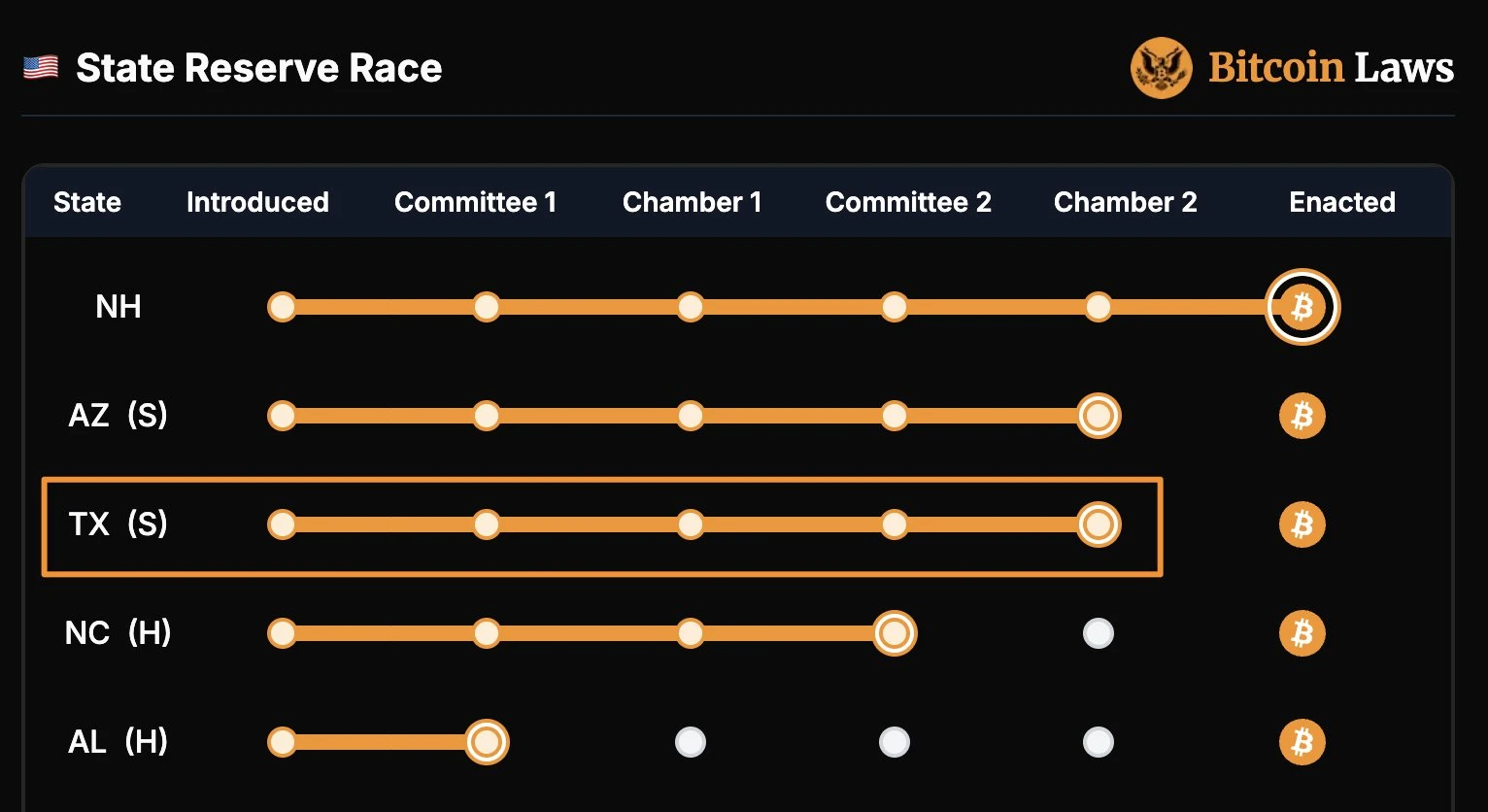

Florida Senate Withdraws Consideration of Bitcoin Strategic Reserve Bill

On May 6, according to Cointelegraph, two cryptocurrency bills in Florida have been removed from the legislative process, marking the latest setback for the state's strategic Bitcoin reserve goals. The Florida Senate stated that House Bill 487 and Senate Bill 550 were "indefinitely postponed and withdrawn from consideration" on May 3. The Florida legislative session adjourned on May 2 without passing these two bills, which were intended to promote the establishment of cryptocurrency reserves in the state.

New Hampshire Allows Bitcoin Holdings Up to 5% of State Funds

On May 7, New Hampshire's governor signed HB 302, which adopts the Strategic Bitcoin Reserve (SBR) model from Satoshi Action. The contents of HB 302 include:

- Allowing the state treasury to purchase Bitcoin and top digital assets—authorizing reserves to purchase up to $500 billion in Bitcoin (limited to full stop-loss);

- A holding limit of 5% of total state funds—ensuring Bitcoin supplements the state's broader investments;

- Mandatory compliance with U.S. regulatory custody—assets must be held in multi-signature controlled by the state or through U.S. exchange-traded products to maximize security and transparency;

- Effective 60 days after enactment—providing a clear operational framework for reserves and stacking.

Arizona Senate Approves Bitcoin Reserve Bill SB 1373 and Sends It to the Governor

On May 7, according to Bitcoin News, the Arizona Senate approved the Bitcoin reserve bill SB 1373 and sent it to Governor Katie Hobbs for a final decision.

Previously, the Arizona governor vetoed the state's strategic Bitcoin reserve bill SB 1025.

Texas Bitcoin Reserve Bill SB 21 Passes DOGE Committee Review, Final Outcome Expected in Three Weeks

On May 8, according to Bitcoin Laws, Texas's strategic Bitcoin reserve bill (SB 21) has passed the DOGE committee review without amendments and will enter the final voting phase. Since the Texas legislature will adjourn on June 2, the final outcome of the bill is expected to be revealed in the next three weeks.

This bill is an important legislative measure for Texas to establish a strategic Bitcoin reserve and has completed all committee review procedures, now just one step away from final approval.

Related Images

7. Mining News

Block: U.S.-Made Bitcoin Mining Chip Proto Set to Launch This Year to Address Tariff Risks

On May 2, Block CEO Jack Dorsey stated that the company is manufacturing Bitcoin mining chips, Proto, in the U.S. to address rising tariffs and overseas manufacturing risks. The chip is planned for release in 2025, featuring an open-source design that emphasizes flexibility and direct collaboration with U.S. suppliers. Additionally, Block disclosed that it achieved a gross profit of $2.29 billion in the first quarter, a 9% year-on-year increase, with Cash App gross profit rising 10% to $1.38 billion and Square increasing 9% to $898 million.

Ledn Executive: Bitcoin Mining Companies Should Hold Their Mined Bitcoin

On May 4, John Glover, Chief Investment Officer of Bitcoin lending company Ledn, stated that Bitcoin mining companies should hold their mined Bitcoin and use it as collateral for fiat loans to cover operating expenses, rather than selling Bitcoin and losing the upside potential of an asset that miners expect to appreciate.

Glover noted that holding BTC has many benefits, including price appreciation, tax deferral, and earning additional income by lending out BTC held in company bonds.

Data: Last Week, U.S. Bitcoin ETF Purchases Reached Nearly Six Times Miners' Output

On May 5, data released by asset allocation platform HODL15Capital indicated that in the past week, U.S.-listed spot Bitcoin ETFs purchased approximately 18,644 Bitcoins. During the same period, considering the post-halving mining efficiency (approximately 450 Bitcoins per day), global miners produced only about 3,150 Bitcoins. This means that ETF purchases were nearly six times the output of miners during the same period.

Related Images

8. Bitcoin News

Global Corporate and National Bitcoin Holdings (This Week's Statistics)

El Salvador purchased an additional Bitcoin this week, bringing its total holdings to 6,166.18 Bitcoins, valued at approximately $593 million.

Brown University disclosed holding approximately $5 million in BlackRock's spot Bitcoin ETF, reflecting that institutional funds in universities are positioning themselves in Bitcoin assets.

Strategy (formerly MicroStrategy) increased its holdings by 1,895 Bitcoins on May 1, investing approximately $180.3 million, bringing its total holdings to 155,450 Bitcoins at an average cost of about $68,550.

Semler Scientific increased its holdings by 167 Bitcoins on May 2, with a total investment of $16.2 million, bringing its total holdings to 3,634 Bitcoins, with a year-to-date return of 22.2%.

Australia's Monochrome's IBTC spot Bitcoin ETF holdings rose to 350 Bitcoins, valued at approximately $52.146 million.

BlackRock increased its Bitcoin holdings by a total of $2.5 billion last week, averaging $500 million per day; over the past two weeks, it has cumulatively increased its holdings by 41,452 BTC through its iShares Bitcoin Trust ETF, bringing its total holdings to 614,639 Bitcoins, valued at approximately $58.07 billion. Additionally, its Q1 2025 report disclosed that Bitcoin-related stock assets have reached $5.43 billion, with IBIT ETF holdings increasing from 2.6 million shares to 5.85 million shares, and new positions established in Fidelity's FBTC and Grayscale's GBTC.

Public company KULR increased its holdings by 42 Bitcoins this week, bringing its total holdings to 716.2 Bitcoins, valued at approximately $69 million, with a year-to-date return of 197.5%.

Thumzup submitted an amendment to raise its financing cap from $200 million to $500 million to advance its Bitcoin acquisition strategy, with the board authorizing up to 90% of liquid assets for Bitcoin purchases.

NYSE-listed company Cango added 470 Bitcoins in April, bringing its total holdings to 2,944.8 Bitcoins, with funding sources including $352 million obtained from the sale of its auto finance business.

Japanese listed company Metaplanet increased its holdings by 555 Bitcoins on May 2 at an average price of approximately $89,000, bringing its total holdings to 5,555 Bitcoins, with a total investment of approximately $465 million; it also announced the issuance of $25 million in zero-interest bonds for future Bitcoin purchases, with the bonds maturing on November 6, 2025.

Fidelity: Bitcoin May Soon Surpass Gold's Dominance

On May 4, Jurrien Timmer, Global Macro Director at Fidelity Investments, analyzed the dynamics between Bitcoin and gold, pointing out that Bitcoin may soon surpass gold's dominance. Based on the changes in the Sharpe ratio that measures the risk-adjusted returns of these two assets, gold and Bitcoin are negatively correlated. With Bitcoin's Sharpe ratio at -0.40 and gold's at 1.33, this suggests that Bitcoin may lead the market next, and we will see a transition of the baton from gold to Bitcoin. Jurrien Timmer advised investors to start with a portfolio of four parts gold to one part Bitcoin, as gold's volatility is only a quarter of Bitcoin's, despite their similar Sharpe ratios.

Opinion: Capital Inflows into Crypto Will Naturally Flow to Bitcoin, 1.5% of Personal Portfolio Allocated to BTC

On May 4, renowned investor Kevin O'Leary pointed out that institutions are currently reluctant to touch Ethereum, and when large amounts of capital flow into the cryptocurrency space, it will inevitably flow to the flagship digital asset: Bitcoin. Especially as Bitcoin has recently decoupled from traditional stock indices, this is an important development indicating that this asset is maturing into a unique investment category, even standing alongside gold as a means of hedging and storing value. Additionally, Kevin O'Leary disclosed that he allocated 1.5% of his investment portfolio to Bitcoin, with 19% invested in other areas related to cryptocurrency, including purchasing shares of Coinbase and Robinhood.

Related Images

Coinbase Investor: Bitcoin's Value Could Reach "Unlimited" Dollars

On May 5, Coinbase investor Tim Draper posted on platform X that Bitcoin's value could reach "unlimited" dollars, sounding the alarm for the collapse of fiat trust, the historic weakness of the dollar, and the accelerated dominance of cryptocurrencies. Tim Draper explained that during the Civil War, Confederate silver dollars experienced hyperinflation, and by the end of the war, the ratio of Confederate silver dollars to dollars plummeted to over 10 million to 1. As trust declined, people rushed to exchange them for dollars. The dollar index has had its worst start to the year in 40 years, and market confidence in the dollar may further decline, while the U.S. is hedging against this situation by incorporating Bitcoin into its strategic reserves.

QCP: Macroeconomic Data Reflects Resilience, Stable Inflows into Bitcoin ETFs Indicate Continued Institutional Demand

On May 5, QCP Capital released a market analysis stating: The macro data released last Friday provided a detailed snapshot of the U.S. economy, with non-farm payrolls increasing by 177,000, exceeding the expected 133,000, and the unemployment rate remaining stable at 4.2%. However, behind the strong data, economists continue to warn that the full economic impact of recent tariff increases has yet to be seen, and the market remains cautiously optimistic about this. Meanwhile, the market generally expects the Federal Reserve to maintain interest rates at its policy meeting this week. Despite recording a historic high loss in the first quarter, Strategy has doubled its financing target to $84 billion. This loss was due to the adoption of new digital asset fair value accounting standards, highlighting the company's firm belief in its long-term Bitcoin strategy. At the same time, the stable inflow of spot Bitcoin ETFs indicates that institutional demand remains strong and reinforces the growing role of this asset in diversified portfolios.

Forbes: Wall Street Institutions Prepare for Significant Rise in Bitcoin and Cryptocurrency Markets

On May 6, according to anonymous sources, high-frequency trading giant Tower Research Capital has joined Citadel Securities to "increase bets on cryptocurrencies." With the Trump administration promising to open up Bitcoin trading and the cryptocurrency market, lifting restrictions from the Biden era and rapidly advancing legislation to reshape the financial system, Wall Street is quietly increasing its support for Bitcoin and cryptocurrencies.

Last week, Wall Street giants managing a total of $10 trillion in assets expected to "open business" for Bitcoin this year, allowing advisors to recommend Bitcoin ETFs to clients for the first time.

Related Images

K33 Analyst: Bitcoin Market May Break "May Down Effect," Trump-Related Positive Factors Support

On May 7, according to The Block, analysts from cryptocurrency research firm K33 stated that investors should continue to hold Bitcoin in May, contrary to the traditional "sell in May" strategy.

Analysts believe that although the key deadline for the Strategic Bitcoin Reserve has passed without any public announcement, the market situation in 2025 will be different. Several Trump-related positive factors are expected to drive the market, suggesting that this summer's market performance may not experience the typical sluggishness seen in previous years.

Bitcoin Magazine CEO: Bitcoin Accelerating Transition to Global Reserve Asset

On May 8, according to The Block, Bitcoin Magazine CEO David Bailey stated that Bitcoin is transitioning to a global reserve asset at an unexpected speed. Bailey emphasized that as adoption at the national level increases, Bitcoin has gradually evolved from an early rebellious technology to a strategic consideration for national security. He particularly noted that the acceleration of institutionalization and continued investments from firms like Strategy (formerly MicroStrategy) are driving a clear differentiation between Bitcoin and the broader cryptocurrency market.

Bitcoin Market Cap Surpasses Amazon, Rises to Fifth Place Among Global Assets

On May 9, according to 8Marketcap data, Bitcoin's current market cap is $2.045 trillion, surpassing Amazon to rank fifth among global assets.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。