Interview: bayemon.eth, ChainCatcher

Guest: Omni Network Team

As the rise and fall of new Layer1 projects such as Solana, Near, and Aptos continue, the story of the "Ethereum killer" is no longer fresh, and even seems somewhat cliché, but it is indeed a real pain point in the industry.

With the increasing number of users, the transaction speed of "transparent ledgers" like Ethereum has long been unable to meet the demand for "real-time transactions" - Ethereum tirelessly supports a large number of transactions from around the world day and night, and the infinite expansion of the ecosystem and the limited space of the blocks sometimes cause Ethereum to be as congested as the North-South Elevated Road during rush hour. Therefore, in order to solve the "scalability" in the impossible triangle, more and more teams have begun to build Layer2 expansion solutions for the Ethereum ecosystem to enhance the transaction experience.

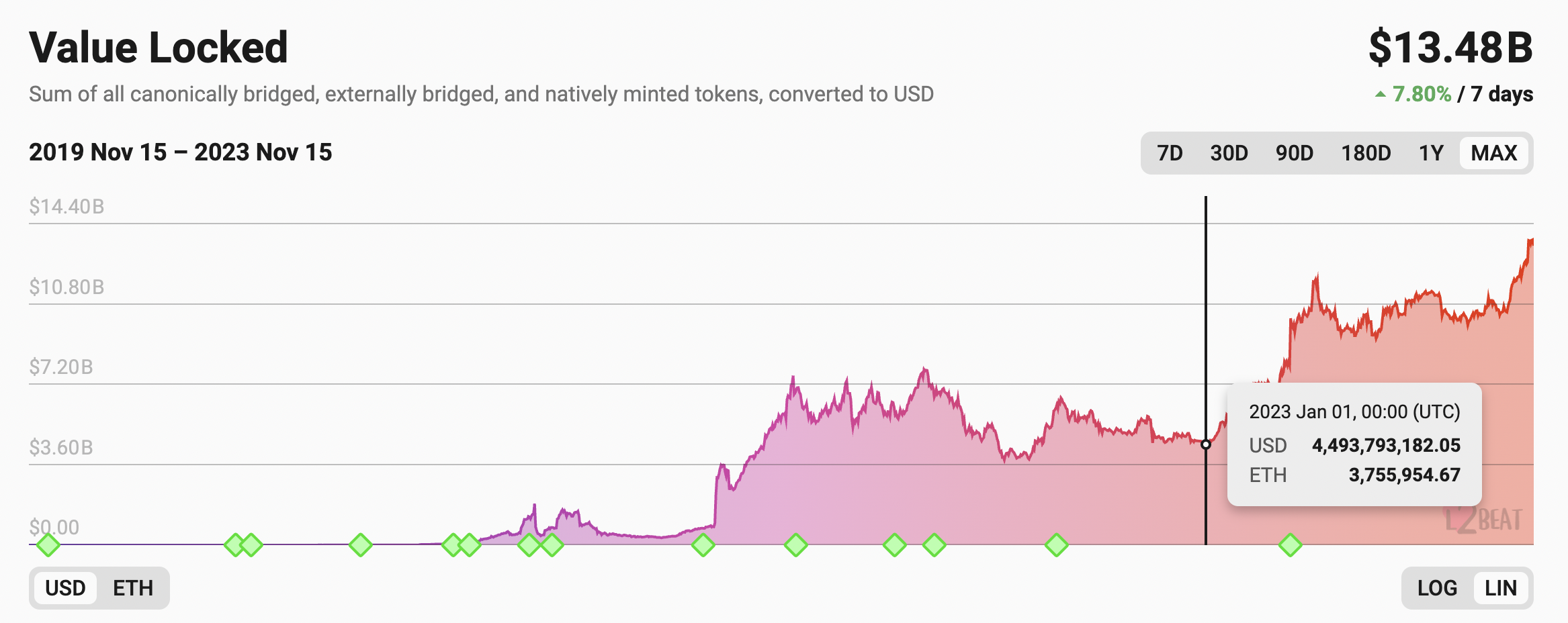

According to L2Beat data, the total TVL of Layer2 networks is as high as 13.48 billion. It should be noted that at the beginning of the year, the total TVL of Layer2 was only 4.536 billion, which means that in the almost past 2023, the total locked amount of Layer2 has almost doubled. In addition, the upcoming Ethereum Cancun upgrade expected to be completed next year is undoubtedly the "official stage" to promote Layer2 to become the grand narrative throughout the Ethereum congestion era.

However, the increase in speed and bandwidth expansion has brought about the fragmentation of the Ethereum ecosystem - users' funds are often locked in a single expansion solution, and the overall Layer2 does not yet have natural interoperability. Moreover, the frequent security incidents of cross-chain bridges in the first half of the year have closed the window for cross-Layer2 operations. At the same time, switching between Layer2 also requires developers to make extensive modifications to the deployment code, making it impossible to smoothly deploy applications on different Layer2. Therefore, whether from the perspective of users or developers, how to achieve cross-Layer2 interoperability safely, stably, and without significantly increasing costs has become a problem that must be considered before the explosive growth of Layer2 in the Cambrian era.

On April 26th of this year, a $18 million financing attracted the community's attention to a cross-chain interoperability protocol called Omni Network. Since 2017, the Omni Network team has been paying attention to the controversies caused by Ethereum Layer2 Rollup, which is like an island. For this reason, the Omni team focuses on providing infrastructure for different Layer2 Rollup solutions, aggregating through the Ethereum re-staking protocol EigenLayer and the Cosmos SDK, completing the modular integration of the Ethereum ecosystem and the interoperability of Layer2 Rollup, while still establishing the underlying security on the Ethereum mainnet. Therefore, Omni Network can be said to possess the security and programmability of Ethereum, bringing a much larger user flow to developers and providing users with a more convenient application access channel.

What was the initial opportunity that led Omni Network to discover the pain points of Rollup interoperability? What significance will the team's six years of continuous efforts bring to the L2 explosion after the Cancun upgrade? This time, ChainCatcher invited the Omni Network team to tell the story of Omni Network's journey as the "last piece of the puzzle" in the grand narrative of Ethereum's expansion from the perspectives of Restaking, cross-chain operation technology, and long-term vision.

Project & Team Introduction

1. ChainCatcher: Please introduce the project structure of Omni Network and the problems it attempts to solve.

Omni Network: Omni Network is the missing infrastructure for future modular expansion of Ethereum, requiring modular protocols for three basic functions:

- Rollups

- Data Availability

- Aggregation

Rollups solve the scalability problem, the data availability solution reduces costs, and Omni aggregates all these modular components to solve the fragmentation problem.

Currently, users and their funds are dispersed across various L2 networks, which particularly affects developers because when they deploy on Rollup, they can only access a small part of the market. Omni Network allows developers to extend their applications to all Rollups to solve the current liquidity fragmentation problem in Ethereum.

We believe that these three sub-protocols will create and capture most of the value in the upcoming market adoption cycle.

2. ChainCatcher: How did Omni Network get started? What initially drove the entire team to build such a cross-Rollup interoperability infrastructure?

Omni Network: In 2020, the team behind Omni built a DeFi protocol called Rift, which quickly gained scale. In the first few days of its launch, the total locked value (TVL) reached the protocol's limit of $50 million. We began to expand Rift to other smart contract platforms and encountered all the problems that Omni solves:

- Liquidity fragmentation

- Poor developer experience

- Insecure cross-chain operations

Since 2017, the Omni team has been building in this field, always focusing on researching the community, and we saw the possibility of transforming Rift into a universal platform that is extremely important for Ethereum. With the increasing adoption of Rollups and after actively exploring the cutting-edge research results at the time, we realized that the opportunity at the Ethereum protocol stack layer would create value several orders of magnitude greater than any DeFi protocol. Therefore, we fully turned to building Omni to provide the right expansion solution when Ethereum turns to a modular future.

3. ChainCatcher: Please briefly introduce the current situation of the Omni Network team and the current division of work and focus of the team.

Omni Network: The Omni team is mainly composed of senior engineers. The team prefers to work with senior engineers who have experience in building large-scale production systems, allowing us to combine many cutting-edge innovations into one platform.

Currently, we have a reserve of 7 years of funding and plan to expand the team size by 2-3 times in the next year. While most companies in the cryptocurrency field are downsizing, we are expanding. We believe that the opportunity to create the missing infrastructure for the modular future of Ethereum will be realized in the next 5 years, and Omni Network is confident in taking a leading position in this field.

If you are a senior engineer with experience in building distributed networks and are interested in joining our team, we are globally distributed, and you can apply here.

4. ChainCatcher: The LinkedIn profile shows that the founding team of Omni (including CEO Austin King, CTO Tyler Tarsi, and COO Matt Poreda) all graduated from Harvard University and the entire team has a very strong technical background. What advantages do you think such a team background has in the project's development?

Omni Network: The only reason we were able to start building Omni so early is that we have an extremely technically intensive team that has been involved in the cryptocurrency field since 2017.

Omni Labs' CEO Austin founded his first cryptocurrency company during his time at Harvard and raised funds for it within two years before selling it to Ripple. The company developed a similar large-scale distributed network (Interledger), processing over 10 billion payments, and at times achieving transaction speeds equivalent to Visa.

Our CTO Tyler met Austin while studying computer science at Harvard, and after graduation, he entered the field of developing trading algorithms for institutions, managing over a billion dollars in assets. Our COO Matt studied at Harvard Business School and had experience at Amazon, Spotify, and BCG before joining Omni.

They combined their expertise in cryptography, large-scale distributed systems, and company building, driving Omni's rapid growth to date.

Cross-Rollup Breaking the Stalemate of Layer2 Development?

5. ChainCatcher: For a long time, the cryptocurrency market has been in a "crypto winter," yet the development of Layer2 Rollup seems to have not slowed down, including the recent mainnet releases of Linea and Scroll, among others. Has this seemingly "contradictory" market environment had an impact on Omni Network? What measures has Omni taken in development and operations to respond to this large environment and potential status differences in the segmented market?

Omni Network: Ethereum was not originally designed to be extended through L2. However, as Ethereum itself cannot achieve scalability, various teams have invented external expansion solutions such as Rolups. This has brought a more promising scalability to the Ethereum ecosystem, but the cost of expansion is fragmentation. Whenever users want to use these Rollups, they have to migrate their assets to the "isolated area" of that Rollup.

Currently, there is no effective and secure communication between these Rollups, which means that users can only use temporary solutions, and even need to return to Layer1 and then migrate to another Rollup in order to access all the latest applications.

This is obviously a huge problem, resulting in a very poor user experience and isolating developers in a Rollup, only able to access a small part of the addressable user market.

Omni solves this problem. It allows developers to build applications that are available across all Rollups by creating a high-performance distributed network that aggregates all L2 networks.

6. ChainCatcher: Omni's official documentation mentions two important features, "Cross-Rollup Programmability" and "Permissionless Expansion," what do you think the significance of these two features is for Layer2 networks, the Ethereum ecosystem, and the entire Web3 world?

Omni Network:

Cross-Rollup Programmability

For developers, Ethereum's EVM looks like a single computer. Although Ethereum is supported by hundreds of thousands of computers distributed around the world, this is a very important design decision because it simplifies development and reduces the chance of introducing programming errors in smart contracts.

For Omni, our goal is to unify the Ethereum L2 ecosystem and provide a similar developer experience, allowing smart contracts to be used across the entire ecosystem without modification. Omni allows developers to build applications and make them available on all L2s, but for developers, it looks as simple as building in a single EVM environment.

Because our two co-founders are engineers, a lot of effort has been put into optimizing the developer experience in product design. This is a huge competitive advantage for Omni, as no other protocol can provide developers with a similar development experience as Omni, while also expanding the user base by more than 10 times.

Permissionless Expansion

Understanding permissionless expansion is crucial to understanding Omni's ultimate vision. Similar to TCP/IP, Omni makes no assumptions about the underlying platform except that it settles to Ethereum. Therefore, Rollups do not need to make any requests or adjustments when joining the Omni network.

Omni is building a global aggregation layer for Ethereum, so it is necessary to have a design that covers all expansion platforms launched on Ethereum.

7. ChainCatcher: In addition to the above features, Omni Network also insists on EVM compatibility, while the current Web3 ecosystem has seen many non-EVM compatible protocols, and "EVM vs. Non-EVM" has sparked a lot of discussion in the community. For Omni, what are the advantages of EVM compatibility compared to non-EVM?

Omni Network: This is actually a very good question because both EVM and non-EVM platforms have their own advantages.

EVM: We believe that the EVM is the equivalent of JavaScript in the cryptocurrency field, similar to the internet. As a language, JavaScript is far from perfect. However, due to its widespread adoption, it has become the de facto language used in the global network. Therefore, from a scalability perspective, we believe that Solidity and EVM play the same role in the cryptocurrency field.

**Non-EVM: At the same time, we do see significant opportunities for improvement in the cryptocurrency execution layer. Considering the advantages of the Solana Virtual Machine in speed and throughput, non-EVM platforms also have their advantages, and there are other good opportunities to implement other virtual machines and languages at the execution layer to provide further optimization for these platforms. However, one of the most exciting things for us is *using non-EVM platforms as a mechanism to bring more developers into the entire cryptocurrency ecosystem.* If we enable people to build smart contracts in languages they are already familiar with, we can significantly reduce the friction for expanding the adoption of cryptocurrency developers, accelerating innovation and global adoption.

Returning to the concept of permissionless expansion - Omni can also integrate non-EVM Rollups. There are no requirements in the Omni protocol for Rollups to use a specific language or virtual machine. This has already been demonstrated through our current development and collaboration with Starkware and its ecosystem.

8. ChainCatcher: In the official documentation of Omni, it is mentioned that developers can use mainstream development tools such as Solidity very smoothly, and we also noticed that StarkWare is among the ideal partners for Omni, and StarkWare has its official language Cairo. What benefits will Omni Network's collaboration with StarkWare bring to projects using relatively "niche" development languages?

Omni Network: Specifically, Cairo is a non-EVM language built from scratch, making it easier to work with StarkWare's zero-knowledge proof-based Rollup technology. This fully demonstrates the powerful capability of building custom execution environments within Rollups, as through StarkWare's integration with Omni, suddenly there is a huge opportunity for developers in its ecosystem. Developers can build their core applications in Cairo and run them in the StarkWare Rollup VM, but through Omni, make them accessible across the entire Rollup ecosystem. Therefore, by leveraging Omni, applications can be globalized without compromising addressable users and liquidity, gaining super-optimized execution capabilities from StarkWare.

Restaking: Security, Consensus, and Applications

9. ChainCatcher: In addition to making Rollup interoperability easier, Omni Network also introduces the concept of "ETH Restaking." Please briefly explain the role of Restaking in Omni Network's consensus mechanism and security, and the reason for using EigenLayer as the Restaking infrastructure.

Omni Network: A core insight we used in inventing Omni is to introduce a communication network for modular systems like Rollups, ultimately protected by Layer1 itself. Our CEO has been building communication networks in the cryptocurrency field since 2017, and his previous company built the Interledger network, which processed over 10 billion payments. But through Omni, because it can leverage Layer1 as the source of truth, we can build a fundamentally more secure and performant network.

We intentionally make Omni as close to the core Ethereum protocol as possible - it is the necessary infrastructure for Ethereum expansion, as if we were building directly into the core Ethereum protocol. Therefore, from a token economics perspective, an important design decision is to use ETH as an asset to provide cryptoeconomic security. Besides achieving unprecedented levels of security, from a development perspective, Omni can reach a scale of hundreds of billions of dollars, achieved by leveraging ETH to provide cryptoeconomic security.

We currently use EigenLayer for contract slashing on Layer1, based on the team's high-quality work in this area.

10. ChainCatcher: In May of this year, during an AMA with Starknet and Kakarot, Omni discussed plans to enhance Layer2 liquidity issues. Regarding liquidity enhancement, will Omni Network add more use cases in the future? If so, please briefly introduce them.

Omni Network: The most exciting thing about Omni is that it introduces a new class of applications that can be built to serve the entire Ethereum user market. Our team has considered many use cases, and some have already built novel applications on Omni, but to name a few:

- Providing global margin accounts for all cryptocurrencies: Today, centralized exchanges still dominate cryptocurrency spot trading, especially cryptocurrency derivatives trading. This is mainly due to the inefficiency of capital caused by the lack of a unified global margin account that can provide collateral across multiple financial instruments. Omni can make this type of product possible, which will be a key innovation in unlocking on-chain financial activities at scale.

- Pure yield optimization abstraction: Today, the only users who can access top yield opportunities are complex network participants who write software while constantly migrating and rebalancing their positions. With Omni, a protocol can be built that has the highest yield potential in every domain, which also means that based on Omni, the first product that can generate revenue from every opportunity in the market has been created. This is crucial for opening DeFi to more users, as it will allow all users to access the best services provided by DeFi at any time and place through simple deposits.

- Global autonomous robots: With interoperability with all Rollups through Omni, developers can build software that dynamically responds to all state updates in the Ethereum L2 ecosystem. This alone can serve as a platform for various protocol designs, having a huge impact on the field of cryptocurrency application design.

These are some examples of new innovations uniquely implemented by Omni, but we also see our developer ecosystem growing significantly through simpler, more intuitive use cases:

- NFT minting: For NFT artists, it is obvious that they want everyone in the cryptocurrency world to be able to buy, not just users on a single Rollup.

- Token launch platforms: Similarly, allowing people from around the world to participate, rather than confining themselves to a small part of the market.

- Gaming: Game developers are only concerned with expanding their user base, so why not provide access through Omni across the entire cryptocurrency system?

So far, Omni has completed two network tests, with over 30 projects built on it - we have processed over 6 million transactions and attracted over 370,000 users. This makes building projects on Omni more attractive for developers.

Long-term Vision: Layer3, OP Stack…

11. ChainCatcher: In the long run, will the prosperity of Layer2 Rollup continue? And Layer3 has already emerged in the current ecosystem. How do you view the development prospects of Layer3, and how will Omni Network handle the relationship between Layer2 and Layer3?

Omni Network: First, Omni can seamlessly connect all Layer3 platforms outside of Layer2. We believe that the Layer2 field will continue to expand, with new platforms and solutions emerging, as there are ample reasons for diversity in the Rollup field. Developers can offer products with different languages, virtual machines, security guarantees, decentralization levels, KYC compliance, and other dimensions. In the past year, we have seen more and more participants entering the Layer2 field, and this trend will continue.

This is necessary for expanding cryptocurrency to mainstream users. We need more blocks to attract the next billion users without causing a sharp increase in Gas and making it difficult for new users to adopt.

With all this happening, Omni will become an essential part of Ethereum's infrastructure, connecting all these platforms and abstracting all this infrastructure expansion for end users to provide a simpler user experience. ```

12. ChainCatcher: Although Layer2 is currently in a state of "many voices," we can also see that RaaS tools led by OP Stack have attracted the attention of many developers and users. Optimism also openly aims to create a "Super-Chain Kingdom." Will the rise of RaaS have an impact on Omni Network? If there is an impact, how will Omni respond to similar impacts in the future?

Omni Network: Of course, in fact, this is a huge opportunity for Omni rather than a challenge. We have already been working with the leading RaaS solution, Caldera. The more Rollups there are, the greater the demand for Omni. As RaaS providers continue to introduce more and more Rollups, Omni will become an essential part of the infrastructure, making it easier for these new Rollups to attract new users and liquidity by abstracting away the complexity that arises when they exist as independent platforms.

Next Milestone

13. ChainCatcher: The roadmap for Omni indicates that it will integrate major Rollup networks such as Arbitrum, Polygon zkEVM, Scroll, Linea, and StarkWare and launch the mainnet in 2024. Can you reveal the current development progress?

Omni Network: Yes, currently we have leading Rollups, including Arbitrum, Linea, Optimism, and Scroll, all of which are using Omni to interconnect. We have close partnerships with Polygon and Starkware, and we will complete the integration work in the future as the mainnet develops.

14. ChainCatcher: In the future, will Omni Network continue to focus primarily on the Ethereum ecosystem, or will it consider providing similar solutions for other blockchains, such as Aptos, Solana, Sui, and so on?

Omni Network: This is a great question because Omni is a universal architecture that other ecosystems can use to create the first restaking use case in practice. However, since Ethereum is still where the majority of users, capital, and activity are concentrated, our team is currently focused on building protocols within the Ethereum ecosystem.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。