On October 12, 2023, Ethereum held the All Core Developers Execution Meeting (ACDE), with the main focus of the developer meeting on the latest progress of the Eearly Cancun upgrade. In addition, it was revealed at the meeting that the test network Devnet-9 related to the Cancun upgrade was launched on September 19, but if the Cancun upgrade cannot be launched on the public test network before the Ethereum Developers Conference in November, the Cancun mainnet upgrade may not be completed on the Ethereum mainnet in 2023.

As one of the most important narratives of Ethereum in 2023, the Cancun upgrade is also the first step in Ethereum's expansion roadmap. Recently, with the price of Bitcoin stabilizing at $35,000, the price of Ethereum has also surpassed $1,900. As the hottest narrative in the current Ethereum, the Layer2 track, the prices of the leading projects Arbitrum and Optimism have risen by 24% and 17% respectively in the past month, and funds and hotspots in the market are gradually being deployed in this track.

As a developer, when choosing a direction at present, Layer2 is an important layout track that cannot be ignored. Whether you are engaged in Infra, DeFi, NFT, Social, Gaming, your project will face the choice of which specific Layer2 ecosystem to layout and root in. This article will take a developer's perspective, starting from the ecological incentives, business models, on-chain operational data, and other aspects of the two leading projects in the Layer2, Arbitrum and Optimism, to deeply analyze the on-chain data performance of the two, helping developers make better choices and layouts in the Arbitrum and Optimism ecosystems.

Before choosing to layout and deeply cultivate the Arbitrum or Optimism ecosystem, do you understand the backgrounds and styles of these two teams?

Arbitrum, born at Princeton University, its co-founder Ed Felten is a professor of computer science and public affairs at the university, and also a former Deputy Chief Technology Officer of the White House. The development team of Arbitrum is Offchain Labs, led by Ed Felten. Many core members of the team have backgrounds from Princeton, and several core members are students of Ed Felten.

Optimism, the core team has a very close relationship with the Ethereum Foundation. Shortly after Vitalik proposed the Plasma architecture in 2017, a non-profit research group, Plasma Group, was established to realize Vitalik's "ultimate vision for Ethereum." Due to the evolution of the Plasma architecture, the core members of the research group closed Plasma Group in 2019 and established a new entity, Optimism. One of the founders of the Optimism team, Karl, is an OG developer of the Ethereum Foundation and has a close relationship with Ethereum's founder, Vitalik. Therefore, since the birth of the Optimism ecosystem, its development has a strong upper-level will of Ethereum, and their ultimate goal is to become Ethereum itself.

From the backgrounds of the founding teams above, we can see that the two teams have significant differences. Arbitrum comes from the academic circle of Ivy League universities in the United States, with deep academic resources, and the founder has also held core government positions, so it should have a certain influence in the upper echelons of the United States. On the other hand, Optimism was born in the Ethereum community, and its core members all come from Ethereum. To some extent, Optimism is closer to the developer community and relatively more "orthodox."

After understanding the backgrounds of the founding teams of Arbitrum and Optimism, it is also important to know how much capital the teams have in hand for developing the Layer2 ecosystem, as it requires a large amount of manpower for development and marketing resources for promotion as a second-layer expansion ecosystem of Ethereum. The following is a summary of the financing situation of Arbitrum and Optimism:

From the summary of the financing information above, we can see that both ecosystems are basically supported by major funds, with both of their financing at the level of over one billion US dollars, and both have relatively strong capital strength. Therefore, whether developers can obtain the support of large capital will be a very core evaluation factor if they want to build a Layer2 mainnet.

As a developer, when choosing to join Layer2, the ecosystem incentives for early customer acquisition and the accumulation of operational data are very important. How are Arbitrum and Optimism doing in this regard?

We have summarized the main ecological activities of Arbitrum and Optimism from 2022 to 2023 for your reference.

The activities within the Arbitrum ecosystem include but are not limited to the following:

• Arbitrum Odyssey: The first phase was in July 2022, and the second phase was in October 2023. This is an activity that encourages users to interact with various types of DApps in the Arbitrum ecosystem to obtain NFTs;

• Airdrop: In March 2023, when it went live, airdrops were distributed based on addresses interacting with DApps in its ecosystem;

• Short-term incentive plan: In October 2023, aimed at allocating a total of 50 million $ARB incentives to decentralized applications in the ecosystem to promote network and ecosystem growth. The incentive plan is divided into two periods, and projects that failed to apply in the first period can reapply in the second period. All incentives are expected to be distributed by January 31, 2024. Notable projects applying for the Arbitrum short-term incentive plan include Curve, Frax, PancakeSwap, Trader Joe, etc.

The activities within the Optimism ecosystem include but are not limited to the following:

• Airdrop:

○ The first activity was in June 2022, distributing 2 billion Optimism tokens to 250,000 early adopters and active users of the network;

○ The second one occurred in July 2022, rewarding over 11 million OP tokens to 307,965 unique addresses to recognize users and governance participants;

○ The third one occurred in September 2023, with a one-time airdrop to addresses that met the conditions from January to July 2023.

• Optimism Summer: From July to October 2022, it encouraged users to interact within designated ecological applications for a chance to receive airdrop incentives;

• Optimism Quests: In September 2022, it encouraged users to experience various types of ecological applications within the Optimism ecosystem, complete specified tasks, and obtain corresponding NFTs.

As the two leading projects in the Layer2 ecosystem, our summary of the above activities shows that both Arbitrum and Optimism are currently making great efforts to attract traffic, including through airdrop rewards, NFT distribution, and other methods. However, in terms of the intensity of activities for user growth, Optimism has been more frequent and has a wider coverage in its activities, from the mainnet launch in 2022 until September 2023, Optimism has been continuously incentivizing users who meet the airdrop conditions; in 2022, it also rewarded interacting users of specific projects (Optimism Summer), and so on. On the other hand, Arbitrum, before the token issuance in March 2023, mainly relied on expected airdrops to attract user interaction, apart from the Odyssey project, there were no particularly large-scale user growth activities. Its short-term incentive plan is similar to Optimism Summer, but it also came later than Optimism by nearly a year. Therefore, in the aspect of user growth, we find that Optimism, which has always been closer to the community, seems to have an edge over Arbitrum.

The above section mainly outlines the backgrounds, financing, and ecological incentive situations of the two leading Layer2 networks, Arbitrum and Optimism, for developers to understand the overall background of the two ecosystems from a macro perspective. As a developer, it is very necessary to deeply understand and compare the basic situation of the business models and on-chain operational data of the two ecosystems before choosing to enter the ecosystem.

First, let's start with the products of Arbitrum and Optimism and see what their current main products are and their respective positioning.

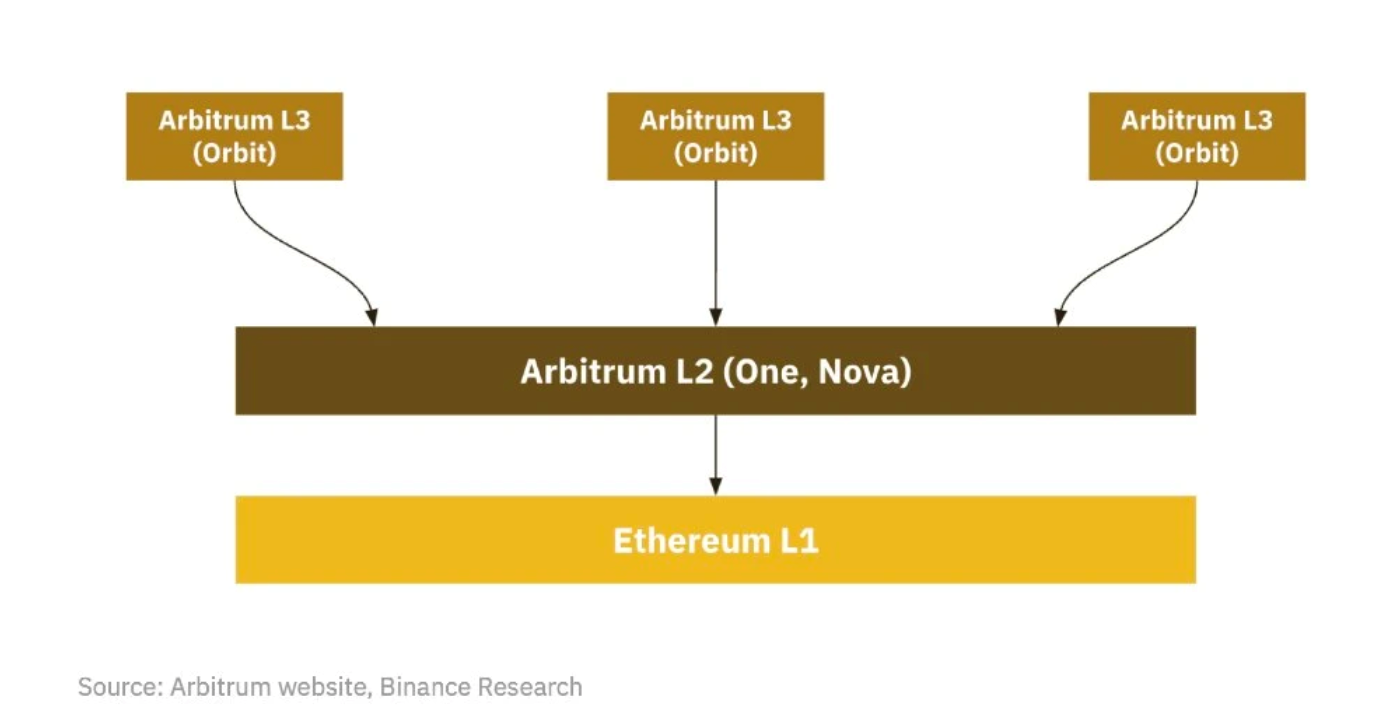

Arbitrum's main products currently include Arbitrum One, Arbitrum Nova, and Arbitrum Orbit. Arbitrum One and Arbitrum Nova belong to the Layer2 network, while Arbitrum Orbit is a technical stack prepared for building Layer3. Specifically:

○ Arbitrum One: The core main network of Arbitrum Rollup, a Layer2 public chain based on Arb Rollup technology. It is a true Layer2, with all transaction data stored on the Ethereum mainnet. Arbitrum One inherits the security of the Ethereum mainnet, making it suitable for applications with high security requirements, such as DeFi and NFT.

○ Arbitrum Nova: A Layer2 network built on AnyTrust, with the most significant feature being that the data on AnyTrust does not necessarily need to be packaged on the mainnet. It introduces a trust assumption, where data availability is managed by a Data Availability Committee (DAC), and as long as it does not exceed a threshold, the data is managed off-chain. Therefore, its biggest advantage is significantly reducing on-chain interaction costs, making it suitable for very high-frequency transactions or large-scale applications, such as social and gaming applications.

○ Arbitrum Orbit: Arbitrum Orbit is a platform for building and deploying Layer3 application chains on top of Arbitrum One and Nova. With the convenience and speed of building and deploying Layer3 exclusive application chains on the Arbitrum Orbit platform, using its provided components, a dedicated application chain can be deployed in as little as 5 minutes. During settlement, Layer3 needs to transfer data to the Layer2 network Arbitrum One or Nova and pay the relevant transaction fees.

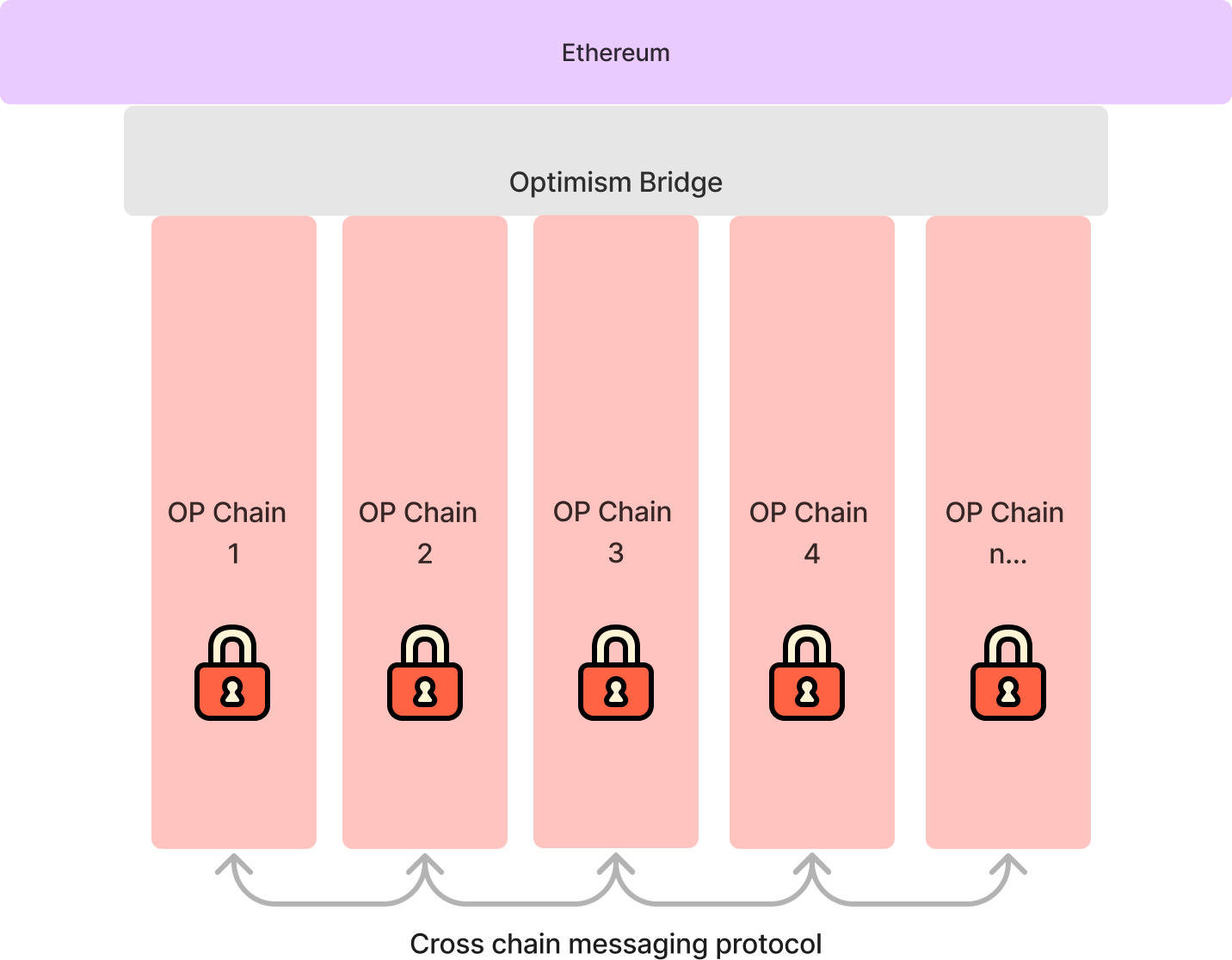

Optimism's establishment is closely related to a group of Ethereum developers, which also gives Optimism a strong upper-level will in its overall development. Currently, Optimism's products include OP Mainnet and OP Stack, with the ultimate goal of building a Superchain based on the Ethereum Layer2.

Source: OP official website

○ OP Mainnet: On July 24, 2023, the OP officially announced that the mainnet of OP was officially renamed OP Mainnet. In the grand narrative of OP's Superchain, OP Mainnet is one of the many Layer2 public chains built using the OP Stack architecture, seamlessly communicating with other Layer2 public chains such as Base and opBNB;

○ OP Stack: OP Stack is an open-source modular toolkit for building the L2 blockchain ecosystem. OP Stack allows developers to assemble a customized Layer2 network according to their own needs and scenarios, and connect to the Ethereum network to share resources. Through OP Stack, "one-click chain deployment" is possible, and its modular framework supports high openness and composability.

○ Superchain: The Superchain is currently only a vision that OP hopes to achieve in the future. Conceptually, it is a horizontally scalable chain network that shares security, communication layer, and open-source development stack, and can be highly compatible with the explosive growth of L2 and L3. Currently, projects such as Base, opBNB, Worldcoin, and Mantle Network, which use OP Stack and join the Superchain, are contributing to the increasingly prosperous and rich OP ecosystem.

In the following section, we will provide a more in-depth comparison and analysis from the perspective of business models.

The differences between the Arbitrum and Optimism models mainly manifest in three aspects: licensing system, consortium model, and charging method. Arbitrum Orbit tends to provide more flexible licensing and development options, especially for L3, but may require a one-time payment for entry. OP Stack adopts a more traditional consortium model, requiring certain conditions to be met to become a member of the "Superchain," including staking and participation in OP governance. These differences in models also determine their different revenue models. Specifically:

Arbitrum Orbit - "One-time fee, unlimited play":

• Arbitrum Orbit offers two scenarios: building L2 and building L3. Building L3 is completely open and does not require a license, while building L2 requires applying for a license from the Arbitrum Foundation or DAO organization and paying a certain fee (i.e., entry fee).

• Once a license is obtained, subsequent development and management within the Arbitrum Orbit ecosystem are free, and developers can freely choose the software to run and interoperate with other chains.

• Arbitrum Orbit attempts to profit by serving as a proprietary development environment codebase.

OP Stack - "Free entry, usage fee":

• The code stack of OP Stack is open-source and free, allowing developers to use it for free to build Layer2 (L2) solutions. The barrier to entry into the OP Stack ecosystem is low, but if you want to interoperate with OP Mainnet, Base, and other chains, you need to obtain a license to become a member of the "Superchain."

• The Superchain license requires compliance with OP governance and may require meeting certain conditions, such as staking OP tokens or sharing revenue with OP Stack. From a tokenomics perspective, introducing the OP staking mechanism at the governance level of the Superchain will to some extent slow down the circulation speed of the token, thereby achieving higher value capture.

• The OP Stack ecosystem adopts a consortium model, and only L2 networks that join the consortium can enjoy the resources of the Superchain, such as cross-chain asset interoperability.

In addition, although both ecosystems have comprehensive project development tools, it is worth paying close attention to two points that are closely related to developers:

First, the different dispute resolution mechanisms used by exchanges. Optimism uses single-round fraud proofs executed on Layer-1, while Arbitrum uses multi-round fraud proofs executed off-chain. Compared to single-round fraud proofs, Arbitrum's multi-round fraud proofs are more cost-effective and efficient.

Second, the differences in virtual machines. Although both are compatible with EVM, Optimism uses Ethereum's EVM, while Arbitrum uses its own Arbitrum Virtual Machine (AVM). This means that Optimism only supports the Solidity compiler, while Arbitrum supports all EVM compilation languages (Vyper, Yul, etc.).

Code is law, data never lies. Next, we will see how Arbitrum and Optimism perform in terms of operational data analysis, including application deployment, TVL, on-chain active addresses, transaction volume, and new user retention.

Source: Arbitrum and Optimism official websites

Source: Defillama

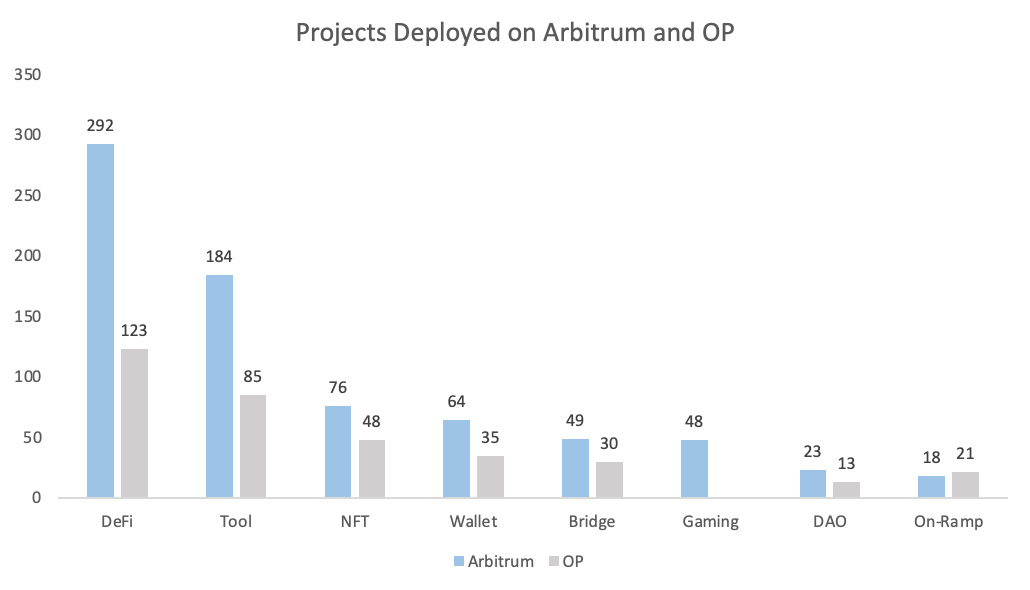

1. Optimism continues to expand its alliance strength by narrating the Superchain, while Arbitrum focuses on cultivating its native applications and continuously strengthening its core advantages in the DeFi track.

a. Although the transaction volume and user base of the Optimism mainnet are not as high as Arbitrum's, the promotion of the OP Stack technology stack has attracted well-known projects such as Coinbase, Binance, and Debank, leading to the continuous prosperity of the OP exclusive chain ecosystem. In recent months, the market feedback indicates that the social application Friend.Tech, built by Coinbase on Basechain, has attracted over 650,000 registered users and generated over $47 million in revenue within just over 2 months, contributing significantly to the development of the Optimism ecosystem. Additionally, the influencer project Worldcoin also announced its migration to the Optimism ecosystem in July, bringing nearly 700,000 registered users in a short period and significantly increasing the number of interacting users and transaction volume on the Optimism mainnet.

In the intense competition of the Layer2 ecosystem, Arbitrum is focused on cultivating and incubating its native applications, especially in the DeFi track, where the number and quality of DeFi applications in the Arbitrum ecosystem surpass those of Optimism. As of October 2023, nearly half of the 754 applications in the Arbitrum ecosystem are DeFi applications, and it has incubated popular DeFi applications such as GMX, GNS, and Radiant, leading to the significant gap in on-chain TVL between Arbitrum ($18.8 billion) and Optimism ($6.8 billion).

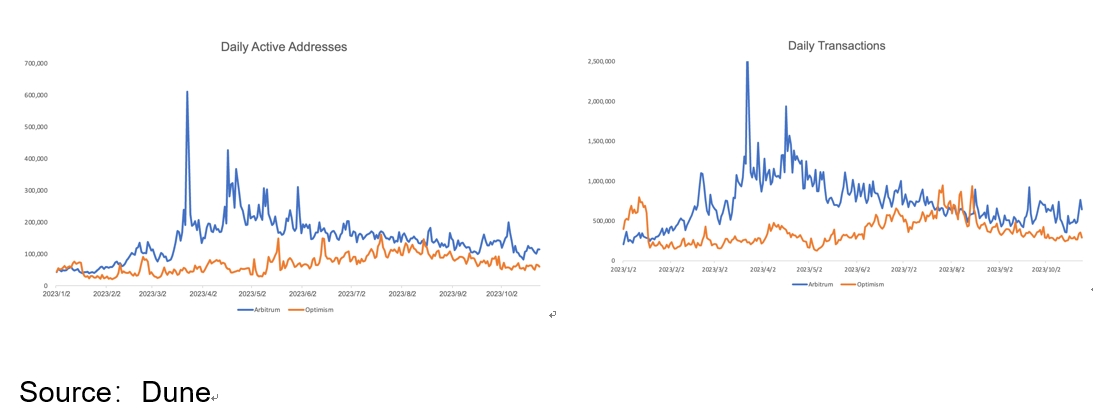

2. The on-chain active addresses and transaction volume of Arbitrum are higher than those of the Optimism mainnet, but with the end of Arbitrum's token issuance and airdrop activities, the number of active addresses and daily transaction volume in both ecosystems is becoming consistent.

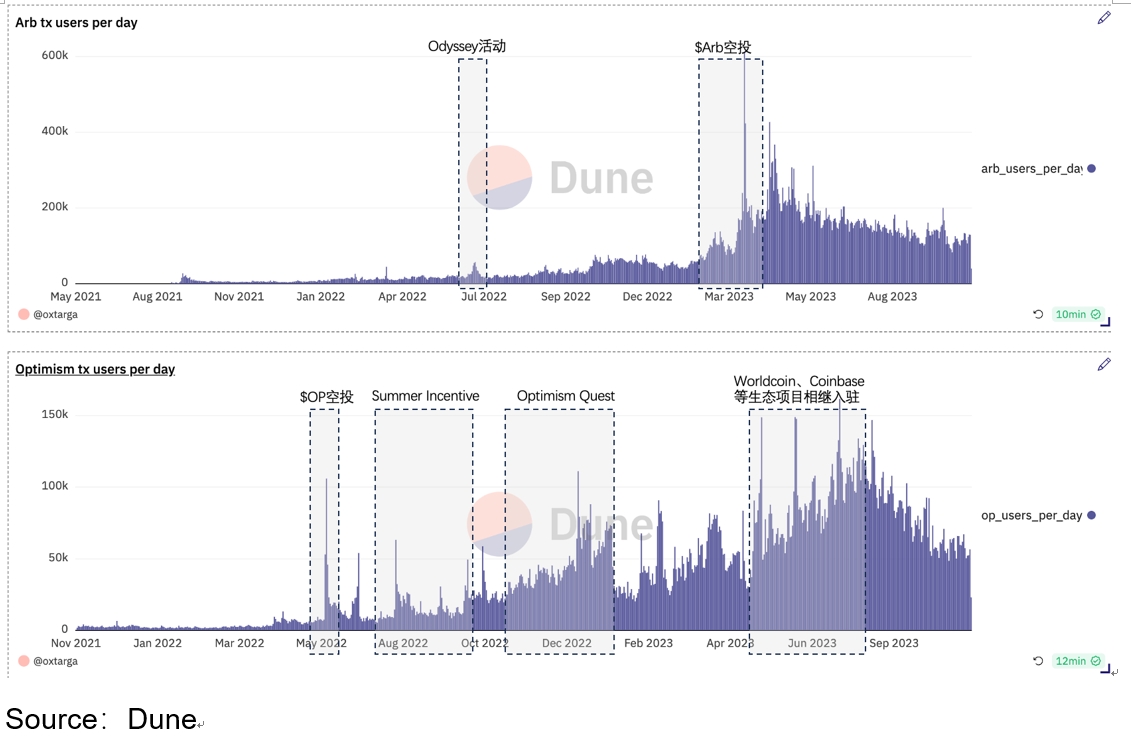

The above chart shows the daily active addresses and daily transaction volume on the mainnets of Arbitrum and OP since January 2023. From the chart, the following observations can be made:

(1) The number of active wallets on the Arbitrum mainnet has generally been ahead of the OP mainnet, especially in March 2023 when the number of daily active addresses peaked at over 600,000 and the daily transaction volume exceeded 2.7 million transactions;

(2) After the airdrop activity on the Arbitrum mainnet ended, both the number of active addresses and transaction volume during the ecosystem's peak period decreased. Looking at the number of active addresses on both mainnets in the past 3 months, the average daily active addresses on Arbitrum in Q3 2023 were around 140,000, with a daily transaction volume of around 620,000 transactions; OP had around 100,000 daily active addresses and a daily transaction volume of around 500,000 in Q3.

(3) From the daily transaction volume chart, it is evident that OP's daily transaction volume exceeded Arbitrum's between July 24th and August 5th, with a daily transaction volume of over 600,000 transactions/day. This was mainly due to the migration of the influencer project Worldcoin to the OP mainnet, resulting in a significant increase in OP's transaction volume in a short period. With Optimism's current strategy of attracting influencer projects and top industry projects, a gradual positive effect is beginning to show, and the gap in operational data such as active users between Optimism and Arbitrum is gradually narrowing.

(4) As the main applications on Arbitrum are DeFi projects, the frequency of operations for this type of application is naturally higher than others. Therefore, in the daily active data, it is noticeable that the daily transaction volume on Arbitrum is significantly higher than on Optimism. However, with the completion of Arbitrum's token issuance and the expected conclusion of airdrops, user interaction has been decreasing since May. Looking at the number of active addresses on both mainnets in the past 3 months, the data for both is gradually converging and becoming consistent.

3. Optimism issued its token earlier and stimulated user interaction to increase on-chain activity through continuous airdrop incentives, while Arbitrum did not issue its token until March 2023, but attracted and accumulated a large number of users through expected airdrops before the token issuance.

From the distribution of daily active users on Optimism shown in the above chart, the Optimism ecosystem also experienced a short-term surge in users when it officially issued its token in May 2022. After the token issuance, Optimism continued to stimulate user interaction through continuous airdrop incentives for new projects and direct user incentives, such as the Summer Incentive (an airdrop incentive activity for new projects) in August 2022 and the Optimism Quest in October, attracting waves of user traffic to increase on-chain activity. Additionally, it is worth mentioning that in July 2023, the well-known project Worldcoin announced its entry into the Optimism ecosystem, also attracting a large number of users to Optimism in a short period.

In contrast, Arbitrum issued its token later than Optimism, officially announcing the launch of the Arb token in March 2023. After this announcement, the number of interacting users on the chain saw a significant increase, with over 600,000 active users in a single day. Therefore, it can be seen that for Layer2 public chain projects, the launch of a token has a very significant effect on user stimulation. However, for on-chain users with low loyalty, after receiving short-term airdrop benefits, they promptly leave, leading to a noticeable decrease in active users after the airdrop activity ends.

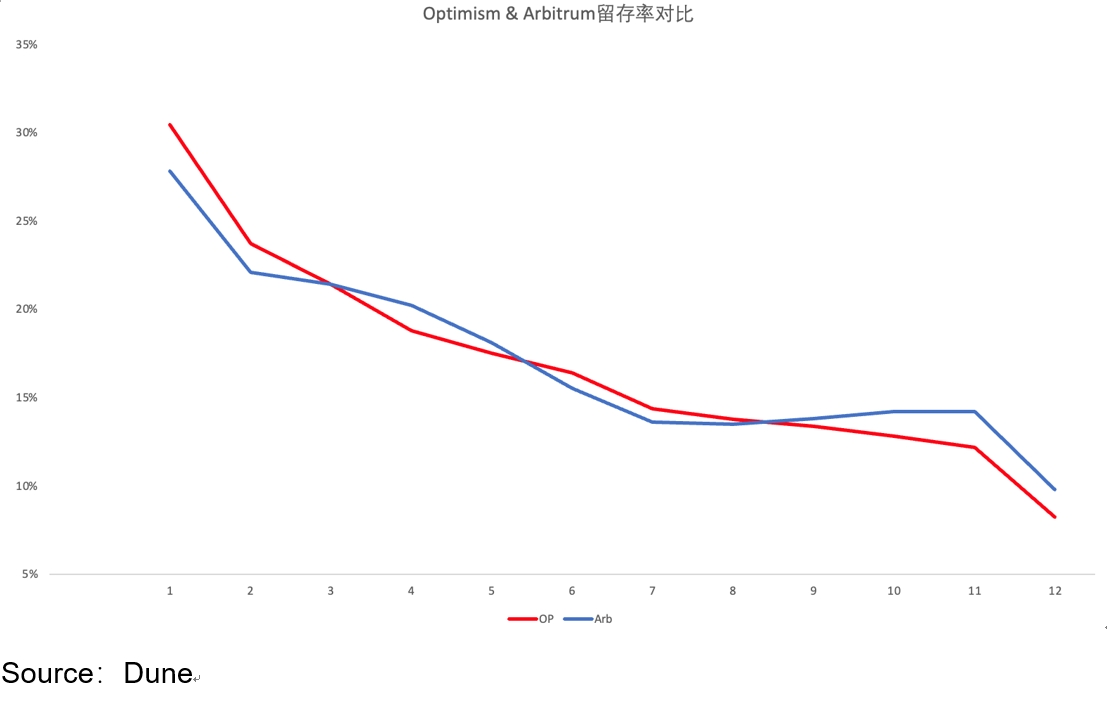

4. The ecosystem token airdrop activities of Arbitrum and Optimism have had a significant short-term effect on increasing on-chain users (acquisition and activation), but in terms of medium to long-term retention, the user retention rates of both ecosystems are generally consistent. The retention rate of new users after 6 months of interaction is between 15.5% and 16.4%, and the retention rate after 12 months is less than 10%. Therefore, it can be seen that the main users interacting on the Layer2 chains are primarily opportunistic, with low loyalty to on-chain interaction.

We have conducted a group analysis of the new user interaction data for Arbitrum and Optimism over the past year, as shown in the above figure. The overall retention rates for new users on Arbitrum and Optimism are basically the same, with short-term retention (within 3 months) exceeding 20%, and the retention rate after 6 months is between 15.5% and 16.4%. After that, the enthusiasm for interaction continues to decrease, and the user retention after 12 months is basically below 10%. This is consistent with our actual observations. Currently, the main motivation for on-chain users to interact is the expectation of airdrops. Therefore, once users complete the interaction required by the airdrop rules, they basically do not engage further. Additionally, due to the lack of truly high-frequency social and gaming products in the current on-chain interaction applications, it is difficult for the short-term on-chain retention rate to remain at a high level.

Conclusion

Based on the qualitative and quantitative analysis of the Arbitrum and Optimism ecosystems in the Layer2 track above, as a developer, the information provided should help you gain a better understanding of the two ecosystems. Finally, for developers committed to deepening their involvement in the Layer2 track, we offer the following recommendations:

1. DeFi applications are more suitable for the Arbitrum ecosystem. From the above operational data, it can be seen that due to the presence of the flagship DeFi product GMX in the Arbitrum ecosystem, it has attracted a large number of financial support and tool-type products to deploy in the Arbitrum ecosystem, and the overall TVL of Arbitrum far exceeds that of Optimism, giving it a unique advantage in DeFi. If you are a developer in the DeFi track, you will likely find more ecosystem partners and support within the Arbitrum system. However, at the same time, this inevitably brings about the problem of increasing competition and crowding in this track.

2. Projects that want to build an independent ecosystem in the future should embrace Optimism. Although Arbitrum has released the Layer3 application chain development kit Orbit, there are currently no projects actually running on it, and the main transaction volume is still on its mainnet Arbitrum One and Nova. In contrast, Optimism, through the first-mover advantage of OP Stack, has already attracted well-known projects such as Coinbase, Binance, and Adventure Gold DAO to build their own exclusive Layer2 network. Based on the current development, if a developer's future product is positioned for a relatively independent ecosystem-specific application chain, OP Stack will be the better choice.

Applications that require high-frequency interaction are products that urgently need to be incubated in Layer2 networks. From the overall user retention mentioned above, it can be seen that the overall user retention rates for Arbitrum and Optimism are not high, and user activity mainly depends on incentive activities such as airdrops. This also indicates the current lack of blockbuster applications in Layer2 networks. The case of the phenomenon-level social product Friend.Tech, which added 650,000 users in 2 months in the Base ecosystem, has fully demonstrated this point. As a developer, in tracks where users can massively enter, such as Gaming and Social, if you can create products with high-frequency usage through the advantages of Layer2, such as low cost, high security, and fast speed, I believe the overall user activity in Layer2 networks will be greatly improved, and users will increasingly rely on this type of infrastructure in Layer2 networks.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。