Author: Tide Capital

Summary

Expectations for spot ETFs have once again driven BTC to rise from the bottom range of $25,000 and set a new high for the year. At the same time, the BTC ecosystem has made significant progress this year, with the emergence of several native protocols such as Ordinals, Atomicals, and PIPE. The innovation in the BTC ecosystem not only brings more possibilities to Bitcoin but also presents unique investment opportunities. We are optimistic about the long-term growth potential of BTC native protocol tokens such as $ATOM, $PIPE, as well as the capture of BTC's beta by established layer 2 protocols like $RIF and $STX.

Spot ETF reignites market sentiment, BTC ecosystem deserves attention

Expectations for spot ETFs have once again driven BTC to rise from the bottom range of $25,000 and set a new high for the year. On October 16, Cointelegraph reported false news about the SEC approving spot ETFs, causing BTC to spike to near $30,000, but the market did not fully retract and instead consolidated near the MA120 before continuing to rise. Clearly, we are in a "bullish sentiment" phase, and the market's bullish sentiment has been ignited.

It is worth noting that the BTC ecosystem has made significant progress this year, giving rise to several native protocols such as Ordinals, Atomicals, and PIPE. The innovation in the BTC ecosystem not only brings more possibilities to Bitcoin but also presents unique investment opportunities, with the performance of related tokens even outperforming BTC. The following will introduce some BTC ecosystem investment opportunities we are paying attention to.

Ordinals Protocol

Major update for Ordinals protocol, flagship $ORDI sees significant rise

On January 21, 2023, Bitcoin developer Casey Rodarmor launched the Ordinals protocol, opening up a new way to play in the Bitcoin ecosystem. On October 24, the Ordinals protocol underwent a major update, releasing version v0.10.0, which added multiple functions such as batch engraving, adding metadata, and ending the numbering of inscriptions. With the rise of BTC and renewed community activity, the flagship $ORDI rebounded from its low. On November 7, Binance listed $ORDI, driving a significant rise in $ORDI, with a nearly 100% increase in a single day.

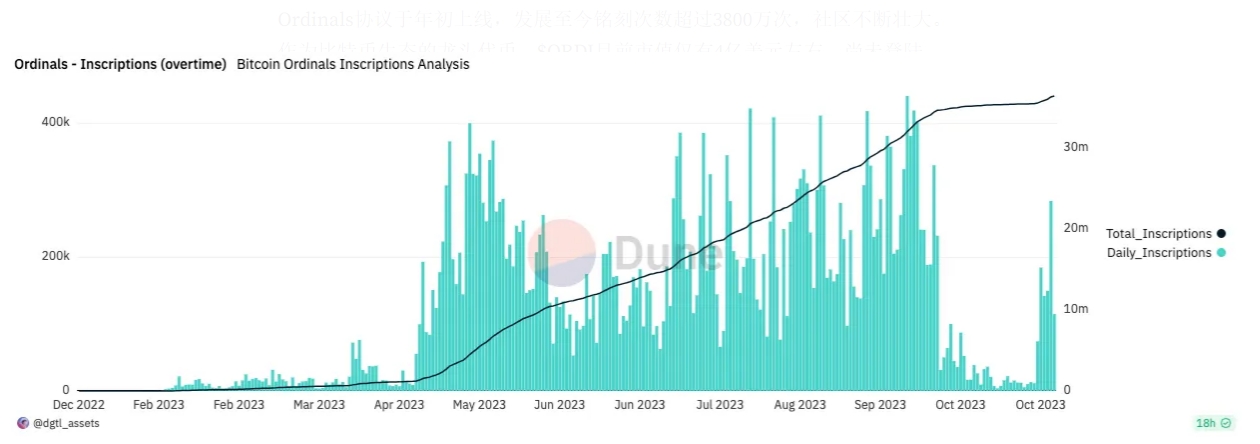

Since its launch at the beginning of the year, the Ordinals protocol has engraved over 38 million times and the community continues to grow. As the flagship token of the Bitcoin ecosystem, $ORDI currently has a market value of only around $400 million and has not yet landed on first-tier exchanges such as Coinbase and Upbit, still carrying some expectations for an increase. Recently, community members have proposed using $ORDI as the governance token for BRC-20, with use cases including community proposal voting and Indexer staking, which is expected to bring practical utility to $ORDI and further boost purchasing demand.

Total number of engravings for the Ordinals protocol exceeds 38 million

$SATS listed on multiple exchanges, with a market value close to $300 million

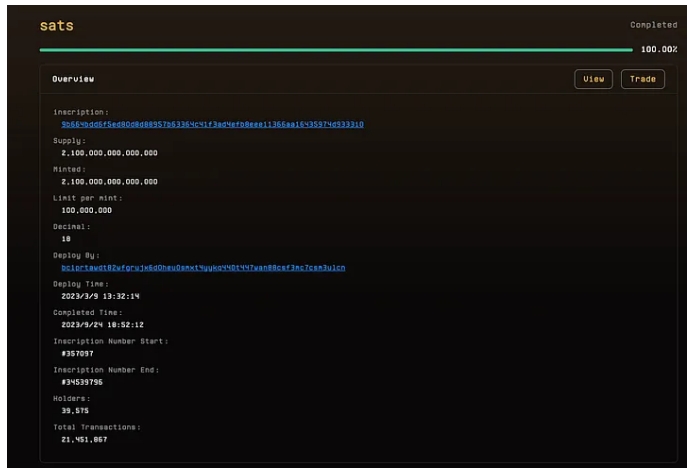

$SATS was deployed on March 9, 2023, with a total supply of 21 trillion, corresponding to the number of Bitcoin sats. Due to the single engraving limit of only 100 million, it was not until half a year later on September 24 that all $SATS were engraved. Among all BRC-20 tokens, $SATS has the most on-chain holding addresses, close to 40,000. Therefore, $SATS has the most supporters and the widest impact among all BRC-20 tokens.

Basic information about $SATS

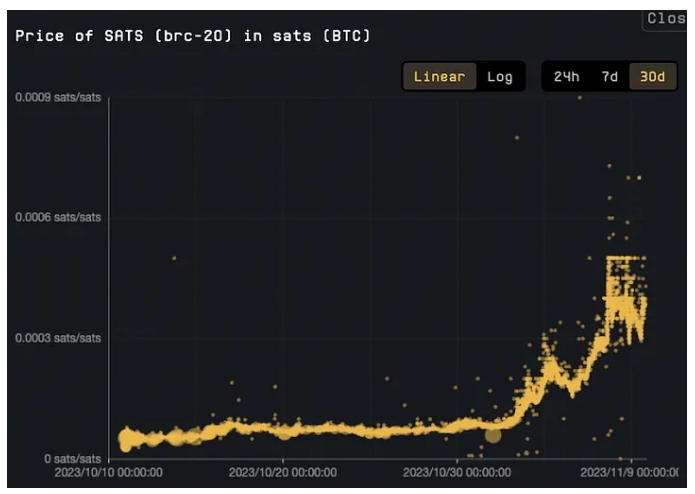

In the past month, $SATS has risen nearly tenfold, successively listed on Bitget, Kucoin, Gate, and other exchanges, with a market value close to $300 million. Exchanges embracing the Bitcoin ecosystem comprehensively are bringing in more funds and attention.

$SATS has risen nearly tenfold in the past month

BRC-100 debuts, expected to kick off native applications such as DeFi, GameFi

On October 25, the Layer 1 Foundation, founded by BRC-20 developer @domodata, released an introduction to BRC-100. BRC-100 is a scalable decentralized computing protocol based on ordinal theory, designed specifically for decentralized applications on the first layer of Bitcoin, such as DeFi, SocialFi, GameFi, and more. Derived from BRC-20, BRC-100 can be expanded and improved, creating possibilities for applications based on the first layer of Bitcoin.

Although the Ordinals protocol has only been launched for 9 months, it has attracted developers from various fields and communities, giving rise to numerous applications and gameplay, such as BRC-20, rare sats, recursive inscriptions, and more. Protocols and applications around Ordinals' improvement and expansion continue to emerge, and their subsequent development is worth our continued attention.

Atomicals Protocol

The Atomicals protocol is a simple and flexible protocol that was launched on September 17 for minting, transferring, and updating digital objects (traditionally known as NFTs) for unspent transaction outputs (UTXO) blockchains such as Bitcoin. Atomical is a way of organizing the creation, transfer, and updating of digital objects, essentially defining a digital ownership chain based on some simple rules.

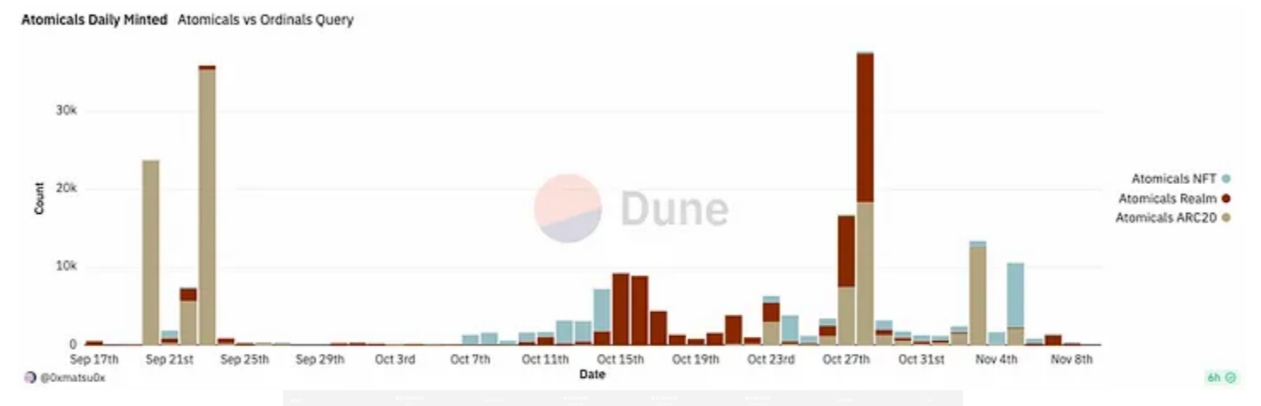

Compared to the Ordinals protocol, the design of the Atomicals protocol is more detailed, with built-in modules for tokens, NFTs, domains, containers, and other common functions for developers and users. Since its launch on September 17, the protocol has attracted numerous developers and users, and has been deployed on wallets, browsers, minting platforms, domain services, and other tools, with a minting volume reaching tens of thousands of times and still growing rapidly.

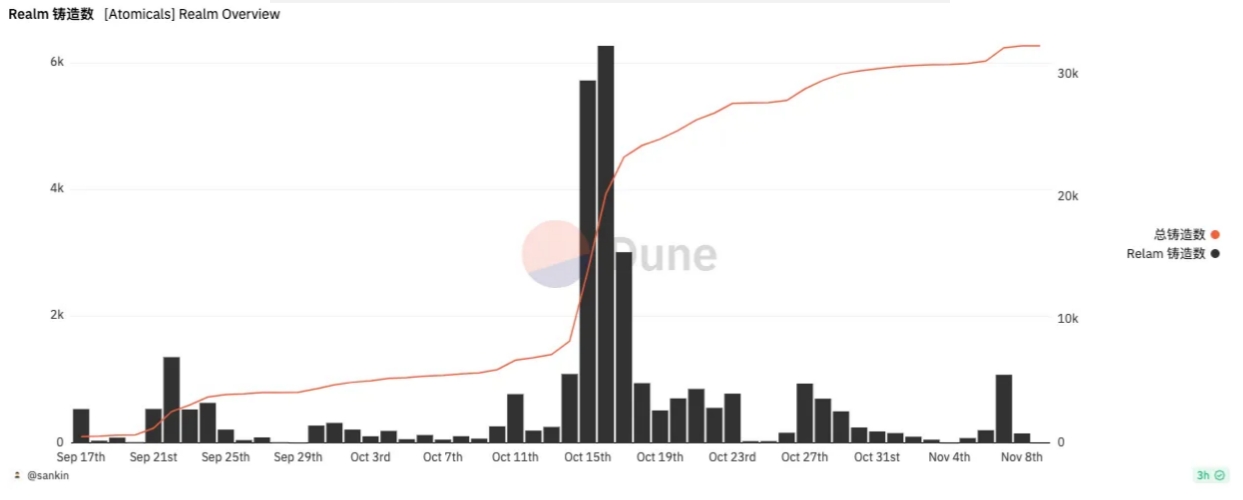

Daily minting volume for Atomicals

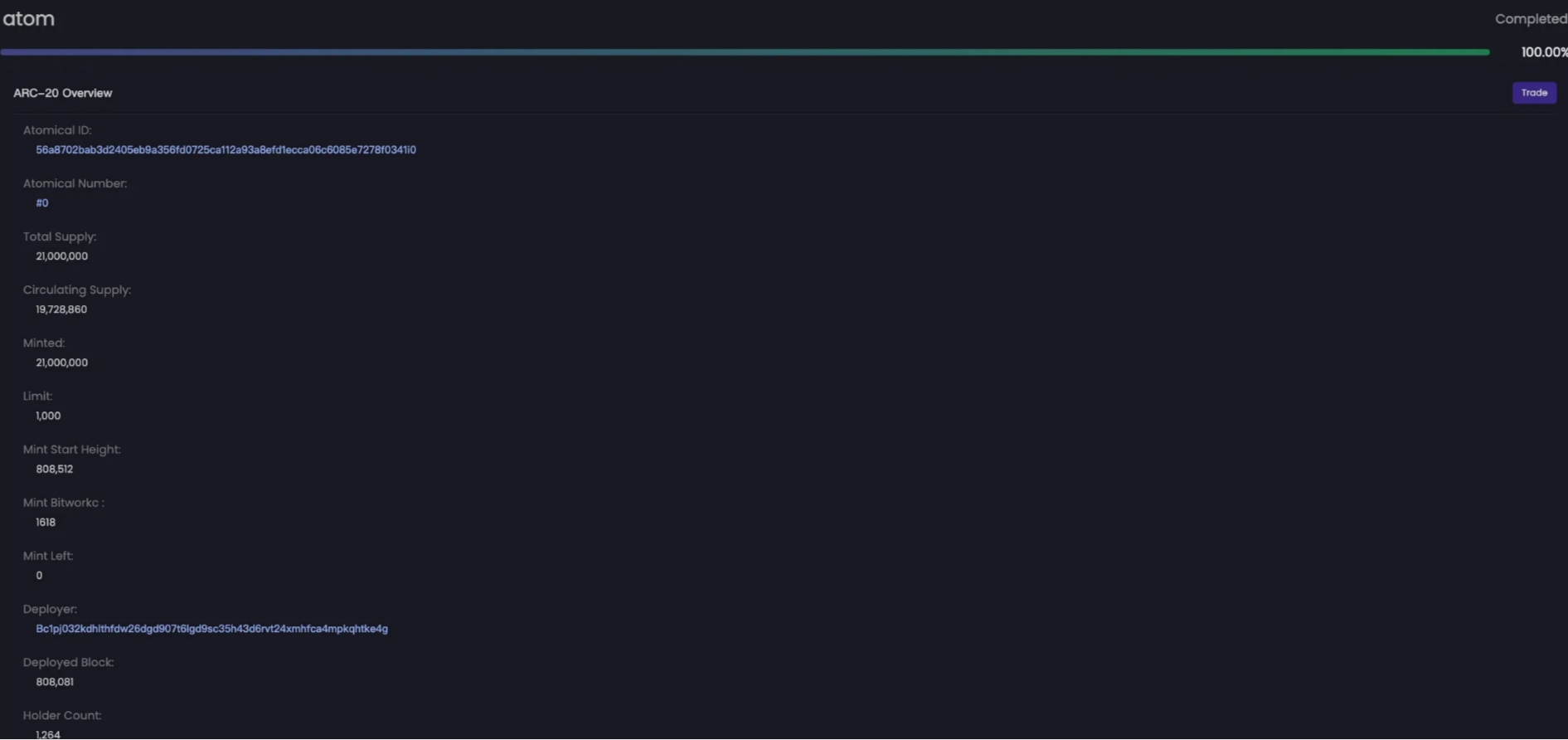

ARC-20 tokens

The ARC-20 token standard of the Atomicals protocol solves the problem of representing arbitrary fungible tokens on the Bitcoin network, using a satoshi to represent the deployed token. Anyone can use a UTXO-supporting wallet to deploy and transfer ARC-20 tokens, with both direct deployment and decentralized deployment options. Additionally, ARC-20 is equipped with a built-in unique naming system, with the first registered token name being permanent.

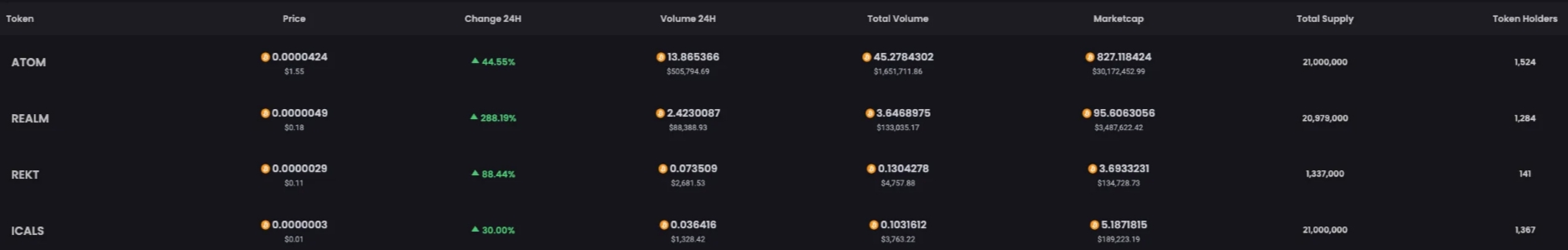

Some ARC-20 tokens

As the simplest gameplay of the Atomicals protocol, multiple ARC-20 tokens have been minted by community members. Among them, $ATOM is the first ARC-20 token to be created and has become the representative token of the Atomicals protocol. With a total supply of 21 million, $ATOM is currently priced at $1.55, with a total market value of approximately $30 million. Compared to the market value of over $400 million for $ORDI, $ATOM has enormous room for growth.

Basic information about $ATOM token

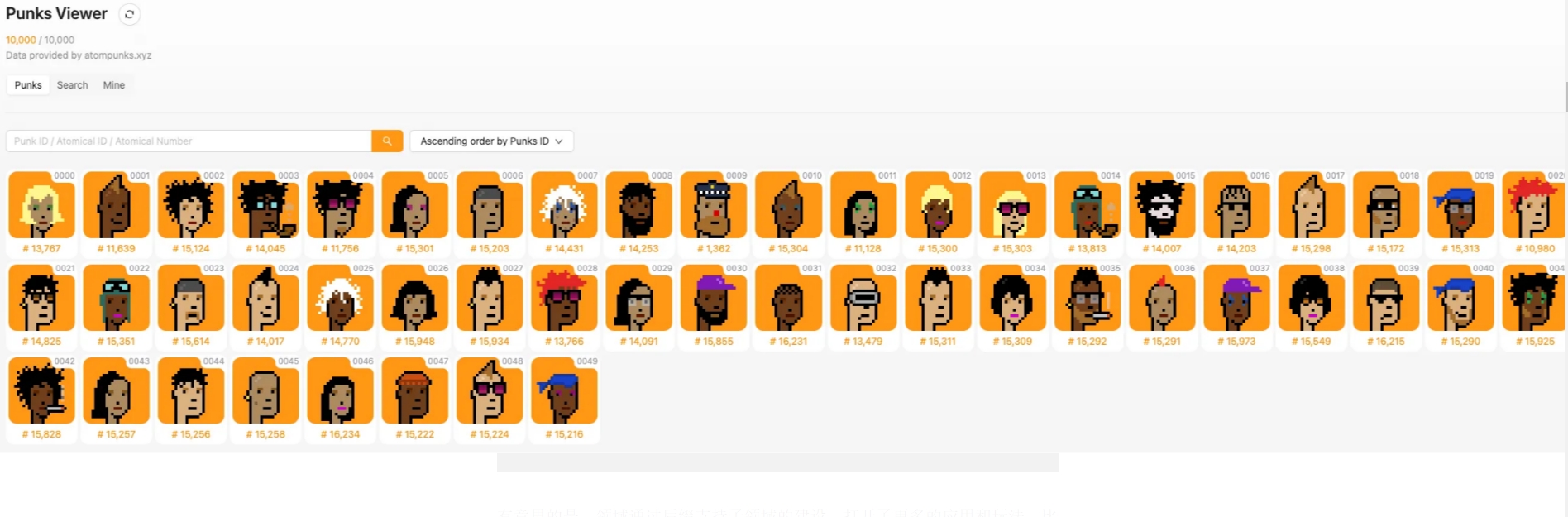

NFT

The "Atomical Digital Object" is a new type of NFT that can be minted and transferred on the Bitcoin network. Unlike traditional NFTs, it does not require centralized services or trusted indexers, but is permanently stored on the Bitcoin blockchain. In addition to immutable content and files, it also supports continuous updates, making it suitable for social media, games, and other applications.

AtomPunks

Realm Name

A Realm Name is an identifier for associating network addresses and resource information, starting with a + and containing at least one letter. Realm Names do not require any intermediaries or centralized registrars, and once a user claims a domain, they will permanently own it until transferred to someone else.

Interestingly, domains support the construction of subdomains through suffixes, opening up more applications and gameplay. For example, users can register multiple DAOs for management under a single domain. Recently, there has been a peak in domain minting, with short-length 1, 2, and 3-digit domains being snapped up. The total number of minted domains has now exceeded 30,000.

Realm minting count

With careful preparation by developers, the Atomicals protocol has relatively complete modules and functionality, with tens of thousands of mintings in just over a month, showing astonishing development speed. As a competitor to the Ordinals protocol, the Atomicals protocol is expected to bring forth more gameplay and applications in the future, worthy of continuous attention.

PIPE Protocol

PIPE is a native Bitcoin token protocol inspired by Casey Rodarmor's RUNES and Ordinals' BRC-20 protocol, mainly developed by the creator of the BRC-20 indexer TRAC. Like BRC-20, PIPE includes deployment, minting, and transfer functions, but differs in that the PIPE protocol is based on Bitcoin's UTXO, allowing for the creation of fungible tokens and NFTs with greater flexibility.

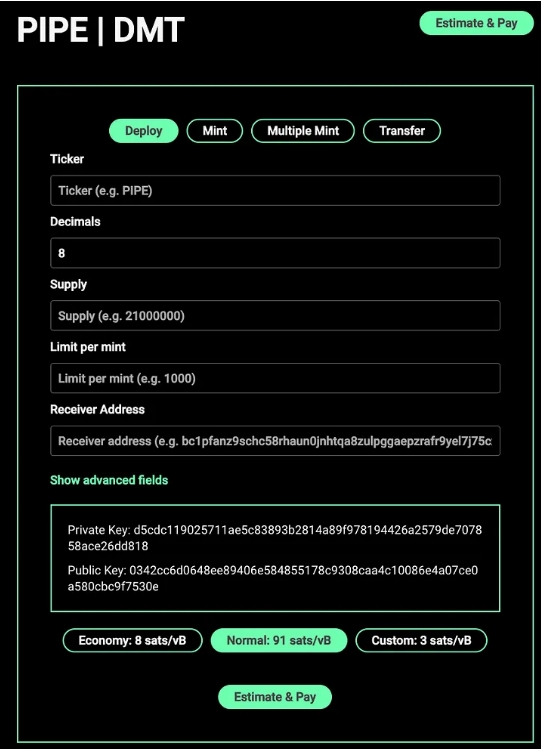

PIPE protocol deployment page launched by Inscribe3

The RUNES protocol proposed by the founder of Ordinals has not yet been launched and has been controversial due to the inability to conduct decentralized minting. The PIPE protocol added fair minting functionality based on the RUNES protocol and was launched ahead of time, garnering support from the community.

$PIPE is the first token to be deployed and minted, with a total supply of 21 million. The current market price is $1.2, with a market value of approximately $25 million.

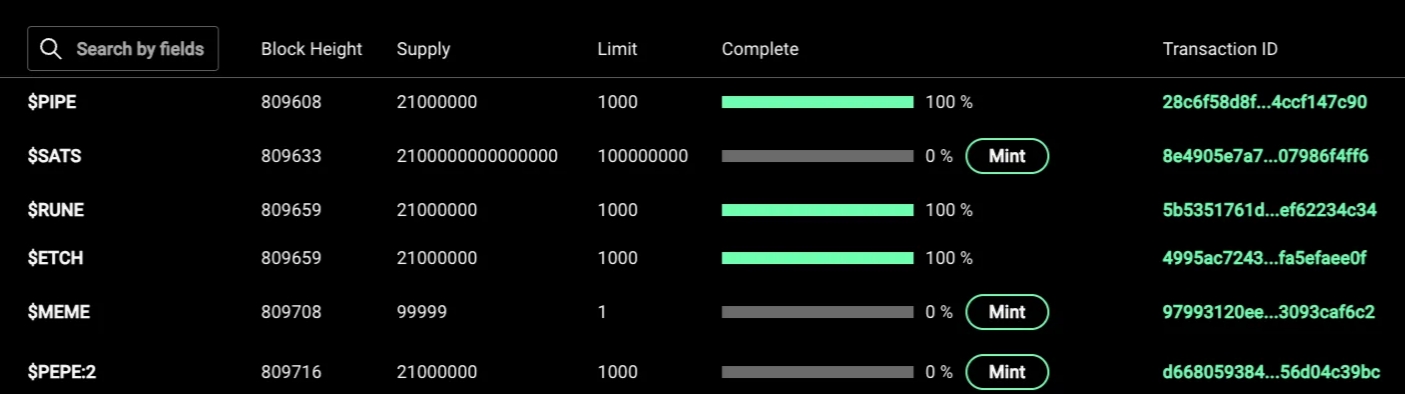

Some PIPE protocol tokens

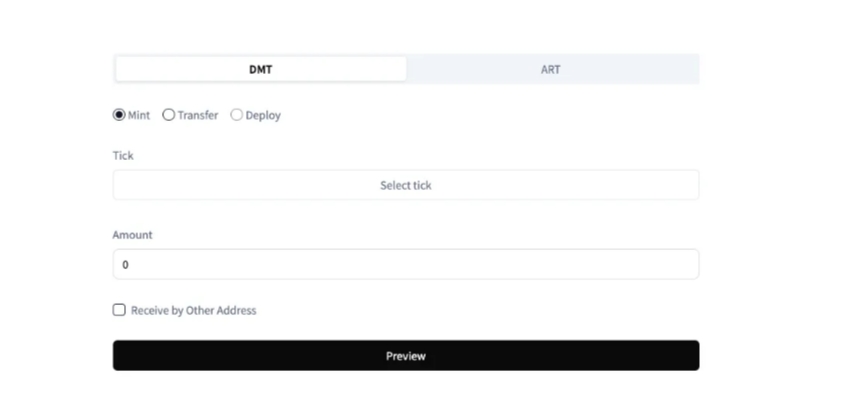

The PIPE protocol is still in its very early stages, with various infrastructure still under development. SatsX recently launched the minting and transfer functions of the PIPE protocol, as well as the trading market. Biston Labs has begun testing the PIPE protocol's Swap, and the related ecosystem is continuously improving.

SatsX recently launched the minting and transfer functions of the PIPE protocol

Sidechains & Layer 2 Protocols

RIF (Rootstock Infrastructure Framework)

RSK (Rootstock) is a Bitcoin sidechain developed and launched by IOV Labs in January 2018, sharing Bitcoin network security and decentralization features through merged mining technology, and is compatible with EVM smart contracts, extending the functionality of the Bitcoin system without sacrificing security. RBTC is the native token of RSK, pegged 1:1 to BTC, and can be converted to BTC through a special bridging mechanism, used to pay for RSK network transaction fees, with a current circulation of 3334.

Based on RSK, IOV Labs further developed the RIF (Rootstock Infrastructure Framework), including operating systems, domain services, relays, and wallets, aimed at helping developers build DApps faster and better through APIs and language libraries. $RIF, its native token, doubled in value first in this round of growth, and Binance also listed perpetual contracts for RIF. Despite a significant increase, RIF's market value is only $110 million, indicating significant upward potential.

Stacks

Stacks is a blockchain network for Bitcoin-based DApps and smart contracts, similar to a sidechain or Layer 2 on Bitcoin, with a relatively complete ecosystem of DeFi, NFT, DAO, and more. STX is its native token, used for paying fees and smart contract costs.

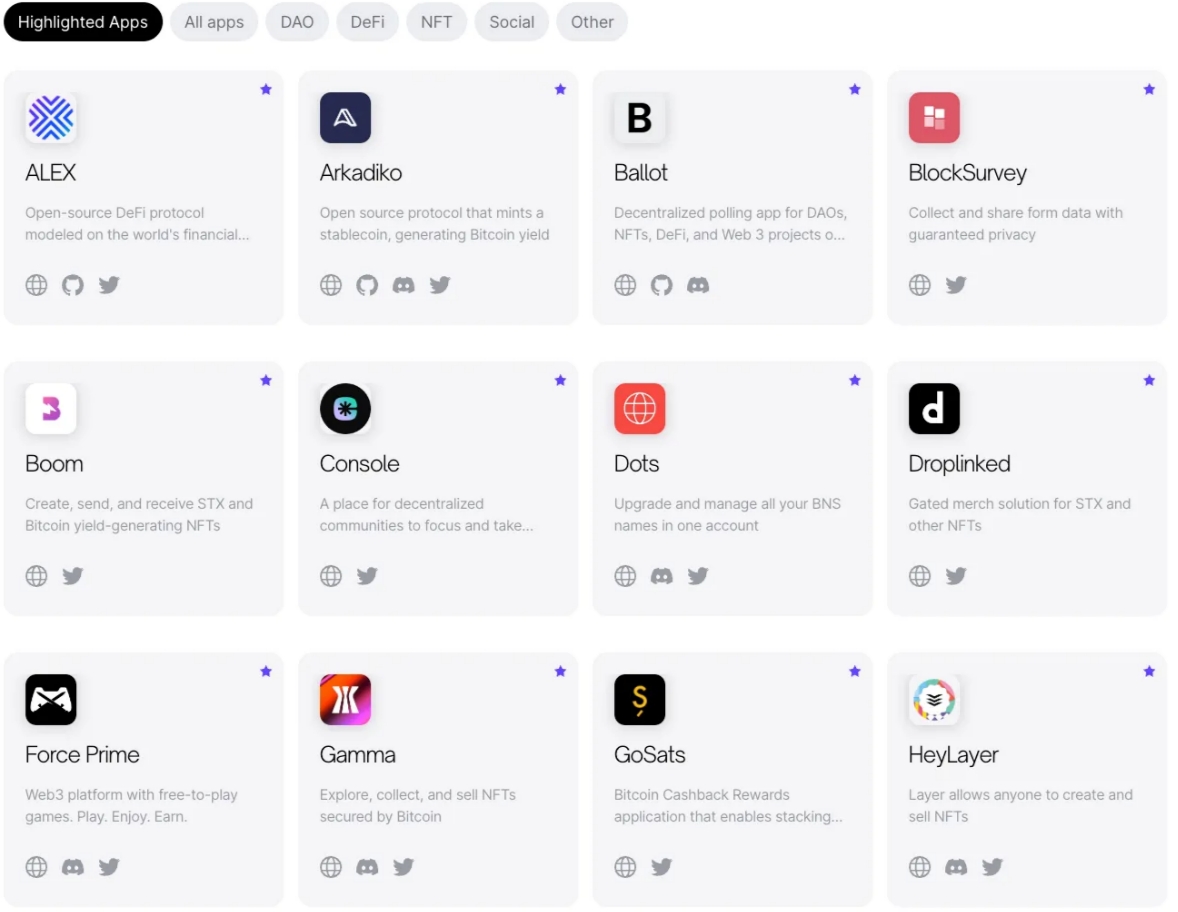

Some Stacks ecosystem applications

On October 20, Stacks released the developer version of sBTC, allowing developers to start building applications using sBTC and testing basic functions such as deposits and withdrawals. sBTC is an asset on the Stacks layer that corresponds 1:1 to BTC, accessible to smart contracts, used for DeFi, NFT, and other applications. Stacks plans to release the Nakamoto upgrade in the first quarter of 2024, significantly enhancing network security and operation speed.

Recently, both the price and TVL of STX have rebounded, with a TVL exceeding $20 million and a market value of $1 billion. Currently, STX is the largest Layer 2 protocol in the Bitcoin ecosystem, with the most DApps, able to capture the premium brought by the rise of Bitcoin and outperform the broader market. After completing the Nakamoto upgrade, the STX ecosystem is expected to experience further growth.

Taproot Assets

On October 18, Lightning Labs released the Alpha version of the Taproot Assets mainnet, allowing developers to issue and manage stablecoins and other assets on the Bitcoin blockchain, opening up new possibilities for the Bitcoin ecosystem.

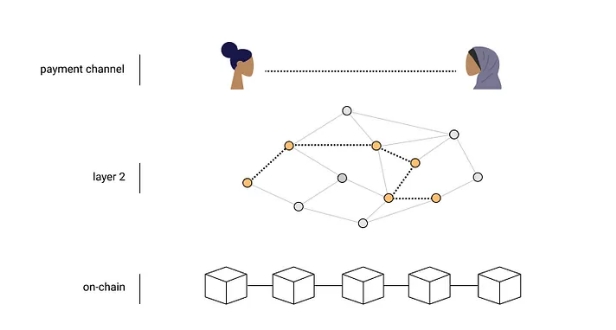

Lightning Labs was founded in 2016 and has been dedicated to developing the Lightning Network to address the slow transaction speed of Bitcoin. The Lightning Network is a Layer 2 solution that provides a way for microtransactions. Users can conduct off-chain transactions through payment channels in the Lightning Network, which are closed when the transaction is completed, and then the transactions are aggregated and settled on the Bitcoin network, reducing transaction fees and increasing the throughput of the Bitcoin network.

Lightning Network schematic

In 2022, Lightning Labs raised $70 million in Series B financing, with investors including early investors in Tesla and SpaceX, as well as the CEO of Robinhood. The funds are mainly used to build the multi-asset layer Taro on top of the Bitcoin network. With strong financial and technical capabilities, Lightning Labs is expected to build a global currency settlement layer on the Bitcoin network, further driving the mainstream adoption of Bitcoin.

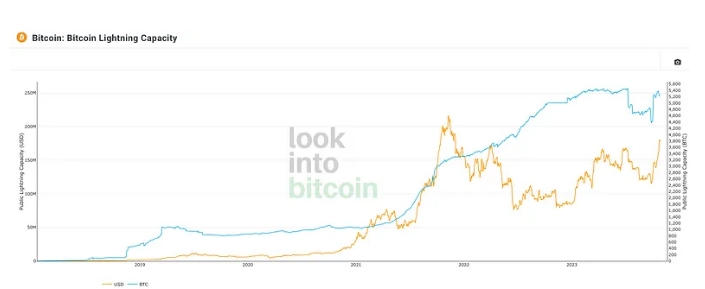

Steady increase in BTC held by all Lightning Network nodes

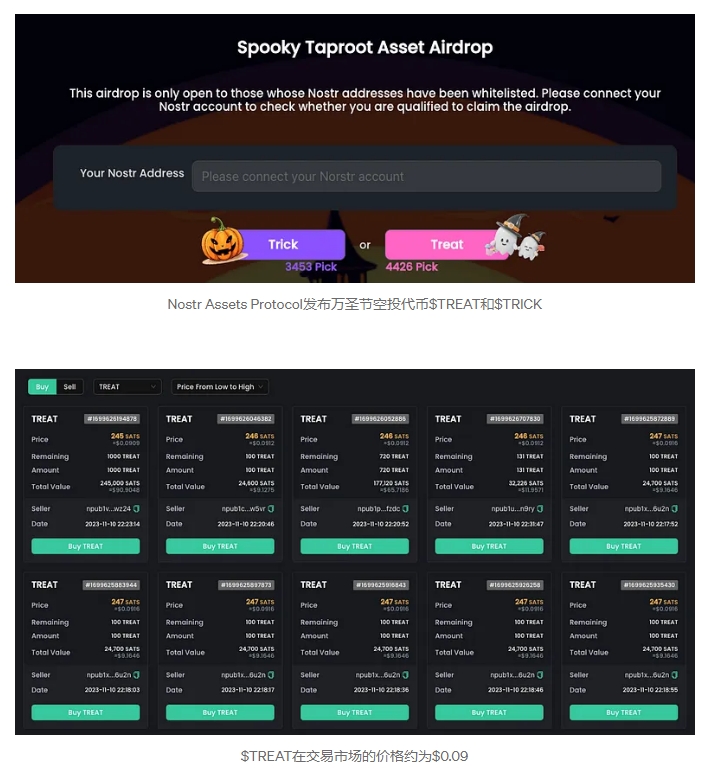

The Nostr Assets Protocol was the first to launch the Taproot Assets mainnet on October 30, and simultaneously released the Halloween airdrop tokens $TREAT and $TRICK. The total supply of both tokens is 210 million, totaling 420 million. Whitelisted users can choose to receive 10,000 tokens of either type, and approximately 80,000 tokens have been claimed by 8,000 addresses. The current market price is approximately $0.09, with a total circulating market value of $7 million and a total FDV of $38 million. The project team holds the remaining tokens and may introduce more gameplay and use cases in the future.

Conclusion

Since the beginning of this year, the BTC ecosystem has seen astonishing development, with various native protocol layers emerging. This has not only brought more gameplay and applications to BTC but also attracted new members to the BTC community, making it more diverse. At present, it is difficult to accurately predict which protocol will ultimately be successful, but it is undeniable that we are at the starting point of a major explosion in the BTC ecosystem, and the future is full of infinite possibilities.

Similar to the public chain competition in 2021, each project has its unique technical characteristics and community culture. The situation of "hundred schools of thought contending" and mutual competition will only expand the track. Looking at the leading tokens in the BTC ecosystem, the market value of $ORDI has reached $400 million, while the market value of $ATOM and $PIPE is only around $30 million. When an ecosystem is in its early stages, we can enter at very low prices, and once the ecosystem sees further development, even a broad-based investment approach can yield huge returns.

More importantly, the emergence of BTC ecosystem protocol tokens provides BTC investors with more choices. In previous bull markets, BTC typically rose first, followed by funds flowing into ETH and other altcoins. In the current round of growth, BTC and its market share have also reached new highs. BTC is the preferred target for institutional allocation of crypto assets, and BTC ecosystem projects supplement institutional investment choices. If BTC spot ETFs are approved, BTC ecosystem projects are likely to be sought after by smart money due to their higher elasticity, thus outperforming other altcoins.

We are optimistic about the explosive growth of BTC native protocols such as Ordinals, Atomicals, and PIPE, as well as the long-term development of established Layer 2 protocols such as Stacks and RIF, and closely monitor investment opportunities related to these tokens.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。