On October 18, 2022, the Aptos mainnet went live, marking the emergence of another important blockchain in Web3. Today, the Aptos mainnet has been running for a year. Aptos is a blockchain that continues to iterate and grow, with engineers continuously optimizing performance, reducing costs, and enhancing decentralization and security. From Bixin Ventures' investment in Aptos in 2022 to its current achievements, we have reason to believe that Aptos is one of the best choices for DeFi projects.

Key Points

1. DeFi demonstrates a more open and efficient model, representing the future of finance

DeFi challenges and replaces traditional finance by improving the efficiency of financial operations and democratizing assets, presenting enormous opportunities for future development.

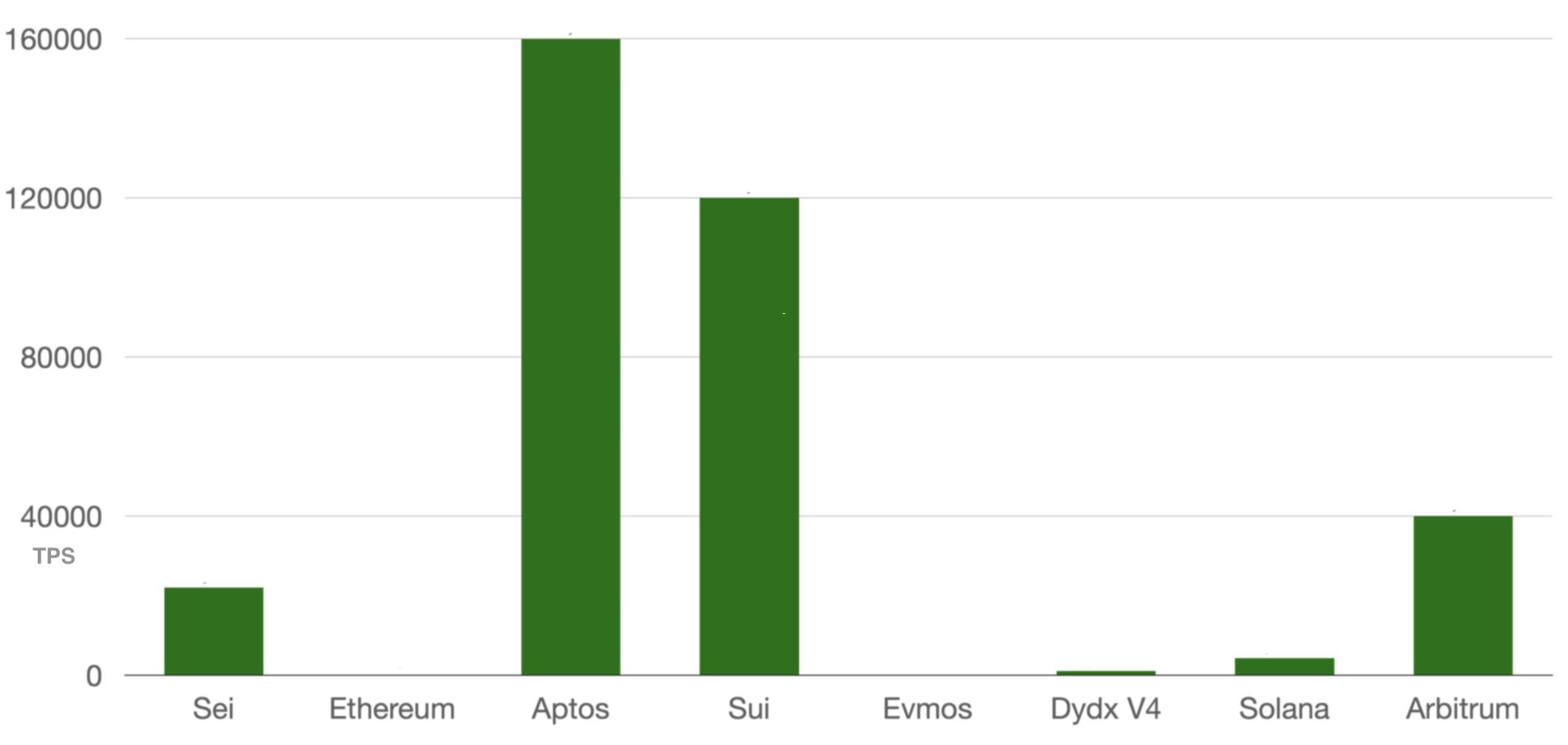

2. Aptos adopts Move language and is set to achieve 160,000 TPS and sub-1-second finality blocks, with low costs suitable for DeFi deployment

By using the developer-friendly Move language, innovative approaches such as parallel execution and Diem-BFT consensus, Aptos is on track to achieve 160,000 TPS and sub-1-second finality blocks, with costs lower than 0.01 cents per transaction. Aptos is currently the blockchain with the lowest latency and highest throughput in the market (according to Messari).

3. 85,000 followers, 200+ projects developed on Aptos, robust infrastructure supporting DeFi development

Aptos has a community of over 850,000 fans, and wallets, browsers, security audits, bridges, domains, and other basic tools make it more convenient for developers to develop and deploy DeFi applications.

4. Multiple high-value grants programs supporting DeFi and other types of projects

Foundation grants program along with the recently launched Registry Program have already begun, providing many opportunities for developers on Aptos. Additionally, there are more DeFi reward programs, including the acceleration program initiated by Aptos and Google Cloud (Aptos Accelerate Program), and the DeFi incentive program initiated by Aptos and Thala, Thala Foundry.

5. Deployment of numerous well-known DeFi projects

For users, there are currently numerous deployed DeFi projects, such as Pancake, Thala, Amnis Finance, Merkle Trade, and upcoming launches like Sushi and Econia in Q4.

1. The limitless potential of DeFi

We all know that Web3 will change the way the world uses the internet.But in this field, decentralized finance is particularly revolutionary, with the potential to disrupt the opaque and centralized traditional financial system that has been established for decades.

1.1 Centralized exchange scandals have led people to turn to DeFi

In centralized exchanges, users need to custody their funds on the platform, effectively transferring ownership of their assets to the platform. Legally, this means users are lending their assets to the custodial platform and become creditors of the platform. The centralized nature of operations has made people aware of the potential risks associated with centralized exchanges.

Why are users turning to DeFi? Firstly, it's about asset security. The emergence of DeFi allows users to control their assets by holding their private keys, meaning no one can misappropriate their funds, significantly enhancing security. Secondly, users can enjoy a certain level of privacy as they don't need to provide personal information, keeping their wallets separate from their real identities. Thirdly, users can experience and use a variety of DeFi applications on-chain, such as DEX, stablecoins, Perp, lending, on-chain payments, yield aggregators, liquidity staking, and more.

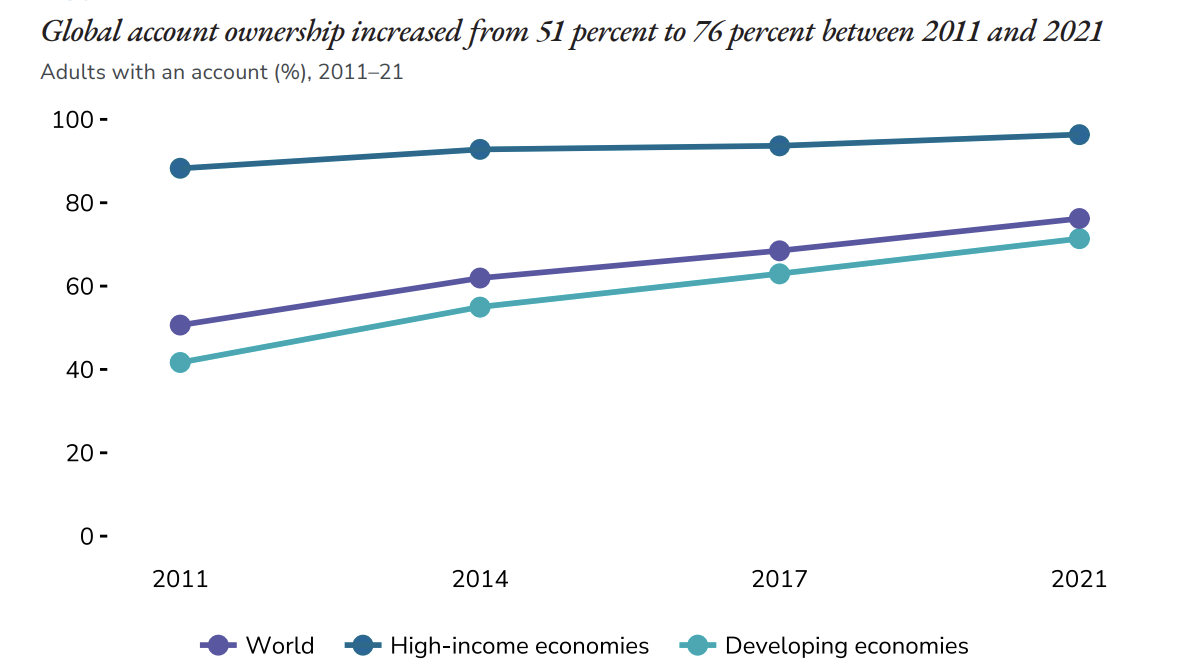

1.2 As of 2021, 23.8% of adults globally still do not have a bank account

As of 2021, according to World Bank data, only 76.2% of the global population aged 15 and above have a bank account or mobile account, meaning that 23.8% of the global population (aged 15+) still do not have access to financial services. Additionally, the 2023 World Bank Annual Report indicates that an estimated 574 million people are expected to remain in extreme poverty by 2030. While poverty has multiple causes, the lack of financial services is a significant contributing factor.

Global population with bank accounts in 2021 Source: World Bank Database

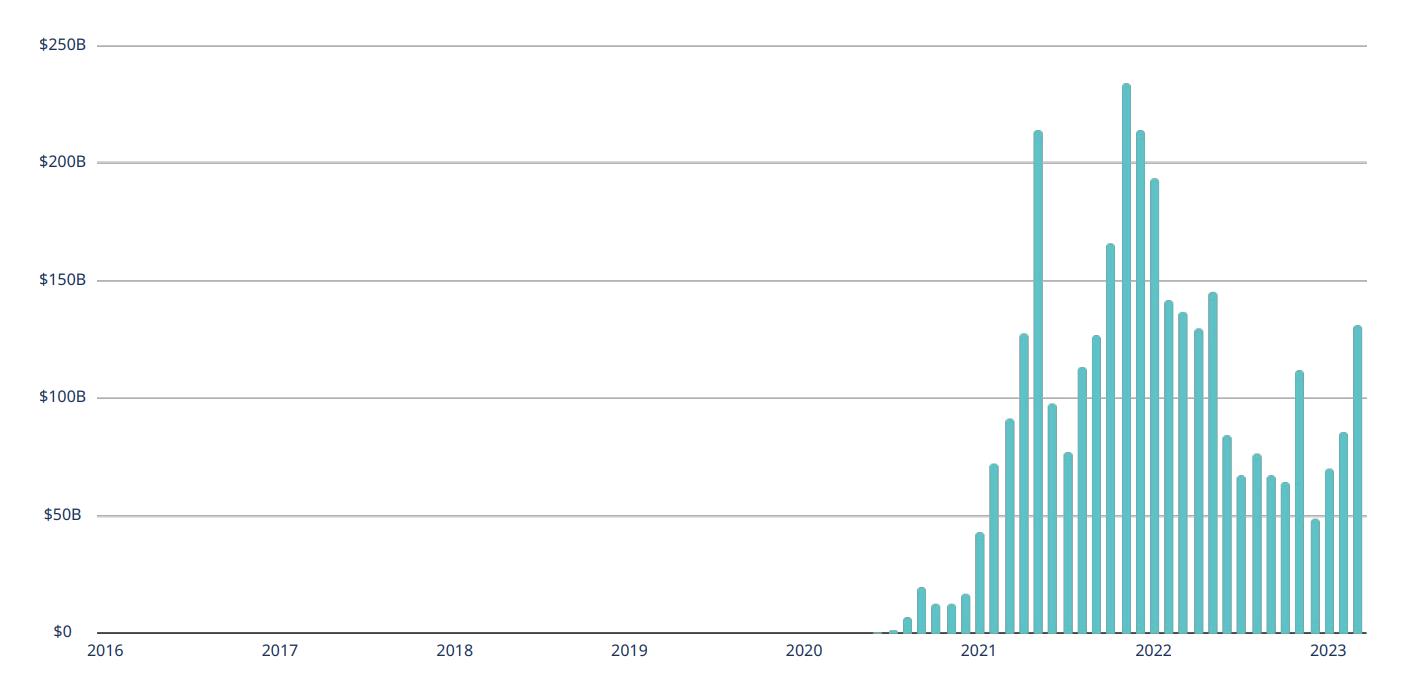

For these reasons, we believe that the development of DeFi is not short-term but rather a long-term positive trend. In fact, as of October 24, 2023, the 24-hour trading volume of DEX reached $5 billion, accounting for only 1.7% of the total trading volume, but showing a 42% increase compared to the daily average of $3.5 billion in 2022. Additionally, the monthly average trading volume of DEX has also surpassed $100 billion.

Monthly average trading volume of DEX Source: Defillama & A16Z

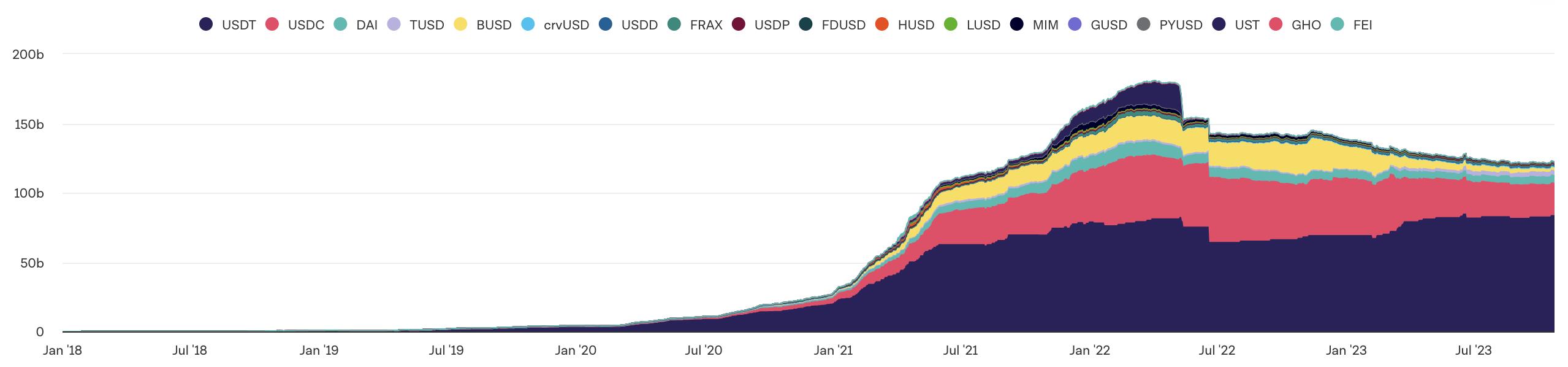

Stablecoins, as the fundamental transaction currency of DeFi, have also shown rapid growth, with the issuance scale exceeding $120 billion. This also demonstrates the need for a decentralized, value-stable USD-denominated asset.

Issuance scale of on-chain stablecoins Source: The Block, Coin Metrics, Defillama

The development of DeFi, which carries such potential, will inevitably require a secure, high-performance, and cost-effective public chain to nurture reliable and innovative DeFi applications. We believe that in the next wave of DeFi innovation, Aptos is the most promising public chain.

2. Aptos is Ready for the Next Wave of DeFi Growth, Upgradeable Features Ensure Continuous Iteration of Aptos

In the early stages, the Aptos technology stack was designed by the top 30 blockchain engineers in the Meta team. Over the next 3 years, a total of 292 developers and dozens of communities participated in the development of the protocol and the improvement of proposals. Compared to other blockchains, Aptos has more significant advantages in security, scalability, fees, decentralization, and infrastructure, making it particularly suitable for high-value DeFi applications with a large number of users.

It is worth noting that since the mainnet went live, the Aptos team has been implementing monthly upgrades to smart contracts, collaborating with developers, listening to their needs, and proactively addressing those needs. Therefore, continuous improvement and iteration in performance, fees, decentralization, and ecosystem can be expected. It can be anticipated that there will be significant changes in the coming months or years. In the Aptos Improvement Proposals (AIP), you can see a large number of updates that have been made so far.

2.1 Move Language & Diem-BFT Consensus Ensure Sufficient Security for DeFi

Aptos, unlike other blockchains, takes a different approach by using the Move language to ensure sufficient security for the blockchain. The Move language is designed specifically for digital assets, defining digital assets through Resources. It abstracts four properties of resources: copyability, indexability, discardability, and storability, allowing users to easily define any type of resource through different combinations of these four properties. Additionally, the Move language also offers verifiability, flexibility, and composability of contracts.

The security of the Move language is reflected in the fact that it provides code verification and VM-level protection to prevent modifications and attacks by other programmers. This is because no blockchain-specific content was added to the core language during its design. Additionally, the Move Prover prevents errors in writing smart contracts. In summary, the Move language is designed specifically for smart contract development, combining simplicity and security, and changing the rules for building Dapps.

Furthermore, the team has designed a high-performance, low-latency BFT engine, which has already undergone 4 iterations. As long as the BFT validation nodes ensure honesty, the Aptos chain will not fork, even if the network is inaccessible or non-secure core components are somehow compromised. The security of the consensus protocol has also been audited and verified.

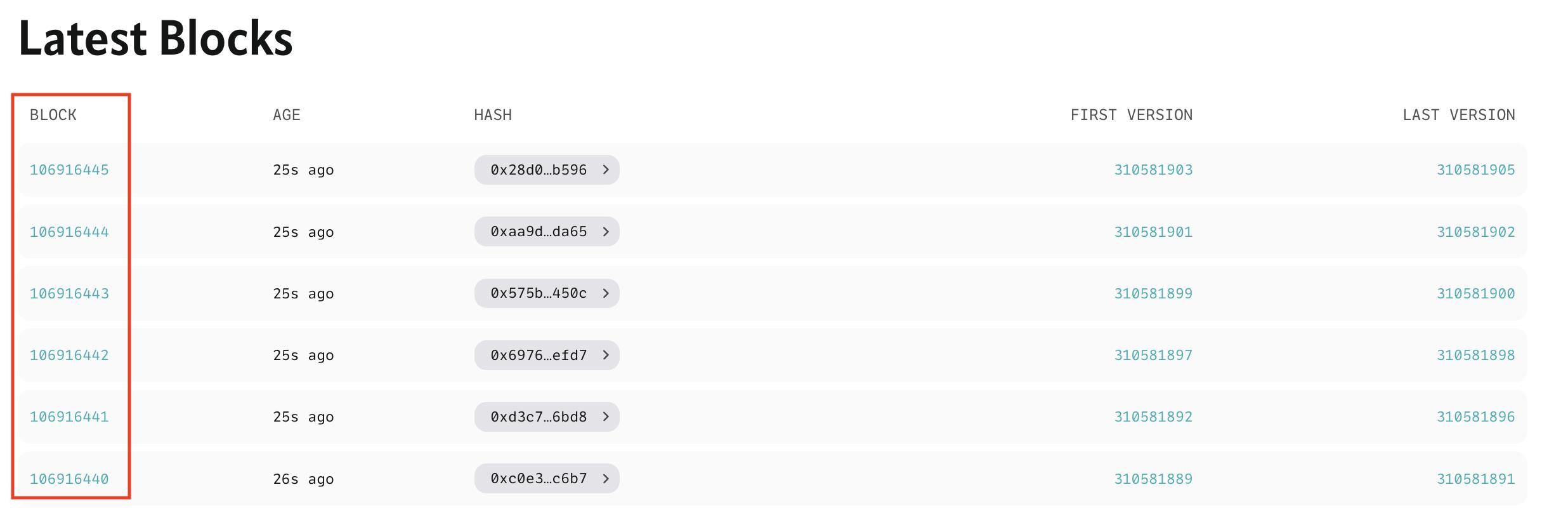

Since the mainnet launch, Aptos has produced over 100 million blocks. Additionally, in July of this year, the weekly user transaction volume on Aptos reached 4.9 million transactions and continues to rise.

Over 100 million blocks have been produced since the launch of the Aptos mainnet Source: Aptos Explorer

We believe that DeFi, as the cornerstone of the Web3 world, must rely on a sufficiently secure underlying public chain, and Aptos is one of the most correct choices for DeFi development teams.

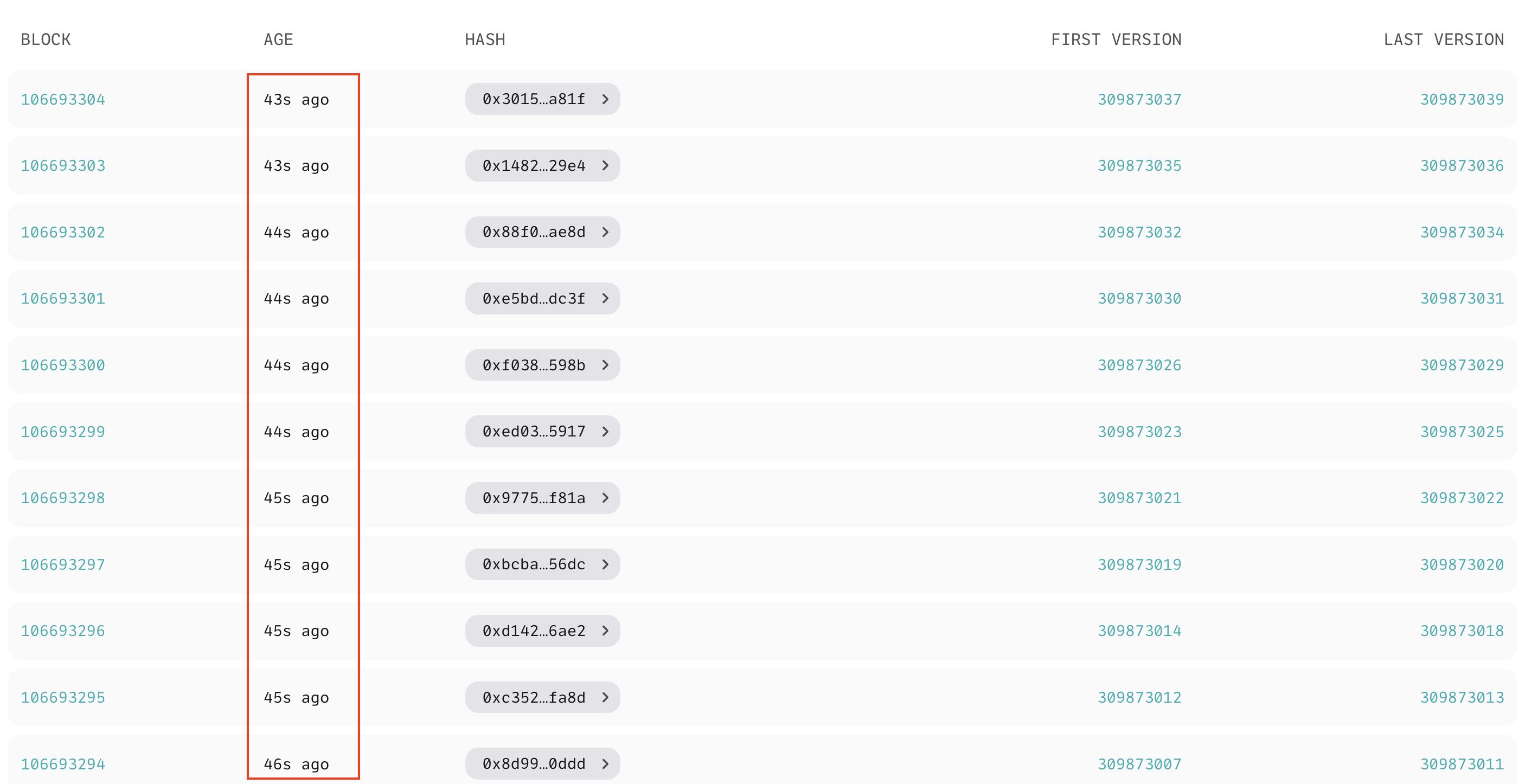

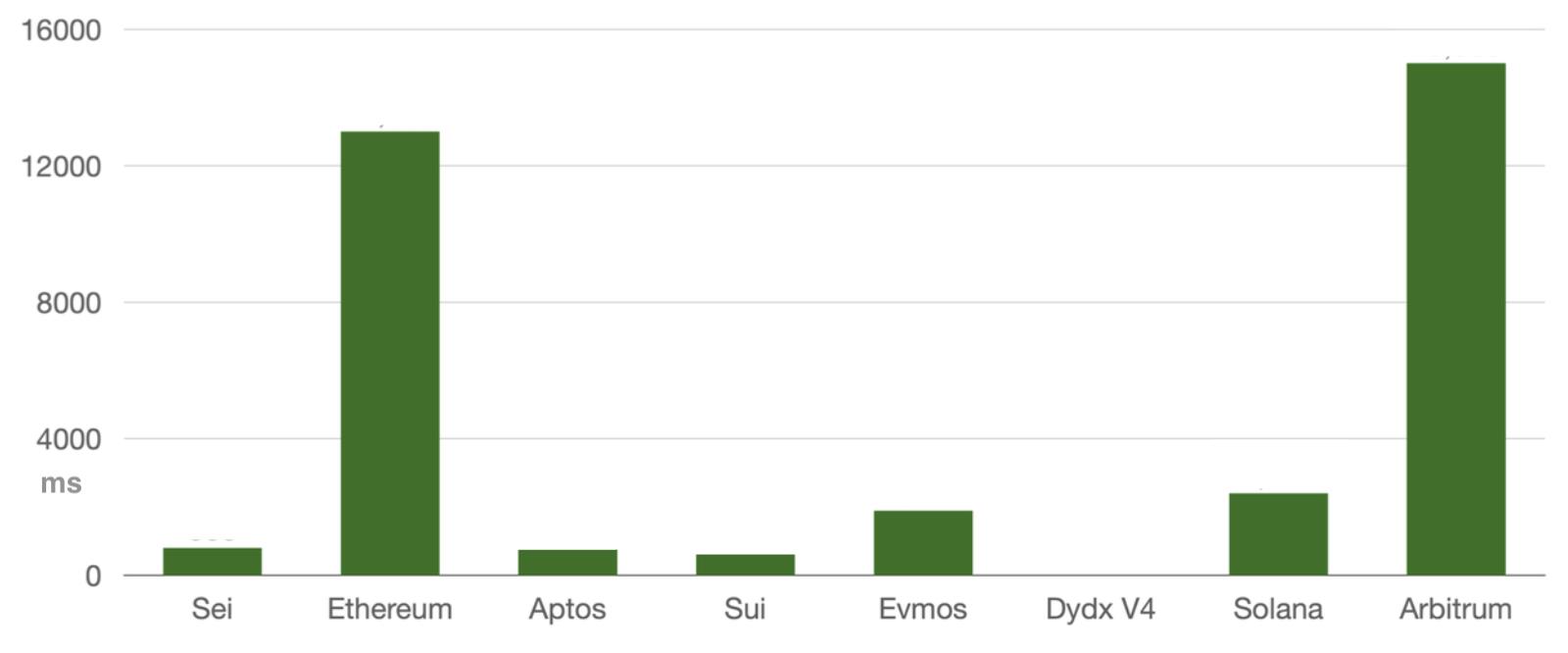

2.2 160,000 TPS, final blocks in less than 1 second, transaction fees of less than 0.01 cents per transaction, supporting a large number of DeFi users

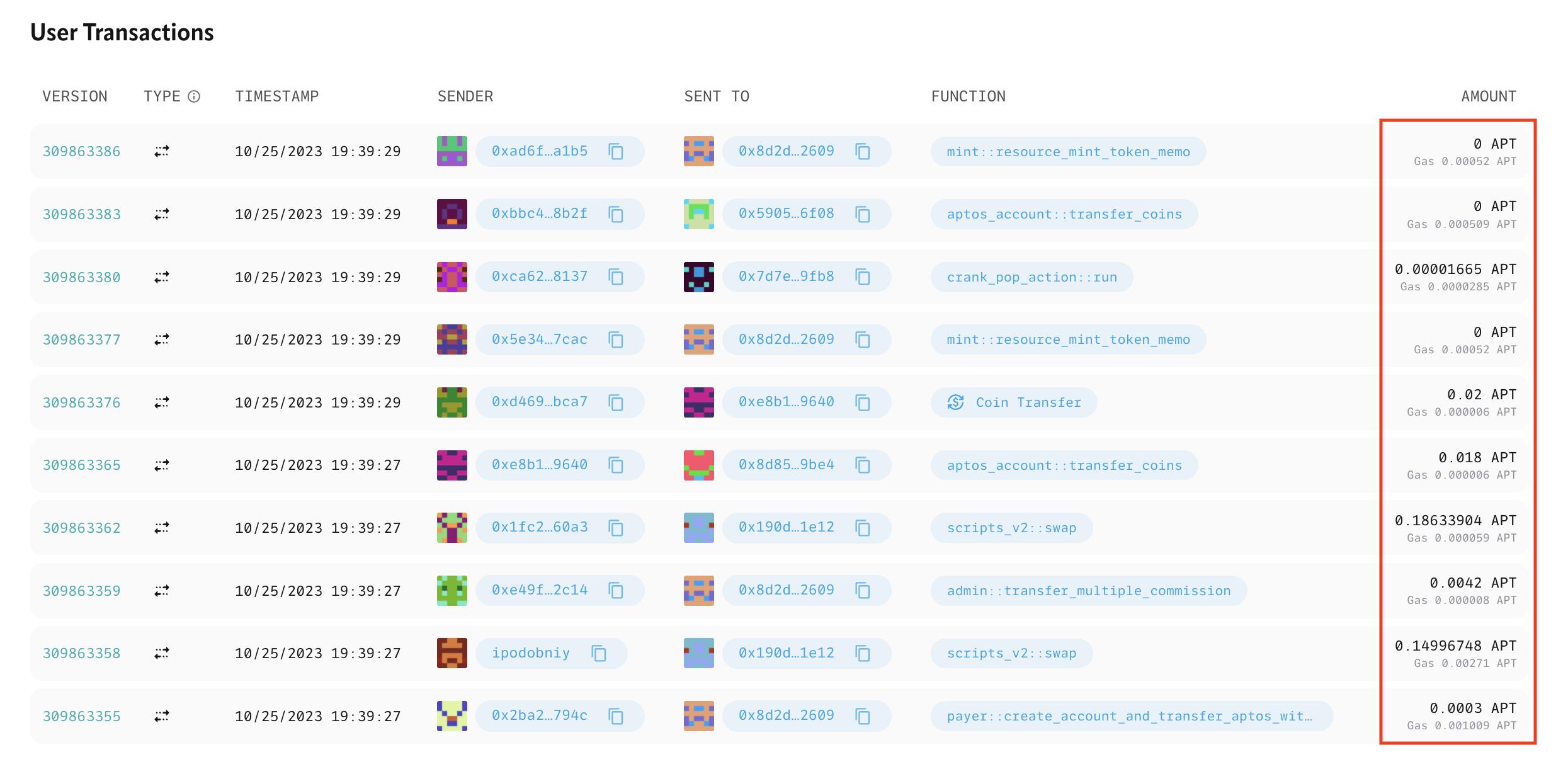

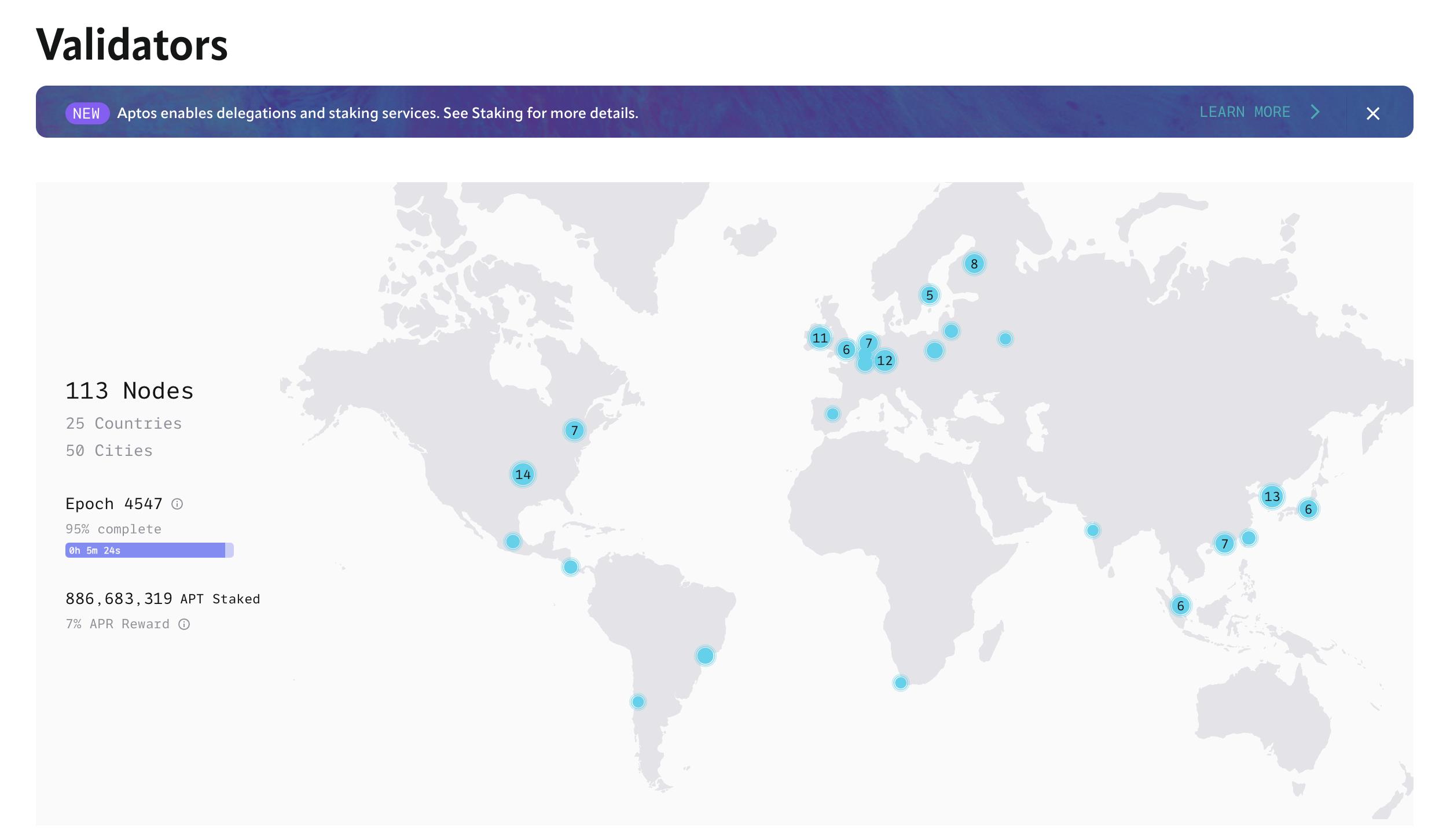

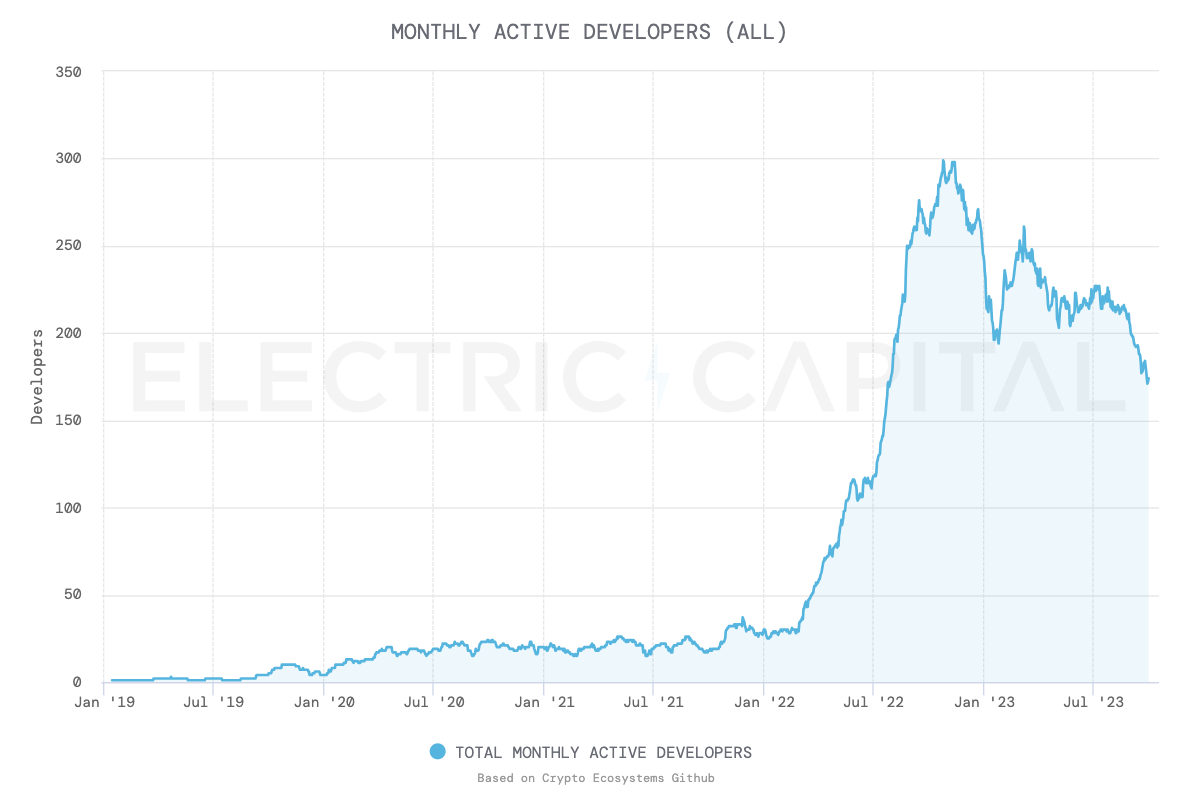

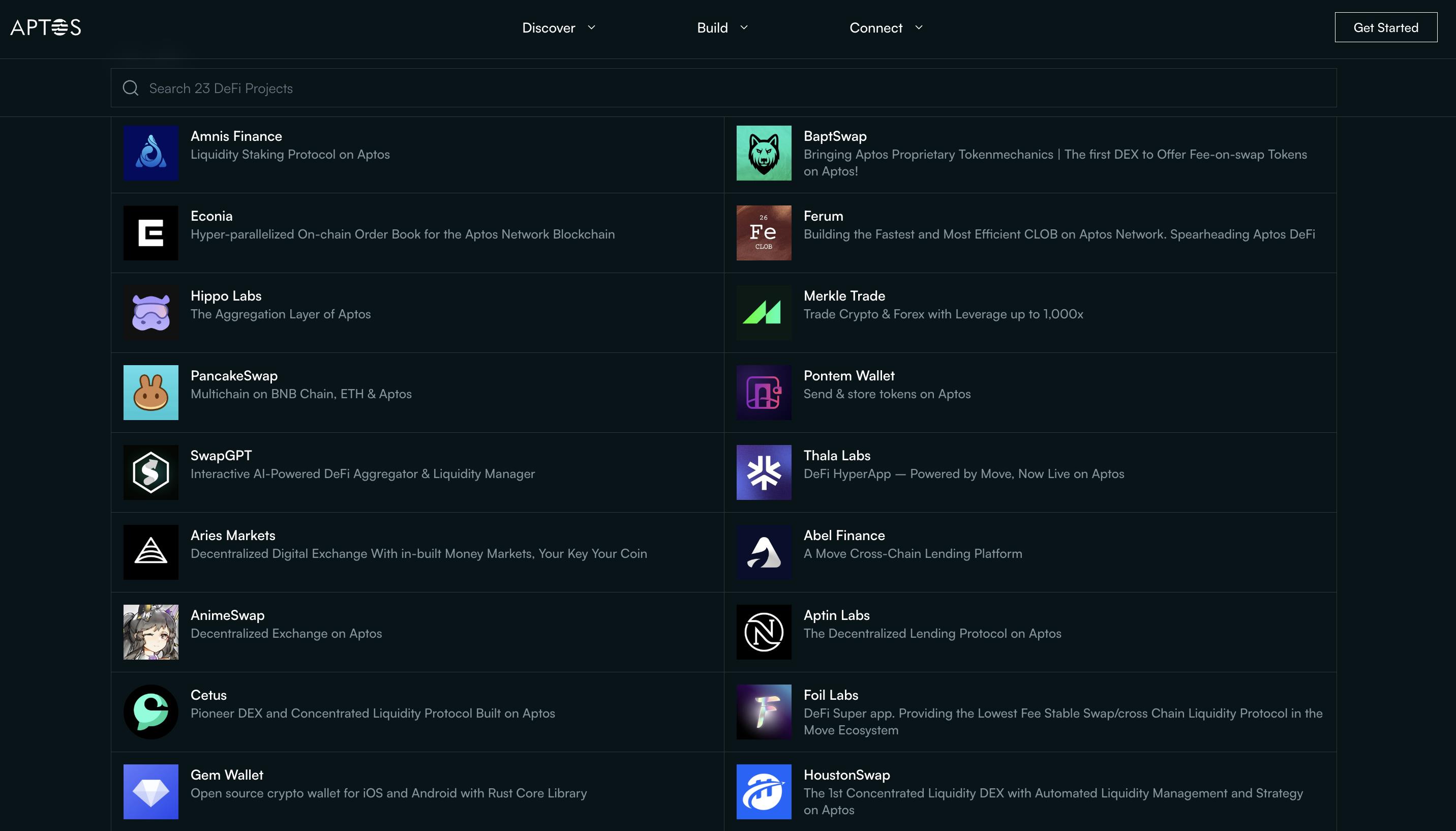

Currently, the actual TPS of the vast majority of blockchains is as low as two digits. However, for DeFi applications to achieve adoption by millions or tens of millions of users and daily transaction volumes in the billions or tens of billions, the underlying public chain must have extremely high throughput and very low latency. If the throughput of the public chain itself is not sufficient, it will greatly limit the development of DeFi. Aptos has achieved a high throughput of 160,000 TPS through innovations such as decoupling consensus and execution, parallel execution, and Diem-BFT consensus. This performance ranks first among mainstream public chains and is significantly higher than the performance of Ethereum L2. The 160,000 TPS also provides DeFi applications with a broader development space. Aptos has extremely high throughput compared to other L1/L2 solutions. Source: Official website or Explorer Block time is also one of the main factors for DeFi developers to choose which public chain to deploy on. Currently, Aptos can achieve block times of less than 1 second and continues to improve. According to Messari, Aptos is the blockchain with the lowest latency and highest throughput in the current market. Actual block time of less than 1 second for Aptos. Source: Aptos Explorer Final block time for mainstream L1/L2 solutions. Source: Explorer of each public chain Expensive transaction fees often hinder the adoption of DeFi users compared to centralized finance. Through the continuous efforts of the Aptos team, such as separating execution fees and storage fees and supporting storage fee refunds, transaction fees of less than 0.01 cents per transaction have been achieved, significantly reducing transaction costs for DeFi users. Transaction fees of less than 0.01 cents per transaction. Source: Aptos Explorer 2.3 113 Validators in 25 Countries and 50 Cities Worldwide, Ensuring Sufficient Decentralization for DeFi One of the core narratives of Web3 is decentralization, and Aptos has done a lot of work to attract more validator nodes to join the Aptos ecosystem. As of October 25, 2023, Aptos has achieved 113 validator nodes, spanning 50 cities in 25 countries worldwide, with a total value of over $5 billion and a combined stake of 886,683,319 APT in the network. The number and geographical distribution of validator nodes ensure the decentralization and security of the network. In future development, Aptos will continue to attract more nodes to make the Aptos network more decentralized and secure. Validators around the world. Source: Aptos Explorer 2.4 850,000 Followers, 200+ Projects Developing on Aptos, Comprehensive Infrastructure Empowers DeFi Development The development of DeFi applications depends on the ecosystem of the public chain, and Aptos has a large user and developer community. Currently, the total number of followers on platforms such as Twitter, Discord, Medium, and Telegram is as high as 850,000 and continues to grow. There are over 200 monthly active developers in the ecosystem, and great companies like Microsoft, Google, Mastercard, and Franklin Templeton have partnered with Aptos. Although there has been a slight decrease in monthly active developers due to pessimism from the beginning of this year, there has been a significant increase compared to the beginning of 2022. Furthermore, we believe that with Aptos' continuous monthly upgrades and optimizations to the public chain, more and more developers will join. Monthly active developers on Aptos. Source: Developerreport In terms of infrastructure, Aptos already has various types of projects such as wallets, explorers, development tools, security audits, bridges, and domain names. DeFi developers can directly collaborate with other projects in the community, significantly reducing the cost of acquiring partners. During Token20249, Aptos announced a partnership with Google Cloud, including running validators on Google Cloud, co-hosting accelerators and hackathons, focusing on supporting the developer ecosystem on Aptos. Additionally, Aptos is collaborating with Microsoft to explore digital payments and asset tokenization. Furthermore, Aptos will leverage Microsoft's Azure OpenAI services. After using Azure OpenAI, Aptos will launch Aptos Assistant, a secure and user-friendly digital assistant that can answer questions related to Aptos. To encourage more projects to join the Aptos ecosystem, the Aptos Foundation has launched Grants for infrastructure and applications to incentivize Developer Toolings, SDKs, Libraries, Documentation, Guides, DeFi, NFT, Gaming, and other applications. You can apply through the application link, and the grant amounts range from $5,000 to $50,000. The Registry lists 7 projects that will be deployed on Aptos. For the artist community, Aptos has launched the Artist Grant Program to support artists in the next generation Web3 world. Additionally, Aptos has partnered with Google Cloud to establish an accelerator program aimed at supporting web3 entrepreneurs and developers. Outstanding projects will receive APT token rewards and Google credits. Recently, in September of this year, Aptos and Thala announced the launch of a $1 million fund to incentivize the development of native DeFi on Aptos. As the supported native DeFi projects go live and grow, the fund size will expand to $5 million. Each project can receive a maximum reward of $250,000, and in addition to the bonus, 5 outstanding projects will also receive GTM guidance, development assistance, and investor referrals. Apply here. Currently, the Aptos official website showcases 23 DeFi applications, including Pancake, Thala, Merkle Trade, Amnis Finance, Sushi, Econia, and more. Additional projects can be found here. DeFi projects on Aptos. Source: Aptos Ecosystem Sushi is a well-known DeFi project, and its first Non-EVM version Sushi V2 will be deployed on Aptos in the coming weeks. Prior to partnering with Aptos, Sushi was deployed on EVM chains such as Ethereum, Polygon, Arbitrum, and BNB Chain. This collaboration represents the cooperation between EVM-based DeFi applications and the Move-based public chain, which is crucial for advancing Sushi's cross-chain and multi-chain goals, marking a significant milestone. Econia has implemented an atomic matching engine, utilizing Aptos' sub-second finality to settle trades at the moment they enter. From spot trading to leveraged perpetual futures, Econia aggregates liquidity to achieve maximum capital efficiency. Econia is secure, decentralized, permissionless, fully on-chain, and always open source, serving as the foundational layer for the next generation of DeFi and an ideal settlement engine for any digital asset.Aptos Labs, as a supporter of DeFi projects, also participated in the seed round financing of Econia ($6.5 million). Econia is set to launch in November with 4 different frontends (Kana, Pontem, Aries, SwapGPT).

Merkle Trade

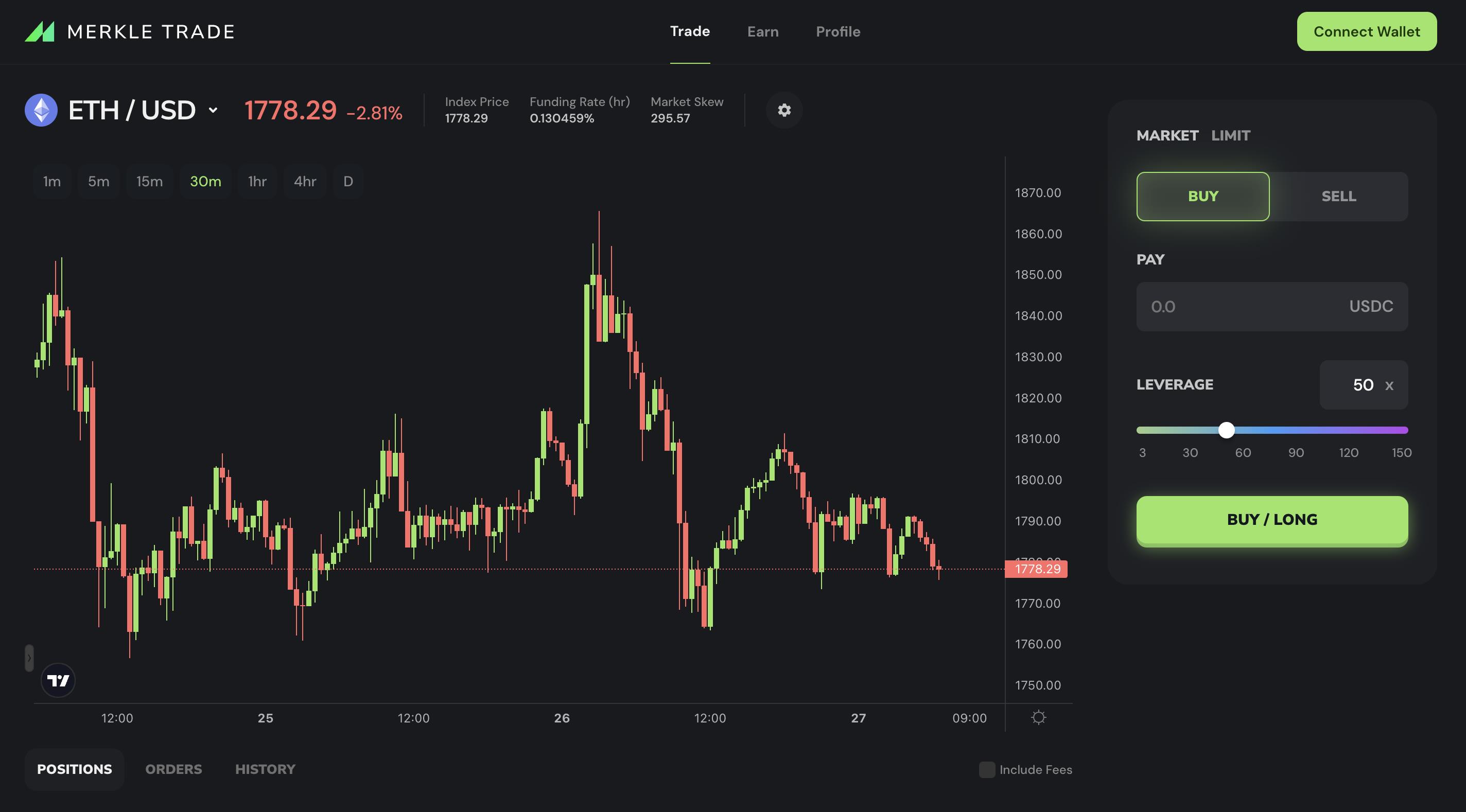

Merkle Trade is a decentralized trading platform for crypto assets, forex, and commodities using a pooled fund model, with leverage of up to 1000x. Its goal is to become the largest decentralized leveraged trading platform, providing an enjoyable trading experience for every user.

Compared to other AMMs, Merkle Trade offers a gamified experience where users can accumulate experience points and improve their rankings on the leaderboard, unlocking rewards. Another feature is the provision of forex and commodity trading pairs, with forex trading fees as low as 0.0075%. Users can trade 3 types of assets on a single platform.

Merkle Trade's mainnet is already live, and everyone is welcome to experience it, with more rewards waiting.

Amnis Finance staking page Source: Amnis Finance official website Join the Aptos ecosystem and develop great Web3 applications! Please follow Aptos on Twitter, Medium, and keep an eye on the positions in the job postings! Bixin Ventures will also continue to support the expansion of the Aptos ecosystem in the Asia-Pacific region. 免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。

3. Multiple High-Value Grants Programs Empower DeFi and Other Projects

4. Many Well-Known DeFi Projects Deployed on Aptos

Trading interface of Merkle Trade. Source: Merkle Trade official website

Thala

Thala is a native DeFi protocol on Aptos, already live on the mainnet. Thala offers stablecoin (Move Dollar) and AMM (Thala Swap) products. Move Dollar (MOD) is generated by over-collateralizing a basket of on-chain assets, including LSD derivatives, LP Tokens, Deposit Receipt Tokens, and RWAs.

Thala Swap is an AMM that allows for dynamic LP adjustments, supporting Weighted Pools, stablecoin pools, and LP-driven pools, expanding the use cases for MOD stablecoin. Additionally, the LaunchPad built on Thala Swap provides a way for individual users to participate in projects at an early stage.

In October of last year, Thala announced the completion of a $6 million raise. In September of this year, Thala and Aptos jointly launched a $1 million DeFi incubation program, welcoming DeFi teams to apply.

Amnis Finance

Amnis Finance is a Liquid Staking project similar to FRAX, offering up to 7% staking rewards. Amnis Finance's model is similar to Pendle, tokenizing yield assets (stAPT) into SY (Standardized Yield) tokens, which are then split into principal (PT) and yield (YT) tokens, effectively tokenizing the yield into a separate token.

The mainnet of Amnis Finance is already live.

Trading interface of Merkle Trade. Source: Merkle Trade official website

Thala

Thala is a native DeFi protocol on Aptos, already live on the mainnet. Thala offers stablecoin (Move Dollar) and AMM (Thala Swap) products. Move Dollar (MOD) is generated by over-collateralizing a basket of on-chain assets, including LSD derivatives, LP Tokens, Deposit Receipt Tokens, and RWAs.

Thala Swap is an AMM that allows for dynamic LP adjustments, supporting Weighted Pools, stablecoin pools, and LP-driven pools, expanding the use cases for MOD stablecoin. Additionally, the LaunchPad built on Thala Swap provides a way for individual users to participate in projects at an early stage.

In October of last year, Thala announced the completion of a $6 million raise. In September of this year, Thala and Aptos jointly launched a $1 million DeFi incubation program, welcoming DeFi teams to apply.

Amnis Finance

Amnis Finance is a Liquid Staking project similar to FRAX, offering up to 7% staking rewards. Amnis Finance's model is similar to Pendle, tokenizing yield assets (stAPT) into SY (Standardized Yield) tokens, which are then split into principal (PT) and yield (YT) tokens, effectively tokenizing the yield into a separate token.

The mainnet of Amnis Finance is already live.