Author: Pedro M. Negron, IntoTheBlock

Translation: Felix, PANews

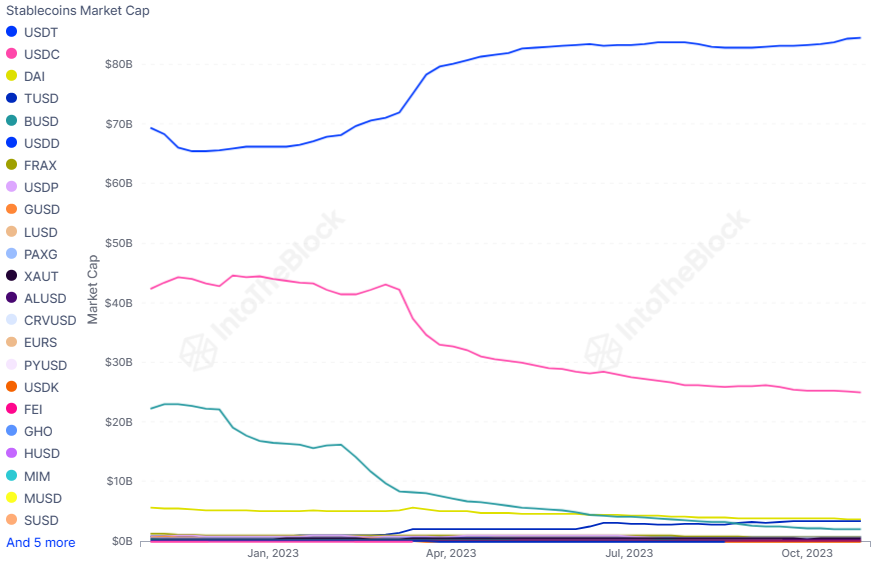

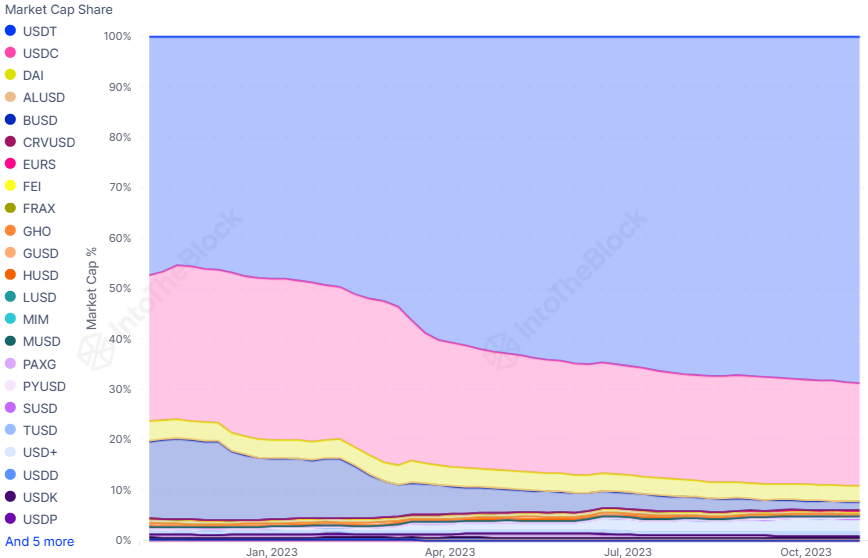

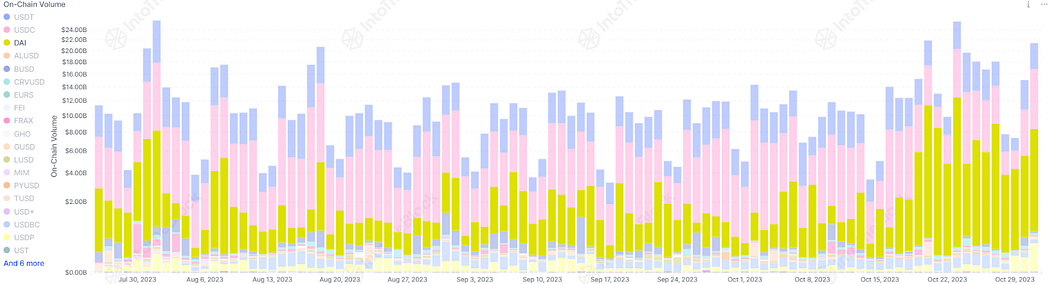

Over the past year, the stablecoin race has undergone significant changes due to regulatory changes, crises, and emerging opportunities, with each change leaving its mark on the industry. USDT has experienced significant growth, while USDC has seen a decline following a regional banking crisis. DAI has recently taken center stage in on-chain transaction volume, thanks to its innovative stablecoin strategy of depositing funds into short-term US government bonds, which currently offer a high APY. Finally, this article also examines how the recent recovery in the crypto market has affected the flow of stablecoins on exchanges.

The market value of USDT recently reached a historic high, consolidating its position as the most widely adopted stablecoin in the crypto market.

Source: IntoTheBlock

Several major participants in the stablecoin market have experienced various events over the past year. BUSD was once the third largest stablecoin in the market, but had to cease operations due to legal issues with US authorities. Since this event, the operator of Binance's BUSD, PAXOS, has only been able to process user withdrawals, leading to a gradual decline in market value as withdrawals are processed. USDC's foreign reserves of $3.3 billion were reported to be held at the bankrupt Silicon Valley Bank, which is crucial for maintaining its peg to the US dollar.

(Related reading: Review of Opportunities for Bottom Fishing, Hedging, and Arbitrage in the USDC De-pegging Crisis)

These series of events have attracted a wave of new users to USDT, further expanding its market share.

Source: IntoTheBlock

With a series of events in the stablecoin race, the entity behind USDT, Tether, has continued to develop, solidifying USDT's dominant position in the market. USDT's current market value is $85 billion, accounting for 68% of the stablecoin market share, consolidating its position as the leading stablecoin provider.

Despite Tether holding over half of the market share, there is still potential for further growth and innovation in the stablecoin race. This trend is particularly noteworthy as some stablecoin providers now offer earning opportunities for crypto users. These stablecoins are subsequently used to purchase short-term US government bonds, which currently offer the highest yield since 2007. This mechanism allows stablecoin holders and crypto users to enter the US bond market without direct participation.

Source: IntoTheBlock

The protocol MakerDAO behind DAI has played a key role in leading this trend. With the reintroduction of DSR (Dai Savings Rate), MakerDAO allows users to lock their Dai assets in smart contracts to earn returns. This new initiative to purchase US government bonds was launched in August 2023, when the DSR rate reached its highest level. Subsequently, DAI's on-chain transaction volume has significantly increased. It is evident that large traders are eager to gain investment returns, as transactions over $100,000 account for over 90% of DAI's total transaction volume. Over the past two weeks, DAI has consistently maintained the top position in on-chain transaction volume among stablecoins. This achievement is significant, especially considering that DAI is the third largest stablecoin by market capitalization.

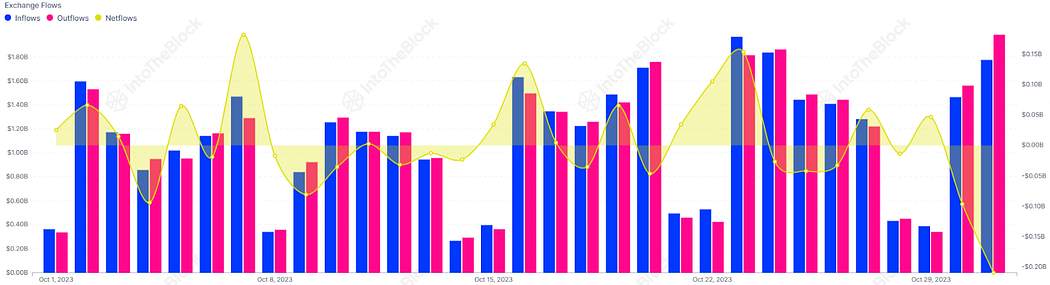

Finally, the recent rise in cryptocurrency prices is also clearly reflected in the stablecoin market.

Source: IntoTheBlock

Flow indicators of various exchanges (assets entering and exiting exchanges) consistently show an inflow trend. Inflows of funds are usually related to users selling assets on exchanges, which is also the reason they transfer assets to these exchanges. This indicates that users are currently using previously held stablecoins to purchase crypto assets, aligning with the recent surge in prices.

In conclusion, the stablecoin market has undergone significant changes over the past year, characterized by regulatory challenges, crises, and innovative strategies. Despite setbacks for some mainstream stablecoins like BUSD and USDC, USDT firmly holds the dominant position, with a market value of $85 billion, accounting for 68% of the market share. However, there is still room for growth and innovation in the stablecoin race, as evidenced by the trend of earning locked stablecoin returns by investing in short-term US government bonds. MakerDAO has played a crucial role in pioneering this initiative, particularly in the re-launch of DSR. The recent surge in cryptocurrency prices is also reflected in the stablecoin market, especially in users purchasing crypto assets, leading to continued inflows into exchanges.

Related reading: Data Review of the Stablecoin Market: Purchasing Power of Stablecoins Hits Short-Term Low After USDC Crisis

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。