Author: Xiyu, ChainCatcher

"One application, one chain" is becoming a new strategy for traditional DeFi applications.

Yesterday, Sam, the founder of Frax, announced in the community that Frax's Layer2 network, FraxChain, will launch its testnet in January 2024; on October 27, dYdX Chain, the Layer1 network developed by the contract platform dYdX, officially launched its mainnet; and on October 19, Kain.eth, the founder of synthetic asset protocol Synthetix, announced the deployment of the application chain SNX Chain based on OP Stack, and so on; in September, DeFi management dashboard protocol DeBank announced its own DeBank Chain plan; and there is also MakerDAO's NewChain plan, and so on.

With the development and popularization of L2 network development frameworks such as OP Stack, Polygon CDK, and modular network CeLestia, the cost of deploying a new chain by developers is getting lower and lower. "Launching a chain" is becoming a new trend or strategy for DApp applications. Some believe that in the future, DApps may choose to deploy their own chains, which can be L1, L2, or L3.

According to data previously compiled by ChainCacther, there are more than 10 L2s developed based on OP Stack, such as Gitcoin's PGN network, and Zora Network launched by NFT number platform.

Related reading: "Layer2 Stacks are rushing to seize developer resources, who will be the ultimate winner?"

However, for users, the response of traditional DeFi protocols to "launching a chain" is more worthy of attention.

Firstly, developing a new chain will change the narrative logic of these DeFi applications and their native tokens. "Launching a chain" will transform them from an application product into an infrastructure, which also implies a change in business model. While the application may profit from transaction fees, the underlying layer captures more of the chain's value. Additionally, the role of tokens in the product will change. In an application, tokens can be used to pay fees or for governance, but in a chain, native tokens can be staked to become validators, capturing MEV and gas rewards on the chain.

Secondly, these applications have accumulated a sufficient number of users since their launch and control over 80% of the funds in the on-chain world. Their every move may affect the security of funds within the protocol, and their actions in response to changes will influence the direction of user attention and future trends in crypto.

Furthermore, most applications choosing to launch new chains opt for frameworks like OpStack, Polygon CDK, etc. However, the underlying architecture used by DeFi applications in developing "dedicated chains" is more diverse. For example, MakerDAO has expressed a preference for using the Solana architecture, and dYdX Chain has chosen the CosmosCDK architecture.

So, how are the current developments of the application chains developed by DeFi applications progressing? What solutions have been adopted?Dydx Chain has more autonomy, supporting DYDX as the native token

dYdX Chain (also known as dYdX V4) is a proof-of-stake (POS) mechanism blockchain built on the Cosmos SDK. The network will use DYDX as the native token on the chain, used for validator staking to ensure the normal operation of the network.

dYdX Chain's mainnet was officially launched on October 27th, and its validators created the genesis block in the early hours of the same day.

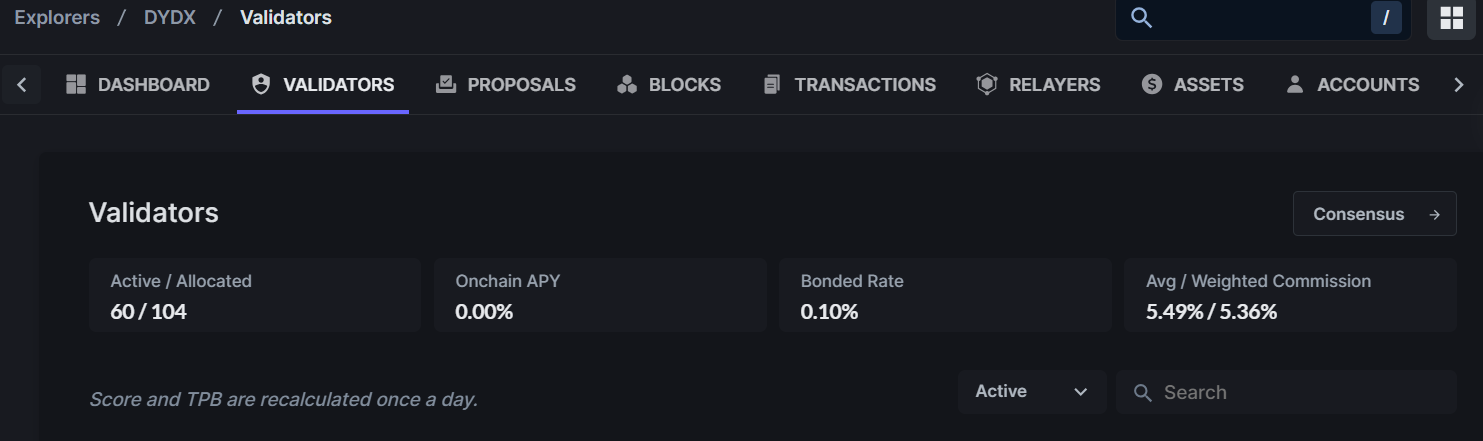

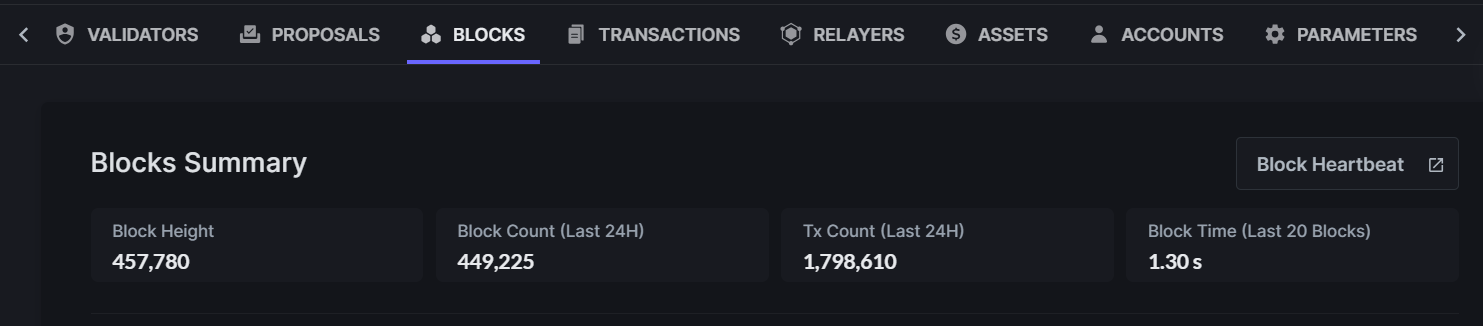

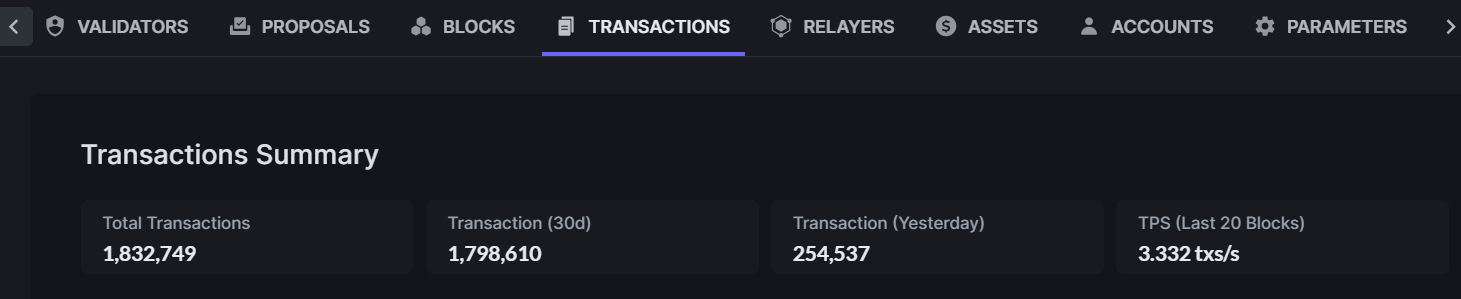

According to the block explorer, as of November 3rd, the dYdX Chain network has 104 participating validators, with 60 active validators. Over 450,000 blocks have been created on the chain, with approximately 1.8 million completed transactions.

Source: https://www.mintscan.io/dydx/validators

Source: https://www.mintscan.io/dydx/validators

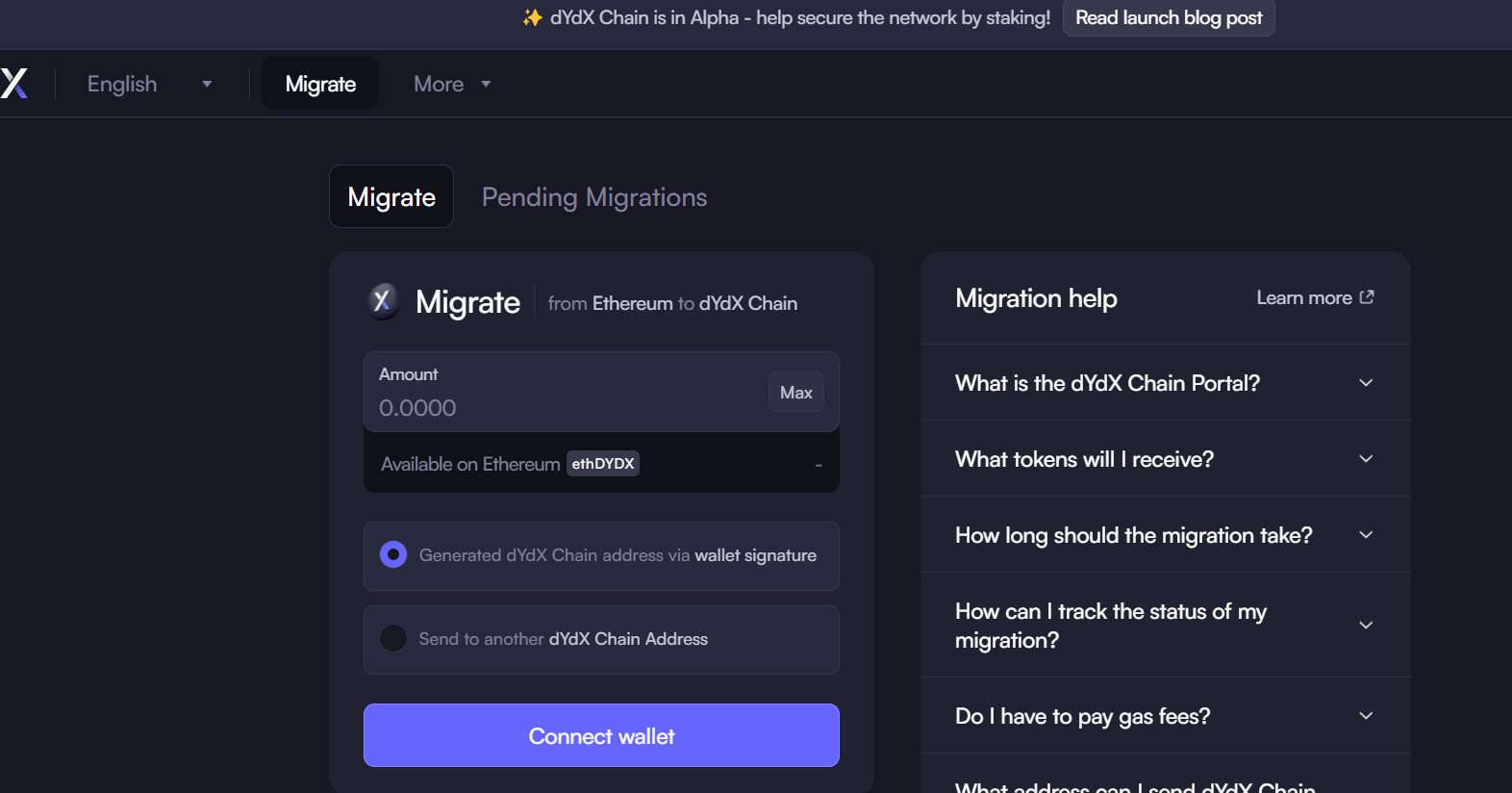

As an independent Layer1 network within the Cosmos ecosystem, dYdX Chain's community and ecosystem development will be managed and promoted by the dYdX Ops subDAO. On October 31, dYdX Ops subDAO announced the launch of a user-oriented cross-chain asset bridge, supporting users to bridge the DYDX tokens on Ethereum (ethDYDX) to the dYdX Chain.

According to a previous proposal by dYdX Ops subDAO, after the launch (also known as genesis) of dYdX Chain, it will be divided into two phases: Alpha and Beta. The Alpha phase will focus on enhancing the stability and security of the dYdX Chain network, while the Beta phase will open up comprehensive trading on the dYdX Chain and the community may consider introducing additional rewards and incentive programs to stimulate more liquidity and activity on the dYdX Chain. The transition from the Alpha to Beta phase will be determined by factors such as community governance voting.

Currently, dYdX Chain is still in the Alpha phase, and a key aspect of achieving stable network operation is the amount of DYDX tokens staked by validators on the dYdX Chain. Therefore, the main task at this stage is to encourage validators to stake more on the dYdX Chain or to encourage DYDX token holders to delegate their tokens to validators for staking. However, since DYDX tokens are primarily in ERC20 format, it is crucial to migrate the DYDX tokens on Ethereum to the dYdX Chain.

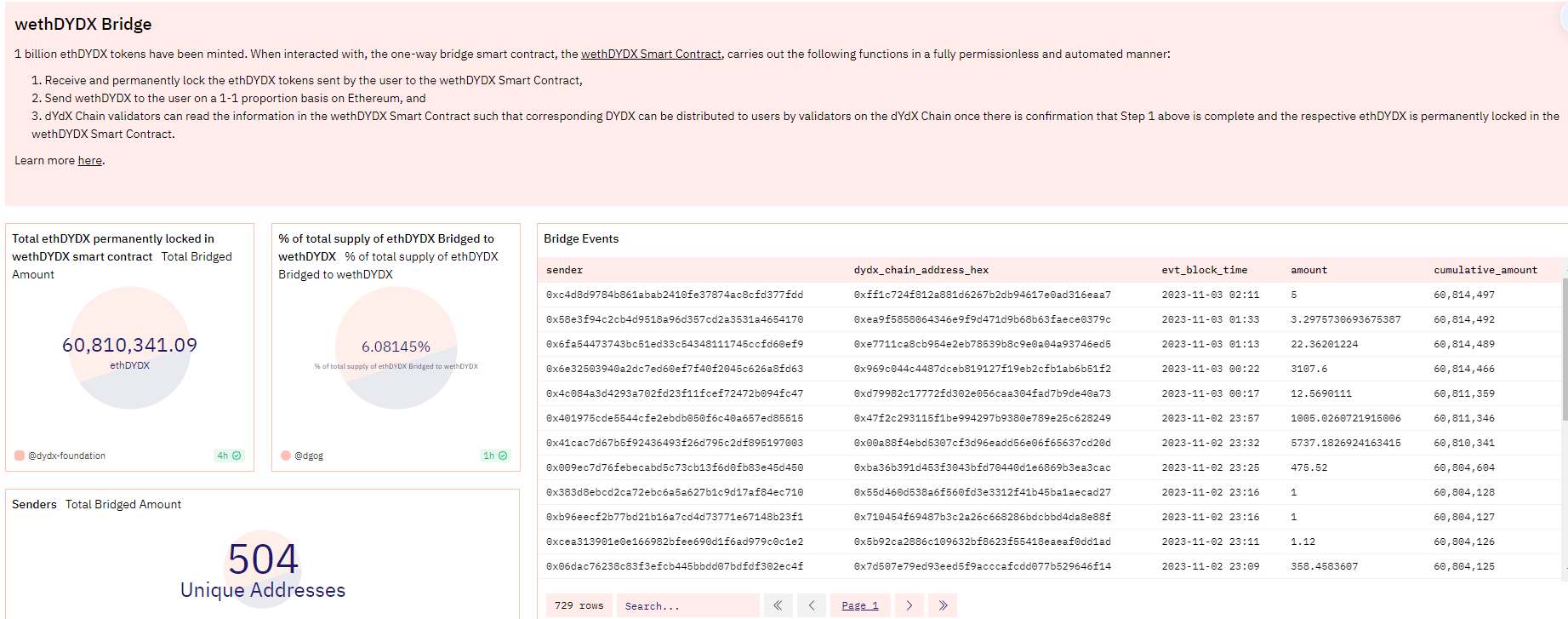

The cross-chain bridge page "bridge.dydx.trade" launched by dYdX Ops subDAO is designed to address this issue, supporting the migration of ERC20-format DYDX tokens from Ethereum to the dYdX Chain. It is important to note that this bridge page is single-threaded and specific, only supporting the transfer of DYDX tokens from Ethereum to the dYdX Chain.

According to Dune Analytics, as of November 3, the cross-chain bridge has already bridged over 60 million ethDYDX, accounting for approximately 6% of the total supply of DYDX tokens (1 billion) and involving over 500 wallet addresses.

Furthermore, on October 27, the dYdX Foundation stated that dYdX Chain plans to distribute all protocol fees (including trading fees denominated in USDC and gas fees denominated in DYDX) to validators and stakers. It also added that dYdX Chain is different from other blockchain networks that rely on token inflation, as it can distribute fees in the form of USDC to validators and equity holders, and the specific distribution will depend on the protocol's allocation mechanism.

Regarding why dYdX Chain chose Cosmos SDK instead of continuing to use Layer2 development stack solutions in the Ethereum ecosystem, founder Antonio once stated, "If there is better technology to build (dYdX), we will use it. I don't care at all about what chain dYdX is built on, I only care about providing the best product experience to users."

However, StarkNet co-founder @TobbyKitty has bluntly stated that the biggest reason for dYdX's migration to Cosmos may be to allow DYDX tokens to operate validator nodes on the new chain, as L1 built on Cosmos CDK has more autonomy to run nodes and manage validators, which is generally not supported on L2 networks.

FraxChain: Using frxETH as the on-chain GasToken, FXS is used to capture sequencer fees

FraxChain is a Layer2 network launched by Frax Finance based on the Hybrid rollup (a fusion of Optimistic and zkRollup) solution.

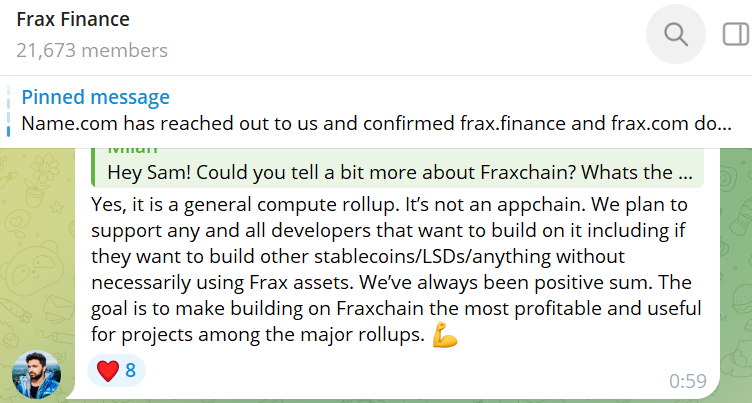

According to the latest statement from Frax Finance founder Sam Kazemian in the community on November 2, FraxChain is a general-purpose Rollup, not an application chain specifically designed for Frax Finance. Developers can deploy stablecoins, LSD, or any type of application on FraxChain, and hope to make projects built on FraxChain the most profitable and popular Web3 projects. Additionally, he added that the team is building core Rollup technology for FraxChain in a paper-driven manner.

Founder Sam stated in a previous interview that FraxChain is expected to launch the testnet by the end of this year and will be fully launched in January 2024. In yesterday's community response, Sam stated that the L2 network FraxChain testnet is expected to go live in early January 2024, and early project builders will also receive the most block space incentives.

About which token will be used on FraxChain, Sam answered, "FraxChain's Gas token is frxETH, and the equity token FXS will play the role of staking token for the FraxChain network sequencer, which can be used to capture sequencer income, share network sequencer revenue, and can also be used to regulate the decentralized mechanism of the sequencer after future updates."

Synthetix, the synthetic asset protocol, launches SNX Chain

Synthetix will deploy the Synthetix Chain application chain, also known as SNX Chain, based on the OP Stack. The first public mention of "developing an application chain" by Synthetix was on October 19 in the latest article by Synthetix founder Kain.eth titled "A fork in the road", where this project's development was named "Project Draco" and is planned to have all management functions of the Synthetix protocol and derivative products migrated to Synthetix Chain by 2024.

He explained in the article that Synthetix Chain will serve multiple purposes: first, it will be the place for overall governance of the Synthetix protocol; second, it will be the primary issuance venue for the sUSD stablecoin assets, supporting SNX holders or using SNX as collateral for borrowing. Additionally, sUSD issued on Synthetix Chain may also serve as a collateral asset on other chains, and in the future, experiments will be conducted with ETH/USDC and other forms of collateral. Furthermore, it will enable unified allocation and management of sUSD issuance and minting fees on the chain. Finally, the liquidity from previous versions of Synthetix will be migrated to Synthetix Chain, allowing for the aggregation and unified management of liquidity across multiple chains or protocols.Currently, there is not much public information about Synthetix Chain, and only some peripheral information can be found from the articles introduced by Kain.eth. However, many users have expressed that Synthetix, as the leading synthetic asset protocol on the Optimism mainnet, is bound to launch its own chain using the OP Stack sooner or later. Currently, there are already multiple products built on the Synthetix protocol, including the perpetual contract platform Kwenta, the options platform Lyra, the options liquidity aggregation protocol Polynomial, and the contract platform Decentrex. In terms of the composition and quantity of products, Synthetix has long had the potential and capability to develop its own chain. In fact, some users have expressed that whether the Synthetix protocol launches its own chain is not very important. The current focus of the protocol is how to attract more users to use Synthetix. With the influx of users and funds, liquidity and user activity will naturally increase, and this can be achieved through cross-chain deployment. Currently, most of Synthetix and its derivative products are deployed on the Optimism mainnet, with no presence on other networks such as Arbitrum, Avalanche, Polygon, and others.

MakerDAO Launches NewChain Application Chain with Continuous Controversy

The NewChain plan of MakerDAO first appeared in the "Endgame" plan announced in May of this year, with NewChain being the final step in the plan.

In September, MakerDAO founder Rune posted a blog post titled "Explore a fork of the Solana codebase for NewChain," exploring the possibility of creating a new NewChain based on the Solana codebase. This statement led the community to mistakenly believe that MakerDAO would choose Solana to build its NewChain, sparking intense controversy and accusations that MakerDAO was betraying Ethereum.

Furthermore, shortly after this statement was made, Ethereum founder Vitalik Buterin sold approximately $581,000 worth of MKR. Many users interpreted Vitalik's sale as an action against MakerDAO's Endgame plan to leave Ethereum and adopt Solana.

Subsequently, MakerDAO founder Rune stated in an interview that NewChain has not yet chosen to use the Solana or Cosmos codebase, and that the exploration was only conducted, which finally calmed the storm.

However, in the same month when the controversy subsided, the MakerDAO community passed a proposal for "Launching the lending protocol Spark Protocol on Gnosis Chain." Gnosis Chain is an Ethereum sidechain compatible with EVM, formerly known as xDai Chain, which previously bridged DAI as its native token. Some users interpreted this action as MakerDAO's determination to escape from Ethereum.

Following the controversy, there were not many public discussions or actions from MakerDAO regarding NewChain.

DeFi Wallet Management Tool DeBank Launches DeBank Chain, Focused on Social Asset Layer

DeBank Chain is an application chain launched by DeFi wallet management tool DeBank, focusing on the social asset layer. The network will revolutionize social interaction by adding an asset layer to social behavior. The testnet was launched in August, and the mainnet is reportedly scheduled to go live in 2024.

DeBank is a well-established DeFi management dashboard where users can track their investment portfolios and execute investment operations using integrated trading features. In 2022, it successively launched the Web3 social platform, Web3 ID functionality, and the Web3 native communication app DeBank Hi, allowing users to follow whale trading dynamics, NFT market trends, track Mirror article updates, and monitor real-time on-chain activities of Web3 friends through the platform.

Currently, DeBank Chain has opened its testnet, allowing users to interact on the test network.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。