Author: Pomelo, ChainCatcher

Two months after Frax Finance founder Sam Kazemian's live speech that "FXS will rise to the top five or top ten of the cryptocurrency asset rankings," Frax has released the V3 version and launched the sFRAX product to enter the RWA track.

sFRAX is a collateral pool that can capture the yield of U.S. Treasury bonds. The funds in this pool can purchase real-world short-term risk-free asset products such as U.S. Treasury bonds, capturing and tracking the Federal Reserve interest rate. As of October 26, the assets in the sFRAX collateral pool amount to approximately 39.5 million, with a yield of 6.5%.

However, the deployment of RWA by Frax V3 in Q3 is just the first move, and there will be a series of new actions released in the next two months, which is also seen as good news worth looking forward to by the community. Among them, Frax will release the upgraded version of LSD, frxETH V2, in November, and launch the Fraxchain testnet in December.

At that time, Frax will become an application that integrates multiple product lines such as "stablecoin, DeFi trio, LSD, RWA, FraxChain" into one. Many believe that from the current product layout, there may still be hope for "FXS to rise to the top five in market value."

Launching sFRAX to enter RWA, Frax V3 did not bring TVL data growth

The core of Frax V3 is the introduction of RWA business and the use of the existing AMO automated market operation strategy mechanism to transform the algorithmic stablecoin FRAX into a decentralized stablecoin collateralized by multiple assets.

In the RWA layout, Frax has launched two products: the collateral pool sFRAX and the bond product FXB.

The former, sFRAX, is a collateral pool or fund pool designed to track the Federal Reserve's IORB interest rate, which is a recognized risk-free rate, allowing on-chain users to enjoy the yield of U.S. Treasury bonds through the FRAX stablecoin.

The specific operation mechanism is that users can collateralize the stablecoin FRAX in the fund pool to obtain sFRAX collateral certificates. The funds in this pool will be used by Frax's custodian FinresPBC to carry out RWA strategies such as U.S. Treasury bonds.

The main RWA investment asset strategies currently include: short-term U.S. Treasury bonds, Federal Reserve overnight repurchase agreements, U.S. dollars deposited in the Federal Reserve Bank, and money market funds.

The latter, FXB (FraxBonds), is a tokenized bond product. The bond holders will automatically convert to FRAX tokens upon maturity, similar to the common discounted bonds in the financial market. In simple terms, Frax will issue different maturity bond products FXB, which users can purchase at a discount. Upon maturity, FXB will automatically convert to FRAX tokens.

For example, Frax can support the issuance of 1-year, 2-year, or 3-year U.S. Treasury bond FXB. Assuming a face value of 100 FRAX for FXB bonds, the longer the term, the greater the discount. For example, a 1-year bond purchase only requires 88 FRAX (12% discount), a 2-year bond requires approximately 70 FRAX (20% discount), and a 3-year bond only requires 60 FRAX (40% discount). Users can allocate FXB bonds based on their risk tolerance and pursuit of yield. Regardless of the initial payment for FXB, they will ultimately receive 100 FRAX upon maturity.

Both sFRAX and FXB are interest-bearing tokens. Holders can not only receive income related to RWA, but also participate in on-chain DeFi product interactions to capture on-chain income or trade in the secondary market, such as providing liquidity for FXB or sFRAX on the Curve platform, or supporting exchange for other tokens.

However, the FXB-related products have not been officially launched yet. The sFRAX collateral pool was launched on October 10, with an initial yield of 10%. Users can collateralize FRAX for sFRAX to receive related income. It should be noted that the yield of the sFRAX collateral pool will decrease with the amount of FRAX deposited, eventually aligning with the Federal Reserve's IORB rate (around 5.4%), which is mostly higher than IORB. Currently, the total amount of sFRAX in the collateral pool is 39,500, with an annualized yield of 6.5%.

In addition to deploying RWA business, Frax V3 has also made adjustments to the collateral assets for the minting of the algorithmic stablecoin FRAX, adding support for assets such as frxETH, sFRAX, and FXB, making it a more diversified stablecoin.

As we all know, FRAX initially gained fame as a hybrid stablecoin collateralized by FXS and USDC. Why the need to adjust the strategy now? This can be inferred from the iterative upgrades of the FRAX stablecoin.

In fact, in the V1 version, FRAX gradually reduced the collateralization ratio of FXS; in the V2 version, it began to use USDC as the sole collateral for the stablecoin and launched the AMO for automatic execution strategies, which can automatically issue FRAX based on the funds in the treasury of USDC collateral and use it for on-chain lending or providing liquidity to generate profits, which will be placed in the FRAX treasury, thus increasing the utilization of funds and expanding the scale of FRAX.

However, in March of this year, due to the bankruptcy of the Silicon Valley Bank, USDC suffered severe anchoring issues, and FRAX, as a decentralized stablecoin entirely collateralized by USDC, was also affected by the anchoring issues even with a 100% collateralization ratio. Subsequently, the collateral assets for FRAX minting began to "de-USDC," hoping that even in extreme market conditions, FRAX could maintain its peg to 1 USD. At that time, founder Sam stated that FRAX should only have one RWA: to deposit dollars into the Federal Reserve main account (FMA), and the ultimate solution to the collateral dilemma for Frax is to open FMA and deposit dollars in the Federal Reserve main account. He later stated in the community that FRAX would soon support the purchase of U.S. Treasury bonds.

The V3 version of Frax attempts to gradually transform the stablecoin FRAX into a fully externally collateralized and multi-decentralized stablecoin that can capture on-chain and off-chain assets. In simple terms, the collateral assets for the FRAX stablecoin will be more diversified, with sFRAX, FXB, frxETH, and others serving as collateral, where the assets behind sFRAX and FXB represent real-world RWA products such as government bonds, making it more secure and reliable. Through the AMO for automatic execution strategies, Frax can also use sFRAX or FXB to capture more profits and increase the collateralization ratio (CR) of the FRAX minting treasury.

For example, the AMO strategy can track data such as the deposit interest rate (IORB) of the Federal Reserve, and when the IORB rate increases, the AMO strategy in Frax will use assets such as treasury bills, repurchase agreements, and U.S. dollars deposited in the Federal Reserve Bank to mint more FRAX for purchasing RWA assets. When the IORB rate decreases, the AMO strategy can use decentralized assets as collateral to balance the collateralization ratio of FRAX collateral assets, and so on.

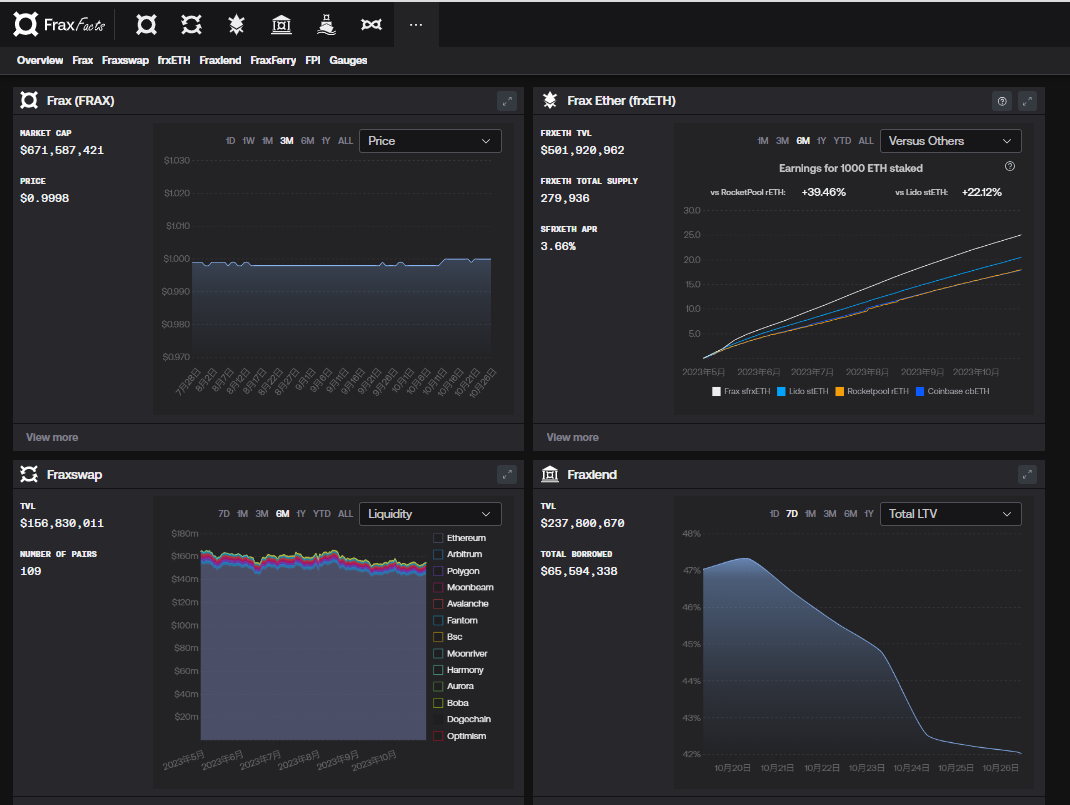

However, despite the launch of RWA by Frax V3 for over half a month, it has not brought significant growth to the scale of the stablecoin FRAX, and the TVL of the stablecoin module has remained stable within a certain range. According to DeFiLlama, the value of assets locked in the stablecoin FRAX protocol has remained stable at around $700 million, and the native governance token of Frax, FXS, has only increased by about 8.6% in the past 14 days.

From the protocol data and asset price changes, it seems that the user response to Frax's release of V3 and the launch of sFRAX for RWA layout has been mediocre, with no real funds being used to support it, and the performance is not as expected.

Some users have expressed that there is no need to worry, as sFRAX is still an early-stage product, but in the long run, the RWA layout is a positive development for Frax.

Upgrading frxETH V2, FraxChain Launching Soon, Can Frax Overtake?

In addition to deploying RWA business, Frax has two major actions worth looking forward to this year: the upgrade of the LSD product frxETH and the launch of the application chain Fraxchain. According to founder Sam's live speech, the former frxETH will release the V2 version in November, and the application chain Fraxchain is expected to launch the testnet before the end of this year, with the mainnet set to be fully launched in January 2024.

Among them, the V2 version of frxETH aims to address centralization issues. In the past, the most criticized aspect of the frxETH V1 version was that all Ethereum nodes were operated by the Frax team, leading to a high degree of centralization.

In the frxETH V2 version, anyone can run a node validator in a permissionless manner, with no whitelist, KYC, or reputation requirements for node operators, ensuring that frxETH nodes become the most efficient operators in a decentralized manner.

How is this achieved? The founder of Frax believes that all LSD platforms are essentially a peer-to-pool lending market, where users deposit ETH into the pool, equivalent to lending funds to the LSD platform. The platform then provides users with a borrowing receipt (such as Lido's stETH), and the borrower rents out the deposited ETH and pays interest to the lender.

For example, Lido's Stake Ether is equivalent to lending ETH to obtain stETH, similar to lending ETH and obtaining aETH on the Aave platform, but on Lido, the borrower running an Ethereum validation node needs permission. On the other hand, Rocket Pool's LSD product allows users to collateralize ETH to obtain rETH, which is borrowing ETH to obtain receipt tokens rETH. When running a node, the user needs to have 8 ETH and then borrow 24 ETH from the collateral pool to make up 32 ETH, and pay interest to the lender.

Unlike other LSD protocols, the product logic of frxETH is designed with a stablecoin mindset, using the frxETH and sfrxETH dual token model. frxETH is a stablecoin pegged to ETH, and only by collateralizing frxETH can users obtain interest-bearing tokens sfrxETH, which is borrowing frxETH to obtain borrowing receipts sfrxETH.

In the frxETH V2, users providing small amounts of ETH can be considered as collateral (or other collateral approved by veFXS holders in the future) to borrow validators, similar to Rocket Pool. Founder Sam stated in the live speech that the plan is to use 4 ETH, so those who want to become node operators will borrow 28 ETH, pay their PoS earnings as interest, and the specific final earnings of the node operator will depend on their strength and strategy.

In summary, frxETH V2 has lowered the barrier for node operators to participate, achieving decentralization and allowing ordinary people to become node operators.

In addition, in terms of sfrxETH returns, Frax has designed various strategies to increase capital utilization, such as sending idle ETH to the Curve AMO (Automated Market Operations) to obtain liquidity and returns.

From this perspective, the main goal of frxETH V2 is to lower the barrier for node operators to participate, make it more diverse, and increase the returns of LSD through various strategies, making it higher than the normal PoS staking returns.

Furthermore, the Fraxchain to be launched at the end of this year will also use frxETH as a means of paying for GAS fees on the chain, which will reduce the supply of frxETH and increase the returns of sfrxETH, further expanding its market share in the LSD market.

Fraxchain will be launched as a Layer2 using the hybrid rollup (Optimistic and zk mixed Rollup) solution, and the founder has stated that the fee income generated by this network will flow to the FXS token, used for burning or distribution to holding users, and so on.

As of now, the Frax protocol has integrated two stablecoins, FRAX and FPI, the lending Fraxlend, the trading Fraxswap, the cross-chain Fraxferry "DeFi trio," the LSD product frxETH, the RWA product sFRAX and FXB, and the application chain Fraxchain, among other product series.

From the product layout, Frax has gradually developed from a stablecoin to a platform that integrates many applications. Depending on the different forms of product supply, the overall Frax platform can be seen as an asset issuer and asset management platform, issuing stablecoins such as FRAX, frxETH, sFRAX, and building real application scenarios such as lending, DEX, cross-chain bridges, chains, and so on for these assets to develop synergistically.

From stablecoins to the "DeFi trio," LSD, RWA, and the future application chain, Frax's current product line has actually achieved the "Endgame Plan" proposed by MakerDAO ahead of schedule. Unlike MakerDAO, these component products of Frax are all issued by the official team and managed and supported by the official team. In contrast, MakerDAO's final product components are implemented through outsourced SubDAOs, such as the lending protocol Spark Protocol launched by Phoenix Labs.

Therefore, the interaction and interoperability between Frax's products will be smoother, making it easier to build DeFi Lego-like products, and more iterative new products can emerge based on these components. This is why Frax has always been seen as one of the most innovative products by users. However, there are also potential issues. A huge system covering stablecoins, trading systems, lending systems, cross-chain systems, LSD, and the upcoming Fraxchain requires very high governance requirements and needs a very efficient and sound governance module. It is also particularly important to isolate risks between different modules and avoid systemic risks leading to the paralysis of the entire system.

Currently, the issuance of FRAX is $675 million, ranking seventh in the stablecoin market and second in the decentralized stablecoin track, second only to DAI ($3.77 billion).

How Far is FXS from Rising to the Top Five in Market Value?

From the public statements of Frax founder Sam, the goal for FXS is to become one of the top five cryptocurrency assets by market value. How far is it from achieving this goal? Perhaps we can draw some conclusions from the market size and data of Frax's representative products.

Currently, in the Frax product components, the TVL of the stablecoin FRAX protocol is $670 million, the asset value locked in the frxETH LSD product is $510 million, the asset value locked in Fraxswap is $150 million, the TVL in the FraxLend lending application is approximately $240 million, and the asset value in the anti-inflation stablecoin FPI is $93 million.

Therefore, the total locked asset size in the entire Frax product system is close to $1.7 billion, approximately $1.66 billion.

If only measured by the TVL indicator, the asset size managed by Frax is close to that of Curve (with a TVL of $1.8 billion). However, the current circulating market value of the CRV token is $420 million, ranking 93rd, with a fully diluted market value of $1.58 billion, while the circulating market value of the FXS token is $440 million, ranking 91st, with a fully diluted market value of $590 million.

Assuming that both have the same fully diluted market value, FXS still has approximately three times the room for growth. However, their ability to capture fees is not the same. According to the DeFiLlama platform, in the past 30 days, Curve captured fees of $3.78 million, while the stablecoin Frax captured fees of only $1.23 million.

In addition, Frax also has two key performance indicators: stablecoin market share and LSD market share. Although FRAX is the second-largest decentralized stablecoin, its market share in the stablecoin market is only 0.56%, while DAI's share is approximately 3.1%, a difference of 6 times.

Furthermore, in terms of stablecoin scale, FRAX has been heavily impacted by MakerDAO's strong promotion of RWA business, especially when in August of this year, the deposit interest rate (DSR) for DAI in MakerDAO briefly increased to 8%, leading some market participants to switch to holding interest-bearing DAI stablecoins. The DSR for DAI has now decreased to 5%. However, founder Sam has stated that the operating costs of Frax's RWA partner company, FinresPBC, are much lower than those of the competitor MakerDAO. Therefore, in the long run, Frax's RWA business may have long-term competitiveness, helping to expand the market size of the FRAX stablecoin.

In the LSD track, the total amount of ETH locked in frxETH is approximately 280,000, with a value of $5 billion, and its market share in the LSD market is 2.47%.

From the perspective of market share in product market size, it seems that Frax still has a long way to go to become one of the top five cryptocurrency projects by market value, and the possibility of achieving this in the short term is relatively slim. However, Frax has always maintained an innovative attitude and has built a moat for its products, making it a benchmark for the future development of DeFi applications.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。