Today's Headlines:

- Worldcoin to use WLD to reward Orb operators and renew market maker loan agreement

- Reddit crypto community has removed moderators accused of conducting MOON insider trading

- FTX partial debt prices exceed 50%, asset recovery rate may increase

- Yearn Finance has improved the YFI token economic model and introduced a voting lock mechanism

- Web3 security company Blockaid completes $33 million financing, with participation from Sequoia Capital, Ribbit, and others

- Cryptocurrency mining company Bit Digital to enter the field of artificial intelligence by purchasing $35 million worth of GPUs

- CoinShares: Net inflows of digital asset investment products reached $66 million last week, marking the fourth consecutive week of capital inflows

- Data: The first batch of 100 million DOT tokens from Polkadot's crowdloan will be unlocked this week

NFT

Project Updates

Worldcoin to use WLD to reward Orb operators and renew market maker loan agreement

Worldcoin announced on its official blog that during the transition phase after the launch of Worldcoin, Orb operators' rewards were paid in USDC. This transition phase is now nearing its end, and operators will receive rewards in the form of WLD.

In addition, upon the official launch of WLD, World Assets Ltd. (a subsidiary of the Worldcoin Foundation) has signed loan agreements with five market makers operating outside the United States. The purpose of their participation is to ensure sufficient liquidity for WLD traded on platforms outside the United States and to enhance the price stability of WLD. These five entities have collectively received a loan of 100 million WLD, which was originally due on October 24, 2023. However, World Assets Ltd. has decided to extend the initial loan agreement to December 15, 2023, reducing the total loan amount by 75 million WLD while keeping all other terms of the agreement unchanged. Therefore, on October 24, 2023, market makers will return 25 million WLD, the current outstanding loan amount.

FTX partial debt prices exceed 50%, asset recovery rate may increase

According to The Block, Thomas Braziel, a partner at 117 Partners specializing in FTX debt, stated that some off-exchange valuations of FTX debt exceed 50%, indicating that the market currently expects about half of users' assets to be recovered. Braziel mentioned that a debt worth over $20 million was sold at an auction last Friday at approximately 52% of its value, but only the "largest and cleanest" debts could fetch this price.

Enthusiasm around the value of FTX debt has grown since the recent announcement of significant investments by the artificial intelligence company Anthropic, in which FTX had acquired a large stake. Creditors hope that selling Anthropic shares will help return funds to creditors, potentially achieving full recovery.

In a January survey, the majority of respondents expected to recover only 25% of their funds. Since then, FTX's current CEO, John Ray III, has led efforts to recover funds by selling tokens and liquidating other assets.

23pds, Chief Information Security Officer of SlowMist, posted a reminder on X platform that the well-known open-source password manager KeePass has appeared in Google search ads phishing official website. Once users enter the "fake official website," they will download Trojan software. Cryptocurrency users should be vigilant about security risks, and Google has begun addressing this issue after receiving complaints.

Yearn Finance has improved the YFI token economic model and introduced a voting lock mechanism

According to The Defiant, Yearn Finance has made comprehensive improvements to the token economic model and introduced a voting lock mechanism. Stakers can choose to lock their YFI tokens for one week to four years to convert them into non-transferable veYFI tokens. Users can stake vault tokens to earn YFI rewards, which are distributed in the form of dYFI and can be used to redeem YFI tokens at a discounted price.

Holders who commit to staking their YFI for a longer period will enjoy enhanced rewards. While users can flexibly exit their positions before the lock-up period ends, they will face up to a 75% reward penalty. veYFI is now the exclusive voting token for Yearn governance.

Reddit crypto community has removed moderators accused of conducting MOON insider trading

According to CoinDesk, Reddit's r/CryptoCurrency community has removed moderators who announced the end of trading Moon before it was publicly announced.

The r/CryptoCurrency subreddit is currently deliberating on the future of MOON tokens. u/mellon9, a core contributor and founder of MoonsDust, proposed a solution to the issue: "We are deliberating on the future of MOON, waiting for Reddit to decide whether to transfer the contract to us or destroy the address."

Matter Labs proposes to deploy wstETH on the zkSync Era mainnet

Matter Labs recently proposed in the Lido community to deploy wstETH on the zkSync Era mainnet. The proposal aims to give Lido DAO control over the wstETH cross-chain bridge component, and Matter Labs will collaborate with TxFusion to design, implement, and deploy the cross-chain bridge specification between Ethereum and zkSync.

Mining News

According to CoinDesk, cryptocurrency mining company Bit Digital is expanding into AI hash power leasing business by purchasing 132 units of FusionOne HPC from digital infrastructure and service provider xFusion Digital Technologies for approximately $35 million. Each unit contains Nvidia's HGX H100 8-GPU, totaling 1056 GPUs, expected to be delivered by the end of the year. The company anticipates generating annual revenue of at least $23-27 million starting from January 2024 to sustain its current Bitcoin mining and Ethereum staking operations, regardless of market conditions.

Bit Digital reported approximately $9 million in revenue for the second quarter and $32 million for the 2022 fiscal year. The company plans to fund this acquisition through cash, digital assets on its balance sheet, new stock issuance, and potential equipment financing. As of September 30, the company had approximately $20.8 million in cash and $50.7 million in digital assets on its balance sheet. The mining company stated that the revenue generated from its HPC and AI business is 15 times that of Bitcoin mining, calculated per megawatt.

Financing News

According to The Block, Web3 security startup Blockaid, co-founded by two former Israeli military intelligence personnel, has raised $33 million in financing, consisting of a $6 million seed round and a $27 million Series A round. Seed round investors include Sequoia Capital, Greylock Partners, and Cyberstarts. Three investors, along with co-lead investors Ribbit Capital and Variant, participated in the Series A round. Blockaid's seed round concluded at the end of 2022, and the Series A round was completed in less than a year after the seed round.

Blockaid was founded by co-founder and CEO Ido Ben-Natan and his former colleague Raz Niv in September 2022. Both had previously worked in the cybersecurity research team of the Israeli military's 8200 Unit and the Israeli Prime Minister's Office. Ben-Natan declined to comment on the structure and valuation of this financing round, as well as whether any investors have joined Blockaid's board. The company operates in New York and Tel Aviv, currently employing approximately 25 staff members, and is seeking to recruit more cross-functional personnel.

Key Data

A whale buys 3574 ETH again, with a total purchase of 14647 ETH since October 20

According to on-chain analyst Yu Jin's monitoring, a whale address that specializes in ETH breakout markets spent 6 million USDC to buy 3574 ETH in the first 20 minutes. Since 10/20, the whale has spent a total of 24 million USDC to buy 14647 ETH, with an average purchase price of $1638.

Data from makerburn.com shows that MakerDAO added another $50 million in RWA assets through BlockTower Andromeda on October 21. The current total protocol RWA assets are approximately $3.327 billion.

HTX's third-quarter revenue reaches $24.75 million, with approximately 2 million HT tokens burned

HTX released its third-quarter financial report, with total revenue of $24.75 million. Revenue sources include trading fees from spot, futures, and OTC trading, margin loan interest, and withdrawal fees. 20% of the revenue is used for quarterly token burns, totaling approximately 2 million HT tokens. As of October 15, approximately 300 million tokens have been burned. The token burn mechanism aims to increase transparency and community participation.

Data: The first batch of 100 million DOT tokens from Polkadot's crowdloan will be unlocked this week

Subwallet data shows that the first batch of Crowdloan unlocks for Polkadot will unlock approximately 100 million DOT on October 24 at 10:00, worth approximately $396 million.

Additionally, Token Unlocks data shows that this week, the following 6 projects will have token unlocks, totaling approximately $8.8 million:

- Cartesi (CTSI) will unlock approximately 21.43 million tokens on October 23 at 12:00, worth approximately $2.8 million;

- Acala (ACA) will unlock approximately 4.66 million tokens on October 25 at 8:00, worth approximately $220,000;

- Euler (EUL) will unlock approximately 145,000 tokens on October 26 at 10:07, worth approximately $390,000;

- Galxe (GAL) will unlock approximately 586,000 tokens on October 27 at 20:00, worth approximately $686,000;

- Yield Guild Games (YGG) will unlock approximately 12.58 million tokens on October 27 at 22:00, worth approximately $2.96 million;

- SingularityNET (AGIX) will unlock approximately 9.53 million tokens on October 28 at 8:00, worth approximately $1.74 million.

According to Lookonchain monitoring, approximately 10 minutes ago, 2 new wallet addresses withdrew a total of 24,784 TRB ($1.88 million) from OKX and Binance. Over the past three days, a total of 7 new wallet addresses have withdrawn 198,755 TRB ($15.06 million) from exchanges, accounting for 7.83% of the total supply.

According to CoinShares' weekly report, digital asset investment products saw a net inflow of $66 million last week, marking the fourth consecutive week of inflows and bringing the total inflows over the past four weeks to $170 million. With recent price increases, the total assets under management (AuM) have risen by 15% since the low point in early September, reaching nearly $33 billion, the highest level since mid-August.

While the recent inflows may be related to the excitement surrounding the launch of a physically-backed Bitcoin ETF in the United States, the inflows are relatively lower compared to the initial inflows following BlackRock's announcement in June, which totaled $807 million over four weeks. This indicates that despite positive news from Grayscale and the SEC lawsuit ruling, this round of inflows is lower, suggesting a more cautious approach by investors this time.

84% of the inflows went into Bitcoin investment products, totaling $315 million year-to-date. Earlier last week, the rise in Bitcoin prices led to a $23 million inflow into Bitcoin short positions. However, these positions have significantly decreased, with a net inflow of only $1.7 million by the end of last week, indicating waning confidence among short sellers. Continued concerns about Ethereum led to an outflow of $7.4 million, the only outflow for "altcoins" (tokens other than Bitcoin) last week. This contrasts sharply with Solana, which saw an inflow of $15.5 million last week, bringing the year-to-date inflow to $74 million, accounting for 47% of the total assets under management.

PANews APP Points Mall Officially Launched

Free exchange for hardcore prizes: imKeyPro hardware wallet, First Class Research Report monthly card, Ballet REAL series wallet, AICoin membership, various peripherals, and hundreds of selected research report collections. First come, first served, experience now!

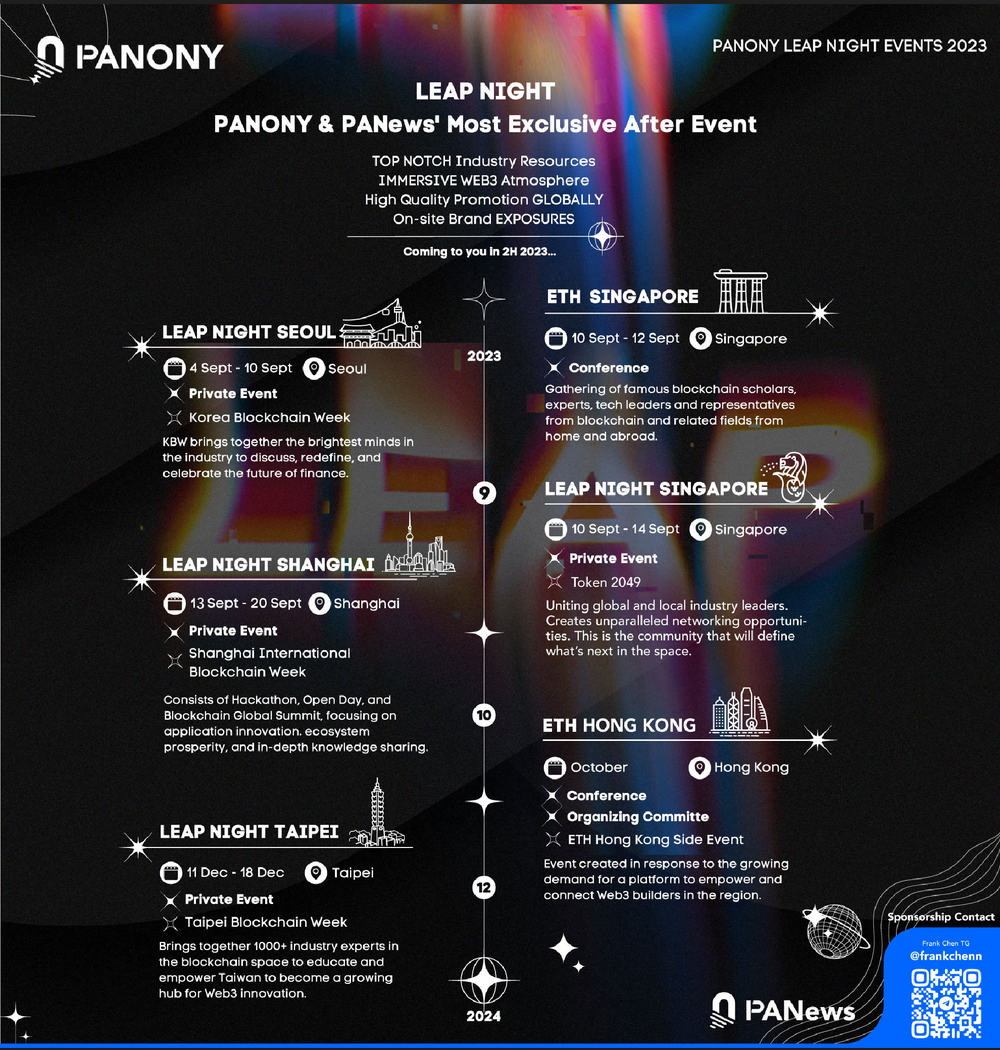

PANews Launches Global LEAP Tour!

South Korea, Singapore, Shanghai, Taipei, multiple locations from September to December to witness a new chapter in globalization!

?Events in multiple locations are being planned, welcome to communicate!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。