Source: Chain Catcher

Author: Mrs Watanabe

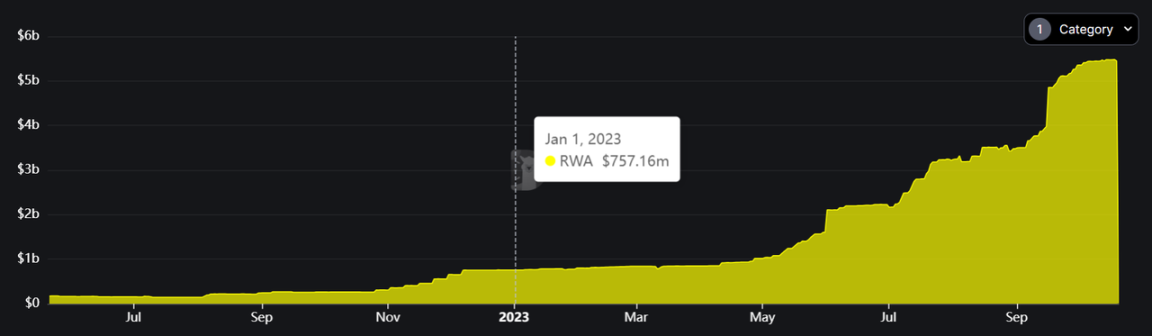

Recently, the discussion and attention on RWA in the market has been continuously increasing. Many well-known large institutions have also entered this field, indicating that RWA may become the next market trend. In fact, the data also proves the popularity of RWA. This year, RWA has become the fastest-growing track in the cryptocurrency field, with a staggering total locked value (TVL) growth rate of 653%. As of October, RWA has become the sixth largest category in Defi, with a total TVL of up to $57 billion. In addition, the number of RWA token holders is also steadily increasing. Currently, the number of RWA token holders has exceeded 45,000, nearly doubling compared to last year.

RWA Data Growth

So, what exactly are RWA assets? What is their current development status? And what are the most representative projects in this field? The following will introduce them one by one.

I. RWA assets are supported by corresponding real-world assets and are fully recorded on the chain

Real-world assets (RWA) refer to tangible and intangible assets in the physical world (such as real estate, bonds, commodities, etc.). The tokenization of RWA brings these off-chain assets onto the blockchain, opening up new possibilities and potential use cases. Tokenized RWA can be stored and traced on the chain, thereby improving efficiency and transparency, while reducing the possibility of human errors.

With the rapid rise of the RWA field, various projects have emerged like mushrooms after rain. Currently, more than 20 projects have successfully launched and operated, with countless more projects set to launch.

However, RWA projects differ from traditional crypto projects. Firstly, behind RWA projects are real underlying asset support. To ensure the authenticity and legitimacy of the assets, every tokenization of RWA assets must meet two core elements: representation and ownership, and both of these elements must be recorded on the chain.

Representation means that the assets must be real and cannot be imaginary. In addition, other details of the assets, such as whether they exist physically, whether they will expire, and who the actual holders are, need to be clearly defined and recorded.

Ownership concerns the legal ownership of the assets. This means that the ownership of the assets must be written onto the chain through legal means, ensuring consensus among the asset holders and providing a mechanism for resolving potential disputes.

II. Constraints faced by the development of RWA assets: Incompatibility with traditional financial regulations

Although the RWA field is developing rapidly, it is still in the exploratory stage, and industry standards have not yet fully formed.

Looking back to the 1990s, the U.S. credit market began the securitization process, packaging various assets through a standard called CUSIPs. This standard could reflect the potential risks of the assets, but could not fully reflect the ownership of the assets. Now, decentralized ledger technology provides a possible solution, becoming the core support for RWA crypto projects.

However, the current problem is that RWA projects still cannot perfectly reflect the risks of the assets, nor can they effectively resolve disputes caused by asset risks. When disputes arise in the crypto world today, most issues still need to be resolved through legal means.

In this context, the current exploration directions of RWA mainly include: gradually recognizing the asset tokens of RWA as legitimate underlying assets in various countries and protecting them through existing legal systems. For example, a series of measures recently taken in Hong Kong seem to be heading in this direction; project parties directly encode assets and protection measures into smart contracts, providing stronger protection within the existing legal framework. This seems to be the development direction in North America in the absence of clear regulations.

Overall, although the current RWA market size is relatively small, compared to traditional finance, its advantages in on-chain clearing and regulation have not yet fully emerged. But as the market size expands and traditional financial institutions gradually understand new technologies, the advantages of new technologies will gradually become apparent.

III. Tokenized Asset Consortium (TAC) emerges to promote RWA assets

On September 7th, Coinbase, Circle, Aave, and other members including Base, Centrifuge, Credix, Goldfinch, and RWA.xyz jointly launched the Tokenized Asset Consortium (TAC). The consortium believes that the tokenization of RWA is the future of the crypto industry, and it is committed to promoting the popularity of RWA globally.

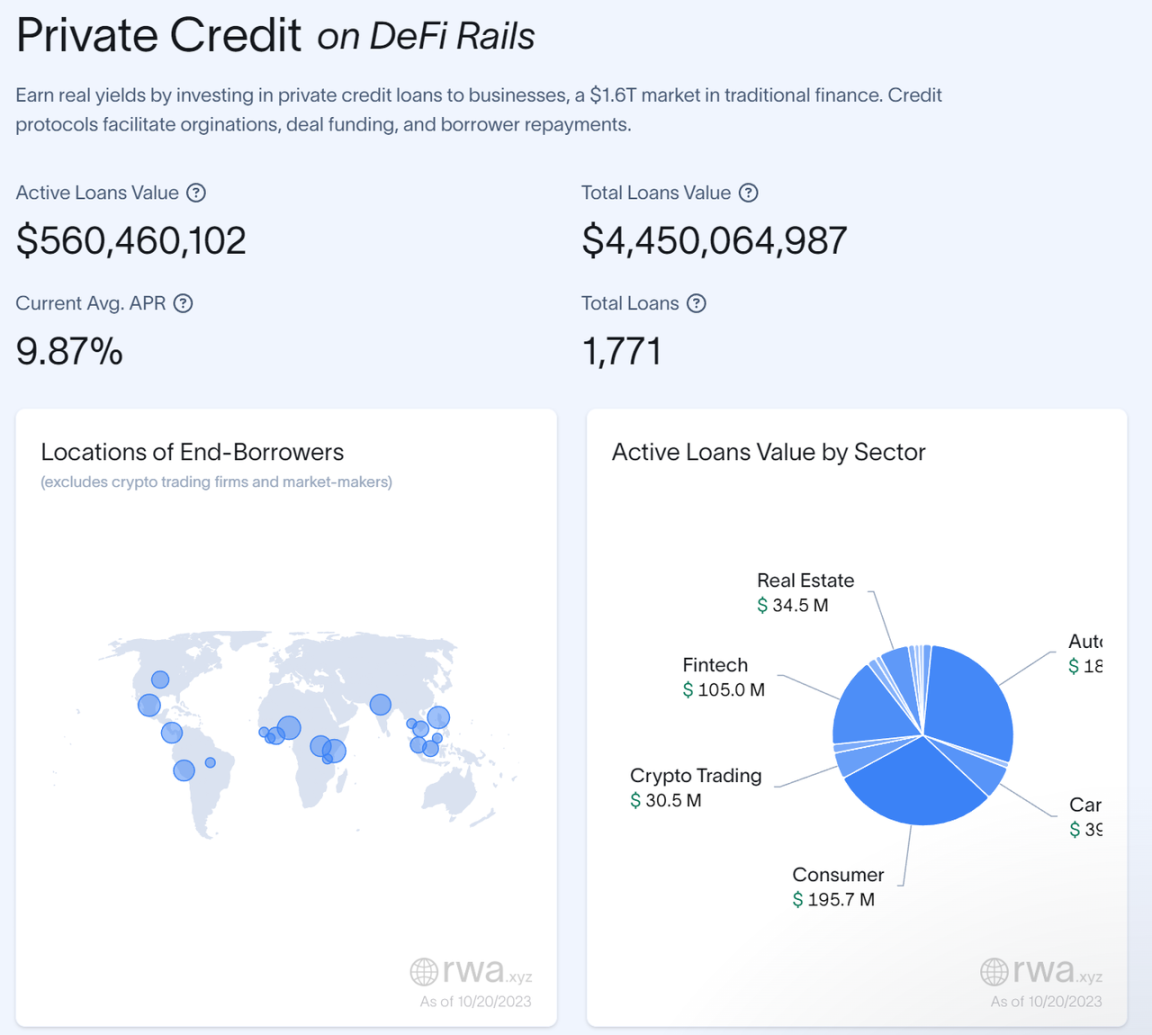

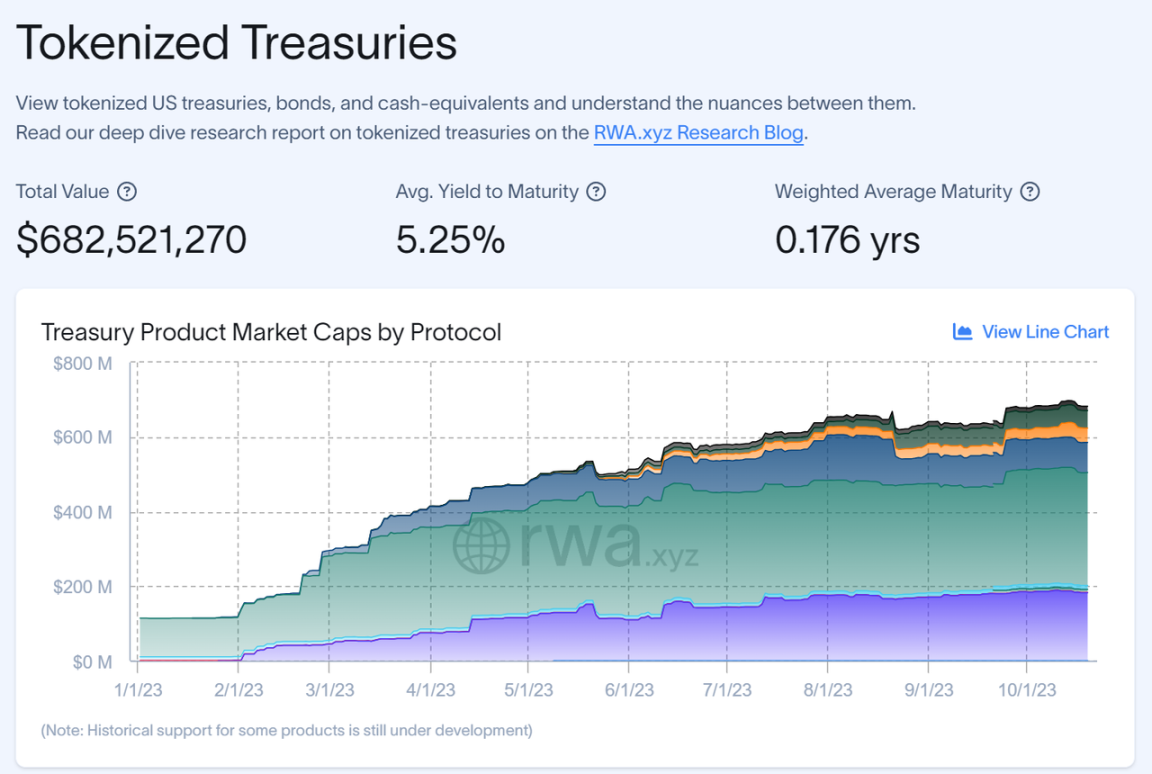

RWA Data Dashboard

According to the tokenized asset dashboard provided by TAC, among the current types of defi tokenized assets, the TVL of private credit reaches $4.4 billion, with an APR as high as 9.87%;

The TVL of U.S. Treasury bonds reaches $600 million, with an APY of 5.25%

In addition to creating educational content and building necessary infrastructure to bring different types of assets onto the chain, the consortium is also considering formulating relevant and compliant principles to promote the adoption of blockchain technology.

Lucas Vogelsang, the founder of Centrifuge, stated: "Through TAC, we are trying to build a market or an entire ecosystem. The more we can standardize and cooperate, the faster the entire industry will reach escape velocity and truly be competitive."

Regarding how real-world assets will be standardized, Lucas said: "I think KYC will become one of the standardizations that will appear sooner or later. Today's KYC credentials are not truly portable, and real-world asset DeFi must undergo KYC. We must figure out how we can practically collaborate in this regard."

Next, we will delve into some of the currently popular RWA projects.

IV. Overview of Representative RWA Projects: MakerDao, Pendle, Ondo Finance, Frax, TrueFi

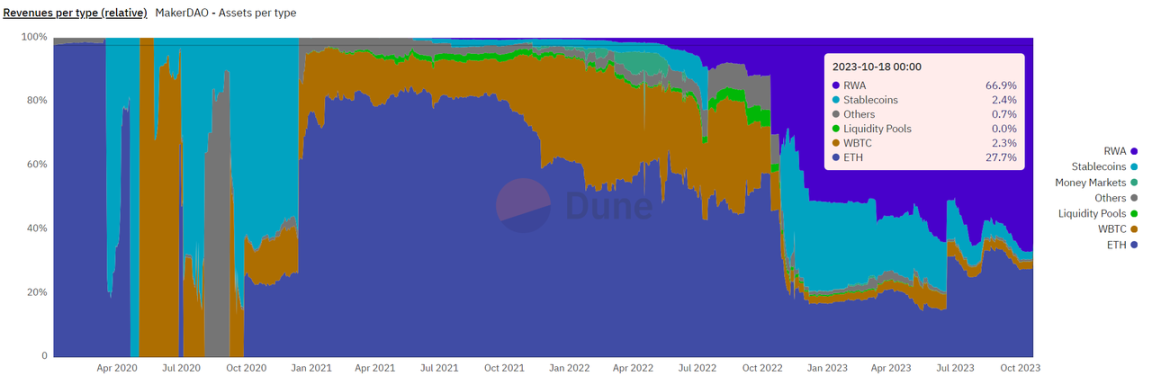

MakerDao is currently the leader in the RWA field and is also the second-ranked Defi project in terms of TVL. Its RWA business has reached a TVL of $3.2 billion, with a growth rate of 400% this year. In March of this year, founder RuneKek proposed the "Endgame" plan, aiming to increase platform revenue through investments in real-world assets and money market funds. Currently, 46% of $DAI is backed by RWA as reserve assets, and 66.9% of Maker DAO's protocol revenue comes from RWA.

MakerDao Protocol Revenue Distribution

Pendle is an LSDFi protocol that received much attention in the first half of this year. In August, it received investment from BinanceLabs, and subsequently announced the integration of two RWA protocols, sDAI from Maker DAO and fUSDC from Flux Finance, into its core product Pendle Earn. Pendle's co-founder and CEO TN Lee stated that RWA has entered the DeFi field, and Pendle can provide users with various traditional financial tools, such as interest rate derivatives, swaps, and fixed income, to help them manage their income.

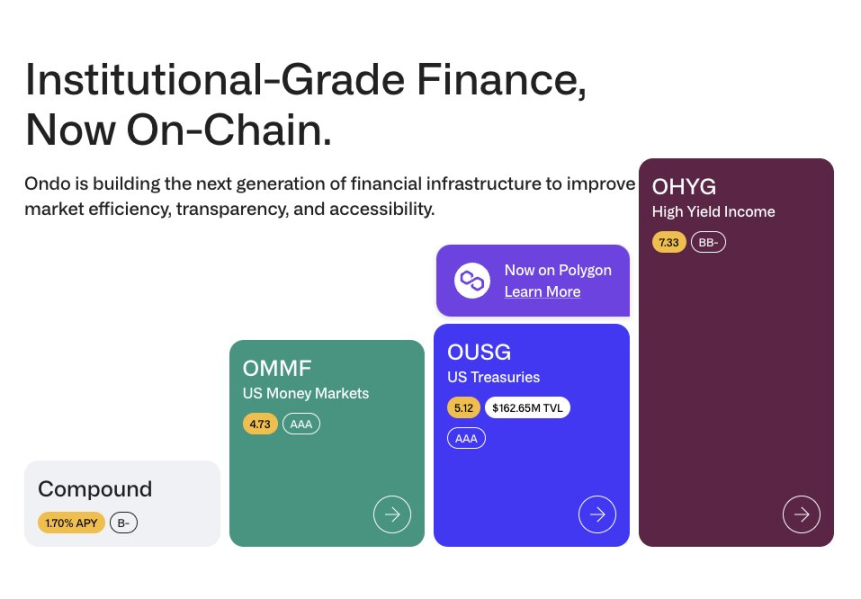

Ondo Finance is the top-ranked tokenized securities Defi protocol. Its investment in the U.S. money market OMMF has an annualized return of 4.7%, while the return on U.S. Treasury bonds OUSG can reach 5.5%.

Official Website Screenshot

On October 12th, Frax released FraxV3, allowing users to earn real-world bond yields on-chain through sFrax and FBX. sFrax converts underlying collateral into various RWAs through AMO to generate income. Users can earn weekly $FRAX rewards by staking Frax, with an initial annualized yield of up to 10%. FXB is an on-chain zero-coupon bond that users can purchase at a discount and redeem for FRAX at face value after a certain period to generate returns. Within one day of the launch of FraxV3, over 150 users have staked over $35 million in the sFRAX collateral pool, with a total staked amount of over 11 million sFRAX.

Maple Finance is a B2C on-chain lending platform, ranking first in TVL in uncollateralized loan protocols. Users can lend funds to Web3 institutions such as market makers or asset management platforms and earn returns ranging from 4% to 14%.

TrueFi is a primarily B2B uncollateralized credit platform. It employs an innovative mechanism to connect borrowers, lenders, and professional credit assessment through smart contracts. Currently, only institutions can borrow on the platform, and after credit assessment by the protocol's internal committee, approval is decided by $TRU token holders. It recently launched a U.S. Treasury fund, but the minimum purchase amount is $100,000, making it relatively high in terms of entry barriers.

V. Conclusion: RWA is Initiating a Crucial Experiment in the Integration of Crypto and Reality

The RWA field, as the intersection of fintech and traditional assets, is at a crucial stage of development. Although its market share is still limited at present, its true potential and advantages compared to traditional financial systems have not been fully realized. However, it is clear that this situation is changing with technological advancements and market maturity.

Traditional financial institutions are gradually recognizing the value of blockchain and decentralized technology, creating favorable conditions for the further development of RWA. We have reason to believe that over time, RWA will better integrate traditional finance and blockchain technology, bringing unprecedented opportunities and value to investors and market participants. Let us look forward to RWA bringing more changes and breakthroughs to the entire financial industry in the future.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。