Original | Odaily Planet Daily

Author | How about husband

Editor | Hao Fangzhou

Can GameFi be one of the breakout points for the next bull market? This answer may be found on Bigtime.

As a product of the last bull market, Bigtime officially launched in 2021, went online for internal testing in April 2022, and after a year and a half of polishing, officially opened the preseason version on October 10th this year. After nearly 3 years, the launch of Bigtime can be said to be highly anticipated.

As a Web3 MMORPG game, Bigtime attracted a lot of attention at its launch due to the luxurious lineup of the team, raising nearly $20 million. The early NFT sales also received support from the majority of users, with a total of over 70 million USDT raised (conservatively calculated). From the perspective of game development and operation, Bigtime has sufficient funds, with a total fundraising and NFT sales of nearly $100 million.

Looking at the team, the team members have outstanding resumes, mostly from large game companies such as League of Legends and Fortnite.

However, in the past week, the sentiment towards Bigtime has shifted from Fomo dominance to gradually cooling down. What happened in just 8 days?

In the following text, Odaily Planet Daily will elaborate on the gameplay, investment and output, and the problems encountered by Bigtime, and judge whether there is still an entry opportunity.

Bigtime Game Mechanism and Token Supply

As an MMORPG game, the overall game mechanism design of Bigtime is similar to Web2 games, with the overall idea being to upgrade and fight monsters. As a Web3 game, the focus is not so much on how well Bigtime's game is made, but more on the adaptability of the game mechanism and token economy.

Therefore, we will first focus on introducing the gold-making gameplay of Bigtime.

Players need to equip NFT items called Time Hourglasses to fight monsters and earn Bigtime tokens, and the Time Hourglasses need to be charged. In addition to purchasing pre-charged Time Hourglasses on the NFT market, players can also purchase Space+Time Guardians to be self-sufficient.

This also involves another in-game currency, "Time Crystals," which can be purchased from the official source in the game and are used for certain high-level dungeon requirements and to accelerate the charging of Time Guardians.

At different times, the cost of NFTs varies, and the optimal gold-making configuration strategy also varies. From the gold-making mechanism and the timeline of the past 7 days:

In the early days of the server, the minimum gold-making standard is 1 Space + 5 hourglasses + one Time Guardian + a certain amount of Time Crystals, totaling 300 USDT. For experienced players, combining the coin price and NFT market prices of these two days, they can break even and make a profit in one day. New players may need about 2-3 days.

In the middle stage, due to the project team lowering the dungeon drop rate and increasing the cost of charging, the entry players at this time have a significantly extended breakeven period due to the high NFT cost and the daily gold-making efficiency not meeting expectations. However, this has led to the emergence of new ecosystem participants, with many large holders of Time Guardians that can operate as charging stations for the hourglasses. This reduces the entry cost for new players. For example, buying pre-charged hourglasses on the NFT market, although the profits are much lower, there is still money to be made.

As of now, the side effects of the official mechanism adjustments are becoming more and more apparent, especially on October 17th, when it was suspected that dungeons were created due to bugs, allowing players to quickly earn tokens. The official has once again lowered the dungeon drop rate, and this issue has been fixed.

The above introduction to the game mechanism and entry cost affects the token supply of Bigtime. Looking at the core pain points of GameFi in general - token demand:

The token demand of Bigtime mainly comes from skins. Synthesizing NFT skins requires a large amount of tokens. So where does the value of the skins come from?

Friends familiar with traditional online games must be very clear that skins are a social tool for big players to show off. Most of the skins in Bigtime also serve this purpose, without providing additional in-game values. But they do have some additional uses, such as the entry threshold for the Honor Dungeon (high-level dungeon) and the unique competition for skins.

Overall, the token demand of Bigtime, as it stands now, is not strong. The official mainly maintains the long-term operation of the game by suppressing the supply side.

Player Earnings and Game Appeal Decline Together

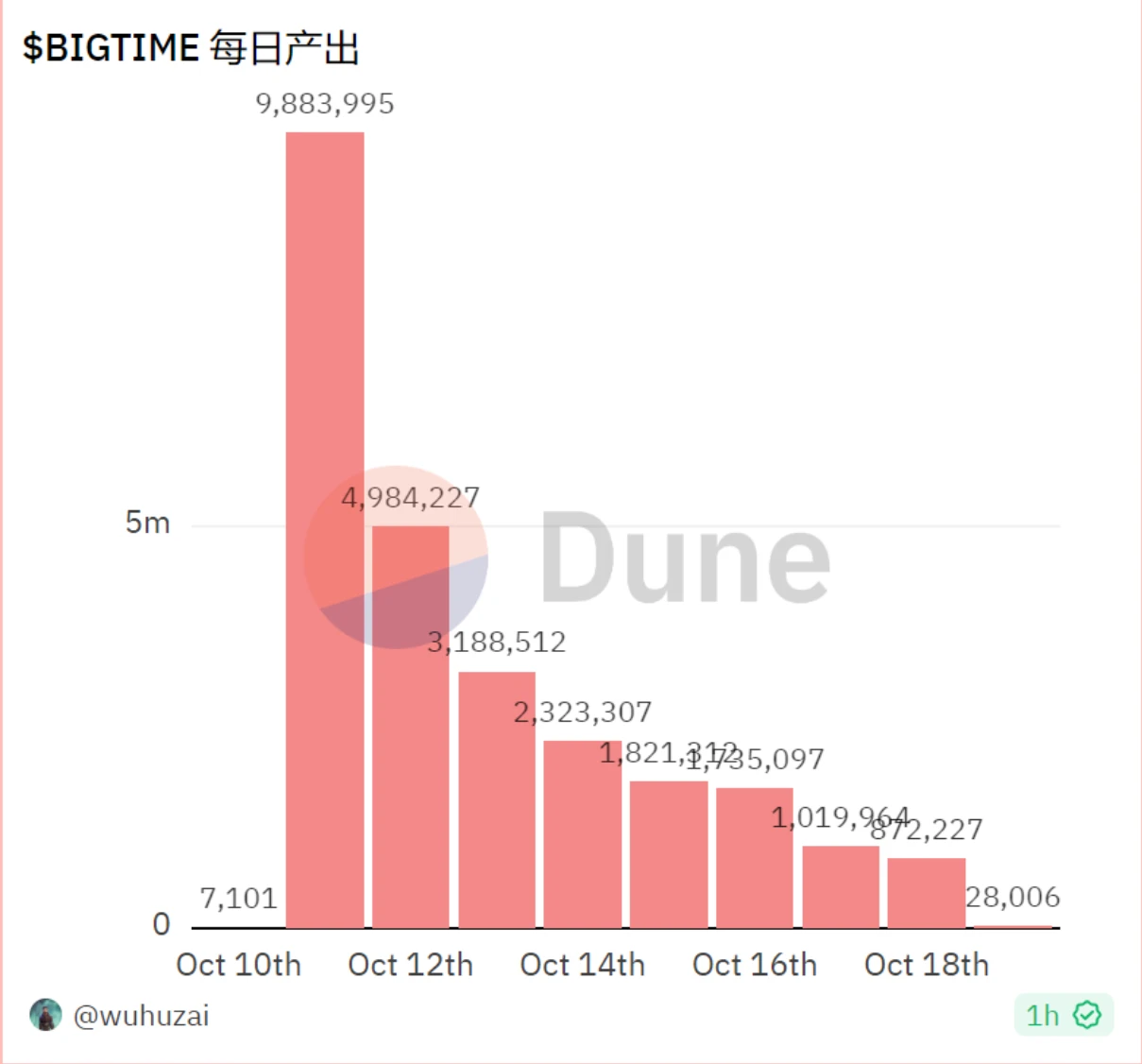

Before the preseason started on October 10th, the Bigtime version had been updated to V 0.28 on October 6th, and some internal testing players were already able to earn Bigtime tokens, with an estimated daily output of over 3000 tokens. In nearly four days, the specific amount of tokens produced, the official stated in an AMA that the "total amount has not been counted." The total output on the 11th was nearly 10 million, and it is not known whether this includes the gold-making volume of the early internal testing players.

Although there were players who hoarded coins by gold-making before the preseason of Bigtime, it seems that it did not cause much selling pressure on the market from the early development of the Bigtime preseason.

Gold-making Efficiency

According to feedback from the community players, the daily output per account was nearly 3000 tokens on the first day, but after the project team made multiple adjustments to the dungeon token drop rate, the daily gold-making output decreased day by day.

According to the statistics of Bigtime token daily gold-making volume by wuhuzai in Dune, as shown in the following figure:

From the official perspective, since Bigtime tokens were not pre-sold, the source of token production comes from in-game gold-making, and reasonable control helps to extend the game's lifespan and increase daily activity.

From the player's perspective, the reduction in dungeon drop rates has extended the breakeven period for most players. The project team's autonomous control is overly centralized.

The above issues regarding gold-making output rate are the superficial reasons for the decline in the popularity of Bigtime, and the extended breakeven period affects the enthusiasm of new players. Even the previous invitation links required off-chain purchases, and now they are distributed for free, but the number of new players is growing slowly.

Early on, Bigtime attracted players by offering high token drop rates, and then limited the number of new players through invitation codes, triggering FOMO sentiment.

Bigtime Token Price

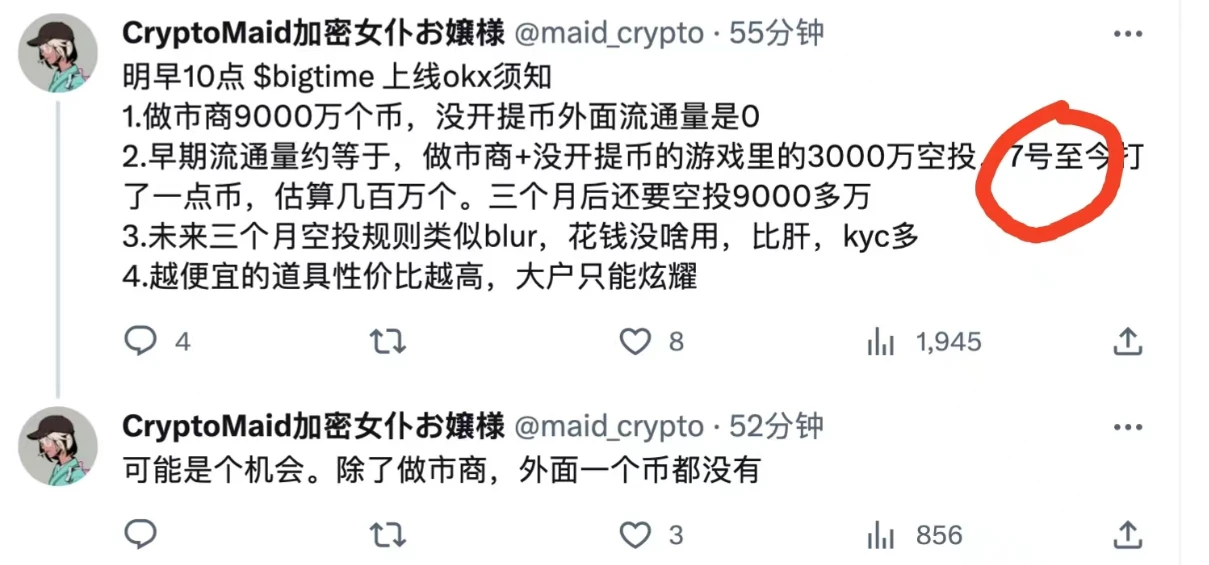

As a recent focus project in the GameFi field, Bigtime has been sought after by many top exchanges. Bigtime tokens were first listed on OKX on October 11th, followed by Coinbase on the 12th, and although Binance did not list spot trading, it opened a futures channel.

Looking at the price trend of Bigtime in the following figure, the initial price was 0.01 USDT, and it rose to a high of 0.34 USDT.

In addition to the listing on exchanges as a reason for the price boost, the overall circulation is also relatively low, which is one of the reasons for the initial price increase. Early token selling pressure was low, and the airdrop volume of internal testing players and the gold-making volume in the first few days before the server opened were not high compared to the circulation ratio.

As of today, according to Dune statistics and Coingecko data, the total output of Bigtime tokens is about 25 million, and the total circulation is about 150 million.

The above discussion about the price of Bigtime tokens indicates that the initial price increase and high gold-making efficiency had a similar effect, drawing attention to Bigtime. However, the decrease in gold-making efficiency led to a decline in the token price, causing rationality to gradually return to players or token buyers outside the game, leading them to take a more calm and cautious approach to the development of Bigtime, rather than blindly following the trend.

The entry opportunity has been missed, so where is the new timing?

As of now, according to observations by Odaily Planet Daily, users who have made money through Bigtime can be divided into three categories: gold-making players on the day of the server opening and before, players who hoarded NFTs before the server opening, and short-term speculators who bought tokens after the listing on OKX.

Do users who have not yet entered Bigtime still have a chance?

We can consider four possibilities:

- The official increases the token drop rate, shortening the breakeven period for gold-making.

- The token price rises, which also shortens the period.

- The entry barrier is lowered, the NFT market falls, costs decrease, and the period is also shortened.

- The demand for tokens is increased, providing more utility for the tokens.

The first three possibilities are short-term effects related to gold-making players, and only by attracting new users can the hype be sustained. However, the core point is to increase the demand for tokens, which will drive supply growth. Given the current situation of Bigtime, it is probably difficult to achieve.

One fact that blockchain game players often overlook is that Bigtime, as a project nominally developed by a US entity, needs to comply with regulatory requirements in its operation. To some extent, Bigtime is wearing a Web3 facade (token economy) but fundamentally operates in a Web2 mode. Although assets are on-chain, the asset drop rate is controlled by the team dynamically, and the project's revenue comes from NFT sales and recharging time crystals, combining Web2 charging models with Web3 entry barriers.

Currently, the functional mechanism of time crystals has led to the pain point of insufficient demand for Bigtime tokens. Suppose Bigtime abandons time crystals and gives the Bigtime token the function of accelerating charging, to some extent, this could increase the demand for the token.

Overall, the launch of Bigtime has given us a basic concept of the 3A masterpiece of GameFi, although it has some flaws, the road ahead is gradually becoming clear.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。