Author: Haotian

Last night, Lightning Labs released the Taproot Assets mainnet alpha version, which means that stablecoins and other assets can now be built on the Bitcoin network. These assets are completely controlled by the programmable features of Bitcoin Script, decentralized, and ultimately applied through the Lightning Network. At first glance, it seems that Bitcoin has ushered in a true BRC20 era?

So, what is the technical implementation logic of Taproot Assets? How does it differ from BRC20 on Ordinals? Will it bring about another wave of new BRC20 token issuance? Next, let's try to objectively interpret these questions.

Technical Implementation Logic

In my previous article introducing BitVM, I explained the limited but achievable programming capabilities of Bitcoin, which involve writing "simple code" in the Script of a Taproot address and using it as a spending condition instruction for UTXO.

In the context of asset issuance for Taproot Assets, this simple set of opcodes can be specified for token issuance total, issuance time, issuance recipients, etc., and can be linked to a set of multi-signature addresses to collectively trigger these opcodes. For example, if a user at address A generates a multi-signature address B and plans to issue 10,000 USDT to address C using address B, then address A can be considered the project owner of the USDT asset on Bitcoin, and address C becomes the first recipient of the USDT.

The successful issuance of the token requires a signature trigger from address A, and subsequently, if address C wants to transfer the asset to other addresses, it also requires a signature trigger from address A. You might wonder, if address C needs to distribute the token to thousands of addresses, does it have to wait in line for a signature from address A? This is where the key lies. Address C, as the recipient of the asset, is usually deployed on the Lightning Network, allowing for efficient, low-cost, and frequent interactions between the two addresses that have established bidirectional channels.

Originally, the Lightning Network only supported point-to-point scenarios, but the new Taproot Asset has implemented point-to-multi functionality, supporting the forwarding of a payment to multiple receiving addresses within a transaction channel, and the script can transfer assets to multiple addresses based on conditions. This allows the token issued to address C to be distributed to a large number of addresses using the Lightning Network, ultimately achieving decentralized ownership of the asset. This technical implementation logic of issuing tokens using the Bitcoin network has been successfully demonstrated.

Moreover, address C can be managed by Lightning Network relay nodes, which can execute accounting based on rules. Similar addresses can be managed by different relay nodes to distribute their assets (for example, the owner can give their USDT tokens to 10 relay nodes for distribution, with each distribution node acting as a hot wallet address for a CEX, and they can then manage secondary distribution and accounting).

In this logic, the collective action of the project owner, issuance condition addresses, recipient addresses, multi-signature trigger control, efficient and trustworthy distribution network, and other necessary components results in the emergence of a decentralized asset issuance, management, and distribution accounting system.

"True" or "False" BRC20?

The BRC20 logic on Ordinals involves embedding JSON data packets in the script, writing parameters such as Mint and Transfer in the data packet to define asset circulation rules, and ultimately leaving the interpretation to the third-party Ordinals protocol. Throughout the process, the Bitcoin network merely serves as a data memorandum and does not participate in verification calculations, nor does it determine ownership disputes over assets. Furthermore, there may be bugs in handling transfer logic, and users become the main force behind asset minting and transfers, with no project owner, no empowerment, and a lack of liquidity.

In contrast, the discovery of multiple assets on Taproot Assets appears to be more advanced and sophisticated. It involves a project owner, and asset issuance and destruction can be determined by the "True" or "False" opcodes in the script. The subsequent circulation of assets is supported by the trustworthy technology of the Lightning Network, which is itself a high-frequency circulation application. While not absolute, compared to Ordinals, the multi-asset network supported by Taproot Assets seems more like the "new" token standard that geeks have in mind. (Note: This distinction is based on technical logic differences, and market factors such as speculative logic and scarcity-driven profitability are not within the scope of this discussion.)

New BRC20 Token Issuance Craze?

Perhaps, at this moment, many people are imagining that since true BRC20 tokens have arrived, theoretically, the previous prosperity on Ordinals can be replicated. In theory, it can, but personally, I believe that the systemic engineering of Taproot Assets is relatively strong, and the establishment of a complete project is not so easy because of its multi-signature system, issuance transfer logic, especially the operation and maintenance of point-to-multi accounting management on the Lightning Network, which involves significant costs and barriers. Unlike on Ordinals, where issuing a token only requires one transaction, so replicating the BRC20 hot trend is more difficult. On the contrary, the Lightning Network is naturally suitable for high-frequency consumption, so the best tokens to be issued using Taproot Assets are stablecoins like USDT and USDC.

Clearly, the Lightning Network has also emphasized the use of stablecoins. As for other project owners who insist on deploying other tokens on Bitcoin instead of using the more advanced Ethereum EVM smart contracts, it is not impossible, as long as the project owner is willing and the market is willing to accept it, anything is possible. Following the inherent conditions of the Lightning Network payment scenario, the only vision I can think of is that tokens suitable for payment will thrive in this environment, while it would be odd to play with POS staking tokens in this way. (If there are any, various play methods such as DEX, lending, derivatives, etc., can also be implemented, depending on whether anyone is willing to implement them at a high cost.)

Above all.

To be honest, I prefer to describe Taproot Assets as the era of multi-assets on Bitcoin, rather than calling it BRC20 just for the sake of convenience and to highlight its innovation. Moreover, whether the market will hype up Taproot Assets remains to be seen, although it possesses the qualities and conditions for it. However, regardless of whether the market hypes up Taproot Assets, there are two visions worth looking forward to:

1) Stablecoins like USDT will retest the waters of the Bitcoin network and will become mainstream in the Lightning Network application scenario. Whether they can reclaim the stablecoin dominance of TRON's BitTorrent is worth expecting.

2) The Lightning Network's accompanying wallet application popularity, offline consumption payment channels, and other data will experience a wave of growth, which will be a turning point for the Lightning Network. Whether it will have a stimulating effect on potential Nostr-related social platforms remains to be seen.

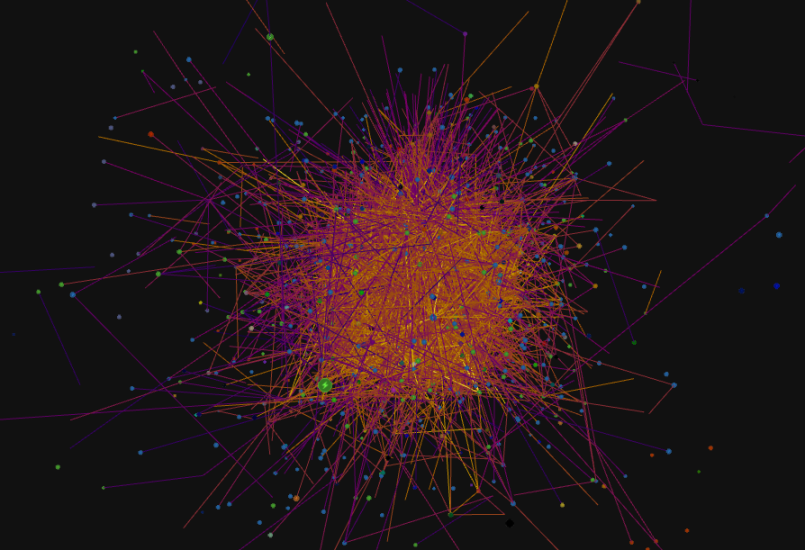

Note: The image shows the global distribution of current Lightning Network channels.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。