By Octopus

Produced by Gyro Finance

After a long silence, Bitmain caused a heated discussion in the industry due to an announcement of delayed salary payment. In the bear market, can Bitmain, once the leader, also not withstand the cash flow pressure?

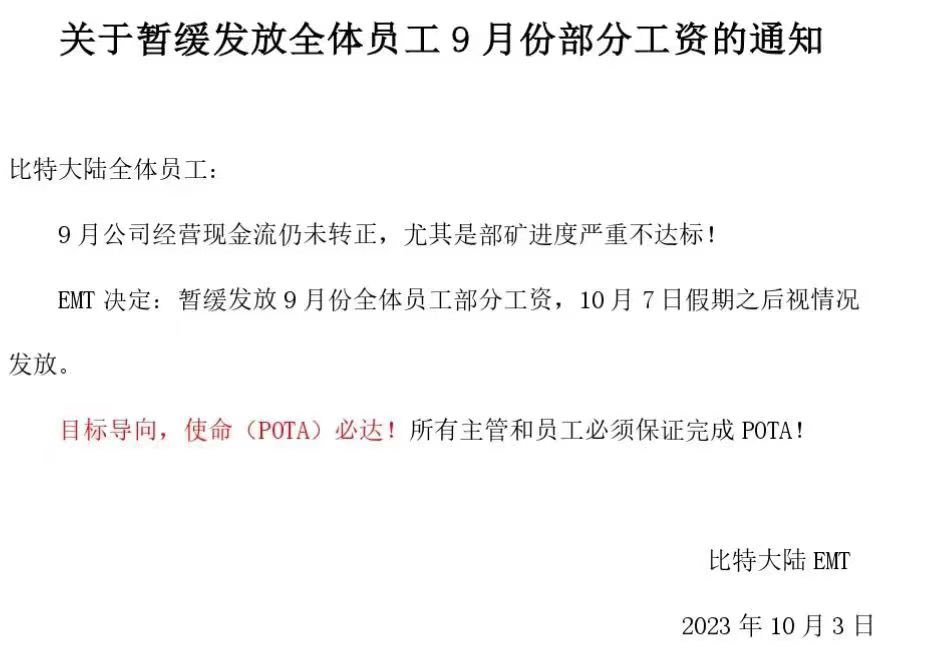

According to Wu Shuo Blockchain News, multiple internal employees of Bitmain confirmed that Bitmain issued a notice: the company's operating cash flow in September has not turned positive, especially the progress of the mining machine deployment in the mine is seriously below standard. EMT has decided to temporarily withhold part of the September salaries for all employees, and the situation will be assessed after the holiday on October 7th. Multiple employees revealed that all performance-based salaries for September were fully deducted, and basic salaries were also halved, with no indication of when the deducted salaries will be paid. As of October 8th, the employees have not received the unpaid salaries, and the year-end bonus for 2022 has not been paid to date.

Source: Wu Shuo Blockchain News

Bitmain once monopolized over 70% of the global Bitcoin mining machine market share, but later suffered a major blow due to the "internal struggle" between the two co-founders, Wu Jihan and Zhan Ketuan. In the first quarter of this year, Bitmain implemented a structural reform of employee compensation, adding "age points" to performance assessments. The older the age above the benchmark age, the more points are deducted. Bitmain employees stated that in the latest compensation adjustment plan, the original fixed salary was adjusted to a basic salary + performance-based salary, and the performance-based salary is linked to job levels, with the performance-based salary ratios for T3x, T4x, and T5x job levels being 30%, 50%, and 70% respectively.

The announcement of delayed salary payment came very suddenly. Just last month, Bitmain held a highly anticipated event in Hong Kong and launched its latest product, the S21 mining machine. At that time, the prevailing sentiment was that Bitmain was making a comeback, so the timing of this announcement is understandably worrisome.

01. The tumultuous path to going public

Since the internal struggle, Bitmain, like a deflated balloon, has lost its former dominance. In addition to the rumored funding chain issue, the difficult path to going public has also hindered the company's further development.

Among the three industry giants, Bitmain, Canaan Inc., and Ebang International, all attempted IPOs in Hong Kong but failed. Canaan Inc. and Ebang International successfully listed on the Nasdaq after failing to go public in Hong Kong, with the former listing in November 2019 and the latter on June 26, 2020. As the mining giant, Bitmain has been seeking a listing in the U.S., but internal power struggles have repeatedly delayed its listing plans.

Bitmain was the last of the three mining machine giants to announce an IPO plan. Previously, Bitmain was expected to submit an IPO application to the Hong Kong Stock Exchange in July 2018, with plans to raise at least $3 billion. The listing application was supposed to be submitted by the end of August that year. Before the news of the listing plan was exposed, Bitmain conducted pre-IPO financing, and related PPTs began to circulate online.

According to the financing PPT at the time, Bitmain's mining machines accounted for over 70% of the market share, the company's mining pool computing power exceeded 50% of the entire Bitcoin network computing power, and the total profit for the past 9 quarters was $3.2 billion, with a revenue of $2 billion in the first quarter of 2018, earning it the title of "mining giant" in the market. Rumors about Bitmain's valuation of $50 billion and $30 billion were rampant online.

Doubts began to spread, mainly from two aspects: the mining machine business and the fork plan.

According to public data, mining machine revenue accounted for over 90% of Bitmain's total revenue, but it has been technologically stagnant since 2016. In the past, Bitmain's S1, S2, and S9 machines brought surprises to the market. The S9, launched in 2015, used 16nm technology with a power consumption of 110 W/Thash, giving it a 25% power consumption advantage over its competitors at the time and sold out immediately. However, after the S9, Bitmain did not release any remarkable new products.

The V9 mining machine, launched in June 2018, had high power consumption and low computing power and has been discontinued. Its upgraded version, the S9i mining machine, still used 16nm technology, while its competitor, Canaan Inc., released the 7nm Avalon A9 series in the same period. According to Bitmain's pre-IPO fundraising documents, the company's mining machine inventory, including V9 and S9, amounted to $1.2 billion. However, new mining machines had yet to be released, casting a shadow over its future revenue-generating capabilities.

In addition, according to an internal investment report from IDG Capital in 2018, Bitmain had used most of the company's profits to purchase BCH, totaling $2.5 billion. BCH stemmed from Bitmain's Bitcoin hard fork plan, officially putting Bitmain at odds with the market. Data shows that BCH's user base is 3%-10% of Bitcoin's, with a value not exceeding 20% of BTC.

Because of this hard fork, while the outcome of the IPO fundraising was still uncertain, mining machines remained the main source of funding for Bitmain's support of BCH. If Bitmain's IPO application were to continue, the most powerful response to the market would be a truly significant technological upgrade product. However, the newly released S21 mining machine does not seem to meet the standard for a major upgrade.

02. Cryptocurrency mining industry in a slump

It's not just Bitmain; other leading mining companies are also deeply mired in declining revenue.

Earlier, Ebang International announced its performance for the first six months of the 2023 fiscal year. The data shows that Ebang International achieved a revenue of $4.09 million in the first half of this year, a decrease of 83.69% from $25.06 million in the same period in 2022; a gross profit of $990,000, compared to a gross profit of $14.24 million in the same period in 2022; and a net loss of $8.38 million, compared to a net loss of $10.92 million in the same period in 2022.

Jiangnan Technology released its financial report for the fourth quarter of 2022 and the full year. The data shows that the company's total revenue for 2022 was 4.3789 billion yuan, a 12.2% decrease year-on-year; and the gross profit was 1.7479 billion yuan. In order to increase sales volume, Jiangnan Technology reduced product prices, which weakened its profitability. In the cold winter of virtual currency, the effect of boosting sales was also very limited.

Since last year, with the decline in Bitcoin prices and the rise in energy costs, mining profits have continued to shrink, plunging the entire cryptocurrency mining industry into a difficult environment, leading to a more than 80% drop in mining machine prices.

The outbreak of the Russia-Ukraine conflict led to Russia cutting off its natural gas supply to Europe, forcing countries to seek alternative energy sources. Data from the European Energy Exchange shows that the price of electricity contracts delivered in the first quarter of 2022 was €184.62 per megawatt-hour. After the escalation of the Russia-Ukraine conflict, the price of electricity contracts delivered in the third quarter of 2022 soared to €375.75 per megawatt-hour, nearly three times the price in the same period in 2021 (€97.14 per megawatt-hour). The sharp increase in global electricity costs has put a heavy burden on mining companies, which are heavy electricity consumers.

The decline in Bitcoin prices cannot be ignored either. According to CoinMarketCap data, as of the close on October 10th, the price of Bitcoin was $27,600 per coin. This price is a 57.36% drop from the peak of $64,800 per coin in November 2021. On August 18th this year, the price of Bitcoin once experienced a flash crash, dropping from $28,600 per coin the previous day to a low of $25,200 per coin, a drop of over 11%.

The rise in electricity costs and the decline in Bitcoin prices are bound to affect miners' enthusiasm for mining, thereby reducing the demand for mining machines in the market. However, chip orders need to be placed 6 months to a year in advance, and upstream manufacturers still produce 150,000 to 200,000 mining machines per month. Therefore, the entire mining machine market is definitely oversupplied, and this situation is unlikely to be reversed in the short term. The accumulated inventory of mining machines is difficult to digest, and reducing prices to clear inventory is an inevitable measure.

Overseas mining practitioners are also struggling. Mining giants Core Scientific and Compute North have both filed for bankruptcy protection, while Argo Blockchain sold its Helios mine in Texas to Galaxy Digital for $65 million, successfully avoiding bankruptcy.

In the cold winter, the performance of cryptocurrency mining companies has generally declined, and chip companies upstream of the mining industry are also struggling. Semiconductor giant Intel previously stated that its Blockscale ASIC chip series dedicated to cryptocurrency mining will cease production. The company is expected to stop accepting orders for this series before October 20th this year and stop shipping by April 20th next year.

Galaxy's mid-year report on the Bitcoin mining industry shows that despite several key areas of reversal in the mining field, the astonishing growth in network computing power in the first half of this year has offset many favorable factors, resulting in a historic high in mining difficulty.

Cryptocurrency mining practitioners are facing unprecedented challenges.

03. Conclusion

Even a strong company like Bitmain is struggling in the difficult market environment, unable to stand alone.

Bitmain's financial difficulties highlight the inherent risks of engaging in the cryptocurrency industry. Even the most mature participants in the industry will be profoundly affected by market fluctuations. The cryptocurrency community is closely watching whether Bitmain can overcome this funding shortage or face further setbacks.

Bitcoin is expected to undergo its fourth halving in April 2024, and the market's expectations for this are positive. Cryptocurrency mining companies are also waiting for the outbreak of this round of market trends. However, before that, Bitmain must first consider how to solve its funding problems and smoothly transition to the day of the halving.

Reference Articles

Is no one buying Bitcoin mining machines? Ebang International's revenue drops by over 80%, the long winter of the cryptocurrency mining industry

2023 Deep Report on the Bitcoin Mining Industry: Halving is imminent, miners' survival and preparation

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。