This article will analyze the similarities and differences between SA and Friend.tech, as well as examine their outstanding features.

Written by: Deep Tide TechFlow

I believe Friend.tech has become a well-known product for everyone, but at the beginning of this article, I would like to briefly summarize the leader of this Social Ponzi, and then describe in detail its imitation Stars Arena on the Avalanche chain.

Review of Friend.tech

Let's go back to the early morning of August 10th this year, when Friend.tech attracted a large number of Degen and speculative players. This product, which generates token economy based on personal Twitter social graph, was thought to be just a flash in the bear market, but unexpectedly brought news of Paradigm's seed round financing at the end of the first week, bringing more surging popularity and TVL growth.

Like Blur, another product invested by Paradigm, Friend.tech's core mechanism also chose to transform Twitter users into core users of the application using points, leveraging the potential token airdrop expectations, and motivating users through tangible points. Starting from August 19th, Friend.tech will distribute a total of 1 billion points during the 6-month testing period, distributed every Friday, and the points will not be recorded on the chain. The final interpretation of the points distribution rules belongs to the official.

According to Coinbase's senior software engineer yuga.eth, Friend.tech was built by Racer, the chief developer of TweetDAO and Stealcam. Friend.tech's economic model mainly includes a group share growth model, fee structure, and point incentives.

When new users join, they must purchase their own Share to become the homeowner, which also lays the groundwork for the current bot Flip. The only variable affecting the price of each Share is the number of Shares issued. Friend.tech charges a 10% transaction fee for each transaction, with 5% going to the shareholders and 5% to the national treasury.

After attracting people's attention to SocialFi, various imitations emerged on different chains. During the holiday period, Stars Arena (referred to as SA below) surged to the top of the imitations with the highest heat and TVL, showing a trend of challenging Friend.tech. Now let's take a look at the similarities and differences between SA and Friend.tech, and analyze its outstanding features.

Rise of Stars Arena

Stars Arena is an imitation of Friend.tech on the Avalanche chain. Stars Arena changed the term "Share" to "Ticket," and similar to Friend.tech, as long as you purchase the other party's Ticket, you can enter the other party's private chat room. This private chat room is slightly different from Friend.tech. In Friend.tech, if the homeowner does not choose to reply to a member, other members cannot see the other party's messages, while in SA, both the homeowner and the members' messages can be seen.

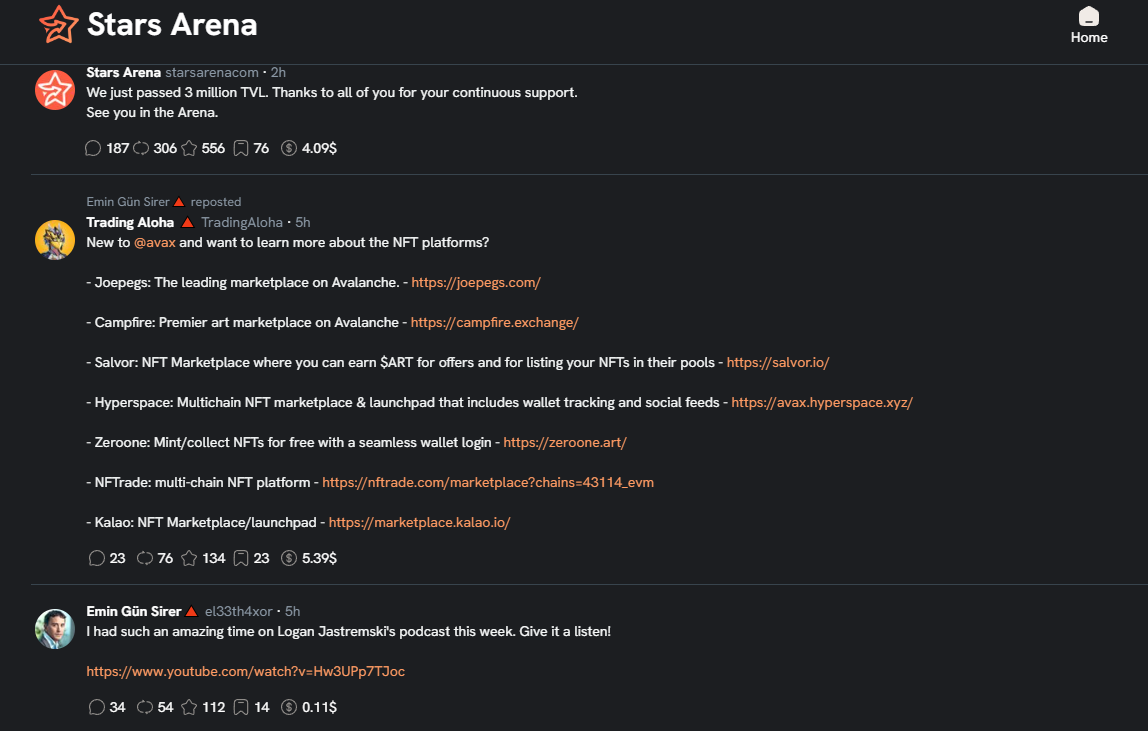

In addition, the bigger change compared to Friend.tech is that Stars Arena has added a public information flow feature, where users can post Twitter-style posts and receive retweets, likes, and tips. Furthermore, it has adjusted the profit-sharing mechanism, with 7% of the transaction fee going to the creator's wallet, 2% to the platform, and 1% to the referrer.

In other words, compared to FriendTech, SA chooses to share more of the transaction fee with the creators and has added an invitation rebate mechanism in the hope of attracting more new users.

Whether it's SA or other imitations, the financial attributes such as incentives and financing are what speculators value. Since everyone is buying and selling 10% of "Shiba Inu," what makes SA able to retain speculators in the imitations?

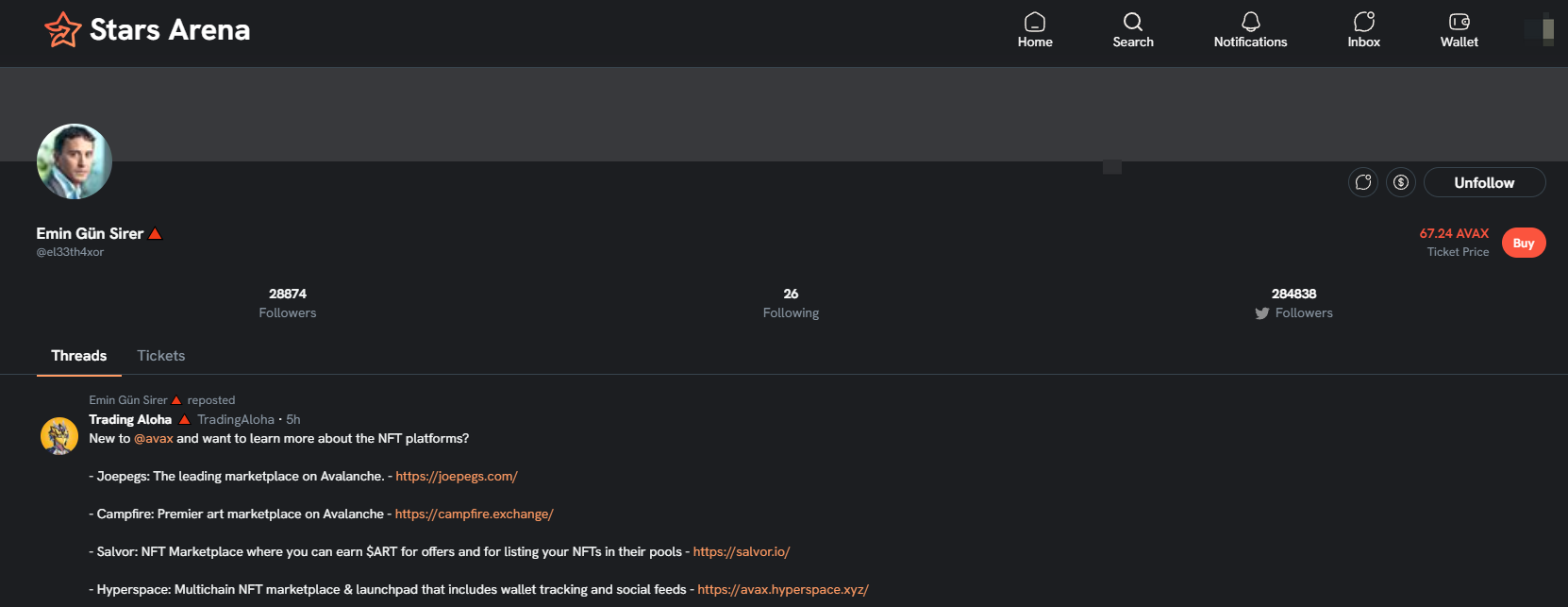

Compared to other imitations, SA has a smoother user experience. SA initially provides a PC version, and the mobile version has also been adapted, with a simple and clear UI design. For example, on the personal profile page, SA will display the KOL's Followers and Following within the platform, as well as the Followers and Following on Twitter. The personal panel is well-organized, showing the quantity and price curve of Buy and Sell, without the need to switch to other tools as with Friend.tech.

Most importantly, it has activated on-chain activities on Avax, and therefore has gained strong support from Avalanche's official. The official accounts of Avax and the founder of Avax, Emin Gün Sirer, have both joined StarsArena, and the founder has recently frequently mentioned SA on his own Twitter. Official endorsement is one of the conditions that retail investors are willing to pay for.

In summary, the differences between Friend.tech and SA are:

Admission does not require the first purchase of oneself, priced in Avax;

Initially launched on PC, with the mobile version also adapted;

Added Twitter-style public information flow feature with retweet/like/tip functions;

Chat rooms can send images;

UI is clearer, with columns showing the platform's Followers and Following, as well as the Followers and Following on Twitter;

Personal page shows the price curve;

Different profit-sharing mechanism: 7% to creators, 2% to the platform, 1% to referrers.

Data Performance

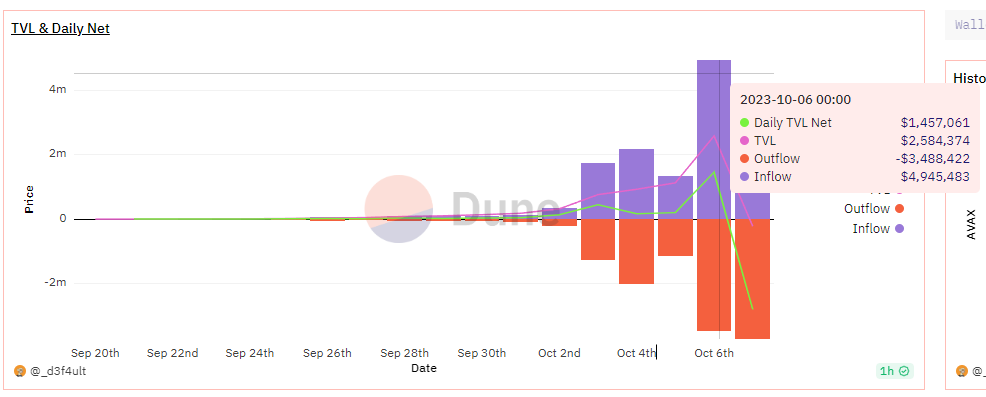

SA's rise coincides with the National Day holiday period. Data from Dune shows that since October 2nd, SA's daily TVL has shown a significant increase, reaching around $1.45 million on the 6th.

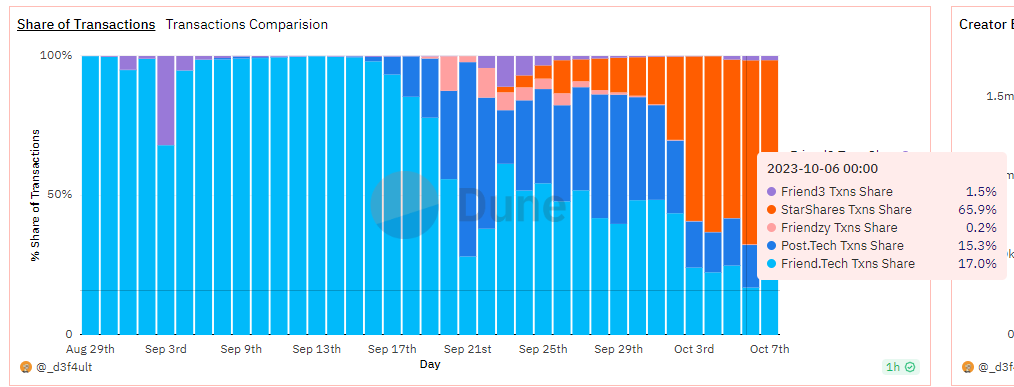

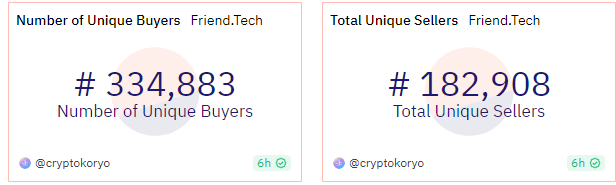

Furthermore, if various SocialFi products are compared, it can be observed that since late September, SA's daily trading volume (shown in red in the graph below) has been increasing and gradually surpassed the trading volume of Friend.Tech, occupying more than 60% of the trading volume in the entire SocialFi track.

This data performance indicates that after Friend.Tech led the way in creating a hot spot, capital has shown a clear spillover effect and has attempted to find more profitable imitations.

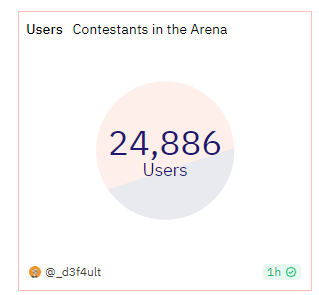

However, compared to the relatively large user base of Friend.Tech, the current active user base of SA is only around 25,000, which means that fewer users are generating more trading volume, indicating the short-term speculative fervor.

In addition to the data, the author also found in the actual experience that as soon as an account is registered on SA, there will be accounts conducting buy and sell operations, just like Friend.Tech, it is also filled with bots. Whether the short-term heat and increase in trading volume are related to bots, and whether it can maintain the heat for 2-3 months like Friend.Tech, still needs to be observed.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。