This article will start from the current market situation of L2, and delve into the technical innovation and principles of Mantle Network, as well as its key measures in ecological development.

In the current L2 market, competition is gradually intensifying. We can observe that dozens of L2 solutions have become increasingly homogeneous in their overall technical approaches. When OP and ZK became the only two choices, the differences between different L2 solutions seemed less apparent.

At the same time, applications often have the option to move to different L2 solutions for another round of expansion. From a technical perspective, it seems feasible to choose any L2 solution.

In a homogeneous competitive environment, what elements does an L2 need to stand out?

Whether it's technology or ecology, differentiation is crucial.

For example, when discussing Base's L2, you naturally think of Friend.Tech. A breakout point in the ecosystem brings about topicality, liquidity, and popularity, from which the underlying L2 also benefits. So, who will be the next distinctive L2? In a situation where the four major players in the L2 market have firmly occupied the leading market share, the up-and-coming standout with unique features is more worthy of attention, and Mantle Network is one of them.

Starting from addressing common L2 issues, Mantle Network has implemented modular design and an independent data availability layer. In terms of ecological development, Mantle Network has made differentiated arrangements, focusing on areas such as LSD and RWA that are closer to generating income, creating opportunities for it to gain a unique market position and user base.

At the same time, the substantial reserve of treasury funds and a series of recent marketing activities seem to convey its confidence in development and determination to attract users. However, currently, there is a lack of in-depth information about Mantle Network in the Chinese community, with more of a stack and list of materials, leading to a lack of a complete and systematic understanding of its technical design, ecological construction, and development plans.

Therefore, this article will start from the current market situation of L2, and delve into the technical innovation and principles of Mantle Network, as well as its key measures in ecological development.

Potential and financial strength, leveraging the future up-and-comers

Before delving into the technical design of Mantle Network, a more intuitive way is to quickly understand its basic situation through multiple sets of data.

Firstly, in terms of the total value locked (TVL), the two veteran L2 solutions, Arbitrum and Optimisum, have an absolute advantage, with a significantly larger market share compared to other L2 solutions.

As Mantle Network's mainnet has only been launched recently (in July), it does not have a significant advantage in TVL compared to other L2 solutions outside of Arb and OP, and its development will take time.

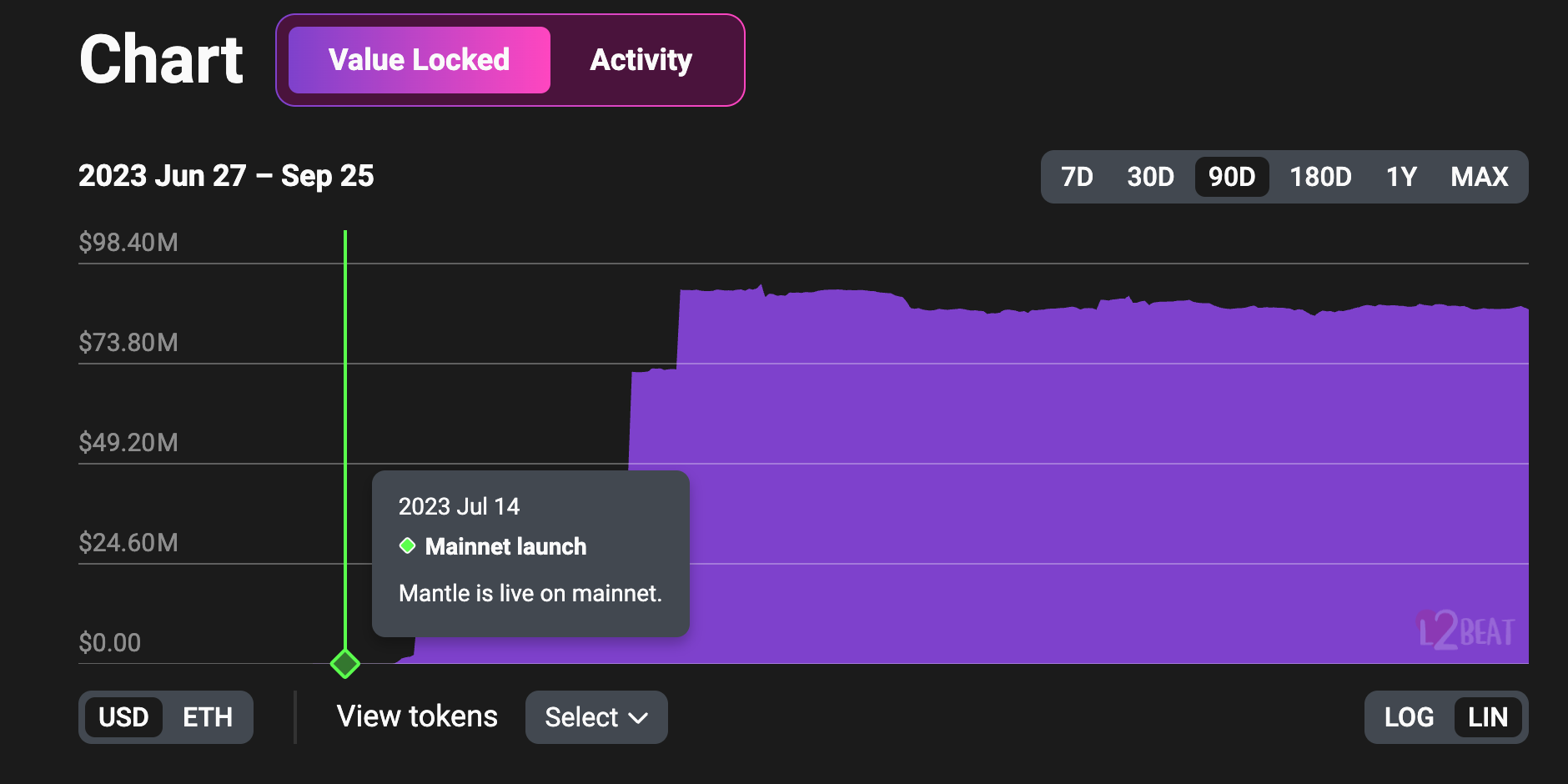

However, in terms of incremental growth, data from L2BEAT shows that Mantle's own TVL has experienced rapid growth in the two months since the mainnet launch, and has reached a relatively stable state after August, currently standing at around 90 million USD.

From sudden growth to relative stability, the data also indicates that Mantle has achieved initial ecological attraction and activation. However, to take TVL to the next level, it will require some differentiated ecological development. We will further introduce more specific practices in the following sections.

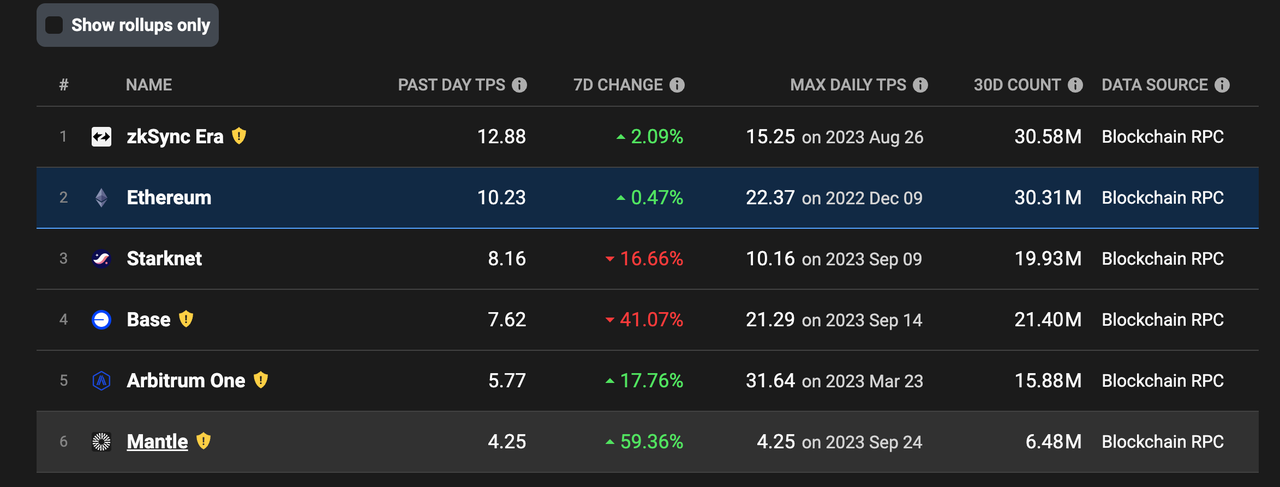

At the same time, Mantle Network has seen a significant increase in on-chain activity in the past week.

Although the absolute value of TPS is not high, its increase also indicates an increase in transaction volume, which is to some extent related to the efforts of some on-chain collaborative projects.

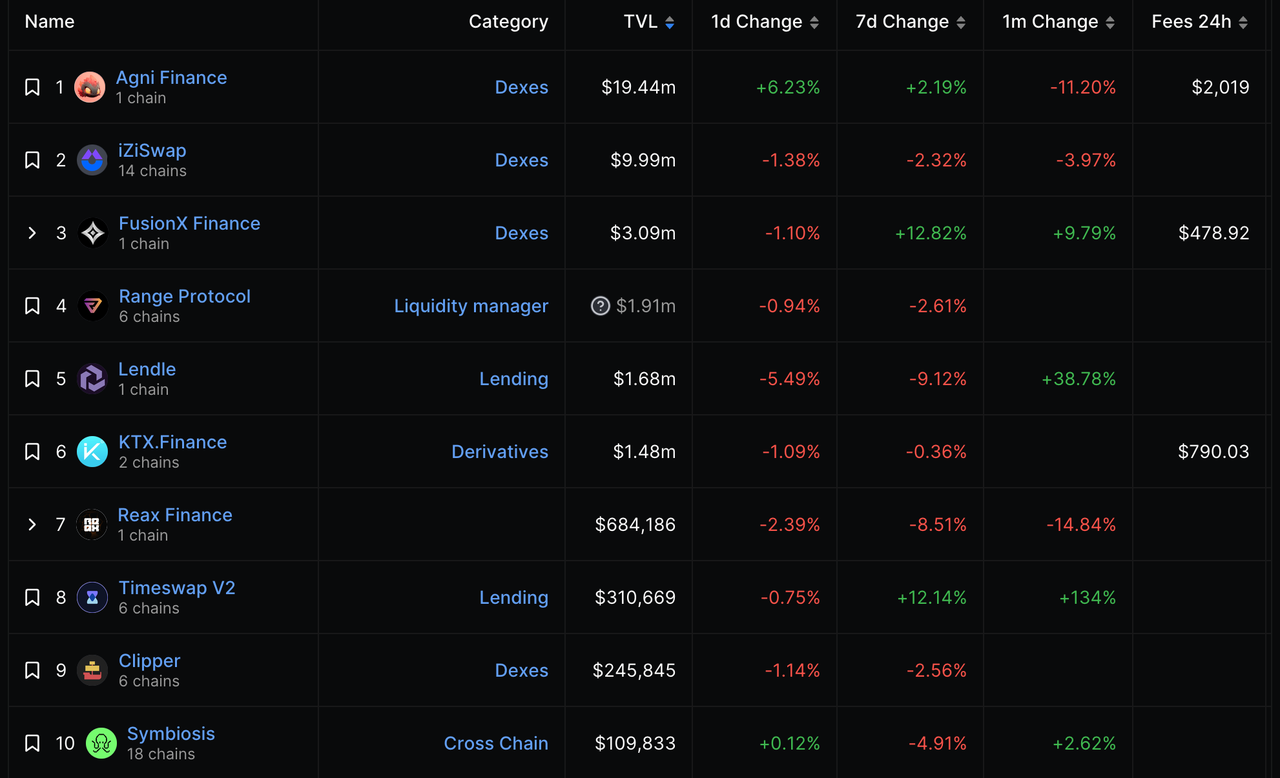

Specific to existing projects, it can be seen that Mantle's ecosystem mainly focuses on DEX and lending. Among the top ten projects by TVL, DEX and lending occupy a significant portion, with an equal number of exclusive projects and cross-chain projects. Similar to other L2 solutions in the early stages of development, projects related to the DeFi track form the foundation, and to stand out in the competition later on, it will be necessary to introduce more distinctive applications or bring in larger star projects from existing tracks to achieve high volume.

Taking all the above data into account, we believe that Mantle Network has already begun to take shape. With a noticeable trend in TVL and a significant increase in on-chain activity, there is an urgent need to further unleash its potential.

However, for a project to reach new heights, both technological innovation and ecological development require substantial financial support. This is also where Mantle Network significantly differs from other L2 projects: a substantial reserve of funds, which serves as a huge lever to drive future ecological development.

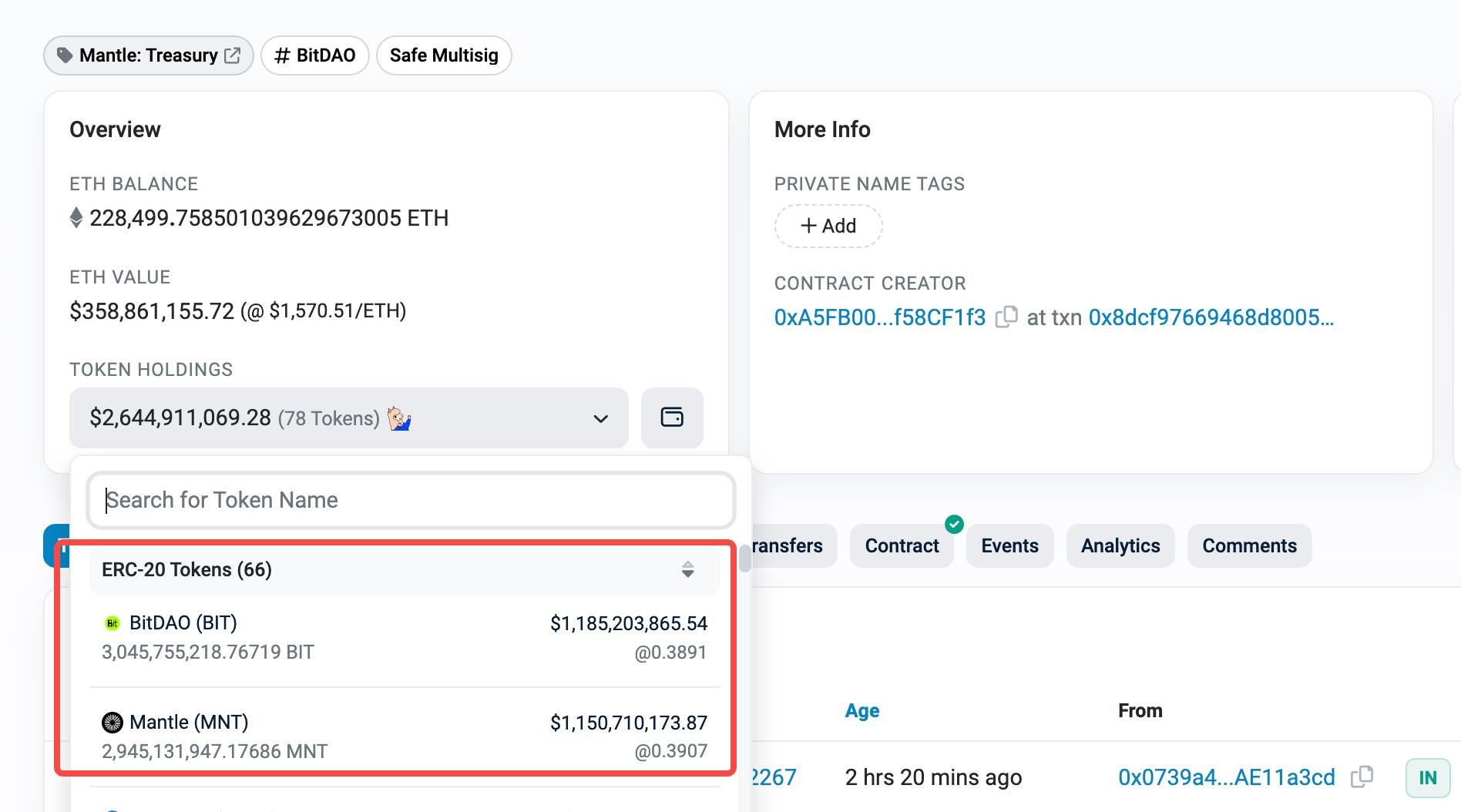

As early as May this year, Mantle Governance passed BIP-21, in which the token BIT was converted to Mantle's native token MNT at a 1:1 ratio, to be used for the project's future operations and ecological development.

Therefore, Mantle currently has an extremely well-funded Mantle Treasury. As of the writing of this article, the total reserve of tokens, including MNT, in the treasury smart contract deployed on Ethereum has reached 2 billion USD. This scale also makes Mantle Treasury the largest project treasury in the entire crypto industry, providing confidence for future development.

In its EcoFund support plan already published on its official website, Mantle has allocated 200 million USD to invest in and assist native projects and technical partners within its ecosystem.

Stimulated by this massive investment, it is foreseeable that more projects will achieve cooperation in the future and become part of its ecosystem, and even produce exclusive or phenomenon-level applications.

It is worth noting that resource advantages are not everything for a project. When financial support is behind the potential, the next question that interests us more is: Does Mantle Network also have distinctive technological features and advantages to attract more projects and liquidity?

Modular design and independent DA layer, a powerful combination to break through the competitive encirclement

When it comes to Mantle Network's technology, the most frequently seen label is "modular."

However, there is still a lack of comprehensive introductions in the market about what modularization means for L2, what problems it solves, how it specifically addresses them, and the connections between the various modules.

To systematically understand Mantle Network, we can first make an analogy with L1.

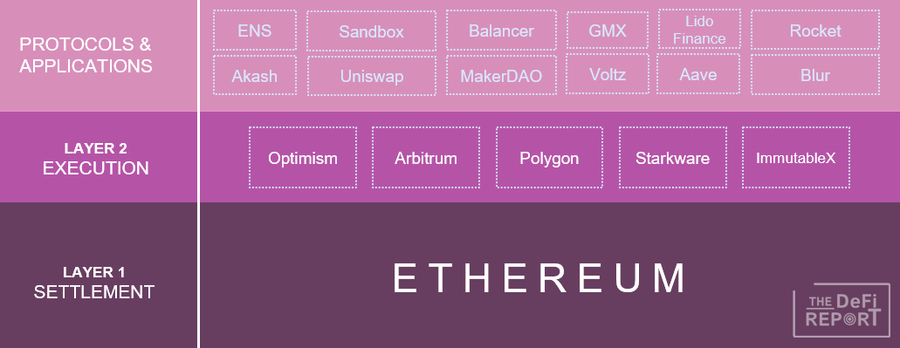

In Ethereum, the various functional modules such as execution, settlement, consensus, and data availability are clearly defined and responsible for different tasks. The benefit of this approach is that each module can be independently optimized and iterated, and it is also easier for developers to understand and participate. At the same time, the separation of execution and settlement has allowed Ethereum to take an important step forward in scalability and performance improvement.

So, why is modular design also needed on L2?

In fact, the core issues of L2 are consistent with L1, involving transaction processing, state verification, and data availability. Therefore, the modular design of L2 is actually an extension and continuation of the modular thinking of L1.

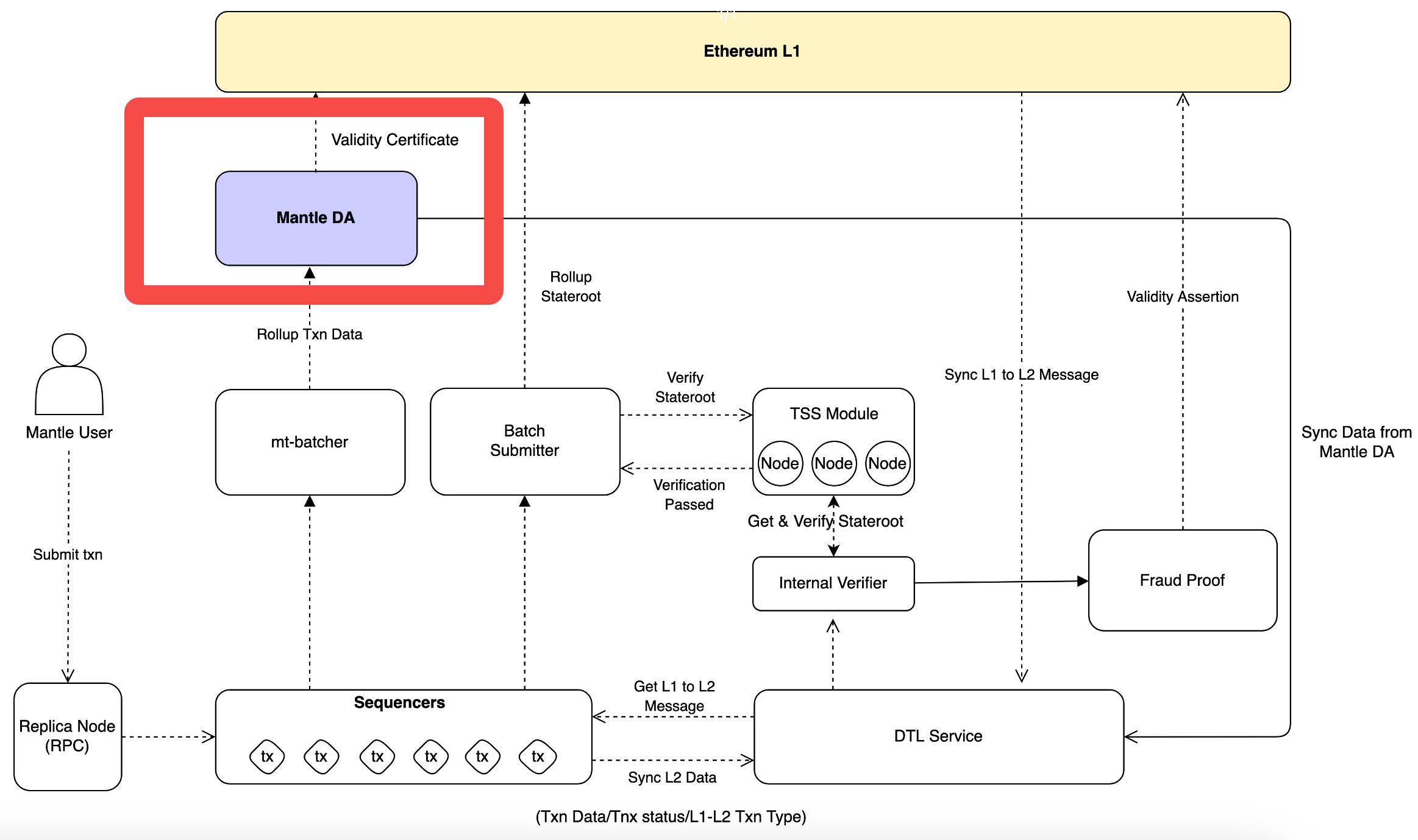

Mantle Network is precisely such a highly modular L2 solution. In Mantle, modular design mainly covers three core areas: transaction processing, state verification, and data availability.

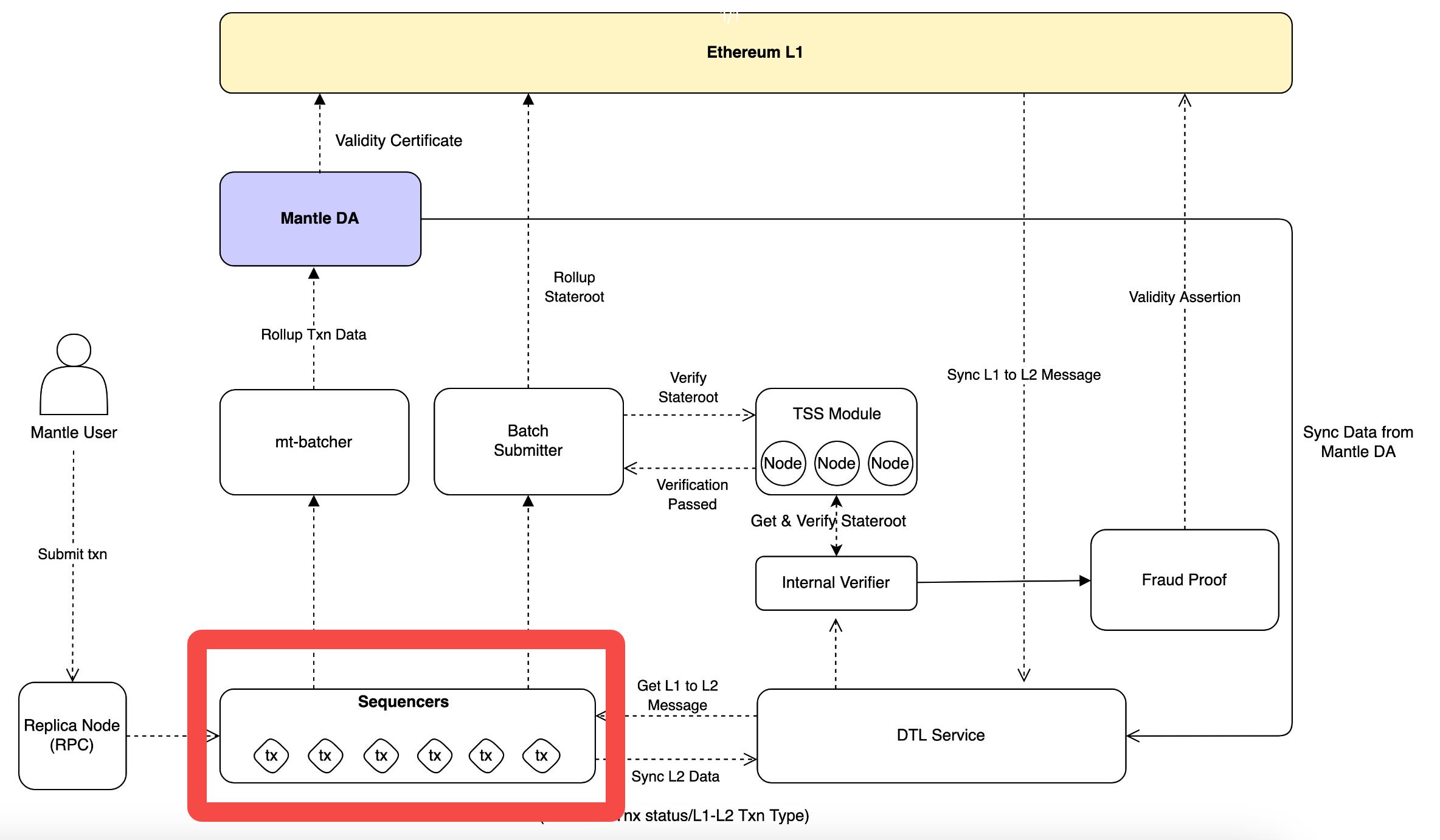

Transaction Processing: Moving towards decentralized sequencers

Firstly, transaction processing in Mantle is handled by Sequencers. Sequencers are responsible not only for receiving user transaction requests but also for sorting and packaging these transactions according to certain rules, ultimately generating a block of transactions to be submitted. This process is similar to a sorting mechanism, ensuring that transactions are processed in the correct order.

In the current design of Mantle Network, initially, centralized Sequencers will be operated by the official foundation, but there are plans to consider decentralization in the future. Specifically, the decentralized approach involves introducing a "scheduler" to determine who the Sequencer will be for the next block generation.

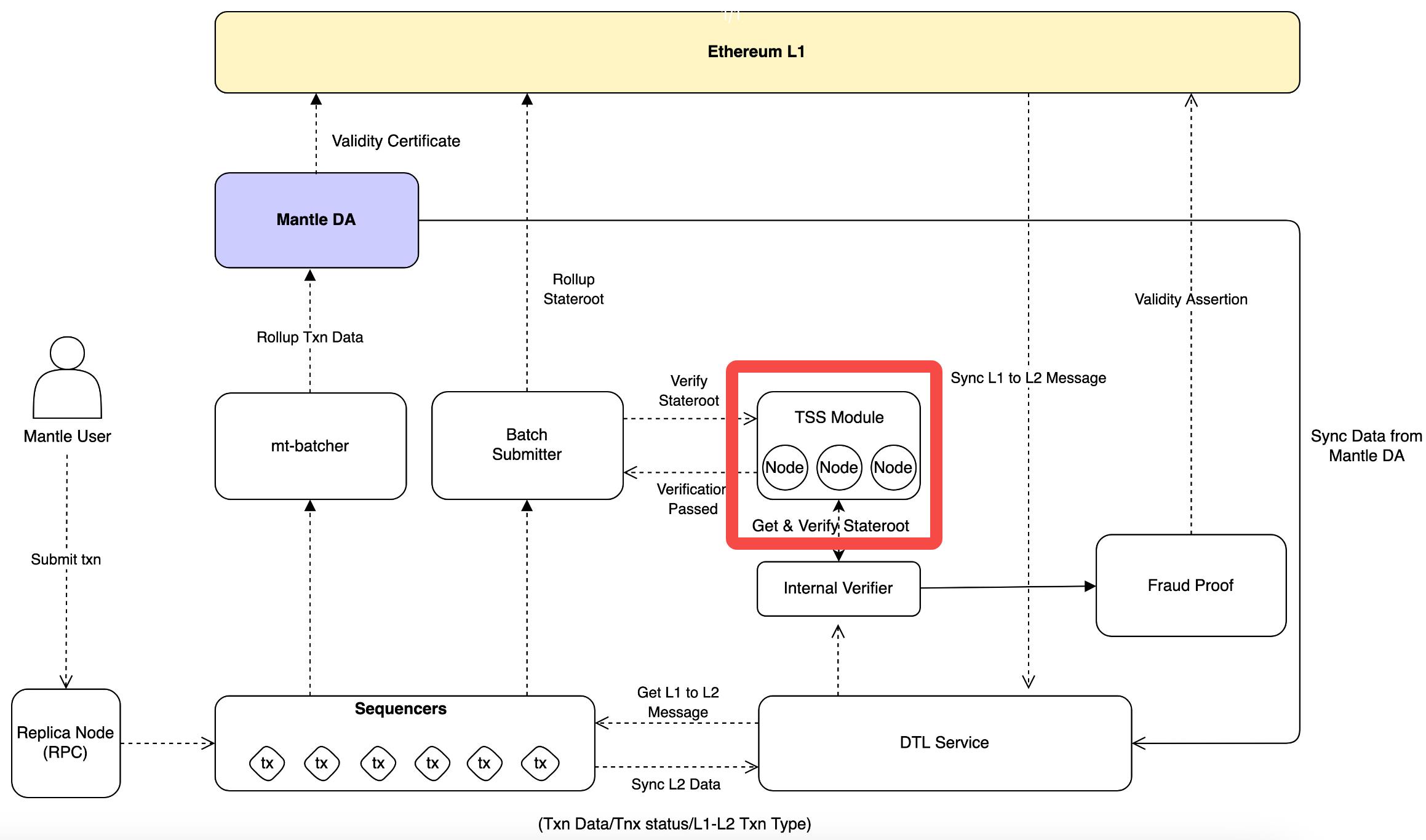

State Verification: TSS Nodes, Shortening the Transaction Challenge Period

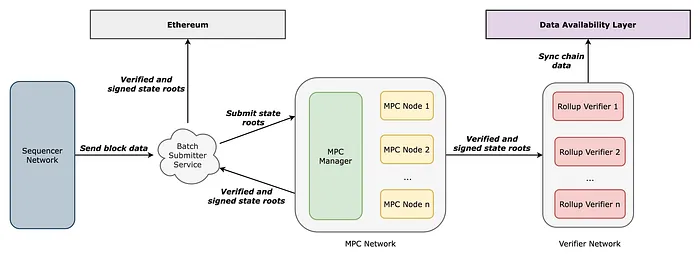

Next, let's look at state verification. Mantle uses a threshold signature scheme (TSS) to achieve this functionality. In TSS, nodes distribute parts of the private key in a distributed manner and collectively sign the transactions packaged by the Sequencer mentioned earlier.

The TSS method involves multi-party secure computation (MPC) related technology, and specific details are not explained in depth here, but its essence is the collective participation of multiple parties in judging the correctness of transactions.

In simple terms, this is somewhat like a group of "transaction inspectors," where multiple individuals independently check a batch of transactions for any issues, reducing the probability of problems occurring with that batch of transactions.

Therefore, the core purpose of introducing TSS nodes with a modular architecture is to: verify transactions in L2 before they need to be verified and agreed upon at the L1 layer.

Since TSS nodes verify the status and correctness of transactions in advance, the challenge period for withdrawing from L2 to the Ethereum L1 network in the OP Rollup mechanism (which typically takes about 7 days to prevent issues with original transactions on L2) can be significantly shortened.

In addition, nodes responsible for verification in the Mantle network need to stake MNT tokens. Any malicious behavior will result in the removal of TSS nodes, and the removed stake will be distributed among other nodes.

Initially, well-known companies will be involved in the TSS nodes. Subsequently, the launch of nodes will be decided by Mantle Governance to gradually achieve decentralization. After transactions are sorted and packaged by the sequencer and verified by TSS-related nodes, the next consideration is how to make the transaction data that has already occurred available.

Data Availability: Independent DA Layer, Leveraging EigenLayer to Enhance Reliability

Mantle Network has introduced EigenDA technology to address this issue. EigenDA not only ensures high data availability but also has a carefully designed system of rewards and penalties. Through this approach, data availability nodes (DA nodes) can receive appropriate incentives, thereby providing more stable and reliable services.

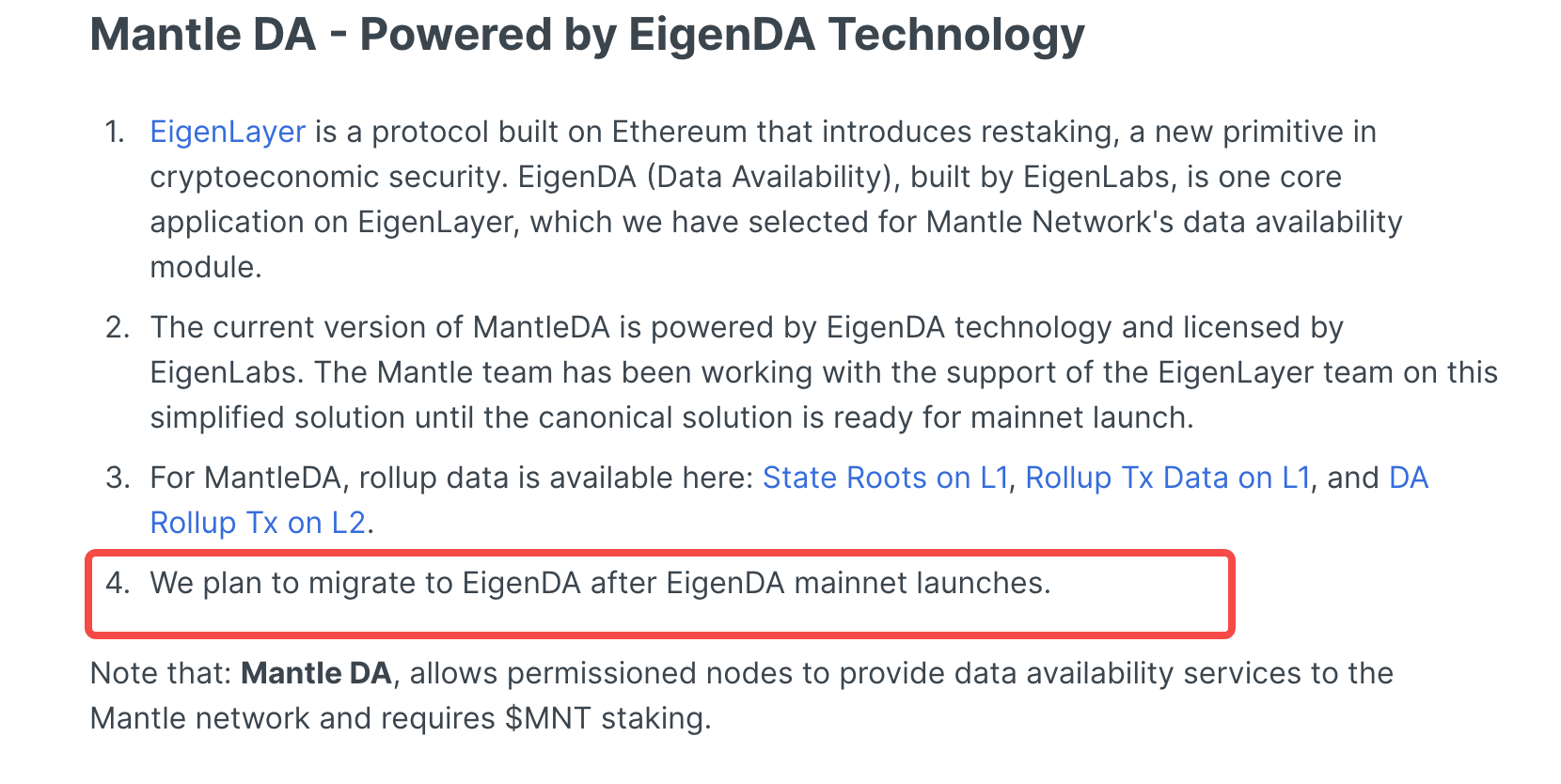

It is important to note that in the specific implementation, since the mainnet of EigenDA has not yet been officially launched, the current version of Mantle Network's DA layer is a simplified version based on EigenDA technology, called Mantle DA.

Subsequently, after the launch of the EigenDA mainnet, the corresponding technical migration will be considered.

Setting aside specific migration timelines and execution, in principle, choosing to collaborate with EigenLayer to further enhance data availability is a key feature that sets Mantle Network apart from most L2 solutions, and is also an important design for enhancing L2 security.

However, considering that most readers may not have a deep understanding of this concept, we will provide a brief explanation here.

- What is Data Availability?

In simple terms, data availability means that any node in the network should be able to access complete transaction history and other key data. This is done to ensure the transparency and verifiability of the network, thereby maintaining trust in the system.

- When is data available or not available?

Data availability:

- Integrity: All transaction data is complete and not lost.

- Accessibility: Any node can easily access this data.

- Timeliness: New transaction data should become available immediately after confirmation.

Data unavailability:

- Data loss or corruption: Important transaction history or state data is lost or corrupted.

- Data withholding: Malicious nodes or attackers intentionally do not publish data.

- Network partition: Data cannot propagate throughout the entire network.

- How does Mantle handle data availability?

Mantle uses EigenDA (Eigen Data Availability) technology to address data availability issues. EigenLayer is built on Ethereum, and its core idea is to use a "re-staking" mechanism to ensure data availability. The following are its main operational steps:

Re-Staking: Ethereum's Layer 1 validators can choose to participate in EigenDA and use their staked $ETH on Ethereum as collateral.

Data Publishing and Storage: When Mantle's Sequencer publishes new transaction data, this data, after TSS verification, will be published on Ethereum and can be stored by Layer 1 validators participating in EigenDA.

Performance Requirements and Incentive Mechanism: These Layer 1 validators need to meet certain performance requirements, such as data storage and propagation speed. In return, they can earn additional income. According to the current design, validators have sufficient motivation to participate in Mantle because they may receive dual rewards in ETH and MNT.

Supervision and Punishment: If a validator fails to provide data availability services as required by the protocol, their staked $ETH will be confiscated or reduced.

Data Availability Verification: Anyone can verify the data availability on the Mantle network through these Layer 1 validators.

Combining these three core modules, a complete Mantle transaction lifecycle can be outlined.

From transaction initiation, to Sequencer sorting and packaging, to TSS node state verification, and finally to EigenDA data storage and availability assurance, each step has specific modules responsible, forming a highly collaborative and efficient system.

Finally, we can also summarize Mantle Network's modular design and the purposes and benefits of its components in a table:

LSD and RWA, One Step Closer to the Ecological Layout of Hotspots

As mentioned at the beginning of the article, the development of L2 cannot be separated from the construction of a distinctive ecosystem. Friend.Tech on Base has already proven the attractiveness of a hotspot to user liquidity. For Mantle Network, the current focus is on the closer-to-income points of LSD and RWA.

First, Mantle separates LSD as an important component in its entire product structure. In the ecosystem construction described on its official website, there are two major product types, one being LSD, and the other being others.

In addition, both internal and external actions of Mantle reflect proactive layout in the LSD track. From internal forum proposals, it can be seen that Mantle initiated and passed a proposal to approve the launch of its own LSD protocol.

This proposal allows users, including Mantle Governance, to deposit ETH into the protocol and receive mntETH tokens that generate income. This means that Mantle is not only building the foundational layer of L2, but also actively creating the LSD protocol, with overall rules, design, and income generation similar to what we commonly see with stETH, for example.

However, in terms of protocol launch, Mantle seems to be making smooth progress. Mantle Governance (the treasury), institutions, and other partners have collectively injected 270,000 ETH to provide initial funding support for their own LSD protocol. This level of funding can directly place the amount of staked ETH in Mantle's LSD protocol in the top 3 in the market.

At the same time, Mantle is actively advancing in external collaborations. Lido has approved the allocation of 40,000 ETH to its liquid staking platform, meaning that stETH liquidity will be added to Mantle, establishing a strategic relationship through income sharing agreements.

The significant layout in LSD brings the greatest benefit to Mantle: establishing a competitive advantage while revitalizing its own ecosystem.

First, the mnETH tokens in the LSD protocol can empower other projects in the Mantle ecosystem, allowing users to stake/borrow using mnETH in other projects, reviving ecosystem projects and attracting users to generate income.

Second, LSD is a verified and relatively stable track, more resource-intensive (the amount of staked ETH is a key factor).

Mantle's resource advantage can be maximized to quickly find its comparative advantage in competition with other L2 solutions. While technical advantages may not be so obvious, resource advantages can help the project quickly establish its position and brand recognition, which is particularly important in the current competitive environment of L2.

Similarly, if choosing the LSD track is based on the stable income generated from staking around Ethereum, then RWA is an extension to real-world income.

On September 12, Mantle Governance internally passed MIP-26 proposal, planning to allocate $60 million to create the stablecoin Seed that supports generating RWA income;

At the same time, in external collaborations, it has also partnered with the well-known RWA protocol Ondo Finance to introduce USDY, which can generate RWA income, into the Mantle ecosystem. Compared to building its own interest-bearing stablecoin, a more convenient way is to directly inject USDY liquidity into its DEX ecosystem, allowing users to obtain USDY and generate income without going through the Ondo protocol, which is undoubtedly more attractive for quickly attracting users in the short term.

Whether it's LSD or RWA, we can see a similar path, with "self-built" and "external introduction" as two approaches to building the ecosystem. The former focuses more on long-term development, while the latter leans more on short-term leveraging.

The ultimate goal is to further establish Mantle as the top choice for obtaining stable income in L2. In addition, we also see some of Mantle's developments in other areas, such as its integration with Game7 DAO, a Web3 game incubation and acceleration project under BitDAO, which may make the entire chain game direction more promising.

Incentivizing Long-term Development

In more direct marketing activities, Mantle Network previously launched the Mantle Journey Alpha Season, encouraging users to complete various interactive tasks to earn MJ points for redeeming rewards in MNT and related NFTs.

After the end of the Alpha season, it can be seen that there will be more seasons and task themes in the future to attract users to participate in different forms in the long term.

For example, Mantle recently announced its first native NFT series, Mantle Citizen, for a casting event, with the specific time yet to be determined. From the name, Citizen also implies recognition for holding NFT identity, reflecting a long-term sense of user integration into the Mantle ecosystem:

Visually, every time a user achieves a milestone in the Mantle ecosystem, their NFT character will grow, allowing users to add various accessories;

In terms of potential income, although not directly stated, this limited edition minted NFT also raises expectations for more airdrops and income from participating in the event.

At the same time, the design of the NFT itself also invited internationally renowned visual artist Chen Man to create it. Overall, the NFT series Citizen reflects Mantle's determination and confidence in long-term user acquisition, from production, empowerment to influence building.

Future Outlook

Although the competition in L2 will not end with the emergence of Mantle Network, the project itself may not necessarily be the optimal solution for L2. However, through Mantle, we can see that newer L2 solutions are making commendable breakthroughs and attempts in both technology and ecosystem, providing examples and references for the development and market participation of other L2 solutions.

In summary, we believe that the current advantages of Mantle Network are:

Latecomer and Resource Advantage: While learning from existing L2 methods, it leverages its strong funding and ecosystem expansion resources to achieve rapid scalability;

Ecosystem Differentiation: LSD and RWA are both tracks that are close to income and relatively stable, where there is income, there is heat, and where there is heat, there is willingness to use and inject liquidity. Finding key ecosystem entry points is crucial in the face of competition.

At the same time, Mantle Network also faces challenges, such as the current centralization of the sequencer and TSS nodes in terms of technology, and how decentralization will ultimately be implemented remains to be observed. Additionally, its flagship modular design is not a unique moat, as other L2 solutions can also use components like EigenDA.

However, for users, when a new project emerges, choosing to join is better than questioning the future.

In a situation where other established L2 solutions have little room for participation, paying attention to emerging stars like Mantle, seeking opportunities for income and development, and making feasible interactive actions and operations while controlling costs is a good choice for users. For the project, the support of Mantle's incentive program is an irresistible condition.

In a bear market with tightened liquidity, receiving incentives can provide crucial support for the project's survival, and it also allows bear market building to have relatively strong support. Ecosystem projects and L2 solutions often mutually benefit each other. In an L2 environment with not very intense internal competition, the possibility of running top projects is increasing under the stimulation of various incentives and cooperation.

Perhaps, the competition in L2 is far from over. When every player in the race puts forth their best resources to compete for unique market positioning and user impressions, the real show is just beginning.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。