Written by: Alfred, LDCapital

Crypto's ideal state is decentralized, permissionless, and operates on digital rules, which may sound contradictory to traditional regulation. However, the current development of the crypto industry is rapidly integrating with regulatory bodies worldwide. While this may not be favored by many crypto natives, the frequent introduction of national laws and regulatory dynamics has become the absolute focus of industry development.

Belief in sovereign freedom and mathematical order will remain at the core of the industry in the future. However, for new entities to be widely integrated into the existing world order and rapidly promoted and developed globally, the game and integration with regulation are an inevitable path. This article will review the current progress of the most important trends in 2023 from the perspective of industry observers. (Given the common practices of various national regulations, this article uses "virtual assets" more frequently to refer to broad encrypted assets and digital assets).

I. Singapore — Leader in Virtual Asset Regulation

Following the bankruptcy of Three Arrows Capital and FTX, Singapore's regulation has become more cautious and strict, leading to a slowdown in development. However, due to its stable policies and open environment, Singapore remains one of the top choices for global Web3 companies and entrepreneurs.

1. MAS's Three-Tier Virtual Asset Regulatory Framework

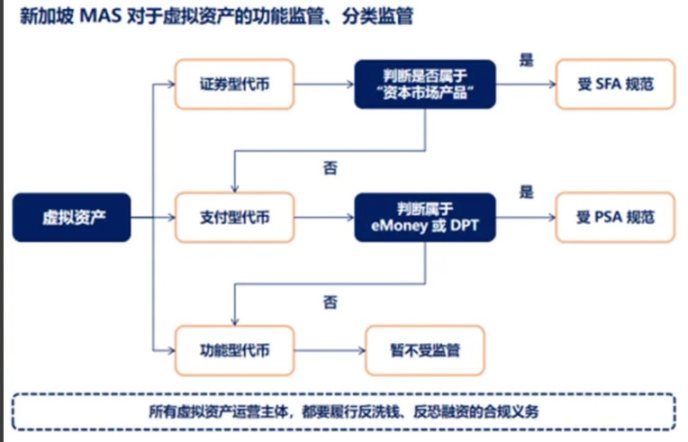

The Monetary Authority of Singapore (MAS) is the central bank and comprehensive financial regulatory authority of Singapore, responsible for regulating the Web3 industry. MAS adopts a functional and categorized regulatory approach for virtual assets to legalize regulation.

According to MAS's revised "Digital Token Offering Guidelines" released in May 2020, virtual assets are classified into three categories based on their functions and characteristics: Security Tokens, Payment Tokens, and Utility Tokens. Among them, eMoney and DPT in the Payment Tokens category are electronic currency and digital payment tokens, respectively, used for cryptocurrency payments such as BTC and ETH.

Source: Web3 小律

Assets classified as Security Tokens are regulated under the Securities and Futures Act (SFA), while Payment Tokens are regulated under the Payment Services Act (PSA). Assets falling under SFA and PSA regulations require regulatory approval from MAS and the corresponding licensing to operate compliantly. Additionally, all virtual asset activities, like other financial activities, must comply with anti-money laundering and counter-terrorism financing regulations.

2. Introduction of the Final Stablecoin Regulatory Framework

On August 15, 2023, MAS announced the final version of the stablecoin regulatory framework, aiming to ensure that regulated stablecoins in Singapore maintain a high degree of value stability, making it one of the first jurisdictions globally to include stablecoins in its local regulatory system.

According to the regulatory framework, stablecoins are digital payment tokens (DPT) pegged to the Singapore dollar or any G10 currency, maintaining a relatively stable value. Issuers of such Single-Currency Stablecoins (SCS) must meet four key requirements: value stability, capital requirements, redemption at face value, and information disclosure.

When well-regulated to maintain this value stability, stablecoins can serve as a trusted medium of exchange to support innovation, including the "on-chain" purchase and sale of digital assets. Only stablecoin issuers meeting all requirements under this framework can apply to MAS for recognition and labeling as "MAS-regulated stablecoins." This label will enable users to easily distinguish MAS-regulated stablecoins from other digital payment tokens, including "stablecoins" not subject to MAS's stablecoin regulatory framework. Users choosing to trade stablecoins not regulated by MAS should make their own informed decisions regarding the associated risks.

II. Hong Kong, China — Accelerating Virtual Asset Development

After years of silence, Hong Kong embraced the virtual asset industry with renewed vigor starting from the release of the "Hong Kong Virtual Asset Development Policy Declaration" on October 31, 2022, and has frequently demonstrated its determination through policy implementations in 2023. In its 2022/23 annual report, the Hong Kong Monetary Authority positioned itself as a global leader in developing virtual assets and complementary technologies.

1. Hong Kong's Unique Dual-Licensing System

Hong Kong's current licensing system for virtual asset trading platform operators is the "dual-licensing" system. One license is for "Security Tokens," regulated and licensed under the Securities and Futures Ordinance, while the other license is for "Non-Security Tokens," applicable to the Anti-Money Laundering Ordinance. The Securities and Futures Commission of Hong Kong previously stated that the terms and characteristics of virtual assets may evolve over time, and the definitions of "Security Tokens" and "Non-Security Tokens" may also change. Therefore, virtual asset platforms should hold dual licenses to ensure compliance.

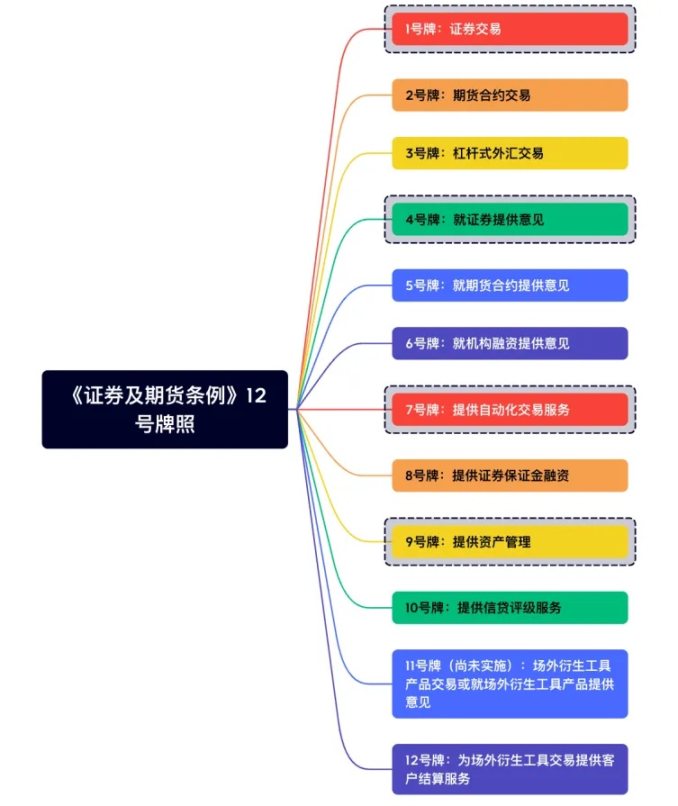

(1) License No. 12 under the Securities and Futures Ordinance

Hong Kong already has a relatively comprehensive licensing access system. If virtual assets are classified as Security Tokens, they require application for relevant securities-related licenses. Currently, there are three types of licenses that virtual asset businesses must apply for: License No. 1, License No. 7, and VASP License. Additionally, depending on the actual business operations, License No. 4 and License No. 9 may also be required.

Source: LD Captial

(2) VASP License

The Virtual Asset Service Provider (VASP) licensing system stems from the amended Anti-Money Laundering and Counter-Terrorist Financing (Financial Institutions) Ordinance, which was passed by the Hong Kong Legislative Council and enacted in December 2022, becoming Hong Kong's first law involving the regulation of virtual assets.

According to the "2022 Anti-Money Laundering and Counter-Terrorist Financing (Financial Institutions) Ordinance," virtual assets are defined as encrypted digital value expressed in the form of a unit of account or stored economic value, which can be used as a medium of exchange for payment of goods or services, debt settlement, investment, or for voting on changes to the terms of virtual asset-related transactions. They can be transferred, stored, or traded electronically and can be expanded or narrowed by the Securities and Futures Commission or the Financial Secretary through gazette publication. The definition of virtual assets under the Anti-Money Laundering Ordinance covers most virtual currencies in the market, including BTC, ETH, Stablecoins, Utility Tokens, and Governance Tokens.

Virtual asset trading platforms already holding License No. 1 and License No. 7 must also apply for the VASP License from the Securities and Futures Commission, but with a simplified application process. On August 3, HashKey and OSL upgraded their operations by applying for and quickly obtaining retail service approval through a simplified process after obtaining License No. 1 and License No. 7, expanding their business scope from serving professional investors to retail users.

At the same time, the Anti-Money Laundering Ordinance provides a transition arrangement for "existing virtual asset exchanges," stipulating a transition period until June 1, 2024. Virtual asset trading platforms that already hold License No. 1 and License No. 7 but have not yet obtained the VASP license are recommended by the Securities and Futures Commission to implement a 12-month transition period. Those not intending to apply for a license should prepare to orderly end their business in Hong Kong, with the closure deadline set for May 31, 2024. In simple terms, from June 1, 2024, virtual asset exchanges without a VASP license will be unable to operate compliantly.

2. Accelerated Development of Stablecoins

Regarding stablecoins, the SFC also clearly stated in the "Consultation Summary" that the Hong Kong Monetary Authority had published a "Consultation Summary on Cryptocurrency and Stablecoin Discussion Papers" in January 2023, indicating that regulatory arrangements for stablecoins would be implemented in 2023/24, establishing a licensing and permit system for activities related to stablecoins. Before stablecoins are regulated, the SFC believes that stablecoins should not be included for retail trading. On May 18, the Hong Kong Monetary Authority announced the launch of the "Digital Hong Kong Dollar" pilot program, with 16 companies from the financial, payment, and technology industries selected to participate in the first round of trials in 2023. The pilot program delves into six potential use cases, including comprehensive payments, programmable payments, offline payments, token deposits, Web3 transaction settlements, and token asset settlements. At the World Blockchain Week on September 19, Hong Kong Legislative Council member Dennis Kwok stated that the regulatory framework for the Hong Kong Dollar stablecoin may be introduced in June next year.

III. United Arab Emirates — Establishing a Tailored Virtual Asset Regime

The Dubai Virtual Asset Regulatory Authority (VARA) was established in March 2022, making it the world's first government agency specifically set up to regulate the virtual asset industry, responsible for managing and supervising activities related to virtual assets in Dubai (including special development zones and free zones, but excluding the Dubai International Financial Centre). Previously, Binance, Okex, crypto.com, and Bybit all obtained MVP licenses in Dubai and established companies. On February 7, 2023, in accordance with Dubai Law No. (4) of 2022 on Virtual Asset Regulation, approved by the board, VARA issued the 2023 Virtual Asset and Regulatory Activities Regulations, which came into immediate effect, requiring all market participants conducting virtual asset business or providing services in the UAE region (excluding the two financial free zones ADGM, DIFC) to obtain approval and licenses from the Securities and Commodities Authority (SCA) or VARA.

VARA has identified seven different virtual asset (VA) activities, covering advisory services, broker-dealer services, custody services, exchange services, lending services, management and investment services, and transfer settlement services. The licensing process is divided into four stages: temporary licensing, preparation and operation of the minimum viable product (MVP) license, and the so-called full market product (FMP) license. Before the phased (4) FMP license approval, holders of MVP licenses are not allowed to provide services to retail consumers. Currently, three companies have officially obtained VASP licenses for relevant activities, with Binance, OKX, and Bybit at different stages of MVP.

The Dubai government has taken a bold and proactive approach to the development of virtual assets, not only promoting the establishment of independent regulatory agencies and policies but also vigorously developing artificial intelligence and the metaverse, rapidly becoming an influential international participant in the virtual asset field.

IV. Europe — EU Introduces the Most Comprehensive Unified Virtual Asset Regulatory Framework

1. European Union

On May 31, 2023, the European Union officially signed the landmark regulation — the Markets in Crypto-Assets Regulation (MiCA), published in the Official Journal of the European Union (OJEU) on June 9. This marks the first globally unified and comprehensive regulatory framework for virtual assets, providing a common virtual asset regulatory system for the 27 member states of the EU, creating a unified market covering a population of 450 million.

The regulation spans 150 pages, providing a comprehensive regulatory framework for companies and individuals to view specific regulations in the corresponding chapters. It mainly includes the scope and definition of regulation, the classification and related regulations of crypto-assets, regulations for crypto-asset service providers, regulatory authorities, and more. According to this regulation, any company offering crypto-assets to the public must issue a fair and clear white paper, warning of risks without misleading potential buyers, register with regulatory authorities, and maintain appropriate bank-style reserves for stablecoins.

MiCA defines crypto-assets as digital representations of value or rights that are transferred and stored electronically using distributed ledger technology or similar technology. In terms of crypto-asset classification, MiCA categorizes assets into electronic money tokens, asset-referenced tokens, and crypto-assets outside of these categories. Electronic money refers to crypto-assets that maintain a stable value by referencing the value of an official currency, primarily involving regulations in Chapter Four; asset-referenced tokens refer to crypto-assets other than electronic money tokens that aim to maintain a stable value by referencing another value, right, or combination, including one or more official currencies, primarily involving regulations in Chapter Three; utility tokens refer to crypto-assets used solely to provide access to goods or services offered by the issuer, primarily involving regulations in Chapter Five. According to the existing regulation, MiCA has not provided a clear regulatory approach for security tokens and NFTs, and more practical use cases are needed to explain the specific classification of existing tokens in the crypto market.

MiCA will be officially implemented after an 18-month transition period, on December 30, 2024, and by mid-2025, the committee will report on whether further legislation is needed to meet the needs of NFTs and decentralized finance.

2. United Kingdom

Following the introduction of the MiCA regulation in the EU, the United Kingdom is also accelerating the legislation of virtual assets. On June 19, 2023, the House of Lords approved the Financial Services and Markets Bill (FSMB), and on June 29, the bill was approved by King Charles of the United Kingdom. Royal approval is a procedural step that follows legislative agreement, bringing cryptocurrencies under the scope of the FSMB for legal regulation, and the bill also includes measures to supervise cryptocurrency promotions.

In a statement, UK Financial Services Minister Andrew Griffith expressed that after the UK's exit from the EU, the UK is able to control its own financial services rulebook, allowing the regulation of cryptocurrency assets to support their safe adoption in the UK. On July 28, the UK and Singapore agreed to jointly develop and implement global regulatory standards for cryptocurrencies and digital assets.

V. United States — Key to the Development of the Virtual Asset World

The U.S. Securities and Exchange Commission (SEC) has been active in recent years, making the United States the most stringent regulator globally. However, traditional financial and crypto companies in the U.S. are also working to promote industry development and regulatory integration. Since 2022, U.S. legislators have submitted over 50 digital asset bills to Congress. Currently, U.S. regulation is both a key obstacle to development and an important accelerator for future development, as it concerns the most important source of liquidity in the crypto world — the flow of the U.S. dollar.

1. SEC and CFTC

(1) SEC and Howey Test

The U.S. Securities and Exchange Commission (SEC) is an independent agency of the U.S. federal government established under the Securities Exchange Act of 1934, responsible for the supervision and regulation of securities in the United States, serving as the highest regulatory authority for the U.S. securities industry. The SEC exercises powers granted by Congress to ensure that public companies do not engage in financial fraud, provide misleading information, engage in insider trading, or other violations of securities laws, or else face civil litigation.

With the development of crypto assets with financial attributes, the SEC analyzes whether a particular crypto asset is considered a security and therefore subject to regulation and constraints under the Securities Act of 1933 and the Securities Exchange Act of 1934, based on the framework titled "Framework for 'Investment Contract' Analysis of Digital Assets" released on April 3, 2019. A key method for this determination is the "Howey Test": Is it an investment of money? Is it a common enterprise with the expectation of profits solely from the efforts of others? The SEC and federal courts have emphasized that the Howey Test is flexible and subjective. If a crypto asset is defined as a security through the Howey Test by the SEC, it will be subject to regulation.

2. SEC Regulation's Impact on the Crypto World

SEC Chairman Gary Gensler has publicly stated on multiple occasions that, except for truly decentralized virtual currencies like Bitcoin, the vast majority of crypto tokens meet the investment contract test and should be considered "securities," requiring registration of their offering and sale with the U.S. Securities and Exchange Commission or compliance with exemption requirements. Given that most crypto tokens are subject to securities laws, most crypto intermediaries must also comply with securities laws.

Defining tokens as securities will mean that crypto asset issuers or trading platforms will incur high costs and fees to adapt to the already comprehensive and strict regulatory standards in the United States. Additionally, they will continue to be subject to regular reviews and legal enforcement by regulatory authorities. Most importantly, regulating under existing regulations, without adaptive revisions, will fundamentally change the operation of the existing crypto asset industry, hindering current operations and future innovative exploration.

3. CFTC Embraces Crypto but Remains Strict

The U.S. Commodity Futures Trading Commission (CFTC) is an independent agency established by the U.S. government in 1974, authorized by Congress to manage and enforce the Commodity Exchange Act of 1936 (CEA) and its promulgated regulations. It is primarily responsible for regulating U.S. commodity futures, options, and financial futures and options markets.

Current CFTC Chairman Rostin Behnam has stated in interviews that the CFTC and the SEC, led by Gary Gensler, have significant differences in their approaches to crypto asset regulation. He believes that many current crypto assets are commodities rather than securities, such as BTC and ETH. He also criticized the SEC's approach to crypto asset regulation, stating, "I am strongly opposed to enforcement regulation. I have done everything I can to maintain transparency." He also stated that financial innovation is in the national interest and compared crypto innovation with other "milestones in market structure," such as "the transition from floor trading to electronic trading 20 years ago."

However, the CFTC has recently demonstrated its strict regulatory approach to the market by enforcing actions against three DeFi projects involving derivatives, imposing penalties on three U.S.-based blockchain companies, Opyn, Inc., ZeroEx, Inc., and Deridex, Inc., which ultimately admitted guilt and settled. While in the past, many may have viewed the CFTC as a mild and friendly regulator due to SEC enforcement and the CFTC's proactive attitude, it is now apparent that the CFTC's regulation in certain areas may be even more stringent.

2. Bitcoin Spot ETF

1. ETF and Bitcoin Spot ETF

An ETF, or exchange-traded fund, is an open-end investment fund that holds a portfolio of assets issued by the company that issues fund shares, and as an index-based investment product, it can track a broad index as well as sub-sectors or industry sectors of that index. ETFs are composed of investment portfolios based on the compilation of various indices, and by trading ETFs, investors can trade a range of underlying asset portfolios, achieving the goal of risk diversification. Common examples include ETFs for financial stocks, energy stocks, or commodities.

A Bitcoin spot ETF primarily invests in spot assets related to Bitcoin, following the price of Bitcoin, allowing investors to buy and sell fund shares on regular exchanges, enabling investors to gain exposure to Bitcoin price fluctuations without actually holding the cryptocurrency.

2. Why Bitcoin Spot ETF is Important

ETFs will simplify the investment process for investors and lower the barriers to entry, encouraging more investors to use ETFs to invest in Bitcoin. Additionally, the introduction of a Bitcoin spot ETF in traditional financial markets, leveraging the strong sales force and revenue expectations of fund giants, will bring trillions of dollars into the market. As the largest cryptocurrency, the introduction of a Bitcoin spot ETF will drive the birth of compliant products for more crypto assets and inflows of funds, thereby promoting the development of the entire industry.

3. Current Progress of ETFs

Several major U.S. fund giants have submitted applications for Bitcoin spot ETFs, including BlackRock, Fidelity, ARK, Bitwise, WisdomTree, and Valkyrie, among others. The SEC needs to respond to the applications before four deadlines, including rejection, approval, or postponement. The SEC did not approve any applications at the first deadline, and a decision on many applications is expected in mid-October.

Former SEC Chairman Jay Clayton, Wintermute co-founder Evgeny Gaevoy, and other U.S. financial leaders have all indicated that the approval of a spot Bitcoin ETF is inevitable, only a matter of time. While many voices have suggested good news for Bitcoin ETFs in October, the author believes that formal approval is more likely next year.

3. Other

1. Stablecoins

This year, Republican members of the U.S. House Financial Services Committee proposed a new stablecoin regulation draft aimed at transferring the jurisdiction of stablecoins from the U.S. Securities and Exchange Commission (SEC) to federal and state banking and credit union regulatory agencies, but it did not pass the Democratic-majority Senate. In August, global payment giant PayPal announced the launch of the PYUSD stablecoin for transfers and payments, issued by Paxos Trust Co. and backed by the U.S. dollar, short-term government bonds, and cash equivalents. Additionally, on August 16, Dante Disparte, Chief Strategy Officer of USDC issuer Circle, called for swift stablecoin legislation in the United States.

2. RWA

RWA in the United States

RWA is one of the fastest-growing areas in the United States, and RWA related to U.S. Treasury bonds has become an important asset in the crypto world. In a paper on tokenization released by the Federal Reserve on September 8, it was stated that tokenization is a new and rapidly growing financial innovation in the crypto market. The Federal Reserve's increasing emphasis on asset tokenization was analyzed from the perspectives of scale, advantages, and risks. On September 7, industry leaders in the crypto world announced the establishment of the Tokenization Alliance (TAC), with founding members including Aave Companies, Centrifuge, Circle, Coinbase, Base, Credix, Goldfinch, and RWA.xyz. These companies are collectively committed to bringing the next trillion-dollar asset onto the blockchain through the tokenization, education, and promotion of real-world assets.

DeFi and NFT

Recently, DeFi and NFT have been the focus of enforcement by U.S. regulatory agencies. As mentioned earlier, the CFTC enforced actions against three DeFi protocols, and the three companies ultimately admitted guilt and settled. In August and September of this year, the SEC took regulatory enforcement actions against Impact Theory, LLC, a base LA entertainment company, and Stoner Cats 2 LLC for offering unregistered securities. Impact Theory, LLC reached a settlement with the SEC by introducing an investor compensation policy.

The United States has long been known for its comprehensive financial system and high regulatory standards. However, this year, the U.S. has been criticized by the industry for not formally introducing new regulations suitable for the industry's development, unlike other countries and regions. The current characteristic of U.S. regulatory agencies is to regulate and enforce virtual assets within the existing system, without formally introducing new rules suitable for industry development. This approach may hinder the development and innovation of the crypto industry in the United States. Nevertheless, the United States still has highly innovative enterprises and a large traditional interest group involved in Web3, which will continue to drive regulatory changes. External regulatory developments and next year's U.S. elections may be key turning points.

Japan and South Korea

Japan

Japan was an early participant in the cryptocurrency space, but in 2014, the country experienced one of the most severe setbacks in the industry when the global major Bitcoin exchange Mt. Gox was hacked and collapsed. The incident resulted in retail investors losing up to 850,000 bitcoins, and the debt repayment process has lasted for nine years without resolution. Recently, on September 21, the trustee responsible for the Mt. Gox bankruptcy case decided to further postpone the payment to creditors for another year, pushing the original payment date from October 31, 2023, to the new date of October 31, 2024. Since the Mt. Gox incident, Japan has implemented stricter regulations on the cryptocurrency industry, adopting clearer and more transparent control policies than other countries, such as the amendment of the Payment Services Act in 2017, which brought cryptocurrency exchanges under regulatory oversight through a licensing system supervised by the Financial Services Agency (FSA).

In recent years, Japan has accelerated a series of positive policies related to the crypto industry. On June 1, 2022, Japanese Prime Minister Fumio Kishida made a statement in the House of Representatives, stating that "the arrival of the Web3 era may lead to economic growth in Japan, and I strongly believe that Japan must vigorously promote this environment from a political perspective." Shortly thereafter, Japan established the Web3 Policy Office of the Ministry of Economy, Trade and Industry, the Liberal Democratic Party's Web3 Project Team, and other policy institutions to vigorously promote the development of Web3 in Japan.

In April 2023, the ruling party's Web 3.0 project team in Japan released a white paper proposing measures to promote the development of the crypto industry in Japan. In June 2023, the "Funds Settlement Act Amendment Bill" in Japan was passed in the Upper House, making it the first country in the world to enact legislation for stablecoins. The "EDCON 2024" Ethereum developer conference will also be held in Japan.

South Korea

South Korea is one of the most enthusiastic countries for trading cryptocurrencies. In 2017, the country, with a population of over 50 million, accounted for 20% of all Bitcoin transactions and became the largest market for Ethereum. In the following years, the South Korean government implemented a series of policies to crack down on speculative activities in cryptocurrency trading, such as trader admission and exchange regulatory registration. However, the enthusiasm for crypto trading remains high. When a token gains popularity among South Korean traders and is listed on South Korean exchanges, the token's price on South Korean exchanges often far exceeds that on global exchanges, a phenomenon known as the "kimchi premium."

In the midst of the crypto frenzy, South Korea's regulatory efforts have also accelerated in recent years. In June of this year, the South Korean National Assembly passed the "Virtual Asset User Protection Act," which introduced a regulatory system for virtual assets. It is expected to help protect users in the virtual asset market and establish a sound, standardized, and transparent market order. The Financial Services Commission of South Korea is preparing for the second phase of legislation for virtual assets. The law will be implemented one year after the government issuance process, expected to be in July 2024.

Recently, the South Korean blockchain industry has been actively laying out infrastructure. On September 12, New Han Investment Securities, KB Securities, and NH Investment Securities, three major securities companies, formed the "Token Securities (TS) Security Token Alliance" and began jointly building infrastructure. On September 21, the city of Busan approved a plan for the establishment and future schedule of the "Busan Digital Asset Exchange," which is scheduled to be established in November and officially operate in the first half of 2024. In addition, the city of Busan proposed to establish Busan as a "blockchain city" centered around the Busan Digital Asset Exchange and to establish a plan for a 100 billion Korean won (approximately 75 million USD) blockchain innovation fund.

G20 — Advocate for Global Virtual Asset Regulatory Framework

The current characteristic of virtual asset regulation is the lack of uniform standards and specific regulations across countries and regions, which has created high difficulty and cost for the operation and development of projects and companies, and has also provided space for regulatory arbitrage by speculators. The G20, as an economic cooperation forum organization representing 85% of global GDP, 80% of global trade, and two-thirds of the global population, is actively advocating for a globally unified virtual asset regulatory framework.

On September 9, 2023, the leaders of G20 member countries expressed agreement with the previous recommendations of the Financial Stability Board (FSB) and the International Monetary Fund (IMF) on crypto asset activities and markets, as well as global stablecoin regulation and supervision. They will discuss the advancement of the roadmap proposed by the FSB and IMF at the meeting in October. At the New Delhi Summit on September 11, the leaders of G20 member countries reached a consensus on the rapid implementation of a cross-border framework for crypto assets. This framework will promote global crypto asset information exchange starting in 2027, with countries automatically exchanging crypto transaction information between different jurisdictions each year, including transactions conducted on unregulated cryptocurrency exchanges and wallet providers.

The G20's progress in virtual assets is positive, but the G20 is characterized by the integration of various political ideologies and complex interests. It is currently in a period of anti-globalization power struggle among major countries, and the progress of substantive policy implementation in the future may be slow.

Conclusion

The cost of regulatory compliance for crypto companies remains high. Although laws have been introduced in various countries and regions, the definitions, classifications, and regulatory methods for virtual assets vary among countries. This requires crypto companies and individual investors to adapt to different rules in different regions to comply with regulations.

Virtual assets are innovative and unique, and are more suitable for the establishment of new regulations for regulation. The lifecycle of virtual assets spans multiple stages, such as mining, staking, issuance, trading, transfer, payment, lending, derivatives, etc. The asset categories are also complex, with a single token having payment, security, and utility attributes. If regulation classifies virtual assets within existing, unamended regulatory frameworks, it will be difficult to adapt to the current industry development. New regulations and regulatory methods should be based on the widely recognized characteristics of virtual assets. Balancing regulation and development is a significant test of the wisdom of government and industry negotiations.

The regulatory path of integration and change is an inevitable route. More virtual asset regulatory laws are expected to officially begin implementation in 2024. The process of adapting to regulation will be long and difficult, but injecting new liquidity and large-scale applications into the current market requires a path of integrating regulation and changing existing systems.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。