作者:1912212.eth,Foresight News

5 月 15 日,加密货币数据平台 CoinMarketCap(CMC)上线其全新功能——CMC Launch。其首发项目为 Aster(AST)。作为数据平台,这是近期以来的一大动作,那么其背后的意义和思考究竟是什么?Aster 又有哪些亮点成为 Launch 第一个上线项目?

CoinMarketCap 新推出的 Launch 类似于任务平台 Galxe 银河,筛选部分优质项目为其提供展示平台。用户可直接在 CMC 官网点击链接参与任务活动(如关注推特账号、交易互动等)获得积分,并在后续获得项目确定性空投。

值得注意的是,CoinMarketCap 官方提示其任务活动由第三方运营。对任何任务或奖励不承担责任,也无控制权。

CoinMarketCap 自 2013 年成立以来,已成为加密货币领域主流数据平台之一,月活跃用户超数千万,页面浏览量高达一度超 8 亿。然而,随着加密市场的快速发展,行业竞争日益激烈,数据平台的功能边界正在被重新定义。

加密项目数量呈爆炸式增长,仅 2024 年就新增了数千个新代币。 新项目要想在拥挤的市场中脱颖而出,面临着巨大的流量和用户获取难题。与此同时,Pump.fun、PancakeSwap 的 SpringBoard、Raydium 的 LaunchLab 等竞争对手也在通过 Launchpool 或类似机制为早期项目提供曝光机会。继币安 Alpha 持续受到市场关注后,项目方曝光需求陡然提升,CoinMarketCap 推出 CMC Launch,不仅是对市场需求的回应,也是其在竞争中寻求差异化的重要一步。

此外,随着加密市场的成熟,投资者和用户对早期项目(Pre-TGE,代币生成事件前)的关注度日益提高。早期项目因其高潜力和高风险,吸引了大量寻求“下一件大事”的用户。CoinMarketCap 通过 CMC Launch 为优质早期项目提供高能见度的展示平台,同时为用户提供参与空投、互动任务等机会,以增强社区粘性。

过往,因多个项目方在空投上暗藏猫腻,该发的不发,承诺的少给,规则突然更改淘汰掉不少用户,甚至以各种理由拒绝发放空投。CoinMarketCap 作为平台方,相当于以自身品牌作为担保,为空投规则发放做背书。长远来看,对于 CoinMarketCap 自身、高质量项目方以及散户而言,无疑是合作共赢的新尝试。

数据平台向生态建设者的转型并非 CoinMarketCap 独有。2024 年,Arkham Intelligence 推出了自己的永续合约交易所,显示出数据平台扩展业务边界的趋势。 CoinMarketCap 背靠币安的资源支持,在品牌、流量和技术上具有天然优势,推出 CMC Launch 顺应了行业向综合性平台发展的潮流。作为独立运营平台,还可增加其收入盈利。

- Aster($AST)是一个去中心化永续合约交易所,由 Astherus 和 APX Finance 合并而成,获得 YZi Labs(Binance 的独立分支)投资。

- Aster 定位于下一代永续合约 DEX,旨在为从新手到专业交易者的所有用户提供无缝的交易体验。项目在 BNB Chain 和 Arbitrum 上运行, Aster 的核心技术亮点包括:

- 双模交易界面:简单模式(Simple Mode)支持一键交易,最高提供 1001 倍杠杆,适合新手;专业模式(Pro Mode)则为资深交易者提供高级工具,如深度图表和复杂订单类型。

- 非托管交易:Aster 无需 KYC(了解你的客户)验证,

Aster 通过与 PancakeSwap 等合作伙伴的协作,整合了稳健的流动性池和收益产品,支持铸造和持有资产(如 ALP、USDF 和 LP 代币)。

Aster 已在市场中展现出强劲的吸引力。根据 CoinMarketCap 官方数据,Aster 目前拥有 3600 亿美元的总交易量,1360 万美元的未平仓合约,其总锁仓价值(TVL)已升至 3.1244 亿美元。

据其官网显示,目前参与者需关注项目方推特、关注其 CMC 社区以及进入 Aster 空投界面进行交互赚取积分。

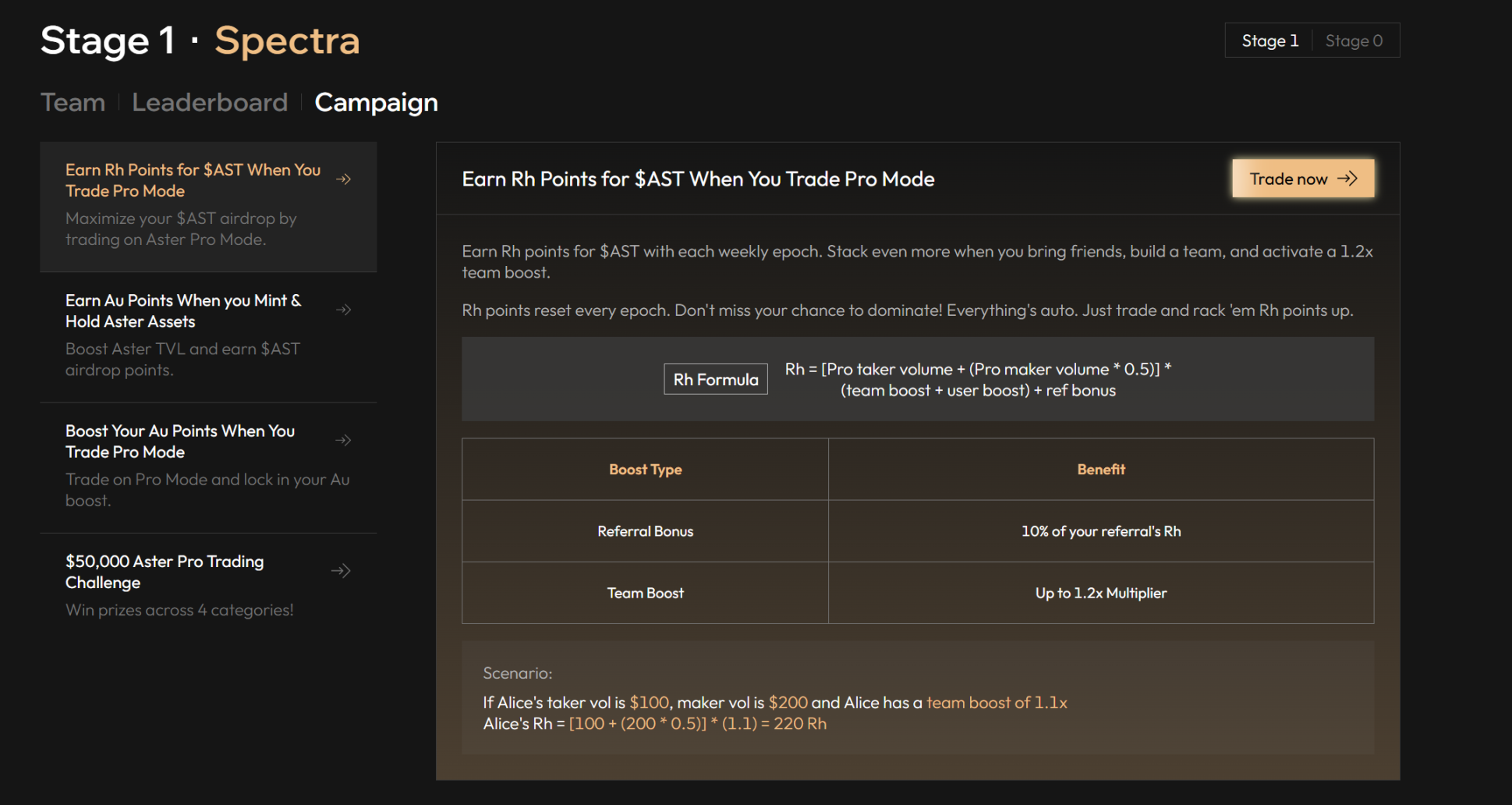

用户还可通过以下方式累积积分,增加未来 $AST 空投分配:

Au 积分:通过铸造和持有 ALP、USDF 或合格的 LP 代币获得,适合偏好低风险的投资者。

Rh 积分:通过在专业模式下交易永续合约获得,交易量超 30 万美元可获得 3 倍 Au 积分加成,适合高频交易者。(https://www.asterdex.com/en/stage1/campaign)

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。