Author: Nancy, PANews

In 2017, the old project Mixin unexpectedly attracted attention within the industry again, but this time it was due to being stolen.

On September 25th, the security agency SlowMist issued a security alert stating that the database of Mixin Network's cloud service provider was attacked, involving approximately $200 million. Subsequently, Mixin tweeted acknowledging that a portion of the mainnet assets were lost due to a hacker attack, and they had contacted Google and SlowMist for assistance in the investigation.

Regarding compensation for user losses and details of the attack, Mixin founder Feng Xiaodong responded in a live broadcast that the official compensation would be at most 50%, with the remaining amount to be compensated in the form of bond tokens. The specific details of the attack will need to wait for the official announcement. As of now, the official has not provided an accurate account of which assets were stolen and the amount involved.

As the Mixin theft incident escalated, the "veteran of the cryptocurrency industry" Li Xiaolai, who had been out of the spotlight for a long time, returned to the public eye. Li Xiaolai is not only an investor in Mixin, but the promotion of this project also heavily relied on his personal influence.

Maximum compensation for stolen assets is 50%, mainly from Li Xiaolai's platform B.watch

According to Mixin's preliminary verification, the amount involved in this attack is approximately $200 million. Currently, Mixin's recharge and withdrawal services have been suspended and will be reopened as soon as the vulnerabilities are confirmed and repaired through discussions among various nodes. According to data released by PeckShield, the mainstream assets involved in this attack, including $94.48 million worth of ETH, DAI, and BTC, are all over $23 million, with a total value of around $140 million.

It seems that the hackers only chose assets with good liquidity. However, according to Feng Xiaodong, assets such as BOX and XIN did not suffer severe theft. Of the remaining assets of over $900 million, BOX and XIN account for about $400 million. The reason why BOX and XIN did not suffer widespread theft is that these assets have no value outside the Mixin ecosystem. Some community members also expressed that the reason why EOS (one of the assets in BOX) was not stolen may be related to the power of EOS's super nodes to freeze accounts.

The majority of the stolen funds came from B.watch. According to DefiLlama data, as of September 25th, Mixin ranked eighth in public chains with a TVL of approximately $350 million, with B.watch contributing over $260 million, accounting for 75.2% of the total amount. B.watch is a one-stop investment research community launched by Li Xiaolai, which once set a threshold of holding more than $500,000 worth of encrypted assets and supported BOX dollar-cost averaging.

Regarding the compensation issue of concern to users, Feng Xiaodong revealed that the assets of all affected users can only be compensated for up to 50%, with the remaining portion to be compensated in the form of bond tokens. In the future, the official will use profits to repurchase, and Mixin's annual profit is approximately between $10 million and $20 million. Additionally, the official has newly launched a system for user asset migration, but the assets that can be transferred temporarily are only half of the user's balance, with the rest displayed in the form of bond tokens.

It is worth mentioning that the trading platform ExinOne on Mixin once invested client wealth of over $5 million into FCoin for wealth management. After FCoin's collapse, the platform also proposed solutions such as issuing bond tokens and delaying redemption.

Li Xiaolai personally promoted the token, and the price dropped by over 88% from its peak

Mixin is a public chain project launched at the end of 2017, focusing on multi-currency payments. In 2017, Mixin's token $Xin raised 8 million EOS, which was valued at approximately 88 million RMB at the time.

Mixin remained relatively unknown for two years after its launch until Li Xiaolai personally supported it. According to Tianyancha, Li Xiaolai and Feng Xiaodong are both shareholders of FeeXman (Beijing) Technology Co., Ltd. Feng Xiaodong holds 94% of the shares, while Li Xiaolai holds 5%. Luo Yonghao was also a shareholder of FeeXman, holding 4% before withdrawing from the shareholder ranks in February 2016. In addition, Mixin's behind-the-scenes members also include industry veterans such as Lao Mao. When news of the theft broke today, some users went to Li Xiaolai's Weibo to ask, "Where are the users' funds?"

On July 3, 2019, Li Xiaolai, who had been inactive for a long time, live-streamed on Mixin's chat app Mixin Messenger, sharing his investment knowledge and recommending the new project BOX. Public information shows that BOX is a completely open, transparent, and zero management fee blockchain ETF product designed by Li Xiaolai. The total issuance of BOX is 200 million, composed of BTC, ETH, EOS, DOT, MOB, XIN, and UNI. Each BOX contains 0.0001 BTC, 0.0001 ETH, 0.03 EOS, 0.005 DOT, 0.01 MOB, 0.0008 XIN, and 0.01 UNI.

To express his long-term optimism for BOX, Li Xiaolai once shared in the group that he exchanged 100,000 BOX with 100 BTC, 150,000 EOS, and 800 XIN. Additionally, Li Xiaolai's other project B.watch also launched the new coin BOX and used its own shares as an incentive.

In addition, Li Xiaolai claimed on his personal WeChat account "Learn, Learn Again, and Learn More" that "dollar-cost averaging is the only reliable investment strategy for ordinary people" and called on everyone to participate in BOX dollar-cost averaging. He also revealed that over the past month, more than 2.8 million BOX had been dollar-cost averaged. Furthermore, Li Xiaolai also established a BOX dollar-cost averaging practice group to personally guide members in dollar-cost averaging, despite setting an entry fee of about 2,000 RMB per year, it still attracted thousands of members.

Despite the strong appeal of Li Xiaolai's dollar-cost averaging with personal interests, it still failed to reverse the downward trend of Xin. According to CoinMarketCap data, as of September 25th, Xin has dropped by nearly 88.6% from its peak and can only be traded on DEX on BigOne and Mixin, hence being mockingly referred to as a "standalone coin." Li Xiaolai has long publicly stated that he is staying away from the chaos of the cryptocurrency industry and is focusing on writing his own book.

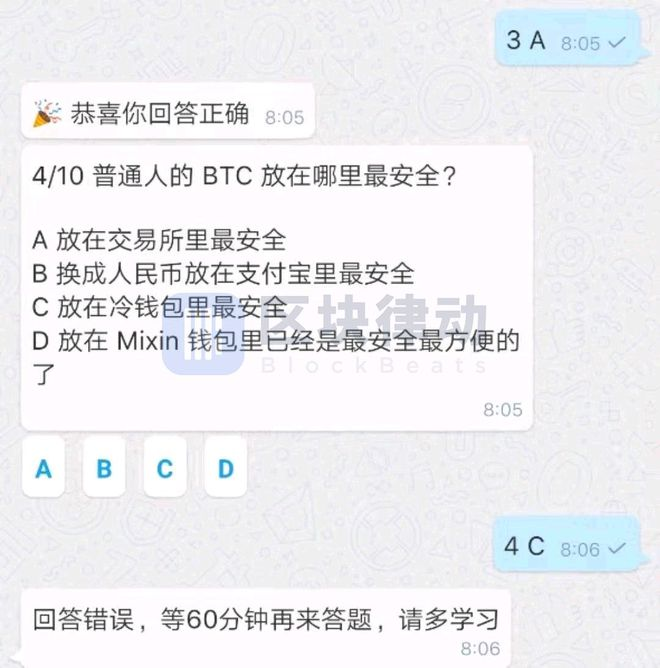

Li Xiaolai's involvement brought attention to Mixin, but Mixin itself has been controversial. For example, in December 2019, Mixin launched a "check-in to receive Bitcoin" activity. According to the rules, checking in for a year could earn 0.0679 BTC. At the time, based on the price, users who persisted for ten years could earn over 300,000 RMB worth of Bitcoin, which attracted a large number of active users. Li Xiaolai once claimed on Weibo that Mixin had 60,000 daily active users. However, shortly after the check-in activity began, the official began to continuously modify the rules, including inviting new users, answering questions, and even depositing money to participate, which caused community backlash. Interestingly, in the question-and-answer section, Mixin intentionally raised users' awareness of its security, such as the answer to the question "Where is the safest place for an ordinary person's BTC" being Mixin wallet.

It is worth mentioning that regarding Li Xiaolai's dollar-cost averaging plan, the founder of Lebit Mining Pool, Jiang Zhuo'er, once predicted, "What is stored on Mixin is (tokens that can be exchanged for BTC by the operator). If the operator does not exchange, runs away, is seized, stolen, or goes bankrupt, your BTC will be lost."

The Mixin attack incident once again confirmed, "Not your keys, not your crypto."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。