Today's headlines:

- US SEC solicits public opinion on ARK and VanEck's Ethereum spot ETF

- "Hong Kong star Julian Cheung assists in police investigation" tops Weibo hot search list

- Ethereum client Nethermindv releases version 1.20.4, Holesky to restart on September 28

- Bloomberg: Hedge funds including Silver Point have purchased over $250 million worth of FTX debt since the beginning of the year

- ConsenSys' Web3 development tools Truffle and Ganache to shut down, with a 90-day migration period

- L2BEAT: Validums and Optimiums are not L2, and the risk of DA from operators is not based on Ethereum

- Cryptogame company Proof of Play completes $33 million seed round financing, led by Greenoaks and a16z

- Data: 42,540 addresses have not claimed 70.6 million ARB airdrops, accounting for approximately 6% of the total airdrop

Regulatory news:

- US Second Circuit Court of Appeals rejects SBF's motion for pre-trial release According to Cointelegraph, a jury of three judges at the US Second Circuit Court of Appeals rejected the motion for pre-trial release of SBF. The jury mainly based its ruling on the First Amendment and stated that Judge Lewis Kaplan, who is responsible for SBF's criminal case, had "correctly determined" that SBF's statements interfered with witnesses. Earlier, US Federal Judge Lewis Kaplan rejected SBF's motion for pre-trial release on September 12, stating that he had created the situation himself. SBF's criminal trial is scheduled to begin on October 3.

Later, it was reported that the trial process of FTX founder's case starting on October 3 is expected to last 6 weeks.

US SEC solicits public opinion on ARK and VanEck's Ethereum spot ETF The US Securities and Exchange Commission (SEC) is reviewing the applications for Ethereum spot exchange-traded funds (ETFs) from ARK Invest and VanEck, two asset management companies. Yesterday, the SEC solicited public opinion on the potential benefits and risks of approving these ETFs. The regulatory agency has opened a 45-day public comment period for these two filings.

NFT

Project updates:

"Hong Kong star Julian Cheung assists in police investigation" tops Weibo hot search list Hong Kong star Julian Cheung's involvement in the JPEX case and his visit to the Hong Kong Police Headquarters to assist in the investigation has become a hot topic on Weibo, currently ranking first on the hot search list.

It is reported that JPEX had invited Julian Cheung and several other artists and internet celebrities for promotion, describing Julian Cheung as the "Hong Kong Brand Ambassador." However, Julian Cheung's agent had previously responded that they had notified JPEX not to use his image before obtaining a license and reserved the right to pursue JPEX. Julian Cheung was invited to the Hong Kong Police Headquarters (located in Wan Chai) to assist in the investigation this morning. Subsequently, he was allowed to leave the law enforcement department.

Later, several Hong Kong media outlets reported on the progress of the JPEX case, stating that as of 5 pm yesterday, a total of 2,197 victims had reported cases, involving approximately HK$1.37 billion. Previously, Hong Kong artist Jacqueline Chong, who was suspected of fleeing to Singapore, returned to Hong Kong and went to the Commercial Crime Bureau for investigation last night, leaving at 3:40 am today. Some media outlets discovered that JPEX had applied to cancel the license of its Lithuanian subsidiary.

A lawyer for Binance.US requests the court to dismiss the SEC's lawsuit, opposing "false trading" allegations According to The Block, a lawyer representing Binance.US requested the Washington, D.C. court to dismiss the lawsuit filed by the US Securities and Exchange Commission (SEC), stating that the allegations of false trading "lack factual basis." The motion to dismiss stated: "Apart from conclusory allegations and isolated instances of interaction with the Sigma Chain account, the SEC's complaint does not provide specific allegations of improper conduct by Sigma Chain. Under securities law, wash trading requires fraudulent intent to manipulate the market. The SEC's allegations of false trading, while sensational, lack factual basis. Therefore, this case should be dismissed."

The motion also questioned the SEC's description of some tokens provided on the platform as securities, including BNB, BUSD, SOL, ADA, MATIC, FIL, ATOM, SAND, MANA, ALGO, AXS, and COTI. Binance.US's lawyer stated: "In this case, the SEC has not alleged that any buyer of digital assets on the Binance.US platform received any promises from the seller (or anyone else), let alone delivery of future value." The lawyer cited the "materiality doctrine" in the motion and stated that the SEC cannot treat digital assets as securities. This doctrine holds that if an institution wants to make decisions on matters of national significance, it must have explicit congressional authorization.

Earlier on June 6, it was reported that in the lawsuit against Binance, the SEC stated that Zhao Changpeng is the actual owner of Binance's market maker Sigma Chain, and multiple Binance employees are involved in its operation.

Ethereum client Nethermindv releases version 1.20.4, Holesky to restart on September 28

Blockchain tool and infrastructure developer Nethermind tweeted that Nethermind client version 1.20.4 has been released, and Holesky will restart at 20:00 on September 28th Beijing time. Earlier, the Ethereum Holesky testnet failed to start due to network configuration errors, and developers plan to restart it soon.

According to Bloomberg's analysis of court records, hedge funds such as Silver Point Capital, Diameter Capital Partners, and Attestor Capital have purchased over $250 million worth of FTX debt since the beginning of the year. Court documents show that in a recent transaction, asset management company Hudson Bay Capital Management purchased $23 million worth of FTX debt from a cookie distributor and shortly after sold about half of it to Diameter. In the bankruptcy debt market, a bankrupt company's payable debts trade at extremely low prices. Data from bond broker Claims Market shows that in recent weeks, the quotes for some lower-tier FTX debts have risen to about 35% of face value, compared to 12% at the beginning of the year.

FTX reminds that September 29th is the deadline for customers to submit claims. The submission deadline for customer claims is 4:00 PM Eastern Time on September 29, 2023. Customers are advised to log in to the customer claims portal website to start the claims process. FTX requires customers to provide KYC information during the claims process, and the KYC verification process will continue after the deadline. In addition, for accounts previously frozen due to network security events, FTX sent a separate notice on September 17, 2023.

Venture capital firm GGV Capital announced that the company will split into two completely independent partnerships, each with its own unique brand name. The US partnership, led by managing partners Glenn Solomon, Hans Tung, Jeff Richards, and Oren Yunger, will primarily invest in North America, Latin America, Israel, Europe, and India/US cross-border, with offices in Silicon Valley and New York. The Asian partnership, led by managing partners Jenny Lee and Jixun Foo, will primarily invest in China, Southeast Asia, and South Asia, with headquarters in Singapore. Additionally, the RMB fund under the brand Jiyuan Capital will continue to be independently managed by managing partner Eric Xu. The transition is expected to be completed by the first quarter of 2024.

Coinbase CLO Paul Grewal stated at the Mainnet 2023 annual summit hosted by Messari that they have not completely ruled out the possibility of issuing tokens for Base. He mentioned that tokens may be feasible at some point in the future, but they are not currently focused on the protocol's economics and tokenization. Regulatory clarity is also very important.

Blockchain development company ConsenSys announced on its official blog that it has decided to retire its Web3 development tools Truffle and Ganache in order to focus its efforts on partners in the Ethereum ecosystem. They will provide support for developers using MetaMask tools (such as Snaps and SDK) to build dApps. Recognizing the importance of Truffle and Ganache to many Ethereum projects, they will work with HardHat to provide a smooth transition for all developers currently using them. ConsenSys is committed to supporting Truffle and Ganache users in transitioning to HardHat, Foundry, and other ecosystem tools such as Remix, Thirdweb, and OpenZeppelin.

Linear Finance announced that it was attacked on September 21, leading to the depletion of all LUSD liquidity on PancakeSwap and Ascendex, causing the price of LUSD to drop to zero. The attacker was able to mint LAAVE infinitely, then exchanged this liquidity asset for LUSD on Linear Exchange and sold it on PancakeSwap and Ascendex. To protect the protocol, all protocol contracts allowing token minting, burning, or swapping have been suspended. The LUSD bridging contract has been disabled. The Linear team has hired a leading industry team to track down the attackers and bring them to justice. They have shared the wallets known to be involved in the attack with all major exchanges and authorities. The team's top priority is to restore the protocol and recover losses for users before the issue is fully resolved.

Microsoft announced that "AI Copilot" will be launched on Windows on September 26th, running across applications and devices. It will be available to enterprise customers on November 1st.

L2beat/The Ethereum Foundation has stated that second-layer scaling solutions outside of Rollups are no longer considered Layer 2 because they do not implement DA on the Ethereum mainnet. Validums and Optimiums are not considered L2 as they do not implement DA based on Ethereum, introducing additional trust assumptions (the same applies to EigenDA). If operators of offline DA solutions do not provide the data needed to rebuild the state, funds are at risk. However, plasma and state channels still qualify as L2 (mainly due to historical reasons).

According to L2BEAT's concept, the current Ethereum L2 includes four types: zkRollups, Optimistic Rollups, State channels, Plasma.

Warning: T-Mobile data leak, beware of sim swap hijacking risk](https://www.panewslab.com/zh/sqarticledetails/hdjfysk2.html)

23pds, Chief Information Security Officer of SlowMist, stated on X platform that users should beware of the sim swap hijacking risk caused by the T-Mobile data leak. With T-Mobile data leaked, T-Mobile customers need to be highly vigilant against scams and attacks using personal information, and be cautious of attackers using leaked information to deceive T-Mobile official customer service, leading to personal Sim Swap risk.

Stacks expected to release sBTC developer version in October, incentive testnet applications now open](https://www.panewslab.com/zh/sqarticledetails/f83p9q7v.html)

According to the official blog, the Bitcoin Layer 2 network Stacks stated in a blog post that the Stacks ecosystem is preparing for the sBTC developer version, allowing selected developers to build and test early versions of sBTC (a BTC version supported 1:1 on the Stacks layer). The sBTC testnet will allow users to start testing the deposit and withdrawal processes of sBTC, and developers in the Bitcoin L2 ecosystem can begin integrating these deposit and withdrawal processes into their applications using simple APIs and wallets such as Leather and Xverse.

The sBTC developer version will include a frontend application providing a simple interface to test sBTC deposit and withdrawal transactions. In addition to the tools themselves, in-depth documentation, tutorials, and sample applications will be provided to ensure that developers can quickly and easily get started and running. The sBTC working group expects to deliver the developer version in the week of October 18. Given the release of this version, applications for the incentive testnet plan are currently open.

X CEO confirms: X platform to launch financial payments and video call features](https://www.panewslab.com/zh/sqarticledetails/9zvwax6d.html)

Yaccarino, CEO of X (formerly Twitter), posted a video yesterday confirming that the platform will soon launch financial payment features and unlock video call functionality.

In the video sharing the new features, Yaccarino wrote, "Here's a hint of what's coming soon. Guess who's coming?" The two-minute video discusses various things users will be able to do on X in the future, including the upcoming financial payment feature and video call functionality. Additionally, users will be able to seek jobs through X in the future.

Morgan Creek founder: Approval of Bitcoin spot ETF could attract $300 billion in funds to the market](https://www.panewslab.com/zh/sqarticledetails/a353iudj.html)

According to Bitcoin Magazine, Mark Yusko, CEO and Chief Investment Officer of Morgan Creek Capital, stated in an interview that the approval of a Bitcoin spot ETF by the U.S. Securities and Exchange Commission (SEC) could attract $300 billion in funds to the market. He emphasized the importance of the approval of a Bitcoin spot ETF in the United States, noting that it provides institutional investors with a bridge to enter the Bitcoin market. Senior ETF analyst Eric Balchunas of Bloomberg stated that about $150 billion would flow into the market after the approval of a Bitcoin spot ETF, but Yusko believes that the actual inflow of funds could be more. He said, "I would further argue that it's more likely $300 billion. The price of Bitcoin will rise significantly at that time."

Yusko emphasized the importance of being a pioneer in obtaining ETF approval, stating that "the first to enter will get the vast majority of the assets." However, he believes that BlackRock entering the market is a game-changing move. In a place where many have tried and failed to obtain SEC approval for a spot ETF, Yusko believes that BlackRock will be the first and only applicant to receive approval. Yusko believes that a spot Bitcoin ETF "will be approved around the end of the year," either before the end of this year or early 2024.

Latest Ethereum meeting: Dencun mainnet activation may not occur this year due to Holesky startup failure affecting the process](https://www.panewslab.com/zh/sqarticledetails/v4h03p37.html)

Christine Kim, Vice President of Galaxy Research, summarized the 118th Ethereum Core Developers Consensus Meeting (ACDC), which mainly discussed the preparation work for Devnet-9 and changes to the Ethereum Consensus Layer (CL).

Devnet-9 is the second testnet, including a full set of code changes in the Dencun upgrade. Devnet-9 will be the first testnet to activate EIP-7514 and EIP-7516, which were added to the Dencun upgrade at the last execution layer meeting. Parithosh Jayanthi, DevOps engineer at the Ethereum Foundation, stated that their team will launch Devnet-9 on September 27; EL and CL client teams such as Lodestar, EthereumJS, Lighthouse, and Geth have confirmed their readiness for this testnet release.

Tim Beiko, an Ethereum core developer, raised questions about the Dencun testing schedule at this meeting, as it was previously suggested to sequentially launch Dencun on the following testnets: Holesky, Goerli, and then Sepolia. However, due to network configuration errors, the Holesky testnet failed to start and will be restarted on September 28. Therefore, Tim Beiko stated that if developers cannot ensure the release of Dencun on a public testnet before the Ethereum developer conference Devconnect in November 2023, the mainnet activation of Dencun is unlikely to occur this year.

Cryptocurrency exchange Bybit to suspend its UK services next month](https://www.panewslab.com/zh/sqarticledetails/reuta7pp.html)

Cryptocurrency exchange Bybit announces the suspension of its services for UK residents/nationals

Bybit has announced that starting from 16:00 on October 1, 2023 (Beijing time), it will no longer accept new account applications from confirmed UK residents/nationals ("UK customers"). From 16:00 on October 8, 2023, UK customers will no longer be able to make new deposits, create new contracts, or increase any existing positions for all products and services. However, they can reduce and close positions, and withdraw funds from the platform. It is recommended that UK customers affected by these measures take action to manage and reduce their positions before 16:00 on January 8, 2024. After the specified deadline, their uncleared positions will be liquidated, and the liquidation funds will be available for withdrawal.

Funding News

According to The Block, blockchain gaming company Proof of Play, led by Amitt Mahajan, co-founder of FarmVille and former Zynga executive, has raised $33 million in a seed round of financing, with Greenoaks and a16z leading the investment. Other participants in this round of financing include Ravikant, who early invested in Uber and Twitter, Balaji Srinivasan, Twitch co-founders Justin Kan and Emmett Shear, as well as Mercury, Firebase, Zynga, and Alchemy.

Proof of Play aims to create fun and easy-to-use blockchain games. Its first game, a social role-playing game called "Pirate Nation," was released in beta in December. According to the statement, FarmVille had over 300 million players and was the top-ranked game in Facebook's history. In addition to creating FarmVille, Mahajan has also served as an executive at Zynga and later founded Toro (later acquired by Google).

Crypto transfer and payment company Mesh completes a $22 million Series A financing

According to TechCrunch, crypto transfer and payment service startup Mesh (formerly Front Finance) has completed a $22 million Series A financing, with Money Forward leading the investment, and participation from Galaxy, Samsung Next, Streamlined Ventures, SNR.VC, Hike VC, Heitner Group, Valon Capital, Florida Funders, Altair Capital, Network VC, and several angel investors. To date, Mesh has raised a total of $32 million in funding. The new funds will further develop its tools for deposits, payments, and expenses, and support the operation of its products.

Mesh was founded by Bam Azizi and Adam Israel in 2020. Prior to founding Mesh, Azizi founded the cybersecurity and identity company NoPassword, which was acquired by LogMeIn in 2019. Adam Israel previously served as a managing director at HSBC. Enterprises can use Mesh to allow customers to move assets (including cryptocurrencies) between different platforms, and users can connect accounts with read, write, and transfer capabilities for different asset categories and holdings to Mesh, allowing the platform to aggregate all their accounts. Mesh supports in-app asset transfers across exchanges and wallets, as well as cryptocurrency payments and expenses.

Singapore fintech company DCS Fintech Holdings completes a $10 million strategic financing

According to Cointelegraph, Singapore fintech company DCS Fintech Holdings has secured a $10 million strategic investment from Foresight Ventures to create a payment solution that links cryptocurrencies and fiat currencies.

DCS Fintech Holdings' subsidiary DCS Card Centre (formerly Diners Club Singapore) is a credit card issuer regulated by the Monetary Authority of Singapore, and will use the funds to develop new payment solutions to provide seamless connectivity between Web2 and Web3. DCS Card Centre deployed and issued the anchored dollar payment token DUS on the PlatON network in early September.

Bitmain to invest $53.9 million in Core Scientific and reach a new hosting agreement

According to Businesswire, Bitmain has announced its decision to invest $53.9 million in the Bitcoin mining company Core Scientific to expand the long-term partnership between the two companies. Bitmain and Core Scientific have reached an agreement involving a combination of equity and cash to provide funding for the purchase of new, more efficient Bitcoin mining equipment. In addition, Bitmain has reached a new hosting agreement with Core Scientific to support Bitmain's mining operations.

Under the terms of the purchase agreement, Bitmain will provide Core Scientific with 27,000 Bitmain S19J XP 151 TH Bitcoin mining servers in exchange for $23.1 million in cash and $53.9 million worth of Core Scientific common stock, with the value per share to be determined based on the reorganization plan approved by the bankruptcy court, which is expected to be completed in the fourth quarter of this year.

Mining News

PANews reported on September 22 that Bitdeer Technologies Group, a mining company under the control of Wu Jihan, has released a prospectus today, planning to issue up to 150 million shares of Class A common stock, with a face value of $0.0000001 per share, for resale by B. Riley Principal Capital II, LLC in Delaware. The shares included in this prospectus are Class A common stock, and Bitdeer may, at its discretion, issue and sell shares to B. Riley Principal Capital II after the release of this prospectus, based on the Common Stock Purchase Agreement signed on August 8, 2023. Bitdeer stated, "We will not sell any securities under this prospectus, nor will we receive any proceeds from the resale of our Class A common stock by the selling security holders. However, under the purchase agreement, we may choose to sell our Class A common stock to B. Riley Primary Capital II after the release of this prospectus, and receive total proceeds of up to $150,000,000."

According to the latest equity disclosure data from Futu, as of August 31, three institutional investors have increased their holdings of Bitdeer (NASDAQ: BTDR), a mining company under Wu Jihan. These investors include BlackRock, First Trust Advisors L.P., and Credit Suisse Asset Management. The world's largest asset management company, BlackRock, holds a total of 99,810 shares of BTDR stock, and BTDR has been included in several ETFs under BlackRock. First Trust, a provider of investment products and advisory services, holds 46,680 shares of BTDR stock. Credit Suisse Asset Management currently holds 13,850 shares of BTDR stock. The institutions with the highest holdings of BTDR stock are Sequoia China and Sequoia Capital Operations, with ownership percentages of 3.63% and 1.15%, respectively.

At the 2023 World Digital Mining Summit held today, Bitmain released the water-cooled mining machine ANTMINER S21 with an energy efficiency ratio of 1XJ/T. There are two configurations: S21 Hyd, with a hash rate of 335T and an energy efficiency ratio of 16J/T, operating at temperatures below 40°C, with a limit temperature of 40 to 45°C; S21, with a hash rate of 200T and an energy efficiency ratio of 17.5J/T, capable of withstanding temperatures of 45°C. The new mining machine can be pre-ordered before October 7 at a price of $14/T, and after October 8, the price will be $19.6/T.

Important Data

The world's 12 largest Bitcoin ETFs collectively hold over 100,000 BTC

Research by Coingecko shows that the 12 largest spot and futures Bitcoin ETFs available for trading globally collectively hold 102,619 BTC, slightly less than 0.5% of the total BTC supply. The ProShares Bitcoin Strategy ETF currently holds 35,890 BTC, making it the oldest and largest fund in the field. Among the top 12 Bitcoin ETFs, 2 (or 16.6%) are provided by ProShares and are tradable in the United States.

According to Lookonchain monitoring, a total of 81 new wallets created on September 15 began withdrawing LINK from Binance on September 18. So far, these wallets have withdrawn a total of 4.7 million LINK (approximately $31.58 million) from Binance.

According to CoinDesk, FTX has filed a lawsuit against former employees of Salameda, seeking to recover approximately $157.3 million. Salameda is a Hong Kong-registered entity affiliated with FTX, reportedly controlled by SBF. The lawsuit alleges that Michael Burgess, Matthew Burgess, their mother Lesley Burgess, Kevin Nguyen, Darren Wong, and two companies owned or controlled several accounts registered with FTX.com and FTX US, and fraudulently withdrew assets in the days leading up to FTX's bankruptcy.

It is alleged that during the 90 days prior to FTX's bankruptcy application on November 11, 2022, the defendants obtained cash-out benefits constituting preferential transfers, "which are avoidable under bankruptcy law." At that time, the defendants rushed to withdraw assets and used their relationships with FTX personnel to ensure that their withdrawal requests were prioritized over other clients.

Nansen: Partial user data leaked due to attack on third-party vendor

Nansen stated on X platform that partial user data was leaked due to an attack on a third-party vendor. According to preliminary investigations, 6.8% of Nansen users were affected. The leaked data includes email addresses of these users, and a small portion of users' password hashes were also leaked. In addition, blockchain addresses of some users were leaked. As a security precaution, Nansen has requested affected users to reset their passwords via official email.

Scopescan stated that there are only 2 days left until the deadline for claiming ARB airdrop tokens. Currently, 42,540 addresses have not claimed a total of 70.6 million ARB tokens (approximately $58.4 million), accounting for 6% of the total airdrop. The average idle time for these addresses is 384 days, with most addresses being idle for over 1 year. Among the 42,540 addresses, there are 37,338 entities, with the largest entity controlling 635 addresses and eligible to claim 1,224,875 ARB tokens. 2,573 addresses have never executed outgoing transactions on Arbitrum, with most of them being protocol contracts or only using Arbitrum Nova. Most of the unclaimed addresses are eligible to claim 1,250 ARB tokens.

Earlier today, it was reported that unclaimed ARB airdrop tokens will be sent to the DAO treasury in approximately 2 days, according to Arbitrum's reminder.

PANews APP Points Mall Officially Launched

Free exchange of hardcore prizes: imKeyPro hardware wallet, First Class Cabin research report monthly card, Ballet REAL series wallet, AICoin membership, various peripherals, and hundreds of selected research report collections, first come, first served, experience now!

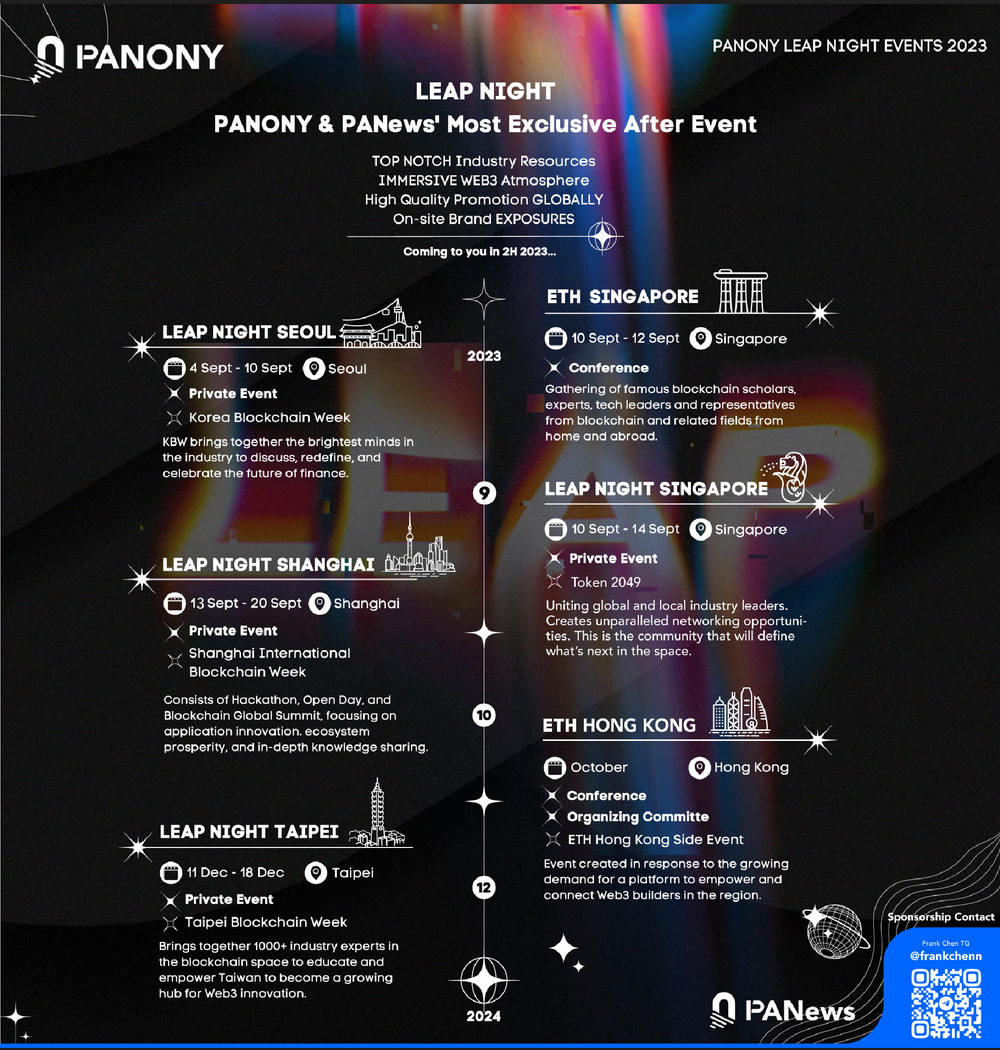

PANews Launches Global LEAP Tour!

Korea, Singapore, Shanghai, Taipei, multiple locations will gather from September to December to witness a new chapter in globalization!

?Events in multiple locations are being planned, welcome to communicate!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。