Author: Pomelo, ChainCatcher

Since Coinbase officially announced the launch of the Base mainnet on August 9th, the locked value of encrypted assets in Base has exceeded $500 million in just one month, making it the third largest Layer2 network.

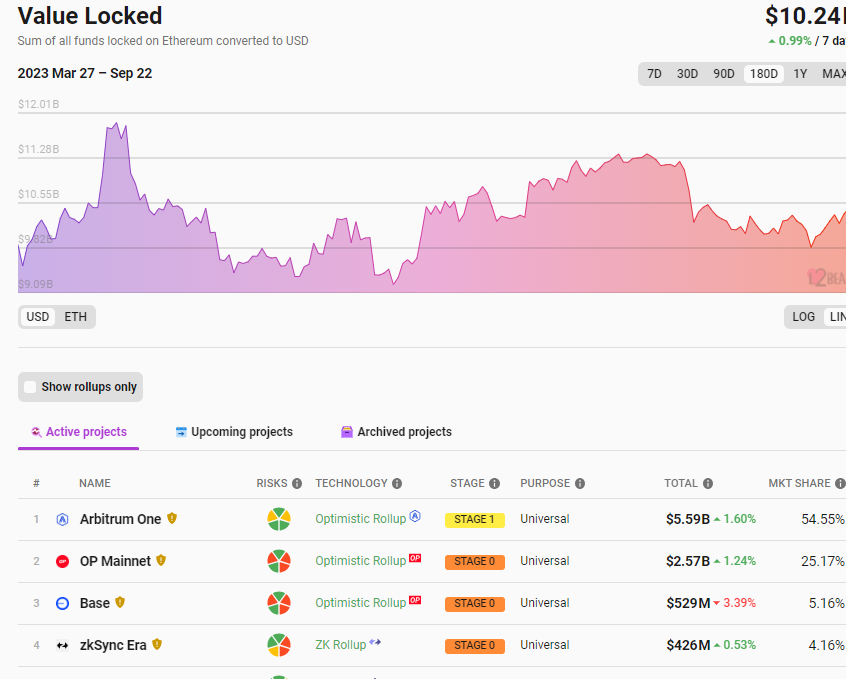

According to L2Beat data, as of September 22nd, the TVL of the Base chain is approximately $530 million, with a market share of 5%, ranking third among many Layer2 networks, only behind Arbitrum and Op Mainnet, and surpassing zkSync Era. According to DeFiLlama data, Base's TVL has surpassed the Layer1 public chain Solana, ranking ninth in the entire public chain market.

In addition, according to Basescan, the total number of addresses participating on the Base chain is currently 22.85 million, far exceeding Arbitrum (12.5 million) and Op Mainnet (12.7 million).

Whether measured by the amount of locked assets or the number of participating user addresses, Base has become the most active network in the current public chain market, even in the case where Coinbase explicitly stated that it would not issue coins. However, there are new statements about whether Base will issue tokens. According to Decrypt's report on September 22nd, Coinbase's Chief Legal Officer Paul Grewal responded to the question of "whether Base will have tokens" during an interview at the Messari summit, stating that "this possibility is not completely ruled out, and believes that tokens may be feasible at some point in the future." However, at present, the focus is not on the protocol's economics and tokenization, and regulatory clarity is also very important.

So, why has Base achieved such outstanding results within just one month of its launch? What are the secrets behind its explosive growth? What opportunities do ordinary users have to participate?

From the thousand-fold coin BALD to the social app Friend.tech, who is the driving force behind the surge in Base users?

Base made its first public appearance in February of this year. As a Layer2 network built on the OP Stack incubated by Coinbase, it quickly gained attention in the crypto industry upon its debut, with the dual resources of Coinbase exchange and the leading Layer2 network Optimism. After the mainnet was officially launched in August, the Base ecosystem lived up to expectations, giving birth to one hot project after another, from the early thousand-fold coin BALD to the now popular social app Friend.tech.

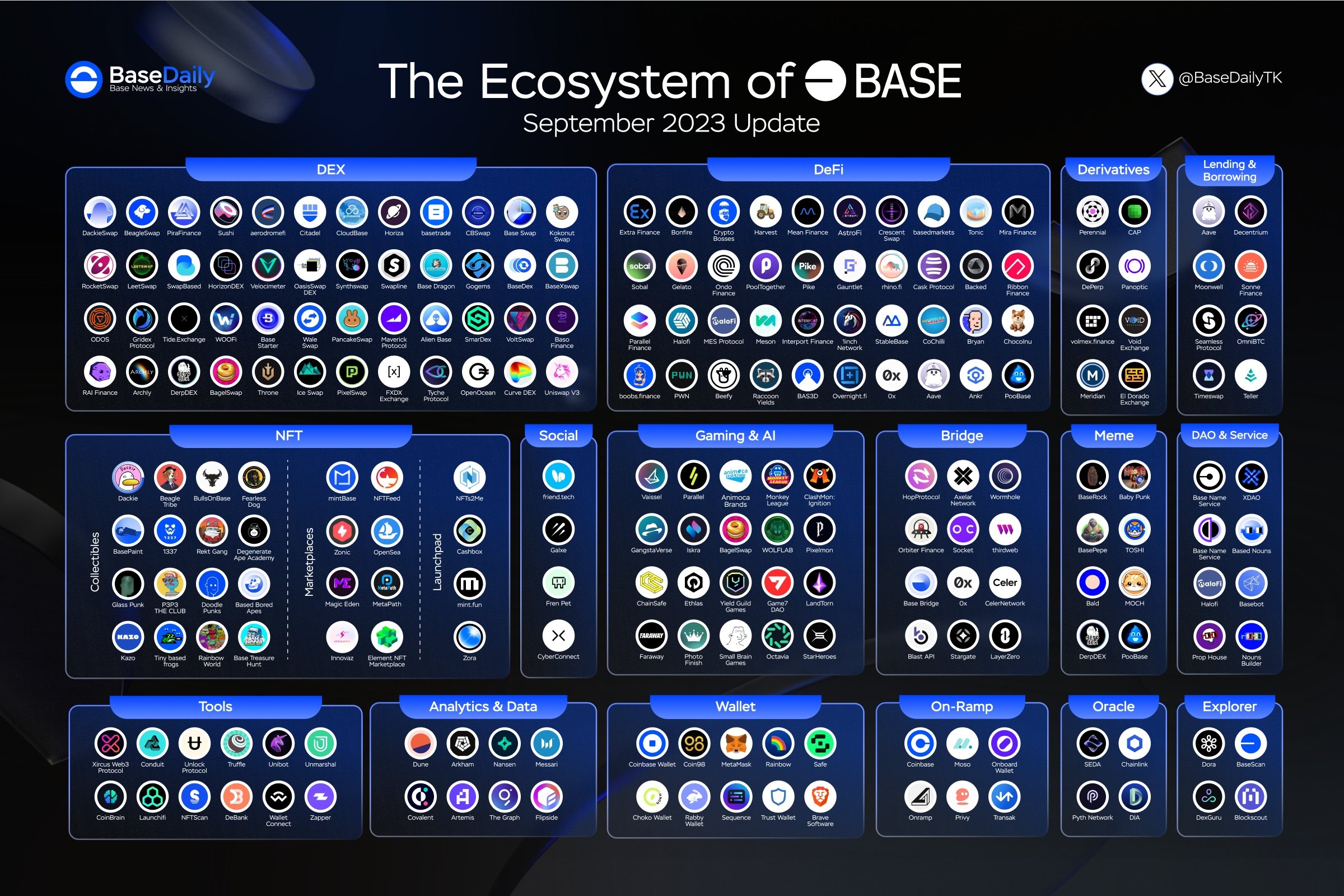

According to the Base Daily account tracking the ecosystem's development, currently, there are over 300 projects or Dapps deployed on the Base ecosystem, covering developer tools, wallets, oracles, cross-chain bridges, as well as DeFi, social, gaming, NFT, and DAO applications. Among them, top-known projects such as Uniswap, Curve, Sushi, and Opensea have all been deployed on Base.

In addition, according to BaseScan data, since its launch, the daily transaction volume on the Base chain has exceeded that of the Optimism and Arbitrum networks multiple times, with the daily transaction volume reaching a record high of 1.88 million transactions on September 14th.

In addition, according to BaseScan data, since its launch, the daily transaction volume on the Base chain has exceeded that of the Optimism and Arbitrum networks multiple times, with the daily transaction volume reaching a record high of 1.88 million transactions on September 14th.

Compared to the development of applications and user numbers on other Layer1 and Layer2 networks, Base's ecosystem development has caught up with or even surpassed most public chain networks shortly after the mainnet launch. Despite Coinbase's explicit statement that Base will not issue tokens and with no airdrop expectations, how has the Base network managed to attract so many projects and users voluntarily?

It is well known that the prosperity of a public chain's ecosystem depends on "solid technology, popular applications, ecosystem support, and incentive expectations." As a Layer2 network backed by Coinbase, Base naturally understands this.

Firstly, in terms of technology and security, Base is built on the open-source Op Stack stack of the Layer2 leading project Optimism, which inherits the security of the Ethereum mainnet, and has transaction speed and throughput far exceeding Ethereum, with transaction gas fees much lower.

In terms of ecosystem support, Base has the dual resources of Coinbase and Optimism's OP Stack. Among them, Coinbase, as one of the top 5 centralized exchanges globally, not only has hundreds of millions of users but also has substantial funds and cash flow, providing a large number of user resources while also being able to provide significant financial support.

Based on Coinbase founder Brian Armstrong's remarks on the launch of Base, he divides the growth of cryptocurrencies into four stages: first, developing underlying protocols (Bitcoin, Ethereum); second, establishing exchanges (Coinbase Exchange) as a bridge for entering digital currencies; third, creating decentralized applications or DApps for the general public (such as Coinbase Wallet, Coinbase's Ethereum staking product cbETH); and fourth, building open decentralized applications DApps. The fourth stage is to be achieved through Base, and the Coinbase team sees Base as an important step in realizing an open and free economy. Base will become an important deployment site for Coinbase's on-chain products, providing more open ecosystem support for DApp developers, thus becoming a seamless entry point for Coinbase users to access a wider range of crypto economies.

From this perspective, Base plays an important role in Coinbase's development plan, becoming an important entry point for Coinbase users to enter the Web3 world. Coinbase's resources are also empowering the Base network. Today, Coinbase is not just an exchange, but also offers on-chain staking solutions cbETH, Coinbase Wallet, stablecoin USDC, crypto asset custody, and other businesses and products. Base can integrate or build new applications based on these existing Coinbase products, such as automatic integration of the Base mainnet in the Coinbase Wallet, without the need for users to add it themselves; Circle has already launched native USDC on the Base network. In the future, excellent project tokens within its ecosystem may also have the opportunity to be listed on the Coinbase platform.

Regarding Optimism, first, Base will share the ecosystem support within Op Stack. In addition, according to the income swap agreement proposed by both parties in August, the Optimism Foundation will provide Base with the opportunity to earn $118 million worth of OP tokens over six years, and many users speculate that these OP tokens will be rewarded to Base's ecosystem project parties and users. In simple terms, Optimism may provide $118 million worth of OP token incentives to Base's ecosystem users, so while Base does not issue coins, users can earn OP tokens.

In terms of incentive expectations, Base has adopted different incentive strategies for ecosystem users and developers. For developers, on the day of the Base network's launch, the Base Ecosystem Fund was created, which is used to invest in early projects built on Base, combined with dedicated support from the Base team to help projects succeed. On September 8th, the Base Ecosystem Fund announced that it had completed investments in six projects in its ecosystem, including: perpetual contract platform Avantis, decentralized limit order book BSX, on-chain custody service Onboard, insurance aggregator OpenCover, on-chain creator platform Paragraph, and on-chain financial oracle Truflation; for users, on the day of the mainnet launch, it launched a one-month on-chain activity called "OnChain Summer," featuring content related to 50 of the most outstanding builders, brands, products, artists, and creators.

In the creation of popular projects in the ecosystem, Base seems to never lack a narrative. Before the mainnet was officially launched, a meme coin called BALD was born, with a price increase of over a thousand times in one day, and the TVL broke through $100 million within 2 days, with the liquidity pool size exceeding $25 million. Although BALD eventually ended in collapse, the wealth effect story of BALD opened the floodgates of traffic for Base.

At that time, the Base mainnet was not open to the public, and the operation of the BALD token involved the creator holding a large number of tokens in advance, then pushing up the token price, and taking advantage of the rise to sell off, leading to users being trapped, which was later jokingly referred to as a "rugging" scheme. Many users speculated that BALD might just be a pawn, and the real strategist might be Coinbase, seizing the user and market sentiment on the eve of the mainnet launch, bringing heat and attention to the Base chain.

Although its true mastermind may not be related to Coinbase, the impact of BALD has continued, especially in the early days after the launch of the Base mainnet, where the Base ecosystem was dominated by "rugging" schemes, with numerous rug DEX and lending protocols, such as Leetswap and Rocketswap, experiencing security incidents. The native lending protocol Magnate Finance's contract deployer was associated with the solfire scam and later ran away.

The real breakthrough in this situation came with the emergence of the social app Friend.tech, which flooded major social networks with invitation codes, allowing users to tokenize (KEY) their Twitter accounts for trading, with the price of KEY designed to increase exponentially with the user's holding amount, quickly attracting user attention and remaining one of the most active applications on Base to this day.

From the thousand-fold meme coin BALD to the invitation code flooding of Friend.tech, the commonality is the repeated telling of stories of getting rich on the Base chain. This seems to be the secret recipe that Base has mastered to attract user attention and heat. For a new public chain, getting rich stories are the most attractive, and a popular application is enough to make a chain a star or even revive it from the dead. From BALD to Friend.tech, the Base chain has also completed its magnificent transformation from a meme rug scheme to application innovation. Today, Coinbase's latest response regarding whether Base will issue tokens will also open up a new growth story for it.

What other opportunities does the Base ecosystem have?

Today, the development of the Base chain is still in its early stages. Although the locked value of encrypted assets on the chain has exceeded $500 million, from the perspective of ecosystem application development, only the TVL of the DEX platform Aerodrome exceeds $100 million, while the TVL of most applications is maintained between one to two hundred million dollars. Compared to the scale of application funds on other public chains, there is still a lot of room for development in the Base chain ecosystem. So, what applications does the Base chain have for users to participate in? This article will take stock of the native applications represented by Base.

It is important to note that there have been many instances of native projects running away on the Base chain, and users need to pay attention to the security of their funds when participating in early stages.

First, let's take a look at the latest developments of the first six projects that received the initial investment from the Base Ecosystem Foundation.

- Decentralized derivatives platform Avantis

Avantis is a perpetual contract platform on the Base network, which is not yet officially launched and is in the whitelist application period. Users can apply for the whitelist using their email.

- Limit order book trading platform BSX

BSX is a decentralized limit order book spot and perpetual contract exchange trading platform, similar to centralized exchanges like Binance and Coinbase. Currently, BSX is not yet officially launched, and users can apply for early user registration via Twitter and email.

- Cryptocurrency custody platform Onboard

Onboard is a cryptocurrency custody service and deposit/withdrawal platform, allowing users to deposit and withdraw cryptocurrencies through their MPC wallet and smart contracts, similar to aggregating their on-chain assets like we do with WeChat Pay, Alipay, and UnionPay for P2P transactions.

- Insurance aggregator OpenCover

OpenCover is the first L2 insurance aggregator to collaborate with insurers such as Nexus Mutual, aiming to protect DeFi users from on-chain risks such as smart contract breaches and oracle failures. Users can insure funds deposited in DeFi protocols such as Uniswap, Aave, and Curve on OpenCover, with insurance starting from $5,000 per week and premiums starting from $1.14.

- On-chain content creator platform Paragraph

Paragraph is an on-chain content creator platform where users can write, publish, and monetize their content, similar to a decentralized version of Newsletter (creators provide information or content to subscribers by regularly sending emails). On the Paragraph platform, creators can turn posts into collectibles, send news briefs to wallet addresses, and generate profits through regular membership.

- On-chain financial data oracle Truflation

Truflation is an on-chain financial data oracle that calculates the latest US inflation rate and various inflation category price indices, such as food or housing, by compiling real-time financial data from over 18 million data points and more than 40 data sources, automatically providing daily inflation data reports (i.e., CPI).

What native DEX, lending, and applications are there on the Base chain?

- Official cross-chain bridge Base Bridge

Base Bridge only supports asset transfers between Base and Ethereum. Additionally, since Base is built on the OP Stacks plugin, when users use the official cross-chain bridge to withdraw assets from the Base network to Ethereum, there is a 7-day waiting period.

If users want instant transactions, they can use third-party cross-chain bridges such as Orbiter Finance, Hop Protocol, LayerZero, Synapse, Socket, Stargate, Wormhole, etc.

- Top DEX platform Aerodrome

Aerodrome is a fork of the DEX platform Velodrome on the OP mainnet, launched on the Base mainnet on August 28th. Currently, users can trade any native token in the Base ecosystem on the Aerodrome platform. The current TVL is $117 million, making it one of the largest applications in terms of funds on the Base chain.

Aerodrome's token mechanism design is similar to Velodrome, combining the veToken model from Curve and the (3,3) game theory from Olympus DAO to optimize token liquidity incentives.

On the Aerodrome platform, there are two tokens, AERO and veAERO. The former, AERO, is an ERC20 utility token with an initial supply of 5 billion, which can be allocated to liquidity providers. The latter, veAERO, is a governance NFT token, allowing users to lock AERO to become veAERO and exercise related voting rights.

In addition to Aerodrome, the native DEX platforms on the Base chain include Baseswap (TVL of $15.5 million), Alien Base (TVL of $7.81 million), DackieSwap, Synthswap (TVL of $4.07 million), Baso Finance, etc. Additionally, it has integrated Uniswap, SushiSwap, Balancer, AMM protocol Maverick Protocol, WOOFi, DODO cross-chain aggregator DODO X, and other DEX platforms.

- Lending application Sonne Finance

Sonne Finance was originally a lending protocol on the Optimism chain and has now been deployed on Base, supporting DAI, USDC, USDbC (USDC on Base), and WETH asset collateral lending, with a current TVL of $6.61 million.

In the lending track, Base has launched Compound V3, Aave V3, the lending protocol Moonwell on Moonbeam, and the cross-chain lending protocol Pike Finance. Currently, the largest native lending protocol in terms of TVL on the Base track is Seamless Protocol, with a TVL of $1.06 million.

- Decentralized domain name service provider Base Name Service (BaseNS)

BaseNS is a domain name service provider on the Base chain, independent of Coinbase or Base development and management, supporting users to register and apply for domain names with the ".base" suffix.

- Social app Friend.tech

Friend.tech was launched on Base on August 10th, allowing users to tokenize the popularity of their accounts (KOL) by binding them to their Twitter accounts using Key. Regular fan users can become shareholders by purchasing shares of Key issued by KOL, granting them the right to chat privately with them, view specific content, and also profit from buying and selling Key shares.

According to Dune data, on September 21st, the total market value of Friend.tech's "Keys" had reached $106 million, with the platform's founder Racer accounting for 37.6% of the "Keys" market value. Today, the official announcement has been made that the web version is now live, allowing users to use friend.tech in their browsers.

In addition to Friend.tech, the social track has also integrated CyberConnect, the task platform Galxe, and the DAO organization Tally.

Reference reading: "Replay of Friend.tech's Launch for 20 Days: 0 Cost Freeloading of About 2500 ETH, Was the Explosion a Premeditated Act?"

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。