The competition pattern of Rollup is undetermined.

By: Huang Shiliang

Currently, the Rollup in the Ethereum ecosystem is engaging in fierce competition. Rollup can be seen as a special public chain, which is almost the same as a public chain for users.

When many public chains were competing, it started around 2016, but ultimately it seems that Ethereum has formed a monopolistic advantage, and it currently seems difficult for other chains to challenge the Ethereum ecosystem.

The confirmation of ETH's monopolistic advantage was around 2022, after the super bull market formed by DeFi and NFT, the only ecosystem left is Ethereum. Former strong competitors such as BSC, Solana, Polkadot, and Avalanche have weakened in the bear market.

While public chains have created many investment opportunities, most coins are severely volatile, and holding ETH seems to be one of the few coins that dare to hold for the long term without fear of roller coasters.

Now, the competition among Rollups, will it also form a monopolistic Rollup and have investment opportunities similar to ETH?

It should be around 2021 when the concept of Rollup started to heat up. At that time, Arbitrum had an absolute advantage in both technical strength and timing. Currently, it still seems that Arb maintains an advantage in both technology and ecosystem.

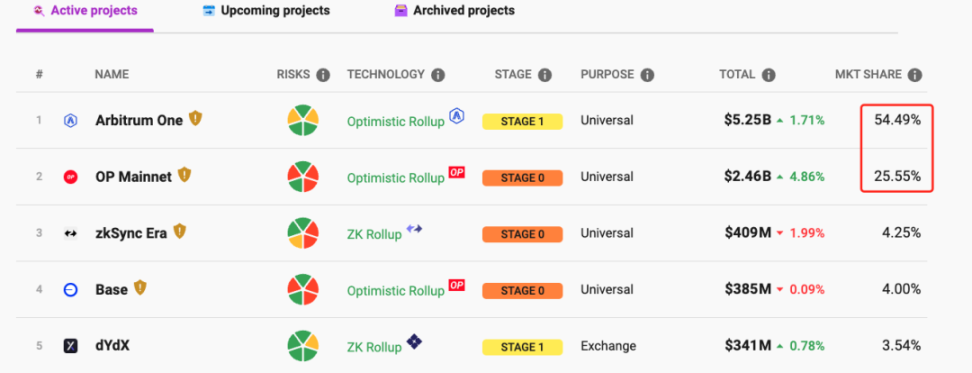

OP Mainnet has a good economic model, issued coins earlier, and formed alliances with many ecosystem products, establishing a duopoly with Arbitrum in many indicators.

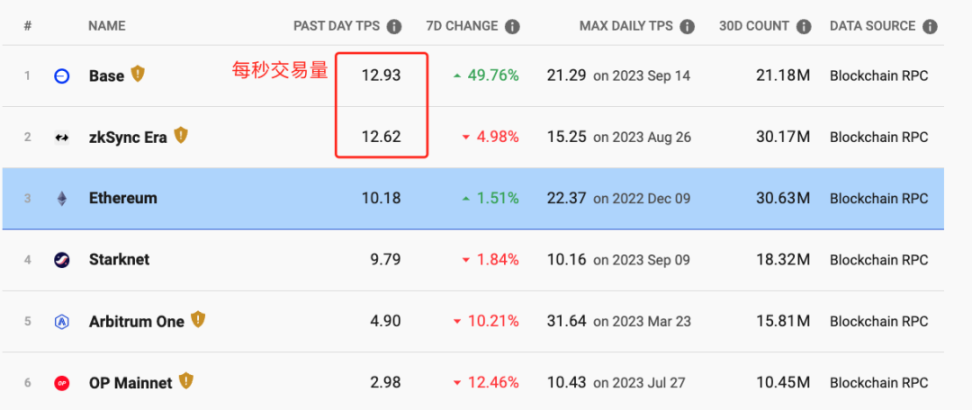

Recently, Coinbase's Base-rollup, quickly took the lead in popularity. Now, Base's TPS is already the highest among all Rollups.

These two sets of data are convenient for display, but it is too difficult to comprehensively evaluate the advantages and disadvantages of Rollup, so we can only use some simplified models to evaluate.

TVL is for the present, TPS is for the future.

Arb and OP, which have issued coins, occupy the top spot in TVL, while Base and zksync, which have not issued coins, occupy the top spot in TPS.

Imagine, if Base and zksync both issued coins, how much would the TVL advantage of Arb and OP decrease?

From these two simplified data models, I feel that the competition among Rollups has lasted for more than two years, and it is now completely unclear which Rollup has the potential to form a monopolistic advantage.

From the fierce competition among many DEXs, Uniswap emerged as a monopolistic DEX, and from the fierce competition of public chains, ETH emerged as a monopolistic public chain, we can probably summarize the following perspectives to evaluate whether a monopoly project has emerged in a category.

1. Technological Threshold.

Some performance indicators determined by technology, such as OP-rollup's ultimate TPS can reach 100 transactions per second, while zk-rollup claims to achieve 1000 transactions per second.

Also, the lowest gas cost, like OP can achieve one-tenth of L1, and zk can achieve one-twentieth? and so on.

Transaction security confirmation time, like OP can achieve the same level of security for transactions 7 days later as L1, while zk claims to be able to confirm transactions in 10 minutes.

Security and decentralization are also performance indicators determined by technology.

If a specific project can achieve outstanding performance in these technology-determined indicators, but other projects cannot, then it has the potential for a monopoly.

Uniswap's V3 version relies on efficient capital quality and its code has applied for copyright protection, ensuring that other projects cannot fork for two years, thereby helping Uniswap establish a monopolistic advantage.

Currently, it seems that no project in the Rollup category has a technological threshold that other projects cannot surpass.

2. Ecosystem Threshold.

Evaluating the ecosystem of specific projects in the Rollup category can be divided into the following sub-indicators.

1) The number, diversity, and activity of user groups.

For example, the current user group of zksync is obviously just a single group of airdrop hunters. This is an unreliable indicator.

2) The number, diversity, and brand mutual support of ecosystem partners and allies.

For example, Op Mainnet currently has the most and most reliable allies.

This indicator is particularly easy to form a threshold because if a large project collaborates with OP, it is not easy to collaborate with Arb, after all, everyone has their reputation, and it is not convenient to be involved in multiple projects.

3) The number, diversity, and activity of developers.

Although Rollup projects are basically project-based, meaning that Rollup developers are self-funded, not the open-source developer model of open-source projects.

But blockchain projects still have the tradition of open source. If there is support from open-source developers for Rollup, it seems that the brand support will be much better.

Currently, OP Mainnet seems to have relatively more open-source developers, mainly because it has received frequent support from the Ethereum Foundation. Arb also seems to have quite a few five-cent developers.

Open-source developers are a good threshold, after all, once people are invested in a project, they are not easy to go elsewhere, and developers are not Sun Wukong.

A typical example is the number and quality of developers for Uniswap, which makes us feel that Uniswap is a very cool project.

4) The number, diversity, TVL, etc. of ecosystem projects.

If a Rollup has DeFi, NFT, gamefi, etc., and each one is very powerful, these are very good thresholds. Because building an ecosystem is very difficult.

This is how Ethereum won.

When EOS was born, it was awesome, but its ecosystem was all gambling projects, and it didn't survive a bull-bear cycle before it went under.

Currently, Arbitrum is the most successful in ecosystem projects, and compared to other Rollup projects, Arb has established a good threshold.

3. Brand Influence and Reputation Threshold.

This is a very powerful and significant threshold. Once a specific project establishes a superior brand in a category, this threshold becomes very real.

For example, Uniswap has almost become synonymous with DEX.

Currently, in the Rollup category, I think projects like OPMainnet are too cunning, as the project name is directly the same as the technical term Optimistic, which has established a good brand advantage.

Similarly, there is zkevm, and Polygon, which directly named a Rollup as zkevm, making everyone think you are part of the EVM family from the start.

But currently, I feel that overall, no project in the Rollup category has established a brand advantage, and everyone is still equally low.

4. Innovation Capability Threshold.

Projects continuously produce new products and technologies, which is a significant threshold.

Uniswap and ETH are the strongest in innovation in their respective fields, thus forming a huge threshold.

The development time of Rollup is not enough at the moment, and it is completely unclear which project has strong innovation capabilities.

Op and Arb continue to release new products, but the time is not enough to see.

But one indicator that can be evaluated is research and development investment. Projects like Arb and Op have issued coins and set aside development costs, so it can be assumed that their innovation capabilities are not poor.

And a project like zksync has raised several billion dollars, so its innovation capability is probably very strong.

In addition, regarding token prices, it is more of a result than a cause of monopoly. That is, if a specific project has a monopolistic advantage, its token price will be high.

Finally, from the above four dimensions, I feel that in the Rollup category at present, it is not yet clear which specific project has the potential for a monopoly. Further observation is needed.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。