As a rising star in the stablecoin field, the stablecoin USDM recently released by Mountain Protocol has attracted much attention. What outstanding features can be expected from it?

Recently, Castle Island Ventures, a well-known venture capital firm in the cryptocurrency field, announced that it is leading the seed round financing for Mountain Protocol, with other participants including Coinbase Ventures, New Form Capital, and Daedalus Angels.

In the overall quiet environment of the bear market, the stablecoin USDM released by Mountain Protocol, as a newcomer in the stablecoin field, has recently attracted attention. What outstanding features can be expected from it?

Background: Expansion of the Stablecoin Market + Increase in U.S. Bond Yields

Among various applications of cryptocurrency assets, stablecoins are undoubtedly one of the most successful cases. As of 2022, the total market value of stablecoins worldwide has exceeded 120 billion US dollars. Stablecoins provide global users with a relatively stable payment and value storage tool.

Mainstream stablecoins, such as Tether's USDT and Circle's USDC, are pegged 1:1 to the U.S. dollar. This makes them more suitable as payment tools rather than investment or storage tools. On the other hand, U.S. Treasury bonds and other fixed-income assets can provide stable investment returns for holders.

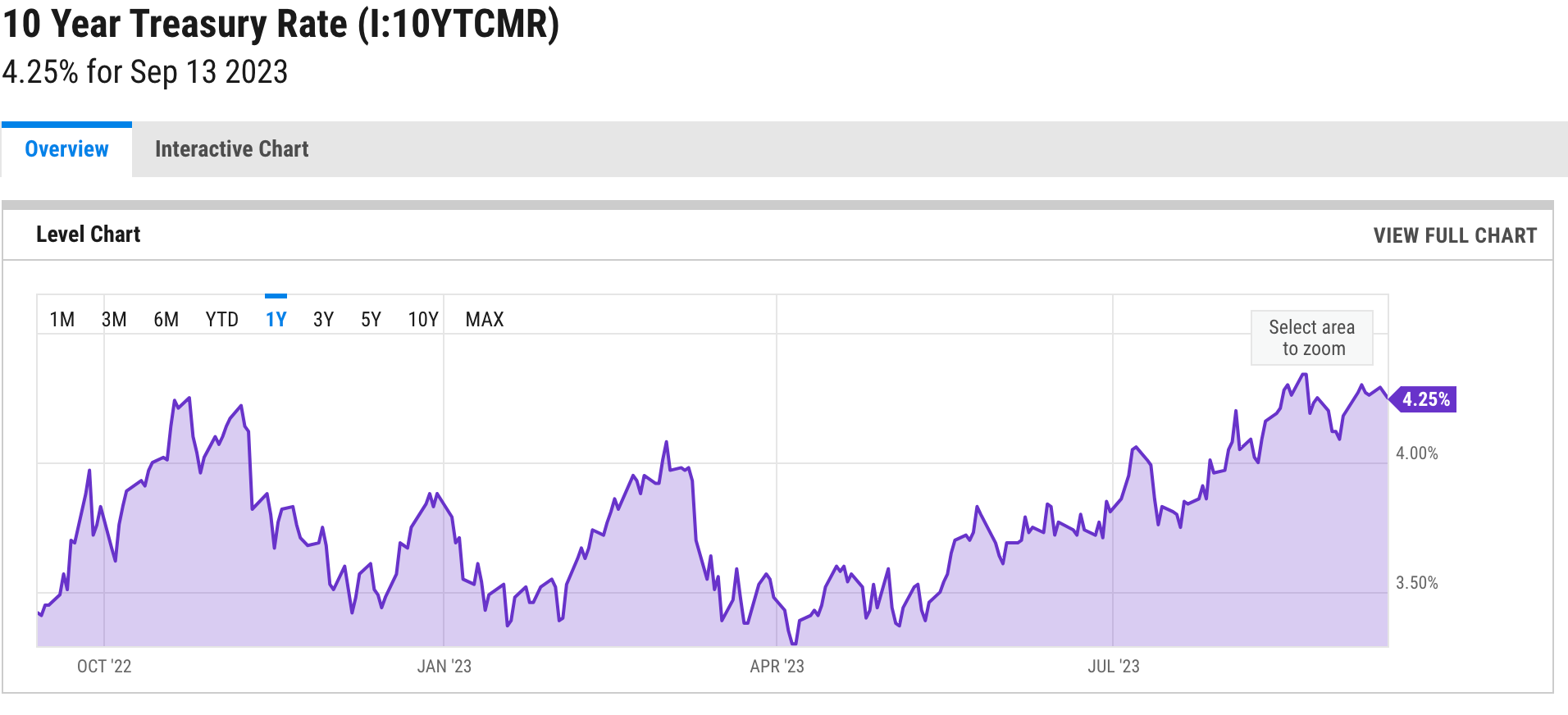

Recently, the continuous interest rate hikes by the Federal Reserve have led to a significant increase in U.S. Treasury bond yields, with short-term bond yields reaching around 5%. This provides local U.S. investors with the opportunity to directly invest in U.S. bonds to obtain stable returns. However, for most global investors, there are still certain barriers to directly investing in U.S. bonds.

If there is a stablecoin that can convey the returns of U.S. bonds, then a large portion of global investors can easily enjoy risk-free U.S. dollar returns by holding this stablecoin.

This is the problem that the newly established stablecoin issuing institution Mountain Protocol aims to solve. Its USDM stablecoin, launched with a rebase mechanism, aims to provide global users with a stablecoin option that can obtain returns from U.S. Treasury bonds. Whether this can be achieved truly needs further understanding of the product operation mechanism of USDM.

Product Introduction: USDM, Operating Platform, and Compliance

Mountain Protocol's product can be divided into two parts: the USDM token and the Mountain Protocol platform.

USDM Token:

USDM is a stablecoin issued on the Ethereum blockchain according to the ERC20 standard. It is pegged 1:1 to the U.S. dollar. The full name of USDM is Mountain Dollar, and it is issued and redeemed by Mountain Protocol company.

The collateral behind USDM consists of short-term U.S. Treasury bonds (T-Bills) with an average term of less than 3 months or shorter. U.S. Treasury bonds are considered the safest U.S. dollar-denominated assets.

Specifically, the collateral can consist of any of the following instruments:

Treasury bills, or soon-to-mature Treasury bills.

Money market funds invested in short-term U.S. Treasury bonds.

Repurchase agreements (repos) collateralized by U.S. Treasury bonds.

What sets USDM apart from other stablecoins is its rebase mechanism. Mountain Protocol will adjust the total supply of USDM based on the yield of U.S. Treasury bonds. Specifically, this is achieved by changing the value of the rewardMultiplier variable.

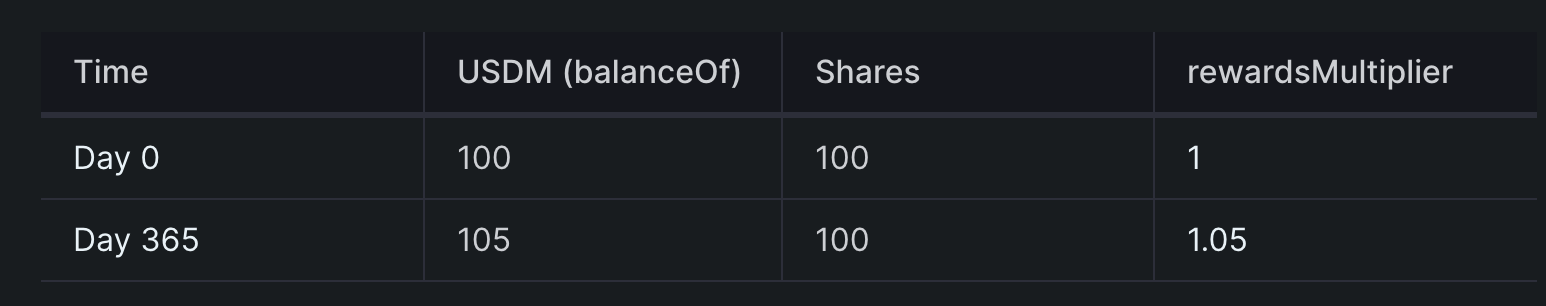

The rewardMultiplier is similar to the accrued interest on traditional Treasury bonds. It increases on a daily basis in a compound manner, accruing interest for the day. When the rewardMultiplier increases, the balance of USDM held by users' accounts will also increase accordingly.

The rewardMultiplier variable is updated around noon UTC time every day. The rewardMultiplier starts at 1 and increases daily through the addRewardMultiplier function.

For example, if the rewardMultiplier increases from 1.00 to 1.05, it indicates a 5% yield on U.S. bonds for the year. Then a user holding 100 USDM will receive 105 USDM through the rebase mechanism, achieving the transfer of returns.

Mountain Protocol Platform:

The Mountain Protocol platform allows users to purchase and redeem USDM. On the platform, users need to complete KYC real-name authentication to obtain an account. They can then choose to purchase USDM using U.S. dollars or stablecoins.

The platform provides two interfaces for users: a web portal and an API interface. Users can choose to operate through the portal website or integrate the API into their own trading systems.

Once USDM is in a user's Ethereum wallet, it can be freely transferred. If a user wants to redeem USDM, they need to transfer the tokens back to the address provided by Mountain Protocol and then submit a redemption request through the platform. Upon receipt, the platform will return equivalent U.S. dollar assets.

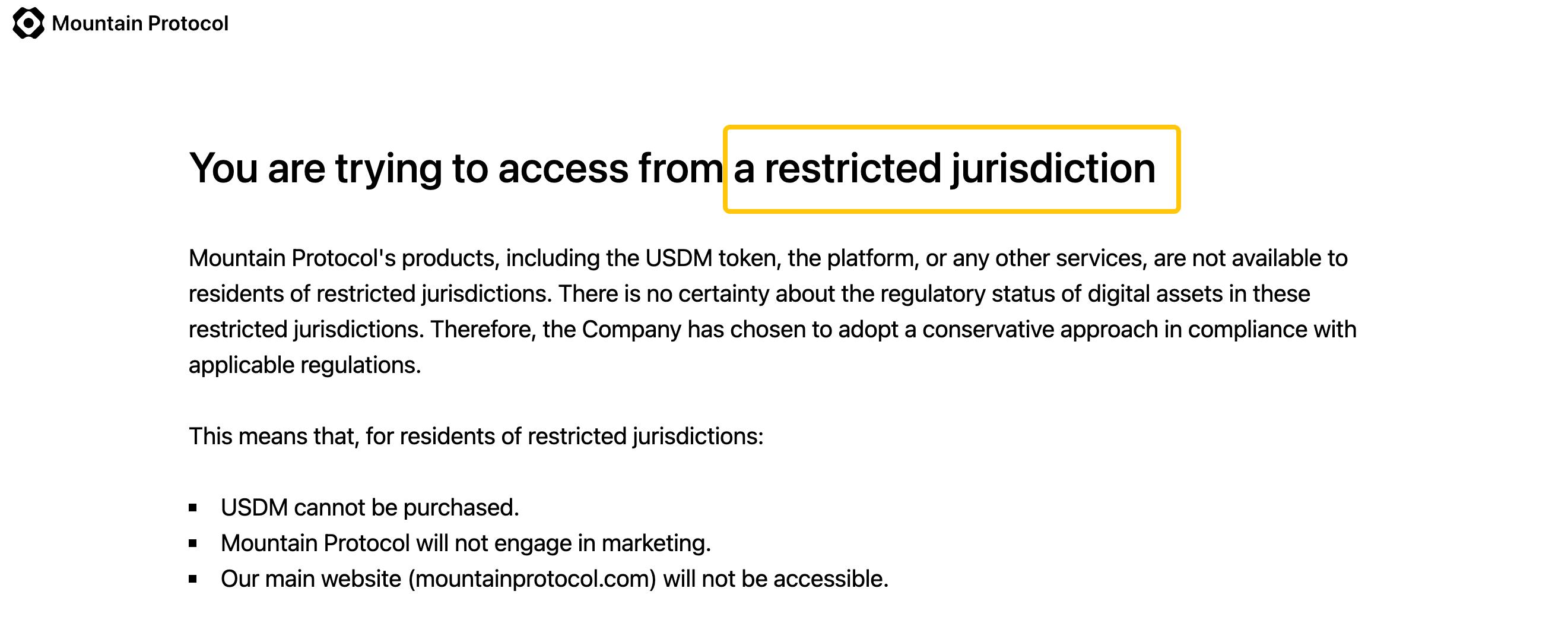

Note that the protocol does not provide services to users in the U.S., and logging in with a U.S. IP address will prompt restrictions.

For end users, the usage experience of USDM is similar to that of other stablecoins. It is mainly divided into primary users and secondary users. Primary users need to operate on the Mountain Protocol platform after completing KYC, while secondary users can freely use USDM in wallets and exchanges. USDM can be freely used as a means of payment and trading.

Security and Regulation

It should be noted that USDM is issued by Mountain Protocol Limited. The company has obtained a digital asset business license from the Bermuda Monetary Authority (BMA), allowing it to issue and redeem USDM. The company has committed to providing 1:1 U.S. dollar support when token holders request redemption. Therefore, USDM has a redemption mechanism similar to other stablecoins.

As for why Bermuda was chosen, the author speculates that this is to pave the way for the legalization of its global financial business.

Bermuda is one of the jurisdictions with relatively friendly and open regulation of digital assets. In 2018, Bermuda passed the Digital Asset Business Act, providing a clearer compliance path for digital asset companies.

The Bermuda Monetary Authority has approved and regulated multiple digital asset companies, including Circle, Tether, and Coinbase, all of which have received licenses from it. This reflects the experience of the Bermuda Monetary Authority in regulating digital assets. Obtaining a regulatory license from the Bermuda Monetary Authority can enhance the compliance and user trust of Mountain Protocol. Compared to operating without a license, this move can to some extent reduce regulatory risks and pressure.

However, Bermuda is still an offshore financial center, and its regulatory measures may be more relaxed compared to the U.S., the EU, and other regions. Therefore, the fact that Mountain Protocol has obtained a Bermuda license does not mean it has reached the highest global regulatory standards. Users still need to carefully evaluate this.

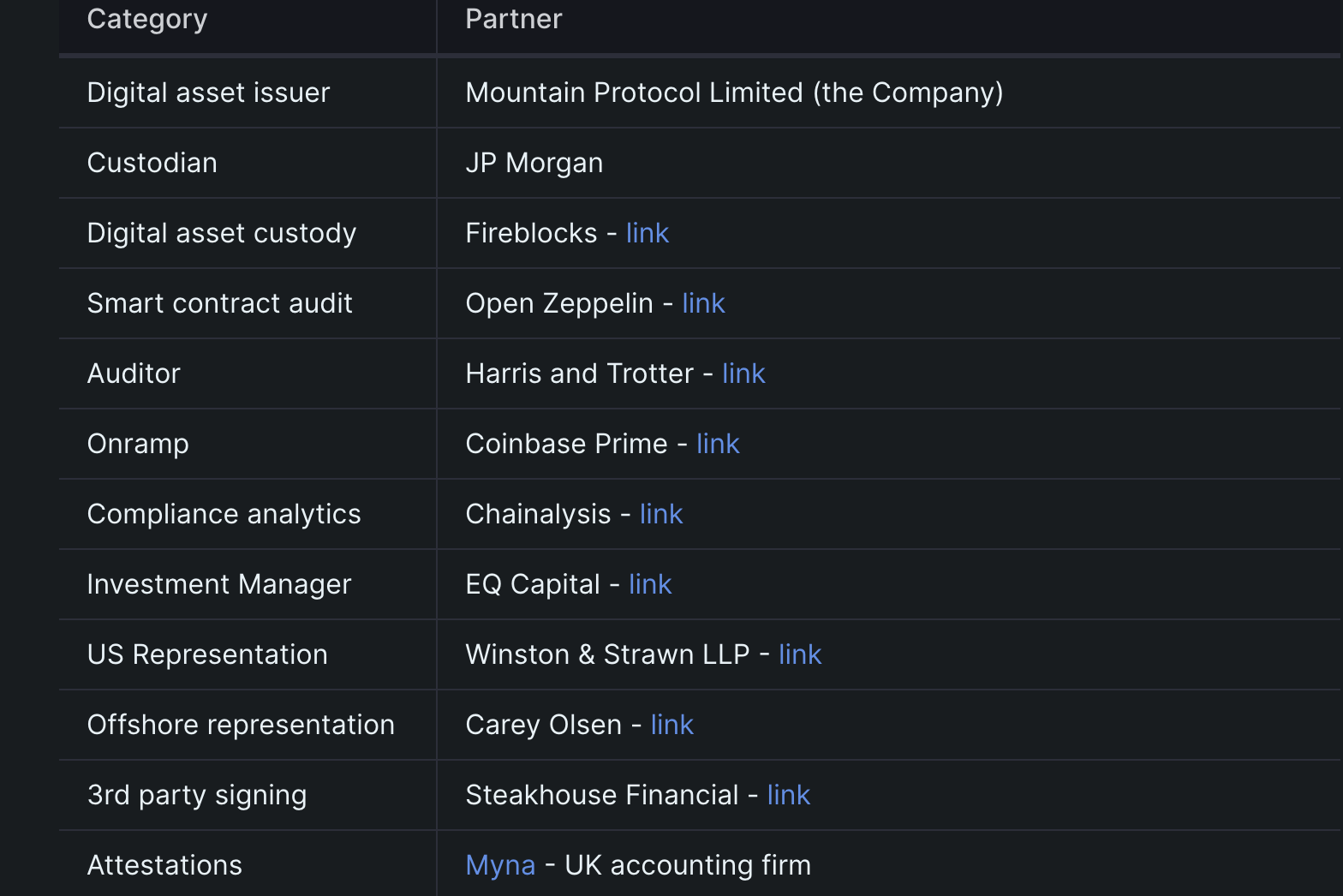

In addition, the main partners of Mountain Protocol include:

All parties play different roles in the operation of Mountain Protocol to ensure compliance and security to the greatest extent possible. According to publicly available information on Github, OpenZeppelin has issued an audit report on its contracts.

At the same time, the company will have a licensed accounting firm publish a reserve proof every month to provide users with transparency about the existence and composition of the "USDM reserve" after the first 30 days of operation.

Advantages and Limitations

From the above public information, the following advantages of Mountain Protocol can be summarized:

It provides a way for global users to obtain U.S. dollar returns. Through the rebase mechanism, USDM can convey the returns of U.S. Treasury bonds to any holder of its tokens, reducing the barriers to obtaining returns from U.S. bonds.

USDM has a payment license issued by the Bermuda Monetary Authority, demonstrating regulatory compliance. This can reduce users' compliance concerns.

Mountain Protocol has publicly disclosed the smart contract code of USDM and has undergone third-party security audits, to some extent ensuring code security.

However, Mountain Protocol also has some limitations:

USDM is currently targeted at institutional investors and has not yet been opened to individuals. This limits its market size.

USDM relies on secondary market liquidity. If secondary market trading is not active, users may have difficulty redeeming USDM at 1:1.

As a relatively centralized institution, Mountain Protocol still needs to establish user trust through regulation and transparency.

Future Impact: The "Yield Battle" of Stablecoins?

The emergence of USDM indicates that one of the development directions for stablecoins is to evolve towards providing returns. This provides a new option for users who wish to earn returns by holding stable assets.

Compared to existing stablecoins such as USDT and USDC, the main competitive advantage of USDM is its rebase mechanism. This may prompt other stablecoin issuing institutions to consider incorporating similar mechanisms into their products. If all stablecoins offer holding returns, it could trigger a "yield battle," thereby driving the development of this niche market.

Of course, as a new project, USDM still significantly lags behind established stablecoins in terms of market size and liquidity. To gain a larger market share, it needs to continue to accumulate user trust through regulatory compliance and product optimization.

For the broader investors and users, USDM provides a completely new option for obtaining stable U.S. dollar returns. However, due to its relatively centralized operating model, users need to weigh the risks and returns. Cautious users may choose to hold only a certain proportion of USDM, rather than completely replacing existing stablecoins.

As the first yield-bearing stablecoin in the cryptocurrency market, USDM undoubtedly has a certain degree of innovation and experimental significance. Through the rebase mechanism, it may solve the problem of not being able to earn returns by holding stablecoins. However, as a new project, USDM needs to continuously undergo market testing in terms of liquidity and user acceptance.

Overall, USDM provides new ideas for the development of stablecoins and brings new choices for users to earn returns.

Let's wait and see if USDM can become the new favorite in the stablecoin market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。