Author: Biteye Core Contributor Fishery Isla

Editor: Biteye Core Contributor Crush

Community: @BiteyeCN

Recently, within just one month, the revenue models of creators on the two tweet-based social platforms X (formerly Twitter) and FriendTech have gained significant attention.

Although both of these revenue models have certain flaws, the fact that they have garnered such attention proves the feasibility of the SocialFi track, which combines finance and social aspects.

In addition to the two platforms mentioned above, another noteworthy event in the SocialFi track recently is the launch of the Debank Chain based on the OP stack by DeBank.

Debank has a steady and methodical approach. After establishing the two major social functions, Hi and Stream, it began working on the chain, with Debank Chain serving as the encrypted asset layer built after the social functions.

It is evident that the team has a clear goal of breaking down SocialFi based on functionality, first perfecting the social features, and then considering using blockchain technology to address the financial needs.

Due to Debank's meticulous layout in the social field, involving many clever designs, before introducing Debank Chain, let's first discuss the shortcomings that X and FriendTech have shown, and then see if Debank can address these issues.

Musk's X has three obvious issues with its creator revenue model:

- Lack of transparency: The calculation method for revenue is not detailed, making it difficult for content creators to understand their actual earnings.

- Payment system restrictions: To receive X's sharing revenue, one needs to register a Strip account, which has very strict restrictions based on the country/region of the applicant. Many creators can only watch the revenue reminders but cannot open payment accounts.

- Fake accounts/bots: After X launched the creator revenue model, bot accounts and spam information became more rampant, encroaching on the browsing space of normal users. Distinguishing between real users and bots will be a major challenge for Musk in the future.

Meanwhile, FriendTech's creator revenue model also has some fatal issues:

- Incomplete social functions: The webpage often experiences bugs.

- High transaction wear and tear, unsustainable business model: Due to the presence of front-running bots, transaction wear and tear is very high, and so far, related bots have made profits exceeding 2 million USD. This wear and tear rate, even for a profitable business model, cannot be sustained.

- Coarse economic model, speculation-driven: The price curve of Keys is only related to the number of holders, and creators cannot earn revenue when there are no transactions.

Next, we will discuss Debank's social landscape from the perspectives of the asset layer and the social layer, in order to get a glimpse of whether Debank can solve the problems encountered by similar products.

01. Debank Asset Layer: Debank Chain

The development of Debank Chain is based on the OP Stack, mainly focusing on solving the key issues mentioned above while maintaining strong security: minimizing gas costs to the maximum extent, providing an experience similar to account abstraction close to Web2, and ensuring the security of L1 assets.

The Debank team has modified the consensus mechanism, reducing the gas cost of individual transactions by 100 to 400 times to adapt to the high-frequency nature of social interactions.

Additionally, the team has integrated a system similar to account abstraction at the chain level, allowing users to enjoy an experience close to Web2 while maintaining 100% compatibility with the current EVM standard.

This new account system supports transactions signed with dedicated L2 private keys, reducing the use of L1 private keys in social scenarios and enhancing the security of users' L1 assets.

Debank Chain launched its testnet on August 11 and plans to release the mainnet in 2024. Currently, only the Rabby wallet has integrated the DeBank testnet, and the official public RPC has not been released. This greatly limits bot and front-running attacks.

It is important to note that Debank Chain is not the same as the already launched Debank Layer2 (also written as Debank L2), as the former is still in the testnet stage.

The latter has been online for over a year and is currently serving as the payment account for Debank's social products. However, detailed documentation or introductions have not been found in public channels, and this Debank L2 has also been targeted by many airdrop bloggers.

Looking at it today, the already open-sourced Debank Chain is also positioned as a social asset chain, so it is likely to become an alternative to Debank L2.

02. Debank Social Layer

Debank Hi

Debank Hi is positioned as a Web3 instant messaging service, or a chat tool. For Web3 messaging applications, it has the following characteristics:

- Account system based on 0x addresses

- Open, permissionless

- Transparent

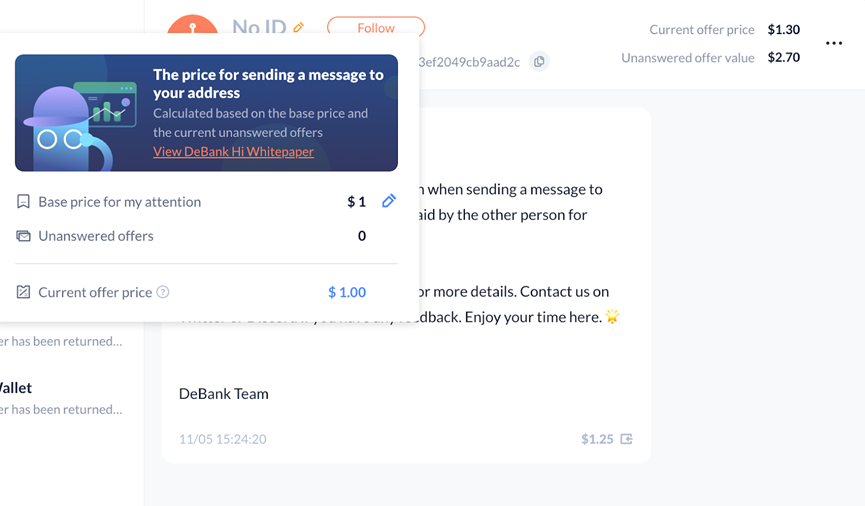

Its interface layout is somewhat similar to the chat built into Twitter, but unlike common chat tools, Debank Hi effectively avoids spam issues by introducing the concept of an "attention market."

What is the attention market?

It defines user attention to messages as a scarce asset, designs an attention asset trading market, where sending messages requires purchasing the recipient's attention, and receiving messages involves selling one's own attention. It uses an effective automated pricing model to reduce transaction friction.

Attention, as an asset, defines the user's act of opening a message as a form of attention asset. However, it is worth noting that this definition does not include the attention spent on reading a particular message.

Different messages provide different values to attract recipients' attention, so the attention spent here cannot be simply priced and traded.

Introducing the attention market can effectively prevent spam and ensure decentralization, meaning no account will be blocked by algorithms.

Although zombie behavior is often accused of disrupting normal user experiences, it is not easy to eliminate zombies without centralization risks.

Marking and blocking potential zombie addresses is a privilege that no decentralized platform should have. Establishing an effective attention market means that everyone should pay the price equally, including bots. Therefore, zombies no longer need to be treated differently.

In Web2, users are constantly bombarded with information and advertisements. Platforms profit from selling users' attention to gain advertising revenue and scale growth, leading to increased equity returns. By trading, users can take control of their own attention, reclaim agency, and receive compensation for the time and energy spent.

Debank Stream

Debank Stream is a system for posting similar to Twitter, and its distinguishing feature is that Stream accounts are linked to Debank's asset statistics. With the protection of asset statistics, Debank Stream can have many advanced and novel features.

One of these features is the introduction of the concept of Contribution Value. As the official promotional language states, "a Web3 social feed that calculates each user's contributions to the platform itself!" Stream can calculate each user's contribution to the platform itself! A true Web3 product needs to attribute every bit of value it gains to its original creators.

With the concept of Contribution Value, it is possible to implement a Reward Pool allocation. This is a post tipping feature that provides real earnings, rewarding not only the author but also all contributors during the post publishing process.

Whenever a post is published on Stream, Debank creates a corresponding reward pool. Over the next 3 days, any user can deposit assets into this pool.

Each user's contribution to the post during these 3 days will be recorded to determine the rewards they are eligible for. After 3 days, the rewards are settled. If the pool's funds exceed the post's realized value, users will receive rewards matching their contributions, with the excess going to the author.

If the pool funds are less than the realized value, rewards will be distributed based on each user's contribution proportion to the realized value. Rewards are typically paid immediately after settlement.

The Debank team believes that users' time and attention are valuable. Every minute spent on Twitter becomes the foundation of its value and ultimately translates into Twitter's profits through advertising.

On DeBank Stream, however, every minute spent, every article published or read, every comment and repost made, is calculated as a value contribution and recorded in your account.

Every natural day, users receive a contribution record reflecting their contributions to the platform. For each post on DeBank Stream, the realized value is calculated, describing the user attention value the post has gained during its dissemination on DeBank Stream.

In the calculation, factors such as the number of views, comments, and shares, as well as the net assets of these users, are taken into account. This determines the contribution of individual users to the post.

The rampant impersonation attacks on Twitter can be addressed by DeBank Stream through considering user net worth and TVF (Total Value of Followers, the total value of followers' assets) to help users identify the reliability of content sources (traditional impersonation accounts can inflate follower numbers, but cannot increase the total asset value of fake followers, clever!). This will also ensure that DeBank Stream captures the real attention value of genuine users.

03. Conclusion

The Debank team has laid out multiple segmented product lines, which is beneficial for strong storytelling ability and complete narrative, but the downsides are also obvious, with many innovative product features being abandoned halfway, such as:

Debank canceling the highly praised Feed feature; Rabby removing the Debank entrance;

Furthermore, the release of the unclearly positioned Debank Chain, despite the existence of the fully operational Debank Layer 2, highlights the lack of transparency in the team's decision-making.

However, this also reflects the decisive execution of the Debank team. Currently, Debank is fully focused on optimizing the social aspect of its products, effectively addressing the long-standing impersonation attacks and spam issues that have plagued X and FriendTech, using its Web3 asset analysis technology.

Moreover, the introduction of the attention market feature in the chat tool Hi can effectively enhance the user experience and eliminate the disturbance of spam messages.

On the asset side, Debank can address the restricted payments issue of traditional Web2 through blockchain, and with highly customized OP Stack with abstract accounts, it is far more suitable for social scenarios than the third-party Layer 2 Base relied on by FriendTech, effectively avoiding the generation of spam accounts.

Whether FriendTech can improve its economic model remains to be seen, while Debank has been quietly accumulating strength, and I believe it will definitely bring us surprises in the field of SocialFi in the future.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。