Project Introduction

Flashbots is a research and development organization aimed at mitigating the negative impact of Maximal Extractable Value (MEV) on blockchains, especially Ethereum. Their main goal is to create a permissionless, transparent, and sustainable ecosystem for MEV through products like MEV-Boost. Future MEV development should focus on cross-chain MEV capture, minimizing value loss, minimizing potential negative impact on protocol's real users, and ensuring fair distribution among participants.

Author

Elma Ruan, a senior investment researcher at WJB, holds dual master's degrees in marketing/finance from Ivy League schools and has 5 years of experience in Web3, specializing in DeFi, NFT, and other areas. Before entering the crypto industry, she worked as an investment manager at a large securities company.

1. Research Highlights

1.1 Core Investment Logic

MEV (Miner Extractable Value) is a small part of the underlying infrastructure closely related to transactions within blocks. It has a high income effect, with income increasing in proportion to the complexity of transaction scenarios and relatively low risk. Solving the MEV problem is an important part of Ethereum's development roadmap, aiming to ensure reliable, fair, and trustworthy neutral transactions and address the MEV problem. Future MEV development will focus on cross-chain MEV capture, minimizing value loss, minimizing potential negative impact on protocol's real users, and ensuring fair distribution among participants.

When MEV is mentioned, various strategies such as frontrunning, sandwich attacks, and transaction tracking are often associated with it. These strategies may result in unfair outcomes for certain participants in the blockchain ecosystem, harming the interests of ordinary users. The founders of Flashbots believe that the MEV problem is also an important issue in the Ethereum ecosystem, which may lead to unfair transactions and market distortions. Therefore, the founders created the Flashbots project to provide a trusted, neutral communication channel for the Ethereum ecosystem, enabling private communication between miners and other participants to address the MEV problem. The core infrastructure of Flashbots is the relay, which collects transaction bundles from different participant networks and forwards them to miners. The relay can verify the validity of transactions and prevent malicious transactions. Additionally, the relay can help miners better utilize MEV, thereby increasing their earnings.

The pairing between users and Searchers is facilitated through the Flashbots service. Users can selectively expose their transaction information to Flashbots, and Searchers bundle and submit these transaction information to Block Builders to construct the entire block, facilitating more effective arbitrage operations for Searchers. If users agree, arbitrageurs can share a portion of the MEV profits with users, creating a win-win situation. This mechanism also provides a benign bidding process for other arbitrageurs, who can profit by offering higher prices, avoiding transaction failures, and excessive gas fees. Furthermore, by filtering out failed transactions, it reduces on-chain space occupation, thereby alleviating congestion issues to some extent, achieving a win-win situation.

Overall, it benefits all parties involved:

Proposers: By collaborating privately with Searchers, Proposers can prioritize and gain more benefits.

Searchers: Using Flashbots, they can avoid resource wastage, save costs, and access more transaction information.

Transaction users: They can avoid interference from malicious behavior when initiating transactions and reduce losses due to operational errors.

Flashbots: By obtaining exclusive transaction information from users and Searchers, they can gain more profit opportunities and become stronger.

However, Flashbots also have some disadvantages. Firstly, Flashbots' relay requires a large amount of computing resources and bandwidth, which may lead to some performance issues. Secondly, Flashbots needs sufficient support from participants; otherwise, it may not be effective. This requires Flashbots to establish cooperative relationships with other participants in the Ethereum ecosystem to ensure its widespread application and support. Finally, although Flashbots is currently a non-profit organization, it still needs to submit transactions to centralized Flashbots servers, which may pose some centralization risks.

In the broader industry context, the emergence of Flashbots is a positive signal. As the cryptocurrency market continues to develop, the MEV problem has become increasingly serious. Flashbots' solution provides a viable solution for the Ethereum ecosystem to help alleviate the negative impact of the MEV problem. The fair and market-oriented nature of MEV provides predictable returns for LSD protocols and Ethereum stakers, promoting the growth of Ethereum staking and the adoption of MEV solutions by LSD protocols. Additionally, the fair and market-oriented nature of MEV also promotes the growth of on-chain activity, enhances the on-chain user experience, drives the adoption of MEV products, and increases demand for Ethereum staking, creating a virtuous cycle. Furthermore, market-oriented MEV protocols can better distribute benefits, driving the overall growth of the Ethereum ecosystem.

In the long run, the MEV track has broad prospects. Although it is currently in its early stages, it has already begun to exhibit network effects. Flashbots has laid the foundation for the rapid growth of MEV and provided many opportunities for the future.

1.2 Valuation

The valuation of the Flashbots project has reached $1 billion. According to The Block, the Ethereum infrastructure service provider completed a $60 million Series B financing in July 2023.

2. Project Overview

2.1 Business Scope

Flashbots' business scope mainly includes Flashbots Auction, Flashbots Protect, Flashbots Data, MEV-Boost, and MEV-Share. Flashbots Auction is a permissionless, transparent, and fair ecosystem aimed at efficiently extracting maximum benefits and protecting transaction frontrunning behavior. Flashbots Protect provides a secure, user-friendly way to prevent malicious transactions and allows users to share MEV. Flashbots Data provides tools for analyzing Ethereum MEV stored in a Postgres database. MEV-Boost can enhance the efficiency of validators, promote Ethereum competition, and decentralization. MEV-Share is an open-source protocol designed to allow users, wallets, and applications to internalize the maximum benefit loss (MEV) created by their transactions.

2.2 Past Development and Roadmap

Future Roadmap:

SUAVE is a project called "Single Unified Auction for Value Expression," aimed at solving the MEV (Miner Extractable Value) problem by building a decentralized transaction serialization layer. SUAVE consists of three main components: a general preference environment, an optimal execution market, and a decentralized block-building network. SUAVE aims to empower users and maximize decentralization on public blockchains. It is an independent network that can serve as a plug-and-play mempool and decentralized block builder for any blockchain. Flashbots is one of the creators of SUAVE, and in the SUAVE whitepaper, Flashbots explicitly states that they will continue to improve SUAVE and include it in future important plans.

- Q2 2021: Release the first version of SUAVE, supporting mainstream public chains such as Ethereum and BSC.

- Q3 2021: Support more public chains, including Polygon, Solana, etc.

- Q4 2021: Support cross-chain MEV solutions and more MEV capture strategies.

- 2022: Launch the second version of SUAVE, supporting more MEV capture strategies and higher throughput.

- 2023: Plan to release the SUAVE testnet to begin testing its new features.

- Future: Further enhance the security and decentralization of SUAVE, support more public chains and cross-chain solutions.

In addition, SUAVE's future plans also include collaborating with other MEV-related projects and organizations to promote the development and decentralization of MEV. SUAVE also plans to achieve decentralization through community governance to ensure its long-term sustainability and development.

2.3 Team Overview

2.3.1 Overall Situation

According to LinkedIn, Flashbots currently has 28 employees, most of whom are concentrated in fields such as computer science, mathematics, psychology, and economics. These employees have a wide range of professional backgrounds and are proficient in various technologies and domains, including but not limited to Python, blockchain, machine learning, and C language. Their expertise and skills enable them to address complex technical challenges in the Ethereum ecosystem and make positive contributions to the research and development of the Flashbots project.

2.3.2 Founders

Philip Daian, Co-founder

Additionally, Stephane Gosselin, co-founder of Flashbots, resigned from the company in October 2022 due to differences with the team regarding the review system.

Alex Obadia, former co-founding member and top strategy researcher at Flashbots, left the company on June 20, 2023, for personal reasons.

2.3.3 Core Members

Andrew Miller

Director of Trusted Execution Environment and SUAVE Research

Miller is well-known for his research in cracking Intel SGX code and has been serving as the Deputy Director of Cryptocurrency and Contract Programs (IC3). Miller plans to take a temporary leave from his position as an assistant professor at the University of Illinois, currently focusing on electrical and computer engineering at the university.

Hasu, Flashbots Strategic Director

Hasu serves as a strategic advisor for leading liquid staking protocol Lido and as the strategic director of the Flashbots R&D team to protect users from MEV impact. Currently, he spends approximately 90% of his time on Flashbots and 10% on Lido. He also serves as a research collaborator at Paradigm investment firm, co-founder of Deribit Insights, and has represented MakerDAO. He educates and promotes industry development through writing, social media, and podcasts.

2.4 Financing Situation

The company was founded in 2020 and has gone through two rounds of financing. Initially, the company received seed funding from Paradigm, and the investment amount was not publicly disclosed. In 2023, the company completed a Series B financing round with a funding amount of $60 million, with Paradigm being a significant investor in the Series B financing.

3. Business Analysis

3.1 Target Audience

The main target audience of Flashbots includes the following groups:

1) Arbitrage and liquidation bots, DeFi traders: Profit from extracting value on the Ethereum chain and bundle these transactions to provide to Flashbots' Builders.

2) Ethereum Dapps with complex use cases: These Dapps utilize Flashbots' capabilities to optimize the execution of their transactions, improving efficiency and returns.

3) Professional Builder organizations: These organizations select the most profitable transactions from the transaction bundles sent by Searchers and package them into complete blocks, ultimately sending them to Validators through the Relay. Currently, there are few active Builders in the market, and a few organizations dominate the market share.

4) Miners: Validators of ETH2.0, responsible for proposing blocks to the network and adding them to the chain.

5) Regular Ethereum users: They can interact directly with Flashbots and execute their transactions using the tools and interfaces provided by Flashbots.

3.2 Business Categories

Flashbots' business scope mainly includes the following aspects:

1) Flashbots Auction: Provides an open, transparent, and fair ecosystem for efficiently extracting MEV and preventing frontrunning, in line with the principles of Ethereum. Flashbots Auction provides a private communication channel between Ethereum users and Validators to efficiently communicate the transaction priority within blocks.

2) Flashbots Protect: Provides a user-friendly, secure, and powerful transaction environment for Ethereum users. It is configurable, allowing users to choose which Builders to send transactions to and customize MEV sharing settings according to their needs. It also provides protection against frontrunning, ensuring that transactions are not captured by malicious transactions in the public Mempool, and if a transaction creates MEV, users can receive rewards through the MEV-Share mechanism.

3) Flashbots Data: Provides tools for analyzing MEV on Ethereum, including data on Validator payments, token transfers and profits, exchanges, and arbitrage, storing all data in a Postgres database for querying and analysis.

4) MEV-Boost: Primarily aims to enhance the efficiency of Ethereum Validators by accessing a competitive block-building market. The MEV-Boost mechanism separates the roles of Proposers and Block Builders, promoting decentralization and censorship resistance in the Ethereum network.

5) MEV-Share: An open-source protocol that allows users, wallets, and applications to internalize the MEV created by their transactions. It is neutral, allowing any Searcher to participate, not limited to specific Block Builders.

In summary, Flashbots mainly involves Flashbots Auction, Flashbots Protect, Flashbots Data, MEV-Boost, and MEV-Share, aiming to increase the efficiency of MEV, protect transaction security, and provide competitive block building.

3.3 Business Details

Flashbots' business mainly involves four parts: Searchers, Relays, Builders, and Proposers. These roles play different roles and responsibilities in the process of a single block proposal.

Here is the process and responsibilities of these roles in the process of a single block proposal:

Builders: Builders create blocks by collecting transactions from users, Searchers, or other order flows. Their goal is to maximize their own and the Proposers' MEV and construct blocks with the maximum executable value.

Relays: Relays are trusted third parties that act as a bidirectional communication channel connecting Proposers and Builders. They play the role of Validators, verifying the validity of blocks, calculating the amount to be paid to Proposers, and sending block headers and payment values to the current Proposers.

Proposers: Proposers are Ethereum proof-of-stake Validators. Upon receiving block headers and payment values from Relays, they evaluate all received bids, select the block header associated with the highest payment, and sign it.

Searchers: Searchers monitor the public transaction pool and Flashbots' private transaction pool to find the most profitable transaction order and bundle them to provide to Builders.

The operation process is as follows: Builders create blocks and submit them to Relays. Relays verify the validity of the blocks, calculate the amount to be paid to the Proposers, and send the block headers and payment values to the current Proposers. The Proposers evaluate the received bids, select the block header associated with the highest payment, sign it, and send it back to Relays. Relays publish the block using the beacon node and return it to the Proposers. Finally, rewards are distributed to Builders and Proposers in the form of transactions and block rewards.

1. Flashbots Auction

Flashbots Auction is a system that provides a private transaction pool and sealed block space auction mechanism. This system allows block producers to delegate the search for the optimal block construction in an untrusted environment.

In the regular Ethereum transaction pool, users broadcast transactions to the public P2P network and specify Gas prices, indicating the fees they are willing to pay for computation on the Ethereum network. Upon receiving transactions, block producers sort them based on Gas prices and use a greedy algorithm (in computer science, a greedy algorithm is an algorithm that selects the best local solution, hoping to achieve the global best through local optimal selection. Here, it refers to block producers using a greedy algorithm to produce a block with the highest transaction fees) to generate a block to maximize income from transaction fees. This mechanism combines the characteristics of English auctions and all-pay auctions, where block space is bid on in a public environment, with the highest bidder winning, and all participants bear the cost.

This mechanism has the following issues:

1) The public transaction pool leads to block space bidding wars, increasing network load and gas price fluctuations, which is disadvantageous for participants without frontrunning strategies.

2) All-pay auctions result in unsuccessful transactions failing on the blockchain, wasting valuable block space. Additionally, bidders underestimate their bids due to execution risk, ultimately leading to artificial block space scarcity and a decrease in Validator income.

3) Relying solely on the Gas price mechanism prevents bidding participants from expressing preferences for transaction order, as they can only bid for the top position in the block. This forces participants to adopt other ineffective strategies to increase their chances of getting their transactions included in blocks, such as sending a large number of useless transactions to occupy block space. This situation leads to waste of public resources and efficiency loss.

On the contrary, Flashbots Auction uses the First-Price Sealed-Bid Auction (FPSBA) mechanism, allowing participants to communicate specific bids and transaction order preferences through private channels without incurring the cost of unsuccessful bids. This mechanism maximizes the income of Validators, as each transaction has a corresponding bid, and Validators can choose the most profitable transaction combination. Additionally, different participants need to determine their bids based on the expected MEV opportunity, which is essentially a price discovery process that can derive the market value of MEV opportunities. Most importantly, the FPSBA mechanism eliminates frontrunning issues caused by public bidding.

Flashbots Auction Roadmap

The Flashbots team has adopted a gradual approach to decentralize the Flashbots Auction architecture. In this process, they will introduce new technologies and improvements in phases to gradually enhance the entire architecture.

- Pre-transaction privacy: Transactions are only made public after being included in a block, excluding intermediaries such as relays and block builders.

- Failed transaction privacy: Unsuccessful transactions will not be included in blocks and will not be made public.

- Efficiency: MEV extraction will not cause unnecessary network or congestion issues.

- Bundle merging: Merging multiple incoming bundles in a conflict-free manner.

- Irreversible protection: Once a block containing Flashbots bundles is propagated, it is difficult to modify through chain reorganization, preventing timestamp attacks.

- Complete privacy: Intermediaries such as relays and validating nodes cannot see transaction content before it is included on-chain.

- Openness: No trusted intermediaries for reviewing transactions.

Technical Architecture

The Flashbots Auction architecture proposes a network consisting of three different participants, each specializing in maintaining the necessary communication channels. Block builders are responsible for constructing complete blocks, and Validators make proposals.

For Searchers

Searchers refer to Ethereum users who, for various purposes, prioritize using the Flashbots private transaction pool instead of the conventional P2P transaction pool. These users are responsible for monitoring the state of the chain and sending transaction bundles to relays.

They can be mainly categorized into three types:

- Ethereum transaction bot operators: They need fast, risk-free access to block space, such as arbitrage and liquidation bots.

- Ethereum users seeking transaction frontrunning protection: For example, Uniswap traders.

- Ethereum Dapps with complex use cases: Such as implementing account abstraction or zero-Gas transactions.

Block Builders

Block Builders are professionals who accept transactions from users and Searchers and strive to construct the most profitable blocks from these transactions. The constructed blocks are sent to Validators through MEV-enhanced relays. Searchers send bundles to one or more block builders.

Relays

Relays are a component of PBS (Periscope Block Scope) responsible for hosting blocks from block builders for use by Validators.

Through MEV-Boost technology, Validators can select the most profitable blocks from multiple relays. Each relay keeps the block's content confidential until the Validator decides to propose it to the network.

Specifically, relays perform the following steps:

- Receive new blocks from block builders.

- Send the most profitable blocks to Validators when requested.

- Validators establish their commitment to propose the complete block by signing the block header.

- After receiving the signed block header from Validators, relays send the complete block to Validators.

- Execute all operations quickly and reliably to ensure Validators do not miss the proposal deadline.

Validators/Proposers

In PoS Ethereum, Validators are responsible for proposing blocks to the network and appending blocks to the blockchain.

Bundles

Searchers use Flashbots to submit transaction bundles to block builders for inclusion in blocks. A transaction bundle combines one or more transactions and executes them in the provided order. In addition to Searchers' transactions, a bundle may potentially include pending transactions from other users in the mempool, and it can selectively choose specific blocks for inclusion.

Bundle Pricing

Flashbots' block builders aim to include the most potentially profitable transactions in the blocks they construct. In PoW Ethereum, block builders achieve the maximum profit goal of Searchers by inserting their bundles at the top of the block and removing transactions from the end of the block. The transactions at the end of the block are the least profitable but still need to be mined. Therefore, for a Flashbots bundle to be considered profitable, it must have a higher Gas Price than the transactions it replaces at the end of the block.

In PoS Ethereum, the experience rule for pricing bundles on Flashbots is essentially the same; more profitable transactions are typically favored by the block building algorithm. The profitability of a bundle/transaction is determined by the Gas Price, priority fee, and direct Validator payment price used for each transaction.

In the PoS mechanism, bundles do not place transactions between bundle transactions but can be placed anywhere in the block. This means that in addition to bundling transactions, other transactions from the mempool can be added to the blockchain. However, transactions in the bundle are not directly added to the blockchain.

Bundle Sorting Formula

Flashbots block builders have implemented a new algorithm designed to generate the most profitable blocks. This design has some important changes for Searchers:

- No longer sorting and including bundles based on effective Gas Price, the algorithm optimizes the overall block profit.

- No longer guaranteed to be executed at the top of the block.

- Other transactions (e.g., from the mempool) may be implemented between two different bundles rather than between transactions within a bundle.

RPC Endpoints

Advanced users can interact with the RPC endpoint on relay.flashbots.net or one of the following testnet URLs.

Searchers Reputation

During high load periods, Flashbots provides consistent access to Flashbots block builders for Searchers with a good performance record. To address complex application layer attacks, specifically Layer 7 attacks, various solutions are being explored, including introducing a Searchers reputation mechanism to enhance the Flashbots infrastructure.

EIP-1559 Support

Since mev-geth v1.10.5-mev-0.3.0, Flashbots has started supporting EIP-1559 transactions. For Searchers who wish to continue using traditional transaction methods, no configuration changes are required. However, EIP-1559 brings significant changes to the base fees for blocks, meaning Searchers who previously used 0 Gas price for transactions need to make some adjustments. Nonetheless, Searchers still have the opportunity to prioritize fee payments, either by transferring directly to the Coinbase address or by paying a Gas price higher than the EIP-1559 base fee. In any case, the user's transaction must include at least the Ethereum Gas Price equal to the base fee.

2. Flashbots Protect

Overview

Flashbots Protect RPC does not track any user information (such as IP addresses, location, etc.) and does not store or record user information. Flashbots Protect is a user-friendly, secure, and powerful Ethereum transaction method suitable for both beginners and experienced users.

It has the following main advantages:

1) Configurability: Users can choose to send transactions to different builders and set MEV shares.

2) Frontrunning prevention: User transactions will not be discovered by public mempool sandwich bots.

3) MEV returns: If a user's transaction generates MEV, the user can receive up to 90% of the return through MEV-Share.

4) No failed transactions: Only when a user's transaction operation is not revoked or rolled back will it be included in the transaction, so users do not need to pay for failed transactions.

MEV-Share (more detailed information below)

Through MEV-Share, users have the opportunity to receive up to 90% of the MEV revenue generated by their transactions on exchanges. By default, Protect users will connect to a sustainably tuned Stable configuration, continuously optimized by Flashbots for better execution while protecting users from harmful MEV.

Flashbots MEV-Share nodes maintain a stable configuration that is continuously optimized to provide better execution for users while protecting them from harmful MEV. Users only need to send transactions to Flashbots Protect to receive revenue. Advanced users can have more precise control over transactions and preferences by using the advanced panel or manually setting their Protect RPC requests.

There are three ways to use Flashbots Protect:

1) Add Flashbots Protect RPC (https://rpc.Flashbots.net) to the user's wallet, suitable for most users.

2) Send transactions to https://rpc.Flashbots.net using eth_sendRawTransaction.

3) Send transactions to Flashbots using eth_sendPrivateTransaction.

The simplest way to use Flashbots Protect is to add Flashbots Protect RPC to the user's wallet and configure which builders to send transactions to and customize MEV-Share settings.

Improving Transaction Inclusion Speed

Transactions sent through Flashbots Protect are by default only shared with Flashbots, which only builds a portion of Ethereum blocks. If users want to increase the chances of their transactions being included, they can choose to share their transactions with more builders. Simply select other builders in the "Connect wallet to Protect" button options.

Canceling Transactions

Transactions submitted to Flashbots Protect are sent to Flashbots MEV-Share nodes and held there for up to 6 minutes.

Flashbots Protect allows users to cancel pending transactions by submitting a cancel transaction to Flashbots Protect. When canceling a transaction, users need to send a new transaction that meets the following conditions:

To cancel a transaction, users can submit it using the same address, including the same nonce, sender, and recipient addresses, with an empty data field. This cancellation transaction is free and is primarily used to verify control over the original transaction account. Since the cancellation transaction will not be allowed to enter the blockchain, it will not incur any fees.

Fixing Stuck Transactions

If a user's transaction is in a "pending" state or has a very high nonce, the user needs to clear the activity and nonce data in MetaMask. This will cause MetaMask to update the nonce and transaction history from the network. During this process, the user's funds and keys are secure.

3. Flashbots Data

MEV-Inspect

mev-inspect-py is a tool for Ethereum MEV detection. It can analyze various information in blocks, including validator payments, token transfers and profits, transactions, and arbitrage, among others. All this data is stored in a Postgres database for easy querying and analysis.

The block detection process is as follows:

- Obtain the block's trace information, receipts, and block data from the RPC endpoint.

- Decode the trace information using known ABIs (Application Binary Interfaces) to understand its meaning.

- Extract structured objects from the decoded trace information, such as transfers and exchange operations.

- Save these structured objects to the database for future querying and analysis.

4. MEV-Boost

MEV-Boost is an open-source middleware software used by Validators to access a competitive block building market. Developed by Flashbots, it aims to achieve proposer-builder separation (PBS) in Proof of Stake (PoS) Ethereum. Through MEV-Boost, Validators can obtain blocks from the builder market. Builders prepare complete blocks, optimize MEV extraction and fairly distribute rewards, and send the blocks to relays. An instance of MEV-Boost can be configured to connect to multiple relays.

Relays aggregate blocks from multiple builders and submit the most profitable block to the proposer. The proposer's consensus client then propagates the most profitable block received through MEV-Boost to the Ethereum network for validation and block inclusion.

5. MEV-Share

MEV-Share is an open-source protocol designed to maximize the realized extractable value (REV) generated by internal transactions in users, wallets, and applications. Through an "orderflow auction" approach, it allows users to choose to share transaction data with Searchers willing to package their transactions. Users are free to redistribute Searchers' quotes to themselves, Validators, or other participants. MEV-Share is neutral, open to Searchers, and does not favor any specific block builder. Its goal is to reduce the centralized impact of exclusive order flow on Ethereum and enable wallets and other order flow sources to participate in the MEV supply chain.

Using MEV-Share is simple; users only need to send transactions to Flashbots Protect, leveraging the Flashbots MEV-Share node. Through MEV-Share, MEV is returned to its original creators: the users. The protocol is designed for scalability and decentralization, allowing Searchers to integrate without permission and without favoring any specific block builder.

Users send their transactions to a specific MEV-Share node, which selectively shares transaction information with Searchers based on the user's privacy preferences. Based on this information, Searchers submit partial bundles to the MEV-Share node, attempting to extract MEV from the user's transactions without viewing the complete transaction data. The MEV-Share node simulates a portion of the bundles submitted by Searchers. It then shares successful bundle information with the block builder. In other words, the MEV-Share node helps Searchers share their successful transaction bundle information, meaning users receive 90% of the MEV return from their own transactions. This mechanism ensures users receive fair compensation in the process.

Currently, MEV-Share nodes only accept retrospective operations.

6. REV

Since the merger on September 15, 2022, the project has changed MEV to REV (Realized Extractable Value).

REV can be split into the following 2 parts:

- REVS, which is the value passed to Searchers.

- REVM, which is the value passed to miners.

It is important to note that, as described below, REV already includes the cost of opportunity mining (i.e., the actual REV depends on the network gas price at the time of mining).

Searchers' REV consists of the following parts:

In the transactions performing the extraction operation, Vout represents the value flowing from the searcher to the blockchain (excluding Gas fees); Vin represents the value flowing from the blockchain to the searcher; MEVg represents the Gas price of the transaction; MEVs represents the size of the transaction, i.e., the total Gas consumed. Vout, Vin, and MEVg are denominated in the base network currency (ETH), while MEVs is calculated in Gas units. Separating Gas fees from Vout helps quantify the extraction cost and is the method for calculating REV.

Here, the term "blockchain" refers to any address not related to the EOA performing the extraction transaction or controlled by the searcher's smart contract (corresponding to a smart contract or EOA). Identifying these addresses is a heuristic guided process based on known searcher patterns and may have omissions. Additionally, any auxiliary transactions related to MEV extraction (such as the "meat" in sandwich attacks) are not part of the above variables. Turning to the miner side:

Where geff represents the effective Gas price of transactions that should have been included in the block in the absence of opportunity utilization. Therefore, REV includes the opportunity cost borne by miners through including MEV extraction transactions.

As transactions in the mempool are transient, geff cannot be measured solely through blockchain data and logs. Because Flashbots adopts an approximate method, this method also serves as a lower bound for the value realized by miners:

Where gtail is the Gas price of the last transaction in the block.

Therefore, even though the roles of miners and searchers are somewhat blurred, the cost of opportunity extraction, i.e., the reduced part of MEV.gtail, can be clearly determined.

Finally, at this stage, the value allocation between searchers and miners depends entirely on the choice of MEV, which in turn is influenced by other searchers attempting to exploit this opportunity.

3.4 Industry Space and Potential

3.4.1 Background

MEV can be classified as follows:

1) Transaction Execution Type:

Pre-transaction MEV: Operations conducted before transaction execution, mainly obtaining value through auctioning public transaction pools or redirecting transactions.

Mid-transaction MEV: Value generated during transaction execution, including manipulating transaction queue order, transaction reordering, and other operations.

Post-transaction MEV: Operations conducted after transaction execution, usually related to interactions with smart contracts on the blockchain, including mining rewards and flash loans.

2) Market Manipulation Type:

Pre-market MEV: Obtaining benefits through market operations outside of exchanges, such as information manipulation and coordinated manipulation.

In-market MEV: Obtaining benefits through operations and trading activities within exchanges, including market manipulation and stop-loss activation.

Post-market MEV: Obtaining benefits through operations after trades are completed, such as trade returns and market adjustments.

3) Blockchain Protocol Type:

Contract transactions MEV: Transactions executed using smart contracts to obtain value through manipulating contract logic.

Block mining MEV: Manipulating block order during the mining process to obtain value.

Addressing the MEV (Miner Extractable Value) problem is an important part of the Ethereum development roadmap. On November 5, 2020, Ethereum co-founder Vitalik Buterin released an updated Ethereum development roadmap, introducing a new phase - "The Scourge," aimed at ensuring reliable, fair, and trust-neutral transactions and addressing the MEV problem. This means that protocols addressing the centralization of MEV will receive more attention, and the importance of this track will gradually increase.

In the past few years, the development of MEV has gone through different stages. The early stage (2010-2017) was the budding period of MEV, mainly focused on the Bitcoin network, such as Fee Sniping and double-spend attacks. The formal birth stage (2018-2019) was a period of significant growth in MEV on Ethereum, including the emergence of decentralized exchanges, algorithmic stablecoins, and automated market-making mechanisms on Ethereum, providing more opportunities for MEV.

Currently, there are multiple solutions in the MEV market, with Flashbots being the most prominent organization. Flashbots achieves MEV extraction through encrypted bots, and its MEV auction platform has received widespread attention and generated substantial MEV revenue. The market potential of MEV is enormous. According to data provided by Flashbots, over 206,450 ETH in MEV revenue has been realized before the Ethereum merge, but this is only the revenue accepted by block proposers, and the revenue for searchers has not been calculated. Given the current market development, the market size of MEV may be unlimited. Furthermore, the actual MEV revenue at present is only a fraction of the potential.

Overall, the future prospects of the MEV track are broad, and with continuous technological and protocol innovation, the focus on addressing the MEV problem will further increase, bringing more opportunities and benefits to users and participants.

3.4.2 Market Size

The revenue scale in this field develops almost synchronously with the trading volume in the crypto market. The scale of MEV is influenced by two main factors: there is a positive correlation between arbitrage frequency and price fluctuations, and there is also a positive correlation between arbitrage volume and total trading volume.

Taking Flashbots as an example, its total gross extraction profit is 713.95M, considered benign MEV, which has a positive impact on determining market value, completing core functions of DeFi, and DEX trading volume. The revenue from sandwich attacks is 1206.11M, considered adverse MEV, and most MEV-protective DEXs hope to control and retain this portion of the profit.

Using Uniswap, Pancakeswap, and Sushi as anchor points for cumulative fee income ranking, the cumulative fees of these three DEXs amount to 5.21 billion, with MEV income obtained through Flashbots accounting for approximately 37% of this total. In addition to major DEXs, other DApps, layer 2 solutions, and alternative layers on Ethereum also generate substantial MEV revenue. Analyzing the propagation of these fees throughout the value chain and estimating the scale of various segments requires an analysis of the distribution of MEV profits among different participants.

According to Eigenphi's data, in January and February 2023, MEV searchers obtained $48.3 million from all users' transactions through wallets and RPC, of which $34.7 million flowed to builders, and builders transferred $30.3 million to validators. The profit distribution is as follows: searchers received $7.3 million (17.4%), builders received $4.4 million (10.5%), and validators received $30.3 million (72.1%). It can be seen that the majority of the profit (72%) is still obtained by downstream validators.

Out of $48.3 million, $6.3 million was used for EIP 1559 burning. The priority fees for ordinary transactions transmitted from wallets and RPC to builders and then to validators amounted to $32.554 million. Ordinary transactions from wallets and RPC resulted in the burning of $227.2 million through EIP 1559.

During the bull market in 2021, the overall revenue ceiling reached $476 million. Based on the lower, 10x price revenue multiple, the scale of the entire field is close to $5 billion. The scale of each segment can be roughly estimated based on the proportion, with searchers exceeding $1 billion and validators exceeding $3.5 billion.

However, robots participating in on-chain transactions and profiting from them may still incur many costs of failed transactions and other off-chain hedging costs, which are not included in the calculation. Additionally, this only calculates the income obtained by direct participants, without considering the market of indirect participants. In reality, the scale of the entire field far exceeds the above figures.

3.5 Business Data

Operational Data

Note: Since the merger on September 15, 2022, the project has changed MEV to REV (Realized Extractable Value), which more accurately represents the actual realized and extracted amount compared to the theoretical maximum amount. In simple terms, REV refers to the income earned by miners in the blockchain network, while MEV is a more specific concept that involves the potential value obtained by miners from ordering transactions and manipulating certain on-chain activities.

REV:

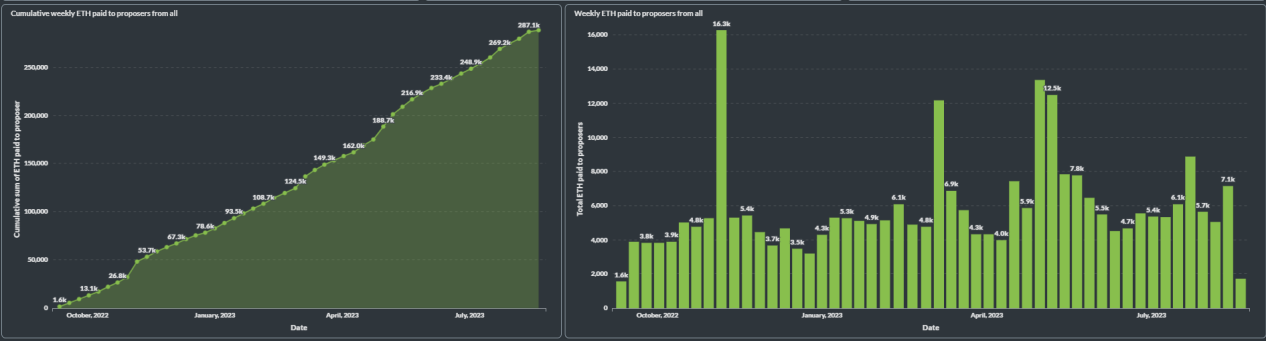

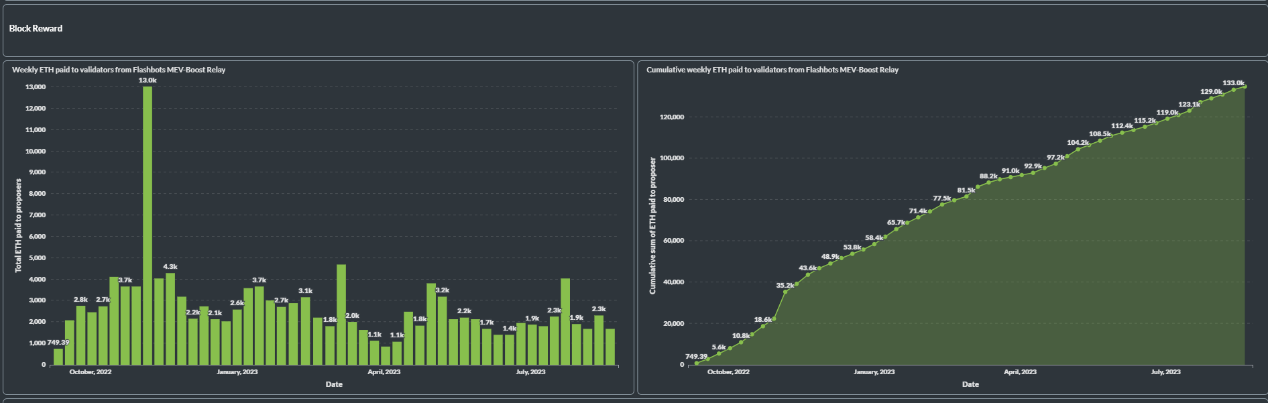

As of August 31, 2023, the total amount of extraction since the merger is 288,829 ETH, with an extraction amount of 18,860 ETH in the past 30 days (Searchers' income not included). Since October 2022, the total amount of Ethereum paid to proposers has been steadily increasing, rising from 1.6K per week in October 2022 to 287.1K per week in August 2023, an increase of over 179 times.

Detailed analysis of REV (the following dataset includes statistics on two types of REV attacks, arbitrage, and liquidation captured by mev-inspect-py after the merger)

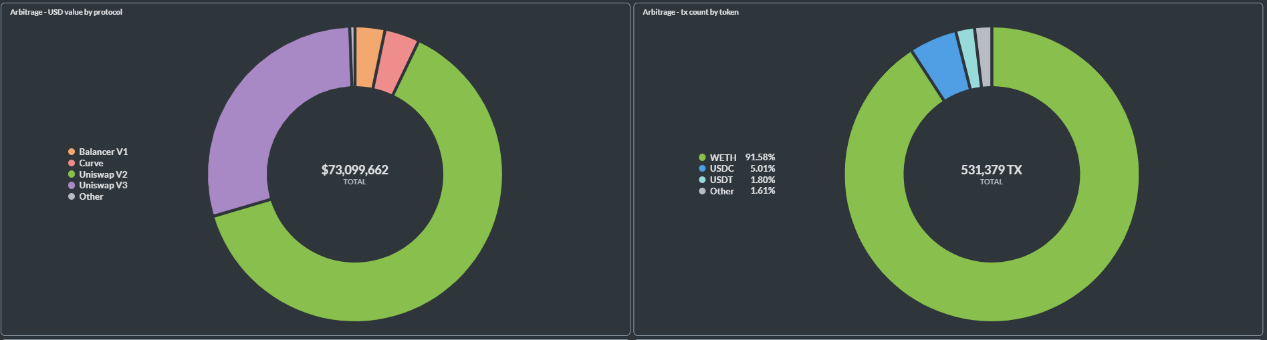

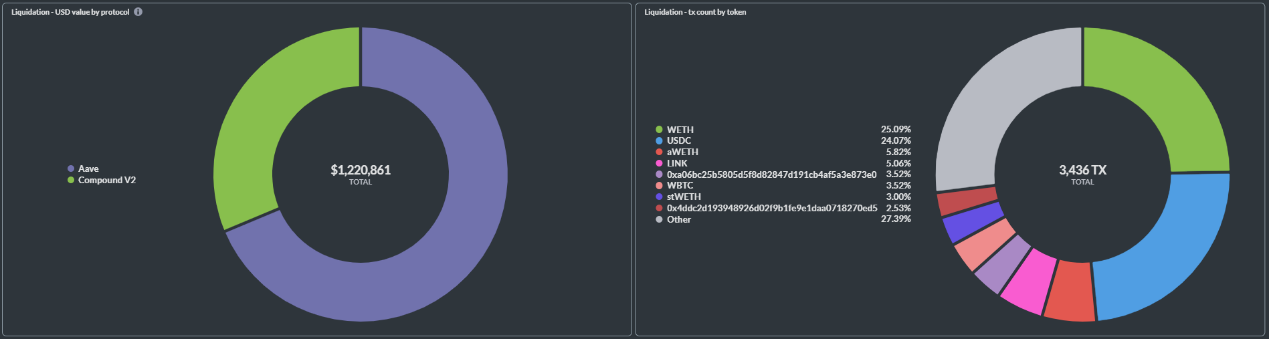

According to the data, the protocol with the largest proportion of MEV arbitrage is Uniswap V2, accounting for 64.11%. This is followed by Uniswap V3, Curve, and Balancer V1. In terms of arbitrage transactions, the highest proportion is for WETH, reaching 91.58%. This is followed by USDC, USDT, and other currencies. In terms of liquidation, the Aave protocol accounts for 68.8%, while Compound V2 accounts for 31.2%. The total liquidation profit value is approximately $1.22 million. In terms of currencies, WETH has the highest proportion, at approximately 25.09%, followed by USDC at 24.07%.

It is important to note that due to incomplete coverage of token prices denominated in USD, the project can only detect approximately 85% of the total arbitrage volume (denominated in USD).

Flashbots Relay Metrics

According to the dataset, which includes the MEV-Boost operation of Flashbots relays on the Ethereum mainnet, it can be observed that the total amount of Ether (ETH) paid to validators in MEV-Boost relay blocks is continuously increasing. In November 2022, the block rewards reached a peak of 13K ETH per week, while overall, the average weekly payment to validators ranged between 2-4K ETH.

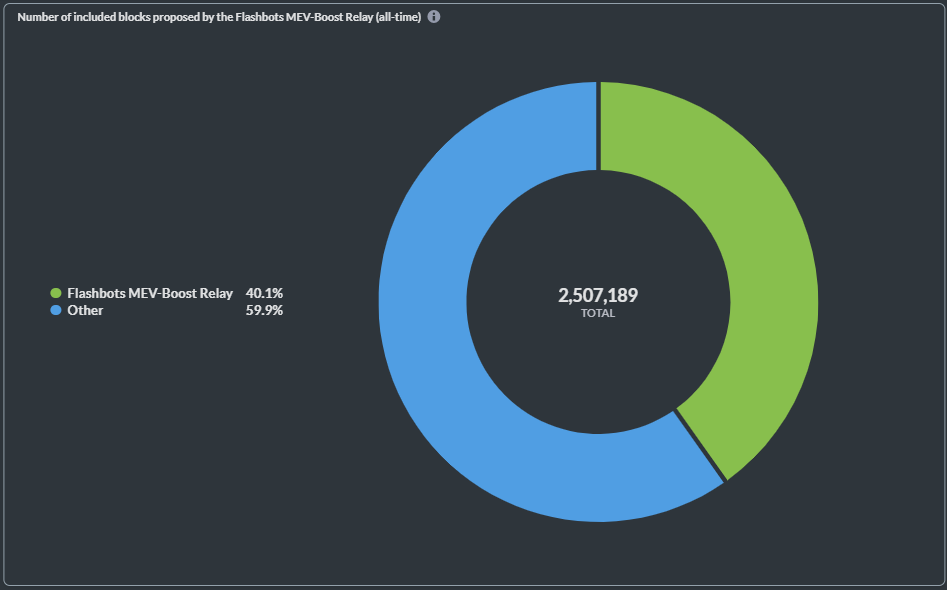

Over the entire period, the total number of blocks submitted by the MEV-Boost Relay is approximately 2.5 million. Flashbots accounts for 40.1% of the proportion, while others account for 59.9%.

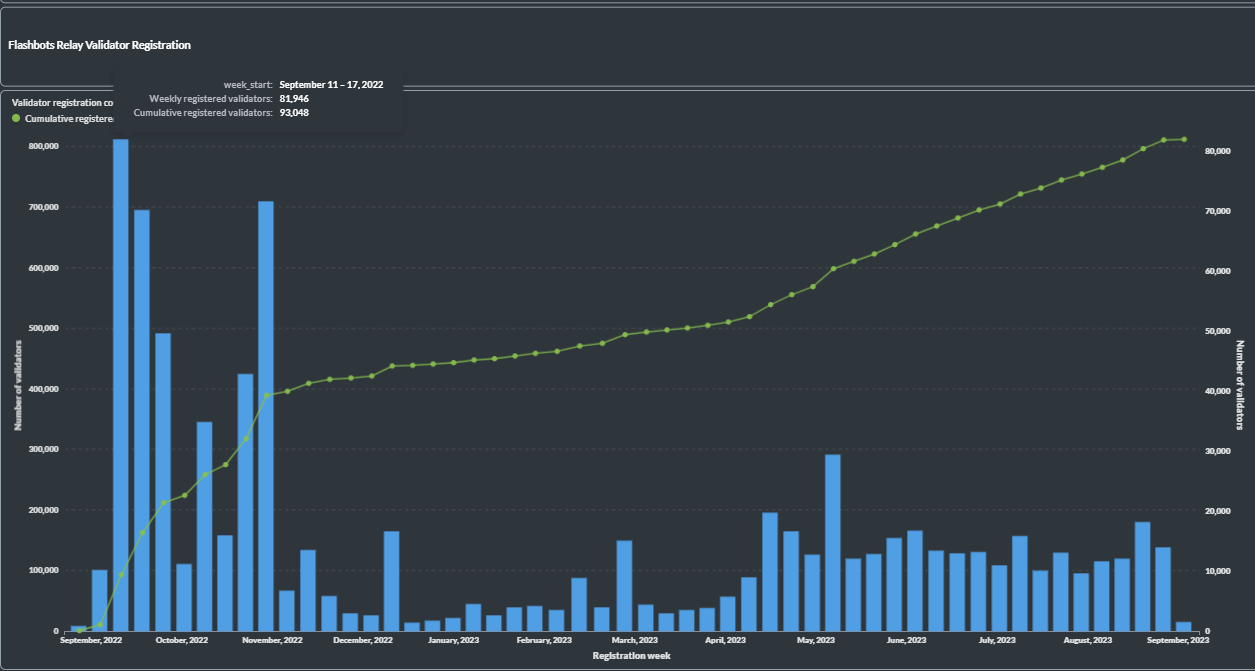

Flashbots Relay Validator Registration Data:

According to the data, registered Flashbots relay validators account for 81% of the current total number of validators. Currently, the total number of validators is approximately 810,000. Overall, the number of registered validators continues to increase. During the period from September to November 2022, the growth rate of validators was high, with peak weekly registrations. However, from November 2022 to September 2023, the number of registered validators showed a significant downward trend. Especially from December 2022 to April 2023, the number of registered validators was at a low point. Currently, the registration volume of validators is maintained at a relatively moderate level.

Social Media Data

Twitter: The project currently does not have an official account.

Discord: There are currently 26,870 followers on Discord, with 3,996 online.

Discussions in the Discord community are very active and cover many technical topics.

3.6 Project Competitive Landscape

3.6.1 Project Introduction

- Manifold Finance

Manifold Finance (FOLD) is an MEV relay infrastructure project aimed at improving connectivity between DeFi, DApps, and protocols, and providing solutions. Founded in 2020 by Sam Bacha, Manifold Finance acts as an intermediary between Ethereum users and validators.

One of their main focuses is protecting users from the impact of MEV attacks, such as sandwich attacks, which can exploit transactions and manipulate prices. Through their first product, YCabal, Manifold Finance redefines the trading process, preventing malicious arbitrage attacks on-chain and reducing gas fees.

- Skip Protocol

Skip Protocol has developed an MEV product ecosystem adapted to the Cosmos. These products aim to help blockchains achieve long-term financial sustainability and utilize MEV to achieve this goal. By providing specialized MEV infrastructure, Skip Protocol enables the blockchain community to autonomously control the acquisition and distribution of MEV income. Their products can help stakers, validators, and protocols profit from MEV while improving the on-chain user experience. Additionally, these products enable traders to execute more complex and profitable trading strategies.

3.6.2 Comparative Analysis

Manifold Finance, Skip Protocol, and Flashbots are all organizations or protocols aimed at mitigating the negative impact of MEV. Among them, Manifold Finance and Flashbots are technical infrastructure, while Skip Protocol is a decentralized protocol.

Manifold Finance reduces the negative impact of MEV through the SecureRPC system and OpenMEV SDK, while Flashbots studies democratization and redistribution of MEV income through a series of products, bringing more transparency to the ecosystem.

Skip Protocol focuses on integrating MEV searchers and validators, creating a sealed bid, closed auction system that allows traders to submit tip transactions to validators, who prioritize them in blocks based on the block's situation to earn more rewards.

Flashbots is a research and development organization aimed at mitigating the negative impact of MEV. The Flashbots auction bypasses traditional public bidding auctions, allowing users to privately communicate their bids and transaction order preferences, while maximizing validator rewards and preventing frontrunning transactions. The combination of private transaction pools and sealed bids ensures fairness and optimal block construction in the Ethereum network.

Therefore, the differences among these three organizations or protocols lie in their products, technical infrastructure, and focus on problem-solving.

3.7 Token Model Analysis

Token Total Supply and Distribution

The project has not yet issued tokens.

4. Preliminary Valuation

4.1 Core Issues

Does the project have a reliable competitive advantage? Where does this competitive advantage come from?

1) Cutting-edge technology and unique market positioning: Flashbots aims to address the frontrunning and transaction reordering (MEV) issues in Ethereum, giving it a competitive advantage in the Ethereum ecosystem due to its cutting-edge technology and unique market positioning.

2) Market demand and industry partnerships: Flashbots also collaborates with multiple projects and exchanges in the Ethereum ecosystem to jointly advance technology and market development, providing a greater competitive advantage for the Flashbots project.

3) Strong team capabilities: The Flashbots project is composed of top engineers and researchers from the Ethereum developer community. With deep blockchain technical backgrounds and rich experience, they can address market challenges and drive project development. Strong team capabilities are an important factor in establishing the competitive advantage of the Flashbots project.

What are the main variable factors in the operation of the project? Are these factors easy to quantify and measure?

1) Transaction volume: This is an important indicator for measuring the activity and user participation in the Flashbots project. Higher transaction volume means more users are using Flashbots' services. This can be quantified and measured by tracking the number, value, and frequency of transactions.

2) Partnerships and community engagement: The Flashbots project needs to closely collaborate with different stakeholders in the Ethereum ecosystem, such as Ethereum miners, researchers, and developers, to jointly drive Ethereum's development. The number and quality of partnerships, as well as the activity and engagement of the community, can be important indicators for measuring project collaboration and community building.

3) Technological innovation and research achievements: One of the goals of the Flashbots project is to drive innovation in new technologies in Ethereum. Measuring the impact and quality of the project in terms of technological innovation and research achievements may be relatively more subjective, but can be measured by evaluating the quality and impact of the technical specifications, tools, and software in which the project participates.

These variable factors can be quantified and measured to some extent, especially in terms of transaction volume. Partnerships and community engagement can be preliminarily measured by monitoring social media activities, the number and quality of collaborative projects, and the number of participants in activities. Technological innovation and research achievements may require more in-depth evaluation and assessment, taking into account factors such as quality, feasibility, and impact.

4.2 Major Risks

1. Centralization issues: Flashbots is an organization aimed at maximizing Ethereum's benefits, but this may sometimes conflict with the expectations of the Ethereum community. For example, Flashbots announced that it would review transactions blacklisted by the U.S. Department of the Treasury's Office of Foreign Assets Control, a decision that has garnered widespread public attention and opposition. These issues may affect the reputation and user trust of Flashbots in the Ethereum community.

2. Insufficient liquidity: Insufficient liquidity in Flashbots auctions may prevent it from functioning effectively, thereby affecting the feasibility of its business model. Additionally, liquidity issues in Flashbots auctions may hinder its ability to attract sufficient user and validator participation, thereby impacting its long-term development.

3. Performance Issues: The operation of Flashbots' relays requires a large amount of computing resources and bandwidth, which may lead to some performance issues. Additionally, performance issues with Flashbots may affect its stability and reliability in the Ethereum network, thereby impacting the feasibility of its business model.

4. Transaction Ordering Market Issues: The transaction ordering market in Flashbots auctions may result in some transactions being prioritized, which could cause public dissatisfaction and scrutiny.

5. Legal and Regulatory Issues: The operation of Flashbots auctions may be subject to legal and regulatory restrictions, which could affect the feasibility and long-term development of its business model.

6. Mechanism Risks: The development of permissioned and exclusive transaction routing infrastructure may have a negative impact on the neutrality, transparency, decentralization, and fairness of Ethereum. Flashbots Auction, as an open and democratic choice, needs to find solutions in its future development to avoid this impact.

5. References

- Official Website

- Flashbots Explorer

- Flashbots Docs

- Official Blog

- LinkedIn - Flashbots

- Medium - Flashbots

- Fundraising Information

- Skip Protocol Official Website

- The Future of MEV and the Future of the Crypto World

- LD Capital: Is the Importance of the MEV Track Underestimated?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。