Selected News

Trending Topics

Source: Overheard on CT (tg: @overheardonct), Kaito

BONK: BONK's popularity has surged, surpassing Pumpfun to become the largest launchpad, with 58% of BonkFun's transaction fees used for buying back BONK. The token's market value has skyrocketed due to an active buyback and burn mechanism, placing it among mainstream memecoins, with strong community support. Discussions generally believe that BONK possesses both meme and utility characteristics, and its ecosystem is expanding, giving rise to more new projects and narratives.

TON: Toncoin has gained widespread attention due to its collaboration with the UAE to launch a "Golden Visa" program. This program allows eligible $TON holders to obtain UAE residency and business rights by staking $100,000 for three years and paying a fee of $35,000. Although the project has not yet received explicit endorsement from UAE officials, its practical application in cryptocurrency is seen as a breakthrough development, sparking discussions on compliance.

DOGDOG: DOGDOG's popularity on Twitter is rising, being referred to as a leading dog-themed meme coin in the Bitcoin ecosystem. Tweets emphasize its unique advantage based on Bitcoin, the most decentralized and secure chain, suggesting it has the potential to surpass meme projects on Ethereum and Solana. Currently, market sentiment is highly optimistic, with many users predicting it will "moon." Meanwhile, DOGDOG's market value has significantly exceeded that of other competitors, further solidifying its leading position.

PUMP: Discussions about PUMP mainly focus on its competition with BonkFun. Currently, BonkFun has surpassed Pumpfun in both market share and daily trading volume, marking a significant shift in the launchpad landscape. Tweets express both recognition of Pumpfun's early innovations and skepticism about its prospects in the context of BonkFun's rise, resulting in a divided overall sentiment.

DOGE: Discussions about DOGE center on price increase expectations and its role in the meme coin market. Notably, Musk mentioned DOGE while discussing US debt issues, leading to widespread dissemination; there are also rumors that the America Party may adopt DOGE as its mascot. On the price front, some predict DOGE may soon break $1. Overall, the meme market is on the brink of explosion, with DOGE seen as one of the key driving forces.

Selected Articles

In our daily lives, money is just a line of numbers on a banking app, the sound of a scan at the checkout, or a text received when a salary is deposited. But in a broader world, "money" is often absent, represented by closed Western Union offices, the only bank branch within dozens of kilometers, or the fans that can't be waved in long lines and sunburned skin. Stablecoins like USDT and USDC are not just codes and consensus; they are like wooden boats carrying people across the river in a currency storm. Stablecoins quietly catch those left behind by traditional finance, with countless small payments made at our fingertips piecing together the future financial system day by day. The form of money is quietly changing on the other side of the world.

Bitcoin is transitioning from "digital gold" to a new type of mortgage asset in American housing finance. In 2025, the Federal Housing Finance Agency (FHFA) will require Fannie Mae and Freddie Mac to study the inclusion of cryptocurrencies in mortgage assessment systems, potentially formally introducing Bitcoin into the $6.6 trillion mortgage market. This institutional trial marks a move for decentralized assets to gain "housing leverage" functionality, becoming part of household asset allocation. Behind this is not only the push from Wall Street but also a reflection of the Trump administration's embrace of a "national strategy for crypto finance." Although the volatility of crypto assets still raises regulatory disputes, the institutionalization of Bitcoin mortgages may be opening a gateway to a new financial paradigm.

On-chain Data

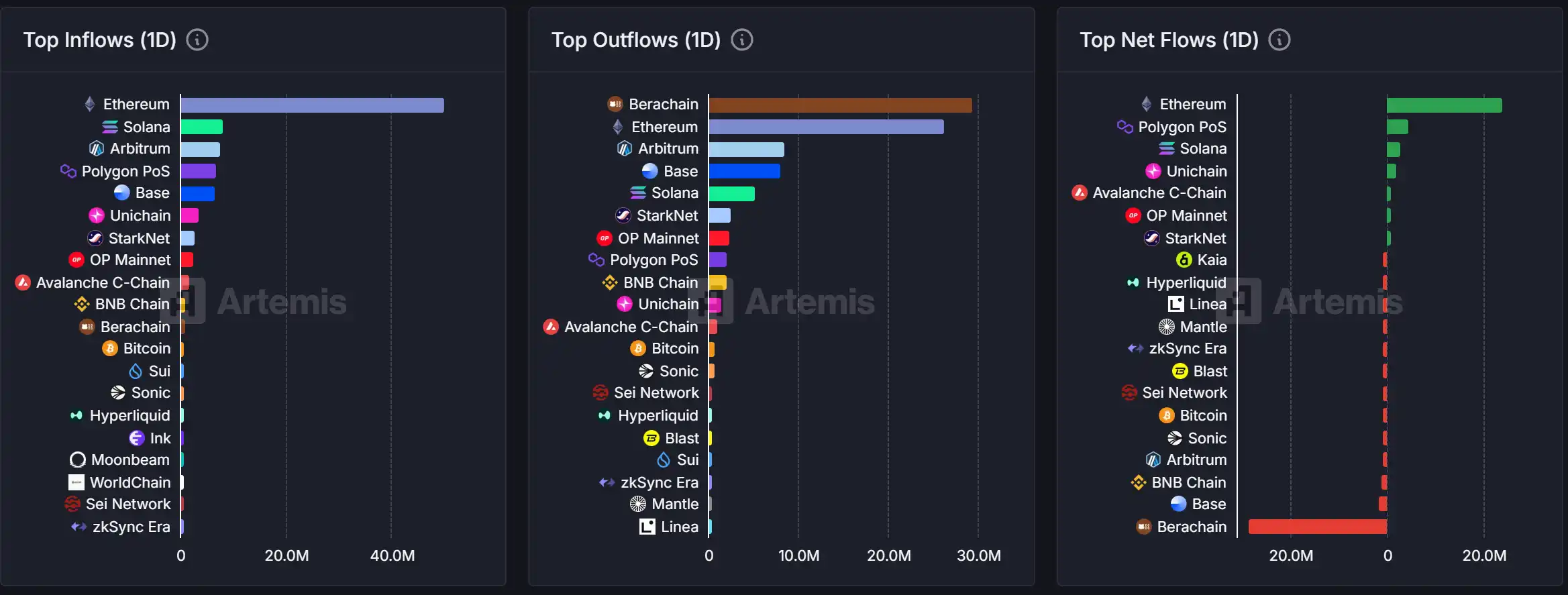

On-chain capital flow situation on July 7

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。