Author: Joyce, BlockBeats

Editor: Jaleel, BlockBeats

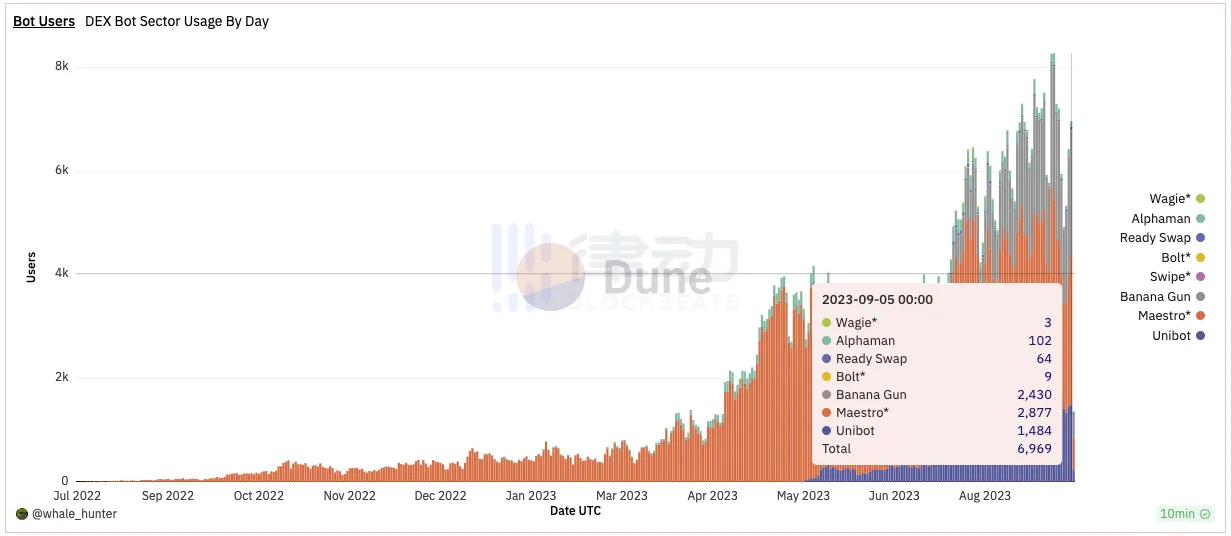

The iteration of the TG bot track is much faster than most people imagine. Maestro has surpassed the leading Unibot in terms of user volume even before the coin is issued, and now Banana Gun is also gaining momentum.

According to the latest data from Dune, the daily active user count of Banana Gun has far exceeded Unibot, approaching Maestro.

Image source: Dune

Like Unibot, Banana Gun is a Telegram bot that helps users quickly obtain tokens by sniping contracts. Its most famous feature is the Sniper function for opening, which is expected to become the preferred sniper and manual buyer for users on Ethereum.

Income is one of the factors for evaluating TG bots. It is worth noting that before the token sale, Banana Gun's Telegram group had less than 300 members, yet it was able to achieve a stable daily income of 10-25 ETH.

Upcoming release, how about Token Economics?

Banana Gun views the issuance of tokens as a way to brand marketing and achieve a positive flywheel effect. This presale will be conducted on their own dApp. In the first three weeks of the sale, Banana Gun filtered out robot users who completed tasks and distributed NFTs to them, although the use of NFTs had not been announced at that time.

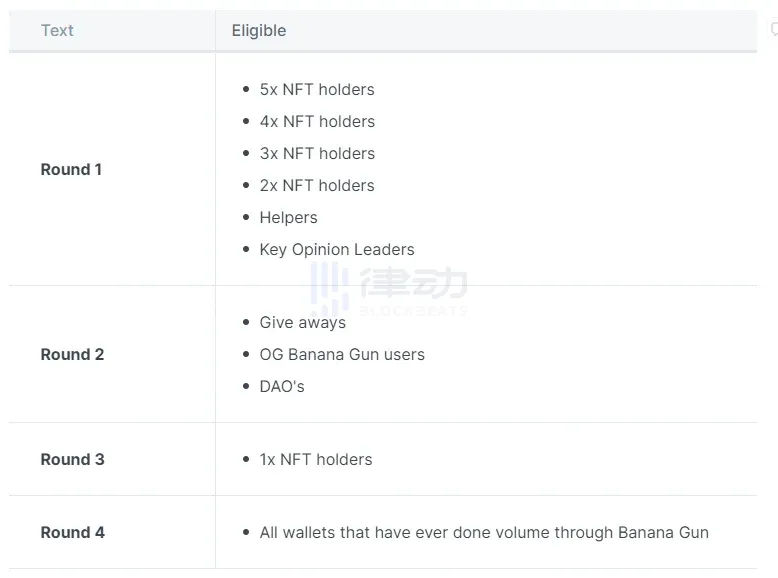

In this presale, the expected upper limit is 800 ETH, and the presale issuance price is $0.65. To ensure even distribution, the team will introduce a tiered system during the presale, which will be hosted on their own decentralized application (dApp).

There will be four rounds of distribution, first come, first served. The first round will not be oversubscribed and will target users holding 2-5 Quest NFTs, users who have helped the project, and KOLs. The subsequent three rounds will be oversubscribed, focusing on early loyal users. Considering that Banana Gun has generated 500 ETH in income in just three months, the sale may end as early as the second round.

Image source: Banana Gun

To ensure a stable release, Banana Gun will leave a few days between the release, income sharing, banana bonuses, and airdrops.

This time, 10 million $BANANA will be released, with 20% allocated to the presale, 3% to the liquidity pool, 1.2% to airdrops, 10% reserved for the team, with half of the team's reserve locked for 2 years and released linearly over 3 years, and the other half locked for 8 years and released linearly over 3 years. The treasury reserve will account for 65.8%, with most of it locked, and the released portion will be used as rewards for users using the bot.

The presale price is $0.65 per $BANANA, corresponding to an initial market value of $1.56 million and an initial FDV of $6.5 million. The initial liquidity will be injected with $300,000 in $BANANA and $195,000 in liquidity, totaling $390,000. In an ideal state, the liquidity ratio of $BANANA will reach 25% of the circulating market value, which can maintain the health of the token market in terms of volatility and depth.

There will be 2.4 million tokens in circulation, accounting for 24.2% of the total token supply. Both buying and selling taxes will be 4%, and the team promises to "reduce taxes significantly when the market value increases." Currently, 2% of the buying and selling taxes are allocated to token holders, 1% to the team, and 1% to the treasury.

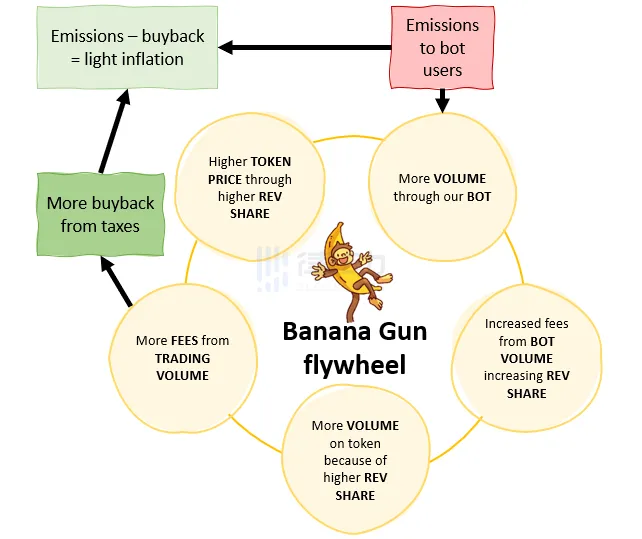

Banana Gun Ecosystem Mechanism

In the ecosystem built by Banana Gun, a mechanism is provided for the conversion of roles between robot users, $BANANA holders, and Banana Gun investors. Every transaction made using Banana Gun will receive $BANANA as a reward, calculated as fee*X, where X is between 0.05 and 1, and the team claims that it will be adjusted according to market conditions. $BANANA holders can receive a share of income on the dApp, including 40% of fee income and 50% of token transaction tax income. The fee for using Banana Gun is 1%, and the fee for manual trading is 0.5%, with a 4% tax on token transactions.

For the potential risk of token inflation, Banana Gun has also made considerations to control the deflation/inflation rate within 30%. Token price, number of robots, and trading volume are factors to consider. Firstly, 1% of the treasury tax will be repurchased, which can usually offset most of the inflation issues. In addition, the issuance of $BANANA is adjustable, and the characteristics of its ecosystem mechanism will also encourage users to actively participate in trading and hold $BANANA. The team also stated that there will be functions launched in the future that can consume tokens.

According to the content of the official document, Banana Gun has prepared two rounds of airdrop plans for users who have invested time and effort: 100,000 and 20,000 respectively. The first airdrop will be based on the NFTs collected by users on Banana Gun, with different difficulty levels of NFTs corresponding to different point scores. After calculation, the number of tokens that can be obtained will be determined, and it can be viewed directly on the dApp. The second airdrop will be released in subsequent social media marketing activities.

How to Sniper with Banana Gun?

Unlike Unibot, the distinctive feature of Banana Gun is its excellent sniper opening function, with a focus on the First Block. The second is the trading function. Now let's take a look at how to play with Banana Gun, which has outstanding sniper opening functionality and a clear airdrop plan.

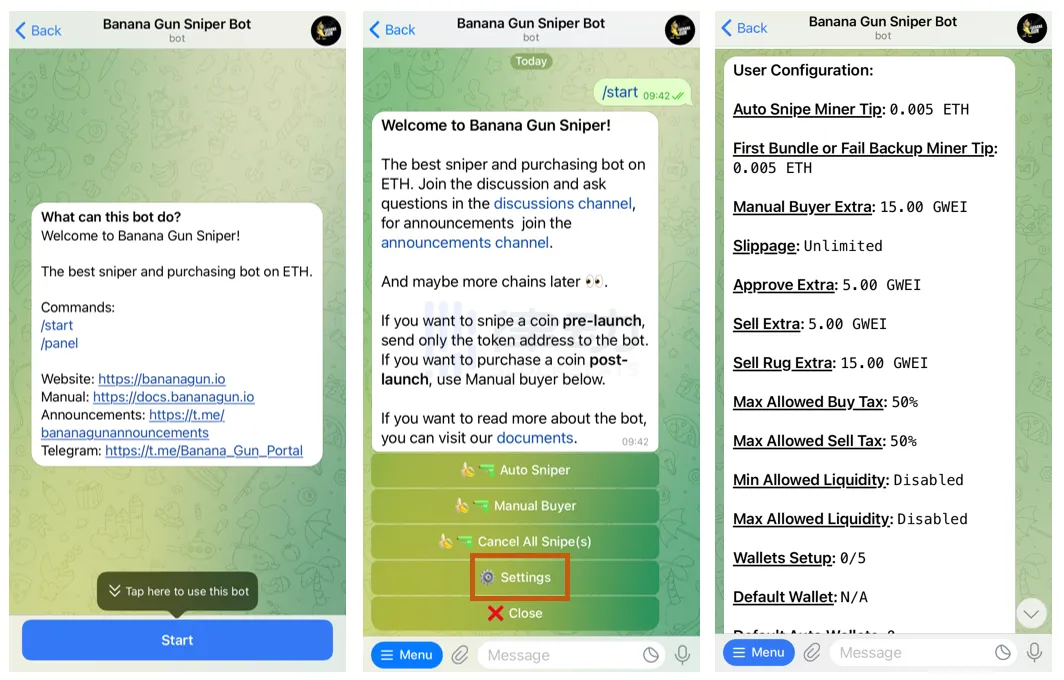

Enter Banana Gun's Telegram bot channel, click start to enter the guide, and go to the setting to enter the Sniper's setting page.

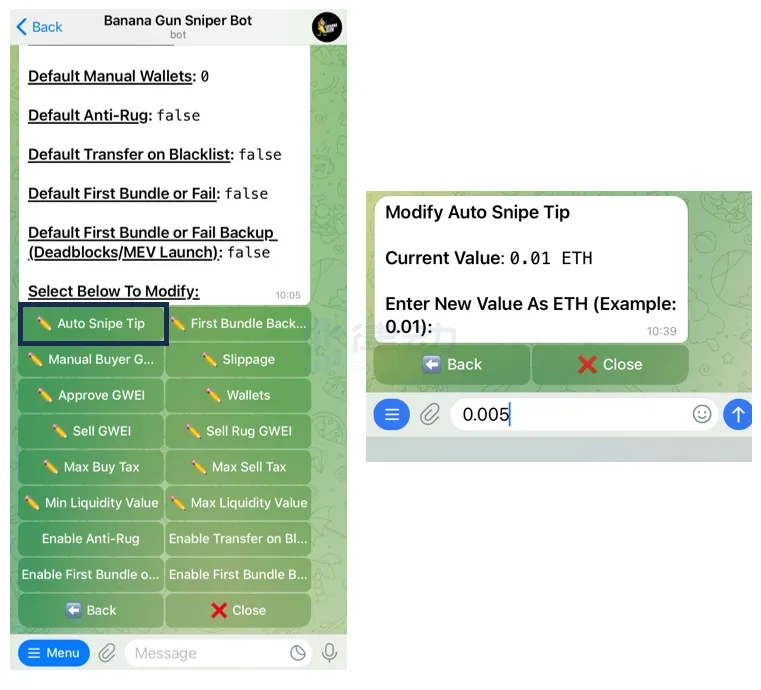

Below the parameter display area, select the parameters to be modified.

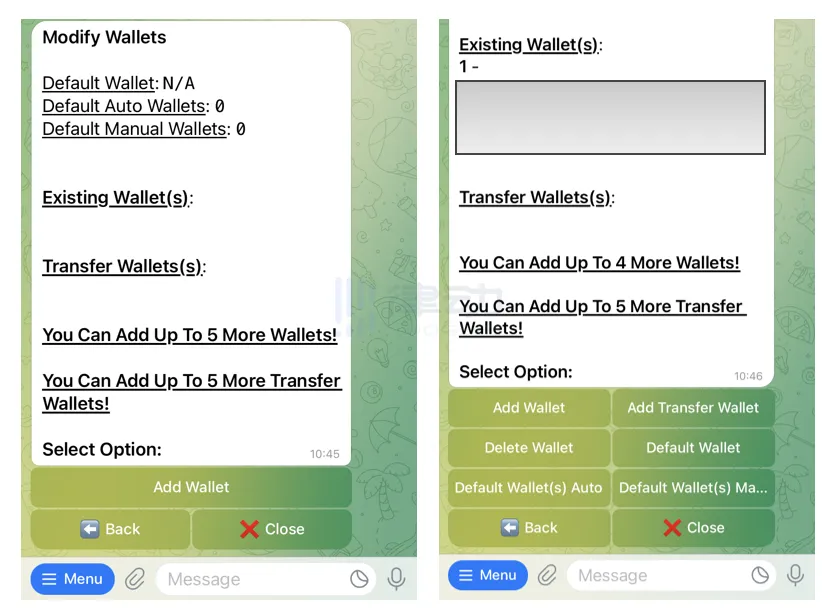

After successfully setting, click Wallets to add a wallet, which can be imported with a private key or generated directly. Each Telegram account can use up to 5 wallets. After the wallet is generated, continue to set up automatic and manual wallets. Then set the fee to be paid for sniping. Banana Gun uses a unified bribe form, and within the same contract, the queue order is determined by the amount of the bribe, so different amounts of bribes need to be set for different projects.

After the basic settings are completed, you can enter the contract you want to "snipe" and the maximum expenditure for each wallet. Banana Gun can automatically fetch messages from the Telegram channel to find any messages containing Ethereum contract addresses from robots or administrators, and will initiate a purchase or start the automatic sniper.

Read more: How to Snipe - Banana Gun Manual

The Duel of Bot Track Dragons

Many in the community also believe that there is still a lot of room for growth in the bot track. In the short term, the token economics of bots have opened up new ideas for empowering funds and coin prices. Paying attention to new products and new iterations like Banana Gun may have the opportunity to capture a new round of market uptrend.

Last month, Unibot's trading volume accounted for 2% of Uniswap's, referencing Uniswap's absolute leadership in the DEX track, and Unibot's trading volume may surpass some well-known VC-supported DEXs. It's no wonder that some in the community believe that the relationship between Unibot and Banana Gun is like that of Uniswap and Sushi.

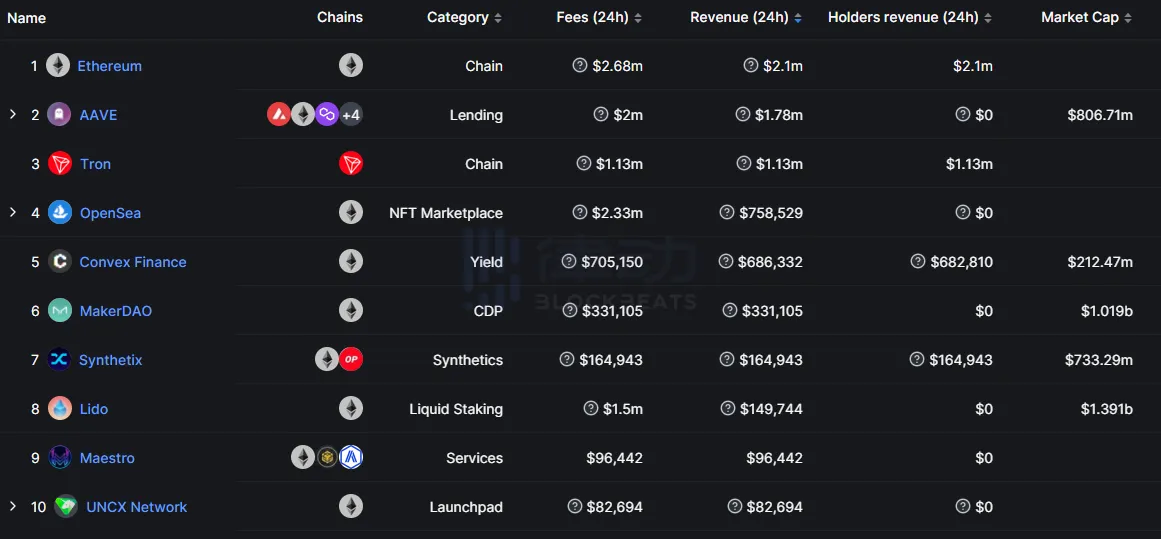

Image source: DefiLlama

From the latest income data, Maestro's income has already ranked ninth, which may indicate that the bot track is not a false narrative, but has real demand.

Bot tools solve some long-standing problems for crypto users. These functions include copy trading, sniping new coins, automated airdrop interactions, and using AI to generate smart contracts or NFTs. Without these advanced bot tools, individual crypto traders would face significant challenges in improving their technical advantages.

With the support of Telegram's 550 million monthly active users, the bot ecosystem is becoming increasingly rich, and BlockBeats will continue to pay attention to the TG ecosystem.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。