Today's Headline Highlights:

- Grayscale Wins Lawsuit Against the US SEC

- Shanxi Police Dismantle Money Laundering Criminal Gang Using Gold and Virtual Currency, Involving a Total of 135 Million Yuan

- OpenSea Announces Open Standard for "Redeemable NFTs" and Plans to Launch Other Products Based on This Standard

- Twitter Obtains Currency Transmitter License in Rhode Island, USA

- Ethereum Foundation Officially Launches Ethereum Execution Layer Specification (EELS)

- BNB Smart Chain Completes Network Upgrade and Hard Fork, Deposit and Withdrawal Functions Have Been Restored

- EOS Tokens Approved in Japan, Will Be Tradable with Japanese Yen on Regulated Exchanges

- Grayscale's GBTC Daily Trading Volume Reaches Highest Level Since the Cryptocurrency Market Crash in June 2022

Regulatory News

- US SEC Charges Los Angeles Entertainment Company Impact Theory for Unregistered NFT Offering

- Chairman of the US House Financial Services Committee Writes to Powell, Condemning the Federal Reserve for Undermining Clarity in Stablecoin Legislation

- US SEC Commissioner Hester Peirce Opposes SEC Enforcement Actions Against NFTs

- US SEC Submits Sealed Motion Against Binance

- US Department of Justice: All Expert Witnesses Proposed by SBF Should Be Prohibited from Testifying

NFT

- Cross-chain NFT Market BlueMove to Cease Operations on the Sei Network on August 31

- JJ Lin Uses Newly Customized Stellar NFT as His Digital Identity and Has Used It for His X Account Avatar

Artificial Intelligence

Project Updates

According to Caixin, mainland "Hong Kong drifters," even if they do not have permanent residency in Hong Kong, are eligible to open accounts on HashKey Exchange as long as they have a Hong Kong identity card, can provide proof of a fixed address in Hong Kong, and have Hong Kong bank account information. The platform will conduct IP address and VPN detection on users, and compliant users holding Hong Kong permanent identity cards who trade from within mainland China will be monitored after network detection. HashKey currently has tens of thousands of pre-registered users and is expected to officially provide trading services to registered retail investors in September. The goal is to reach 500,000 to 1 million registered users (including local and overseas users) by 2023 and to reach 10 to 15 million users by the end of 2025.

Currently, four partner banks can provide this service, including a Hong Kong note-issuing bank, two Chinese banks operating in Hong Kong, and virtual bank Zhongan Bank. 98% of digital assets on the platform are stored in independent cold wallet systems, with only 2% stored in hot wallets. KPMG, PricewaterhouseCoopers, and Ernst & Young have conducted external independent audits, internal audits, and code audits for HashKey Exchange, respectively. The exchange has partnered with ON Insurance (AIA Insurance) to insure user assets, with 50% of assets in cold wallets and 100% of assets in hot wallets being protected, with an initial insurance coverage of around $500 million.

Earlier news: HashKey to Launch MATIC/USD and AVAX/USD Trading Pairs for Professional Investors

DCG Reaches Tentative Agreement with Genesis Creditors, Expected Recovery Rate of 70%-90%

According to CoinDesk, Digital Currency Group (DCG) has reached a tentative agreement with Genesis creditors to resolve the claims made in the Genesis bankruptcy. The plan can provide unsecured creditors with a recovery of 70%-90% in USD equivalent based on the face value of digital assets, and a recovery of 65%-90% in physical form. All estimated recovery rates are subject to market prices and final documentation.

To meet its existing liabilities of approximately $630 million in unsecured loans due in May 2023 and $1.1 billion in unsecured promissory notes due in 2032, the parties have reached a new partial repayment agreement, divided into a 2-year loan of approximately $328.8 million and a 7-year loan of $830 million. In consideration of the partial repayment agreement due in May 2023, DCG will pay $275 million in four installments.

Mantle Network Plans to Allocate $238 Million to Promote Ecosystem Development

The Mantle Network governance page shows that the Mantle community has recently initiated a proposal to use the Mantle Treasury to promote ecosystem development. Specific content includes providing up to $160 million in liquidity support for applications, providing up to $60 million in seed liquidity for RWA-supported stablecoins, and providing approximately $18 million in liquidity support for third-party cross-chain bridges.

Reuters: SBF Appeals Court's Detention Decision

According to Reuters, SBF's lawyers have appealed the judge's decision to detain him before trial. SBF's trial is scheduled to take place on October 3 at the Southern District of New York federal court, overseen by U.S. District Court Judge Lewis Kaplan. Kaplan had previously revoked SBF's bail, stating that he had attempted to interfere with witnesses at least twice. SBF is currently being held at the Metropolitan Detention Center in Brooklyn, and his lawyers have argued multiple times that this has hindered his trial preparation and violated his constitutional rights. SBF will face trial on charges of wire fraud, commodities fraud, securities fraud, money laundering, and related conspiracy.

The Wall Street Journal: Binance Considering Complete Exit from Russian Market

According to The Wall Street Journal, Binance is reevaluating its operations in Russia, including the possibility of a complete exit from the market. A spokesperson stated, "All options are on the table, including a complete exit." Previously, Binance announced on its Telegram channel that Binance P2P had banned Russian residents from using legal tender currencies other than the Russian ruble. Overseas Binance customers in Russia were also prohibited from using currencies such as rubles, euros, dollars, and Ukrainian hryvnias.

Optimism to Transfer Initial OP Token Allocation to Base Network on August 30

According to official announcements, Optimism has announced that it will transfer the initial OP token allocation to Base on August 30, as part of a planned transaction. Last week, Base and Optimism developers jointly announced a revenue sharing and governance sharing protocol. Base will pay Optimism Collective 2.5% of its revenue or 15% of its profits, whichever is higher. In return, it will receive up to 118 million OP tokens.

Racer, the founder of the decentralized social protocol friend.tech, issued an apology, stating that the plan to restrict users from using the bootleg version of the app was driven by "fear" and "zero-sum thinking." Racer said, "I'm sorry. Fear led me to tell you not to use other products, which was foolish. This goes against the crypto culture I interact with online every day. I know I've disappointed many of you. Live the way you want to."

Coinbase: Fix Implemented for Some Wallets Showing Zero Asset Balances, User Funds Secure

Some Coinbase users reported on social media that their wallet Bitcoin balances were showing as zero. Coinbase later stated that some Coinbase Wallet users may encounter errors when trying to create new wallets or import existing wallets. The cause of the issue has been identified and a fix has been implemented, with the team monitoring the results. User funds are secure. Coinbase's latest tweet states that the wallet error has been resolved and balances are now displaying correctly.

Boba Network: BobaAvax to Cease Operations from October 31, Users Need to Transfer Funds Before Then

Ethereum Layer 2 Scaling Network Boba Network Announces Closure of BobaAvax on Avalanche

Boba Network has announced that its Layer 2 scaling solution, BobaAvax, on Avalanche will be discontinued and will no longer be available after October 31. Users of BobaAvax or the BobaAvax application are required to transfer all funds to the Avalanche mainnet before October 31 to avoid the risk of permanently losing access to assets on BobaAvax.

Sushi has also issued a notice stating that liquidity providers on BobaAvax must take the following actions before October 31: 1. Remove all existing liquidity from BobaAvax; 2. Transfer funds out of BobaAvax to ensure security. Additionally, Sushi strongly advises against adding any new liquidity to BobaAvax, and failing to remove liquidity or transfer assets by the specified date may result in users permanently losing access to their assets on BobaAvax.

The Uniswap community has initiated a proposal to deploy V2 on all chains with V3 instances and is conducting a temperature check vote on the proposal. The proposal states that currently, the only specification deployment of Uniswap V2 is on the Ethereum mainnet, and there is demand for V2-style AMM on chains other than Ethereum. Many V2 forks have been deployed and modified to varying degrees, which may pose security risks to users. If these forks have liquidity, it is likely to accumulate in Uniswap V2. Additionally, integrating Uniswap V2 pools into a universal router will help gradually improve the execution quality of applications already using the router, allowing their users to trade.

According to the proposal, chains with V3 deployments have passed the community review process and are eligible for V2 deployment by default. V2 deployments should be owned by the same contract that has V3 deployments on their respective chains and be subject to the same cross-chain governance mechanism. V2 deployments should be cataloged in a text record in the new ENS subdomain v2deployments.uniswap.eth, which includes the bridge sender contract address and the UniswapV2Factory contract address on the target chain.

The current support rate for the proposal is 97.31%, and the vote will end on August 31. If the temperature check vote passes, the on-chain vote for the proposal will be released on September 1, and if the on-chain vote passes, the proposal will be executed on September 12.

Curve Community Successfully Passes Proposal to Remove Chainlink Price Safety Limit in crvUSD Oracle

According to the Curve governance platform, the proposal initiated by Curve Finance founder Michael Egorov to remove the ±1.5% safety limit on Chainlink prices in the crvUSD oracle has been passed through on-chain voting. Egorov stated in the proposal that if the Chainlink price deviates too much from the internal oracle EMA (1.5%), the Chainlink data source will be used directly. However, using market spot prices during extremely unstable market conditions can lead to unnecessary losses.

Mining News

Jiang Zhuoer's Q2 Financial Report: Total Revenue of $73.9 Million, Mining Revenue of $15.9 Million

Jiang Zhuoer released the Q2 2023 financial report, which shows a total revenue of $73.9 million, a 33.7% increase compared to the $55.2 million in Q1 2023. The mining machine sales revenue was $57.8 million, and the mining revenue was $15.9 million. The company's costs in Q2 amounted to $143.9 million. The company holds 1,125 bitcoins and $66.1 million in cash and cash equivalents. The company expects total revenue of approximately $30 million in Q3 2023. The company's total hash rate sales in Q2 2023 were 6.1 million TH/s, a 44.2% increase compared to Q1 2023.

Argo Blockchain Financial Report: Debt and Net Loss Halved Compared to the Same Period Last Year

According to Cointelegraph, the mid-year financial report of crypto mining company Argo Blockchain shows a net loss of $18.8 million in the first half of 2023, a reduction of over 50% compared to the $39.6 million net loss in the same period last year. Argo also noted that by mid-2023, the company's debt had decreased by $4 million, with a total debt of $75 million. Compared to the $143 million debt in June 2022, the company has reduced its debt by $68 million. Argo's revenue decreased by 31% compared to the first half of 2022, with a net revenue of $24 million by mid-2023, attributed to the decline in Bitcoin value, the increase in global hash rate, and related network difficulty. Argo reported that it mined a total of 947 bitcoins in the first half of this year, only a 1% increase compared to the BTC mined in the same period in 2022. It is worth noting that the global total hash rate increased by 78% in 2023. As of June 2023, Argo's balance sheet reflected $9.1 million in cash holdings and 46 bitcoins.

Important Data

Curve Finance Founder Sells 160 Million CRV via OTC for $64.26 Million

Data from Dune Analytics shows that Curve Finance founder Michael Egorov has sold a total of 160 million CRV via over-the-counter (OTC) transactions since August 1, estimated to have earned $64.26 million based on the previous trading price of $0.4.

Additionally, DefiLlama data shows that in the CRV borrowing on Aave V2, there are 1.189 billion CRV with a liquidation price of 0.249 USDT, valued at approximately $30 million. According to Coingecko, the current price of CRV is $0.4879, with a 6.4% increase in the last 24 hours.

It is reported that in order to save his loan and potentially prevent a cascading liquidation in the entire DeFi space, Egorov has conducted a series of OTC transactions with over a dozen counterparties, selling a large amount of CRV in exchange for stablecoins to repay his debts. Egorov confirmed in a statement that buyers who violated the cooperation agreement would not be negatively affected, but he "believes they will" adhere to the commitment of a 6-month lock-up period.

Blockchain security firm PeckShield has stated that the fifth-largest whale address on the Bitcoin chain holds 94,643 bitcoins (valued at approximately $2.46 billion). The seized address is believed to be under the control of the U.S. government and is directly linked to the 2016 Bitfinex hack. On February 1, 2022, the address starting with 1CGA4 (controlled by the U.S. Department of Justice) transferred approximately 567.5 BTC (valued at approximately $21.88 million) to the seized address.

CoinShares: Digital Asset Investment Products Experienced Net Outflows of $168 Million Last Week

According to the CoinShares weekly report, digital asset investment products experienced a total net outflow of $168 million last week, marking the largest fund outflow since the U.S. regulatory crackdown on exchanges in March 2023. The net outflow for Bitcoin investment products totaled $149 million, while Ethereum investment product outflows amounted to $16.8 million.

PANews APP Points Mall Officially Launched

Free redemption of hardcore prizes: imKeyPro hardware wallet, First Class Cabin research report monthly subscription, Ballet REAL series wallet, AICoin membership, various peripherals, and hundreds of selected research report collections. First come, first served, experience now!

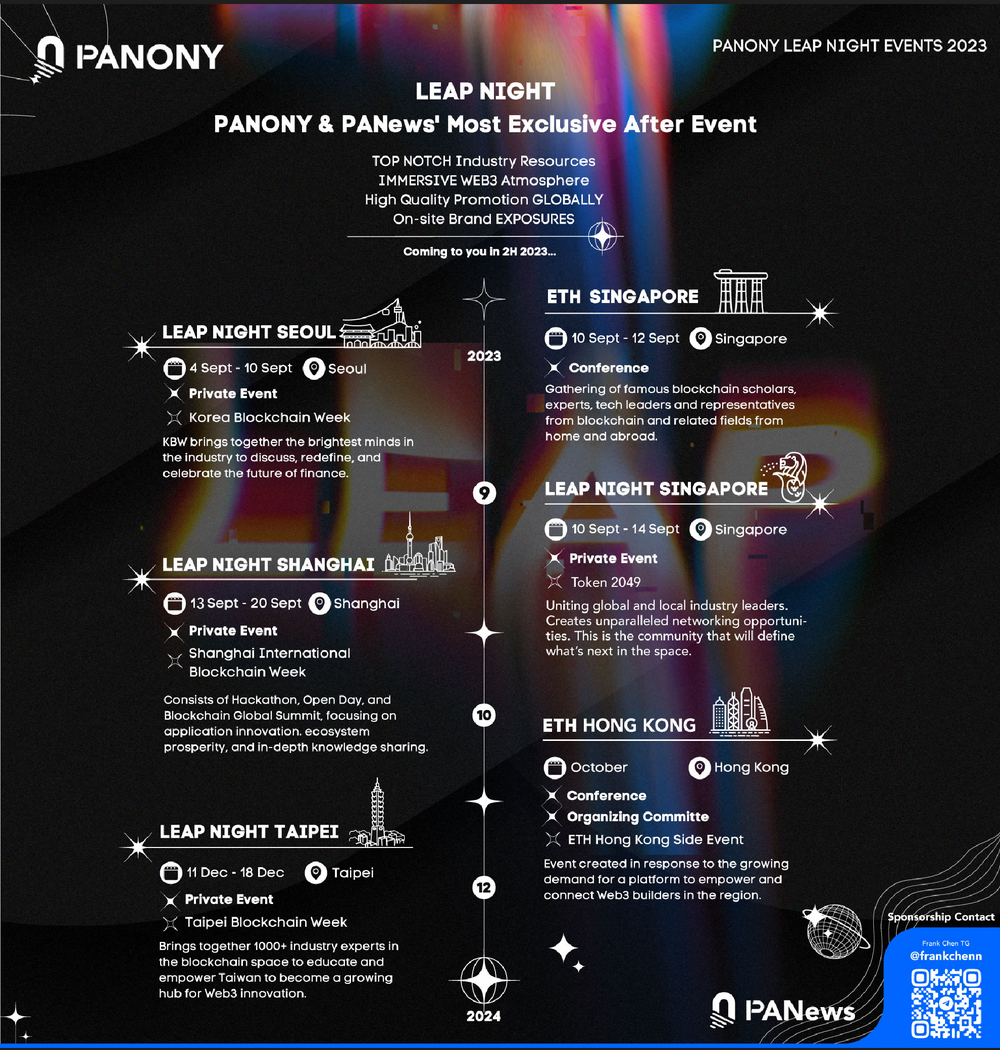

PANews Launches Global LEAP Tour!

Korea, Singapore, Shanghai, Taipei, September to December, multiple locations come together to witness a new chapter in globalization!

?Collaboration welcome for events in multiple locations, contact now!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。