RWA assets have received widespread attention in the cryptocurrency world. Since they are RWAs, so-called "real-world assets," they are inevitably constrained by the framework of the real world, especially the legal system and ownership structure of real-world assets. Therefore, compared to the direct token issuance on the chain in the past, the issuance framework and process of RWA tokens are more complex.

It is crucial to differentiate asset issuance models. For example, there are nearly ten similar projects offering almost the same returns for the same type of government bond tokens. How to distinguish their advantages and disadvantages? Especially for fixed-income products similar to government bond products, which often meet the demand for financial management and have a significant allocation ratio, how to identify the risk points of similar products?

Taking government bond-type tokens as an example, the asset issuance model and related legal documents determine what underlying assets investors are actually purchasing: whether it is the corporate debt of a company investing in government bonds, or the fund shares of a fund investing in government bonds, or government bond ETFs repackaged through a certain entity, or government bond tokens that can ultimately be redeemed with the U.S. Department of the Treasury. Different types of underlying assets correspond to different types of risks, and these risks may be difficult to perceive for the most part of the time, until the occurrence of a black swan event.

This article will organize and analyze the common types of RWA token issuance in the market, hoping that readers can further understand the RWA asset issuance framework and effectively identify risks in the process of further integration between the crypto world and the real world.

Classification of Asset Issuance Models

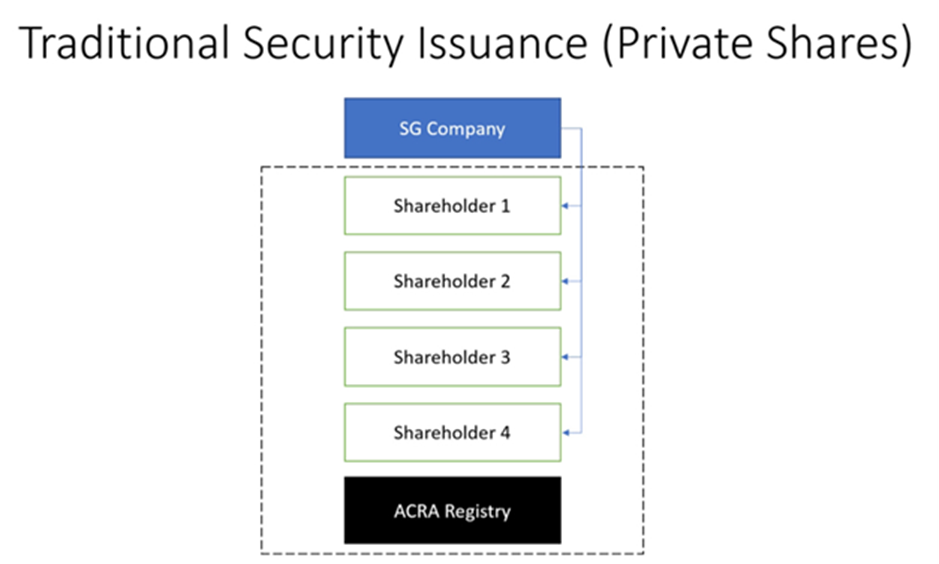

To understand the RWA token issuance model, let's first take a look back at the traditional asset issuance model. Taking securities as an example, the following figure shows the typical issuance model of Singaporean company equity.

Figure 1: Traditional stock issuance model, Source: DigiFT

A company may have multiple equity holders, and the ownership of these equities will be registered with ACRA, and their transaction and transfer records will also need to be registered with ACRA.

Here, ACRA is the securities registration institution in Singapore. In other markets, there may be corresponding institutions or different market mechanisms involved, such as transfer agents in the United States, whose functions include registering and recording securities holders.

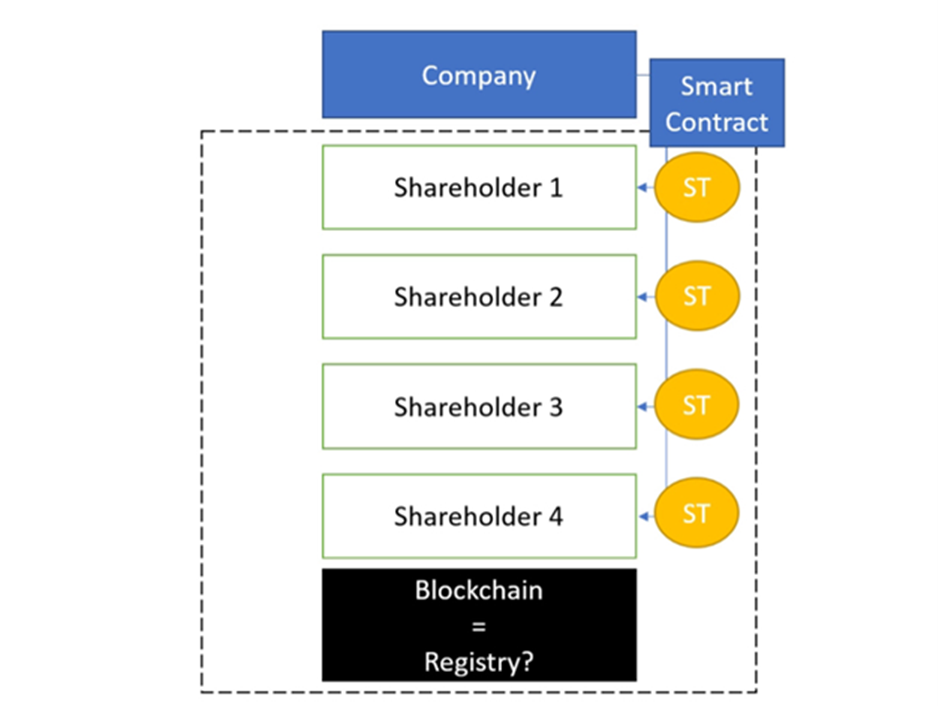

Figure 2: Direct issuance model, Source: DigiFT

To issue tokens on the blockchain, it is actually registering and recording ownership of securities on the blockchain and recording each transfer process.

In a few countries and regions where financial innovation is relatively advanced, they support direct registration of securities on the blockchain, such as the DLT Act in Switzerland. Therefore, in these regions and countries, securities can be directly issued through authorized institutions using the blockchain as the ledger. However, in other major financial markets such as the United States, Singapore, and Hong Kong, the relevant laws do not currently support direct registration and recording of securities on the chain, so most assets need to take a "detour."

As a result, the mainstream issuance models in the current market can be classified into two categories: the direct issuance model and the asset-backed model. Essentially, both issuance models involve issuing relevant bonds on the chain, but the form of issuance and the corresponding rights are completely different.

It is important to note that if private securities meet certain conditions, such as a limited amount of sales and facing a limited type of investors, their impact on the financial market is very limited, and they can also be issued in compliance. This is also the reason why most RWA projects currently only target qualified investors.

Direct Issuance Model

The direct issuance model involves the asset issuer using the blockchain as a bookkeeping tool to register and record the assets and issue corresponding tokens on the chain. The tokens represent the underlying assets themselves. Investors who purchase and hold such assets can directly obtain various related rights belonging to the assets, such as voting rights for stocks and repayment rights for bonds.

However, the direct issuance model still has many limitations in the current market environment. For example, such securities are tokenized and are not compatible with the current mainstream securities exchange structures (such as Nasdaq, SGX, etc.), or there are certain friction costs. Currently, the legal structure is also not perfect, and there are not enough legal cases to serve as references for future judgments.

Case Study

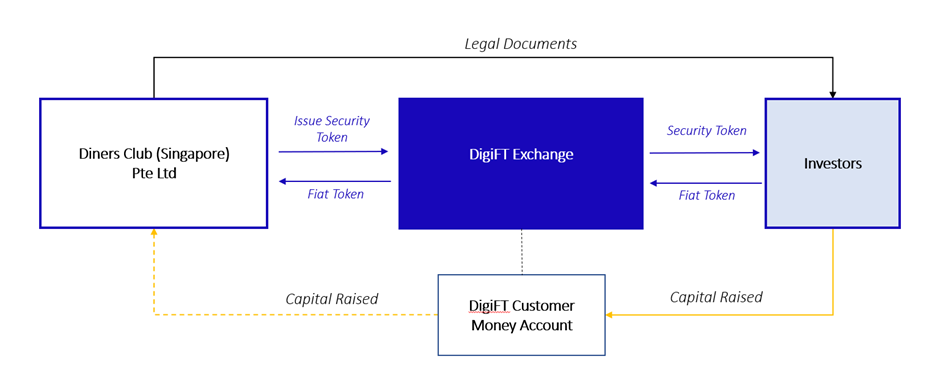

Many current RWA projects also use the direct issuance model, such as issuing bonds to bring real-world economic interests onto the chain. Previously, DigiFT issued the Diners Club Debt Security Token, which is one such case. Its issuance structure is as follows:

Figure 3: Diners Club Debt Security Token issuance structure, Source: DigiFT

Diners Club International Ltd. is a direct banking and payment services company under Discover Financial Services and is one of the most well-known brands in the U.S. financial services industry.

Diners Club (Singapore) Pte Ltd. (DCS) is the franchised entity of Diners Club International Ltd., established in 1973, and is a limited liability private company registered in Singapore. Its main business is to provide credit card and debit card services in Singapore under the "Diners Club" brand. DCS issued tokenized notes for a one-month period on DigiFT as part of its financial management plan, using the direct issuance model.

Here, DCS is the asset issuer, and the tokens issued represent its company's notes. Any user holding these tokens can redeem the corresponding assets from DCS upon maturity.

Asset-Backed Model

Due to the current legal imperfections and the limited nature of on-chain assets, many projects also choose to use the asset-backed model for issuance. Essentially, this type of token is a new security that represents the economic rights of the underlying assets. The asset issuer registers and records the assets outside the blockchain system, and after a third party purchases the assets, tokens are issued in proportion to the corresponding relationship, with the counterparty risk lying with the asset issuer and the token issuer.

The asset-backed model is currently a common RWA model that can bring real-world returns onto the chain, but it introduces additional risks, and although the issued tokens may contain the economic value of the underlying securities assets, the rights may differ from the actual securities rights.

Case Study

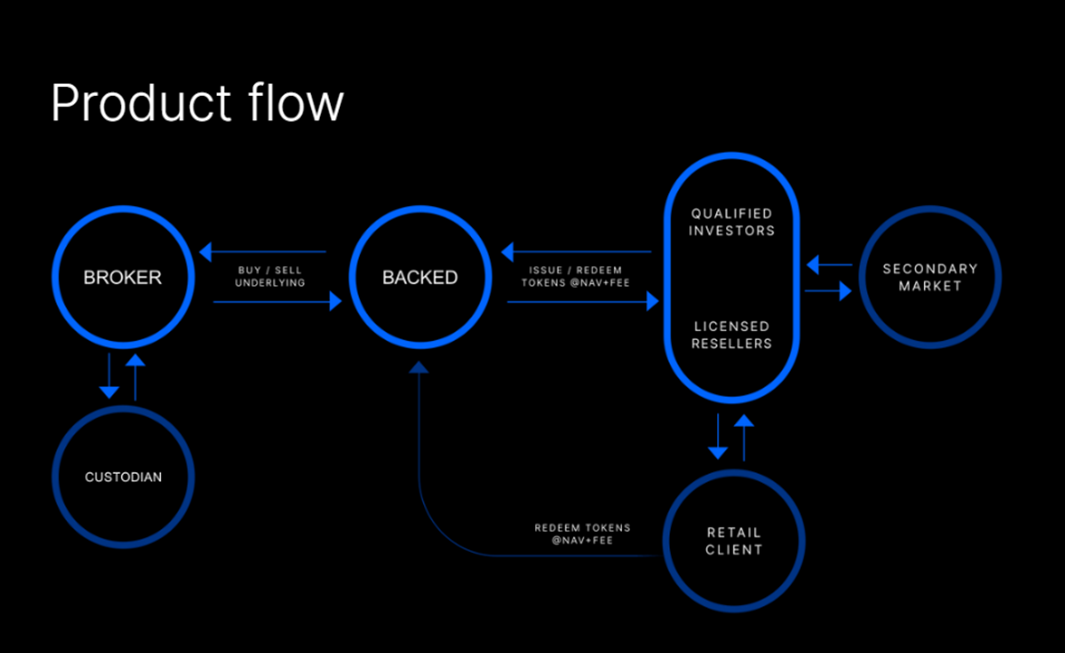

Backed Finance is a regulated institution headquartered in Switzerland that, under the DLT Act in Switzerland, can bring real-world securities onto the chain in a packaged form, endowing tokens with economic rights. Under the asset-backed model framework, purchasing its tokens only provides the economic rights corresponding to the tokens. Backed Finance also states in its legal documents that its tokenized assets only track the prices of the underlying assets and do not include a range of traditional securities rights such as voting rights. Its issuance structure is as follows:

Figure 4: Backed Finance product operation process, Source: Backed Finance

Backed Finance purchases the corresponding assets through a third-party institution, and after the assets are held by a licensed custodian, issues the corresponding tokens. Each token tracks the price of the underlying assets through on-chain and off-chain data but does not involve other rights such as stock voting rights. Currently, the assets it issues include assets such as Coinbase stock and Blackrock iShares ETF. The asset issuer here is the issuer corresponding to the underlying assets, such as Coinbase for its stock, and the token issuer is Backed Finance. Here, there are at least two levels of counterparty risk, coming from Coinbase and Backed Finance. Backed Finance is a typical project that issues corresponding tokens using the asset-backed model, and in its legal documents, it explicitly states that the tokens only track the prices of the underlying assets and do not hold other securities rights.

Conclusion

The tokens issued through the direct issuance model represent the underlying assets and can provide investors with direct related rights, making it a healthier issuance model. Due to the current legal imperfections and the lack of enough legal cases as references, the legal risks of using direct issuance for RWA assets are relatively high. The asset-backed model relies on the token issuer to map the trust assets. This model has a very high trust cost, and project parties increase their trustworthiness through various means, such as obtaining licenses, using oracles for proof of reserves, and regularly disclosing bank accounts. If there are complete legal documents, a sound operational process, and sufficient information disclosure, the tokens issued through the asset-backed model can also provide investors with relatively complete rights and have relatively high flexibility. However, the asset packaging model is a "detour" within the existing framework, and we look forward to the large-scale application of the direct issuance model.

Over the past few hundred years, financial securities have transitioned from paper securities to electronic securities. However, as a new financial bookkeeping tool, we believe that blockchain will have more complete legal and related infrastructure in the future to tokenize securities, further improving efficiency and reducing costs.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。