Market Overview

As concerns about higher bond yields and inflation heat up, and worries about China's economy slowing down more than expected are compounded by debt crisis concerns, major global stock indices have experienced three consecutive weeks of decline, with the S&P and Nasdaq hitting their largest declines since the March 2008 banking crisis and the end of last year, respectively. After the extremely optimistic market sentiment in July, it now seems to have retraced to a neutral range, with data showing that some institutions have been buying on dips in the past two weeks.

Stock Market

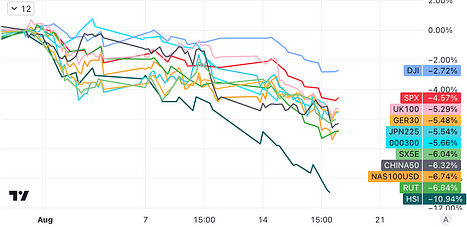

The S&P 500 index fell by more than 5% since the end of July, the Nasdaq 100 index and the Russell 2000 index fell by nearly 7%, the CSI 300 index fell by 5.7%, the Hang Seng Index fell by nearly 11%, the Nikkei 225 index fell by 5.5%, and the Dow Jones Industrial Average index fell relatively modestly. Nevertheless, due to the stock market's rise of around 20% since the beginning of the year, the current pullback still falls within a healthy range and has not yet triggered a significant deterioration in market sentiment.

The differences in declines are mainly reflected in changes in investment styles, interest rates and inflation environment, and comprehensive reflection of profit prospects.

The Dow Jones Industrial Average index is mainly composed of large, stable, and long-established companies. In an environment of rising inflation and interest rates, investors may be more inclined to invest in these defensive companies. Meanwhile, the Nasdaq index is mainly composed of technology and growth stocks, and the Russell 2000 index is mainly composed of small-cap stocks, which may appear riskier in the current environment. High-valuation growth stocks (such as many Nasdaq components) may face greater pressure, as the rising cost of capital may erode future profit prospects. In contrast, many companies in the Dow Jones may perform better in an inflationary environment, as they may find it easier to pass on cost increases to consumers.

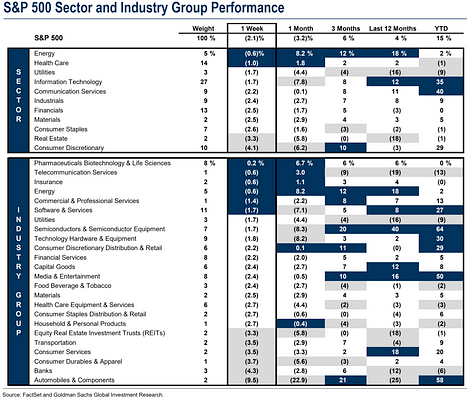

In terms of industries, the biopharmaceutical, communication services, and energy sectors performed well last week, while non-essential consumer goods such as automobiles, durable goods, and transportation and tourism sectors lagged behind.

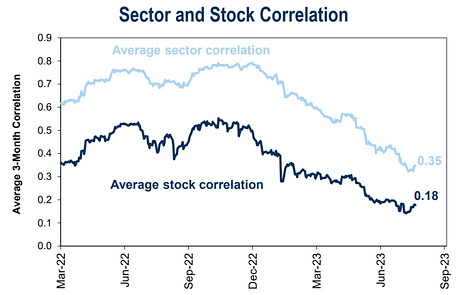

Due to the comprehensive decline, there has been a slight rebound in the correlation between stocks (0.15–0.18) and sectors (0.33–0.35):

Interest Rate Market

Supported by supply-side pressure and strong economic data, the yield on the 10-year US Treasury bond touched a high of 4.33% last Thursday, the highest level since October, while the 1-12 month bond yields remained almost unchanged. In the UK, due to still strong inflation indicators and wage growth faster than expected, the yield on the 10-year UK government bond soared to 4.75% last week, reaching the highest level since October 2008.

Concerns about the deteriorating real estate crisis in China and its impact on the weak Chinese economy have also intensified negative sentiment.

Chinese real estate giant Evergrande Group filed for bankruptcy in New York on Thursday night. The real estate crisis is a major drag on the struggling Chinese economy. Prior to the news of Evergrande, another Chinese real estate giant, Country Garden, recently warned of losses of tens of billions of dollars in the first six months of this year. Moody's downgraded the company's rating, citing "increased liquidity and refinancing risks."

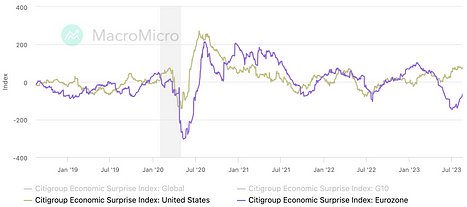

Overall, the stock market's retreat more reflects a repricing of interest rates and price expectations rather than a signal of a complete loss of momentum in the economy. The market's overly optimistic assessment of the economic outlook in a rising interest rate environment in the past few months, as measured by the Citi Economic Surprise Index for the Euro-American economy, has rebounded this summer, and macroeconomic momentum is still there:

Regarding the interest rate market, the rise in the yield of the 10-year Treasury bond is not a signal that the Fed will significantly raise interest rates in the future. It is mainly because the previous rise in long-term interest rates did not match the rise in short-term interest rates, and the recent adjustment is not unexpected, as the bond market structure should not maintain long-term distortions. The Fed's interest rate hike expectations have reached their limit, and the marginal impact of marginal changes on the interest rate market is limited. In addition, it can be seen that the spread between long and short-term bond yields has narrowed significantly since August, which can also be seen as a signal of a rebound in long-term economic growth expectations:

Foreign Exchange Market

The US dollar followed the rise in yields, with the DXY reaching a two-month high last week. The USD/JPY briefly rose to 146.2, the lowest level for the yen exchange rate since November last year, exceeding the range that triggered intervention by Japanese authorities in September and October last year. However, Japanese Finance Minister Taro Aso stated last week that the authorities did not intervene in the absolute currency level.

The renminbi briefly fell below 7.3 last week, hitting the lowest level since October last year, but on Thursday and Friday, due to the People's Bank of China's defense of the renminbi exchange rate and a significant increase in the central parity rate, the exchange rate rebounded significantly, with USDCNY ultimately holding at 7.28.

In the last three days of last week, the People's Bank of China set the onshore renminbi against the US dollar at around 7.2, about 1000 basis points higher than the market price. This is the largest-scale defense of the renminbi through the central parity rate guidance in recorded history. The central parity rate is a reference point for trading, and its range is limited to between +2% and -2%, nominally the People's Bank of China will unlimitedly buy at this price range. In addition to raising the central parity rate, there are reports that state-owned banks directly sold US dollars to buy renminbi in the foreign exchange market last week.

The People's Bank of China had just cut interest rates on Monday, and more monetary and fiscal stimulus measures are on the way, leading to continued depreciation pressure on the renminbi due to the widening interest rate spread. However, mainstream institutions do not currently expect the renminbi to continue to depreciate significantly at its current level.

For years, China has been highly sensitive to any sharp fluctuations in the renminbi, as the speculative attacks that accompanied the depreciation of the renminbi eight years ago are still fresh in memory (the 2015 exchange rate reform). The current market's heightened pessimism, China's capital outflow, and the potential for a more serious depreciation vicious cycle risk are present, highlighting the necessity of appropriate intervention.

Hot Events

[New York Fed Survey: Short-term inflation expectations of US consumers hit new low since 2021]

A survey released by the New York Fed on Monday showed that US consumers' one-year short-term inflation expectations fell from 3.8% in July to 3.5%, hitting a new low since April 2021, marking the fourth consecutive month of decline. Consumers' inflation expectations for the three-year and five-year periods also declined, both falling from 3% to 2.9%.

[Bank of Japan: Service industry inflation in July reaches 2% for the first time in 30 years]

The CPI rose by 3.3% year-on-year, in line with expectations, but the "core core CPI" excluding energy and food rose by 4.3% year-on-year, still the fastest since 1981.

[Fed Meeting Minutes Lean Hawkish: Warns of significant upward inflation risks, cautious about stock market rise]

The minutes showed that most policymakers still believe that there are significant upward risks to inflation, which may require further rate hikes; many believe that even when cutting rates, the balance sheet may not necessarily stop shrinking; almost all policymakers believe that a 25 basis point rate hike in July was appropriate, with two supporting keeping rates unchanged. Fed staff no longer expect a mild recession this year, and expect PCE inflation to fall to 2.2% by 2025.

At the July FOMC policy meeting, Fed staff pointed out that stock prices have generally risen, corporate bond spreads have narrowed somewhat, and asset valuation pressures are "significant," with the risk assessment for May being "moderate"; they also mentioned residential and commercial real estate prices, calling them "relatively high" compared to fundamentals. Fed policymakers also pointed out the "significant risk of a sharp decline in commercial real estate valuations, which may have adverse effects on other financial institutions such as banks and insurance companies."

[Following energy and food, signs of sticky inflation reappear in the US, with used car prices rising for the first time in four months]

According to statistics, wholesale data for used cars in the first half of August in the US rose month-on-month for the first time in four months, raising concerns that this is another sign that inflation may stick around for a long time after the rebound in energy and food prices.

[US retail sales in July rose by 0.7% month-on-month, exceeding expectations and reaching the largest increase since January]

Reaching $696.4 billion, exceeding the previous value of 0.3% (revised to 0.2%), and also exceeding the market's expectation of 0.4%, marking the largest increase in six months. Benefiting from continued growth in real wages, US retail sales in July exceeded expectations across the board, indicating a robust performance of the US economy.

[China's holdings of US Treasury bonds fall to a 14-year low]

On Tuesday, August 15, the US Treasury Department released the International Capital Flow Report (TIC), showing that as of June this year, China's holdings of US Treasury bonds had fallen for the third consecutive month, with holdings decreasing by $11.3 billion month-on-month, reaching a total of $835.4 billion, the lowest since June 2009.

Since April last year, China's holdings of US Treasury bonds have been below $1 trillion. As of February this year, China had reduced its holdings of US Treasury bonds for seven consecutive months, reaching a new low for more than 12 years, and after increasing holdings in March and April, it reached a new low since May 2010 in May.

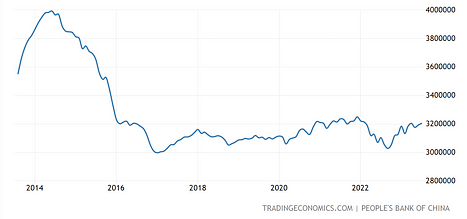

However, China's foreign exchange reserves rose to $3.193 trillion at the end of June, showing an overall upward trend this year:

[Google's "most powerful model" Gemini makes its debut, may be released in the fall]

The media revealed that Google's "new killer" Gemini combines the capabilities of the GPT-4, Midjourney, and Stable Diffusion models, and can also provide analytical charts, create graphics with text descriptions, and control software using text or voice commands.

[Bridgewater's flagship fund is bearish on US stocks and bonds in late July]

Bridgewater released a report to investors stating that in late July, its flagship fund Pure Alpha was "moderately" bearish on US stocks and bonds. Among the 28 assets analyzed by the fund, 15 assets took a bearish position, including the US dollar, metals, and global stocks. The two most bullish positions were the Singapore dollar and the euro. The latest 13F report shows that Bridgewater increased its holdings of Pinduoduo and Chinese ETFs in the second quarter of this year, heavily invested in US stocks and emerging market ETFs, and divested from Netflix and gold ETFs.

Market Sentiment

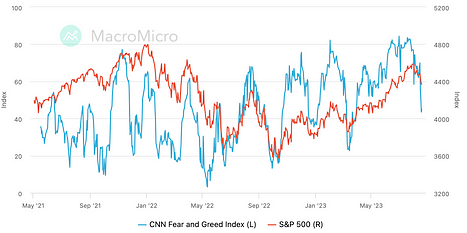

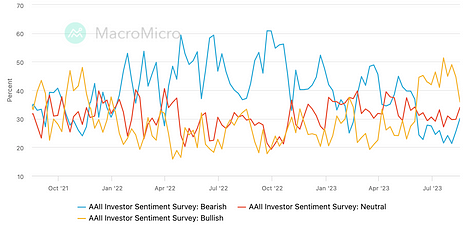

Earlier this year, there was a lot of pessimism in the market, and the shift from pessimism to optimism was the driving force behind the stock market rebound. We quickly saw it shift from overly pessimistic to overly optimistic, and now we are starting to see this situation reverse.

The CNN Fear & Greed Index has fallen significantly to the level at the end of March, with the current reading of 45 falling into the neutral range:

In the AAII investor survey, the bullish ratio fell significantly from 44.7% to 35.9%, while the bearish ratio rebounded for two consecutive weeks, currently at 30.1%:

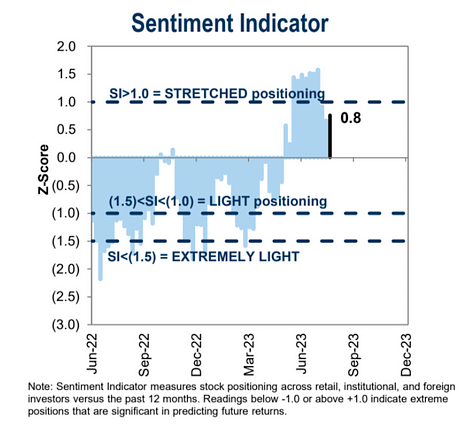

The sentiment indicator for positions at Goldman Sachs rose from 0.7 to 0.8 compared to the previous week:

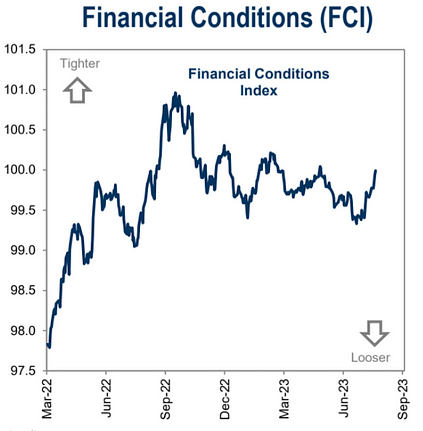

Financial stress surged to the highest level since March:

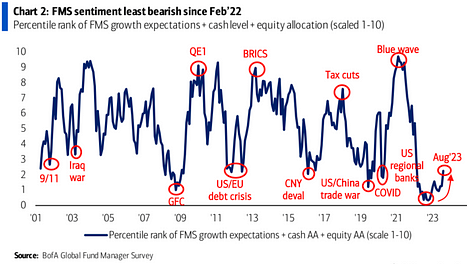

A Bank of America survey showed that investor pessimism is at its lowest since February last year. Investors still expect a softening of global economic growth over the next 12 months, but believe that central banks can achieve a soft landing during this period.

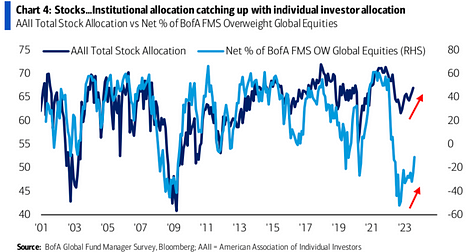

Currently, investors' asset allocation is at the lowest level of underweighting stocks in 16 months, with the overweighting of technology stocks at the highest level in over two and a half years:

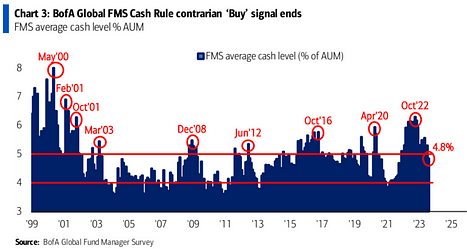

The cash allocation ratio decreased from 5.3% in the previous month to 4.8%, the lowest level since November 2021:

Funds and Positions

Overall Positions

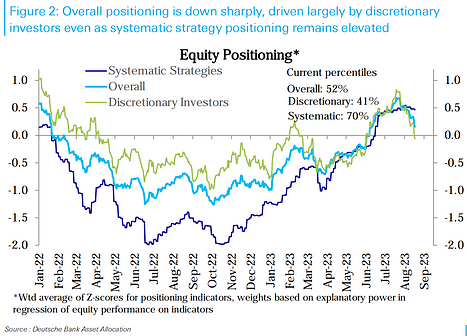

The Deutsche Bank-summarized level of US stock holdings has fallen for the fourth consecutive week to the lowest level in two months (historical 52nd percentile). Most of the decline is driven by subjective strategies, with this portion of holdings slipping slightly below neutral (41st percentile); the position of systematic strategy funds has not changed much over the past week and remains at the highest level since the end of 2021 (historical 70th percentile).

Industry Positions

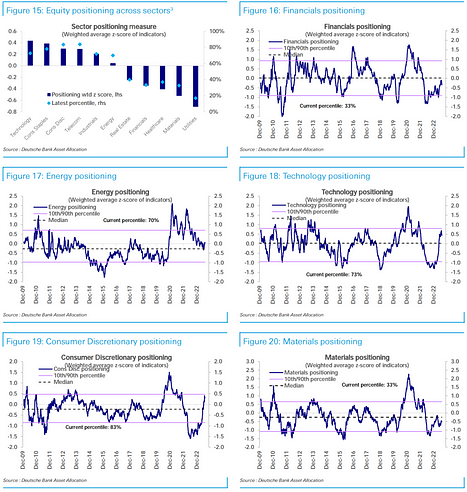

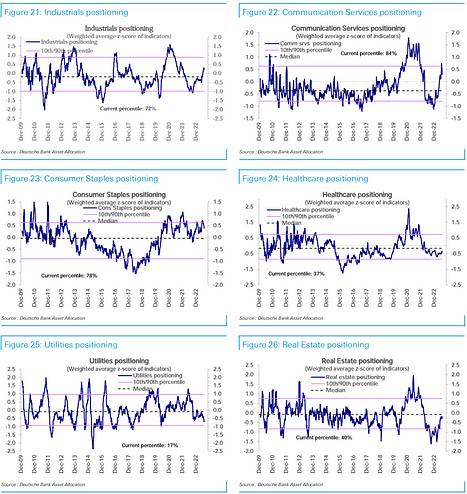

Holdings in technology (73rd percentile), consumer essentials (78th percentile), non-essential consumer goods (83rd percentile), and communication services (84th percentile) are still overallocated, but have decreased this week.

Holdings in industrials (72nd percentile) have also decreased, but still remain moderately overallocated, as are energy holdings (70th percentile).

Real estate holdings (40th percentile) are moderately underallocated and remain relatively stable, while financial holdings (33rd percentile) are underallocated and decreased this week.

Healthcare (37th percentile) and raw materials (33rd percentile) holdings are underallocated and relatively stable, while utilities (17th percentile) holdings are underallocated and trending downward.

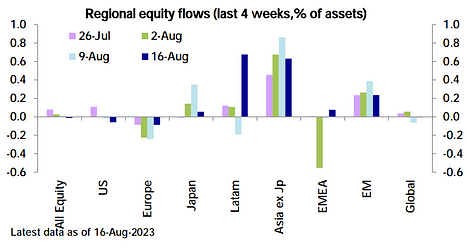

Fund Flows

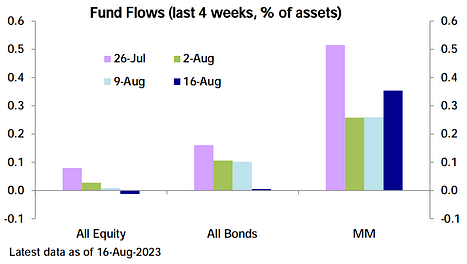

Global equity funds saw a net outflow of $21 billion, driven mainly by a net outflow of $5.2 billion from the US, marking the 23rd consecutive week of net outflows from the European market (-$1.3 billion), while emerging markets saw a net inflow for the 6th consecutive week ($3.7 billion), mainly into Chinese funds, but at a slower pace than last week; the inflow speed of money market funds accelerated to $21.8 billion, marking the fifth consecutive week of inflows; net inflows to bond funds slowed significantly to a five-month low (+$0.3 billion).

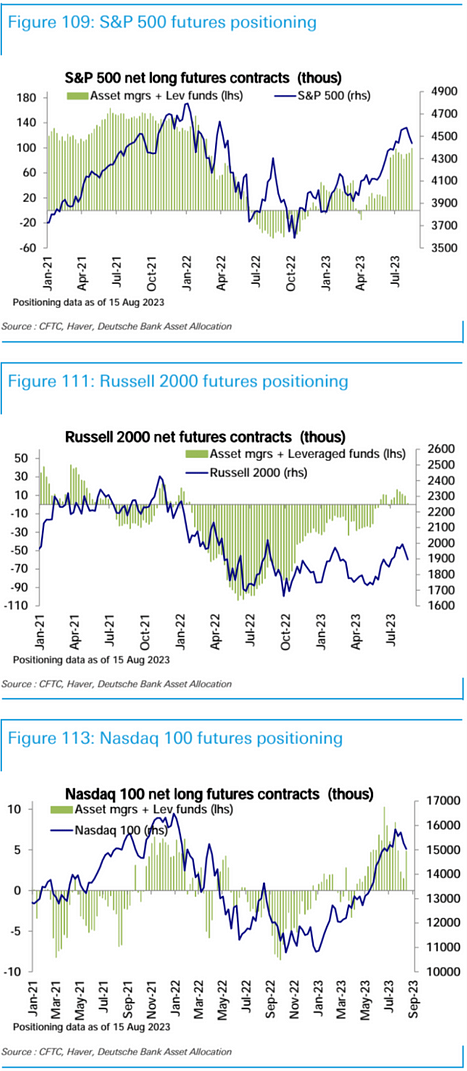

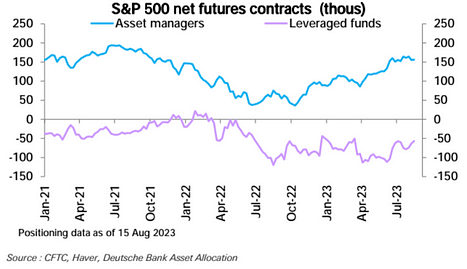

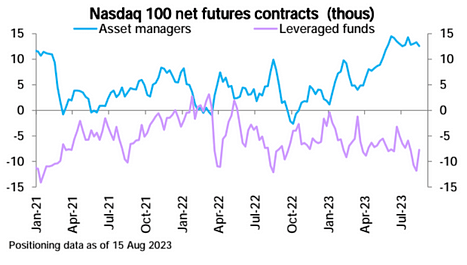

Futures Data

Despite the pullback in the spot market, net long positions in US stock futures rose for the third consecutive week as of last Tuesday, mainly driven by an increase in net long positions in the S&P 500 and Nasdaq 100, while net long positions in the Russell 2000 decreased, very close to neutral.

Of particular note, the increase in net long positions last week was mainly driven by leveraged funds, which are more sensitive to changes:

In other futures markets, net short positions in bonds decreased for the second consecutive week, mainly due to a decrease in net short positions in the 5-year and 30-year bonds, while net short positions in the 2-year and 10-year bonds increased. In the foreign exchange market, net short positions in the US dollar increased, mainly due to an increase in net long positions in the euro and pound, and a decrease in net short positions in the Swiss franc and yen. Net short positions in the Canadian dollar and Australian dollar increased. In the commodities market, net long positions in crude oil decreased slightly. Net short positions in silver and gold increased, marking the fourth consecutive week of reducing net long positions in gold, and net short positions in copper also increased.

Goldman Sachs PrimeBook Data

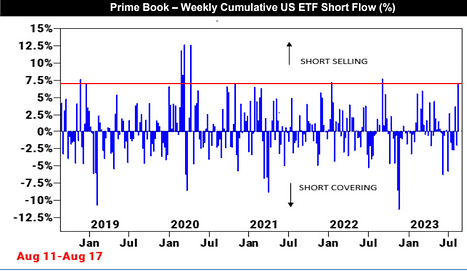

During the market downturn, hedge funds increased their short positions in US ETFs at the fastest pace since September 2022, with a single-week increase exceeding 7% of market value. However, this may not necessarily be a bearish signal, as they observed increased trading activity in US stocks over the past few trading days, with investment managers increasing their exposure to individual stocks, while also increasing beta hedging, and ETFs generally represent market or industry betas.

Stablecoin Flows in the Crypto Market

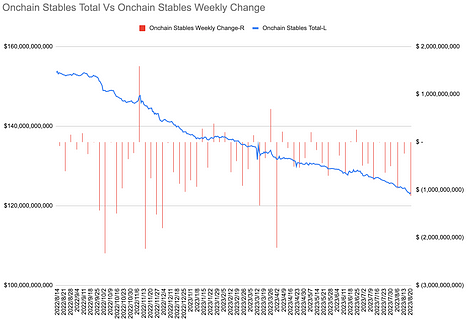

On-chain stablecoins saw a net outflow for the ninth consecutive week, with a significant outflow of $1.13 billion last week, marking the largest single-week outflow since April 2nd this year:

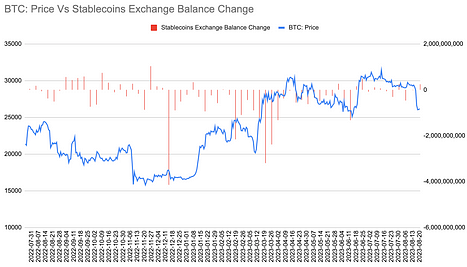

However, stablecoin balances within exchanges increased for the first time in two weeks, with a net increase of $240 million:

This Week's Focus

The main catalysts driving the market this week are Federal Reserve Chair Powell's speech at the Jackson Hole Economic Symposium on Friday and Nvidia's (NVDA) second-quarter earnings report on Wednesday.

Jackson Hole Symposium Preview

The Jackson Hole Symposium will be held from August 24th to 26th. This year's theme is "Structural Changes in the Global Economy," with a special focus on the strength of the global economy and potential inflation risks. The symposium may be a decisive moment, as the market will closely watch for signals from the Federal Reserve regarding expectations for higher neutral interest rates, as this could be interpreted as a hawkish stance, implying higher rates to slow down the economy.

Key points of the Fed Chair's speech:

It is expected that Powell will rely heavily on recent data, including the latest CPI and core personal consumption expenditures (PCE) inflation reports.

He is expected to emphasize some progress in combating inflation but will maintain his recent remarks about the need to remain vigilant. He may be relatively optimistic about the economic situation and will continue to emphasize completing the work on price stability, including achieving below-trend growth.

UBS believes Powell may maintain a sufficiently hawkish stance to open the door for more rate hikes, but they are confident he will not put a rate hike on the table for September.

Bank of America suggests that Powell may reiterate the Fed's commitment to its 2% inflation target and push back against market pricing of the extent of rate hikes next year. The bank believes that given the significant uncertainty in estimating the neutral interest rate, they do not expect to see any major shifts in the Fed's stance on the neutral interest rate at this meeting.

Nvidia Earnings Preview

Nvidia (NVDA) will release its second-quarter earnings report after the US market closes on Wednesday, marking the biggest test of the AI hype cycle to date. It will show whether the AI frenzy that has swept the market over the past 8 months has truly brought economic value. While Google and Microsoft achieved positive profit growth last quarter, they did not attribute the growth to AI but rather to increased revenue from their existing businesses. Revenue, gross margin, data center revenue, gaming revenue, and earnings per share are key indicators to watch for Nvidia.

Market Commentary

[Wall Street warns that a 5% US bond yield may become the new normal, and inflation may force the Fed to raise rates to 6%]

Bank of America warns investors to prepare for the return of a 5% US bond yield, which would bring the bond market back to the pre-financial crisis level. Given that the average inflation rate for personal consumption expenditures reached 3.7% in the second quarter, the Fed may be forced to tighten policy rates to at least 6%. Meanwhile, yield curve inversion indicates that the risk of a US economic recession still exists in the short term.

[JPMorgan warns that the US economy may lose a major boost, as consumer excess savings are about to run out]

JPMorgan estimates that the cumulative excess savings of US consumers peaked at $2.1 trillion in August 2021, but by June 2021, it had decreased to -$910 billion. The household liquidity surplus supported by cash and cash-like assets is currently about $1.4 trillion, which will be exhausted by May next year, and this liquidity may not necessarily support consumption above trend levels.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。