Author: Nancy, PANews

As one of the few blue-chip NFTs that have shown relatively strong performance in the bear market, DeGods recently saw a surge in trading volume after its second-generation project y00ts announced its migration to Ethereum. However, the bullish news of the third season NFT release was met with community selling pressure, including large-scale selling by whale investors. What exactly happened to DeGods? This article from PANews will explore the truth.

New Season NFT Requires Paid Upgrades, Massive Selling Leads to Floor Price Halving

As a blue-chip stock on Solana, DeGods once sparked a buying frenzy, with a total trading volume exceeding $100 million. In December 2022, DeGods announced that it would release new roadmaps for two projects this year, and the community had high expectations for its potential.

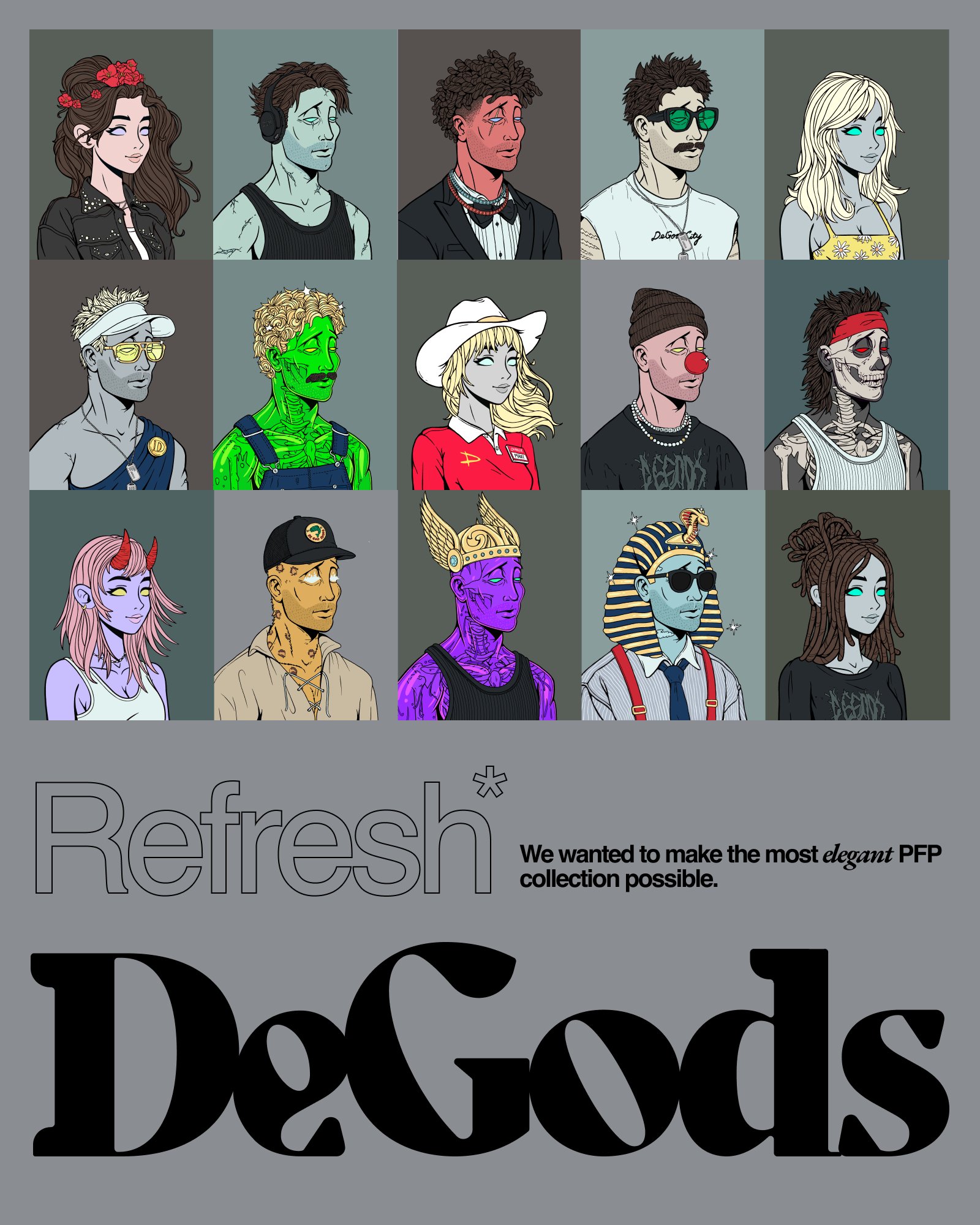

In early August, DeGods founder Frank tweeted a "vaccine" to the community, revealing that although the content of the third season update of DeGods will have the same characteristics as the current series, the style/aesthetics have been redesigned and will not be similar to the original DeGods. The original DeGods had a more "violent Gore" artistic style, but the artistic style of the third season is expected to be more popular. He also emphasized that the third season will adopt a non-random "reveal" mode to avoid the common occurrence of massive selling of low-rarity NFTs after the reveal.

Frank's remarks reduced the community's concerns about content homogenization. It is worth noting that the blue-chip PFP NFT project Azuki had a major failure due to the high similarity of the new series Elementals content. However, some community members expressed dissatisfaction with Frank's "spoilers." Many community members commented that they prefer dark art. In response, Frank stated that the original version was his and co-founder Jonny's favorite, but the project itself is meant to serve the community, not themselves.

However, with the official unveiling of the details of the third season update, DeGods faced community criticism.

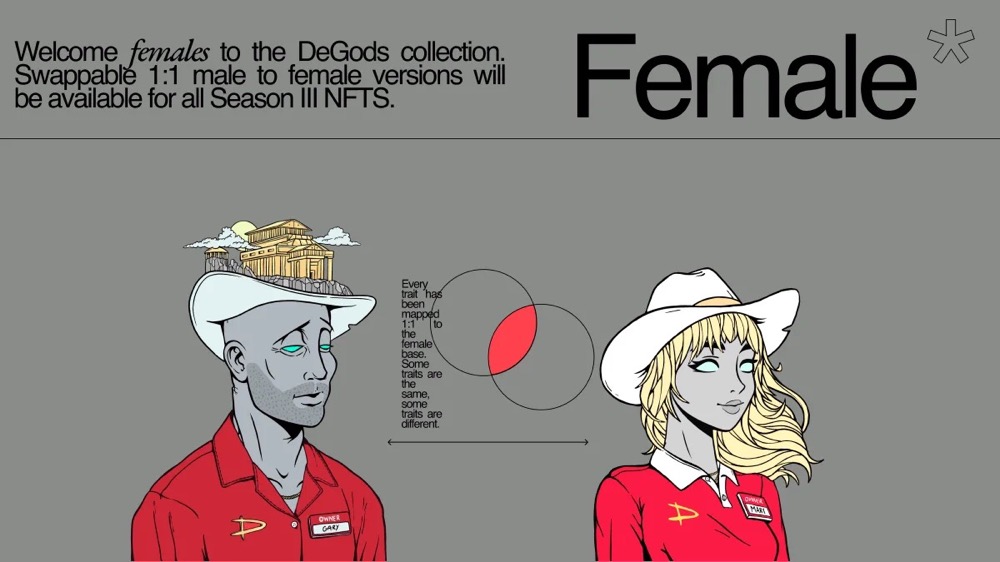

According to the official introduction, the third season series adds 20,000 new artworks, with one DeGod NFT containing 4 generated artworks. The team will replace some unpopular NFT features and provide 4 styles for holders to choose from. In addition, DeGods has also introduced female characters, allowing holders to freely choose the gender of the NFT.

Furthermore, DeGods has launched the Points Parlor, a value-added function for the third season series, where users can pledge DeGods to earn points to unlock rewards such as Uber Eats gift cards, MacBook Pro, Tesla, and collect $DUST. Currently, in addition to supporting Season III DeGods NFT, it has also partnered with Kraken NFT, Mintify, Wreck League, and Floor.

What angered the community is that the third season of DeGods adopts a paid model, requiring holders to spend 333 DUST (currently valued at $352) to generate more diverse NFTs. $DUST is the native utility token of DeGods, which can be obtained by burning NFTs or pledging DeGods. In the eyes of many community members, the third season not only fails to empower the original DeGods and enhance its value, but also hurts loyal users.

Facing community doubts, Frank apologized to the community and stated that the team would adjust its strategy. According to a recent official tweet from DeGods, in addition to delaying the gender conversion feature to September, the team acknowledged that 333 $DUST is indeed expensive for holders, and they will implement a 33.3% price reduction every 30 days.

However, these measures seem to have failed to restore holders' confidence. DeGods saw a large number of sales, including a whale investor selling about 200 DeGods in one go, halving the floor price. According to Blur data, as of August 16, the floor price of DeGods had dropped to 4.27 ETH, a decrease of about 52.1% over the past 7 days. Furthermore, the price of $DUST also experienced a sharp decline. CoinGecko data shows that over the past 7 days, the price of $DUST has dropped by over 56.8%. This further confirms the community's dissatisfaction.

Migrating to Ethereum Stimulates Surge in Trading Volume After Successive Departures from Solana and Polygon

In addition to the controversial new season NFT in the community, the multiple on-chain migrations of DeGods and its second series project y00ts have also attracted attention.

At the end of 2022, DeGods and y00ts announced their respective migrations from Solana to Ethereum and Polygon, leading to a surge in prices and trading volume. Interestingly, the DeGods team had previously requested $5 million from the Solana Foundation as a condition for staying in the Solana ecosystem.

In October, y00ts announced its migration to Ethereum, less than five months after announcing its move to Polygon. At that time, y00ts' migration to Polygon also received a $3 million donation, stating that the funds would be used for team expansion, business development, graphic design, content creation, and event coordination. However, due to y00ts' decision to leave the Polygon ecosystem, the sponsorship was fully refunded. Polygon Labs stated that $1 million of the refunded funds would be used to support "Polygon's native builders and creators."

It is worth noting that since April of this year, after DeGods opened up the migration of remaining DeGods and y00ts to the Ethereum network, the team will impose a 33.3% royalty on all remaining DeGods and y00ts. Therefore, if y00ts migrates again and imposes fees, will it cause further community dissatisfaction?

Regarding y00ts' relocation, Frank explained that it was to unite the communities of its two series of NFTs. In the eyes of NFT collector Lamboland, despite spending millions of dollars, y00ts' decision to pivot after encountering difficulties is commendable. The main reasons for y00ts' departure from the Polygon ecosystem are: first, Polygon has lower liquidity than Ethereum and significant trading friction; second, y00ts focuses on luxury brand marketing, while Polygon is positioned as an affordable NFT public chain, which is inconsistent with its positioning.

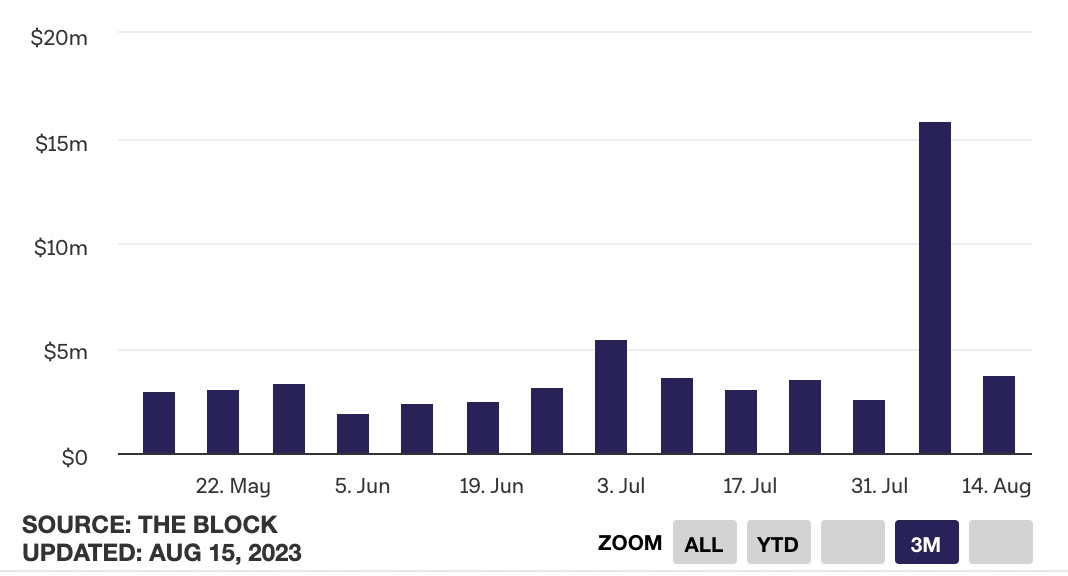

In fact, although the NFT market on Polygon has grown rapidly this year, it still lags behind Ethereum in terms of user volume, trading volume, and liquidity. Therefore, influenced by the announcement of y00ts' migration to Ethereum, the trading volume of DeGods and y00ts both surged. Data from The Block shows that DeGods' weekly trading volume increased by about 6.2 times to approximately $15.83 million after the new announcement, compared to $2.54 million in the previous week. This to some extent indicates that the community is more optimistic about y00ts' migration to Ethereum. Data from OpenSea also shows that y00ts' sales in the past seven days have increased by 260%, and trading volume has surged by 413%, although this has also been affected by large-scale selling.

Overall, from the market performance of DeGods, the development dilemma faced by PFP NFTs due to the lack of new narratives is becoming increasingly apparent.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。