Author: Mary Liu, BitpushNews

Bitcoin's trend continues to be sluggish, breaking through the important psychological barrier of $30,000 in the past 24 hours, reaching $29,333 at the time of writing. In addition to Bitcoin, the second largest cryptocurrency Ethereum fell by 0.2% to $1,840. Other altcoins also experienced declines, with Cardano falling by less than 1% and Polygon dropping by over 1%. Memecoins also saw losses, with Dogecoin falling by 1% and SHIB dropping by 4%.

Unlike the US stock market, which continues to affect investor sentiment, the crypto market appears dull and uneventful. Multiple indicators show that Bitcoin is currently experiencing the lowest volatility on record.

Impact of Economic Cycles on Bitcoin Market

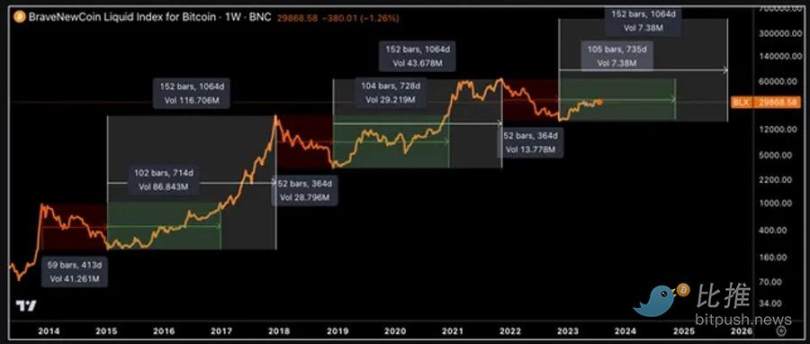

A recent report from research firm Delphi Digital illustrates the predictable consistency of price behavior and trends within the crypto market. The report delves into the interrelationship between Bitcoin's four-year cycle and broader economic trends, demonstrating this cyclicality through the time between peaks and troughs, the recovery period to the previous cycle's high, and the time it takes for prices to rebound to a new cycle peak.

These 4-year cycles include Bitcoin reaching a new all-time high (ATH), experiencing approximately an 80% retracement, then bottoming out about a year later. It often takes about two years to recover to the previous high, and finally, prices rise again for a year, setting a new historical high.

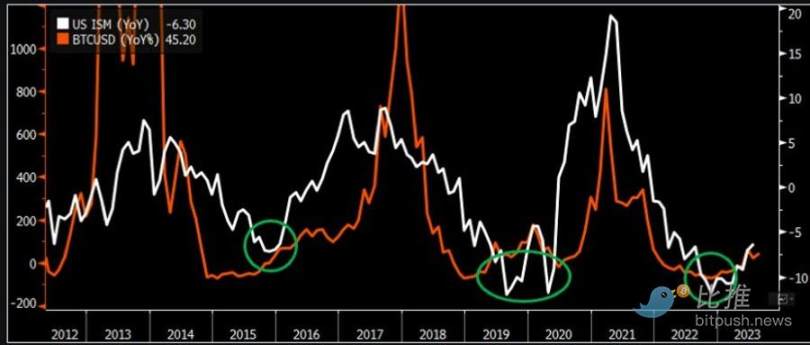

As indicated by the US ISM index, there is a correlation between Bitcoin price peaks and changes in the business cycle.

The above figure shows that during Bitcoin price peaks, the ISM often shows signs of topping out, with active addresses, transaction volume, and fees reaching their highest points. Conversely, as the business cycle shows signs of recovery, network activity levels also experience a resurgence.

Delphi Digital also emphasizes the role of Bitcoin halving in these cycles. The recent two halvings occurred approximately 18 months after BTC bottomed out, and about 7 months before the appearance of a new ATH. This historical pattern suggests that a new ATH for Bitcoin is expected to occur around the fourth quarter of 2024, consistent with the expected timing of the next halving.

Bitcoin Price Trend Appears Similar to the Early Stage of the Bull Market in 2015-2017

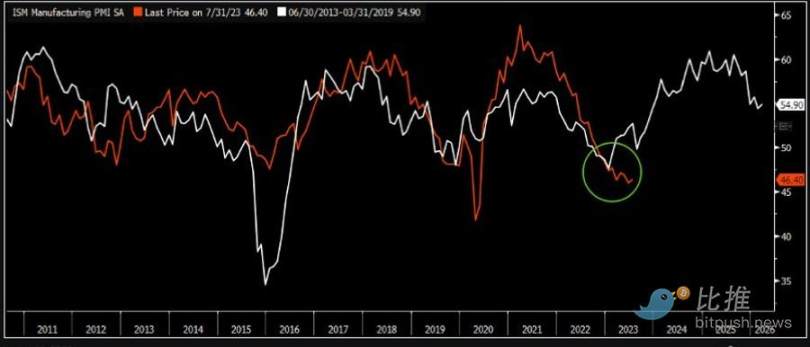

The report also points out the striking similarities between the current market environment and the period from 2015 to 2017. The consistency in market behavior, economic indicators, and historical trends indicates that the current stage is similar to a period of increased risk exposure and potential growth, just as experienced during that period.

The report highlights the trading patterns in the market, especially the trading patterns of the S&P 500 index, which are very similar to those observed from 2015 to 2017. These patterns persist even during periods of uncertainty such as income decline, reflecting the sentiment of that period.

The consistent patterns of Bitcoin cycles, their synchronicity with broader economic changes, and the upcoming halving in 2024 are all correlated.

Delphi emphasizes the similarities between the dim global growth prospects in 2015-2016 and the recent economic uncertainty in 2021-2022. Factors such as a strong US dollar and global liquidity cycle changes echo the past.

What Are the Market Catalysts?

Gautam Chhugani, an analyst at the top US financial advisory firm Bernstein Research, wrote in a report, "The market remains dull, looking for the next major catalyst."

The analyst believes that the first catalyst could be the supply of new stablecoins, such as Tether, USD Coin, or PYUSD recently announced by PayPal, which provide a liquidity backbone for cryptocurrency trading.

Stablecoins remain a relatively promising but emerging area of regulation, and the US is likely to prioritize legal clarity for such tokens as a national priority, extending the dominance of the US dollar into the digital economy.

The current market value of the crypto market is approximately $1.2 trillion. Chhugani said, "As the market becomes a more regulated onshore stablecoin market, we expect new demand to emerge, and we expect stablecoin growth to approach $2.8 trillion allocated to digital assets over the next five years."

Another catalyst is the tokenization of traditional assets, which represents another potential source of funds flowing into the crypto space. Bernstein expects $2 trillion of traditional assets to be tokenized over the next five years, providing further entry points for the crypto economy. Chhugani stated, "Although the regulatory timeline for the tokenization of traditional assets is longer, the tokenization of money market treasuries and short-term bonds is already underway."

Momentum could also come from the crypto technology itself. Bernstein believes that "second-layer" blockchains built on networks like Ethereum present significant opportunities, with the analyst pointing out that historically, the tokenization of new market infrastructure has been beneficial for future scalability and the adoption of new users.

The analyst stated, "Native crypto tokenization is a capital multiplier for cryptocurrencies… While many tokens have failed, a few have created valuable infrastructure and capital."

Most importantly, spot Bitcoin exchange-traded funds (ETFs) could attract retail and institutional investors to collectively invest in funds that hold cryptocurrencies themselves, rather than regulated derivatives such as futures. In June, Bitcoin received a boost after BlackRock applied to establish such a fund, but the biggest driver is only likely to come when the US Securities and Exchange Commission approves ETFs and investors flock in.

Chhugani said, "We expect the spot Bitcoin ETF market to be quite large, accounting for about 10% of the Bitcoin market value within 2-3 years. Cryptocurrency ETFs will benefit from the strong brand marketing of leading global asset management companies and the distribution push of retail brokers and financial advisors."

Investors are still awaiting regulatory decisions on a series of newly submitted spot Bitcoin ETFs, including BlackRock's spot Bitcoin ETF, but the SEC has already delayed its decision on Ark Invest's ETF.

As for when these catalysts will emerge, only time will tell us the answer. Delphi Digital analysts believe that the current consolidation of Bitcoin prices around $30,000 is similar to the period from 2015 to 2017, and indicators suggest that Bitcoin is poised to set a new historical high by the fourth quarter of 2024, consistent with the historical halving pattern.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。