The article discusses the rise of Telegram bots in the field of cryptocurrency trading, which combine trading with social platforms to provide a convenient cryptocurrency trading experience. Despite facing challenges such as competition and security, they may bring more innovation and development in the future.

Author: COMB Financial / Source: https://blog.comb.financial/click-chat-and-trade-a-look-at-c

Translation: Huohuo / Plain Language Blockchain

1. Bluetooth, Blueberries, and Bots

Over 1,000 years ago, there was a Viking king named Harald Bluetooth. It is said that he was very fond of blueberries, to the extent that he left noticeable blue stains on his teeth. This discolored tooth gave him a unique nickname - "Bluetooth".

Just as Harald unified the legacy of Denmark and Norway, modern Bluetooth technology connects various electronic devices. In homage to this historical similarity, the Bluetooth logo features the Nordic runes HB, representing his initials, demonstrating the connection between past and present.

This spirit of unity is once again echoed, not through the technology that connects our devices, but through the technology that combines cryptocurrency trading bots with the popular social messaging platform Telegram.

2. Telegram Bots are the Bluetooth of 2023

These bots are designed to cater to individual trading habits and integrate with DEX, providing a new trading experience, especially for degens.

From managing your crypto wallet to facilitating trades on DEX and sniping newly launched tokens, these bots (or digital butlers) are addressing some of the most pressing pain points in trading on DEX.

3. So, What Exactly Are Telegram (TG) Bots?

They are essentially tools on Telegram designed to automate tasks, whether it's cryptocurrency trading or real-time updates on various content such as NFT prices and wallet tracking.

Users initiate operations by entering commands in the bot's Telegram channel. A menu pops up, allowing users to set up a new crypto wallet or link an existing one. Once the wallet is in place, users can transfer funds to the provided address. Additional menus guide users through various trades.

In essence, the services of these bots may vary slightly, but they primarily operate on the same mechanism.

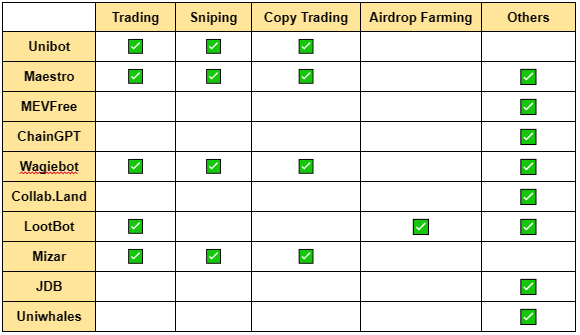

Here are the various functions provided by TG bots:

1) Trading: TG bots can quickly purchase tokens. Simply paste the contract address into the chat, and you can buy the token. Your trading performance is updated in real time with just a refresh. With pre-approved trading functionality, the bots can also sell cryptocurrencies at lightning speed.

2) Setting automatic trading parameters: Traders can set specific thresholds, such as stop-loss and take-profit. Once a crypto token reaches these levels, the bot executes the trades. This hands-free approach means your trading strategy remains effective even when you're offline.

3) Following Smart Money trends: These bots can replicate trades of experienced traders. Here, the bots monitor "smart money" wallets and offer a one-click copy function.

4) Security features: A prominent feature of many bots is their anti-rug function. If token developers attempt to manipulate the market, these bots can detect impending trades and sell positions before the developer stops. They can also identify malicious trades that could prevent tokens from being sold.

5) Sniping: TG bots can automatically purchase tokens upon listing or increasing liquidity. Their settings often match those of the developers' trading setups, ensuring immediate purchase after the developer migrates. Even if tokens don't trade after adding liquidity, these bots can automatically send purchase orders based on the developer's "method ID." This ID reveals the nature of the developer's transactions with the token contract, potentially triggering trades and allowing early buying. Bots can also execute trades across multiple wallets to avoid wallet restrictions.

4. Why the Sudden Surge of TG Bots?

The rise of TG bots is no mere coincidence. As memecoins find themselves in the spotlight, the crypto Twitter community searches for "smart money" wallets on the blockchain that transform small investments into substantial returns and replicate trades. Telegram bots are the perfect tool for achieving this purpose.

You'll find that Telegram is not just a messaging app; it's a hybrid of social engagement and crypto alpha information. However, there are still many manual steps, such as reading alpha and purchasing coins, which require more time and effort. Compared to some existing DeFi interfaces, TG bots offer a more streamlined and simpler token trading option, but in reality, this may be a bit cumbersome.

Furthermore, proponents of these bots insist that they could serve as a gateway for new cryptocurrency users. This is mainly due to their intuitive design, which enhances usability. Telegram currently has over 800 million monthly active users. It's a big playground for cryptocurrency expansion.

Additionally, most ordinary people want a "get rich quick" scheme. With numerous stories of overnight cryptocurrency fortunes, the focus has shifted from mainstream currencies to memecoins. This is not just about making money quickly; it's about ideology. Memecoins often talk about creating fairness and providing a platform free from the constraints of risk capitalism.

In addition, its prominence on platforms like Coingecko and DeFiLlama has further boosted its visibility. Coingecko has introduced a dedicated section for these Telegram bots, while Coinmarketcap has launched its own Telegram bot, called CoinMarketCap PriceBot.

5. Revenue Sources for TG Bots

Subscription-based access: TG bots operate on a membership model. To access their services, users need to pay a fee, such as a 0.1 ETH 30-day subscription or a 1 ETH annual subscription. This approach is quite niche, community-centric, and best suited for influencers with a large following.

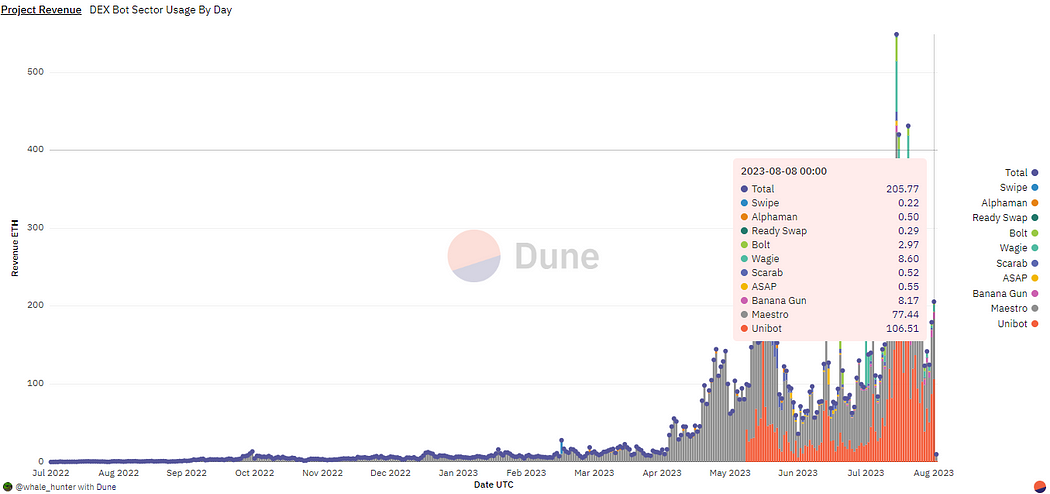

Zero upfront fees, transaction fees: Unibot charges a 1% fee for each transaction, in addition to the usual Uniswap transaction fees. Unibot returns 40% of this collection to its token holders in a loop. This is a win-win for the platform and token holders.

Hybrid model: A fusion of the above two, this is the strategy of Maestro TG Bot. Maestro emulates Unibot, charging a 1% transaction fee. However, Maestro has not ventured into token issuance, considering all the fees it collects as protocol revenue. It has also introduced a $200 monthly VIP community service, allowing members to access Smart Money addresses.

Token holding utility: By holding a specified number of tokens, users can access TG bot's trading bots for free.

6. Current Landscape of TG Bots

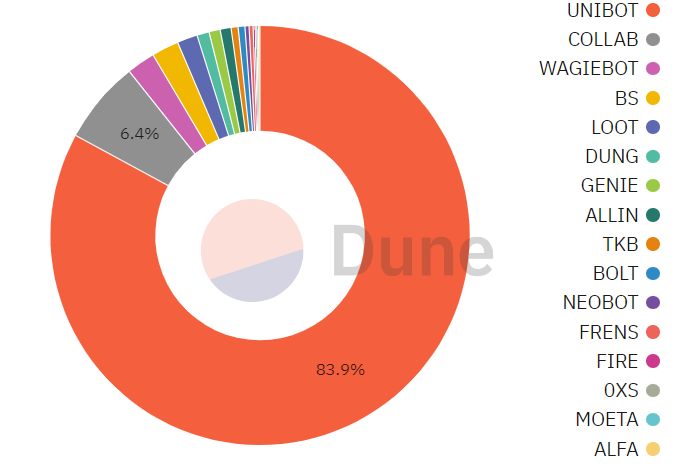

The value of tokens associated with these bots has soared, reaching a market capitalization of $258 million. Unibot is the leader in this field, occupying nearly 73%-75% of the market value and approximately 84% of the FDV market share. Its token $UNIBOT has rapidly increased in value, growing 50 times in just the last quarter.

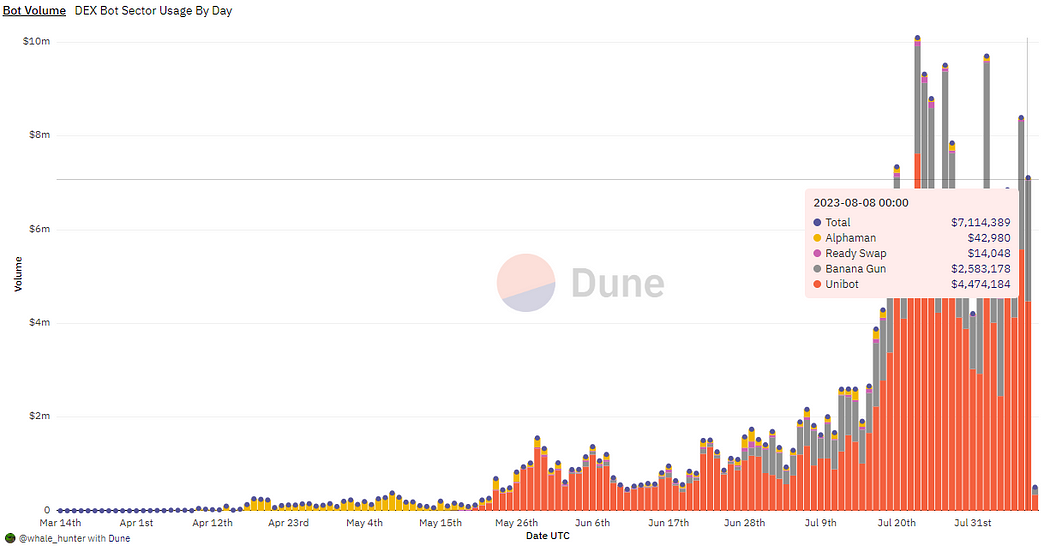

The user metrics for Telegram bots peaked in July 2023, with daily active users exceeding 6,000. In the latter half of July alone, Unibot's daily users surged from a mere 400 to 1,700. Another bot, Maestro, was one of the early entrants in this field, with a loyal user base of 2,000-3,000 users daily. However, it's not alone at the top.

On July 23, 2023, we saw the daily trading volume of TG bots soar past the $10 million mark. The cumulative trading volume has also surpassed $230 million.

Although the hype around native token trading for bots remains high, the recent decline in their trading volume seems to reflect a lull in bot users and overall activity.

In terms of revenue, Telegram bots have successfully converted user adoption into substantial income sources. However, it's important to recognize that not all generated revenue is strictly related to actual trades. Take Unibot, for example. It has accumulated a total of 4.9K ETH. Interestingly, over 85% of this figure comes from "taxes" on purchases and sales, rather than traditional trading income. This indicates alternative ways of generating revenue for these projects.

7. Risks

The future of TG bots is still in its formative stage, with its value only scratching the surface of a few billion dollars.

However, it's not all sunshine and rainbows. Developers and project teams face the pressure of continuous innovation and introducing new features. Additionally, with new players entering the TG bot arena, the threat of competitive price wars, especially in transaction fees, looms large.

8. Future Prospects

Security remains a core concern for users. How to ensure the security of wallets and tokens? Entrusting a wallet to a platform or creating a new platform brings the fear of private key leakage. This inherent risk limits the amount of funds users are willing to store on the platform.

There are also issues with new token contracts and models. Take PNDX from the NFT market, not Larva Labs, for example. This contract has inherent flaws. Unfortunately, the radar of TG bots has overlooked these pitfalls, leading to a domino effect and causing users to withdraw liquidity.

So far, the main focus of these bots has been on trading functionality. However, we may soon see the evolution of bots, shifting from trading functionality to new applications, and even aggregating various functions.

Not limited to Telegram, some bots are now also making a mark on platforms like Discord, expanding their reach and providing users with more trading options. Additionally, some bots now offer multi-chain functionality, making cross-chain transactions possible.

While using Telegram bots may not be cheap at the moment, the situation may change. With intensifying competition, services are starting to become more and more similar, and affordable fees may become a new battleground.

Furthermore, for long-term sustainability, projects must find a way to allow users to easily switch between regular chatting and trading on Telegram.

In summary, while this trend is certainly exciting, the current prosperity may reflect the surge in token prices rather than genuine demand. But there is no doubt that the arena is boiling. With the increasing number of bots, we are bound to witness more innovation.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。