Writing: Florence

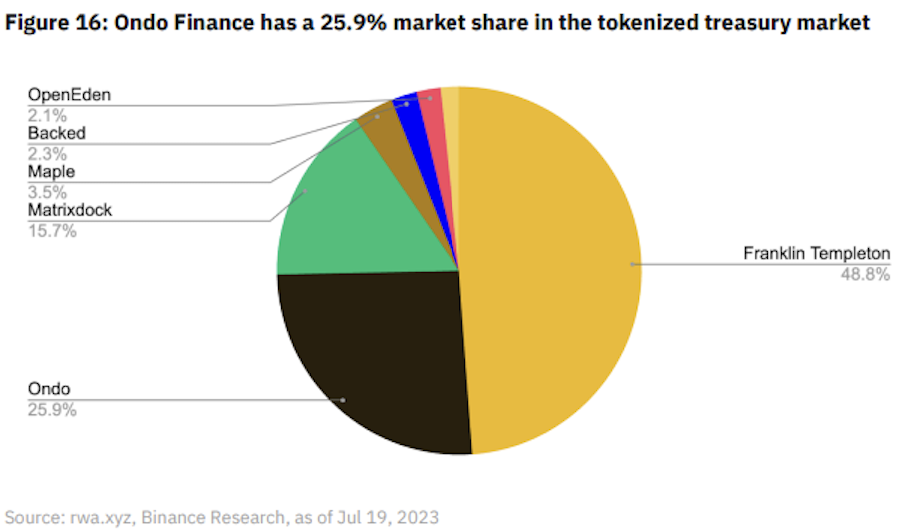

The attention on tokenized real-world assets (RWA) has been growing this year, with the tokenized U.S. Treasury market alone accounting for a market size of $603 million, with the largest player being the traditional financial Franklin Templeton fund group. Meanwhile, the decentralized investment platform Ondo Finance has been catching up since January this year, with estimated assets of $156 million.

Franklin OnChain U.S. Government Money Fund FOBXX

Franklin Templeton is an asset management company headquartered in California, providing services in 155 countries globally, managing assets of approximately $1.4 trillion as of March 31, 2023.

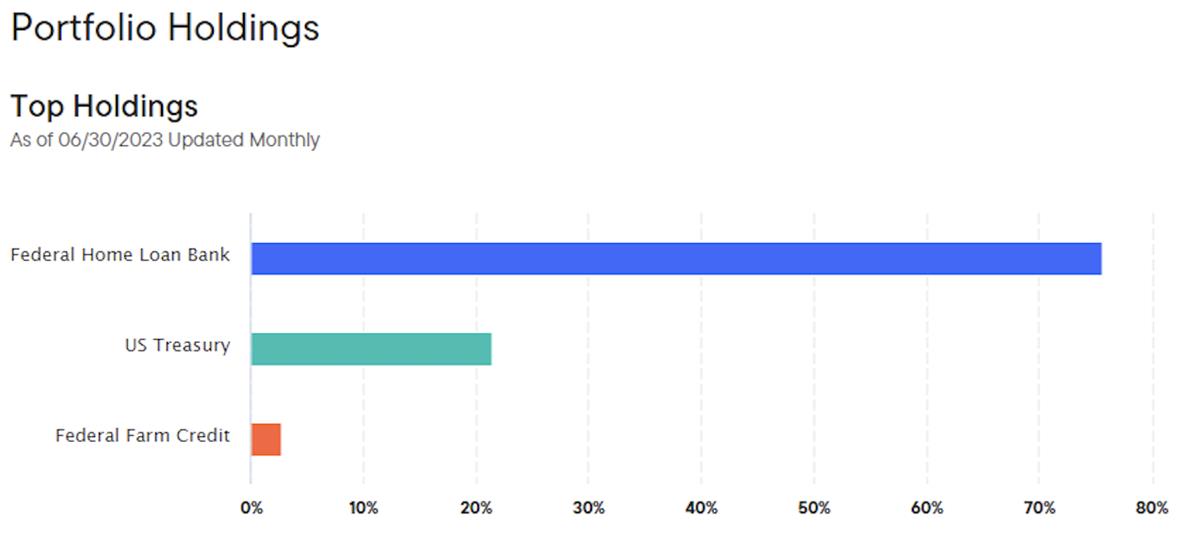

The Franklin OnChain U.S. Government Money Fund (FOBXX) was established on April 6, 2021. 99.5% of the fund's total assets are invested in U.S. government securities, cash, and repurchase agreements fully collateralized by U.S. government securities or cash. By the end of June, the total assets were nearly $300 million, with a net expense ratio of 0.20%.

FOBXX is the first U.S.-registered mutual fund to process transactions and record share ownership on a public blockchain, initially issued on the Stellar blockchain. In April this year, it expanded to Polygon, and may also be issued on the Avalanche and Aptos blockchains, as well as the Ethereum Layer 2 solution Arbitrum.

Investing in FOBXX requires a dedicated on-chain wallet for transactions (created by the fund's transfer agent at account opening), and investors can check their fund balance through the Benji Investments app. Only this wallet has the right to purchase, redeem, and hold fund shares, and the private keys associated with the investor's wallet are held by the fund's transfer agent.

Due to concerns about blockchain barriers affecting investor willingness, Franklin Templeton has been offering fee-related discounts to make tokenized funds more attractive. Without subsidies, it would charge a fee of 0.89%, but currently, the fee is capped at 0.2%. The fund's annualized return over the past year is 3.75%.

Decentralized Investment Platform Ondo

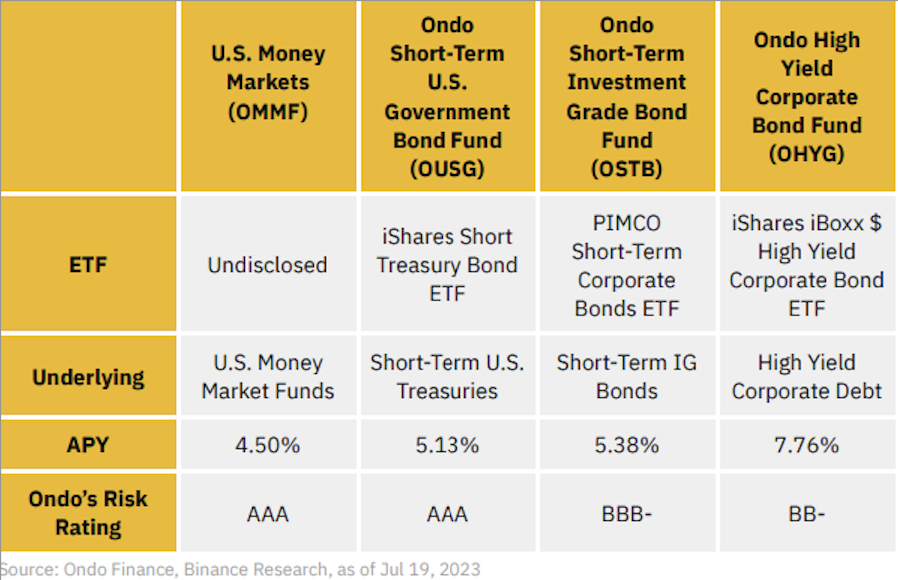

The decentralized investment platform Ondo Finance is led by Nathan Allman, a former Goldman Sachs employee, and is backed by prominent investors including Peter Thiel's Founders Fund, Coinbase Ventures, and Tiger Global. Ondo announced the launch of tokenized public debt products in January, allowing stablecoin holders to invest in U.S. Treasury and investment-grade corporate bonds through its tokenized funds. According to Binance's report, their annualized returns exceed 4.5%, higher than Franklin Templeton's FOBXX at 3.75%. The current value of tokenized products is approximately $156 million, about half of FOBXX's amount.

Ondo's partner is the U.S. compliant exchange Coinbase, which is also a partner of the stablecoin USDC. Investors verified through KYC by Ondo Finance can invest their USDC in Ondo's products. Taking OUSG as an example, the process is as follows:

Investors connect their wallet on the Ondo website → Invest with USDC (minimum amount of 100,000) → Coinbase converts USDC to USD → Remit to Clear Street (its custodian and primary broker) → Fund managers buy and sell BlackRock iShares ETFs listed on NASDAQ (code SHV) according to instructions → Return the investment to the investor's wallet address in the form of tokenized OUSG.

Ondo Finance is a DeFi protocol and is not regulated by the SEC.

RWA Cannot Be Fully Controlled by Blockchain Technology

The traditional financial system has long relied on many intermediary systems, including intermediaries, background checks, and regulatory roles, which can maintain a certain level of security and control in transactions but also bring high costs. Supporters believe that tokenization on the blockchain can save traditional finance a lot of costs. Despite the media reports of the continuously rising RWA market value and its early stages, the biggest players are still in traditional finance. Even Franklin Templeton is only using blockchain technology for transaction processing and recording share ownership, and other processes still rely on human roles, not as fully automated as DeFi advocates imagine.

Assets like real estate, gold, stocks in traditional finance, or even the hottest carbon credits today can be tokenized and brought into the world of blockchain, but their operation still heavily relies on human operations. For example, the Mitsui Digital Assets Platform, Mitsui & Co. uses its expertise in real estate to select suitable cases (including real estate and other infrastructure) and handle complex matters such as management fees, utility fees, and taxes, and finally distribute the profits directly to investors, similar to traditional finance's real estate investment trusts (REITs), but it uses blockchain technology to make the entire process transparent. Blockchain only plays a partial technical role, and there are still many professional roles such as case selection, legal, and management that cannot be replaced by smart contracts.

RWA is not without risks, as besides the technical barriers and risks of blockchain itself, the nature of the assets also has a significant impact. Previously, the decentralized stablecoin protocol MakerDAO decided to stop providing additional loans to one of its RWA vaults, Harbor Trade, because $2.1 million of the assets were in default. RWA is not foolproof, and in this example, the protocol's risk management capability is crucial, as even bank loans face the risk of bad debts.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。