Author: Mars_DeFi, Crypto KOL

Translation: Felix, PANews

If users want to maximize profits, they can maximize the value of stablecoins through yield-generating stablecoins.

Yield-generating stablecoins refer to assets that generate returns through DeFi activities, derivative strategies, or RWA investments. Currently, these stablecoins account for 6% of the $240 billion market cap of stablecoins. With growing demand, JPMorgan believes that reaching a 50% share is not out of reach.

Yield stablecoins are minted by depositing collateral into a protocol. The deposited funds are used for investment in yield strategies, and the returns are shared among holders. This is similar to a traditional bank lending out deposited funds and sharing interest with depositors, except that the interest on yield stablecoins is higher.

This article aims to overview 20 yield-generating stablecoins.

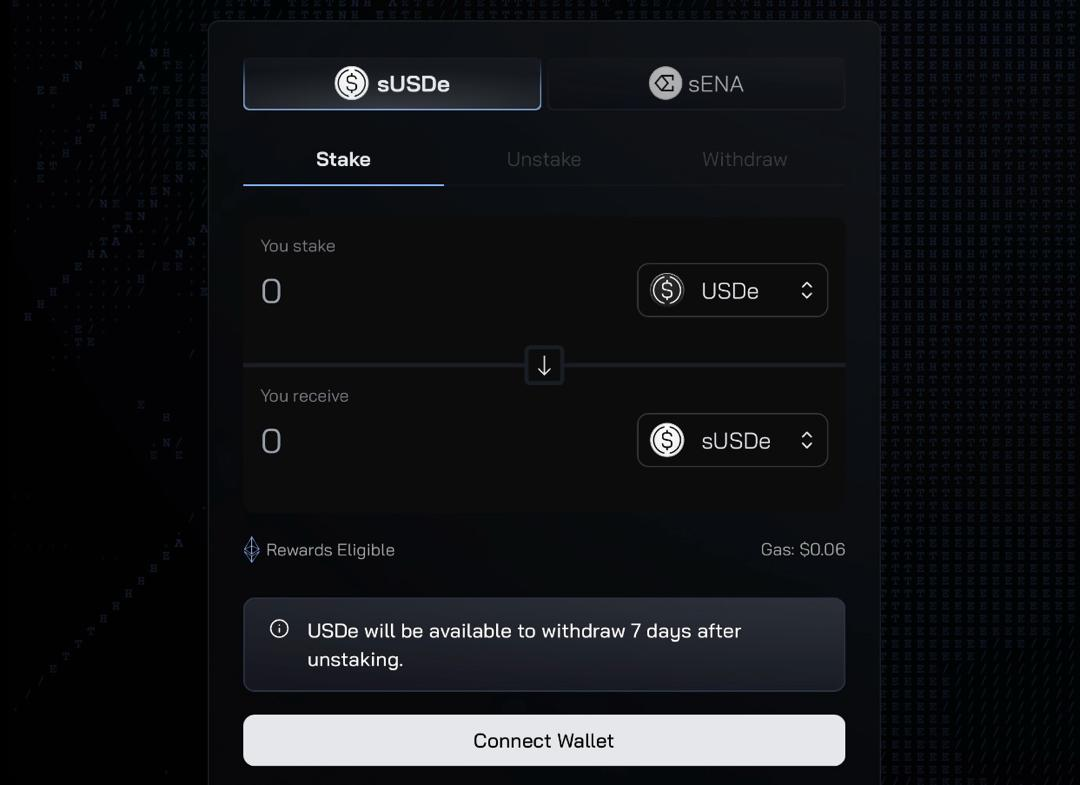

1. Ethena Labs (USDe / sUSDe)

Ethena maintains the value of its stablecoin and generates returns through delta-neutral hedging.

USDe is minted by depositing staked ETH (stETH) into the Ethena protocol. The ETH position is then hedged through shorting.

In addition to the returns from stETH (currently an annual interest rate of 2.76%), the positive funding rate from shorting also generates returns, which Ethena distributes to users who stake USDe for sUSDe (annual interest rate of 5%).

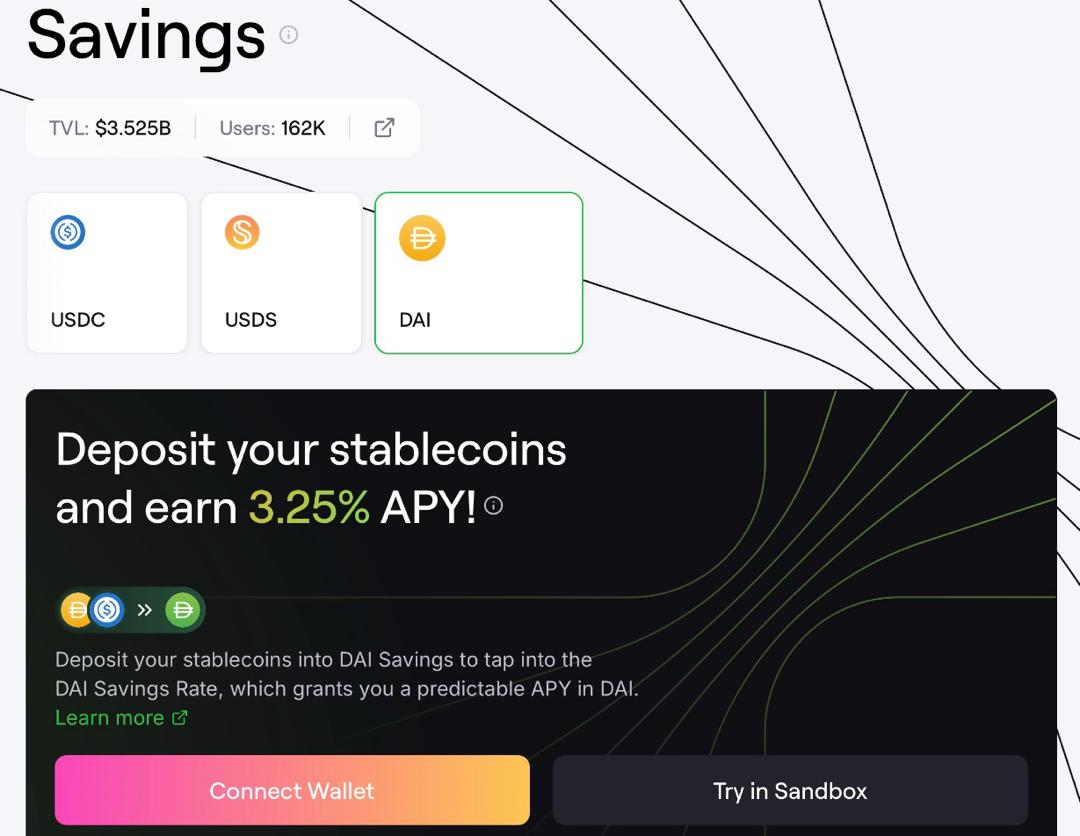

2. Spark (sDAI)

sDAI is generated by depositing DAI into Maker's DAI Savings Rate (DSR) contract. The current annual yield is 3.25%.

Returns are accumulated through the interest from DSR (the rate is determined by MakerDAO). sDAI can also be traded or used in DeFi like other stablecoins.

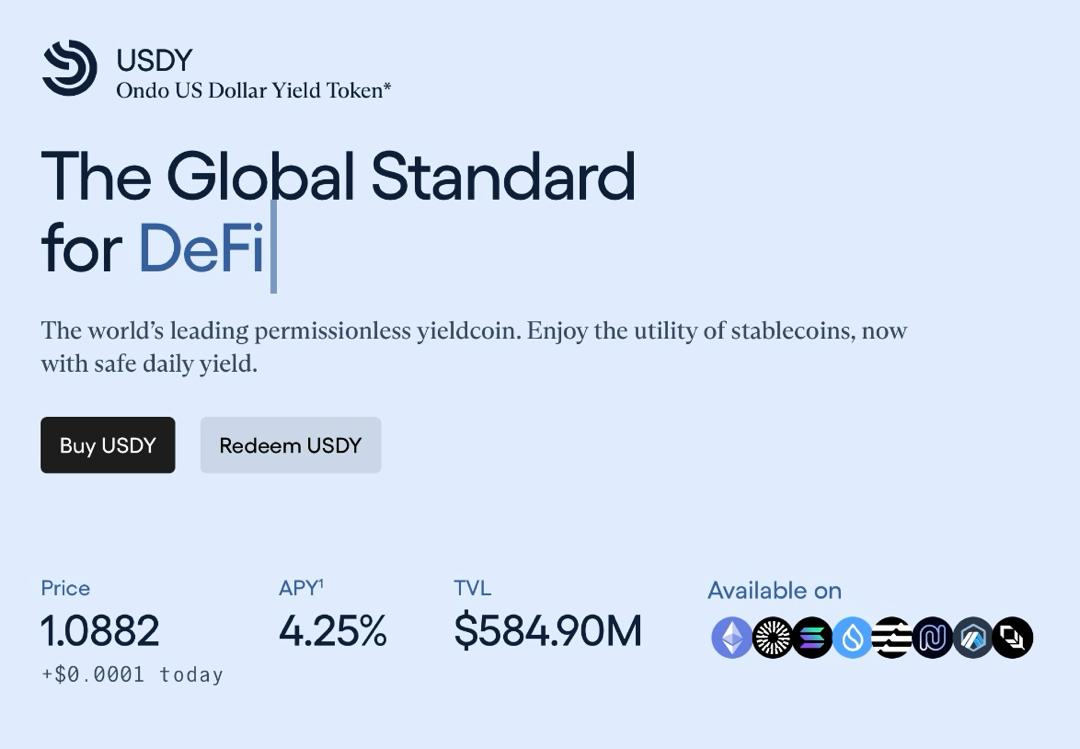

3. Ondo Finance (USDY)

Ondo issues USDY with USDC deposits. The deposited assets are used to purchase low-risk assets such as treasury bills (approximately 4 - 5% annual interest rate), with most of the interest shared among USDY holders.

The yield of USDY is set monthly and remains stable throughout the month. This month's annual yield is 4.25%.

Note: The yield of USDY is reflected in the token price rather than the quantity, which is why USDY is always above $1.

4. BlackRock (BUIDL)

BUIDL stablecoin represents ownership of a tokenized money market fund (MMF) managed by BlackRock.

The fund invests in cash and other instruments, such as short-term treasury bills and repurchase agreements, and allocates interest to BUIDL holders.

The fund's yield is calculated daily but distributed monthly to BUIDL holders.

5. Figure Markets (YLDS)

YLDS is the first yield-generating stablecoin registered as a public security with the SEC in the United States.

Figure Markets generates returns by investing in the same securities held by high-quality money market funds (MMF), which carry higher risks than tokenized government-backed money market funds (MMF).

YLDS offers an annual interest rate of 3.79%. Interest accumulates daily and is paid monthly in USD or YLDS tokens.

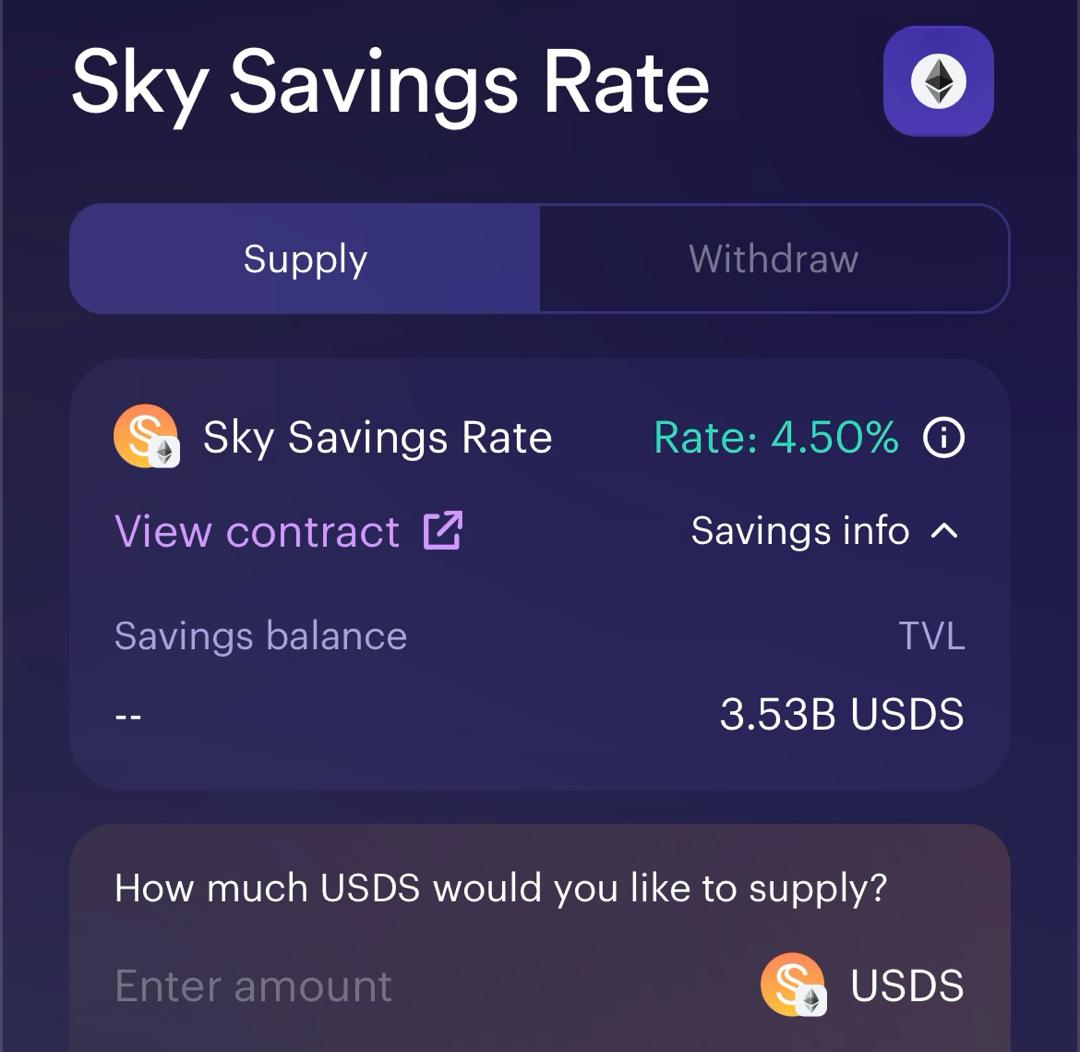

6. Sky (USDS / sUSDS)

USDS is a renamed version of DAI, minted by depositing eligible assets through the Sky Protocol.

It can be used in DeFi and can earn returns from the Sky Savings Rate (SSR) contract. sUSDS is issued based on USDS deposits, with an annual interest rate of 4.5%.

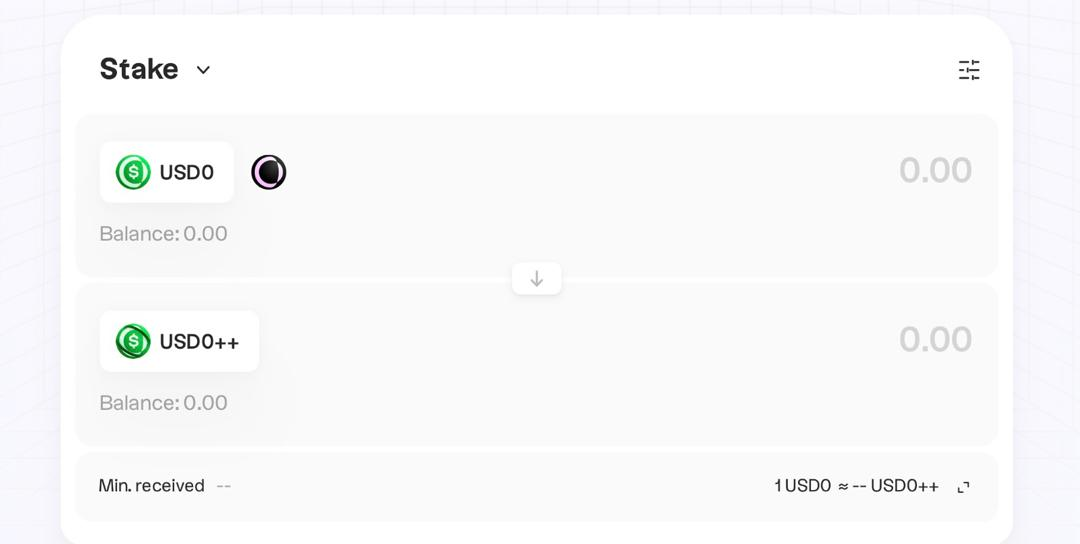

7. Usual (USD0)

USD0 is fully backed by real-world assets (RWAs) such as treasury bills and is minted by depositing USDC or eligible RWAs as collateral on the Usual platform.

Users can also stake USD0 on Curve to earn USD0++ (annual interest rate of 0.08%). USD0++ can be used in DeFi, with returns distributed in USUAL tokens (annual interest rate of 13%).

Note: To earn USD0++ returns, a 4-year staking period is required.

8. Mountain Protocol (USDM)

Mountain Protocol generates returns by investing in short-term U.S. Treasury bonds, but USDM is specifically aimed at non-U.S. users.

The returns from these U.S. Treasury bonds are distributed to USDM holders through a daily adjustment system, so the balance automatically reflects the earned returns.

USDM currently offers an annual yield of 3.8%.

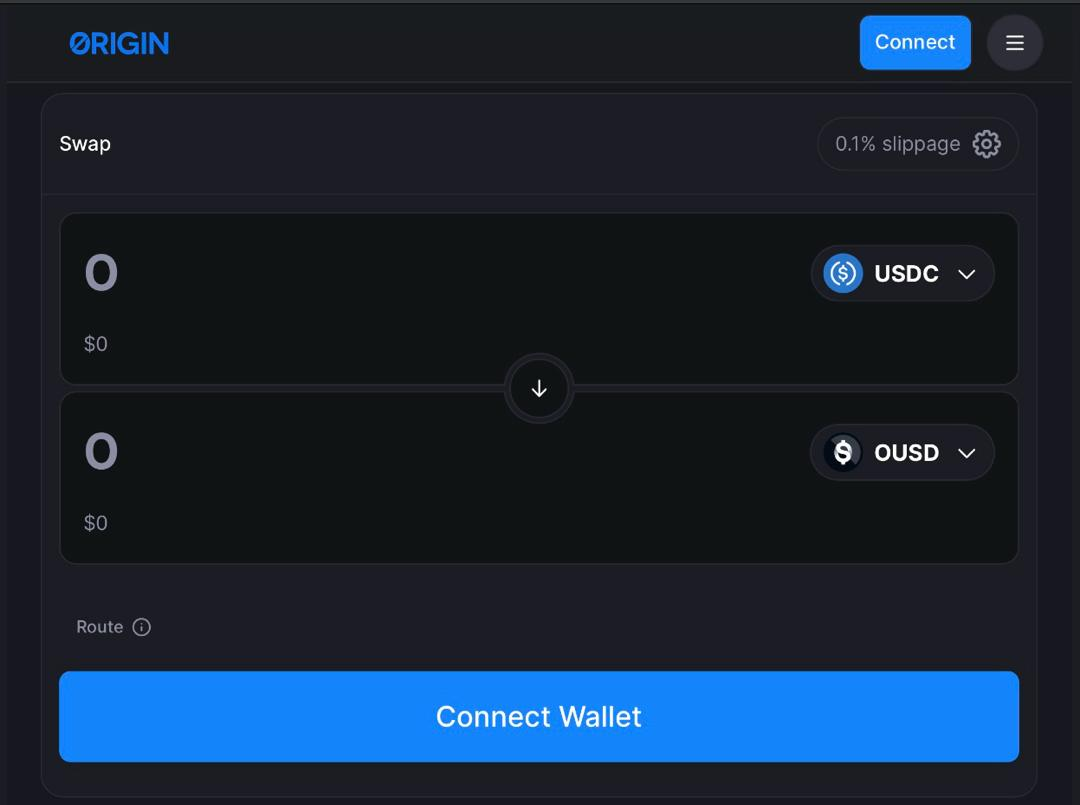

9. Origin Protocol (OUSD)

OUSD is minted by depositing stablecoins such as USDC, USDT, and DAI on the Origin Protocol.

Origin deploys the collateral into low-risk DeFi strategies, generating returns through lending, liquidity provision, and transaction fees. These returns are automatically allocated to OUSD holders.

OUSD is backed by stablecoins, with an annual interest rate of 3.67%.

10. Prisma Finance (mkUSD)

mkUSD is supported by liquid staking derivatives. Returns are generated through rewards from the underlying staked assets (2.5% - 7% variable annual interest rate) and distributed among mkUSD holders.

mkUSD can be used for liquidity mining on platforms like Curve or staked in Prisma's stable pool to earn PRISMA and ETH rewards from liquidations.

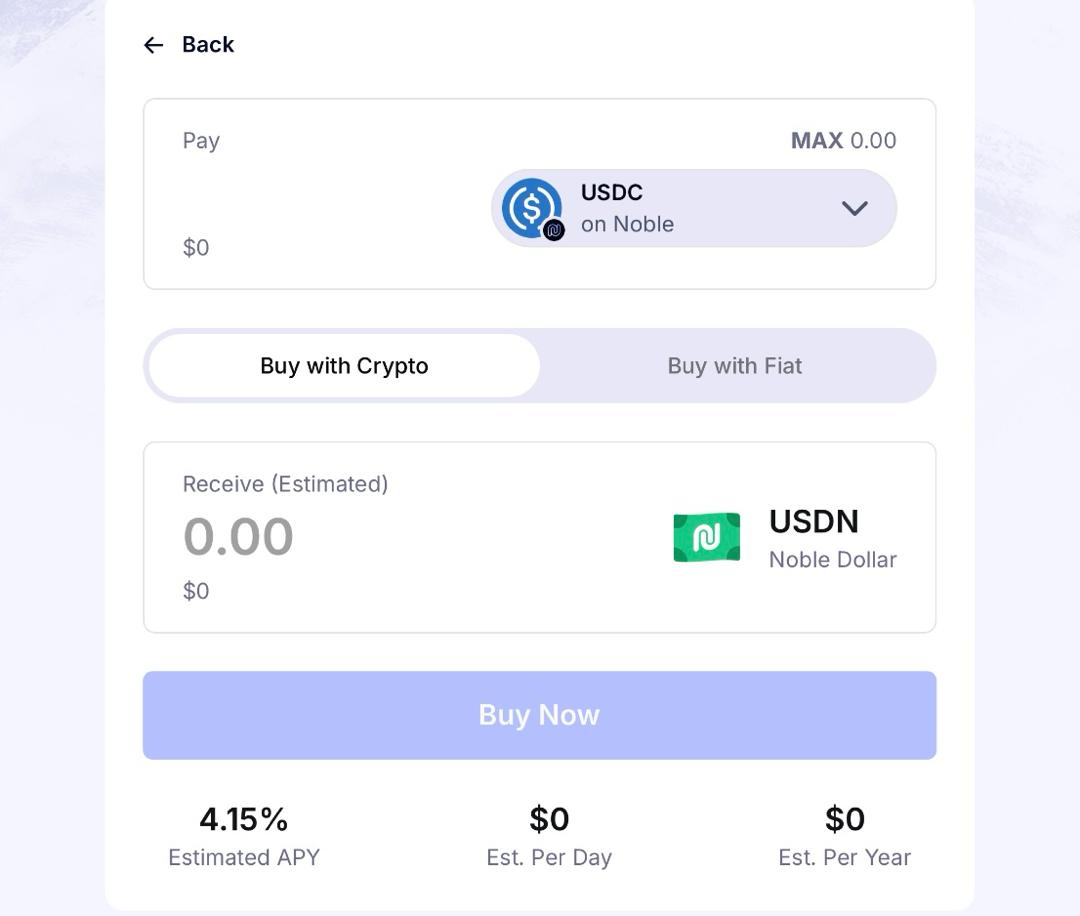

11. Noble (USDN)

USDN is backed by short-term Treasury bonds. Returns come from the interest on short-term government securities and are distributed to USDN holders (annual interest rate of 4.2%).

Users can earn base returns by depositing USDN into a flexible vault or by depositing it into a USDN lock-up vault (with a maximum lock-up of 4 months) to earn Noble points.

12. Frax Finance (sfrxUSD)

frxUSD is backed by assets from BlackRock's BUIDL, generating returns by utilizing its underlying assets (such as Treasury bills) and participating in DeFi.

The yield strategy is managed by a benchmark yield strategy (BYS), which dynamically allocates staked frxUSD to the highest-yielding sources, allowing sfrxUSD holders to achieve maximum returns.

13. Level (lvlUSD)

lvlUSD is minted by depositing and staking USDC or USDT. These collaterals are deployed in blue-chip lending protocols like Aave and Morpho.

Users can stake IvIUSD to receive sIvIUSD, thereby enjoying the returns from DeFi strategies.

The annual interest rate is 9.28%.

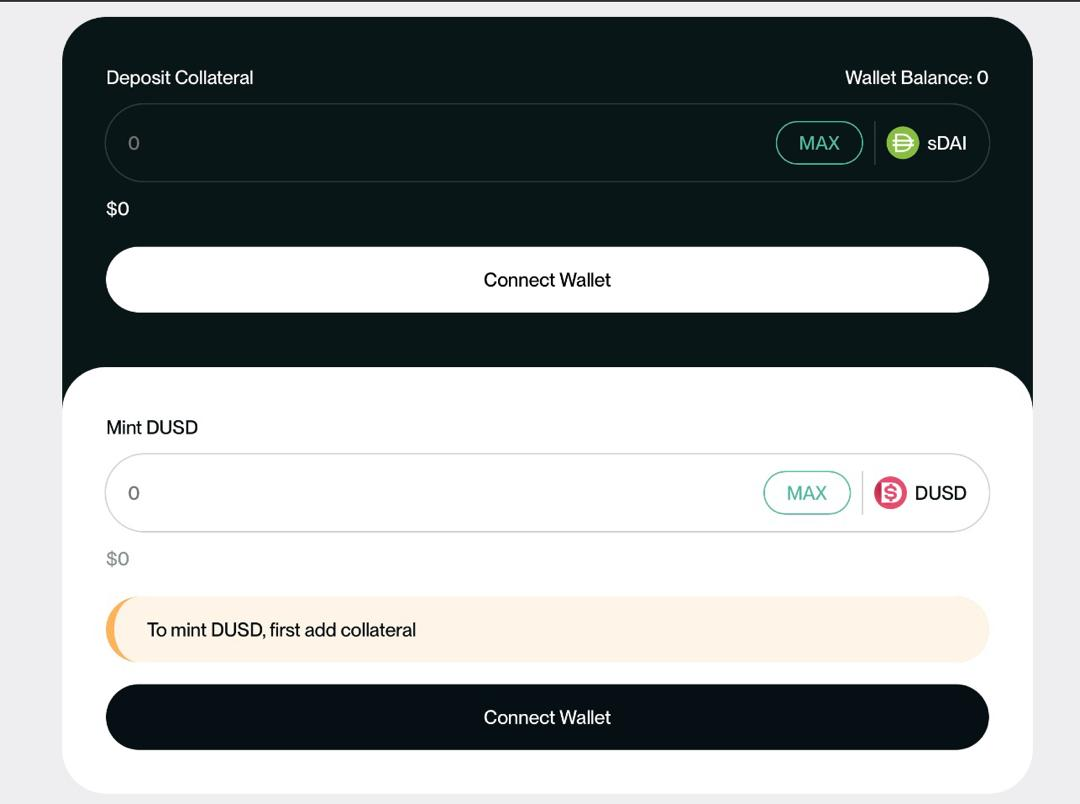

14. Davos (DUSD)

DUSD is a cross-chain stablecoin that can be minted with sDAI and other liquid collateral. It generates returns through re-staking derivatives and distributes the returns from the underlying assets to DUSD holders.

DUSD can be deposited into liquidity pools or appreciation vaults, or staked on Davos to earn an annual interest rate of 7-9% along with lending interest returns.

15. Reserve (USD3)

USD3 is minted by depositing PYUSD on Aave v3, DAI on Spark Finance, or USDC on Compound v3.

The returns generated from allocating collateral to top DeFi lending platforms will be distributed to USD3 holders (annual interest rate of approximately 5%).

Reserve Protocol provides over-collateralization for USD3 to prevent decoupling.

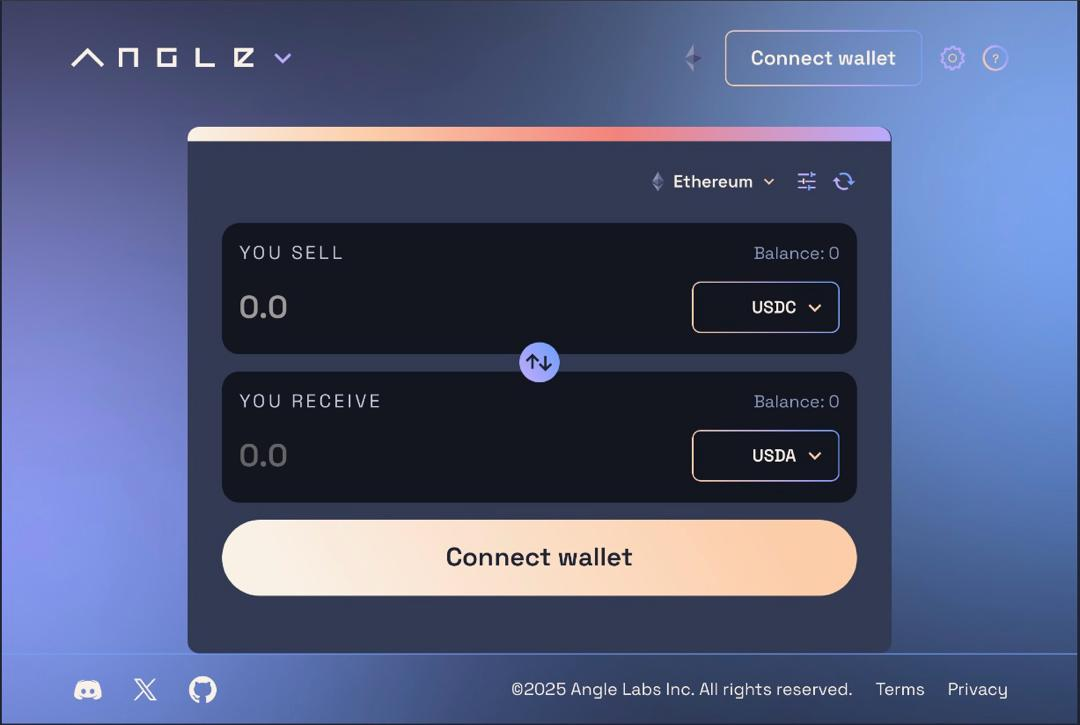

16. Angle (USDA / stUSD)

USDA is minted by depositing USDC. The yield of USDA is generated through DeFi lending, treasury bills, and tokenized securities trading.

USDA can be deposited into Angle's savings solution to obtain stUSD. stUSD holders receive the yield generated by USDA (annual interest rate of 6.38%).

17. Paxos (USDL)

USDL is the first stablecoin to provide daily yields under a regulatory framework. Its yield comes from short-term U.S. securities held in the Paxos reserve, with a yield of approximately 5%, and USDL holders automatically receive the yield from USDL.

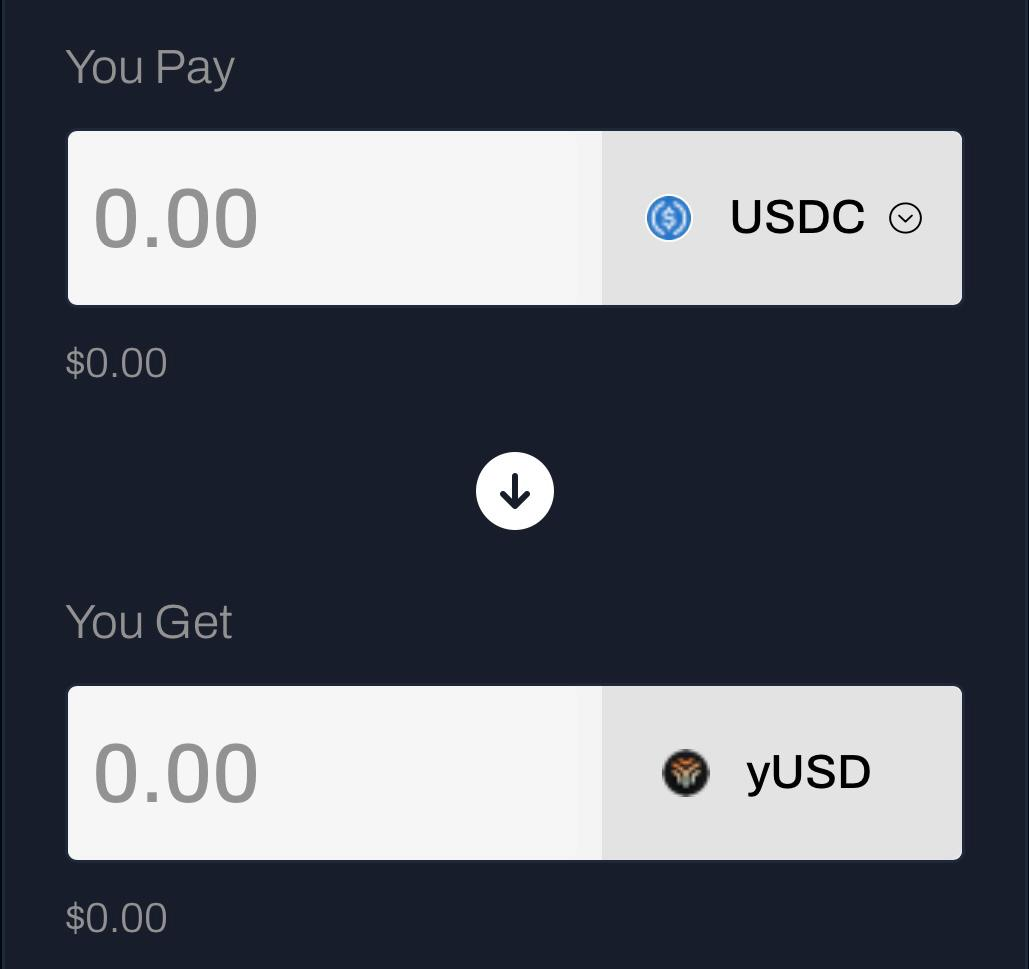

18. YieldFi (yUSD)

yUSD is backed by stablecoins and can be minted by depositing USDC or USDT on YieldFi (annual interest rate of 11.34%).

YieldFi generates returns by deploying collateral through delta-neutral strategies, while yUSD can be used in DeFi strategies such as lending and providing liquidity on protocols like Origin Protocol.

19. OpenEden (USDO)

USDO is backed by tokenized U.S. Treasury bonds and money market funds (such as OpenEden's TBILL).

Its underlying assets are invested through on-chain and off-chain strategies to generate returns. The returns are distributed to USDO holders through a daily rebase mechanism.

The underlying assets are invested through on-chain and off-chain strategies to generate returns. These returns are distributed daily to USDO holders.

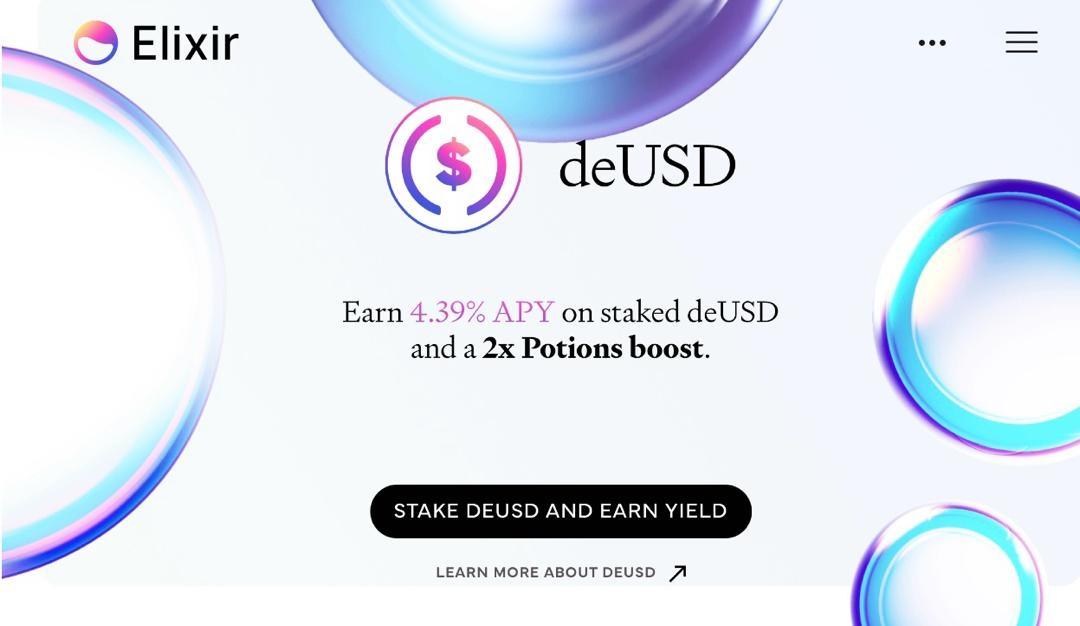

20. Elixir (deUSD / sdeUSD)

Similar to Ethena's USDe, the yield of deUSD comes from its investments in traditional assets such as U.S. Treasury bonds and the funding rates generated from lending within the Elixir protocol.

Users who stake deUSD for sdeUSD can earn an annual yield of 4.39% and double potion rewards.

Related reading: Stablecoin Yield Guide: Which of the 8 Types is Best?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。