Author: Frank, PANews

What can happen in 15 minutes in the world of cryptocurrency? For most people, it's just the formation of a candlestick; but for participants in the Bitcoin short-term prediction market, it often means "life or death in one round."

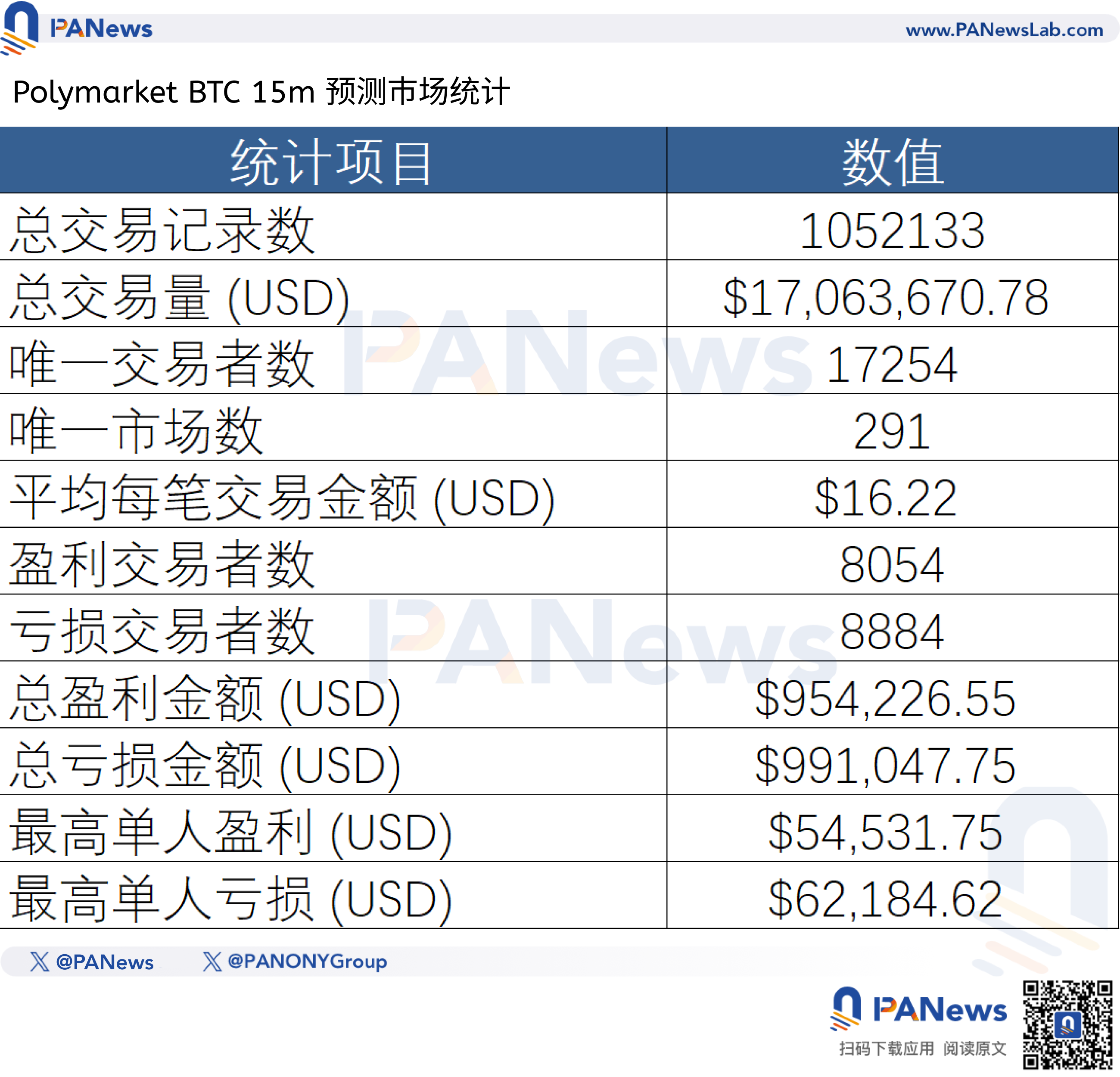

Recently, the PANews analysis team conducted a comprehensive data review of the recent Bitcoin 15-minute rise and fall prediction market. In a vast database covering about 3 days, 291 short-term markets, and a total of 1.05 million transactions, we see not just cold numbers, but a naked game of algorithms versus human nature.

This is not a playground where one can get rich by luck, but a folded world ruled by 3.6% algorithmic robots.

Retail Lottery Center, Bustling Ant Market

If we only look at the macro data, this market presents a lively scene.

During these 3 days, the BTC 15-minute prediction market generated a total of 1.05 million transactions, with a total trading volume of about 17 million dollars. The average trading volume per market is about 58,600 dollars. Of course, from the perspective of trading volume, the scale of the crypto prediction market is still relatively small, far less than the trading scale of traditional crypto markets.

In this period, a total of 17,254 independent addresses participated in the market's transactions. The average number of independent trading addresses per market is 881. The average transaction amount is 16.22 dollars, which means the main composition of the market is not institutional competition, but rather the high-frequency "lottery buying" behavior of thousands of retail investors.

Among them, there are 8,054 profitable addresses and 8,884 loss-making independent addresses. The ratio of profit to loss is close to 1:1.1. The market did not experience a one-sided slaughter; most losers only incurred minor losses, and this illusion of "still being able to play" retained a large number of users.

However, the limitations of market depth are also glaring. Data shows that the highest profitable address made a total profit of 54,531 dollars, while the address with the highest loss incurred a loss of 62,184 dollars. This data indicates that the liquidity depth of the market limits the upper limit for large players; it is difficult to earn a million dollars from a single transaction here because the opposing market depth is not sufficient.

The median entry point for all addresses is 0.544, indicating that buyers generally entered the market with confidence in either a "bullish" or "bearish" outlook. However, the median exit point is 0.247. This means that the vast majority of active selling behavior is "panic selling," with an average loss of about 50%. This also indicates that retail investors often cannot hold onto profitable positions but frequently operate on losing positions, ultimately handing their chips back to market makers at lower prices.

Robots vs. Real Users, 3.6% Machines Rule the Market

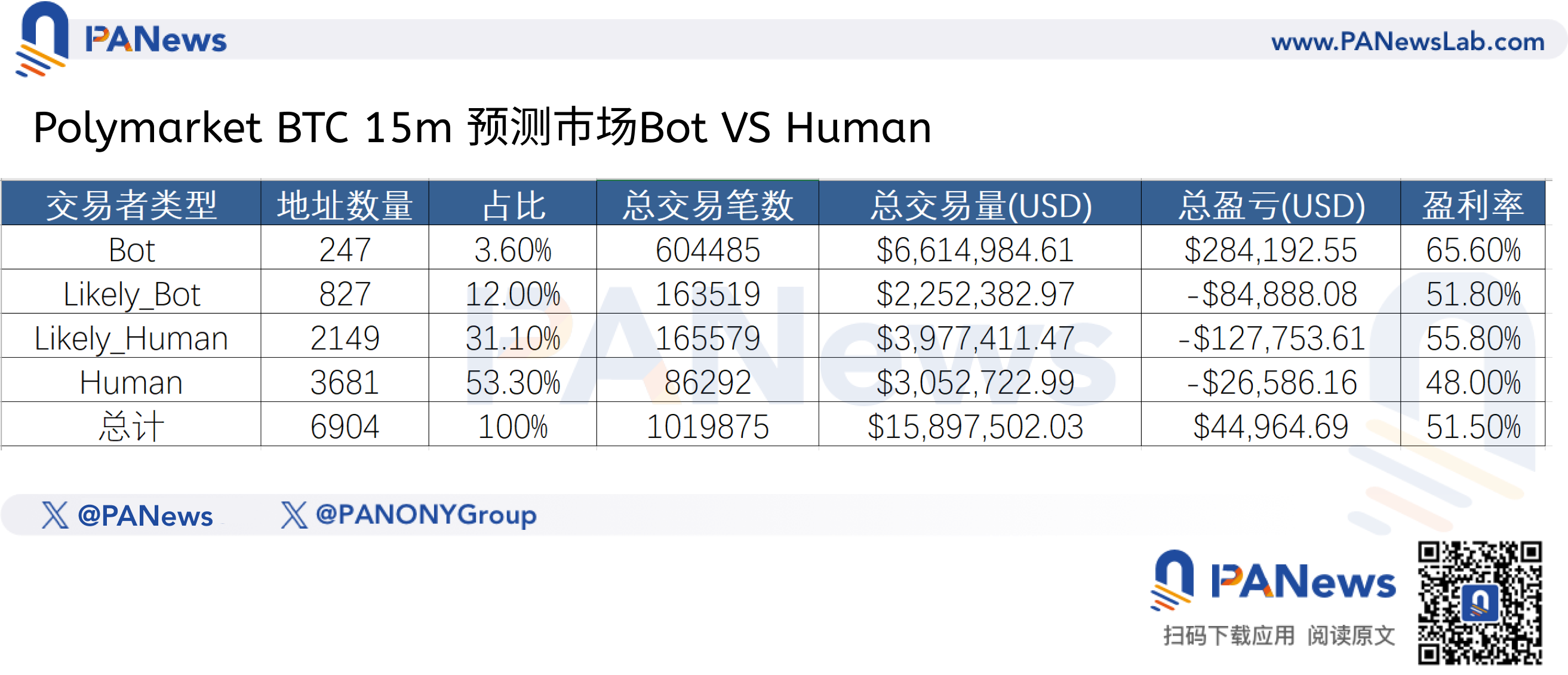

If retail investors are playing a psychological game, their opponents are conducting a ruthless dimensionality reduction attack. Data analysis results ruthlessly reveal: in this market, manual traders are facing a comprehensive crushing by algorithms.

First, from the results, robot addresses indeed overwhelmingly outperform real users in terms of returns.

Although these robot addresses are a very small number, only 247, accounting for only 3.6%, they contributed to over 600,000 transactions, with a trading share exceeding 60%. Thus, a very small number of algorithms dominate pricing power and liquidity, while the vast majority of retail investors merely act as consumables providing funds.

In terms of transaction amounts, the ratio of robot transactions to real user transactions is relatively close.

Moreover, the advantage of robots in terms of returns is very clear. Pure robot addresses made a total profit of about 284,000 dollars over these three days, while the overall returns of addresses categorized as robot-like trading, human-like trading, and purely human trading are all negative. Among them, the overall profit and loss of real traders is -154,000 dollars. Every bit of excess profit in the market essentially transfers from the pockets of real users to the accounts of algorithms. Manual trading faces an insurmountable gap when competing against high-frequency algorithms.

In terms of win rates, robot addresses also perform better, with an average win rate of about 65.5%, while real users have a win rate of only 51.5%.

From this analytical perspective, the current state of the crypto short-term prediction market shows a scenario where machines harvest real users, and manual trading results face a huge gap compared to high-frequency robots. Another angle also indirectly confirms a result: that through algorithm optimization, excess returns can be achieved in prediction markets.

Smart Money Decoded: "Speed" is Poison, "Accuracy" is the Antidote

However, if you think that just writing a script and running a robot will guarantee profits, you are gravely mistaken. We found an counterintuitive phenomenon in the list of top earners: there is also severe differentiation in the world of robots; "high frequency" does not equal "high profits."

Take the address 0x5567…a7b1 as an example; it is the address with the most transactions among all addresses. It conducted over 33,700 transactions, averaging more than 67 transactions per hour. However, its profit is relatively meager, only 4,989 dollars, with an average profit of only 0.14 dollars per transaction.

This is not an isolated case. Data shows that among ultra-high-frequency addresses that trade more than 50 times per hour, only 40% can achieve profitability, and the average return of the group is even -10%. Under the pressure of gas fees, slippage, and extreme competition, blindly pursuing speed leads robots to ultimately work for miners.

Now let's look at another case, the address 0x0ea5…17e4, which is also a robot address, ranking first in profitability among all addresses. However, its trading frequency is not that high, averaging only 22 transactions per hour and participating in only 61% of the markets. This means that the trading logic of this address does not place orders every second but trades based on specific filtering conditions, only executing trades when the market meets the corresponding conditions. This address has a win rate of 72% and total profits of about 54,500 dollars.

Risk Control Becomes the Lifeline for Human Traders

Additionally, for human traders, the data also leaves a glimmer of hope.

We found that ultra-low-frequency trading addresses (less than 1 transaction per hour) have an average win rate of 55%, a figure that far exceeds those of blindly churning high-frequency robots. This indicates that, without the support of top algorithms, human manual judgment based on market feel and logic has a higher win rate than algorithm-based robots.

But where do humans fall short? The data provides the answer: risk control.

Low-frequency traders (1-5 transactions per hour) have an average single transaction loss of about 47 dollars, ranking highest among all address categories. Human traders often can see the right direction, but human weaknesses lead them to stubbornly hold on when they are wrong and fail to hold on when they are right. Ultimately, the "small gains and large losses" profit-loss ratio becomes the biggest curse for human traders in this market.

1.05 million transaction records and 17 million dollars in liquidity reveal a cruel truth:

The Bitcoin 15-minute prediction market is not a cash machine for retail investors, but a food chain where top algorithms harvest inferior algorithms, which in turn harvest humans.

For ordinary participants, the data offers a brutally cold suggestion: either evolve into a top sniper with a 72% win rate or become an extremely restrained low-frequency hunter. Beyond that, any frequent operations or attempts to compensate for technical gaps through "diligence" will ultimately only make you a part of this vast ecosystem that provides profits.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。