Author: Yokiiiya

Recently, I conducted an in-depth study and analysis of Coinbase Global, Inc. (NASDAQ: COIN), covering comprehensive data, legal documents, internal communications, and market analysis up to early 2026. This is the story of how Coinbase evolved from a fringe project in Y Combinator in 2012 to a giant controlling the global flow of crypto assets.

This article will delve into the counterintuitive decisions behind its rise—seeking compliance in chaos; reveal the internal turmoil behind the cultural purge and racial discrimination allegations in 2020; detail its thunderous tactics to reshape the regulatory environment through "money politics" in the 2024 U.S. elections; and predict the future risks of building Web3 super applications and monopolizing the ETF custody market through the Base chain.

I. The Gene of Rise: Advancing in Rebellion (2012-2017)

Coinbase's success did not stem from having the most advanced technology, but from its business strategy, which at the time seemed the most "rebellious": in a world of crypto-anarchism and liberalism, it chose to don a suit and make peace with the banking system it sought to disrupt.

1.1 Route Correction During Y Combinator and the Origin of "Bitbank"

In 2012, when Brian Armstrong applied to join Y Combinator (YC) S12 batch, his project was not called Coinbase, but "Bitbank." The name itself revealed Armstrong's initial ambition—not just to create a wallet, but to establish a bank.

As a former fraud engineer at Airbnb, Armstrong had a unique perspective. At Airbnb, he witnessed the friction and pain of funds flowing between 190 countries. He realized that while Bitcoin solved the technical problem of value transfer, its user experience was extremely poor. At that time, Bitcoin users had to use complex open-source desktop clients, facing 34-character hash addresses, and a small mistake could lead to the loss of all assets.

Armstrong's core insight was "Trust as a Service." He mentioned in his YC application that there were only 100,000 Bitcoin users at the time, and the purchasing process required multiple unreliable intermediaries. Although YC was initially skeptical of this idea (Armstrong's first application was rejected), he impressed YC partners Garry Tan and Paul Graham with the Android wallet prototype he showcased in his second application—along with his experience in payment security and growth hacking at Airbnb.

The addition of Fred Ehrsam was another decisive moment. As a former foreign exchange trader at Goldman Sachs, Ehrsam brought the Wall Street gene that Armstrong lacked. This combination of "Silicon Valley geek + Wall Street trader" infused Coinbase with a DNA that was distinctly different from its competitors: rigorous, conservative, and even somewhat dull, but exactly what financial institutions needed.

1.2 Key Successful Decision: Reverse Compliance Strategy

The years 2013 to 2014 were the "Warring States" period for cryptocurrency exchanges. Japan's Mt. Gox accounted for 70% of global Bitcoin trading volume, operating in a wild style, lacking audits, and often misappropriating customer funds. Against this backdrop, Coinbase made its most important strategic decision in history: to seek full compliance in the U.S. rather than evade regulation through offshore registration.

This decision was not only expensive at the time but also highly risky:

Building Banking Relationships: In its early days, Coinbase not only struggled to open bank accounts but also faced the risk of being cut off by banks at any moment. Armstrong and Ehrsam spent considerable effort lobbying institutions like Silicon Valley Bank to establish the first stable fiat channels.

The License Long March: Coinbase chose not to register in a single lenient jurisdiction but embarked on a long "License Long March," applying for money transmitter licenses in all 50 states of the U.S. This significantly slowed its early expansion speed but also built a high competitive barrier.

Thus, when Mt. Gox collapsed in 2014 due to hacking and mismanagement, resulting in the loss of 850,000 Bitcoins, market panic reached its peak. However, Coinbase, due to its transparent reserve system and compliance framework, absorbed almost all the U.S. traffic seeking safety.

This event established Coinbase's position as a "safe haven for cryptocurrency," allowing it to remain resilient amid the regulatory storms in the following years.

1.3 Early Financing and Capital Landscape

Coinbase's early financing list was not just about money but also about endorsements.

Series A and B: Led by Union Square Ventures (Fred Wilson) and Andreessen Horowitz (a16z). Marc Andreessen of a16z not only brought funding but also opened his extensive network in Washington and Wall Street to Coinbase.

Strategic Investors: Coinbase brought in traditional financial giants like the New York Stock Exchange (NYSE), USAA, and BBVA as strategic investors. These endorsements sent a clear signal to the outside world: Coinbase is a crypto company recognized by the "establishment."

II. Internal Wars: Cultural Purge, Racial Allegations, and Moral Crisis (2018-2021)

With the company's rapid expansion, significant tension gradually built up internally at Coinbase. In 2020, this tension erupted against the backdrop of the racial justice movement and political polarization, leading to the most profound cultural transformation and public relations crisis in the company's history.

2.1 "Non-Political" Declaration and the 5% Purge

In the summer of 2020, massive "Black Lives Matter" (BLM) protests erupted in the U.S. following the death of George Floyd. Major tech companies in Silicon Valley expressed their support, and employee activism surged at companies like Twitter and Facebook.

According to internal sources, in June 2020, during an all-hands Q&A session (AMA), an employee asked Brian Armstrong to publicly support the BLM movement. Armstrong refused to answer directly, stating only that the company was focused on economic freedom. This response triggered a strong backlash internally, leading some employees to organize a "virtual walkout" and vehemently criticize management in Slack channels.

On September 27, 2020, Armstrong published the famous blog post "Coinbase is a Mission-Focused Company." In it, he drew clear boundaries:

Prohibition of Political Discussions: Coinbase would not engage in any social activities or political debates unrelated to its "core mission" (i.e., increasing economic freedom through cryptocurrency).

Focus on Business: Employees should focus on work like a "champion team" rather than engage in social justice debates within the company.

Armstrong then issued an ultimatum: employees who disagreed with this cultural direction could resign, and the company would offer extremely generous severance packages (typically 4-6 months' salary). Ultimately, about 60 employees (5% of the total workforce at the time) accepted this offer and left the company.

This decision was viewed by outsiders as "even somewhat dictatorial," but it also garnered support from old-school Silicon Valley investors like Paul Graham. In hindsight, this "purge" allowed Coinbase to maintain high organizational efficiency during the subsequent IPO sprint in 2021, avoiding the endless internal cultural wars that plagued companies like Google or Facebook. Armstrong effectively filtered out a "mercenary" team that most aligned with the company's business goals through this action.

2.2 Racial Discrimination Allegations and PR "Front-Running" Tactics

Just as the "non-political" storm had not yet settled, Coinbase faced more serious moral allegations.

At the end of 2020, New York Times reporter Nathaniel Popper completed an in-depth investigation aimed at exposing systemic discrimination against Black employees at Coinbase. According to the investigation, there was a significant attrition of Black employees at Coinbase between 2018 and 2019, and they faced pay disparities (7% lower salaries) and workplace bullying. Specific allegations were shocking: some managers had publicly suggested that Black employees were involved in drug dealing or carrying guns; Black employees were generally stereotyped as "incompetent."

Coinbase adopted a highly aggressive defense strategy—"front-running." A few days before the New York Times article was published, Coinbase sent an open letter to all employees and posted it on its official blog. The letter not only previewed the upcoming negative coverage but even listed the names of former employees that the article might cite, claiming that the internal investigation found no evidence of misconduct.

This move broke the conventional rules of corporate public relations. Typically, companies wait to respond after a report is published, but Coinbase chose to take the initiative, attempting to set the narrative framework before the public saw the report. Although this approach drew criticism in the media for "witness intimidation," it successfully conveyed a strong message to internal employees and investors: Coinbase would not be manipulated by the media.

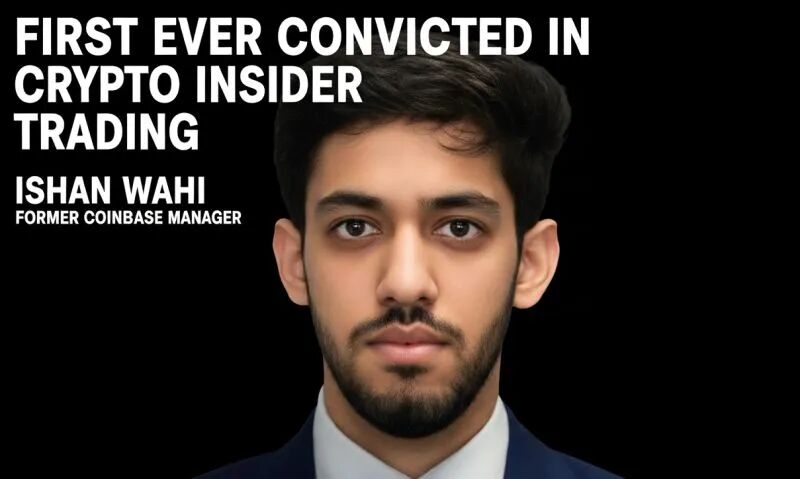

2.3 Ishan Wahi Insider Trading Case: The First Case of Crypto Insider Trading

In 2022, Coinbase found itself embroiled in another scandal, this time directly questioning the fairness of its core business.

Former Coinbase product manager Ishan Wahi exploited his position to gain advance knowledge of token listing schedules, conspiring to trade with his brother Nikhil Wahi and friend Sameer Ramani. Hours or even minutes before Coinbase announced new token listings, Nikhil and Ramani would buy large amounts of the relevant tokens through anonymous wallets and sell them after the announcement when prices surged. The group was involved in trading at least 25 different tokens between June 2021 and April 2022, illegally profiting over $1.5 million.

The case was classified by the U.S. Department of Justice (DOJ) as the first case of cryptocurrency insider trading, with Ishan Wahi ultimately pleading guilty and being sentenced to two years in prison. However, the more far-reaching impact came from the SEC's involvement. In a civil lawsuit, the SEC explicitly defined nine of the tokens involved as "securities." This was effectively the SEC's first formal designation of specific tokens as securities in court documents, directly challenging the legality of Coinbase's business model—if these tokens are securities, then Coinbase is operating an unregistered securities exchange. This case became a legal prelude to the SEC's subsequent lawsuit against Coinbase.

III. From Passive Defense to Political Counterattack—2024 Elections and Regulatory Retaliation (2022-2025)

Faced with the relentless pressure from the SEC under Gary Gensler's leadership, Coinbase chose not to settle like Kraken or Binance but instead launched a comprehensive counteroffensive encompassing legal, public opinion, and electoral strategies.

3.1 Legal Battle: Injunctions and Litigation Victories

When the SEC refused to respond to Coinbase's petition for clear digital asset regulations, Coinbase opted for a rare legal maneuver: applying for a "Writ of Mandamus" in federal appeals court, attempting to compel the regulatory agency to fulfill its duties. This "sue the government" stance was extremely aggressive.

By early 2025, as the political winds shifted, this legal gamble paid off. The SEC lost several key lawsuits and ultimately announced in February 2025 the withdrawal of most of its charges against Coinbase. This victory was not only for Coinbase but was also seen as a confirmation of the survival rights of the entire crypto industry.

3.2 2024 Elections: A Textbook Victory of "Money Politics"

Coinbase deeply understood that in the U.S., legal issues ultimately become political issues. Therefore, it played the role of a super donor in the 2024 elections.

Ohio Senator Sherrod Brown, the chairman of the Senate Banking Committee, is one of Washington's most prominent cryptocurrency skeptics. He has repeatedly obstructed the passage of pro-crypto legislation and has rigorously questioned Coinbase executives during hearings. To bring him down, Coinbase partnered with companies like Ripple to fund the Super PAC "Fairshake."

Data shows that the crypto industry invested over $119 million in the 2024 election cycle, with more than $40 million specifically targeting Sherrod Brown's Ohio Senate seat. This funding was primarily used for aggressive advertising, ultimately helping Republican challenger Bernie Moreno win by a narrow margin.

In addition to money, Coinbase also launched the "Stand With Crypto" grassroots campaign, mobilizing over 2.6 million cryptocurrency holders as a voter base. They graded politicians (from A to F) and organized voter turnout in swing states. This dual pressure of "money + votes" fundamentally changed the political calculations in Washington. Sherrod Brown's defeat sent a chilling signal to all politicians: opposing cryptocurrency could jeopardize your political career.

By 2025, Coinbase's lobbying expenditures had reached record levels (nearly $1 million in a single quarter), and it hired top lobbyists, including former Obama campaign manager David Plouffe, to join its advisory board. This marked Coinbase's transformation from a "tech newcomer" to a "Washington power player."

IV. Transformation of Business Model—From Trading Commissions to Financial Infrastructure (2021-2026)

Coinbase's financial statements reveal that its business model is undergoing a profound, structural transformation. It is moving away from reliance on retail trading sentiment and instead depending on subscription services and institutional custody fees.

4.1 Changes in Revenue Structure: Saying Goodbye to "Living by the Market"

In 2020, 96% of Coinbase's revenue came from trading commissions, meaning its performance was entirely tied to Bitcoin price fluctuations. However, according to forecasts for 2025, this proportion is expected to drop to 59%, while subscription and service revenue will account for a significant share.

2020: Almost entirely reliant on trading: Coinbase explicitly stated in its listing materials that trading revenue accounted for "over 96%" of net revenue in 2020. This meant it was essentially a "crypto brokerage/exchange," vulnerable to market downturns.

2021: The bull market pushed trading revenue to extremes but also exposed the problem of "over-reliance on market conditions." Total trading revenue for 2021 was about $6.8 billion, compared to about $1.1 billion in 2020 (the bull market amplifier). Such explosive growth is exhilarating but highlights a fact: revenue quality is highly tied to market volatility and trading volume.

2023: After the bear market, service revenue became "half of the pie." In 2023, Coinbase's net revenue was about $2.9 billion, with trading revenue around $1.5 billion and subscription and service revenue about $1.4 billion—almost evenly split. This represents a structural turning point: even if trading cools down, service revenue can provide a floor.

2024: As the market warms up, trading rebounds, but service revenue continues to grow and "stabilizes." The 2024 10-K shows subscription and service revenue at about $2.3 billion, while trading revenue also saw significant growth (total revenue around $6.564 billion). Looking specifically at Q4 2024: trading revenue was $1.6 billion, and subscription and service revenue was $641 million—trading will be more vigorous in a bull market, but service is no longer optional.

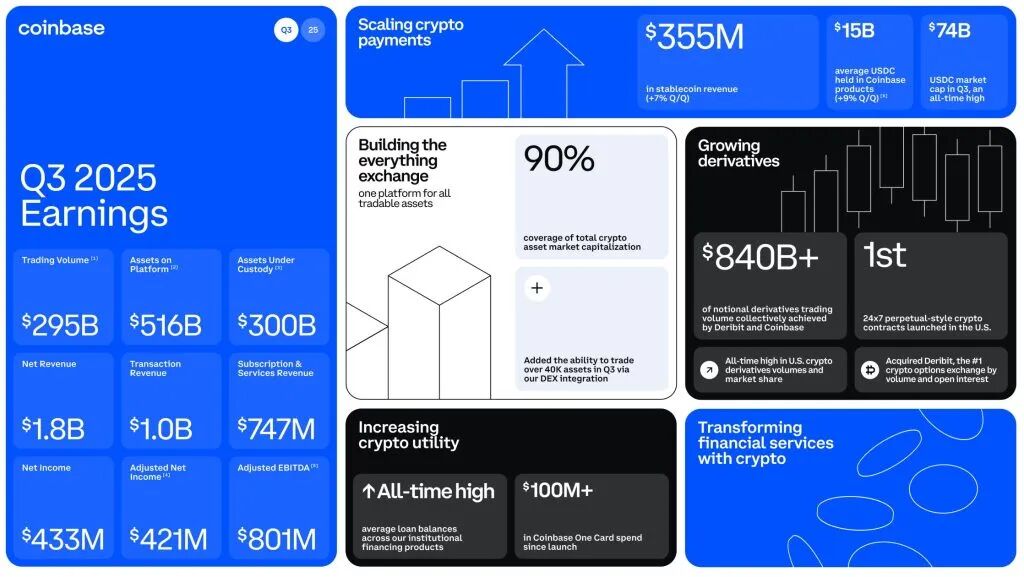

2025 (using quarterly data to assess "stability"): Service revenue increasingly resembles a "foundation." Q2 2025: trading revenue was $764 million, and subscription and service revenue was $656 million, already very close. Q3 2025: trading revenue was $1 billion, and subscription and service revenue was $747 million.

Additionally, institutions consistently expect that by 2025, subscription and service revenue could reach about 41% of total revenue (with trading at about 59%), while in 2020, trading accounted for about 96%—this long-term trend is quite evident.

4.2 Stablecoin Printing Machine and ETF Monopoly

The USDC issued jointly by Coinbase and Circle has become a core pillar of its revenue. As the Federal Reserve maintains interest rates, the reserve assets of USDC generate substantial interest income. Coinbase effectively enjoys a net interest margin (NIM) similar to that of banks, and this income remains extremely stable even during bear markets.

The approval of Bitcoin spot ETFs in 2024 is the crowning achievement of Coinbase's institutional business.

Market Share: By 2025, Coinbase was managing about 85% of Bitcoin ETF assets, including major products like BlackRock's IBIT and Grayscale's GBTC.

Moat: This monopolistic position not only brings stable custody fees but, more importantly, embeds Coinbase into the underlying architecture of the global financial system. Now, if you purchase a Bitcoin ETF from Fidelity or BlackRock, your assets are effectively stored in Coinbase's cold wallets.

Coinbase's long-term narrative can be summarized as: transitioning from a "trading fee-driven high-volatility business model" to a hybrid model where "trading revenue remains important but is smoothed out by more sustainable service revenues from stablecoins/staking/custody/subscriptions."

V. Web3 Layout—Base Chain and "Super App" Ambitions

If the first decade of Coinbase was as an exchange in the Web 2.0 era, the future Coinbase is attempting to become the operating system of Web 3.0.

5.1 Base Chain: The King of L2 Without Issuing Tokens

In 2023, Coinbase launched the Layer 2 network—Base—based on the OP Stack. This move marks a significant strategic shift for the company.

Counterintuitive "no token issuance" strategy: Unlike Arbitrum and Optimism, which bribe users with airdropped tokens, Coinbase insists that Base will not issue tokens.

Compliance Considerations: Not issuing tokens avoids the risk of SEC classification as securities.

Shareholder Interests: The sequencer revenue from Base is directly included in Coinbase's financial reports. This means that COIN stock itself becomes the "invisible token" of the Base ecosystem.

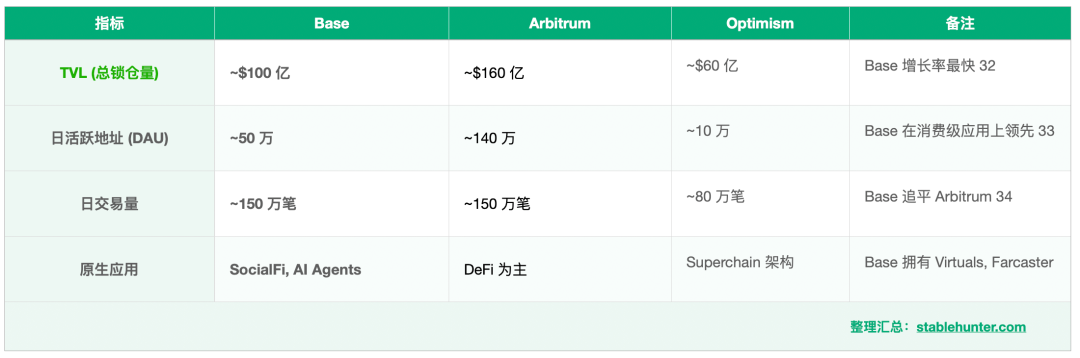

Market Performance Comparison (Q4 2025 Data):

5.2 "Onchain is the new Online"

Brian Armstrong put forth a grand argument: cryptocurrency is not just an asset; it is a new internet architecture.

Base App (formerly Coinbase Wallet): Coinbase is transforming its wallet into a WeChat-like "super app." In this app, users can not only transfer funds but also post and socialize through the Farcaster protocol, conduct automated trading via AI Agents, and even purchase real-world assets (RWA) directly on-chain.

AI Agent Economy: By 2025, Base will become the center of the AI agent economy. For example, the Virtuals protocol allows AI to have its own wallets and autonomously conduct value exchanges. Coinbase provides critical payment rails that enable AI to make millisecond payments using USDC.

Section Six: Future Prospects and Risks (2026 and Beyond)

6.1 "Universal Exchange" and Neo-banks

Coinbase's 2026 roadmap shows its ambition to become an "Everything Exchange."

Full-category Trading: In addition to cryptocurrencies, Coinbase plans to launch stocks, commodities, forex futures, and prediction market contracts. This will put it in direct competition with Robinhood, Interactive Brokers, and even the Chicago Mercantile Exchange (CME).

National Trust Bank License: Coinbase is applying for a National Trust Bank license in the U.S. Despite strong opposition from the Independent Community Bankers of America (ICBA), if approved, this would allow Coinbase to hold user deposits directly, completely bridging the gap between fiat and cryptocurrency, and becoming a true "crypto-native bank."

6.2 Systemic Risks: Concerns of Single Points of Failure

Coinbase's success itself is becoming a risk.

Custody Concentration: Coinbase controls 85% of Bitcoin ETF custody assets. This means that if Coinbase's private key management system has a vulnerability or suffers an attack from insiders (such as rogue employees), the entire U.S. ETF market could face catastrophic consequences. This "too big to fail" concentration is likely to attract the attention of the Financial Stability Oversight Council (FSOC), which may require it to adhere to regulatory standards similar to those for Global Systemically Important Banks (G-SIBs).

Fidelity's Challenge: Traditional financial giant Fidelity is actively competing for custody market share through its digital asset division (Fidelity Digital Assets). For example, MicroStrategy recently transferred some Bitcoin from Coinbase to Fidelity, signaling that the monopoly in the custody market may face challenges.

In Conclusion

Coinbase's story is a microcosm of the maturation of the crypto industry. It demonstrates that in a decentralized world, centralized compliance bridges still hold immense value. By enduring the pains of compliance in the early days, decisively cleansing internal dissent in 2020, and showcasing impressive political maneuvering in 2024, Coinbase has earned itself a ticket to the future.

Now, it is no longer just an exchange; it is the gatekeeper of the on-chain world, a digital vault on Wall Street, and an incubator for Web3 super apps. In 2026 and beyond, its greatest challenge will no longer be survival, but how to manage the systemic responsibilities that come with being a global financial infrastructure.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。